Micron snaps up Taiwan chip fab for $1.8 billion to meet surging AI memory demand

2 Sources

2 Sources

[1]

Micron to boost DRAM output with $1.8bn chip fab buy

Taiwan's Powerchip sells legacy fab it opened just 19 months ago after spending $9.5 billion Micron has found a way to add new DRAM manufacturing capacity in a hurry by acquiring a chipmaking campus from Taiwanese outfit Powerchip Semiconductor Manufacturing Corporation (PSMC). The two companies announced the deal last weekend. Micron's version of events says it's signed a letter of intent to acquire Powerchip's entire P5 site in Tongluo, Taiwan, for total cash consideration of US$1.8 billion. "The acquisition includes an existing 300 mm fab cleanroom of 300,000 square feet and will further position Micron to address growing global demand for memory solutions," the company stated, adding that the company "expects this acquisition to contribute to meaningful DRAM wafer output beginning in the second half of calendar 2027." Powerchip's take on the deal includes news that it will establish a long-term foundry relationship with Micron "on DRAM advanced packaging wafer manufacturing." The deal means PSMC will leave the Tongluo site and move the production lines it operates there to another of its facilities in the city of Hsinchu. PSMC has assured its foundry customers it can do this without disrupting its operations, but also says it plans to "phase out low-margin products to reduce reliance on mature process foundry services" and build more products for AI applications. That's a remarkable decision given that PSMC opened the Tongluo site less than two years ago. In its May 2024 'Hooray, we're open!' announcement, PSMC said it invested more than NT$300 billion (US$9.5 billion) on the facility, and that it had capacity to produce 50,000 12-inch wafers per month under 55, 40 and 28 nanometer technology nodes. The company also scoped a second fab on the site to produce 2 nanometer chips. Nineteen months later, the company is walking away from Tongluo and the legacy chip business and has seemingly taken a financial hit along the way. Micron says the acquisition "complements ... ongoing global expansion plans as the company invests to meet long-term demand from its customers." The company is already building new memory fabs - it announced a new one in New York State just last Friday - and late last year told investors that new datacenter builds to house AI infrastructure have created a "sharp increase" in demand forecast for memory and storage that semiconductor companies won't be able to meet for the foreseeable future. That collision of supply and demand has sent memory prices soaring and created an environment in which Micron was able to pre-sell all the high-bandwidth memory it will produce in 2026. Manufacturers of PCs, servers, GPUs, and smartphones have warned the cost of their wares must rise along with the cost of memory. This deal may make matters worse for more buyers, because PSMC used the Tongluo site to make legacy DRAM products - the kind of memory used in less advanced products. With the company now exiting the legacy chip biz, that memory will also become more scarce, giving the laws of supply and demand another moment in which to work their way on markets. ®

[2]

Powerchip shares jump after Micron moves to buy Taiwan fab for $1.8 billion

TAIPEI, Jan 19 (Reuters) - Shares of Taiwan's Powerchip Semiconductor Manufacturing Corp rose nearly 10% on Monday, after U.S. memory chipmaker Micron Technology said it would buy a fabrication plant from the company. Micron Technology said on Saturday it had signed a letter of intent to acquire Powerchip's P5 fabrication site in Tongluo, Miaoli County, Taiwan, for $1.8 billion in cash. Powerchip is one of Taiwan's major semiconductor foundries and produces both legacy chips and memory chips. Micron said it expects the deal to help boost its output of dynamic random access memory (DRAM) wafers beginning in the second half of 2027. The purchase will add about 300,000 square feet of cleanroom space, a highly controlled environment needed for chip production, the company said. It will allow Micron to ramp up DRAM production in phases at a time when global demand for memory continues to outpace supply, the company added. Micron is one of only three major suppliers of high bandwidth memory (HBM) chips essential to AI technology, alongside South Korea's Samsung and SK Hynix <000660.KS >. Micron CEO Sanjay Mehrotra said last month he expects memory markets to remain tight beyond 2026. The company's shares gained a whopping 240% in 2025, far outpacing the benchmark chip index's 42% gain. Micron has been operating in Taiwan for more than 30 years and is the island's largest foreign direct investor, according to Micron Taiwan's website. Its facilities in Taichung, Taiwan, are a key production hub for DRAM and HBM products. Powerchip said in a statement on Saturday that Micron will establish a long-term foundry relationship with the company for DRAM advanced-packaging wafer manufacturing, and will assist Powerchip in enhancing its specialty DRAM process technologies. Micron said the transaction is expected to close by the second quarter of 2026, subject to regulatory approvals. (Reporting by Wen-Yee Lee; Editing by Himani Sarkar)

Share

Share

Copy Link

Micron Technology signed a letter of intent to acquire Powerchip's P5 fabrication site in Taiwan for $1.8 billion, adding 300,000 square feet of cleanroom space to ramp up DRAM production. The deal comes as memory markets remain tight, with Micron having already pre-sold all its high-bandwidth memory output for 2026 amid soaring demand from AI infrastructure.

Micron Acquisition Targets Critical DRAM Production Expansion

Micron Technology has signed a letter of intent to acquire Powerchip Semiconductor Manufacturing Corporation's entire P5 fabrication site in Tongluo, Taiwan, for $1.8 billion in cash

1

. The semiconductor industry deal adds approximately 300,000 square feet of cleanroom space to Micron's operations and positions the company to boost DRAM production capacity beginning in the second half of 20272

. The transaction, expected to close by the second quarter of 2026 subject to regulatory approval, represents a strategic move to address growing global demand for memory solutions as AI infrastructure builds accelerate worldwide1

.

