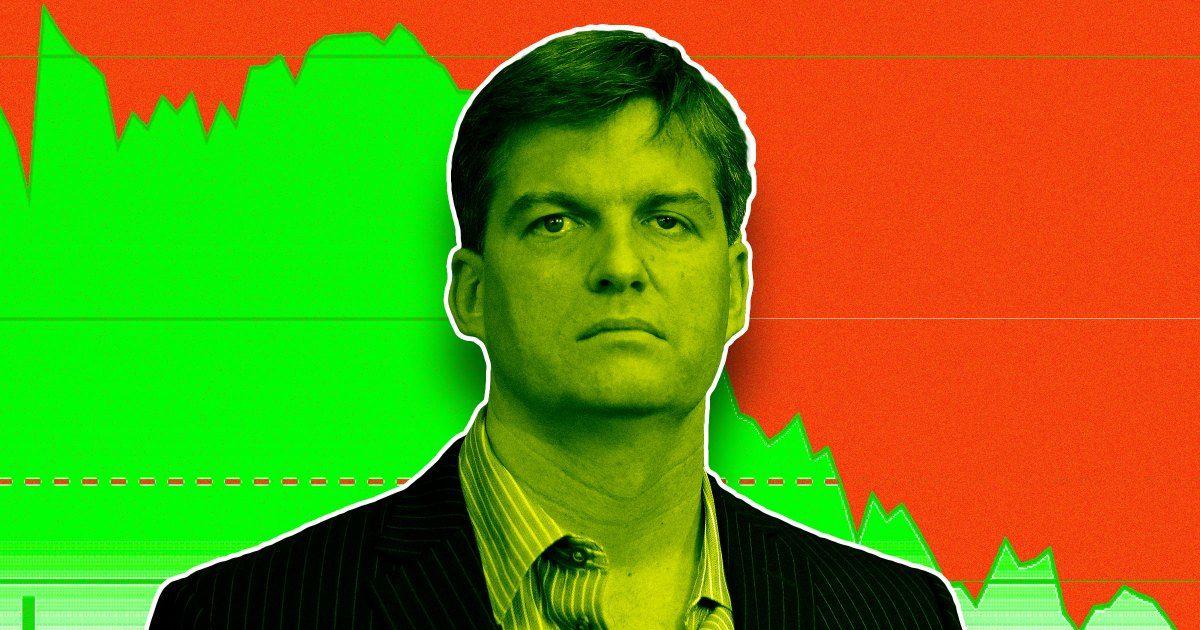

Michael Burry Bets $1 Billion Against AI Bubble as Market Faces Reality Check

8 Sources

8 Sources

[1]

