Trump approves Nvidia H200 exports to China with 25% revenue cut, sparking national security debate

96 Sources

96 Sources

[1]

US taking 25% cut of Nvidia chip sales "makes no sense," experts say

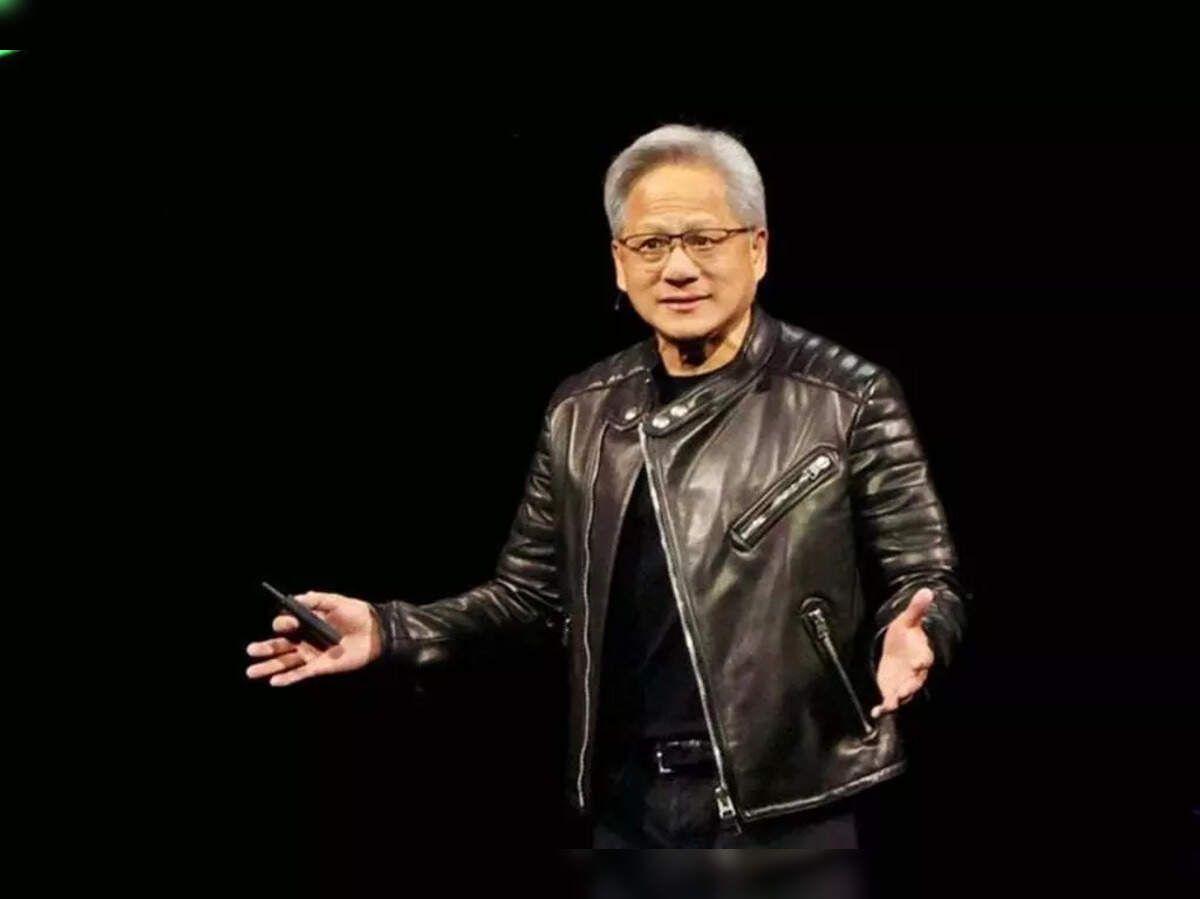

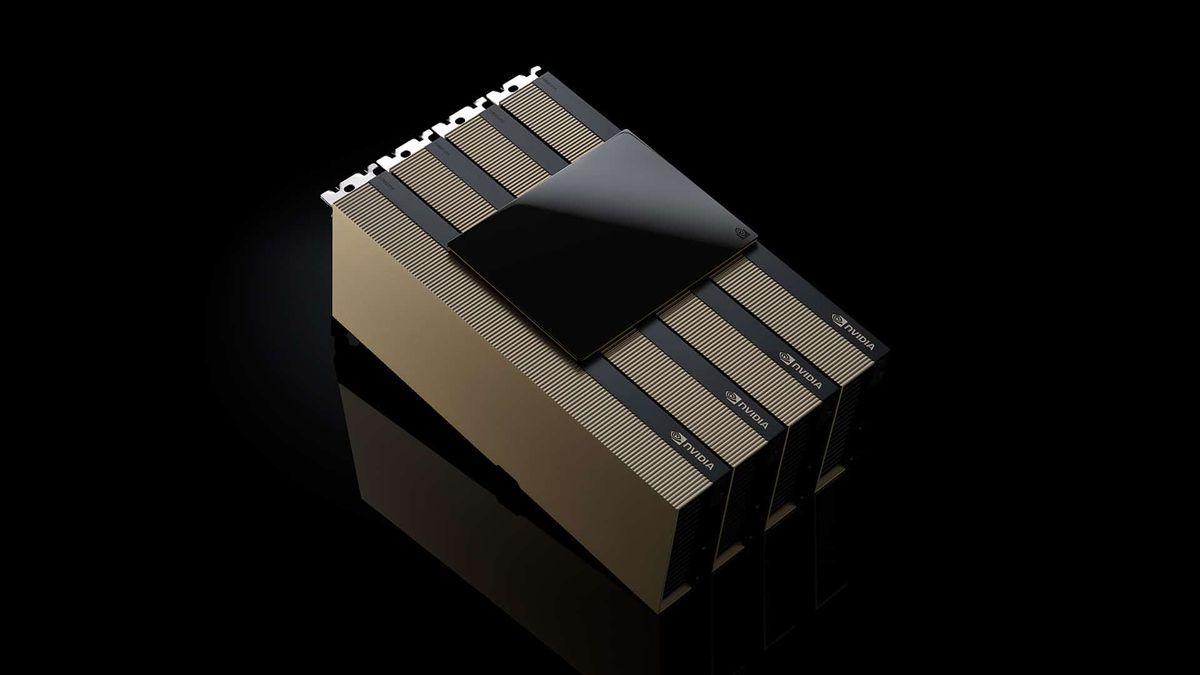

Donald Trump's decision to allow Nvidia to export an advanced artificial intelligence chip, the H200, to China may give China exactly what it needs to win the AI race, experts and lawmakers have warned. The H200 is about 10 times less powerful than Nvidia's Blackwell chip, which is the tech giant's currently most advanced chip that cannot be exported to China. But the H200 is six times more powerful than the H20, the most advanced chip available in China today. Meanwhile China's leading AI chip maker, Huawei, is estimated to be about two years behind Nvidia's technology. By approving the sales, Trump may unwittingly be helping Chinese chip makers "catch up" to Nvidia, Jake Sullivan told The New York Times. Sullivan, a former Biden-era national security advisor who helped design AI chip export curbs on China, told the NYT that Trump's move was "nuts" because "China's main problem" in the AI race "is they don't have enough advanced computing capability." "It makes no sense that President Trump is solving their problem for them by selling them powerful American chips," Sullivan said. "We are literally handing away our advantage. China's leaders can't believe their luck." Trump apparently was persuaded by Nvidia CEO Jensen Huang and his "AI czar," David Sacks, to reverse course on H200 export curbs. They convinced Trump that restricting sales would ensure that only Chinese chip makers would get a piece of China's market, shoring up revenue flows that dominant firms like Huawei could pour into R&D. By instead allowing Nvidia sales, China's industry would remain hooked on US chips, the thinking goes. And Nvidia could use those funds -- perhaps $10-15 billion annually, Bloomberg Intelligence has estimated -- to further its own R&D efforts. That cash influx, theoretically, would allow Nvidia to maintain the US advantage.

