China Approves First Batch of Nvidia H200 AI Chips During Jensen Huang's Strategic Visit

18 Sources

18 Sources

[1]

Nvidia CEO Jensen Huang to visit China as company prepares to start H200 shipments to the country -- plans to meet with state officials unclear despite Beijing curbs on the chip

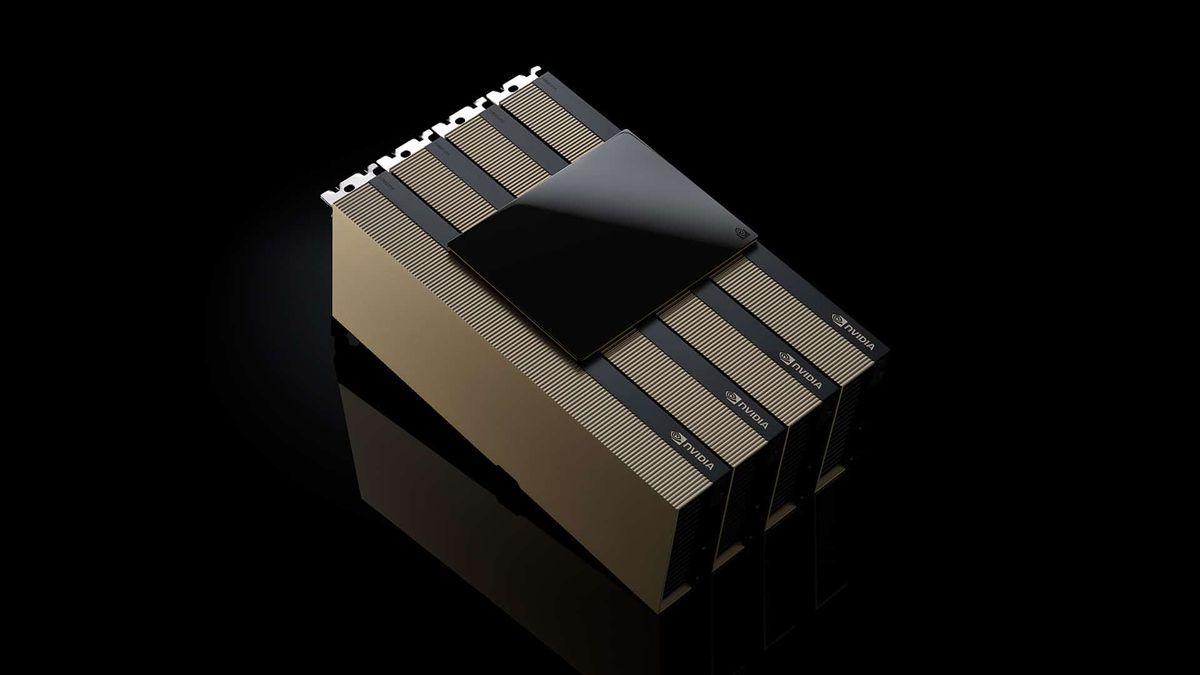

Jensen Huang, chief executive of Nvidia, is preparing to travel to China in late January, a routine Lunar New Year visit that this year coincides with the company's renewed effort to regain access to this market, reports Bloomberg. But while the U.S. government now allows the export of some of AMD's and Nvidia's AI GPUs to China, it remains to be seen how many of these processors the country is going to consume, given its effort for self-sufficiency. Huang plans to attend internal company events tied to the Lunar New Year and is also expected to travel to Beijing, although it remains uncertain whether meetings with senior Chinese officials will occur, the report says, citing people familiar with the matter. The itinerary is not finalized and could still change. Nvidia reportedly declined to comment on the visit, which is in line with the company's current policy of not giving investors any hope on its return to the Chinese market of AI accelerators. Huang has made similar trips at this time of year before, as the company maintains significant operations in China. However, this is the first time that the head of Nvidia will be visiting China now that the company is guaranteed to get an export license to ship its H200 GPUs to the People's Republic. The Chinese government seems to have put curbs on such shipments; as a result, it is expected that Huang will meet Chinese authorities to negotiate about imports of H200 to the country. The Chinese government is expected to authorize imports as soon as this quarter for selected use cases by commercial companies like Alibaba or Baidu, which have a significant portion of their workloads relying on Nvidia's CUDA software stack. At the same time, China plans to prohibit the H200 from being deployed by the military, sensitive government agencies, critical infrastructure operators, and state-owned enterprises. As a result, Huang's trip to China becomes more than just a visit to his employees and partners in the country, but potentially a way to negotiate shipments worth billions of dollars. Whether or not the head of Nvidia can actually persuade China's government to let more H200 AI accelerators in the country is something that remains to be seen, but this is certainly what business media expects him to do. Follow Tom's Hardware on Google News, or add us as a preferred source, to get our latest news, analysis, & reviews in your feeds.