'The Big Short' Investor Michael Burry Bets Against AI Hype

Michael Burry, the investor who is famous for predicting the 2008 housing market crash and was portrayed by Christian Bale in the Oscar-winning movie "The Big Short," has a new bubble prediction. This time, it's AI. Burry's hedge fund Scion Asset Management disclosed put options on Nvidia, and an even larger one on Palantir, according to regulatory filings from Sept. 30 that were released on Monday. Both companies are considered AI darlings, and their stocks have been buoyed high on the tails of the AI trade. Nvidia is the only company in the world to be worth more than $5 trillion. Palantir's stock was up 150% this year. Palantir CEO Alex Karp was visibly unhappy about Burry's decision. "I do think this behavior is egregious and I'm going to be dancing around when it's proven wrong," Karp told CNBC on Tuesday morning. Days before his positions were disclosed, Burry posted and still has pinned a rather cryptic X post showing a photo of Christian Bale portraying him in "The Big Short" movie, along with text that says "Sometimes, we see bubbles. Sometimes, there is something to do about it. Sometimes, the only winning move is not to play." Then on Monday, Burry posted four more images with no context to his X profile. One of them was depicting declining year over year growth in the cloud segments of Amazon, Alphabet and Microsoft in 2023 to 2025 versus 2018 to 2022. All three of those companies dominate the market as top cloud providers. Another chart was titled "U.S. tech capex growth is matching the tech bubble of 1999-2000." Other experts have also warned of similarities between the current state of the AI market and the 1999 dot-com bubble, which burst in 2000 and evaporated around five trillion dollars in market value. Every other company's earnings report nowadays mentions the word "AI," in a striking parallel to the way every company in the early 2000s would plaster ".com" to delight investors, which has started to worry some skeptics that stock prices may have become detached from actual earnings. Earlier this year, Apollo Global Management's influential chief economist Torsten Slok said that the only difference between the dot-com bubble and the "AI bubble today is that the top 10 companies in the S&P 500 today are more overvalued than they were in the 1990s." More recently, the Bank of England also warned that stock market price valuations were comparable to the peak of the dot-com bubble. The third photo in Burry's X post was a Bloomberg diagram showing the circular dealmaking by top AI companies, with Nvidia in the center of the trade. The circular dealmaking concerns have been getting more attention in recent months, especially as AI darlings Nvidia and OpenAI continue to announce deal after deal worth billions. The AI industry has increasingly become a tangled web of multibillion-dollar investments, rapidly expanding inwards as a handful of tech giants with overlapping interests ink partnerships with each other. These circular investments inject more money into the system and prop up not just the market but the entire U.S. economy. So, if all goes according to plan, they can continue to build economic growth. But if even one cog is faulty, and breakthroughs slow down or demand doesn't pan out as expected, it could create a domino effect that can take the whole system down. In a final post, Burry posted a page from a book called "Capital Account." He had highlighted two segments describing the telecommunications crash, which followed the dot-com bubble burst: "By 2002, it was commonly reported that less than 5 percent of US telecoms capacity was in use. Thousands of miles of expensive fibre optic networks remained 'unlit' beneath the ground," and "Wholesale telecoms prices fell by more 70 percent a year in 2001 and 2002. Many of the companies which not long before had been valued at huge premiums to their invested capital, now sought protection from creditors." It's not out of bounds to say that Burry is drawing a parallel between the current AI-driven state of the stock market and the financially turbulent times of the early 2000s. The investors of the 2000s weren't completely incorrect on the potential of the internet. The internet did turn out to completely change society and our everyday lives, and the demand for the fibre optic networks did eventually arrive. But investor enthusiasm overestimated just how fast and large these companies could deliver on the hype. Fed researchers issued a similar (though much less bubble-certain) warning earlier this year, pointing out the risk that comes with building expensive infrastructure too quickly for anticipated demand. If the demand doesn't scale as expected, the Fed researchers wrote, it could lead to "disastrous consequences," much like the railroad over-expansion of the 1800s that led to an economic depression towards the turn of the century.

[2]

AI valuations face renewed scrutiny

Pat Gelsinger's comments add weight to the growing belief that AI valuations look overheated Growing debate over the stability of artificial intelligence valuations has intensified in recent weeks as the market becomes increasingly dominated by AI companies. The sharpest warning yet comes from a figure whose name remains inseparable from the events of 2008, when the subprime mortgage collapse triggered a global financial crisis. Michael Burry, whose actions during the subprime crisis became central to the blockbuster movie The Big Short, has taken new positions that show his deep skepticism toward the current AI boom. Recent financial disclosures show Burry's firm, Scion Asset Management, has opened large option positions tied to Nvidia and Palantir, with a notional value exceeding $1 billion. These positions suggest that he sees downside risk in stocks widely viewed as pillars of the AI surge. Although Scion also opened shorts in companies outside the AI arena, the scale of these AI-linked positions has drawn the most attention. This is because they reflect his readiness to challenge market consensus during earlier speculative cycles. These filings only cover activity through late September 2025, so it remains unclear whether he has already repositioned, although the timing alone has amplified public debate. The renewed focus on Burry comes at a moment when concerns over circular financial relationships are rising. Nvidia has been at the center of several arrangements viewed as unusually structured, including deals involving xAI, and AMD and OpenAI have also formed partnerships that combine hardware supply with equity exposure. Such patterns reinforce the view that valuations may be driven more by momentum than by clear, long-term revenue expectations. They also appear at a time when companies are committing large budgets to data center expansion, advanced CPU integration, and hardware needed to support demanding AI tools. Former Intel CEO Pat Gelsinger has also said that the AI sector is in bubble territory, although he believes the correction could happen gradually rather than suddenly. His comments show a belief that the sector's revenue models lag far behind its investment pace, raising questions about whether current spending levels will ever be justified by returns. Meanwhile, market reactions have shown renewed volatility, with Nvidia and Palantir both experiencing sharp declines as investors reassess exposure. Despite Burry's reputation, not everyone agrees with his assessment. Perhaps unsurprisingly, Palantir CEO Alex Karp publicly dismissed bubble warnings in direct terms, insisting that AI-driven economic expansion will ultimately justify current valuations. Whether Burry is again signaling structural risk ahead of the market or simply responding to short-term sentiment will become clearer as the sector moves from rapid expansion to measurable results. For now, the tension between optimism and caution continues, leaving investors to interpret signals from a figure whose past predictions reshaped financial history. Via Tom's Hardware

[3]