[2]

Department of Commerce may approve Nvidia H200 chip exports to China | TechCrunch

Advanced Nvidia AI chips may be headed to China after all. The Department of Commerce is planning to allow Nvidia to ship H200 chips to China, according to Semafor, which cited sources. These chips are much more advanced than the H20 chips Nvidia developed specifically for the Chinese market, but the company would only be able to send H200s that are roughly 18 months old, Semafor reported. "We applaud President Trump's decision to allow America's chip industry to compete to support high paying jobs and manufacturing in America. Offering H200 to approved commercial customers, vetted by the Department of Commerce, strikes a thoughtful balance that is great for America," an Nvidia spokesperson told TechCrunch. The news report comes a week after U.S. Commerce Secretary Howard Lutnick said the decision on exporting these H200 chips to China was in President Donald Trump's hands. A decision to send these chips to China would conflict with Congressional concerns about national security. Pete Ricketts, a Republican senator from Nebraska, and Chris Coons, a Democratic senator from Delaware, introduced a bill on December 4 that would block the export of advanced AI chips to China for more than two years. The Secure and Feasible Exports Act (SAFE) Chips Act would require the Department of Commerce to deny any export license on advanced AI chips to China for 30 months. It's unclear when legislators will vote on the proposed bill. While Congress has long been clear about sending advanced AI chips to China -- on both sides of the aisle -- President Trump has waffled on whether or not to allow the exports. The Trump administration hit chip companies like Nvidia with licensing requirements to send their chips to China in April before it formally rescinded a Biden administration diffusion rule that would have regulated AI chip exports in May. Over the summer, the U.S. government signaled that companies would be able to start sending chips to China as long as the government got a 15% cut of all revenue, as chips became a bargaining tool in trade talks with China. However, by that point, the market for U.S.-developed chips in China was strained, if not permanently damaged. In September, China's internet regulator, the Cyberspace Administration of China, banned domestic companies from buying Nvidia's chips, leaving companies in the country to rely on less advanced domestic chips from Alibaba and Huawei.

[3]

Trump says Nvidia can sell more powerful AI chips to China

"This policy will support American jobs, strengthen US manufacturing, and benefit American taxpayers," Trump said. "Nvidia's US customers are already moving forward with their incredible, highly advanced Blackwell chips, and soon, Rubin, neither of which are part of this deal." While the Trump administration lifted AI chip export limits in May, a group of senators urged the President last month to continue denying China access to Nvidia's most powerful chips in an effort to preserve the US's leading position in AI. The new approvals further reward Nvidia CEO Jensen Huang's efforts to suck up to the White House, but rely on China actually wanting to purchase Nvidia's chips -- something it's barred Chinese companies from doing in favor of supporting domestic chip manufacturing.

[4]

The Nvidia H200 export saga, as it happened -- Beijing ponders response and buyers line up, while Blackwell remains locked behind restrictions

The U.S. government has formally approved the export of Nvidia's high-performance H200 AI chips to China, reinstating access to a class of silicon previously barred under national security rules. Sales will be allowed to select Chinese customers pending government review, and each chip must be routed through U.S. territory for inspection and accompanied by a 25% import duty. The move ends a freeze that ultimately led to Nvidia losing its entire Chinese market share and upended development plans for large-scale AI models in the region. The announcement, first made by President Donald Trump via Truth Social, comes after months of internal debate within the U.S. administration over how to apply export restrictions without accelerating China's ability to develop domestic alternatives. The H200, a powerful GPU from Nvidia's Hopper generation, significantly outperforms the previously approved H20 and had been considered too capable for Chinese markets under earlier rules. Its reauthorization hints that there's been a shift in Washington's approach, namely to maintain technological superiority, but it will allow controlled access to limit the pace of Chinese self-sufficiency. The decision to allow H200 exports follows concerns that sweeping restrictions were producing unintended results. Since the initial wave of AI chip bans in 2022, Chinese firms have intensified development of homegrown accelerators, with Huawei's Ascend 910C making significant progress in training and inference workloads. While still behind Nvidia in absolute performance, Huawei's architecture is increasingly seen as serviceable for national and commercial deployments, especially as its fabrication partners improve yields. Internal discussions in Washington, as reported by multiple sources, shifted focus from outright denial to managed access. Officials seem to have eventually concluded that permitting H200 sales -- while keeping newer architectures like Blackwell and the upcoming Rubin out of reach -- could slow China's push for chip independence without giving away the U.S. lead in performance. The H200 remains one generation behind Nvidia's cutting-edge designs but is fully capable of training modern foundation models and large-scale AI systems. This repositioning allows U.S. regulators to reassert some control over China's access to advanced silicon while capturing financial and political value from every sale. Under the terms of the new export framework, each H200 must be manufactured by TSMC, shipped to the U.S. for inspection, and then re-exported to China. The 25% duty is collected at the U.S. checkpoint, with the funds directed to federal revenue. Chinese regulators have not publicly responded to the U.S. announcement but are said to have begun internal reviews. According to reporting by The Information, officials from the National Development and Reform Commission and the Ministry of Industry and Information Technology have held meetings with Alibaba, ByteDance, and Tencent to assess their projected demand for H200 GPUs. The companies have been asked to provide use cases and expected unit volumes, with the understanding that the government may impose caps or usage guidelines. Two sources present at those meetings told The Information that regulators are considering import limits tied to domestic procurement. Companies may be required to demonstrate that they are also investing in Chinese accelerators such as Huawei's Ascend or Cambricon's Siyuan series. This model, used previously to guide purchases of data center components and server platforms, allows Beijing to balance near-term hardware needs with its goal of reducing reliance on U.S. suppliers. China has also continued to apply informal pressure to shift buyers toward domestic chips. In August, Chinese regulators issued guidance to steer state-backed entities and infrastructure projects away from Nvidia's H20, resulting in widespread cancellations of contracts. The H200 presents a different scenario, given its substantial performance advantage, but officials are expected to apply similar discretion in determining which sectors and use cases are eligible. SuperCloud, a domestic cloud services provider, confirmed that it expects major Chinese companies to proceed with H200 purchases if permitted, though in a subdued fashion. "The training of leading Chinese AI models still relies on Nvidia cards," said Zhang Yuchun, a general manager at SuperCloud, when speaking to Reuters. "I expect the leading Chinese tech companies to buy a lot although in a low key manner." Nvidia's ability to meet demand in China will likely be constrained by supply. The company has kept H200 output relatively low as it focused on ramping production of its Blackwell-class B100 and B200 GPUs, as well as preparing for its Rubin successor. Also speaking to Reuters, two sources familiar with Nvidia's supply chain said that H200 manufacturing has been deprioritized in favor of fulfilling high-margin orders from U.S. hyperscalers and sovereign AI programs in allied countries. Chinese firms looking to place orders may therefore find themselves at the back of the queue. Alibaba and ByteDance are both thought to be "keen to place large orders" should Chinese regulators give them the green light to do so. However, the companies are concerned about supply and are said to be actively seeking clarity from Nvidia on this. If all this goes ahead, the H200 would reintroduce training-scale compute capacity to Chinese AI developers after a long period of reliance on repurposed hardware and grey-market acquisitions. The chip delivers roughly six times the performance of the H20 and approaches the capabilities of Nvidia's H100, which has been banned from China since late 2022. Unlike most Chinese accelerators, the H200 supports Nvidia's CUDA software ecosystem, simplifying model porting and cluster integration. Ultimately, Nvidia is unlikely to resume large-scale H200 production unless it receives strong approval from both U.S. and Chinese regulators, and equally strong demand from Chinese customers. The chip is already considered a transitional product within Nvidia's roadmap, with Blackwell occupying the top end of the current generation and Rubin expected to extend that lead in 2026. U.S. officials have attached a number of technical and procedural conditions to the H200 export approval. Each unit must be shipped to the U.S. before entering China, creating a traceable logistics trail that allows U.S. Customs and Commerce Department inspectors to verify compliance. Nvidia has also introduced optional location-verification software that can confirm whether a chip is operating in an authorized geography. The system uses a combination of secure telemetry and latency-based network checks to determine the approximate location of a GPU within a customer's infrastructure. While not mandatory -- at least not yet -- the feature has been privately demonstrated as a tool for audit and compliance. Nvidia has framed the technology as a data center management solution rather than a surveillance system, and the company has emphasized that it cannot remotely deactivate or control chips in the field. Nonetheless, the software has raised concerns in Beijing, with the Cyberspace Administration of China questioning whether the technology constitutes a backdoor or allows external access to sensitive operations. Nvidia has stated that the system, which will first be made available on Blackwell chips, cannot be used for eavesdropping and does not transmit any user data to third parties. It remains to be seen whether Chinese buyers will enable the feature or attempt to route around it using intermediaries. The compliance measures reflect a broader concern that export controls, while useful on paper, have proven difficult to enforce. We've seen several examples of banned Nvidia GPUs like the A100 and H100 appearing in the likes of Chinese university research and start-up product documentation since their respective bans. Many of these were likely acquired through grey-market channels or indirect resellers in third countries. The U.S. Justice Department has already indicted several individuals involved in smuggling high-performance Nvidia chips to China in violation of export rules. Cases are ongoing in multiple districts, and officials have signaled that enforcement will intensify as more tracking capabilities become available. The approval of H200 exports arguably represents a concession rather than any long-term structural change in U.S. policy. The Biden and Trump administrations have consistently maintained that the U.S. must retain leadership in AI hardware and semiconductor manufacturing. The H200, while advanced, is no longer Nvidia's leading product, and allowing access to it gives Washington a tool to slow China's push for independence without giving up the top tier of its technology stack. From Beijing's perspective, the decision provides short-term relief. AI developers can resume training at scale using supported hardware and familiar toolchains, but the long-term imperative remains unchanged. China continues to invest in domestic foundries, chip design houses, and packaging capacity. Huawei is expanding its Ascend production targets, and other firms are attempting to design new architectures that bypass the limitations of restricted U.S. IP. The H200 will be welcomed by those who can access it, but the approval comes with strings attached and no guarantee of duration. Chinese firms must navigate what could be a complex approvals process, limited supply, and reputational risk. Nvidia, meanwhile, must manage Washington's expectations while preventing its technology from slipping beyond authorized use. The success or failure of this arrangement may determine how future export rules are written. If H200 exports proceed smoothly, it could serve as a model for calibrated engagement, but if compliance breaks down or political conditions shift, the window may close just as quickly as it opened.