[2]

China Tells Alibaba, Tech Firms to Prep Nvidia H200 Orders

The discussions signal Beijing is moving ahead with plans to approve shipments of the H200, which would mark a major win for Nvidia, and China plans to approve some imports of H200 chips as soon as this quarter, though they would be barred from sensitive agencies and critical infrastructure. Chinese officials have told the country's largest tech firms including Alibaba Group Holding Ltd. they can prepare orders for Nvidia Corp.'s H200 AI chips, suggesting Beijing is close to formally approving imports of components essential to powering artificial intelligence. Regulators have recently granted in-principle approval for Alibaba, Tencent Holdings Ltd. and ByteDance Ltd. to move to the next stage of preparations for purchases, people familiar with the matter said. The companies are now cleared to discuss specifics such as the amounts they would require, the people said, asking not to be identified discussing private talks. Beijing will encourage companies to buy a certain amount of domestic chips as a condition for approval, according to the people, though no exact number has been set. Nvidia shares rose as much as 2.6% in New York, while the American depositary receipts of Taiwan Semiconductor Manufacturing Co. gained as much as 1.9%. The discussions signal Beijing is moving ahead with plans to approve shipments of the H200 -- a last-generation semiconductor that's been thrust into the heart of sensitive US-China trade negotiations. It shows the government is prioritizing the needs of the major Chinese hyperscalers from Alibaba to Tencent, which are spending billions of dollars to build the data centers they need to develop and operate AI services. That would mark a major win for Nvidia, which has angled to resume business with the world's largest semiconductor arena. Chief Executive Officer Jensen Huang has said that the AI chip segment alone could generate $50 billion in the coming years. In its absence, local rivals such as Huawei Technologies Co. and Cambricon Technologies Corp. have thrived and plan to sharply increase production. Beijing's guidance to its largest tech firms runs counter to reports in recent weeks that the government was blocking H200 shipments. Last week, the Financial Times reportedBloomberg Terminal suppliers of parts for the chip had paused production. Representatives for Nvidia declined to comment, while the Commerce Ministry didn't respond to a faxed request for comment. Alibaba, Tencent and ByteDance representatives did not respond to requests for comment. Read more about Nvidia and China A Guide to Nvidia Chips at Center of US-China Rivalry China to Approve Nvidia H200 Buying as Soon as This Quarter Anthropic CEO Says Selling Advanced AI Chips to China Is 'Crazy' House Seeks Say Over AI Chip Sales After Nvidia's China Win US Clears Path for Nvidia to Sell H200s to China Via New Rule The H200 is an older-generation chip that the Trump administration has said can be exported to China, even as it restricts sales of leading-edge components on national security grounds. Nvidia is the leading maker of artificial intelligence accelerators -- the chips that help develop and run AI models -- which are highly prized by the world's data center operators. Get the Tech Newsletter bundle. Get the Tech Newsletter bundle. Get the Tech Newsletter bundle. Bloomberg's subscriber-only tech newsletters, and full access to all the articles they feature. Bloomberg's subscriber-only tech newsletters, and full access to all the articles they feature. Bloomberg's subscriber-only tech newsletters, and full access to all the articles they feature. Bloomberg may send me offers and promotions. Plus Signed UpPlus Sign UpPlus Sign Up By submitting my information, I agree to the Privacy Policy and Terms of Service. China plans to approve some imports of H200 chips as soon as this quarter, Bloomberg News has previously reported, though they would be barred from sensitive agencies and critical infrastructure -- a key designation that remains to be defined. That reflects the enormous demand for AI chips that stems from a Beijing-led push to develop the technology, as well as the inability of local chipmakers like Huawei and Semiconductor Manufacturing International Corp. to make enough of them. Alibaba and ByteDance had earlier told Nvidia in private that they are interested in ordering more than 200,000 units each of the H200. Both companies -- alongside prominent Chinese startups, including DeepSeek -- are rapidly upgrading their models to compete with OpenAI and other US rivals. Nvidia executives have stressed that there's strong demand from Chinese customers for the H200. But they indicated that the company hasn't spoken directly to Beijing about approval and don't know when China may green-light sales. They added that license applications have been submitted to Washington and the last details of approval from the US government are being finalized. Beijing hasn't publicly indicated whether it will allow the imports of H200. The country is largely focused on a self-sufficiency drive to build up its chipmaking capabilities, a push that's included readying a new round of incentives of as much as $70 billion for the chip sector. Around mid-2025, Chinese officials urged local companies to avoid using Nvidia's less powerful H20 processors, an AI accelerator the US previously allowed to be shipped to China. China's cyberspace agency also told companies such as Alibaba to halt orders for Nvidia's RTX Pro 6000D, a workstation chip that can be repurposed for AI applications.

