Nvidia CEO Confirms No Plans to Ship Blackwell GPUs to China Amid Ongoing Trade Restrictions

6 Sources

6 Sources

[1]

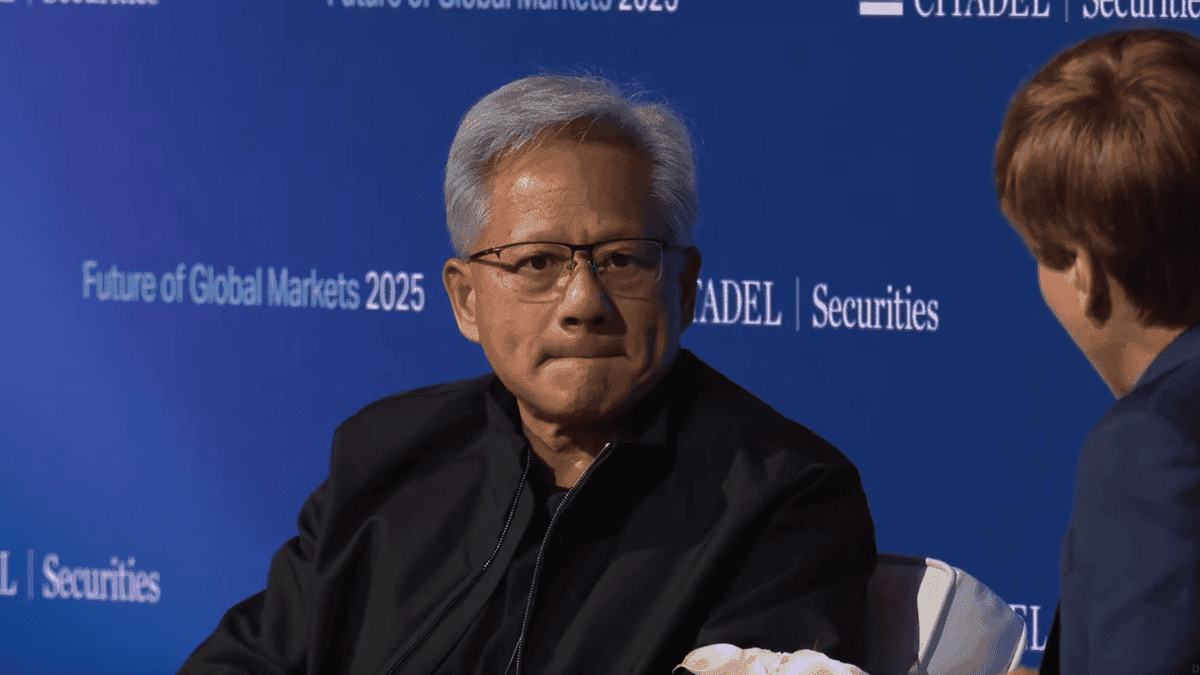

Jensen Huang confirms there are no plans to ship Blackwell GPUs to China right now, chipmaker at Beijing's mercy -- Nvidia CEO says shipments haven't been approved by Chinese authorities

