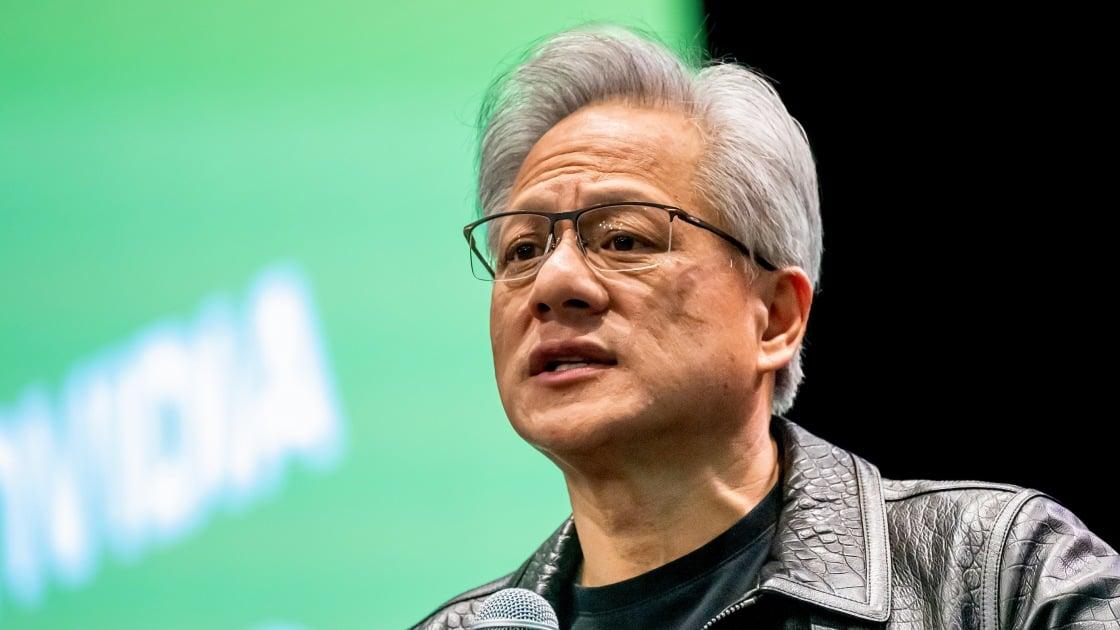

Nvidia CEO Jensen Huang Dismisses Rumors of Intel Foundry Takeover Amid AI Chip Demand and Onshoring Discussions

2 Sources

2 Sources

[1]