"Big Short" investor's challenge signals shift in Wall Street's AI romance

Why it matters: Wall Street can't stop talking about the risks of an AI bubble, yet investment bets that the bubble will deflate or burst haven't gained much traction. That could be changing. By the numbers: Scion Asset Management, Burry's firm, disclosed put-option positions worth roughly $912 million against Palantir and $187 million against Nvidia in its latest 13F filing. * Together, those short bets make up nearly 80% of his portfolio, a massive wager that the AI boom is overcooked. Catch up quick: Burry made his money with a contrarian bet against subprime mortgages before the financial crisis erupted. * That move made him famous via the Michael Lewis book "The Big Short" and subsequent movie. * Retail investors track Burry's investments and copy them feverishly via Reddit threads and Discord chats. * That's important for a company like Palantir: Roughly half its shares are owned by individual investors, aka, retail. State of play: It's not just about Burry vs. Karp. There's been a recent rally into "smaller, weaker balance sheet, high short interest and unprofitable stocks" according to a recent note from Stuart Kaiser, head of U.S. equity trading strategy at Citi. * AppLovin CEO Adam Foroughi slammed short-seller reports as "littered with inaccuracies." The Securities and Exchange Commission has since been investigating the company's data-collection practices, Bloomberg reported. * GameStop CEO Ryan Cohen has said it's "un-American to bet against business," but also said it's a free market in July. Zoom out: Executives may publicly rebuff short sellers, but they tend to follow their advice according to one research paper showing insider share selling increases after companies blame short sellers. The bottom line: Short selling is not a popular bet when the market is up 90% from its fall 2022 lows.

[4]

The Big Short Guy Just Bet $1 Billion That the AI Bubble Pops

Michael Burry, who famously shorted the US housing market before its collapse in 2008, has bet over $1 billion that the share prices of AI chipmaker Nvidia and software company Palantir will fall -- making a similar play, in other words, on the prediction that the AI industry will collapse. According to the Securities and Exchange Commission filings, his fund, Scion Asset Management, bought $187.6 million in puts on Nvidia and $912 million in puts on Palantir, as CNN reports. Burry similarly made a long-term $1 billion bet from 2005 onwards against the US mortgage market, anticipating its collapse. His fund rose a whopping 489 percent when the market did subsequently fall apart in 2008. It's a major vote of no confidence in the AI industry, highlighting growing concerns that the sector is growing into an enormous bubble that could take the US economy with it if it were to lead to a crash. "This new disclosure suggests that he now believes that there is an AI bubble which is due to pop," Quiver Quantitative cofounder James Kardatzke told The Telegraph. Investors have poured tens of billions of dollars into firms like Nvidia and Palantir, ballooning their valuations to historic levels. Nvidia recently closed with a market cap of $5.04 trillion, becoming the first company ever to cross the $5 trillion threshold. Palantir's market cap is also up over 150 percent year-to-date. Its current valuation is upwards of 200 times its forward earnings, spreading fears that it may be grossly overvalued. The news of Burry's latest short comes amid a significant AI tech selloff. Shares of Nvidia and Palantir dropped just under four percent and nine percent respectively on Tuesday, indicating shaky confidence that AI companies will be able to justify their enormous valuations due to flagging revenue growth. Investors are also growing skeptical as the AI industry turns to making major deals amongst each other; circular financing that has further stoked fears of an AI bubble. Experts have been predicting a reality check for a tech-heavy stock market that has ballooned out of proportion. Burry is clearly in his element. Last week, he posted on X-formerly-Twitter for the first time in two years, with a picture of actor Christian Bale, who portrayed him in the 2015 film, "The Big Short." "Sometimes, we see bubbles," he wrote in the caption. "Sometimes, there is something to do about it. Sometimes, the only winning move is not to play." Four days later, Burry disclosed that he'd bet against Nivida and Palantir. As CNN points out, Burry's track record isn't perfect. For instance, he called in January 2023 to "sell" in a now infamous tweet, only to admit that he was "wrong" two months later. At the time, the Nasdaq 100 index entered a bull market, surging by more than 21 percent between December 2022 and March 2023. Nonetheless, given his pivotal call to short the US housing market certainly gives his latest dire warning about an AI bubble some gravitas. Even with Palantir beating Wall Street expectations in its latest quarterly earnings, the company is feeling the pressure this week. "Despite the great results, when you coincide that with the comments that Michael Burry made and everybody already talking about concerns about an AI bubble, I think the combination of those factors really helped drive a pullback in the shares, the broader tech index and as a result the broader markets," CFRA Research tech analyst Angelo Zino told CNN. "We're not overly concerned about the pullback, but I would say it's one of those situations where you've got to keep an eye on it," he added. Meanwhile, Palantir CEO Alex Karp was scandalized by Burry's major bet against the AI industry. "The two companies he's shorting are the ones making all the money, which is super weird," he told CNBC today. "The idea that chips and ontology is what you want to short is bats*** crazy." Karp, though, was clearly using his media appearance to reassure spooked investors. "It's crazy motivating," Karp added. "Every time they short us, we are just like tripling down on getting the better numbers, in part honestly, to make them poorer."