[3]

Exclusive: China gives green light to importing first batch of Nvidia's H200 AI chips, sources say

Jan 28 (Reuters) - China has approved its first batch of Nvidia's H200 artificial intelligence chips for import, two people familiar with the matter told Reuters, marking a shift in position as China seeks to balance its AI needs against spurring domestic development. The approval covers several hundred thousand H200 chips and was granted during Nvidia (NVDA.O), opens new tab Chief Executive Jensen Huang's visit to China this week, the sources said, requesting anonymity due to the sensitivity of the matter. The first batch of approvals has been allocated primarily to three major Chinese internet companies, with other enterprises now joining a queue for subsequent approvals, one of the sources said. They declined to name the companies that received the initial clearances. China's industry and commerce ministries as well as Nvidia had not yet responded to requests for comment at the time of publication. Reporting by Reuters staff; Editing by Sonali Paul Our Standards: The Thomson Reuters Trust Principles., opens new tab

[4]

China gives green light to importing first batch of Nvidia's H200 AI chips, sources say: Reuters

China has approved its first batch of Nvidia's H200 artificial intelligence chips for import, two people familiar with the matter told Reuters, marking a shift in position as China seeks to balance its AI needs against spurring domestic development. The approval covers several hundred thousand H200 chips and was granted during Nvidia Chief Executive Jensen Huang's visit to China this week, the sources said, requesting anonymity due to the sensitivity of the matter. The first batch of approvals has been allocated primarily to three major Chinese internet companies, with other enterprises now joining a queue for subsequent approvals, one of the sources said. They declined to name the companies that received the initial clearances. China's industry and commerce ministries as well as Nvidia had not yet responded to requests for comment at the time of publication.

[5]

Nvidia's Huang to visit China as AI chip sales stall

BEIJING -- Nvidia CEO Jensen Huang plans to visit China in the coming days ahead of the mid-February Lunar New Year, two people familiar with the matter told CNBC. The trip comes as questions persist over the U.S. chip giant's ability to sell in the Chinese market, which once accounted for at least one-fifth of revenue from Nvidia's data center business. U.S. export restrictions have prevented Nvidia from selling its most advanced chips to China as Washington seeks to maintain an edge over Beijing in chips used to develop cutting-edge artificial intelligence. Huang is expected to attend an Nvidia company party in Beijing on Monday, said one of the sources, who requested anonymity to speak about the trip. He is also set to meet with potential buyers in China and discuss recent logistical challenges in supplying U.S.-approved Nvidia chips into the market, according to a person with direct knowledge of the travel plans. The Information reported last week, citing sources, that China would only approve local purchases of Nvidia's H200 AI chips for limited purposes such as research. When asked about the report Thursday, China's Commerce Ministry claimed it was unaware of the situation. Bloomberg first reported news of Huang's China trip earlier this week. Nvidia declined to comment on executive travel plans. Huang visited mainland China at least three times last year, including in January for Lunar New Year celebrations.

[6]

China gives green light to importing first batch of Nvidia's H200 AI chips, sources say

China has approved its first batch of Nvidia's H200 artificial intelligence chips for import, two people familiar with the matter told Reuters, marking a shift in position as China seeks to balance its AI needs against spurring domestic development. China has approved its first batch of Nvidia's H200 artificial intelligence chips for import, two people familiar with the matter told Reuters, marking a shift in position as China seeks to balance its AI needs against spurring domestic development. The approval covers several hundred thousand H200 chips and was granted during Nvidia chief executive Jensen Huang's visit to China this week, the sources said, requesting anonymity due to the sensitivity of the matter. The first batch of approvals has been allocated primarily to three major Chinese internet companies, with other enterprises now joining a queue for subsequent approvals, one of the sources said. They declined to name the companies that received the initial clearances. China's industry and commerce ministries as well as Nvidia had not yet responded to requests for comment at the time of publication. The H200, Nvidia's second most powerful AI chip, has emerged as a major flashpoint in U.S.-China relations. Despite strong demand from Chinese firms and U.S. approval for exports, Beijing's hesitation to allow imports has been the main barrier to shipments. The U.S. earlier this month formally cleared the way for Nvidia to sell the H200 to China, where the company is seeing strong appetite. However, Chinese authorities have the final say on whether they would allow it to be shipped in. It was unclear in recent weeks whether Beijing would grant approval as the government wants to balance meeting surging domestic demand for advanced AI chips and nurturing its domestic semiconductor industry. Chinese customs authorities told agents that the H200 chips were not permitted to enter China, Reuters reported earlier this month. But Chinese technology firms have placed orders for more than two million H200 chips, far exceeding Nvidia's available inventory, Reuters reported last month. It remains uncertain how many additional companies will receive approval in subsequent batches or what criteria Beijing is using to determine eligibility. Huang arrived in Shanghai last Friday for routine annual celebrations with Nvidia's China employees and has since travelled to Beijing and other cities, Reuters reported last week. Balancing act The approvals of H200 suggest Beijing is prioritising the needs of major Chinese internet companies, which are spending billions of dollars to build data centres needed to develop AI services and compete with U.S. rivals, including OpenAI. While Chinese companies such as Huawei now have products that rival the performance of Nvidia's H20 chip, previously the most advanced AI chip it was allowed to sell to China, they still lag far behind the H200. The H200 delivers roughly six times the performance of Nvidia's H20 chip. Still Beijing has discussed requiring companies to buy a certain quota of domestic chips as a condition for receiving approval to import foreign semiconductors, Reuters previously reported.

