Kioxia names new CEO to capture AI storage growth while rivals chase high-bandwidth memory

2 Sources

2 Sources

[1]

Kioxia Seeks Growth in AI Storage While Rivals Chase HBM Profits

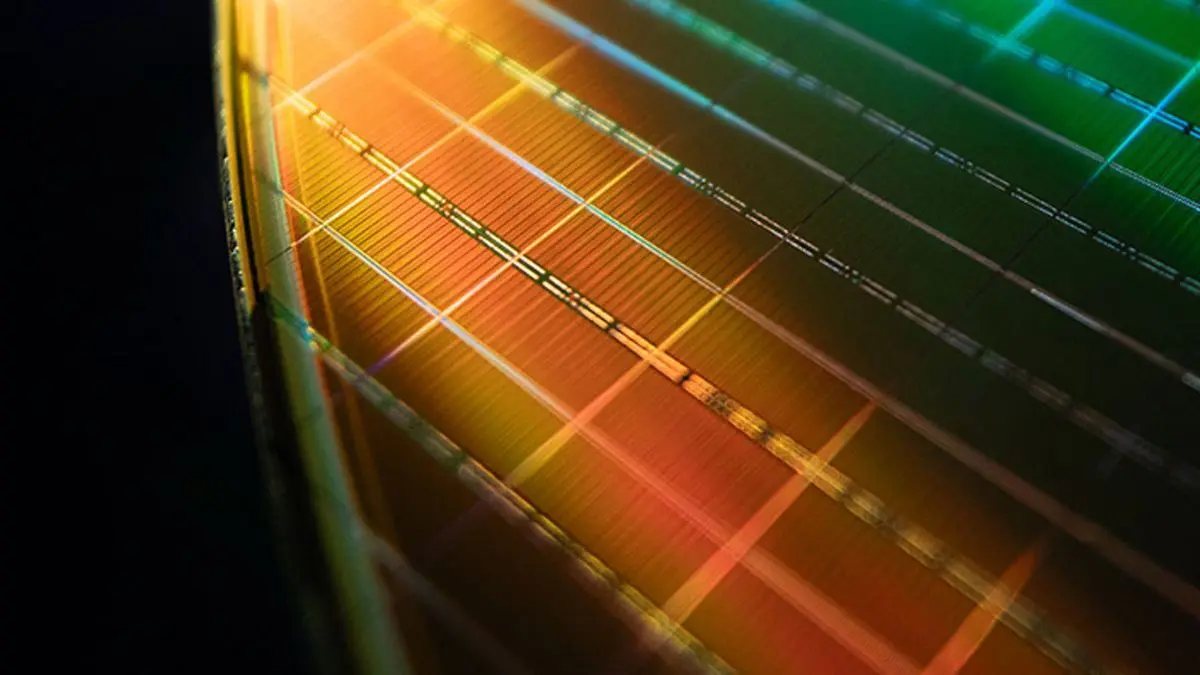

The AI investment rush is fueling Kioxia's comeback, with shares up more than 13 times since their debut on the Tokyo Stock Exchange at the end of 2024. Flash memory maker Kioxia Holdings Corp. sees an opportunity to seize growth in high-density storage for AI data centers while its competitors are preoccupied elsewhere. Kioxia's rivals Samsung Electronics Co., SK Hynix Inc. and Micron Technology Inc. are locked in a heated race to win in high-bandwidth memory, a lucrative product that's twinned with Nvidia Corp. accelerators needed to develop artificial intelligence. They're therefore not investing as much in growing capacity in solid state drives and other advanced NAND storage devices that cloud providers also need to support AI's appetite for data, according to Kioxia Executive Chairman Stacy Smith. "We've got exactly the right product leadership for those segments of the market at exactly the right time," Smith said in an interview in Tokyo. The AI investment rush is giving the Tokyo-based partner to Sandisk Corp. a boost in cash flow that's fueling a comeback following years of belt-tightening. Investors are betting on Kioxia's chances: Shares are up more than 13 times since their debut on the Tokyo Stock Exchange at the end of 2024. Partners for over 25 years, Kioxia and Sandisk said they are extending their joint venture agreements at Kioxia's Yokkaichi plant in central Japan for another five years through the end of 2034. Sandisk will pay Kioxia $1.165 billion over the four years through 2029 -- the first time for such an arrangement and a sign of Kioxia's product leadership, according to Smith. Kioxia's shares jumped more than 11% on Friday on the news alongside a bullish forecast from Sandisk that also lifted the US company's stock 17% higher during extended trade. AI's demand for high-performance storage is placing a premium on Kioxia's leadership in bit density in NAND -- the memory used in smartphones, cars and servers that doesn't require power to store data. Hyperscalers seeking energy-efficient storage options are exploring NAND-based solutions, tightening overall chip supply and lifting Kioxia's pricing power. That's reframing a business once defined by boom-and-bust swings. What Bloomberg Intelligence Says Sandisk reported 3Q earnings guidance that's 163% above estimates, reflecting a sustained upswing in NAND pricing that has climbed rapidly since October. This is driving gross margin to far exceed the peaks of previous cycles. A lack of meaningful capacity additions over the next 1-2 years suggests pricing has room for further expansion on the back of robust AI inferencing demand, as larger models and increased context windows drive higher storage intensity. Click hereBloomberg Terminal for the research -Jake Silverman, analyst Kioxia aims to increase production capacity at a "slightly faster pace" than overall bit growth -- estimated at around 20% this year -- to help the chipmaker gain market share, said Smith, 63, an Intel Corp. veteran who joined the Tokyo-based chipmaker in 2018. The bulk of that expansion will come under new leadership announced this week, with Executive Vice President Hiroo Oota, 63, taking on the role of chief executive officer and succeeding Nobuo Hayasaka, 70, who guided Kioxia through a severe downturn and toward its IPO. But the cautious tempo of chipmakers' NAND capacity expansions over the past few years means there won't be enough flash memory factories through 2027, TrendForce memory analyst Bryan Ao said. Kioxia was spun out of Toshiba Corp., the company that first developed NAND, a breakthrough that made mobile devices possible and helped establish Japan as a global semiconductor power. Renamed following its 2018 sale to a Bain Capital-led consortium, the company has since weathered one of the industry's worst downturns while weighed down with debt, on top of the untimely death of former CEO Yasuo Naruke. "It looks easy when the success comes," Smith said. The journey was fraught with challenges, but the company was able to focus on working its way through the downturn, he said. "It just makes it all the more wonderful when you come out the back end of that."