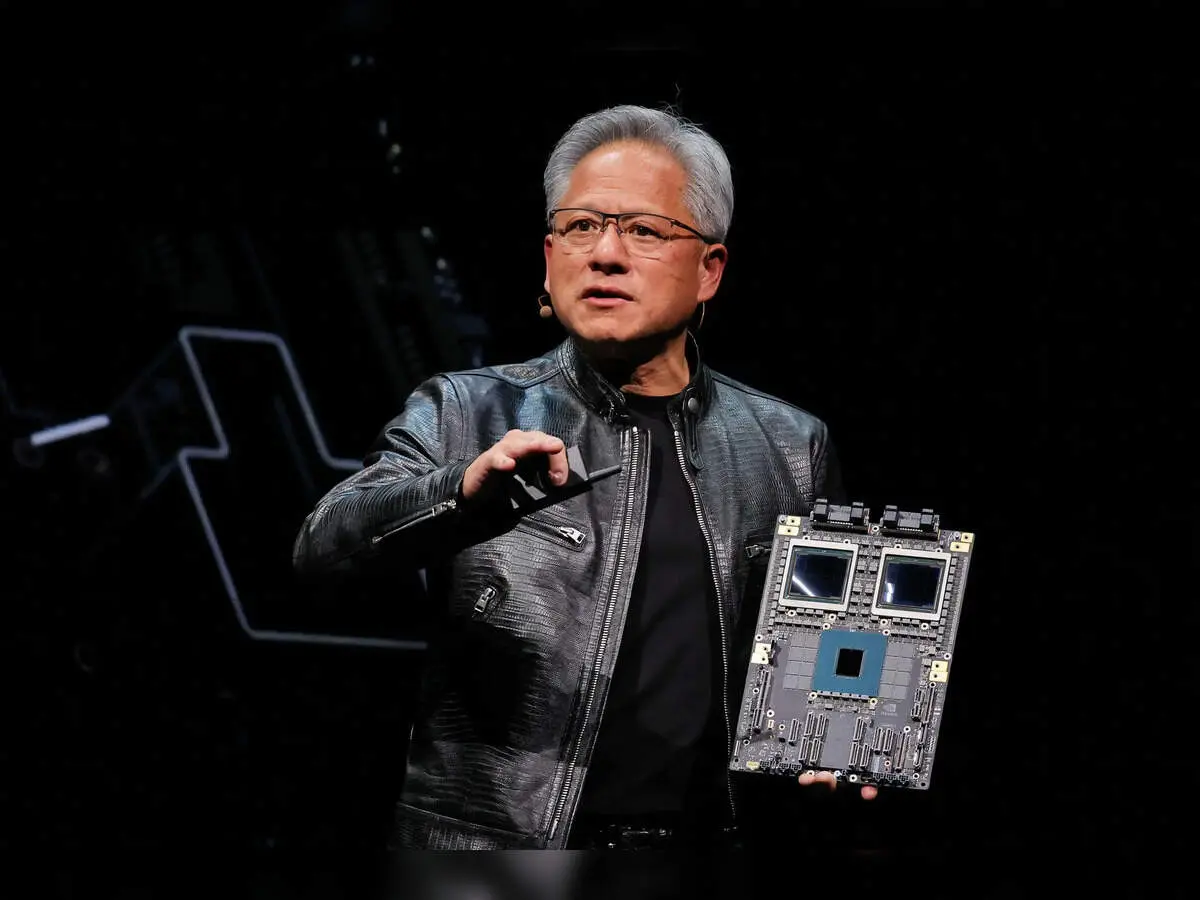

Jensen Huang is in Taiwan for TSMC's sports day event right now. Before attending, he spoke to local media, giving insight on various ongoing developments surrounding Nvidia and its relationship with AI constituents -- including the prospect of selling Blackwell chips to China. President Trump and U.S. Treasury Secretary have already made it clear that Blackwell is reserved for America first, and Huang has just echoed those sentiments by clarifying that "there are no active discussions" surrounding this matter. A few days ago, while speaking to CBS, Trump said the most advanced AI GPUs will not be sold to China. Following that, America's finance chief Scott Bessent hinted at a potential strategy, highlighting that China can have Blackwell chips after they're outdated by a year or two. Jensen's latest comments don't reveal anything new, but they corroborate the existing stance permeating Washington. That said, beyond the White House, Huang reminds us that it's ultimately up to China's discretion whether it wants to deal with Nvidia. Beijing has recently banned its firms from dealing with the chipmaker to focus on local, homegrown silicon as the region grows toward AI independence. Blackwell still makes its way into the country, however, through illicit channels. The previous-gen, Hopper-based H20 is the top-end AI GPU Nvidia sells in China, and there are reports of a Blackwell-based B30A model launching soon. If that comes to fruition and China allows Nvidia to sell it, the chipmaker will have to share 15% of the revenue from all sales with the White House, and that's after export licenses have been granted. A dense layer of red tape covers this AI race, which is informing semiconductor trade policy at the moment. Meanwhile, Huang has even claimed that China is aggressively tailing the U.S. in artificial intelligence -- if not already ahead -- and that most of the popular open-source models in the world today are from China. The region also produces some 50% of all AI researchers globally, implying the competition is stiff. Even though neither Washington nor Beijing wants to engage with each other on cutting-edge AI silicon, both heads of state struck a historic trade truce last month that's said to last a year. This positive development briefly led the markets to think that a chip breakthrough might be on the cards, though it's now clear the two nations don't even want to talk about it.