[7]

Nvidia CEO Jensen Huang Lands In China As Nvidia Awaits Beijing's Verdict On H200 AI Chip - Alibaba Gr Hldgs (NYSE:BABA), NVIDIA (NASDAQ:NVDA)

Nvidia Corp. (NASDAQ:NVDA) CEO Jensen Huang has arrived in China at a pivotal moment as Beijing weighs whether to allow sales of the U.S. chipmaker's powerful H200 artificial intelligence processor. Huang's China Visit Comes Amid Heightened Scrutiny Huang is in Shanghai to kick off Nvidia's annual celebrations with its China-based employees, reported Reuters on Saturday. The visit is described as routine, but it comes amid intensifying competition from domestic Chinese chipmakers and closer scrutiny from regulators. Huang is expected to attend a company event in Shanghai before traveling to Beijing, Shenzhen and Taiwan, the report noted. The Nvidia CEO has made China a regular stop, visiting at least three times last year and meeting China's commerce minister in July. H200 AI Chip At Center Of US-China Tensions Nvidia is awaiting a decision from Beijing on whether it will be allowed to sell its H200 AI chip to Chinese customers, the report said. Chinese authorities have informed customs officials that the H200 is not permitted to enter the country, the publication reported earlier this month. However, on Friday, it was reported that regulators have given preliminary clearance to major Chinese technology firms -- including Alibaba Group Holding Ltd. (NYSE:BABA), Tencent Holdings Ltd. (OTC:TCEHY) and ByteDance -- to move forward with the next phase of purchase planning. The approval allows the companies to begin outlining detailed needs, including the precise number of chips required to support their operations. Previously, Huang said any approval from the Chinese government to import the company's H200 AI chips would be reflected in customer purchase orders, rather than announced publicly. Strategic Stakes For Nvidia And China The H200, Nvidia's second-most powerful AI chip, has become a major flashpoint in U.S.-China technology relations. While Chinese demand for Nvidia's AI processors remains strong, Beijing has reportedly been weighing restrictions to support domestic chipmakers or using the issue as leverage in broader negotiations with Washington. Alibaba and ByteDance had earlier indicated behind the scenes that they were considering orders of more than 200,000 H200 chips apiece to strengthen their AI models and better compete with U.S. players such as OpenAI. Nvidia stock scores high on Quality in Benzinga's Edge Stock Rankings, with a positive price trend in the short, medium and long terms. Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors. BABAAlibaba Group Holding Ltd $172.76-0.27% Overview NVDANVIDIA Corp $187.25-0.22% TCEHYTencent Holdings Ltd Not Available-% Market News and Data brought to you by Benzinga APIs

[8]

Nvidia's Huang plans to visit China as he works to reopen market

Nvidia Chief Executive Officer Jensen Huang is planning to travel to China in late January as he works to reopen a crucial market for his company's artificial intelligence chips. Huang will be in the country to attend company parties ahead of the Lunar New Year holidays, according to a person familiar with the matter. The executive is also expected to visit Beijing, though it's unclear whether he will meet with senior Chinese officials, said the person, who asked not to be identified because the plans are private. Huang's itinerary could still change, depending on whether prospective meetings come through. The China visit -- a trip that Huang regularly takes at this time of year -- comes at a pivotal moment for the world's most valuable company. The U.S. is loosening export restrictions on AI processors, letting Nvidia sell its H200 model in the Asian nation. But on the Chinese side, government officials are deciding how many of the chips to let in. Beijing plans to approve imports of the products as soon as this quarter for certain uses.

[9]

China Poised to Approve Nvidia's H200 Chips for Import. Here's What It Means for Investors

The past year has been fraught with uncertainty for Nvidia (NVDA +1.60%). The company has played a crucial role in the AI revolution, as its graphics processing units (GPUs) became the AI chip of choice, underpinning these technological advances. Subsequent restrictions on the sale of these processors to customers in China -- which is one of Nvidia's biggest markets -- cast a pall over the company's otherwise exemplary results. Reports suggest the standoff may finally be over. Chinese regulators have reportedly instructed some of the country's biggest technology purveyors to submit orders for Nvidia's H200 AI chips for approval, according to a report by Bloomberg, citing "people familiar with the situation." This could mark a turning point for Nvidia, which had previously been shut out of this lucrative market. These well-known Chinese companies, including Alibaba, Tencent, and former TikTok parent ByteDance, have been told they will be required to buy a certain percentage of domestic chips as part of the conditional approval, according to the report. Previous reports suggested that Chinese regulators would prohibit the use of these advanced chips in military applications, government agencies, critical infrastructure, state-owned businesses, or other applications that might raise security concerns. A back-of-the-envelope calculation This could be an important develop for Nvidia and its shareholders. In 2024, sales of lower-quality AI chips to Chinese customers totaled $17.1 billion, despite a moratorium on the sale of its state-of-the-art AI chips. In early 2025, U.S. export restrictions announced by the Trump Administration resulted in an $8 billion hit to sales. CEO Jensen Huang recently said there was "very high" demand for H200 chips in China. He suggested that if the imports were approved, the resulting sales could surpass $50 billion per year. A Reuters report suggests Nvidia has already received orders for 2 million H200 chips from Chinese customers, at a cost of $27,000 each. If accurate, it would result in incremental revenue of $54 billion, which seems to support Huang's assertion. This total would be reduced by the 25% export levy required by the Trump Administration, leaving Nvidia with $40 billion in incremental revenue from existing orders. Nvidia hasn't included any sales to China in its forecast, which would materially increase the company's outlook. Huang previously said Nvidia had an AI chip sales backlog of $500 billion for the six quarters ending in early 2027. CFO Colette Kress has since upped the ante. At an investor event in early January, she said, "The $500 billion has definitely gotten larger." Analysts' consensus estimates for Nvidia's fiscal 2027 (beginning later this month) call for revenue of $320 billion. $40 billion of incremental revenue at a 56% net profit margin could drive Nvidia's earnings per share (EPS) to $8.29. A current price-to-earnings (P/E) ratio of about 46 would imply a share price of $385, representing potential gains of 105% compared to Friday's closing price. This could be a windfall for Nvidia and its shareholders.