[2]

Memory maker Kioxia names new CEO to navigate AI chip boom

Japanese flash memory maker Kioxia Holdings is promoting Executive Vice President Hiroo Oota to chief executive officer and president in a move aimed at expanding its presence in the booming memory chip market. Oota, 63, will succeed Nobuo Hayasaka, 70, who will become a senior executive adviser. The leadership change will take effect following shareholder approval at the company's annual meeting scheduled for June, the Apple supplier said in a statement Thursday. "Oota possesses a deep understanding of our core strengths, the market, and our customers," Hayasaka said at a news conference. "Combined with his exceptional communication skills, I am confident that his strong leadership makes him the best person to take the helm at Kioxia and navigate this rapidly shifting landscape." Shares of Kioxia, which are up more than twelvefold since their initial public offering at the end of 2024, reversed losses and rose 1.6% after the announcement. Oota said the share price reflected positive expectations by investors, adding he would further strengthen communications with stakeholders for a closer relationship. U.S.-based Bain Capital holds 44% of the company's outstanding shares, and Oota said the company's relationship with the fund will not change in the short term. Spun out of Toshiba, the inventor of NAND flash memory, Kioxia has been a beneficiary of an artificial intelligence infrastructure building spree that's lifting memory chip demand and prices. Its high-performance storage solutions like NAND and solid state drives are becoming increasingly important for data centers, elevating their status from commodity to must-haves for any company wishing to win a race to develop artificial intelligence. "To meet the demands of massive data processing in generative AI training and inference, the market requires not only high capacity and reliability but also superior performance and power efficiency," Oota said. "We are committed to advancing our flash memory and SSD portfolios by further enhancing performance and reducing power consumption, moving beyond simple capacity increases." Oota has spent most of his career in the semiconductor business, having joined Toshiba in 1985. He previously served in engineering roles at Toshiba Memory, which was later renamed Kioxia. "Being the CEO of a memory company is an extremely tough job," said Omdia analyst Akira Minamikawa. Given a market known for its boom-and-bust cycles, investment timing has to be spot on, he said. "A leader needs to be on the front lines, traveling and engaging in sales and sensitive to subtle shifts in what the customers are really thinking. Chip manufacturers and chipmaking suppliers, such as ASML Holding, have signaled expectations that the unprecedented AI investment boom is likely to remain in place. Still, there's investor concern about the current pace and whether expansion might be going too fast. Oota agreed the pace won't last forever, but he sees no immediate end of the trend. "While some use the term 'AI bubble,' my discussions with hyperscalers suggest that this is something more fundamental," Oota said. "While history tells us that this pace won't continue indefinitely and will eventually reach a steady state, the current demand is undeniably robust. Therefore, we remain committed to making strategic investments that are closely aligned with this growth while making sure our spending is disciplined." In competing against rival NAND makers such as Samsung Electronics, Oota said the close cooperation that Kioxia has had with Sandisk will remain important, especially in leveraging economies of scale.

Share

Share

Copy Link

Japanese flash memory maker Kioxia is promoting Hiroo Oota to CEO as it positions itself to capitalize on surging demand for NAND storage in AI data centers. While competitors Samsung, SK Hynix, and Micron focus on high-bandwidth memory, Kioxia sees opportunity in high-density storage solutions. The company's shares have jumped more than 13 times since its late 2024 IPO, reflecting investor confidence in its strategic positioning.