[2]

Nvidia still can't sell Blackwell chips to China

Xi and Trump haven't gotten to discuss the chips, though they were supposed to Nvidia's latest generation of Blackwell accelerators won't be available in China anytime soon, according to CEO Jensen Huang, who said there were no "active discussions" about selling the coveted chips to the Middle Kingdom. The comments come as Nvidia increasingly finds itself cut off from the Chinese market. US lawmakers have repeatedly lobbied against allowing the sale of the GPU giant's most powerful AI chips to China. Meanwhile, in Beijing, opposition to Western IT infrastructure has grown, with government officials reportedly pressuring tech titans to ditch Western suppliers in favor of domestic alternatives. Most recently, Chinese officials reportedly banned state-funded datacenters from deploying foreign AI chips. "Currently, we are not planning to ship anything to China," Huang said during a visit to Taiwan on Friday, according to a Reuters report. "It's up to China when they would like Nvidia products to go back to serve the Chinese market. I look forward to them changing their policy." Huang's comments appear to be specific to Nvidia's datacenter GPU products, as the chipmaker is still able to sell some lower-end Blackwell-based consumer cards in the region. The Register reached out to Nvidia seeking clarification on Huang's comments; we'll let you know if we hear anything back. Many had hoped to see Uncle Sam lift restrictions on the sale of Blackwell accelerators in China following claims by Donald Trump that he planned to discuss sales of the chip with Chinese President Xi Jinping. However, those discussions never materialized. Despite this, Huang's revelations are unlikely to have any material impact on the AI arms dealer's financials in the near term. Nvidia's Q3 forecasts already excluded Chinese sales for the quarter, despite reaching an agreement with the Trump administration to resume shipments of its older Hopper-based H20 accelerators in exchange for cutting the feds in on 15 percent of revenues. However, as CFO Colette Kress explained during the company's Q2 earnings call, as of August, the US government had not published regulations necessary to codify the requirement. Even if Nvidia could hawk its wares in the Chinese market -- something that Kress previously estimated would have added two to five billion dollars to its Q3 earnings revenue -- demand in the region appears to have evaporated. Nvidia is scheduled to hold its Q3 earnings call on Wednesday, Nov. 19. ®

[3]

Nvidia CEO has no plan to ship chips to China amid standoff

Gift 5 articles to anyone you choose each month when you subscribe. Nvidia chief executive officer Jensen Huang said his company is effectively blocked from selling its AI chips into China for now, as Washington and Beijing each impose restrictions on its sales into the world's largest semiconductor market. Huang arrived in Taiwan on Friday ahead of meetings with longtime partner Taiwan Semiconductor Manufacturing Co after a whirlwind global tour that included unusually controversial comments about the US-China AI race.

[4]

Nvidia CEO says no 'active discussions' on selling Blackwell chip to China

Nvidia CEO Jensen Huang stated there are no active discussions to sell the company's advanced Blackwell AI chips to China. He indicated that Nvidia is not currently planning to ship any products to China, awaiting a policy change from Beijing. The U.S. has restricted sales of these chips due to national security concerns. Nvidia CEO Jensen Huang said on Friday that there were "no active discussions" about selling the company's state-of-the-art Blackwell chips to China. Blackwell is Nvidia's current flagship artificial intelligence chip that the Trump administration has so far prevented from being sold to China, for fear it would aid the Chinese military and domestic AI industry. While there was speculation last week that talks between U.S. President Donald Trump and Chinese President Xi Jinping in South Korea could end with a deal to allow a scaled-down version of the Blackwell to be sold in China, so far there have been no signs of an agreement. "Currently, we are not planning to ship anything to China," Huang said, soon after arriving in the city of Tainan for his fourth public visit to Taiwan this year. "It's up to China when they would like Nvidia products to go back to serve the Chinese market, I look forward to them changing their policy," he added. The U.S. has allowed Nvidia to sell its H20 chip in China, but Huang has repeatedly said over the past month that China does not want Nvidia in the country, so its market share of the advanced AI chip market is zero. Huang, in remarks seen on a live broadcast by Taiwan's Formosa TV News network, also said he was in Taiwan to visit long-time partner TSMC and participate in the company's sports day.