[5]

Trump: Nvidia Can Sell H200 AI Chips to China, But US Will Get a 25% Cut

President Trump and Nvidia CEO Jensen Huang (Credit: Andrew Harnik via Getty Images) The US government has approved the sale of Nvidia's H200 AI graphics chip systems to China, with certain stipulations. "I have informed President Xi, of China, that the United States will allow NVIDIA to ship its H200 products to approved customers in China, and other Countries, under conditions that allow for continued strong National Security," President Trump wrote on Truth Social. According to Trump, the US will get a 25% cut of sales to "support American Jobs, strengthen U.S. Manufacturing, and benefit American Taxpayers," according to Trump, who notes that Nvidia's Blackwell and Rubin chips are not part of the deal. "The Department of Commerce is finalizing the details, and the same approach will apply to AMD, Intel, and other GREAT American Companies," Trump added. In August, AMD and Nvidia agreed to give the US a 15% revenue slice of the companies' AI chip sales to China. A few weeks later, the US took a 10% stake in Intel. Chinese access to high-end GPUs, AI accelerators, and chip fabrication machines has been a key sticking point in trade negotiations between the US and China. On-again, off-again tariffs have made the situation inconsistent at best and led to an increase in smuggling operations. The H200 is based on Nvidia's previous-generation Hopper design, which is built on a 4nm process node and has access to 141GB of HBM3E memory. CEO Jensen Huang might have joked that no one would give Hopper away once Blackwell comes out, but the H200 is still much faster than Chinese-produced hardware -- as much as double the speed, according to TechPowerUp -- and provides intimate access to the CUDA ecosystem, which in turn gives access to Nvidia's AI design and development tools. That said, Chinese authorities have encouraged Chinese companies to utilize domestic suppliers for their chips, with a government mandate to use at least 50% for inferencing workloads. In July, the Cyberspace Administration of China also flagged Nvidia's less-powerful H20 AI GPU as a potential spying risk, after Nvidia secured White House approval to sell that product in China. However, when China previously attempted to force DeekSeek developers to use Huawei hardware for training instead of Nvidia GPUs, they ultimately reverted to Nvidia hardware because the results weren't positive, the Financial Times reported in August. As much as China would like to strengthen its own supply chain and compete directly with US firms, it's not there yet. For now, Nvidia GPUs like Blackwell and even last-generation H200 Hopper designs are the best available for GPU training, and in many cases, inferencing too. We'll have to see how interested Beijing is in buying these chips, but Nvidia will no doubt make plenty of money from the deal, even if it's giving 25% of revenue to the US government.

[6]

Letting Nvidia sell H200s to China won't slow its AI push

US export controls on AI accelerators have only succeeded in forcing China to develop its own tech Half a decade of US trade policy aimed at denying China access to America's most potent semiconductor tech has only served to spur China to develop homegrown alternatives. The Trump administration's decision on Monday to reverse course and allow the sale of Nvidia's H200 - still one of the GPU giant's most potent AI chips - to Chinese customers, in exchange for a 25 percent cut of revenue from sales, is unlikely to change that. That ship has already sailed, and Beijing is charting a course toward technological independence. As evidence of this, on Tuesday the Financial Times reported that the Chinese government planned to restrict access to imported H200s. Chinese leaders have already been moving in this direction for months. After the Trump administration reversed a sales ban on Nvidia's made-for-China H20 accelerators, Beijing accused the chipmaker of conspiring with Uncle Sam to plant backdoors in its chips. Nvidia has vehemently denied the insinuation. In September, officials in Beijing reportedly ordered the nation's top tech companies to suspend testing and cancel orders of Nvidia's accelerators and pressured them to pursue homegrown alternatives instead. Those efforts have faced challenges. Nvidia's technical superiority has led to market dominance among developers of AI models, including those in China. Following the success of DeepSeek R1 earlier this year, the Chinese AI darling reportedly faced pressure to train its next model using Huawei-designed accelerators. However, unstable chips, glacially slow interconnects, and a dodgy software stack ultimately derailed the effort, and DeepSeek has reportedly re-tasked Huawei's Ascend accelerators for inferencing workloads. Necessity, however, is the mother of all invention. Chinese AI accelerators are therefore already improving rapidly. Earlier this year, Huawei revealed its CloudMatrix 384 rack systems, which on paper boast 60 percent higher performance for dense 16-bit floating point operations and deliver roughly twice the bandwidth and 3.5x the HBM of Nvidia's GB200 NVL72 rack systems. Individually, the Ascend 910C NPUs at the heart of the Huawei system only deliver about 75 percent of the FP16/BF16 performance of an Nvidia H200 and two-thirds the memory bandwidth. But Huawei doesn't need the fastest accelerator to compete with Nvidia, just more chips and power. As the name suggests, Huawei's CloudMatrix systems stitch 384 of the Ascend accelerators together into a single high-performance system. As we've previously discussed, the machine comes with a compromise. While it might be faster than Nvidia's GB200 NVL72 racks, analysts estimate it also consumes three times as much energy. Huawei isn't the only one that's embraced this approach. In November, Chinese search giant Baidu unveiled two new AI accelerators designed to drive down inference costs and speed model training. Baidu's inference-optimized Tianchi256 is expected to arrive early next year with 256 of its in-house M100 accelerators. A larger Tianchi512 with double the accelerators - almost certainly two Tianchi256 systems stitched together - is expected before 2027. Observers believe Baidu's more powerful M300 accelerators will arrive in 2027. These chips are designed to support multi-trillion-parameter model training runs, which have become increasingly common over the past year. We don't yet know how these chips compare to Nvidia's, but it may not matter in the end. If Beijing doesn't want Baidu to use H20s or H200s, they'll use what they've got. Alongside Huawei and Baidu are a slew of other Chinese GPU and XPU vendors, including Biren, Cambricon Technologies, and MetaX. According to the market watchers at TrendForce, Cambricon's next-gen chips will reportedly challenge Nvidia's H100s. For reference, the H200 is just an HBM3e-boosted H100 with more memory. While US efforts may have succeeded in hindering the Middle Kingdom's technological advancement in the short term, they've come at big cost: China is no longer dependent on Western technologies. There's actually an argument to be made that US trade policy has only managed to make Chinese developers more ambitious and clever, because most of today's top open-weight models are from Chinese AI labs. Because the performance caps on AI exports weren't indexed, it was only a matter of time before Huawei or someone else managed to build a more compelling chip than Nvidia or AMD were allowed to sell into China. The Trump administration's policy reversal therefore compounds the failure of past initiatives. As our sibling site The Next Platform pointed out last year, this isn't even the first time the US has made this mistake. As you may recall, in 2010, China became one of the first nations to field a supercomputer accelerated by Nvidia GPUs. The Tianhe-1A catapulted the nation to the peak of the Top500 ranking of publicly known supers. This, understandably, caught the attention of the US and the Department of Energy, which replicated this strategy with the Titan supercomputer two years later. It wasn't long after that the US began cracking down on the export of high-end accelerators to China. In 2015, the US Commerce Department moved to block Intel from selling its Xeon Phi accelerators in China. Unsurprisingly, this did little to dissuade the Chinese, and in 2017, the Tianhe-2A made its debut bearing a homegrown accelerator called the Matrix-2000. Today, the Middle Kingdom's main focus is meeting its own demand, but China's economic policy demands exports of technology and expertise to the world. Leaders from several US tech companies - including Nvidia, AMD, OpenAI, Microsoft, and CoreWeave - have previously warned that by making it more difficult for the rest of the world to buy their chips, the US government was handing the AI arms race to China. Nvidia therefore welcomed the Trump administration's policy change. "We applaud President Trump's decision to allow America's chip industry to compete," the company told The Register in an email. "Offering H200 to approved commercial customers, vetted by the Department of Commerce, strikes a thoughtful balance that is great for America." ®