Kioxia Appoints New CEO Amid AI-Driven Storage Boom

Kioxia Holdings Corp. is promoting Executive Vice President Hiroo Oota, 63, to chief executive officer and president as the Japanese flash memory maker seeks to expand its foothold in the rapidly growing memory chip market driven by artificial intelligence (AI). The leadership change, effective following shareholder approval at the company's annual meeting scheduled for June, comes as Kioxia's shares have surged more than 13 times since their initial public offering (IPO) at the end of 2024

1

2

. Oota will succeed Nobuo Hayasaka, 70, who guided the company through a severe downturn and toward its stock market debut. Hayasaka will transition to a senior executive adviser role, citing Oota's deep understanding of core strengths and exceptional communication skills as key factors in the decision2

.

Source: Japan Times

Strategic Focus on NAND Storage Devices as Competitors Chase HBM

Kioxia sees a significant opportunity in high-density storage for AI data centers while its major competitors—Samsung Electronics Co., SK Hynix Inc., and Micron Technology Inc.—remain locked in a heated race to dominate the high-bandwidth memory market. According to Executive Chairman Stacy Smith, these rivals are not investing as heavily in growing capacity for solid-state drives (SSDs) and other advanced NAND storage devices that cloud providers need to support artificial intelligence infrastructure

1

. This strategic gap creates an opening for the Tokyo-based company, which has maintained product leadership in bit density—a critical factor as hyperscalers seek energy-efficient storage options. The AI investment rush is fueling improved cash flow for Kioxia, marking a dramatic turnaround following years of belt-tightening after the company was spun out of Toshiba, the inventor of NAND flash memory1

.Sandisk Joint Venture Extension Signals Confidence

Underscoring Kioxia's market position, the company announced an extension of its joint venture agreements with Sandisk Corp. at Kioxia's Yokkaichi plant in central Japan for another five years through the end of 2034. In a first-of-its-kind arrangement, Sandisk will pay Kioxia $1.165 billion over the four years through 2029, which Smith characterized as a sign of the company's product leadership

1

. The announcement sent Kioxia's shares jumping more than 11% on Friday, while Sandisk's bullish forecast lifted the US company's stock 17% higher during extended trading. The partnership, which has lasted over 25 years, remains central to Kioxia's strategy for leveraging economies of scale against rivals2

.Related Stories

Memory Chip Demand Drives Pricing Power and Market Share Goals

The AI chip boom is fundamentally reshaping demand patterns for flash memory. Kioxia aims to increase production capacity at a slightly faster pace than overall bit growth—estimated at around 20% this year—to help gain market share, Smith said

1

. AI-driven demand for high-performance storage is placing a premium on the company's leadership in NAND, the memory used in smartphones, cars, and servers that doesn't require power to store data. According to Bloomberg Intelligence analyst Jake Silverman, Sandisk reported third-quarter earnings guidance 163% above estimates, reflecting a sustained upswing in NAND pricing that has climbed rapidly since October. The cautious tempo of chipmakers' capacity expansions over recent years means there won't be enough flash memory factories through 2027, according to TrendForce memory analyst Bryan Ao1

.New Leadership Faces Evolving AI Infrastructure Requirements

Oota, who spent most of his career in the semiconductor business after joining Toshiba in 1985, emphasized the need to meet demands of generative AI training and inference. "To meet the demands of massive data processing in generative AI training and inference, the market requires not only high capacity and reliability but also superior performance and power efficiency," Oota said

2

. He committed to advancing flash memory and SSD portfolios by enhancing performance and reducing power consumption beyond simple capacity increases. While acknowledging that some observers use the term "AI bubble," Oota said his discussions with hyperscalers suggest the current demand represents something more fundamental, though he recognizes the pace won't continue indefinitely2

. Bain Capital, which holds 44% of Kioxia's outstanding shares following its 2018 acquisition from Toshiba, will maintain its relationship with the company in the short term, Oota confirmed2

.References

Summarized by

Navi

[2]

Related Stories

Kioxia Forecasts 2.7x Growth in NAND Memory Demand by 2028, Driven by AI Boom

05 Nov 2024•Business and Economy

Nvidia Pushes for 100M IOPS SSDs to Eliminate AI GPU Bottlenecks

14 Jun 2025•Technology

SK Hynix CEO Kwak Noh-jung Emphasizes Semiconductor Industry's Crucial Role in AI Evolution

21 Feb 2025•Business and Economy

Recent Highlights

1

Pentagon threatens Anthropic with Defense Production Act over AI military use restrictions

Policy and Regulation

2

Google Gemini 3.1 Pro doubles reasoning score, beats rivals in key AI benchmarks

Technology

3

Anthropic accuses Chinese AI labs of stealing Claude through 24,000 fake accounts

Policy and Regulation