Source: Market Screener

Powerchip's Remarkable Pivot Away from Legacy Chips

The Powerchip P5 fabrication plant sale marks a dramatic shift for the Taiwanese semiconductor foundries operator, which opened the Tongluo site just 19 months ago after investing more than $9.5 billion in the facility

1

. The site had capacity to produce 50,000 12-inch wafers per month under 55, 40, and 28 nanometer technology nodes. Powerchip will now relocate production lines from Tongluo to its facilities in Hsinchu and plans to phase out low-margin products to reduce reliance on mature process foundry services while building more products for AI applications1

. Powerchip shares jumped nearly 10% following the announcement, reflecting investor confidence in the strategic repositioning2

.High-Performance Memory for AI Drives Urgent Capacity Needs

Micron's move to acquire existing fab capacity reflects the intense pressure facing memory chip production suppliers. The company is one of only three major suppliers of High Bandwidth Memory (HBM) chips essential to AI technology, alongside Samsung and SK Hynix

2

. Micron CEO Sanjay Mehrotra indicated last month that memory markets will remain tight beyond 2026, with the company having already pre-sold all its high-bandwidth memory output for 20261

. New datacenter builds to house AI infrastructure have created a sharp increase in demand forecast for memory and storage that semiconductor companies won't be able to meet for the foreseeable future1

. This supply-demand collision has sent soaring memory prices across markets, with manufacturers of PCs, servers, GPUs, and smartphones warning that costs must rise accordingly1

.Related Stories

Implications for Legacy Chip Supply and AI Memory Markets

The deal establishes a long-term foundry relationship between Micron and Powerchip for DRAM advanced-packaging wafer manufacturing, with Micron assisting Powerchip in enhancing its specialty DRAM process technologies

2

. However, Powerchip's exit from legacy chips production at Tongluo may exacerbate supply constraints for less advanced products, potentially driving prices higher across broader electronics markets1

. Micron has operated in Taiwan for more than 30 years and is the island's largest foreign direct investor, with facilities in Taichung serving as a key production hub for DRAM and HBM products2

. The acquisition complements Micron's ongoing global expansion plans, including a new fab announced in New York State, as the company invests to meet long-term demand from customers racing to build AI infrastructure1

.

Source: The Register

References

Summarized by

Navi

[1]

[2]

Related Stories

Micron commits $24 billion to Singapore plant as AI demand strains global memory supply

27 Jan 2026•Business and Economy

Micron Invests $7 Billion in Singapore for Advanced HBM Packaging Facility to Meet AI Demand

08 Jan 2025•Business and Economy

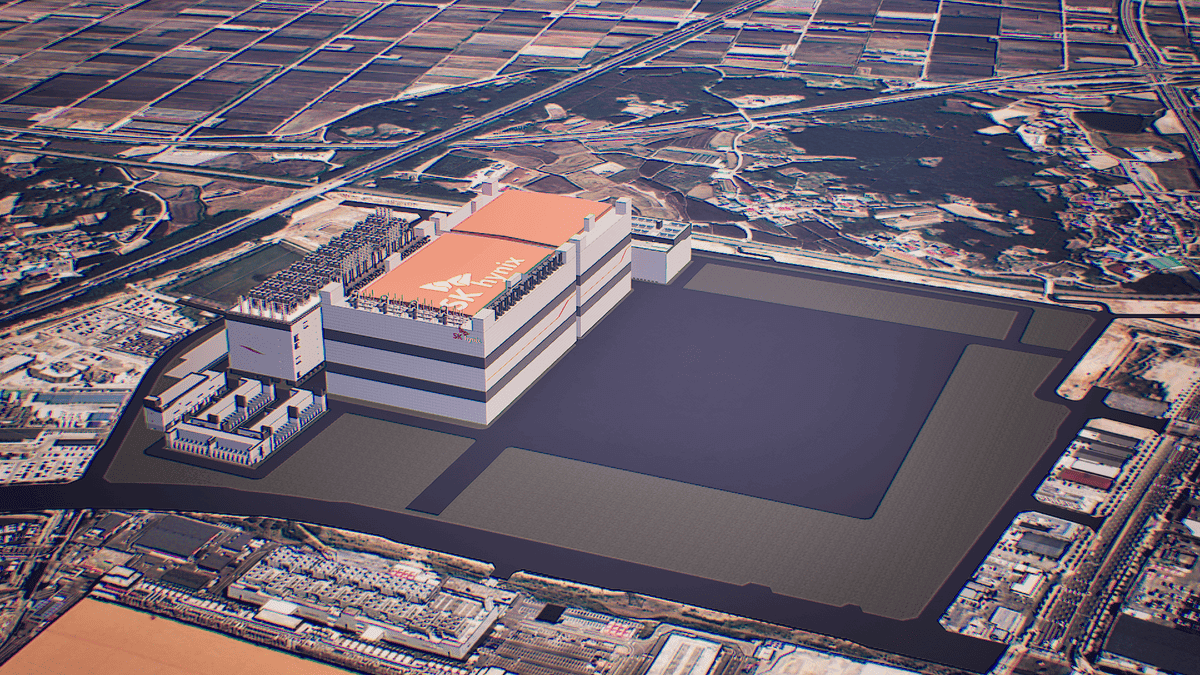

SK Hynix commits $13 billion to world's largest HBM plant as AI demand creates historic shortage

13 Jan 2026•Business and Economy

Recent Highlights

1

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

2

Demis Hassabis predicts AGI in 5-8 years, sees new golden era transforming medicine and science

Technology

3

Nvidia and Meta forge massive chip deal as computing power demands reshape AI infrastructure

Technology