Intel's Foundry Future Hangs in the Balance: Next-Gen Chipmaking Tech Needs Customer Commitment

2 Sources

2 Sources

[1]

Intel's foundry future depends on securing a customer for next-gen chipmaking tech

SAN FRANCISCO, July 24 (Reuters) - Intel (INTC.O), opens new tab warned investors on Thursday that it may have to get out of the chip manufacturing business if it does not land external customers to make chips in its factories. New CEO Lip-Bu Tan said on Thursday the company's engineers were busy working with customers to jump-start its next-generation contract manufacturing process, or foundry, as the company announced big layoffs alongside a wider-than-expected third-quarter loss outlook. Those customers for the company's so-called 14A manufacturing process are crucial to the success of the technology - so much so that if it fails to secure a big one, it could shut down its cutting-edge manufacturing business altogether, according to Intel's quarterly filing on Thursday. The possibility that Intel could drop out of the cutting-edge manufacturing business would be a historic shift for a company that has described itself as a steward of Moore's Law - an observation by Intel co-founder Gordon Moore about the fast rate of development of the chip industry that held true for decades. Intel is the only U.S. chipmaker capable of making advanced computing chips. Intel has struggled for years due to management missteps, missing out on the AI race and losing market share to its longtime rival AMD (AMD.O), opens new tab. Former CEO Patrick Gelsinger poured money into Intel's foundry business, aiming to compete with chip manufacturing giant TSMC (2330.TW), opens new tab. Tan, who has already taken steps to right the ship, said on a post-earnings call on Thursday that he was personally reviewing all chip designs and investments. "We're developing Intel 14A ... from the ground up in close partnership with large external customers," Tan said in a memo released with the results. "Going forward, our investment in Intel 14A will be based on confirmed customer commitments. "We will build what our customers need, when they need it, and earn their trust through consistent execution." Intel said that without a significant customer, it would consider cancelling or pausing development of 14A and subsequent technologies. Should the company take the step, it planned to continue to manufacture chips with its 18A technology and a variant through 2030, according to the filing. In a post-earnings conference call, Tan said on Thursday that he is focused on working with customers to ensure 14A is a success and that tight collaboration with external customers is something that was absent from the company's 18A, which is set to go into high-volume production later this year. Tan said bringing those prospective customers in and gaining their feedback during 14A's development has already made it more promising than 18A. "That gave me a lot more confidence that this time, we have customers (that) are engaging early enough in the inception" of 14A, Tan said. "We learn from our mistakes, and we can learn quicker and then get a better result." The consequences of a decision to halt internal manufacturing would be significant for Intel, the filing said. It would mean that over time, Intel would become dependent on Taiwan's TSMC (2330.TW), opens new tab for contract manufacturing, or foundry, services. Doing so would also put it at a competitive disadvantage to competitors such as AMD, which has longer relationships and experience working with TSMC. Intel had roughly $100 billion of chipmaking equipment as of June 28. If the company halted its 14A manufacturing line, the company expects "significant material impairments" related to the company's foundry assets, the company's filing said. Reporting by Max A. Cherney and Stephen Nellis in San Francisco; Additional reporting by Arsheeya Bajwa in Bengaluru; Editing by Sayantani Ghosh and Stephen Coates Our Standards: The Thomson Reuters Trust Principles., opens new tab * Suggested Topics: * Asia Pacific Max A. Cherney Thomson Reuters Max A. Cherney is a correspondent for Reuters based in San Francisco, where he reports on the semiconductor industry and artificial intelligence. He joined Reuters in 2023 and has previously worked for Barron's magazine and its sister publication, MarketWatch. Cherney graduated from Trent University with a degree in history.