[5]

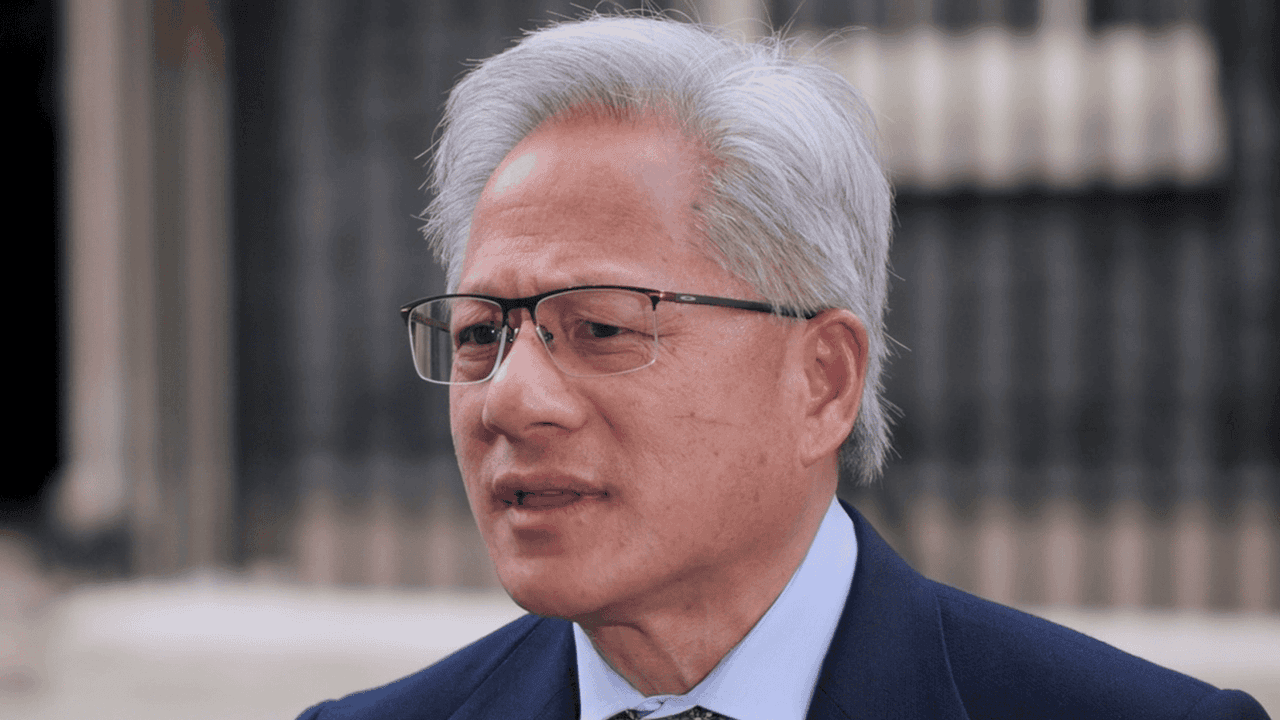

Nvidia boss defends AI against claims of bubble by 'Big Short' investor

Michael Burry, who was played by Christian Bale in the 2015 film The Big Short, has bet against Nvidia and other technology stocks, causing market plunges worth hundreds of billions of dollars. Nvidia boss Jensen Huang has told Sky News the AI sector is a "long, long away" from a Big Short-style collapse. Speaking outside Downing Street following a roundtable with government and other industry figures, the head of the world's first $5tn company defended his sector from criticism by investor Michael Burry. Mr Burry and his firm, Scion Capital, gained notoriety for "shorting" - betting against - the US housing market ahead of the 2008 financial crash. Politics latest: Lammy to take deputy PMQs He was portrayed by Christian Bale in the 2015 film The Big Short, which also starred Steve Carell, Brad Pitt and Ryan Gosling. Earlier this week, filings revealed Mr Burry has now bet against Nvidia and on social media, he has suggested there is a bubble in the sector. Some $500bn was wiped off technology stocks overnight Tuesday into Wednesday, Bloomberg reported. Speaking to Sky News, Mr Huang said: "I would say that we're in the beginning of a very long build out of artificial intelligence." Defending his company and investment, Mr Huang said AI is the first technology that requires "infrastructure to be built" and that Nvidia has seen "great returns" from AI, and that is why it is expanding. Mr Huang said better training of AI has led to much "better" and "useful" answers, and that means "the AIs have become profitable". "When something is profitable, the suppliers want to make more of it, and that's the reason the infrastructure build out is accelerating," he added. Pushed on whether he was worried about a situation like the Big Short, Mr Huang said: "We are long, long away from that." The UK government is betting big on AI in the hopes that it can save money by using it and generate growth by building the infrastructure to back it up. Asked if she was worried about the market, Technology Secretary Liz Kendall told Sky News: "I have no doubts that AI is going to transfer all parts of our economy and our public services." Mr Burry and his firm, Scion Capital's bets against Nvidia and other companies were revealed by regulatory filings earlier this week. The investor also posted on social media for the first time in more than two years, warning of a bubble. 👉Listen to Politics at Sam and Anne's on your podcast app👈 Concerns have been raised about the market surrounding AI, and the growth many companies are experiencing. Nvidia is the largest producer of the specialist computer chips that are used to train and use AI models.

[6]

Michael Burry's big short on AI sent shockwaves across global tech. Which Dalal Street tech stocks caught the whiff?

Michael Burry's latest bearish bets on artificial intelligence (AI) stocks have sent tremors through global technology markets, and the ripples have reached Dalal Street. The famed "Big Short" investor's $1.1 billion wager against AI bellwethers Nvidia and Palantir triggered a sharp sell-off across tech-heavy indices, wiping billions in market value and unsettling investors who had been riding the AI wave. India's AI-linked names weren't spared, with several seeing steep declines as global risk appetite turned cautious. The Nasdaq logged its biggest weekly drop since April, falling about 3% for the week, as investors questioned whether the AI rally that powered markets to record highs had run too far. Chip and software names led the decline, while Treasury yields eased slightly. Burry's Scion Asset Management disclosed roughly $187 million in put options on Nvidia and $912 million on Palantir, bets that have become a symbol of growing skepticism toward AI valuations. His warnings about "hype detached from fundamentals" amplified jitters already brewing from profit-taking and rotation out of tech. In India, the fallout was swift. High-flying AI proxy stocks tumbled as investors booked profits and recalibrated expectations. Netweb Technologies, one of the biggest AI-related gainers earlier this year, fell 15% this week. Zensar Technologies lost 12.5%, while Oracle Financial Services Software declined 5.1%. HCL Technologies slipped nearly 1.9%, Bosch Ltd 1.2%, and Persistent Systems 0.5%. Other AI and data ecosystem players such as Affle (India), Orient Technologies, and Techno Electric also saw selling pressure, falling between 3% and 9%. "The global AI sell-off has clearly dented near-term sentiment in India's tech and AI-proxy basket," said Harshal Dasani, Business Head at INVasset PMS. "Michael Burry's high-profile bearish wagers on Nvidia and Palantir triggered profit-taking across AI-heavy indices, prompting global funds to trim risk. That ripple reached Indian counters through valuation recalibration and passive outflows. Nifty IT mirrored Nasdaq swings last week, even as domestic fundamentals stayed intact. The correction is sentiment-driven rather than earnings-led, but it underscores how