Nvidia CEO says company has not been asked to buy a stake in Intel

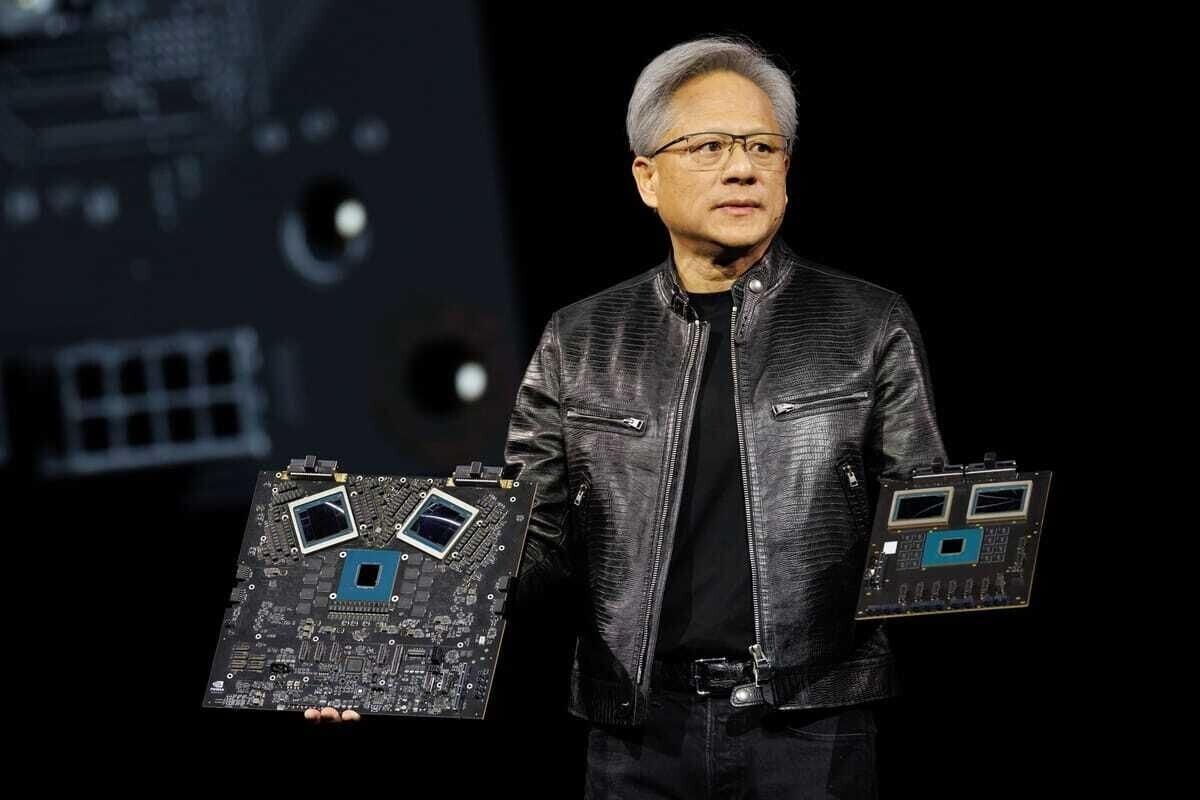

"Nobody's invited us to a consortium," Huang said. "Nobody invited me. Maybe other people are involved, but I don't know. There might be a party. I wasn't invited." As per media report earlier this month reported that TSMC had approached Nvidia, Broadcom and Advanced Micro Devices about taking stakes in a joint venture that would operate Intel's factories. Nvidia CEO Jensen Huang said on Wednesday that his company had not been approached about purchasing a stake in Intel. During a press conference at Nvidia's annual developer conference in San Jose, California, Huang was asked whether Nvidia was part of a consortium with Taiwan Semiconductor Manufacturing Co to buy Intel. "Nobody's invited us to a consortium," Huang said. "Nobody invited me. Maybe other people are involved, but I don't know. There might be a party. I wasn't invited." Reuters earlier this month reported that TSMC had approached Nvidia, Broadcom and Advanced Micro Devices about taking stakes in a joint venture that would operate Intel's factories. Other media had previously reported that Intel, with backing from U.S. President Donald Trump, was considering a plan to separate its manufacturing operations and turn over control of them to a consortium that would include TSMC. Intel and Nvidia shares were both flat in after-hours trading after Huang's remarks. Earlier in the day during a question-and-answer session with financial analysts, Huang said orders for some 3.6 million of Nvidia's flagship Blackwell chips from four top cloud service providers "under represented" demand, since they did not include orders from key customer Meta Platforms and smaller cloud providers and startups. Facebook-owner Meta is among the largest buyers of Nvidia chips and Mark Zuckerberg, CEO of the social media giant, said early last year the company planned to use Blackwell chips to train the company's open-source large language Llama models. Meta has said it expects to spend up to $65 billion in AI infrastructure this year, a large chunk of which is expected to go toward Nvidia chips, mirroring similar commitments from other big tech giants as they race to develop the best AI products. Huang has been trying to allay investor concerns surrounding demand for the pricey AI chips that have made Nvidia one of the world's most valuable firms, after China's DeepSeek made a competitive chatbot with allegedly fewer AI chips. "The good news is that the understanding of R1 was completely wrong," Huang said on Wednesday, referring to DeepSeek's AI model. DeepSeek's focus on reasoning - the ability of an AI system to make inferences - will increase the need for computation, helping drive demand for Nvidia chips, Huang said. Nvidia's shares were up nearly 2% after the analyst call. They fell 3.4% on Tuesday, when investors were unconvinced by Huang's pitch that the company was well-positioned to respond to a pivot in the AI market as businesses shift from training AI models to getting detailed answers from them. Onshoring production In response to an analyst's questions on the impact of higher tariffs under Trump, Huang said Nvidia sees little short-term impact but would move production to the United States in the longer term. He gave no timeline. TSMC, the world's biggest contract maker of chips, has said it plans to make a fresh $100 billion investment in the U.S. that involves building five additional chip facilities. "We're in it," Huang said, referring to TSMC's new chip fabrication facility in Arizona. "We are now running production silicon in Arizona." Reuters reported in December that TSMC was in discussions with Nvidia to produce its Blackwell chips at the company's new plant in Arizona.

[2]

Nvidia CEO Jensen Huang Shuts Down Rumors Of Intel Foundry Takeover: 'Nobody's Invited Us To A Consortium' - NVIDIA (NASDAQ:NVDA), Intel (NASDAQ:INTC)