[10]

Nvidia CEO Jensen Huang in Shanghai amid China regulatory headwinds

The timing of Huang's trip, to kick off annual celebrations with Nvidia's China employees, is routine. He is expected to attend an Nvidia party in Shanghai on Saturday before travelling to Beijing, Shenzhen and then Taiwan Nvidia CEO Jensen Huang is in Shanghai, a person briefed on the matter said on Saturday, as the U.S. chip giant faces fierce competition from local rivals and scrutiny from Chinese authorities. The timing of Huang's trip, to kick off annual celebrations with Nvidia's China employees, is routine. He is expected to attend an Nvidia party in Shanghai on Saturday before travelling to Beijing, Shenzhen and then Taiwan, another person with knowledge of the plans said. Santa Clara, California-based Nvidia did not respond to a request for comment. Chinese news outlet Tencent News first reported Huang's presence in Shanghai on Friday. Huang visited China at least three times last year and in July met with China's commerce minister. Nvidia is waiting for Beijing to decide whether to let the company sell its powerful H200 artificial intelligence chip to Chinese customers, a step already approved by Washington. Chinese authorities have told customs agents that the H200 chip was not permitted to enter China, people briefed on the matter told Reuters this month. It was not clear whether this constituted a formal ban or a temporary measure. The H200, Nvidia's second most powerful AI chip, has emerged as one of the biggest flashpoints in U.S.-China relations. While demand from Chinese firms remains strong, it is unclear whether Beijing intends to ban the chip outright to support domestic chipmakers, is still deliberating restrictions or views potential measures as leverage in negotiations with Washington.

[11]

Beijing Blinks: China Tells Tech Giants To Prep Nvidia Orders - NVIDIA (NASDAQ:NVDA)

Chinese regulators have signaled a major shift in trade policy by telling the country's largest technology firms that they can begin preparing orders for Nvidia Corp. (NASDAQ:NVDA) H200 artificial intelligence chips. Regulators recently granted in-principle approval for Chinese tech giants, including Alibaba Group Holding Limited (NYSE:BABA), Tencent Holding Ltd (OTC:TCEHY), and ByteDance, for the next stage of purchasing preparations. These companies now have clearance to discuss specific requirements, such as the exact volume of chips they will need for their operations. People familiar with the matter told Bloomberg on Friday that Beijing will likely encourage these firms to purchase a certain amount of domestic chips as a condition for final approval. Strategic Victory for Nvidia Formal approval would represent a significant win for Nvidia as it attempts to resume business within the world's largest semiconductor arena. CEO Jensen Huang has estimated that the AI chip segment alone could generate $50 billion in the coming years, according to the report. While Nvidia was absent from the market, local rivals like Huawei Technologies and Cambricon Technologies thrived and planned to increase their own production levels. High Demand Despite Domestic Push Alibaba and ByteDance previously expressed private interest in ordering more than 200,000 H200 units each to upgrade their models and compete with U.S. rivals like OpenAI. Beijing plans to approve these imports as soon as this quarter, though the chips will likely remain barred from sensitive agencies and critical infrastructure. Reportedly, U.S. export limits on Nvidia's most advanced chips have forced Chinese companies to absorb higher costs. Regulatory delays have kept many shipments stuck at the border even after Washington approved exports. That uncertainty has pushed Chinese AI firms to turn to costly black-market supplies or lower-performance domestic chips such as Huawei's Ascend line. Resellers in China reported that black-market servers containing 8 H200 GPUs are currently commanding a 50% premium at roughly 2.3 million yuan ($330,403). NVDA Price Action: Nvidia shares were up 1.24% at $187.14 during premarket trading on Friday, according to Benzinga Pro data. Photo by Saulo Ferreira Angelo via Shutterstock NVDANVIDIA Corp $186.781.05% Overview BABAAlibaba Group Holding Ltd $175.31-1.06% TCEHYTencent Holdings Ltd $76.320.01% Market News and Data brought to you by Benzinga APIs