tightly Indian technology valuations are now tethered to global AI risk appetite." Ross Maxwell, Global Strategy Lead at VT Markets, agreed that the tremors were largely psychological. "The global AI correction has softened the appetite for risk in India's tech stocks," he said. "Indian IT firms and AI-linked proxies are being viewed more cautiously, not because of domestic weakness, but due to contagion in sentiment." Dasani said that "unlike the U.S. market, India's AI participation is primarily services-led -- focused on integration, automation, and analytics rather than core chip or model IP," a structure that gives firms like HCL Tech and Persistent Systems "a cushion" against speculative cycles. Both analysts warned that smaller and mid-tier AI-linked firms are most at risk if global weakness persists. "Stocks that rallied purely on the 'AI story' without proportional earnings visibility look most vulnerable," said Dasani. "Smaller-cap names in ad-tech and platform plays -- such as Affle (India) or 3i Infotech -- may see deeper drawdowns if global risk-off persists." Maxwell echoed that view: "Among the names mentioned, the more premium valued mid-caps and AI-linked firms look most vulnerable. Companies like Affle, Zensar Technologies, and 3i Infotech rely heavily on global digital-spending cycles, which leaves them more exposed to a global AI-driven correction." In contrast, diversified firms such as HCL Technologies, Bosch Ltd, and Oracle Financial Services Software have steadier cash flows and broader revenue drivers, helping them weather global volatility better. Despite the turbulence, experts said the pullback could be constructive. "Indian AI-linked valuations did outrun earnings momentum in 2024, but they remain more grounded than US peers," said Dasani. "Persistent Systems and HCL Tech trade at elevated, yet defendable, multiples given their consistent EBIT growth and expanding AI deal books." Maxwell agreed the correction could "serve as an opportunity and reality check that distinguishes genuine long-term sustainable stocks from over-speculative ones caught up in the furore." "This phase could prove constructive for long-term investors. It's flushing out momentum froth while leaving intact the secular uptrend in data-driven automation, analytics, and AI adoption. Once volatility subsides, this pullback may be remembered as the accumulation window for India's next multi-year digital-transformation leg," Dasani added. Dhanshree Jadhav, Lead Analyst-Technology at Choice Institutional Equities, said she doesn't see direct spillover from the U.S. AI sell-off. "We don't think the company specific news related to Nvidia and Palantir to have related impact on Indian IT companies, which are majorly outsourcing IT services players and partners of top global clients," she said. "Also most of them commented on witnessing AI-led growth momentum during Q2 FY26 results which has just ended." Meanwhile, Anurag Singh, Managing Partner at Ansid Capital, told ET Now that the U.S. AI cool-off is "justified but not alarming." "Markets are taking a bit of a breather in the U.S. and people are beginning to question the AI story and the kind of investments that are going into it," he told ET Now. "Part of the story is that and if that happens, the overall sentiment sours because most of the gains in the last two years are prominently coming from these five-seven companies. It is justified as well, but that is not something to worry about." Singh said that while certain speculative corners of the AI market might be frothy, "the larger U.S. market continues to be a stable story," with no signs of systemic risk. For now, most analysts believe the correction reflects cooling exuberance rather than the start of a crash. "The correction appears to be a tactical pause rather than the start of a structural unwind," said Dasani. "Enterprise AI budgets remain intact, and Indian firms continue to report healthy deal pipelines. Unless U.S. corporate tech spending or cloud budgets materially weaken, this is more a risk-management phase than a regime shift." Maxwell struck a similar note. "At the moment it appears more like a sentiment-driven correction than the start of a deep rotation out of technology," he said. "The fundamental drivers of technology adoption such as digital transformation, automation, and AI deployment in enterprises are still in place." In India, where only a quarter of the IT sector's recent outperformance is directly AI-linked, fundamentals may soon reassert control. "With hype cooling, fundamentals -- order growth, pricing power, and client stickiness -- will reassert control," said Dasani. "That makes India's rally less about the bubble and more about execution durability once global volatility fades." Also read |Fab 7 isn't a bubble: Ansid Capital's Anurag Singh says big tech still has legs, but India needs a year of cooling off (Disclaimer: Recommendations, suggestions, views and opinions given by the experts are their own. These do not represent the views of the Economic Times) (You can now subscribe to our ETMarkets WhatsApp channel)