[7]

Nvidia Set to Win US Approval to Export H200 AI Chips to China

The Trump administration is poised to allow Nvidia Corp. to sell its H200 artificial intelligence chip to China, according to people familiar with the matter, a move that would mark a major lobbying win for the world's most valuable company and potentially let it regain billions of dollars of business lost in a key global market. The decision caps weeks of deliberations by President Donald Trump and his advisers about whether to grant permission to ship the H200 to China. Nvidia Chief Executive Officer Jensen Huang met privately with Trump in Washington last week to discuss export controls, though neither the White House nor the company shared details on their conversation.

[8]

China set to limit access to Nvidia's H200 chips despite Trump export approval

Beijing is set to limit access to Nvidia's advanced H200 chips despite Donald Trump's decision to allow the export of the technology to China as it pushes to achieve self-sufficiency in semiconductor production. According to two people with knowledge of the matter, regulators in Beijing have been discussing ways to permit limited access to the H200, Nvidia's second-best generation of artificial intelligence chips. Buyers would probably be required to go through an approval process, the people said, submitting requests to purchase the chips and explaining why domestic providers were unable to meet their needs. The people added that no final decision had been made yet. Trump on Monday said in a Truth Social post that he had told Chinese President Xi Jinping that the US would allow Nvidia "to ship its H200 products to approved customers in China . . . under conditions that allow for continued strong National Security. President Xi responded positively!" Trump added that "$25% (sic) will be paid to the United States of America". It was unclear how such a mechanism would work. A previous deal to let Nvidia sell its less advanced H20 chip if it gave the government 15 per cent of the revenues has not materialised because the company and the Trump administration have not come up with a legally viable payment mechanism. Shipments to China of Nvidia's H200 and other advanced chips crucial to the development of AI were banned under the Biden administration over concerns that they might be used in military applications. Nvidia chief executive Jensen Huang has been lobbying for the ban to be lifted. Supporters, including White House AI tsar David Sacks, contend that allowing exports would help America by making Beijing reliant on US technology. But critics say the move will give China a big boost. China has used the ban to push domestic chipmakers to make products to compete with Nvidia. Moves include stepping up customs checks of chip imports and offering energy subsidies to data centres using domestic chips. The two regulators in charge of Beijing's years-long semiconductor independence campaign -- the National Development and Reform Commission and the Ministry of Industry and Information Technology -- could apply other measures to ensure the competitiveness of domestic chips, the people said, including banning China's public sector from buying the H200. The return of Nvidia's advanced chips would be welcomed by tech giants such as Alibaba, ByteDance and Tencent, which have been using more Chinese chips for some basic AI functions but still prefer Nvidia's products because of their higher performance and easier maintenance. Many of them are training their AI models abroad to access Nvidia chips banned at home. While Trump has signalled his approval for the export of Nvidia's advanced chips to China, he faces some opposition in Congress. A bipartisan group of senators has introduced legislation that would prevent the administration from approving exports of chips, including the H200, to Beijing for 30 months. But the prospects for the legislation are unclear given that few Republicans -- including many who called for tougher export controls during the Biden administration -- have publicly criticised Trump over the H200 decision. While the president previously allowed Nvidia to sell the H20 to China, Beijing has restricted tech companies' access to the chip, saying its performance was not significantly better than Chinese alternatives. The NDRC and MIIT did not immediately respond to requests for comment.

[9]

White House U-turn on Nvidia H200 AI accelerator exports down to Huawei's powerful new Ascend chips, report claims -- U.S. committed to 'dominance of the American tech stack'

The U.S. can now export Nvidia's H200 AI accelerator to China, with a 25% fee attached. However, following the authorization of the chips, a new report suggests that the decision was made to ensure American tech dominance globally. Reportedly, a major part of the decision is Huawei's recent advancements with its CloudMatrix 384 and Ascend 910C systems, which are on par with both the H200 and Nvidia's GB200 NVL72, a new Bloomberg report suggests. This decision would enable China to continue to access Nvidia's CUDA-based AI accelerators, as many AI systems still rely on that particular software stack. While China is attempting to standardize an instruction set of its own, the open-source CANN, it has been noted that Nvidia chips are preferable for companies such as Deepseek for training advanced AI models. According to sources speaking to Bloomberg, multiple scenarios were considered, including flooding the market to "overwhelm" Huawei, to exporting no AI accelerators, which would mark a dramatic shift, if the previously-approved Nvidia H20 (a cut-down H200) were to be affected. Ultimately, the decision rests somewhere in the middle. China won't get access to Nvidia's latest Blackwell architectures, but it will retain access to the full-fat H200. The White House likely hopes that this move keeps the latest Nvidia chips, while also keeping the country locked into Nvidia's carefully crafted CUDA-shaped moat. "The Trump administration is committed to ensuring the dominance of the American tech stack - without compromising on national security", said White House spokesman Kush Desai, in a statement to Bloomberg. White House officials are reported to have reviewed the performance of Huawei's AI accelerator ecosystem, in particular, the CloudMatrix 384 system, which utilizes 384 Ascend 910C chips. The CloudMatrix 384 is positioned directly against Nvidia's (export-controlled) GB200 platform, but with obvious tradeoffs in performance and efficiency. While Bloomberg notes recent rumblings that Huawei is preparing to up its 910C chip production to 600,000 units next year, the report claims U.S. officials concluded "that Huawei would be capable in 2026 of producing a few million of its Ascend 910C accelerators," according to the insider. The AI race is now bound by pure performance, and the Trump Administration clearly hopes that retaining its architectural advantage by restricting Blackwell will keep Western frontier AI models at the forefront of the industry. Just last week, Nvidia CEO Jensen Huang commented that he would be uncertain whether or not Chinese companies would even end up purchasing the H200. Huang has long since been a vocal detractor against export controls of AI GPUs, as Nvidia wrote off $5.5 billion in AI chips in April 2025. Whether or not the availability of H200 systems on the Chinese market will be enough to recover the shortfall remains to be seen.

[10]