[2]

Intel's foundry future depends on securing a customer for next-gen chipmaking tech

SAN FRANCISCO (Reuters) -Intel warned investors on Thursday that it may have to get out of the chip manufacturing business if it does not land external customers to make chips in its factories. New CEO Lip-Bu Tan said on Thursday the company's engineers were busy working with customers to jump-start its next-generation contract manufacturing process, or foundry, as the company announced big layoffs alongside a wider-than-expected third-quarter loss outlook. Those customers for the company's so-called 14A manufacturing process are crucial to the success of the technology - so much so that if it fails to secure a big one, it could shut down its cutting-edge manufacturing business altogether, according to Intel's quarterly filing on Thursday. The possibility that Intel could drop out of the cutting-edge manufacturing business would be a historic shift for a company that has described itself as a steward of Moore's Law - an observation by Intel co-founder Gordon Moore about the fast rate of development of the chip industry that held true for decades. Intel is the only U.S. chipmaker capable of making advanced computing chips. Intel has struggled for years due to management missteps, missing out on the AI race and losing market share to its longtime rival AMD. Former CEO Patrick Gelsinger poured money into Intel's foundry business, aiming to compete with chip manufacturing giant TSMC. Tan, who has already taken steps to right the ship, said on a post-earnings call on Thursday that he was personally reviewing all chip designs and investments. "We're developing Intel 14A ... from the ground up in close partnership with large external customers," Tan said in a memo released with the results. "Going forward, our investment in Intel 14A will be based on confirmed customer commitments. "We will build what our customers need, when they need it, and earn their trust through consistent execution." Intel said that without a significant customer, it would consider cancelling or pausing development of 14A and subsequent technologies. Should the company take the step, it planned to continue to manufacture chips with its 18A technology and a variant through 2030, according to the filing. In a post-earnings conference call, Tan said on Thursday that he is focused on working with customers to ensure 14A is a success and that tight collaboration with external customers is something that was absent from the company's 18A, which is set to go into high-volume production later this year. Tan said bringing those prospective customers in and gaining their feedback during 14A's development has already made it more promising than 18A. "That gave me a lot more confidence that this time, we have customers (that) are engaging early enough in the inception" of 14A, Tan said. "We learn from our mistakes, and we can learn quicker and then get a better result." The consequences of a decision to halt internal manufacturing would be significant for Intel, the filing said. It would mean that over time, Intel would become dependent on Taiwan's TSMC for contract manufacturing, or foundry, services. Doing so would also put it at a competitive disadvantage to competitors such as AMD, which has longer relationships and experience working with TSMC. Intel had roughly $100 billion of chipmaking equipment as of June 28. If the company halted its 14A manufacturing line, the company expects "significant material impairments" related to the company's foundry assets, the company's filing said. (Reporting by Max A. Cherney and Stephen Nellis in San Francisco; Additional reporting by Arsheeya Bajwa in Bengaluru; Editing by Sayantani Ghosh and Stephen Coates)

Share

Share

Copy Link

Intel warns it may exit chip manufacturing if it fails to secure external customers for its next-generation 14A process, marking a potential historic shift for the company.

Intel's Foundry Dilemma

Intel, the only U.S. chipmaker capable of producing advanced computing chips, is facing a critical juncture in its foundry business. The company has warned investors that it may have to exit the chip manufacturing business if it fails to secure external customers for its next-generation 14A manufacturing process

1

. This potential move would mark a historic shift for a company that has long been considered a steward of Moore's Law.