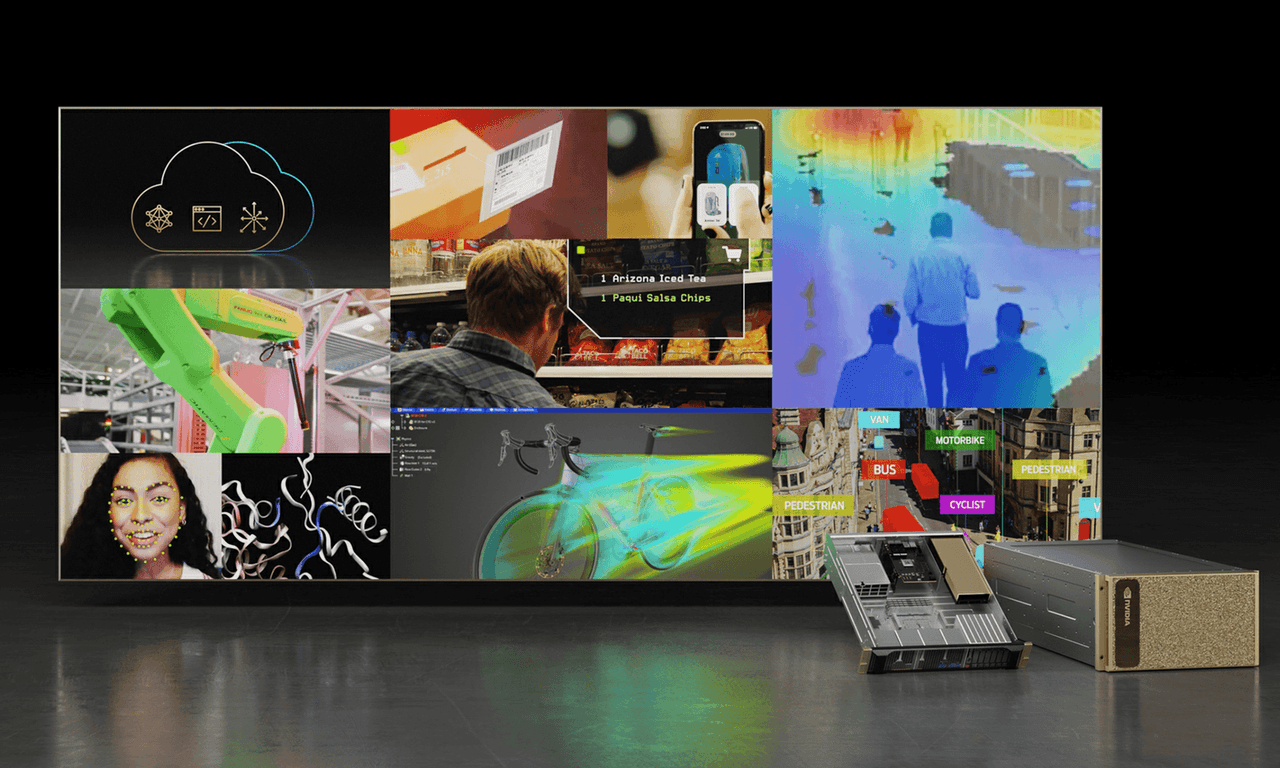

On Wednesday, Nvidia Corporation NVDA CEO Jensen Huang dismissed reports that the company is involved in any negotiations to take over Intel Corp's INTC foundry operations. What Happened: "I don't know where that came from but nobody's invited us to a consortium," Huang said during a press briefing at Nvidia's GTC conference, reported Nikkei Asia. "I'm not trying to say it's not news, but nobody invited me." Earlier this month, it was reported that Taiwan Semiconductor Mfg. Co. Ltd. TSM had approached Nvidia and other major U.S. semiconductor firms to support a plan to manage Intel's foundry division. See Also: Jensen Huang Loses $20B In Wealth: How DeepSeek Hit Nvidia Stock And World's Richest People The reports also suggested that TSMC approached Qualcomm Inc. QCOM. Although Huang denied involvement in the alleged talks, he highlighted Nvidia's growing need for onshore manufacturing in the U.S., particularly amid ongoing tariff uncertainty. "In the near term, based on what we know, we're not expecting a significant impact [from Trump tariffs] on our outlook," he stated, adding, "Long term, we want to retain the [supply chain] agility, but add a very significant part of our agility which is onshore." Subscribe to the Benzinga Tech Trends newsletter to get all the latest tech developments delivered to your inbox. Why It's Important: Intel's stock has dropped more than 42.64% in the past 12 months, with the company posting a net loss of $18.8 billion in 2024. According to a company filing, as of Dec. 31, its foundry division's assets were valued at $108 billion. Meanwhile, Nvidia has seen a significant drop in its market capitalization, losing $420 billion since the launch of its DeepSeek initiative in January 2025. This decline was exacerbated by a lackluster response to announcements made at the recent GTC AI Conference despite unveiling new AI and robotics tools, including the DGX SuperPOD powered by Blackwell Ultra GPUs. Despite these setbacks, Nvidia continues to lead in AI technology, with a roadmap extending to 2028. According to JPMorgan analyst Harlan Sur, Nvidia remains "1-2 steps ahead" in AI acceleration Price Action: Nvidia's stock rose 1.81% on Wednesday, closing at $117.52. In after-hours trading, it climbed another 1.08% to reach $118.79. So far this year, the company's shares have declined by 15.03%, according to Benzinga Pro. Image: Shutterstock Check out more of Benzinga's Consumer Tech coverage by following this link. Read Next: How Nvidia CEO Jensen Huang's Clever Pick-Up Line Turned A Homework Proposal Into Marriage While Building $3.38 Trillion AI Chip Giant Along The Way Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors. INTCIntel Corp$24.18-6.71%Stock Score Locked: Want to See it? Benzinga Rankings give you vital metrics on any stock - anytime. Reveal Full ScoreEdge RankingsMomentum32.64Growth80.42Quality-Value70.57Price TrendShortMediumLongOverviewNVDANVIDIA Corp$118.792.91%QCOMQualcomm Inc$159.502.05%TSMTaiwan Semiconductor Manufacturing Co Ltd$174.470.77%Market News and Data brought to you by Benzinga APIs