Trump blessing Nvidia AI chip sales to China gets chilly reception from GOP

The agreement, which Trump announced in a Truth Social post Monday evening, would allow Nvidia to sell its H200 artificial intelligence chips to China on the condition that the U.S. government gets 25% of the sales. The H200 chips aren't Nvidia's most advanced chip, but are more powerful than the company's H20s, which was previously developed specifically for the China market. The White House, over the summer, gave approval for Nvidia and Advanced Micro Devices to sell their less-powerful chips to China in exchange for 15% of sales revenue. Beijing reportedly told companies not to buy those chips. Chinese President Xi Jinping "responded positively" to the latest proposal, Trump wrote in the social media post. CNBC has reached out to the Chinese embassy in Washington, D.C., for comment. Experts warn that giving China access to the better chips will shrink America's hardware advantage and help Chinese developers vastly improve their AI models and other tech. Some of Trump's Republican allies appear to agree. "Alarm bells go off in my head here," Sen. Lindsey Graham, R-S.C., told CNBC on Tuesday when asked about the chip sales agreement. "I don't mind doing normal business with China. But if you can prove to me this will accelerate their military capability, I'll oppose it," Graham said. "My general view on this is that China's progress on AI is almost entirely parasitic on our technology, in particular on our hardware," Sen. Josh Hawley, R-Mo., said on Capitol Hill earlier Tuesday. "So I don't want China to win the AI race. I want to win the AI race," Hawley said. "But if we want to beat China, I think we need to constrain their ability to leverage our own technology, and I think we would want to reduce their access to our hardware, not increase it." Hawley did not directly criticize Trump, and noted that the president is privy to more information about the situation than he is. "So I think he deserves some deference here," he said. "But I think in the general matter I would want to constrain American hardware going to China," he added. The U.S. Select Committee on China, a Republican-led panel formed to focus on the "threat posed by the Chinese Communist Party," echoed Hawley's concerns. "Right now, China is far behind the United States in chips that power the AI race. Because the H200s are far better than what China can produce domestically, both in capability and scale, @nvidia selling these chips to China could help it catch up to America in total compute," the committee said in a statement on X. Beijing will use the H200s, which boast significantly more processing power and memory bandwidth than China's top chips, "to strengthen its military capabilities and totalitarian surveillance," the panel's statement said. "Finally, Nvidia should be under no illusions - China will rip off its technology, mass produce it themselves, and seek to end Nvidia as a competitor," the panel said. "That is China's playbook and it is using it in every critical industry." Not all Republicans are piling on. "I don't have a real problem with providing them some [chips]," Sen. Thom Tillis, R-N.C., told CNBC. "But we've got to know where it is, how they're using it, those sorts of things." But there is vocal support among both parties for slowing China's ability to obtain the world's best chips. Sen. Pete Ricketts, R-Neb., last week introduced bipartisan legislation that would direct the Trump administration to deny export licenses for advanced chips to China and other foreign adversaries for at least 30 months. "The best AI chips are made by American companies. Denying Beijing access to these AI chips is essential to our national security," Ricketts said in a press release unveiling the bill. Sen. Tom Cotton, R-Ark., one of the bill's cosponsors, said, "It's crucial that we protect American AI innovation from Communist China to win the AI race."

[11]

NVIDIA can now sell its high-end AI chips to 'approved customers in China,' Trump says

NVIDIA is now allowed to sell its second-best H200 processors to China, rather than just the sanction-approved H20 model that China had previously declined to buy, President Trump wrote on Truth Social. The United States will collect a 25 percent tariff on those sales, the Commerce Department confirmed yesterday. Trump said that he informed China's President Xi Jinping of the decision and that he "responded positively." The Commerce Department is finalizing details and the administration will take the same approach with AMD, Intel and other US companies. He added that the administration would "protect National Security," so the latest Blackwell and upcoming Rubin chips are not part of the deal. The 25 percent tariff would be higher than the 15 percent the White House suggested in August. Though the administration won't allow NVIDIA to send its latest high-end chips, it was reportedly concerned that the company would lose business to Huawei if it was completely shut out of China's market, according to Reuters. No details about the number of H200 chips or which companies would be eligible to buy them were released. "Offering H200 to approved commercial customers, vetted by the Department of Commerce, strikes a thoughtful balance that is great for America," NVIDIA said in a statement. The decision is not without controversy, though. Several Democratic US senators called it a "colossal economic and national security failure" that will aid China's industry and military. Republican representative John Mollenaar put it in even starker terms. "NVIDIA should be under no illusions -- China will rip off its technology, mass-produce it themselves and seek to end NVIDIA as a competitor," he said. Despite the current restriction on Blackwell B200 processors, $1 billion worth of those and other high-end NVIDIA chips have made their way to China via black market sales, according to previous reports. That model, along with the H100 and H200, is far more capable than the H20 chip, which was designed to comply with export restrictions for sale to China. NVIDIA has said that the B200 chip is almost ten times faster than the H200 for some jobs, and the H200 is six times faster than the H20. Washington's approval doesn't mean that China will purchase NVIDIA's chips, as Beijing has previously told companies not to use US technology. Huawei is currently the most advanced company in that regard and recently unveiled a three-year plan to catch up with NVIDIA and AMD. However, AI chip experts like Richard Windsor have said NVIDIA's tech is still far ahead of anything that Huawei or other Chinese companies can currently produce.

[12]

Live updates: Trump approves sale of more advanced Nvidia computer chips used in AI to China

President Donald Trump said Monday that he would allow Nvidia to sell an advanced type of computer chip used in the development of artificial intelligence to "approved customers" in China. There have been concerns about allowing advanced computer chips to be sold to China as it could help the country better compete against the U.S. in building out AI capabilities, but there has also been a desire to develop the AI ecosystem with American companies such as chipmaker Nvidia. Nvidia said in a statement that it applauded Trump's decision, saying the choice would support domestic manufacturing and that by allowing the Commerce Department to vet commercial customers it would "strike a thoughtful balance" on economic and national security priorities. But a group of Democratic senators objected to the chip sales.

[13]

Trump's Nvidia Chip Deal Reverses Decades of Technology Restrictions

David E. Sanger has covered the intersection of technology and foreign policy for The Times for four decades, in Asia and in Washington. In the first few months after President Trump returned to the White House, he held firm to an American technology policy that stretches back to the depths of the Cold War. Don't sell your adversaries America's most advanced technology, the thinking went in those early months -- starting with the computing power that has given the United States its edge in space and cyberspace, and in designing nuclear weapons and next-generation fighters. But all that began to change a few months ago. A handful of the nation's richest technology executives and Mr. Trump's own artificial intelligence chief, David Sacks, arrived in Washington with a counterargument: that America's best bet is to suck China and other nations into the "American tech stack," the layer cake of American hardware and software that would making China's users dependent on the most advanced chips in the American arsenal. Quickly that argument focused on the chips designed by Nvidia, now the world's largest company, at least when measured by its $4.48 trillion market capitalization. The company won a huge victory late Monday afternoon, when Mr. Trump declared on his social media account that he was freeing Nvidia to sell its second most powerful chip, known as the H200, to China. The chip gives the Chinese a chance to speed ahead in the neck-and-neck artificial intelligence race. China's own top executives, even the leaders of its most successful A.I. venture, DeepSeek, complain that their progress is limited by a shortage of computing power. Mr. Trump offered little rationale behind the decision, and said nothing about the intense lobbying by Jensen Huang, Nvidia's chief executive and a frequent visitor to the White House. But he did say that in return, 25 percent of all the revenues from the sales would go to the United States. With that announcement, Mr. Trump made clear that decisions once made purely on the basis of national security were now up for sale -- a move of dubious legality, since export licenses cannot be sold under existing federal law. But it also raised the question: If the chips that power the most advanced technology can be sold to the United States' chief technological, military and financial competitor, where is the new line drawn? By the same logic that it is better to have China using American technology, should Washington sell it F-35s? Advanced missiles? And what happens when the Chinese break through the high barrier of producing the chips themselves? At that moment, do they stick with Nvidia's astounding chips, essentially a supercomputer in a tiny box? Or, having received a huge boost from Mr. Trump's decision, do they break out of the tech stack, and turn back to state champions like Huawei, the telecommunications giant that hopes to take on Nvidia, and rely on their own technology, as President Xi Jinping has seemed to suggest? Not surprisingly, on Capitol Hill and beyond, the administration's decision is under new examination and, from many quarters, outright attack. Much as Mr. Trump has upended alliances and the post-World War II order, he is now loosening the stricture of export controls that kept Western technology from its rivals -- first from the Soviets, then from China and an array of other competitors. In an era in which China is producing far more electric cars and solar panels than the United States, dominating in batteries and surging ahead in biotechnology, the design of the most advanced semiconductors is one of America's few sparkling gems, an arena where China has struggled to keep up. To many veterans of the chip wars, Mr. Trump is prioritizing short-term economic gain over long-term U.S. security interests. "This decision is nuts," said Jake Sullivan, who served as national security adviser under President Joseph R. Biden Jr. and designed many of the Biden-era restrictions on chip sales to China. "America and China are competing for leadership on A.I.," Mr. Sullivan said. "China's main problem is they don't have enough advanced computing capability. It makes no sense that President Trump is solving their problem for them by selling them powerful American chips. We are literally handing away our advantage. China's leaders can't believe their luck." Mr. Sacks sees it differently. One of Silicon Valley's most successful tech entrepreneurs, he began arguing in the late spring for what he called a "more nuanced" view. When Mr. Trump agreed to allow Beijing to buy a custom, somewhat dumbed-down Nvidia chip, called the H20, he argued that it was the best way to keep Huawei, China's telecommunications giant and an aspirant to take on Nvidia, from dominating its home market. Mr. Sacks said it was a logical choice. "You just don't want to hand Huawei the entire Chinese market," Mr. Sacks said on Bloomberg television, "when Nvidia is capable of competing for a big slice of it." The idea, he said, was to deprive Huawei of huge revenues from its older, slower chips that it could pour into research and development. "It's a huge subsidy for their R&D," he continued. But the Chinese didn't bite. They refused to buy the H20, saying privately that they were insulted to be offered a chip whose powers were crippled. It may have been a negotiating tactic to get a more advanced chip, called the H200, which Nvidia brought out about a year and a half ago. If so, it worked. Mr. Trump agreed, saying vaguely on social media that it could be shipped "to approved customers in China, and other Countries, under conditions that allow for continued strong National Security." Mr. Trump said nothing about what those conditions would be. But a White House official, who declined to speak on the record about policy decisions, cast the decision as a compromise, splitting the difference between a national security establishment that would ship the Chinese nothing, and Mr. Huang, who they said wanted permission to ship all his products to China. (The company's fastest chip, the one sought by companies seeking to vastly improve their large-scale A.I. offerings and build data centers for high-performance computing, is called the Blackwell. It is still barred for export to China.) Of course, there is the matter of the 25 percent cut for the U.S. government, part of Mr. Trump's argument that he is bringing in cash not only for Nvidia's shareholders but also relieving the burden on American taxpayers. Appealing as that sounds, it creates a situation that appalls most national security traditionalists, who think export controls should be decided according to standards of potential harm to America's advantage, particularly its military edge. Selling that off for short term profit, they argue, is a prescription for trouble. Mr. Sullivan, who is now the Kissinger professor of the practice of statecraft and world order at Harvard's Kennedy School of Government, says it is clear what may happen next. China's leaders "intend to get off of American semiconductors as soon as they can," he said. "So the argument that we can keep them 'addicted' holds no water. They want American chips right now for one simple reason: They are behind in the A.I. race and this will help them catch up while they build their own chip capabilities." It may also create a problem with American allies. One company in the Netherlands, ASML, makes the wildly expensive, precision machinery needed to cut the tiniest of circuits on advanced chips. After lengthy negotiations, the company agreed in the Biden years to cut off China from the most advanced chip-making equipment. But now that it sees the United States profiting from advanced chip sales, it may well question why it should listen to Washington's entreaties about the dangers of giving too much technology to Chinese makers. "It's not reasonable to tell our allies we are going to sell the chips but you can't sell the machines that make those chips," said Rush Doshi, a China expert at Georgetown University and the Council on Foreign Relations. "As a result, it is possible that the allied coordination that supports our most important export controls might be seriously damaged by this decision."

