Nvidia CEO Dismisses AI Bubble Concerns as Company Projects Half-Trillion Dollar Revenue

2 Sources

2 Sources

[1]

Nvidia, one of the few companies profiting from AI, claims there is no AI bubble

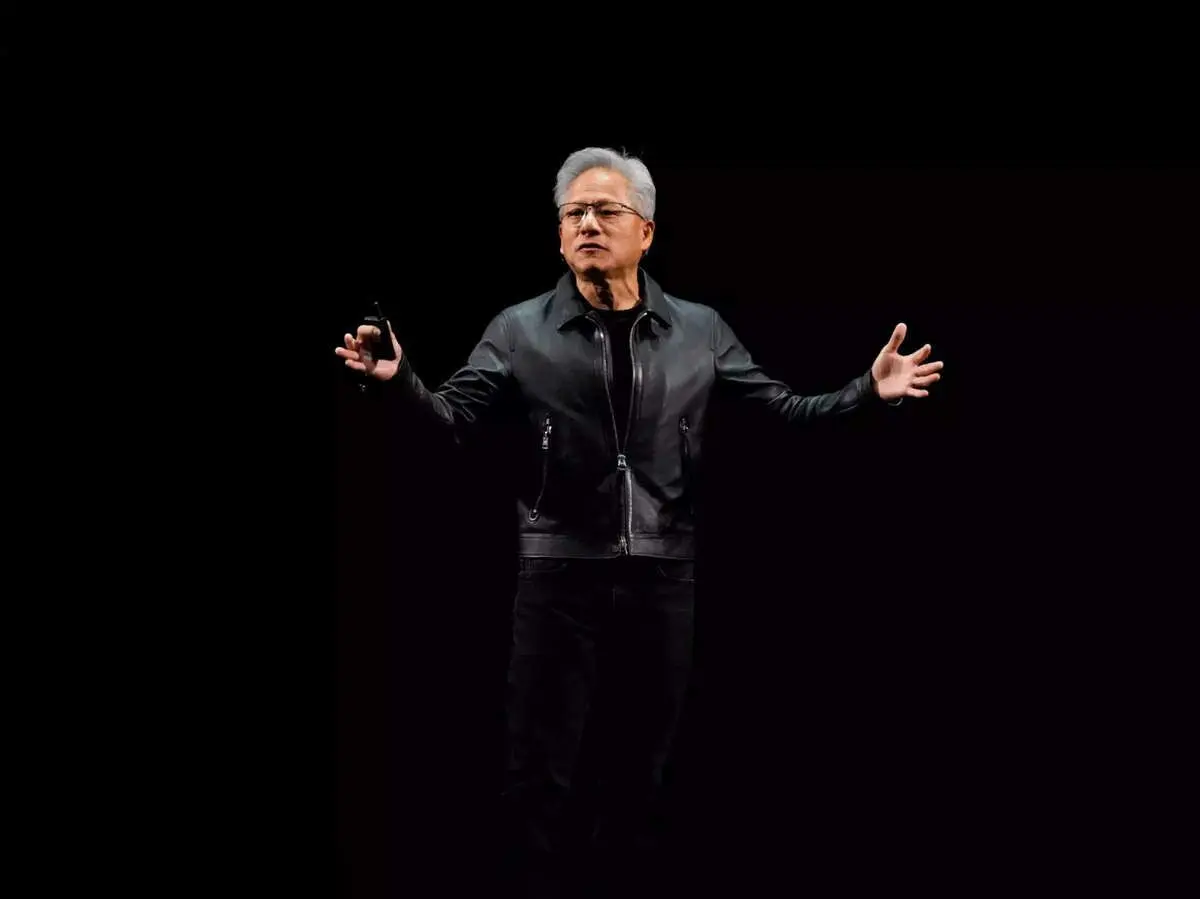

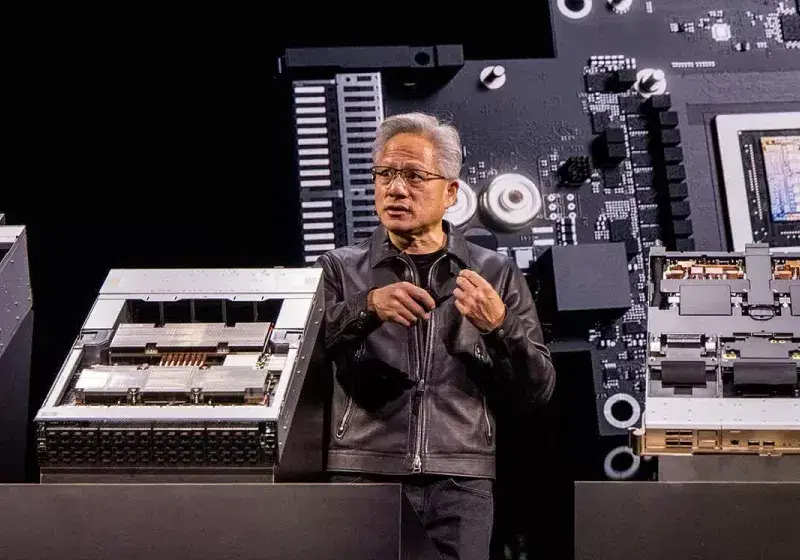

Serving tech enthusiasts for over 25 years. TechSpot means tech analysis and advice you can trust. Winners & losers: Analysts, researchers, and even some tech giants have repeatedly warned that today's AI business is becoming a bubble. A big chunk of all AI investments currently mean purchasing Nvidia's processors, and the company is working to secure its position with a flurry of new partnerships. Unsurprisingly, Nvidia's CEO is among the few who openly dismiss claims that a bubble exists. Nvidia CEO Jensen Huang recently told Bloomberg he doesn't believe the recent AI boom has become a bubble, breaking with months of warnings from across the business world. Speaking at the company's GTC conference in Washington DC, he characterized the current moment as a virtuous cycle. During the event, Huang announced numerous partnerships intended to accelerate the adoption of AI, which turned Nvidia into the world's first $4 trillion company. These include a collaboration with Oracle to build an AI supercomputer for the US Department of Energy, deals to develop 6G technology for Nokia and US telecoms by using AI, a pledge to provide chips for Uber's global robotaxi expansion, and many more. Nvidia also appears intent on protecting its leadership