[5]

Jensen Huang Says Nvidia Has No Immediate Plans To Sell Blackwell Chips To China, Clarifies Comments On China Winning AI Race - NVIDIA (NASDAQ:NVDA), Taiwan Semiconductor (NYSE:TSM)

NVIDIA Corp. (NASDAQ:NVDA) CEO Jensen Huang has said that the company has no immediate plans to sell its cutting-edge Blackwell chips to China. Huang Says 'It's Up To China' Huang's remarks were reported by Reuters, which cites the executive's remarks on a live broadcast by Taiwan's Formosa TV News network. "It's up to China when they would like Nvidia products to go back to serve the Chinese market. I look forward to them changing their policy," Huang said. The Trump administration has thus far blocked the sale of these chips to China, citing potential military and industrial advantages for China. On Friday, the Nvidia CEO also clarified his comments, saying China would "win" the AI race. "That's not what I said," stated Huang, according to Reuters. "What I said was that China has very good AI technology. They have many AI researchers." Trump's Stricter Export Control This announcement comes shortly after the Trump administration reportedly decided to block Nvidia's sale of its latest scaled-down AI chip to China. This move was seen as a response to Huang's warning that Beijing could surpass the U.S. in the global AI race. A group of Republican senators praised President Trump for maintaining strict export controls on Nvidia's high-end Blackwell AI chips, stating that this decision would help ensure America's victory in the global AI race. Huang Stays Optimistic Although Nvidia is permitted to sell its H20 chip in China, CEO Jensen Huang has repeatedly noted that the country has no interest in Nvidia's products, leaving the company with virtually no share in China's advanced AI chip market. Previously, Jensen Huang expressed optimism that his company would be able to sell Blackwell chips in China in the future. See Also: Peter Schiff: Bitcoin Depends On 'Growing Supply Of Fools' -- And Technical Analysis Says He's Not Wrong Stock Stays Resilient Despite the ban, Nvidia's stock has been performing well, with JPMorgan CEO Jamie Dimon calling it an "unbelievable" company. However, he added, "valuations today may be too high" for some of the AI companies. The company's stock has been resilient, even amid the export restrictions imposed by the U.S. Price Action: Over the past year, Nvidia's stock has surged 26.33%, as per data from Benzinga Pro. On Thursday, it declined 3.65% to close at $188.08. Benzinga's Edge Rankings place Nvidia in the 93rd percentile for quality and the 3rd percentile for value, reflecting mixed performance. Check the detailed report here. READ NEXT: Jensen Huang's Nvidia Drops Up To $1B On Poolside -- This Ex-GitHub Exec's AI Powerhouse Just Quadrupled Its Worth Overnight Image via Shutterstock Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors. NVDANVIDIA Corp$188.320.13%OverviewTSMTaiwan Semiconductor Manufacturing Co Ltd$290.000.26%Market News and Data brought to you by Benzinga APIs

[6]

Nvidia CEO says no 'active discussions' on selling Blackwell chip to China

Taipei (Reuters) -Nvidia CEO Jensen Huang said on Friday that there were "no active discussions" about selling the company's state-of-the-art Blackwell chips to China. Blackwell is Nvidia's current flagship artificial intelligence chip that the Trump administration has so far prevented from being sold to China, for fear it would aid the Chinese military and domestic AI industry. While there was speculation last week that talks between U.S. President Donald Trump and Chinese President Xi Jinping in South Korea could end with a deal to allow a scaled-down version of the Blackwell to be sold in China, so far there have been no signs of an agreement. "Currently, we are not planning to ship anything to China," Huang said, soon after arriving in the city of Tainan for his fourth public visit to Taiwan this year. "It's up to China when they would like Nvidia products to go back to serve the Chinese market, I look forward to them changing their policy," he added. The U.S. has allowed Nvidia to sell its H20 chip in China, but Huang has repeatedly said over the past month that China does not want Nvidia in the country, so its market share of the advanced AI chip market is zero. Huang, in remarks seen on a live broadcast by Taiwan's Formosa TV News network, also said he was in Taiwan to visit long-time partner TSMC and participate in the company's sports day. (Reporting by Wen-Yee Lee in Taipei; Editing by Jacqueline Wong and Thomas Derpinghaus)

Share

Share

Copy Link

Jensen Huang states there are no active discussions about selling Nvidia's advanced Blackwell AI chips to China, citing both U.S. export restrictions and Beijing's preference for domestic alternatives. The chipmaker remains blocked from the Chinese market despite previous speculation about potential deals.