[14]

Trump gives Nvidia the OK to sell advanced AI chips to China

Trump reversed the chip-selling ban in July, but demanded that Nvidia pay 15% of its Chinese revenues to the US government. Beijing then reportedly ordered its tech companies to stop buying Nvidia chips manufactured for use in the Chinese market. "We applaud President Trump's decision to allow America's chip industry to compete to support high paying jobs and manufacturing in America," Nvidia said in a statement provided to BBC News. Mr Huang told the BBC in September that the US needed "to make sure that people can access this technology from all over the world, including China." He has also repeatedly warned that China, which has cultivated a chip production ecosystem of its own, was close behind the US in chip development. Nvidia hailed Trump's announcement on Monday. "Offering H200 to approved commercial customers, vetted by the Department of Commerce, strikes a thoughtful balance that is great for America," Nvidia said in its statement. The companies shares rose slightly on the news. Trump said "$25% [sic] will be paid to the United States of America" in his post. The BBC has reached out to the White House for clarification on the arrangement, which will likely face opposition from national security hawks in Congress. Researchers at Georgetown University's Center for Security and Emerging Technology (CSET) said China's People's Liberation Army is using advanced chips designed by US companies to develop AI-enabled military capabilities. "By making it easier for the Chinese to access these high-quality AI chips, you enable China to more easily use and deploy AI system for military applications," said Cole McFaul, senior research analyst at CSET. "They want to harness advanced chips for battlefield advantage."

[15]

Trump says Nvidia can sell H200s to China

US President Donald Trump has signalled he will allow Nvidia to resume sales of its H200 accelerators to China. "I have informed President Xi, of China, that the United States will allow NVIDIA to ship its H200 products to approved customers in China, and other Countries, under conditions that allow for continued strong National Security," Trump wrote in a Monday post to his social network, Truth Social. "President Xi responded positively!" he added, before stating "$25% will be paid to the United States of America" - a seeming reference to past suggestions that the administration would charge license fees on chip exports to China. Trump's post does not contain any detail about how his proposal will protect the USA's national security, an issue that the Biden administration cited as the main reason for its ban on sales of advanced accelerators to China. "These items and capabilities are used by the PRC to produce advanced military systems including weapons of mass destruction; improve the speed and accuracy of its military decision making, planning, and logistics, as well as of its autonomous military systems; and commit human rights abuses," the Bureau of Industry and Security stated [PDF] in October 2022. The Biden administration did allow export of modest accelerators, notably Nvidia's H20 devices. Trump's post brands that policy as a failure. "The Biden Administration forced our Great Companies to spend BILLIONS OF DOLLARS building 'degraded' products that nobody wanted, a terrible idea that slowed Innovation, and hurt the American Worker. That Era is OVER!" Those remarks appear to ignore the Trump administration's April 2025 decision to ban exports of the H20, which it later reversed. The "nobody wanted" remark is also hard to support, as Nvidia valued lost H20 sales to China at $10.5 billion. The post says this new policy applies only to H200 accelerators - which Nvidia bills as ideal for generative AI and HPC workloads thanks to its inclusion of HBM3 memory - and not Nvidia's more recent Blackwell silicon and forthcoming Rubin hardware. Trump's post concludes by stating: "The Department of Commerce is finalizing the details, and the same approach will apply to AMD, Intel, and other GREAT American Companies." At the time of writing, the Department appears not to have made any public utterance about the matter. Correlation is not causation, but in the hours after Trump's post the price of shares in Nvidia and AMD jumped by over two percent. ®

[16]

Trump Says Nvidia Can Sell the H200 Chip to China

Donald Trump says he's going to allow Nvidia to sell the H200 artificial intelligence chip to China, according to a new post from the president on Truth Social. The move will still bar Nvidia from selling its more advanced Blackwell chips to China, but it's still considered a win for the tech company since the lower quality H20 chip had been sidelined by the Chinese government for supposedly not being powerful enough. Trump wrote Monday that he had informed China's president Xi Jingping that he will allow the sale of H200 chips "under conditions that allow for continued strong National Security." Trump did not explain what those conditions might be, but said Nvidia will pay the U.S. government 25% from sales of the chips to China. Over the summer, Nvidia and AMD agreed to give the U.S. government 15% of revenue from chip sales to China in a bizarre quid pro quo arrangement, according to the Financial Times. Experts noted at the time that no private company had ever entered into such a deal and the legality was questioned. Trump's second term has been filled with extreme actions that often confound experts in a given field. Can presidents just unilaterally declare birthright citizenship null and void? Virtually every constitutional expert says no, but the U.S. Supreme Court has taken up the case, and if members of the conservative-dominated court so choose, they could very well invalidate the 14th Amendment. Trump touted the sale of H200 chips as a win for U.S. workers Monday, though it still needs to be formally finalized by the U.S. Commerce Department, which handles export controls. But federal agencies under Trump aren't exactly in the business of second guessing him these days. "This policy will support American Jobs, strengthen U.S. Manufacturing, and benefit American Taxpayers," wrote Trump. The president went on to claim that President Joe Biden's administration had "forced" U.S companies to spend billions of dollars building "'degraded' products that nobody wanted," which he called a terrible idea that slowed innovation and hurt American workers. Obviously those "degraded" products are created that way to give the U.S. a technological edge, just as his government has supposedly tried to do. "That Era is OVER! We will protect National Security, create American Jobs, and keep America’s lead in AI," wrote Trump. "NVIDIA’s U.S. Customers are already moving forward with their incredible, highly advanced Blackwell chips, and soon, Rubin, neither of which are part of this deal." As Bloomberg notes, the Chinese government urged potential customers to reject the less powerful H20 chips. It wasn't an outright ban, and there's still reportedly demand for the H20 in the country, but it still probably applied some pressure on the U.S. to reexamine the issue if the world's second largest market for chips was unlikely to bite. Nvidia CEO Jensen Huang has been cozying up to Trump during the president's second term, just like virtually every other tech CEO in the country. And it looks like Nvidia's lobbying has really paid off. David Sacks, the so-called AI and crypto czar, also pushed back on security concerns about selling chips to China, according to the New York Times. Sacks and Huang have reportedly argued that selling the more advanced chips to China will make the country more dependent on U.S. tech. It remains to be seen what will happen to the SAFE CHIPS Act, a bipartisan bill unveiled last week to restrict any efforts by Trump to loosen the export restrictions, according to Reuters. The bill is sponsored by Republican Senator Pete Ricketts and Democrat Chris Coons. Opposing Chinese tech influence seems to be the only thing that most elected Republicans and Democrats can agree on, though it often doesn't matter what Congress says when Trump wants something. For example, the TikTok ban was bipartisan legislation that even Trump supported until he pulled a 180 in 2024. Trump has unilaterally extended enforcement of the ban several times while a deal is worked out. The next deadline is Dec. 16. "My Administration will always put America FIRST," Trump wrote Monday. "The Department of Commerce is finalizing the details, and the same approach will apply to AMD, Intel, and other GREAT American Companies. MAKE AMERICA GREAT AGAIN!"