in AI hardware amid new competition. Qualcomm recently introduced two new server chips for AI inference, Microsoft seeks to lessen its reliance on Nvidia, and AMD is also partnering with the Department of Energy to build two supercomputers in a $1 billion project resembling Nvidia's. The dense network of deals between companies that also depend on Nvidia has triggered criticism of so called circular investment, a classic warning sign of a market bubble. Nvidia and AMD have described the cycle as mutually reinforcing, but skeptics have drawn comparisons to the late 1990s, when interdependent tech companies helped inflate the dot com bubble to unsustainable heights. The warnings have grown louder. Deutsche Bank, MIT, and even OpenAI CEO Sam Altman have all cautioned that the AI boom could eclipse the dot com era in scale. Deutsche Bank argues that AI spending is singlehandedly preventing the United States economy from sliding into recession, while a recent MIT report found that 95 percent of AI ventures fail to turn a profit. Nvidia remains the outlier. Its hardware powers most of the AI data centers currently being built, and estimates now place the company at roughly 8 percent of the S&P 500. Even if AI is a bubble - and even if it bursts - the long term value of the technology is still an open question. Wired recently drew parallels to past platform shifts like electricity, radio, and commercial aviation, each of which inspired speculative bubbles before eventually settling into the infrastructure of modern life.