Nvidia Blocked from Selling Advanced AI Chips to China

Nvidia CEO Jensen Huang confirmed during a visit to Taiwan that the company has no current plans to ship its cutting-edge Blackwell AI chips to China, stating there are "no active discussions" about such sales

1

. The chipmaker finds itself caught between U.S. export restrictions and Beijing's growing preference for domestic semiconductor alternatives.

Source: ET

"Currently, we are not planning to ship anything to China," Huang said during his visit to Taiwan for TSMC's sports day event

4

. He emphasized that the decision ultimately rests with Chinese authorities, adding, "It's up to China when they would like Nvidia products to go back to serve the Chinese market. I look forward to them changing their policy."U.S. Export Controls Remain Firm

The Trump administration has maintained strict export controls on Nvidia's most advanced AI chips, citing national security concerns about potential military and industrial advantages for China

2

. President Trump and U.S. Treasury Secretary Scott Bessent have made it clear that Blackwell chips are "reserved for America first," with Bessent hinting that China might only access these chips after they become outdated by a year or two1

.

Source: Benzinga

Many had hoped for a breakthrough following speculation about potential discussions between Trump and Chinese President Xi Jinping, but those talks never materialized

2

. Republican senators have praised Trump's decision to maintain these restrictions, viewing them as crucial for ensuring America's leadership in the global AI race.China's Push for Semiconductor Independence

Beyond U.S. restrictions, Beijing has actively moved away from Western AI infrastructure. Chinese officials have reportedly banned state-funded datacenters from deploying foreign AI chips and pressured tech companies to favor domestic alternatives over Western suppliers

2

. This policy shift has effectively left Nvidia with zero market share in China's advanced AI chip market, despite the country representing the world's largest semiconductor market.Huang has repeatedly noted over the past month that "China does not want Nvidia in the country," reflecting Beijing's strategic pivot toward AI independence

4

. The region produces approximately 50% of all AI researchers globally and has developed numerous popular open-source AI models, indicating strong domestic capabilities.Related Stories

Limited Sales Continue Through Restricted Channels

While Blackwell chips remain off-limits, Nvidia can still sell its previous-generation Hopper-based H20 chips in China, which currently represent the top-end AI GPUs available in the Chinese market . Reports suggest a Blackwell-based B30A model may launch soon, though any sales would require Nvidia to share 15% of revenue with the White House after obtaining proper export licenses.

Despite these restrictions, some Blackwell chips still reach China through illicit channels, highlighting the continued demand for advanced AI hardware

1

.Financial Impact and Market Response

The restrictions are unlikely to significantly impact Nvidia's near-term financials, as the company's Q3 forecasts already excluded Chinese sales

2

. However, CFO Colette Kress previously estimated that Chinese market access could have added $2-5 billion to Q3 earnings revenue, representing a substantial opportunity cost.

Source: The Register

Nvidia's stock has remained resilient despite these export restrictions, surging 26.33% over the past year, though it declined 3.65% to close at $188.08 following recent developments

5

. The company is scheduled to hold its Q3 earnings call on November 19, where further details about the impact of Chinese market restrictions may emerge.References

Summarized by

Navi

[2]

[3]

Related Stories

Nvidia Set to Resume AI Chip Sales to China Amid Regulatory Shifts

10 Jul 2025•Technology

Trump Administration Maintains Strict Blackwell GPU Export Ban to China Despite Trade Truce

29 Oct 2025•Policy and Regulation

U.S. Imposes 15% Revenue Share on Nvidia and AMD's AI Chip Sales to China Amid Escalating Tech Rivalry

05 Aug 2025•Policy and Regulation

Recent Highlights

1

Pentagon threatens to cut Anthropic's $200M contract over AI safety restrictions in military ops

Policy and Regulation

2

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

3

OpenAI closes in on $100 billion funding round with $850 billion valuation as spending plans shift

Business and Economy