[12]

China allows Alibaba, others to prep Nvidia orders

China's tech giants, including Alibaba and Tencent, are preparing to order Nvidia's H200 AI chips, signaling Beijing's imminent approval for these crucial components. This move prioritizes major Chinese companies' AI development needs, potentially boosting Nvidia's business. Local chipmakers like Huawei are also expanding production amid these developments. Chinese officials have told the country's largest tech firms, including Alibaba Group, they can prepare orders for Nvidia H200 AI chips, suggesting Beijing is close to formally approving imports of components essential to running artificial intelligence. Regulators have recently granted in-principle approval for Alibaba, Tencent Holdings Ltd. and ByteDance Ltd. to move to the next stage of preparations for purchases, people familiar with the matter said. The companies are now cleared to discuss specifics such as the amounts they would require, the people said, asking to remain unidentified discussing private talks. Beijing will encourage companies to buy a certain amount of domestic chips as a condition for approval, according to the people, though no exact number has been set. Nvidia shares rose as much as 2.3% in premarket trading, while the American depositary receipts of Taiwan Semiconductor Manufacturing Co. gained 1.3%. The discussions signals Beijing is moving ahead with plans to approve shipments of the H200 - a last-generation semiconductor that's been thrust into the heart of sensitive US-China trade negotiations. It shows the government is prioritizing the needs of the major Chinese hyperscalers from Alibaba to Tencent, which are spending billions of dollars to build the data centers they need to develop and operate AI services. That would mark a major win for Nvidia, which has angled to resume business with the world's largest semiconductor arena. Chief Executive Officer Jensen Huang has said that the AI chip segment alone could generate $50 billion in the coming years. In its absence, local rivals such as Huawei Technologies and Cambricon Technologies have thrived and plan to sharply increase production. (You can now subscribe to our Economic Times WhatsApp channel)

[13]

Nvidia Chips Fetch Record Premiums On China's Black Market - NVIDIA (NASDAQ:NVDA)

Nvidia Corp. (NASDAQ:NVDA) is pressing ahead with its China strategy as demand for advanced AI chips remains strong, even while regulatory bottlenecks and supply constraints complicate deliveries. Jensen Huang Signals Confidence In China Demand The chip designer founder and CEO, Jensen Huang, expressed optimism about strong H200 demand in China during the World Economic Forum on January 21, 2026. This confidence persists even as Chinese customs officials hold these high-performance chips at the border. While Washington recently granted Nvidia formal permission to ship the H200 to the world's second-largest economy, some orders remain trapped in a state of extreme sensitivity, SCMP reported on Thursday. Regulatory Uncertainty Pushes Buyers To Costly Alternatives Chinese AI firms were forced to chase expensive black-market hardware and lower-performing domestic alternatives, such as Huawei's Ascend series. Resellers in China reported that black-market servers containing 8 H200 GPUs are currently commanding a 50% premium at roughly 2.3 million yuan ($330,403). Despite these hurdles, Jensen Huang plans to visit China this month to help reopen the market. Taiwan Industry Economics Services research fellow Arisa Liu said Nvidia's China dilemma reflects a choice between near-term performance and long-term strategy, but warned that China's tech sector could face more profound and more widespread short-term damage. Supply Crunch Builds As China Orders Surge At the same time, global demand for AI hardware continues to tighten supply. A December report indicated that global demand for AI hardware continues to strain supply, and Nvidia is feeling the pressure as strong interest from China collides with limited chip capacity and policy uncertainty. Chinese tech firms are placing heavy orders for Nvidia's H200 AI chips, prompting the company to urge Taiwan Semiconductor Manufacturing Co. Ltd. (NYSE:TSM) to raise output. Reports indicate Chinese customers have lined up orders for more than 2 million H200 chips for 2026, far exceeding Nvidia's current availability of roughly 700,000 units. To close the gap, Nvidia has asked Taiwan Semiconductor to begin building additional capacity, with production work expected to start in the second quarter of 2026. Nvidia has priced China-bound H200 variants at about $27,000 per chip, with terms varying by volume. An eight-chip module can run close to 1.5 million yuan, higher than the prior H20 system. ByteDance is among the largest spenders, with plans to allocate about 100 billion yuan to Nvidia chips in 2026. Nvidia became the first company to reach a market cap of $4.5 trillion in October. NVDA Price Action: Nvidia shares were down 0.49% at $183.94 during premarket trading on Friday, according to Benzinga Pro data. Photo by Robert Way via Shutterstock NVDANVIDIA Corp $183.67-0.63% Overview TSMTaiwan Semiconductor Manufacturing Co Ltd $328.570.37% Market News and Data brought to you by Benzinga APIs

[14]