[2]

Nvidia's Huang works to convince investors there's no AI bubble - The Economic Times

Nvidia's chief Jensen Huang sees no AI bubble. He expects huge revenue from new Blackwell and Rubin chips. The company is forming key partnerships to integrate AI. Nvidia is also working to boost American manufacturing. This comes as global trade tensions ease. The chip giant is set for significant growth.Nvidia Corp. Chief Executive Officer Jensen Huang dismissed concerns about an artificial intelligence bubble, saying the company's latest chips are on track to generate half a trillion dollars in revenue during the coming quarters. The Blackwell processor and newer Rubin model are fueling an unprecedented surge of sales growth, Huang said Tuesday at a company presentation in Washington. The event -- Nvidia's first GTC conference held in the nation's capital -- highlighted the partnerships that the company is forging across the industry. The chipmaker is teaming up with Uber Technologies Inc., Palantir Technologies Inc. and CrowdStrike Holdings Inc., among others, to help infuse AI into products. And Nvidia unveiled a new system to connect quantum computers with its artificial intelligence chips. "We have now reached our virtuous cycle, our inflection point," Huang told thousands of attendees at a convention hall blocks from the White House. "This is quite extraordinary." Huang also emphasized the ways his company is helping advance President Donald Trump's economic agenda for building out American manufacturing. The Nvidia chief delivered his remarks days before Trump is scheduled to meet Chinese President Xi Jinping to finalize a trade deal that would ease years of trade tensions that have effective blocked Nvidia's prized AI chips from China. But much of the presentation focused on the AI industry reaching a turning point. Huang's argument: Artificial intelligence models are now powerful enough that customers are willing to pay for them -- and that in turn will justify the costly build-out of computing infrastructure. The remarks helped ease fears of an AI investment bubble, sending shares of Nvidia up more than 4% on Tuesday. Nvidia expects to ship 20 million units of its latest chips. A previous generation -- Hopper -- only had 4 million units in its whole lifetime, Huang said. Nvidia, the world's most valuable company, has benefited more than anyone from runaway spending on AI computing. But it still depends on a small group of customers -- data center operators such as Microsoft Corp., Amazon.com Inc. and Alphabet Inc.'s Google -- for much of its revenue. The three-day Washington event is part of a bid to serve a broader client base. Though Nvidia remains dominant in the market for AI accelerators, the processors that help train and run artificial intelligence models, its challenges are growing. Advanced Micro Devices Inc. and Broadcom Inc. are making inroads in the industry, and companies like ChatGPT maker OpenAI is looking to develop more in-house technology. Just this week, phone-chip maker Qualcomm Inc. announced that it will take on Nvidia in AI accelerators. AMD's stock has more than doubled this year, signaling that investors see it in particular as a major competitor. Nvidia shares were up a less-impressive 43% through Monday's close. Nvidia is also contending with concerns that the cost of AI infrastructure is outpacing the actual economic benefits. Huang and his peers are steadfast in their assertion that AI will revolutionize the world economy and that the computing build-out is money well spent. The chipmaker's pitch to a Washington audience had more patriotic flair than usual. The event frequently stressed Nvidia's role as an American champion and the ways it was helping return manufacturing to domestic soil. Huang even nodded to Trump's signature slogan in his sign-off by thanking the audience for "making America great again." The Santa Clara, California-based company has been seeking help from the White House and lawmakers to sell AI chips in China. A clampdown on exports to that country has cost Nvidia billions of dollars in revenue. Huang said that his projections for the Blackwell and Rubin chips didn't include sales from that country. Ahead of his keynote, Huang told attendees in an impromptu appearance that he would be seeing Trump in coming days on the sidelines of the Asia Pacific Economic Cooperation summit in Seoul.

Share

Share

Copy Link

Jensen Huang rejects AI bubble warnings while announcing major partnerships and projecting massive revenue from new Blackwell and Rubin chips. The company faces growing competition but maintains market dominance.

Nvidia Rejects AI Bubble Warnings Amid Record Projections

Nvidia CEO Jensen Huang has firmly dismissed concerns about an artificial intelligence bubble, projecting that the company's latest processors could generate half a trillion dollars in revenue over the coming quarters. Speaking at Nvidia's first GTC conference in Washington DC, Huang characterized the current AI boom as a "virtuous cycle" rather than unsustainable speculation

1

2

.