[7]

'Sometimes, we see bubbles': Big short Michael Burry's bearish bet on world's most valuable stock meets global AI sell-off

Michael Burry's Scion Asset Management has taken massive short positions on Nvidia and Palantir, signalling caution over the AI boom as global tech stocks face their sharpest decline in months. Michael Burry, the investor immortalised by The Big Short for predicting the 2008 housing market collapse, has once again rattled global markets. His fund, Scion Asset Management, has taken a bearish position against Nvidia and Palantir, two of the biggest symbols of the ongoing artificial intelligence (AI) boom, according to a CNN report. Scion bought $187.6 million worth of put options on Nvidia (NVDA) and $912 million in puts on Palantir (PLTR), positions that profit if the stocks decline. The move comes just weeks after Nvidia briefly became the world's most valuable company, crossing the $5 trillion market cap mark and dethroning tech giants like Apple and Microsoft. The revelation of Burry's bets triggered renewed anxiety in global markets already showing signs of fatigue after months of relentless gains in technology shares. The timing of Burry's move coincides with a broader sell-off in global technology stocks, which have seen their sharpest slide in seven months. On Wednesday, global markets from Tokyo to Frankfurt tumbled as investors reduced exposure to overheated tech counters. Nvidia has fallen 5% over the past five days, while Palantir is down a similar amount. According to Kotak Equities, the debate over an AI bubble is growing louder. "Most observers agree about a bubble," the brokerage noted, "but there is no consensus on the duration, magnitude, or even the nature of the bubble." Before the short positions were revealed, Burry made cryptic posts on X, "Sometimes, we see bubbles. Sometimes, there is something to do about it. Sometimes, the only winning move is not to play." Over the past 18 months, Nvidia's stock has soared more than 200%, fuelled by its unmatched dominance in the AI semiconductor market. The company's powerful graphics processing units (GPUs) have become the backbone of the modern AI revolution, powering large language models like ChatGPT, Gemini, and Claude. Its data centre revenue has surged triple digits year-on-year, as global tech giants, from Microsoft and Amazon to Meta, continue pouring billions into building AI infrastructure. With roughly 80% market share in AI chips, Nvidia has turned into the most critical supplier for the world's biggest technology companies. The rally not only made Nvidia the first company ever to cross the $5 trillion valuation mark, but also turned AI into the single biggest driver of market optimism since the pandemic-era liquidity surge. Michael Burry's latest move is being seen as a symbolic warning to euphoric investors. In the 2000s, he famously shorted the US housing market while others ignored the risks, a bet that later made him a legend. His new positions suggest scepticism that the AI boom has gone too far, too fast, drawing comparisons to earlier tech bubbles. His latest bet appears to reflect that same concern -- that AI enthusiasm may have priced in decades of future growth in just a year. (You can now subscribe to our ETMarkets WhatsApp channel)