NVIDIA Stock Rises After China Signals Progress on H200 AI Chip Imports

Demand Signals Intensify as NVIDIA and China Firms Weigh Volumes Alibaba and ByteDance previously told NVIDIA they would like to acquire more than 200,000 H200 chips each, according to people familiar with the matter. The parties have not finalized quantities or delivery timing. NVIDIA executives have said Chinese customers show strong demand for the H200. However, they have also said NVIDIA has not discussed approval directly with Beijing and does not know when China will approve sales. NVIDIA Chief Executive Officer has said the AI chip market alone could generate $50 billion in the coming years. The Chinese market remains central to that growth outlook. Chinese rivals have expanded during NVIDIA's restricted access, including Huawei Technologies Co. and Cambricon Technologies Corp., which plan to increase manufacturing. Beijing has also advanced a self-sufficiency drive that includes incentives worth up to $70 billion for the semiconductor industry. China's recent approach has also tightened around other NVIDIA products. In mid-2025, Chinese authorities advised local businesses not to use NVIDIA's H20 chips, an AI accelerator previously allowed for export to China. China's cyberspace agency also instructed companies such as Alibaba to stop placing orders for NVIDIA's RTX Pro 6000D workstation processor, which can support AI applications. Markets tied the regulatory shift to move. Shares closed at $184.84 on January 22, 2026, up $1.66 or 0.91%, before extending gains in premarket trading to $187.55. NVIDIA's market capitalization stood at about $4.5 trillion. The stock carried a trailing price-to-earnings ratio of 45.64 and a forward price-to-earnings ratio of 24.15. Supply constraints have also created premium pricing signals inside China. Black market servers containing eight H200 graphics processing units (GPUs) have sold for 2.3 million yuan, or about $330,403, reflecting a 50% premium. NVIDIA stock price movement has also tightened sales terms for H200 chips, requiring upfront payments and adopting strict no-flexibility conditions as it navigates regulatory complexity between Washington and Beijing.

[15]

China approves first Nvidia H200 AI chip shipments, Reuters reports By Investing.com

Investing.com-- China has approved its first imports of Nvidia's (NASDAQ:NVDA) H200 artificial-intelligence chips, as Beijing weighs near-term AI demand against efforts to build domestic capabilities, Reuters reported on Wednesday. The clearance covers several hundred thousand H200 chips and was granted during Nvidia Chief Executive Officer Jensen Huang's visit to China this week, the report said, citing people familiar with the. The initial approvals were allocated mainly to three large Chinese internet companies, with other firms lining up for subsequent batches, the report said. The cited sources declined to identify the recipients because of the sensitivity of the decision. The move marks a notable easing after months of tight scrutiny of advanced AI hardware imports, underscoring China's need for cutting-edge computing power to support data centers and AI development.

[16]

China gives green light to importing first batch of Nvidia's H200 AI chips, sources say

Jan 28 (Reuters) - China has approved its first batch of Nvidia's H200 artificial intelligence chips for import, two people familiar with the matter told Reuters, marking a shift in position as China seeks to balance its AI needs against spurring domestic development. The approval covers several hundred thousand H200 chips and was granted during Nvidia Chief Executive Jensen Huang's visit to China this week, the sources said, requesting anonymity due to the sensitivity of the matter. The first batch of approvals has been allocated primarily to three major Chinese internet companies, with other enterprises now joining a queue for subsequent approvals, one of the sources said. They declined to name the companies that received the initial clearances. China's industry and commerce ministries as well as Nvidia had not yet responded to requests for comment at the time of publication. (Reporting by Reuters staff; Editing by Sonali Paul)

[17]

Nvidia CEO Jensen Huang in Shanghai amid China regulatory headwinds

BEIJING, Jan 24 (Reuters) - Nvidia CEO Jensen Huang is in Shanghai, a person briefed on the matter said on Saturday, as the U.S. chip giant faces fierce competition from local rivals and scrutiny from Chinese authorities. The timing of Huang's trip, to kick off annual celebrations with Nvidia's China employees, is routine. He is expected to attend an Nvidia party in Shanghai on Saturday before travelling to Beijing, Shenzhen and then Taiwan, another person with knowledge of the plans said. Santa Clara, California-based Nvidia did not respond to a request for comment. Chinese news outlet Tencent News first reported Huang's presence in Shanghai on Friday. Huang visited China at least three times last year and in July met with China's commerce minister. Nvidia is waiting for Beijing to decide whether to let the company sell its powerful H200 artificial intelligence chip to Chinese customers, a step already approved by Washington. Chinese authorities have told customs agents that the H200 chip was not permitted to enter China, people briefed on the matter told Reuters this month. It was not clear whether this constituted a formal ban or a temporary measure. The H200, Nvidia's second most powerful AI chip, has emerged as one of the biggest flashpoints in U.S.-China relations. While demand from Chinese firms remains strong, it is unclear whether Beijing intends to ban the chip outright to support domestic chipmakers, is still deliberating restrictions or views potential measures as leverage in negotiations with Washington. (Reporting by Che Pan and Brenda Goh; Editing by William Mallard)

[18]

Nvidia CEO Huang plans to visit China as he seeks to reopen market, Bloomberg reports