Source: ET

"We have now reached our virtuous cycle, our inflection point," Huang told thousands of attendees at the convention hall blocks from the White House. "This is quite extraordinary"

2

. The remarks helped ease investor fears, sending Nvidia shares up more than 4% following the presentation.Massive Scale of New Chip Production

The company expects to ship 20 million units of its latest Blackwell and newer Rubin processors, a dramatic increase from the previous Hopper generation, which only had 4 million units throughout its entire lifetime

2

. This unprecedented surge in production capacity reflects the massive demand for AI computing infrastructure across industries.

Source: TechSpot

Nvidia's hardware currently powers most AI data centers being built globally, with the company now representing roughly 8 percent of the S&P 500

1

. The world's most valuable company has become the primary beneficiary of runaway spending on AI computing infrastructure.Strategic Partnerships and Market Expansion

During the Washington event, Huang announced numerous partnerships designed to accelerate AI adoption across various sectors. Key collaborations include working with Oracle to build an AI supercomputer for the US Department of Energy, developing 6G technology with Nokia and US telecommunications companies, and providing chips for Uber's global robotaxi expansion

1

.The company is also teaming up with Palantir Technologies, CrowdStrike Holdings, and other major players to help integrate AI capabilities into their products

2

. Additionally, Nvidia unveiled a new system to connect quantum computers with its artificial intelligence chips, expanding its technological reach.Growing Competition and Market Challenges

Despite Nvidia's dominant position, the company faces increasing competition from multiple fronts. Qualcomm recently introduced two new server chips for AI inference, while Microsoft seeks to reduce its dependence on Nvidia hardware

1

. AMD is also making significant inroads, partnering with the Department of Energy on a $1 billion project to build two supercomputers, and its stock has more than doubled this year compared to Nvidia's 43% gain2

.Companies like OpenAI are also looking to develop more in-house technology, potentially reducing their reliance on Nvidia's processors. The chipmaker still depends heavily on a small group of customers, including data center operators such as Microsoft, Amazon, and Google, for much of its revenue

2

.Related Stories

Industry Warnings and Bubble Concerns

Contrary to Huang's optimistic outlook, warnings about an AI bubble have grown increasingly loud from various quarters. Deutsche Bank, MIT, and even OpenAI CEO Sam Altman have all cautioned that the AI boom could eclipse the dot-com era in scale

1

. Deutsche Bank argues that AI spending is single-handedly preventing the US economy from sliding into recession, while a recent MIT report found that 95 percent of AI ventures fail to turn a profit.Critics have pointed to the "circular investment" pattern, where companies dependent on Nvidia are also investing in AI infrastructure, drawing comparisons to the interdependent relationships that helped inflate the dot-com bubble in the late 1990s

1

.Political and Trade Considerations

Huang's Washington presentation carried more patriotic overtones than usual, emphasizing Nvidia's role as an American champion and its contributions to domestic manufacturing. The CEO even referenced Trump's signature slogan, thanking the audience for "making America great again"

2

.The company has been seeking White House support to sell AI chips in China, where export restrictions have cost Nvidia billions in revenue. Huang noted that his projections for the Blackwell and Rubin chips did not include potential sales to China, suggesting even greater revenue potential if trade restrictions are eased

2

.References

Summarized by

Navi

Related Stories

AI Investment Bubble Concerns Intensify as Industry Leaders Warn of 'Irrationality' Despite Nvidia's Strong Earnings

18 Nov 2025•Business and Economy

Nvidia's Tepid Forecast Sparks AI Slowdown Concerns Amid Rising Chinese Competition

28 Aug 2025•Business and Economy

Nvidia reports $68 billion revenue as AI boom drives unprecedented chip demand across data centers

24 Feb 2026•Business and Economy

Recent Highlights

1

Samsung unveils Galaxy S26 lineup with Privacy Display tech and expanded AI capabilities

Technology

2

Anthropic refuses Pentagon's ultimatum over AI use in mass surveillance and autonomous weapons

Policy and Regulation

3

AI models deploy nuclear weapons in 95% of war games, raising alarm over military use

Science and Research