[17]

Nvidia can sell the more advanced H200 AI chip to China -- but will Beijing want them?

"This makes domestic self-sufficiency the only viable long-term strategy for Beijing," Shah said. Trump said Chinese President Xi Jinping "responded positively" to the approval of H200 exports to China. And while China held off on H20 purchases, there are reasons the country's companies could want to purchase the H200 product. The H200 is far more advanced than the H20, which could be tempting for China. Meanwhile, Alibaba CEO Eddie Wu said there were supply shortages across the entire semiconductor supply chain. "I think there will be demand for H200 as it is a better chip than H20 and there is a shortage of chips in China," Ben Barringer, head of technology research at Quilter Cheviot, told CNBC on Tuesday. "The big Chinese tech companies will want to use Nvidia and AMD if possible." China's semiconductor industry remains behind that of the U.S. and elsewhere. In particular, China struggles to manufacture the most advanced chips, putting it behind the world's largest chipmaker Taiwan Semiconductor Manufacturing Co. China is also restricted from buying chipmaking tools that could advance its capabilities. Meanwhile, domestic alternatives to Nvidia remain behind in performance. This makes Nvidia's H200 an attractive proposition. "What is not in China's favor right now is the supply -- ramping up advanced AI chips in terms of performance or yields still remains elusive, making it a less economically efficient push," Shah said. "The gap between Nvidia, AMD and Huawei and others is still quite wide when it comes to performance and power efficiency." Even if Chinese firms begin buying Nvidia's product, Beijing's longer-term trajectory of self-sufficiency will continue. "In the long run, for the next five to ten years, China's 'self-reliance' strategy for its own tech and innovation won't change. Jensen Huang of Nvidia has a good time window to sell H200 but it won't be ... forever," George Chen, partner and co-chair, digital practice, The Asia Group, told CNBC on Tuesday. "Xi will not be foolish that today Trump can sell H200, and then China just totally relies on U.S. chips. Huawei, Alibaba and other Chinese tech developers remain strategically important for China's marathon to win the AI race and this will be a long race," he added.

[18]

Trump approves sale of more advanced Nvidia computer chips used in AI to China

WASHINGTON (AP) -- President Donald Trump said Monday that he would allow Nvidia to sell an advanced type of computer chip used in the development of artificial intelligence to "approved customers" in China. There have been concerns about allowing advanced computer chips to be sold to China as it could help the country better compete against the U.S. in building out AI capabilities, but there has also been a desire to develop the AI ecosystem with American companies such as chipmaker Nvidia. The chip, known as the H200, is not Nvidia's most advanced product. Those chips, called Blackwell and the upcoming Rubin, were not part of what Trump approved. Trump said on social media that he had informed China's leader Xi Jinping about his decision and "President Xi responded positively!" "This policy will support American Jobs, strengthen U.S. Manufacturing, and benefit American Taxpayers," Trump said in his post. Trump said the Commerce Department was "finalizing the details" for other chipmakers such as AMD and Intel to sell their technologies abroad. The approval of the licenses to sell Nvidia H200 chips reflects the increasing power and close relationship that the company's founder and CEO, Jensen Huang, enjoys with the president. But there have been concerns that China will find ways to use the chips to develop its own AI products in ways that could pose national security risks for the U.S., a primary concern of the Biden administration that sought to limit exports. Nvidia has a market cap of $4.5 trillion and Trump's announcement appeared to drive the stock slightly higher in after hours trading.

[19]

Trump approves Nvidia H200 exports to China, with 25% fee attached -- report suggests that companies will have to follow strict Beijing rules to import foreign chip, AMD and Intel to benefit from policy shift

U.S. authorises shipments of Hopper-class AI accelerators to "approved" customers. The U.S. will allow Nvidia to export its H200 chips to "approved customers" in China, President Donald Trump announced on Monday, setting off a fresh round of political and regulatory manoeuvring on both sides of the Pacific. The decision authorises shipments of Nvidia's second-tier Hopper-generation chip in exchange for a 25% fee collected when parts arrive in the United States for security review before re-export. The Commerce Department is finalising the terms of the arrangement, which Trump said would also apply to AMD and Intel. H200 sits below Nvidia's latest Blackwell architecture yet remains far ahead of any processor China can legally import today. It is roughly six times more powerful than the H20, the downgraded model Nvidia specifically created to comply with earlier export controls. China restricted tech companies from buying the H20, arguing its performance gains over domestic alternatives were too modest to justify continued reliance on U.S. parts. Trump's announcement briefly lifted Nvidia's share price, but the company's prospects in China now potentially rest on decisions in Beijing as much as in Washington. The Financial Times reports that Chinese regulators have been discussing ways to allow only limited access to H200 -- including an approval process where buyers must explain why domestic chips cannot meet their needs -- and could bar the public sector from purchasing Nvidia hardware altogether. At the time of writing, no official confirmation of this has been released by the Chinese government. The provisional opening nonetheless matters to China's largest cloud providers. Alibaba, Tencent, and ByteDance have adopted domestic accelerators for some inference workloads but continue to prefer Nvidia products for training and maintaining large models, often sending jobs overseas where access to H100-class compute remains unrestricted. If allowed, H200 purchases would ease those workarounds, though companies would still have to navigate both governments' approval systems. Following the announcement, a group of senators described the move as a "colossal economic and national security failure", arguing that H200's performance would give Chinese AI firms a meaningful lift. The bipartisan "SAFE CHIPS Act" introduced last week seeks to prevent the administration from approving exports of advanced chips, including H200, for 30 months. The announcement also coincided with the Justice Department's announcement of "Operation Gatekeeper", which alleges a smuggling network routed Nvidia parts into China and Hong Kong despite existing controls, piling yet more pressure on Washington to create a regulated channel for hardware that continues to leak across borders. Whether H200 reaches China at scale now depends on two competing gatekeepers. Washington is attempting to shape the market through controlled exports and taxes, while Beijing reportedly weighs measures that would keep foreign accelerators available only where domestic suppliers cannot yet compete.

[20]

How Much Could China Gain From Access to Powerful Nvidia Chips?