Source: Reuters

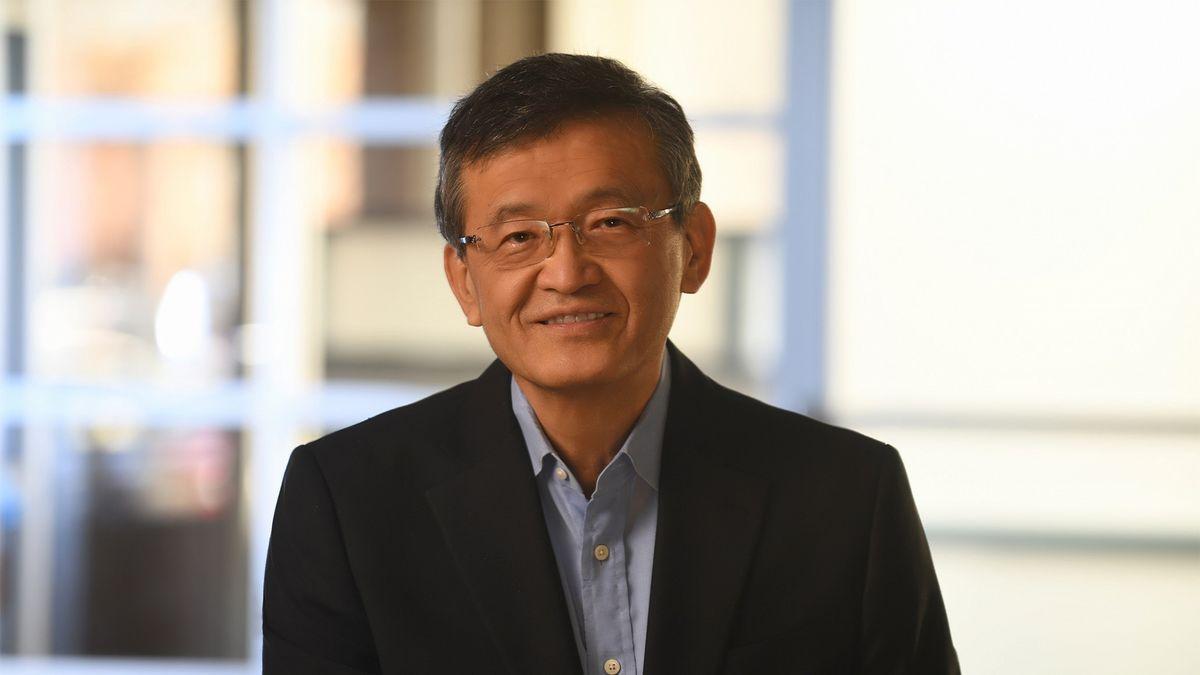

New Leadership and Strategic Shift

Intel's new CEO, Lip-Bu Tan, is taking a hands-on approach to address the company's challenges. Tan is personally reviewing all chip designs and investments, focusing on working closely with customers to ensure the success of the 14A process

2

. This strategy represents a departure from the company's approach with its 18A technology, which lacked tight collaboration with external customers.The Importance of Customer Commitments

The success of Intel's 14A manufacturing process hinges on securing significant customer commitments. Tan emphasized that future investments in 14A will be based on confirmed customer commitments, stating, "We will build what our customers need, when they need it, and earn their trust through consistent execution"

1

. The company is developing 14A from the ground up in close partnership with large external customers, a move that Tan believes will yield better results than previous efforts.Potential Consequences of Exiting Manufacturing

If Intel fails to secure a significant customer for its 14A process, the consequences could be severe. The company may consider cancelling or pausing the development of 14A and subsequent technologies. This decision could lead to:

- Dependence on TSMC: Intel would become reliant on Taiwan's TSMC for contract manufacturing services

2

. - Competitive disadvantage: The company would lag behind competitors like AMD, which have longer-standing relationships with TSMC

1

. - Financial impact: Intel could face "significant material impairments" related to its foundry assets, which include approximately $100 billion worth of chipmaking equipment

2

.

Related Stories

Intel's Struggles and Future Outlook

Intel has faced challenges in recent years, including management missteps, missing out on the AI race, and losing market share to rival AMD

1

. The company's former CEO, Patrick Gelsinger, had invested heavily in the foundry business to compete with TSMC. Now, under Tan's leadership, Intel is taking a more cautious approach, focusing on customer needs and confirmed commitments.The Road Ahead

As Intel navigates this critical period, the success of its 14A process and the securing of external customers will be crucial in determining the company's future in chip manufacturing. The outcome of this endeavor could reshape the landscape of the semiconductor industry, particularly in the United States, where Intel remains the sole advanced chip manufacturer.

References

Summarized by

Navi

Related Stories

Recent Highlights

1

Google Gemini 3.1 Pro doubles reasoning score, beats rivals in key AI benchmarks

Technology

2

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

3

ChatGPT cracks decades-old gluon amplitude puzzle, marking AI's first major theoretical physics win

Science and Research