Share

Share

Copy Link

Nvidia CEO Jensen Huang denies involvement in rumored Intel foundry takeover, discusses AI chip demand, and emphasizes the importance of onshore manufacturing in the U.S. amid ongoing industry developments.

Nvidia CEO Refutes Intel Foundry Takeover Rumors

Nvidia Corporation's CEO Jensen Huang has firmly denied rumors of the company's involvement in potential takeover plans for Intel Corp's foundry operations. During a press briefing at Nvidia's GTC conference, Huang stated, "Nobody's invited us to a consortium. Nobody invited me. Maybe other people are involved, but I don't know. There might be a party. I wasn't invited"

1

2

. This statement comes in response to recent reports suggesting that Taiwan Semiconductor Manufacturing Co. (TSMC) had approached Nvidia and other major U.S. semiconductor firms to support a plan to manage Intel's foundry division.AI Chip Demand and Market Dynamics

Despite the denial of involvement in Intel-related discussions, Huang provided insights into Nvidia's current market position and future outlook:

-

Blackwell Chip Orders: Huang revealed that orders for approximately 3.6 million of Nvidia's flagship Blackwell chips from four top cloud service providers "under represented" demand. This figure doesn't include orders from key customers like Meta Platforms and smaller cloud providers and startups

1

. -

Meta's AI Infrastructure Investment: Meta Platforms, one of Nvidia's largest chip buyers, has announced plans to spend up to $65 billion on AI infrastructure this year, with a significant portion expected to go towards Nvidia chips

1

. -

Market Response: Nvidia's shares saw a nearly 2% increase following Huang's analyst call, despite a 3.4% drop the previous day when investors were unconvinced by Huang's pitch about the company's positioning in the evolving AI market

1

.

Onshoring Production and U.S. Manufacturing

Huang emphasized Nvidia's growing need for onshore manufacturing in the United States, particularly in light of ongoing tariff uncertainties:

-

Short-term Outlook: "In the near term, based on what we know, we're not expecting a significant impact [from Trump tariffs] on our outlook," Huang stated

2

. -

Long-term Strategy: "Long term, we want to retain the [supply chain] agility, but add a very significant part of our agility which is onshore," he added, indicating Nvidia's intention to move production to the United States in the longer term

1

2

. -

TSMC Collaboration: Huang confirmed Nvidia's involvement in TSMC's new chip fabrication facility in Arizona, stating, "We're in it. We are now running production silicon in Arizona"

1

.

Related Stories

Industry Challenges and Competition

The semiconductor industry faces various challenges and competitive pressures:

-

Intel's Financial Struggles: Intel has experienced a significant stock drop of over 42% in the past 12 months and posted a net loss of $18.8 billion in 2024

2

. -

Nvidia's Market Capitalization: Nvidia has seen a substantial decline in its market capitalization, losing $420 billion since the launch of its DeepSeek initiative in January 2025

2

. -

Competitive Landscape: Despite setbacks, Nvidia continues to lead in AI technology. JPMorgan analyst Harlan Sur suggests that Nvidia remains "1-2 steps ahead" in AI acceleration

2

.

As the semiconductor industry continues to evolve, with a focus on AI chip demand and onshore manufacturing, Nvidia's position and strategies will likely play a crucial role in shaping the market's future direction.

References

Summarized by

Navi

Related Stories

Nvidia's $5 Billion Investment in Intel Reshapes AI Chip Landscape

09 Oct 2025•Business and Economy

NVIDIA CEO Jensen Huang Secures 50% Production Boost from TSMC Amid Soaring AI Chip Demand

09 Nov 2025•Business and Economy

Nvidia Set to Resume AI Chip Sales to China Amid Regulatory Shifts

10 Jul 2025•Technology

Recent Highlights

1

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

2

Demis Hassabis predicts AGI in 5-8 years, sees new golden era transforming medicine and science

Technology

3

Nvidia and Meta forge massive chip deal as computing power demands reshape AI infrastructure

Technology