President Trump's announcement that the American chip maker Nvidia would be able to sell semiconductors to China appeared to roll back years of policies aimed at blocking the country's access to advanced technologies. At stake, officials in Washington have argued, is China's ability to use American technology to gain military and economic advantages, particularly through artificial intelligence. By cutting China off, lawmakers wanted to preserve the lead the United States has achieved in A.I. and slow China's efforts to catch up. On the other side, Nvidia's chief executive, Jensen Huang, spent months trying to persuade Mr. Trump to reverse course. He argued that limiting China's access to American technology has only spurred Chinese companies to improve faster. Mr. Trump's decision on Monday to allow Nvidia to sell its second-most-powerful chip, known as the H200, to Chinese commercial customers vetted by the U.S. Commerce Department strikes "a thoughtful balance that is great for America," an Nvidia spokesman said. The impact of Mr. Trump's decision is unclear. But the Chinese government has already spent billions in effort to become an A.I. superpower. The country's chip makers are racing to make advanced chips on their own, and Chinese A.I. companies have become more efficient at using the chips they have access to. "The push for domestic production will continue," said Jiang Tianjiao, an associate professor at Fudan University. "Beijing's strategy is clear." Investor bets that a Chinese company could soon compete with Nvidia have driven huge gains in the country's tech stocks this year. Shares of the partly state-backed chip designer Cambricon have risen more than 120 percent, compared with a year ago. Last week, Moore Threads, a start-up chip maker founded by a former Nvidia executive, went public in one of the Shanghai Star Market's largest offerings of the year. But even Huawei, the telecommunications giant leading China's race to compete with Nvidia, remains at least two years behind the Silicon Valley company, experts said. Chinese chips still lag behind Nvidia's in performance, and the companies face major constraints on their output. Chinese chips can produce, at most, 2 percent as much computing power as foreign rivals, said Tim Fist, a senior adjunct fellow at the Center for a New American Security, a think tank. Computing power is crucial in A.I. development. Advanced A.I. systems are powered by hundreds of thousands of chips known as GPUs, which companies pack into buildings known as data centers to create giant supercomputers that gobble electricity. OpenAI, the A.I. start-up that created ChatGPT, is planning to build five such facilities in the United States that would together consume more electricity than the three million households in Massachusetts. Chinese demand for cutting edge chips is also high. The biggest tech companies, including Alibaba, Tencent and ByteDance, TikTok's parent company, have poured money into A.I. efforts and infrastructure like data centers. For Chinese companies, "gaining access to higher-end chips like the H200 does indeed come at a critical moment," said Frank Kung, an analyst at TrendForce, a market research firm in Taipei, Taiwan. Some officials who worked for former President Joseph R. Biden Jr. have warned that access to the Nvidia chips could help China's A.I. companies buy time while the country's chip makers improve the supply and performance of their own offerings. Mr. Trump's decision to allow Nvidia to sell advanced chips in China has also renewed a debate about how much future advancements in A.I. technology will depend on vast stockpiles of powerful chips. Washington's constraints have pushed Chinese companies to be more efficient. This year, the Chinese start-up DeepSeek rocked the tech industry with its claim that it had created powerful A.I. systems that required fewer chips and were significantly cheaper to build than those of better-funded American rivals. The less powerful China-made chips require more electricity. But industrial electricity costs in China are far lower than in the United States, said Lian Jye Su, a chief analyst at Omdia, a tech research firm. The abundant cheap power has helped companies create sophisticated A.I. systems despite less powerful chips, Mr. Su said. The Chinese government has pushed companies there to buy domestic chips and warned Nvidia's chips may carry risks. In July, China's internet regulator said that it had summoned Nvidia to explain security risks associated with one of its chips developed for sale in China, saying the chips could be shut down remotely or used to track a user's location. Many Chinese tech companies are already using a mix of domestic and foreign chips, said Paul Triolo, a partner at DGA-Albright Stonebridge Group. "Just because some Chinese companies will choose to purchase some number of H200 does not mean domestic development of advanced A.I. hardware will stop," he added. Mr. Trump's willingness to widen China's access to advanced American chips has drawn condemnation from members of Congress and former Biden administration officials. This summer, Mr. Trump proposed the idea of the government taking a cut of A.I. chip sales to China. On Monday, he reiterated that, writing that 25 percent "will be paid to the United States of America." Mr. Trump's transactional approach to export controls on chips has led to some paradoxical outcomes. Hours before he said the Commerce Department was finalizing the details to allow sales of the H200 in China, the Department of Justice announced it had detained two people for selling those chips to the country. Xinyun Wu contributed reporting from Taipei.

[21]

What to know about Nvidia's Chinese competitors as Trump opens up the market

The big picture: Nvidia warns that blocking its sales has accelerated China's domestic chipmaking push -- creating new global rivals and threatening the U.S. lead in the AI race. Catch up quick: The U.S. has approved Nvidia's No. 2 chip, the H200, for sale in China, with Washington taking a 25% cut of future sales, the president said on Monday. * The H200 is a significant upgrade from Nvidia's H20, the chip previously allowed under export rules. * Nvidia's latest-generation Blackwell chips remain barred from China. The company says Blackwell offers 30× the performance of the H200, per the nonpartisan think tank Institute for Progress. Huawei chips Huawei is Nvidia's biggest competitor in China. * It produces what's believed to be the country's most advanced chip, the Ascend 910C, which lags far behind the H200 in compute and memory bandwidth, the IFP says. * But in the context of what's legally available, Huawei's older 910B more than doubles the total processing performance of Nvidia's restricted H20, multiple outlets reported from a July Bernstein Research report. * Huawei has rapidly built out clustered AI systems, and U.S. officials now believe these systems can rival Nvidia's at the platform level. Baidu, other competitors China tech giant Baidu has also emerged as a major player. * The company owns a majority stake in Kunlunxin, whose Kunlun AI chip secured about $139 million from China Mobile. * Baidu recently announced a five-year roadmap for its next-generation Kunlun chips, beginning with the M100 in 2026 and M300 in 2027, CNBC reported. * Baidu's stock is up 50% year-to-date. Cambricon Technologies shares have surged nearly 500% in the last year, surging in August when Beijing urged local companies to avoid using Nvidia's H20 processors, particularly for government-related purposes, Bloomberg reported. * Cambricon plans to triple domestic AI chip production in 2026, according to Bloomberg. E-commerce giant Alibaba is also developing its next-generation AI chip, multiple outlets reported in August. State of play Nvidia is still the clear leader of the pack in terms of chip power. Yes, but: Trump's decision to allow H200 sales reportedly stems from a belief that Huawei already offers AI systems with comparable performance to Nvidia's, sources told Bloomberg this week. * "Huawei can compete far more closely with Nvidia than the US has acknowledged," the sources reportedly told Bloomberg. * White House officials evaluated a Huawei system built around its newer Ascend chips and concluded its clustered platform performed on par with Nvidia's NVL72 -- a system built using Nvidia's top-of-the-line Blackwell GPUs, Bloomberg reported. Meanwhile, a thriving black market for Nvidia chips in China has been reported for months. * This week The Information reported that China has already obtained Blackwell-generation chips, citing undisclosed sources. What we're watching: Will demand for Nvidia's H200s materialize? * China is pushing aggressively to build a self-sufficient chip supply chain. * Regulators are reportedly limiting access to H200s, requiring buyers to justify why domestic chips aren't adequate, the FT reported. Our thought bubble, via Axios' chief technology correspondent Ina Fried: There is demand in China, but the issue right now is access. * Chinese companies would buy H200s if both governments allowed it. The bottom line: Nvidia remains the global performance leader, but China's domestic competitors -- especially Huawei -- are making rapid gains.

[22]

Trump accused of 'colossal economic and national security failure' for allowing Nvidia to sell powerful AI chips to China - business live

Introduction: Trump clears way for Nvidia to sell powerful AI chips to China Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy. Donald Trump has been accused of a "colossal economic and national security failure" for allowing Nvidia to export its H200 artificial intelligence chip to China. The US president announced last night he has granted Nvidia permission to ship H200 chips to China in exchange for a 25% surcharge for the US, a move that could allow the world's most valuable company to win back billions of dollars in lost business. Trump posted on his Truth Social site: "I have informed President Xi, of China, that the United States will allow NVIDIA to ship its H200 products to approved customers in China, and other Countries, under conditions that allow for continued strong National Security. President Xi responded positively!" They, and other Democratic senators, urged Trump to reverse the decision saying: "The Trump administration's announcement that it will allow the export of advanced H200 AI chips to China is a colossal economic and national security failure. The H200s are vastly more capable than anything China can make and gifting them to Beijing would squander America's primary advantage in the AI race. "Access to these chips would give China's military transformational technology to make its weapons more lethal, carry out more effective cyberattacks against American businesses and critical infrastructure, and strengthen their economic and manufacturing sector. Chinese AI giant DeepSeek said as recently as last week that the lack of access to advanced American-designed AI chips is the single biggest impediment to its ability to compete with U.S. AI companies. With this decision, President Trump is poised to remove that barrier. "Senate Democrats and Republicans both know that the 21st century will be defined by whether the leading AI systems are built on values of free societies and free markets or the repressive, authoritarian values of the Chinese Communist Party. The Trump administration clearly doesn't grasp the urgency of this contest. President Trump must reverse course and recommit to preserving American dominance in AI." In October Nvidia CEO Jensen Huang said his company has gone from having 95% of the Chinese market to having 0%, and called bans on its sales to China a "strategic mistake". Selling H200 chips to China - the world's second-largest economy - could mean a windfall worth billions of dollars for Nvidia, which is already valued at $4.5tn.

[23]

Nvidia boss Jensen Huang steers Trump, Congress against AI chip limits and state-level AI rules