[8]

Fund manager who predicted Great Recession sparks fiery Palantir CEO rant

The hedge fund legend who called the 2008 US housing crisis and is the famed investor behind the "Big Short" is back in the spotlight. This time, he is betting against two artificial intelligence giants, taking a massive bearish position against Palantir Technologies and NVIDIA. Image source: Dietsch/Getty Images The Burry-Palantir controversy According to the SEC's 13F filing from Michael Burry's Scion Asset Management, he has placed put options on Palantir Technologies (PLTR), which sent ripples through the AI world. Palantir's stock price, which had surged to a 52-week high following strong Q3 earnings on Monday, November 3, 2025, fell 8% after it was revealed that Burry was effectively shorting the stock with his put options (puts increase in value as stock prices decline). "I think what is going on here is market manipulation," called out Palantir CEO Alex Karp in an interview with CNBC on November 4. Despite Palantir's 8% drop, shares remain up 155% year-to-date. Still, Burry's bet led to Karp responding with an unfiltered tirade, declaring Burry's short bet egregious and vowing to celebrate it if it were to fail. Burry, who has long been a contrarian, is now placing one of his largest bets on companies that are changing the market course daily - Nvidia (NVDA) and Palantir. He purchased put options covering approximately 5 million Palantir shares, valued at around $912 million in the quarter ending Sept. 30, representing 66% of his firm's assets under management. The defense tech firm reported $1.18 billion in revenue, up 63% year-over-year, and even raised its full-year guidance towards $4.4 billion. He owns puts representing 1 million shares of Nvidia -- his second-largest position, worth about $187 million. Karp fires back at Burry Appearing in his first interview following the company's remarkable Q3 earnings, Karp took the opportunity to accuse short sellers of misunderstanding Palantir's business and the broader AI economy. "Most of the GDP growth in this country is because of AI." Further commenting that Burry's position is quite unclear, "It's probably just how do I get my position out and not look like a fool." Karp went on to blast what he sees as the market's inability to distinguish substance from hype, maintaining that, "As far as I can tell, the two companies they're shorting are the ones making all the money." Karp also ranted about the ethical aspects of shorting, underscoring Palantir's role in uplifting warfighters and performing a noble task. Analyst reacts to Palantir's earnings Burry's trade is reflecting a growing market divide, with analysts bullish on Palantir as a critical infrastructure for government data systems and AI deployment. At the same time, those bearish believe this euphoria is short-term. RBC Capital, which raised Palantir's price target to $50 from $45 while maintaining an Underperform rating, views the results as overwhelmingly US-centric, with stagnant international performance. Cautioning investors that while profitability is strong, there is limited clarity around what normalized growth will look like after Palantir's initial AIP (Artificial Intelligence Platform) rollouts stabilize, as reported by TheFly. Meanwhile, Veteran analyst Stephen Guilfoyle credits Palantir's growth to strong fundamentals, noting, "Sales are running wild as are margins. The commercial business is exploding. Cash flows are not just robust; they are enormous. The balance sheet is simply the greatest balance sheet I can remember seeing. The CEO is focused and aggressive." The Arena Media Brands, LLC THESTREET is a registered trademark of TheStreet, Inc. This story was originally published November 4, 2025 at 3:04 PM.