Jan 20 (Reuters) - Nvidia CEO Jensen Huang plans to travel to China in late January as he seeks to reopen a critical market for the company's artificial intelligence chips, Bloomberg News reported on Tuesday, citing a person familiar with the matter. Huang is expected to attend company events ahead of the Lunar New Year holidays in February, and may also visit Beijing, according to the report. Reuters could not immediately verify the report. Nvidia declined to comment. It is unclear whether Huang will meet senior Chinese officials, and his plans could still change depending on whether prospective meetings are confirmed, the report said. This comes after last week, the Trump administration formally approved sales of Nvidia's second-most powerful H200 artificial intelligence chips to China, a move expected to pave the way for shipments despite concerns from China hawks in Washington. However, Chinese customs authorities said a day later, on January 14, that the H200 chips were not permitted to enter the country, Reuters reported. (Reporting by Bipasha Dey in Bengaluru; Editing by Rashmi Aich)

Share

Share

Copy Link

China has approved the import of several hundred thousand Nvidia H200 AI chips during CEO Jensen Huang's visit this week, marking a significant shift in the country's stance. The approval, granted primarily to three major Chinese internet companies, signals Beijing's effort to balance domestic chip development with the urgent needs of its tech giants like Alibaba, Tencent, and ByteDance for advanced AI hardware.

China Gives Green Light to Nvidia H200 During High-Stakes Visit

China has approved its first batch of Nvidia H200 AI chips for import, with the approval covering several hundred thousand units granted during Nvidia CEO Jensen Huang's visit to the country this week

3

. The timing of this decision marks a strategic shift as Beijing seeks to balance its push for self-sufficiency in chip manufacturing against the immediate needs of its technology sector for advanced AI hardware. The first batch of approvals has been allocated primarily to three major Chinese internet companies, with other enterprises now joining a queue for subsequent approvals3

.

Source: Market Screener

Jensen Huang's Strategic Trip to Beijing

Nvidia CEO Jensen Huang traveled to China in late January for what has become a routine Lunar New Year visit, but this year's trip carried far greater significance

1

. Huang attended an Nvidia company party in Beijing and was expected to meet with potential buyers to discuss recent logistical challenges in supplying U.S.-approved chips into the market5

. The visit coincided with the company's renewed effort to regain access to the Chinese market, which once accounted for at least one-fifth of revenue from Nvidia's data center business5

. This marks the first time Huang has visited China since the company received guarantees for an export license to ship its H200 GPUs to the People's Republic1

.Chinese Tech Firms Prepare Major Orders

Chinese officials have told the country's largest tech firms including Alibaba, Tencent, and ByteDance they can prepare orders for Nvidia H200 AI chips

2

. Regulators recently granted in-principle approval for these companies to move to the next stage of preparations for purchases, clearing them to discuss specifics such as the amounts they would require2

. Both Alibaba and ByteDance had earlier told Nvidia in private that they are interested in ordering more than 200,000 units each of the H2002

. Beijing will encourage companies to buy a certain amount of domestic chips as a condition for approval, though no exact number has been set2

.

Source: Bloomberg

Related Stories

Navigating U.S. Export Restrictions and Trade Tensions

The H200 is an older-generation chip that the Trump administration has said can be exported to China, even as it restricts sales of leading-edge components on national security grounds

2

. U.S. export restrictions have prevented Nvidia from selling its most advanced chips to China as Washington seeks to maintain an edge over Beijing in chips used to develop cutting-edge artificial intelligence5

. China plans to approve some imports of H200 chips as soon as this quarter, though they would be barred from sensitive agencies and critical infrastructure2

. The Chinese government is expected to authorize imports for selected use cases by commercial companies like Alibaba or Baidu, which have a significant portion of their workloads relying on Nvidia's CUDA software stack1

.

Source: Reuters

Implications for Artificial Intelligence Development

The discussions signal Beijing is moving ahead with plans to approve shipments of the H200, which would mark a major win for Nvidia

2

. The government is prioritizing the needs of major Chinese hyperscalers from Alibaba to Tencent, which are spending billions of dollars to build the data centers they need to develop and operate AI services2

. Huang has said that the AI chip segment alone could generate $50 billion in the coming years2

. The approval reflects the enormous demand for AI accelerators that stems from a Beijing-led push to develop artificial intelligence, as well as the inability of local chipmakers to make enough of them2

. Both Alibaba and ByteDance are rapidly upgrading their models to compete with OpenAI and other U.S. rivals, driving demand for importing H200 AI chips despite China's push for self-sufficiency in semiconductor production2

.References

Summarized by

Navi

[3]

[4]

Related Stories

US export rules greenlight H200 sales to China, but strict limits put American buyers first

07 Jan 2026•Policy and Regulation

Nvidia prepares to ship up to 80,000 H200 AI chips to China as political hurdles loom

22 Dec 2025•Policy and Regulation

Nvidia's H200 AI chip sales to China stalled by US security review despite initial approvals

28 Jan 2026•Policy and Regulation

Recent Highlights

1

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

2

Demis Hassabis predicts AGI in 5-8 years, sees new golden era transforming medicine and science

Technology

3

Nvidia and Meta forge massive chip deal as computing power demands reshape AI infrastructure

Technology