Share

Share

Copy Link

The investor famous for predicting the 2008 housing crash has placed massive bets against AI giants Nvidia and Palantir, warning of an AI bubble similar to the dot-com crash. His positions have sparked heated responses from tech CEOs and renewed scrutiny over AI valuations.

The Big Short Investor Takes Aim at AI

Michael Burry, the legendary investor who predicted the 2008 housing market crash and inspired the Oscar-winning film "The Big Short," has set his sights on what he believes is the next major financial bubble: artificial intelligence

1

. Recent regulatory filings reveal that Burry's hedge fund, Scion Asset Management, has taken massive put option positions against two AI darlings - $187.6 million against Nvidia and a staggering $912 million against Palantir4

.

Source: Futurism

These positions, totaling nearly $1.1 billion, represent approximately 80% of Burry's portfolio, signaling an extraordinary level of conviction in his bearish AI thesis

3

. The timing of these disclosures has sent shockwaves through the market, with both Nvidia and Palantir experiencing significant declines following the news.Market Reactions and Executive Pushback

The revelation of Burry's positions has triggered immediate market volatility, with approximately $500 billion wiped off technology stocks overnight

5

. Nvidia shares dropped nearly 4% while Palantir plummeted 9% as investors reassessed their exposure to AI companies4

.Palantir CEO Alex Karp responded with visible frustration to Burry's bet against his company. "I do think this behavior is egregious and I'm going to be dancing around when it's proven wrong," Karp told CNBC

1

. He dismissed Burry's strategy as "bats*** crazy," arguing that shorting companies "making all the money" defies logic4

.Nvidia CEO Jensen Huang also defended the AI sector during a visit to Downing Street, telling Sky News that the industry is "long, long away" from a Big Short-style collapse. Huang emphasized that AI represents "the beginning of a very long build out" and highlighted the profitability driving continued infrastructure investment

5

.

Source: Sky News

Historical Parallels and Warning Signs

Burry's skepticism extends beyond individual stock picks to broader structural concerns about the AI market. Days before his positions were disclosed, he posted cryptic messages on X (formerly Twitter), including charts comparing current U.S. tech capital expenditure growth to the 1999-2000 tech bubble

1

. One particularly telling post featured declining year-over-year growth in cloud segments of Amazon, Alphabet, and Microsoft.Experts have increasingly drawn parallels between today's AI boom and the dot-com bubble that burst in 2000, erasing approximately $5 trillion in market value

1

. Apollo Global Management's chief economist Torsten Slok noted that "the top 10 companies in the S&P 500 today are more overvalued than they were in the 1990s," while the Bank of England warned that current stock valuations are comparable to dot-com bubble peaks1

.

Source: Axios

Related Stories

Circular Investment Concerns

A key element of Burry's thesis centers on what he views as problematic circular dealmaking within the AI industry. His social media posts highlighted a Bloomberg diagram showing Nvidia at the center of interconnected AI investments

1

. This web of multibillion-dollar partnerships between tech giants with overlapping interests has created a system where companies essentially invest in each other, potentially inflating valuations artificially2

.Former Intel CEO Pat Gelsinger has also expressed concerns about AI sector valuations, suggesting the market is in "bubble territory" though he expects any correction to occur gradually rather than suddenly

2

.Track Record and Market Impact

Burry's reputation stems from his prescient 2005 bet against the U.S. mortgage market, which generated a 489% return when the housing bubble collapsed in 2008

4

. However, his track record isn't perfect - he called for investors to "sell" in January 2023, only to admit he was "wrong" two months later as the Nasdaq 100 surged over 21%4

.The influence of Burry's positions extends beyond institutional investors, as retail traders closely monitor and often copy his moves through Reddit threads and Discord chats

3

. This retail following is particularly significant for Palantir, where individual investors own roughly half of all shares3

.References

Summarized by

Navi

[2]

Related Stories

AI Investment Bubble Concerns Intensify as Industry Leaders Warn of 'Irrationality' Despite Nvidia's Strong Earnings

18 Nov 2025•Business and Economy

Nvidia Faces Growing Skepticism from Prominent Short Sellers Over AI Boom Sustainability

20 Nov 2025•Business and Economy

Sam Altman Warns of AI Bubble While OpenAI Seeks $500B Valuation

16 Aug 2025•Business and Economy

Recent Highlights

1

Samsung unveils Galaxy S26 lineup with Privacy Display tech and expanded AI capabilities

Technology

2

Anthropic refuses Pentagon's ultimatum over AI use in mass surveillance and autonomous weapons

Policy and Regulation

3

AI models deploy nuclear weapons in 95% of war games, raising alarm over military use

Science and Research