Nvidia CEO Jensen Huang Redefines Company as 'AI Factory,' Addresses Market Concerns

11 Sources

11 Sources

[1]

Nvidia CEO: We're An AI Factory Company Now

For PC builders, Nvidia has long been synonymous with graphics cards. But in a sign of the times, CEO Jensen Huang says his company has evolved from selling chips to constructing massive AI factories. "Nvidia is an AI infrastructure company. We're an infrastructure company, not just 'buy chips, sell chips,'" Huang told journalists at today's GTC event in San Jose, California. His comments come a day after introducing not one but four GPU architectures to power next-generation AI services. Although chip makers have shared roadmaps before, Huang noted it's still rare for a tech company to spill the beans on its future products. "That's kind of like someone goes 'Hi, today I'm going to announce my next four phones.' It makes no sense, right?" Huang said. However, Nvidia is no longer operating like a typical electronics vendor. That's because its major business of selling GPUs for AI development also involves companies spending tens of billions of dollars on data centers to power all the computing. In his keynote on Tuesday, Huang revealed Nvidia has sold 3.6 million Blackwell GPUs to the top four US-based cloud service providers this year, an increase from 1.3 million Hopper-based GPUs last year. "AI infrastructure isn't something you buy today and you deploy tomorrow," Huang said while speaking to the press on Wednesday. "It is something that you invest in two years in advance and you plan for the entire two years and hopefully you stand it up quickly." It's also why Huang introduced four GPU architectures that will fill Nvidia's AI portfolio for 2026 and into 2028. "Everybody's information has to be aligned and we have to plan together to build infrastructure for the world," he added. Although the AI demand has sent Nvidia's financials soaring, it also means the company faces more scrutiny than ever, especially from its customers. "We're an AI factory now. What that means is a factory helps customers make money. Our factories directly translate to customers' revenues," Huang said. "The business bar is much, much, much higher than before," he later added. "The competition bar is much higher than before. The risk tolerance is much lower than before for all of our customers. Does that make sense? Because their revenues directly translate to it. It's a multi-year investment cycle because we're talking about hundreds of billions of dollars." One factor that could increase the costs for Nvidia and its customers has been Trump's brewing trade war, which has led to a 20% tariff on Chinese goods. But for now, Huang downplayed the threat of tariffs. "We have a really agile network of suppliers. They are not just in Taiwan, or just in Mexico, or just in Vietnam. They are kind of distributed in a lot of places," Huang told journalists. "It depends on which countries get tariffed, so I think in the near-term based on what we know, we are not expecting a significant impact to our outlook and our financials," he later added. In the long-term, Nvidia also wants to expand its supply chain to the US, Huang said. This comes as Taiwan's TSMC, Nvidia's main chip manufacturer, has committed to investing $165 billion to build six new fabs in Arizona. "We have the ability to manufacture a lot in the United States. Not all, but a lot," he added.

[2]

Nvidia CEO Jensen Huang says tariff impact won't be meaningful in the near term

Nvidia CEO Jensen Huang: In the near term, the impact of tariffs will not be meaningful Nvidia CEO Jensen Huang downplayed the negative impact from President Donald Trump's tariffs, saying there won't be any significant damage in the short run. "We've got a lot of AI to build ... AI is the foundation, the operating system of every industry going forward. ... We are enthusiastic about building in America," Huang said Wednesday in a CNBC "Squawk on the Street" interview. "Partners are working with us to bring manufacturing here. In the near term, the impact of tariffs won't be meaningful." Trump has launched a new trade war by imposing tariffs against Washington's three biggest trading partners, drawing immediate responses from Mexico, Canada and China. Recently, Trump said he would not change his mind about enacting sweeping "reciprocal tariffs" on other countries that put up trade barriers to U.S. goods. The White House said those tariffs are set to take effect April 2. "We're as enthusiastic about building in America as anybody," Huang said. "We've been working with TSMC to get them ready for manufacturing chips here in the United States. We also have great partners like Foxconn and Wistron, who are working with us to bring manufacturing onshore, so long-term manufacturing onshore is going to be something very, very possible to do, and we'll do it." Shares of Nvidia have fallen more than 20% from their record high reached in January. The stock suffered a massive sell-off earlier this year due to concerns sparked by Chinese artificial intelligence lab DeepSeek that companies could potentially get greater performance in AI on far-lower infrastructure costs. Huang has pushed back on that theory, saying DeepSeek popularized reasoning models that will need more chips. Nvidia, which designs and manufactures graphics processing units that are essential to the AI boom, has been restricted from doing business in China due to export controls that were increased at the end of the Biden administration. Huang previously said the company's percentage of revenue in China has fallen by about half due to the export restrictions, adding that there are other competitive pressures in the country, including from Huawei.

[3]

Nvidia CEO Jensen Huang says to stop worrying about this dark cloud on the stock

Nvidia CEO Jensen Huang told our Jim Cramer that the AI chipmaker does not expect higher tariffs to hurt its business -- a notable revelation given uncertain trade policy has been an overhang on the stock in recent weeks. "In the near term, the impact will not be meaningful" from tariffs, Huang told Jim in an interview Wednesday at the Nvidia's influential GTC conference. Jim had specifically asked the Nvidia boss whether tariffs could "put a cap on your growth." The comments came one day after Huang, in his two-hour GTC keynote presentation, unveiled a host of new hardware and software products that reinforced Nvidia's leadership in the competitive artificial intelligence race . Shares of Nvidia rose about 1.5% Wednesday after falling more than 3% in the prior session, which had put the once-hot stock down more than 20% from its highs reached in early January. The crux of the tariff concern for Nvidia is primarily that its partners that manufacture the data center servers containing Nvidia's advanced AI chips have a presence in Mexico. In early March, President Donald Trump implemented 25% tariffs on imports from Mexico, though some items covered by 2018 North American trade agreement, commonly called the USMCA, were temporarily exempted . Trump has said a wide-ranging round of reciprocal tariffs are intended to go into effect April. 2. NVDA 1Y mountain Nvidia's stock performance over the past 12 months. In a note to clients Tuesday after Huang's GTC presentation, analysts at UBS said they expected tariffs to remain a cloud over the tech industry. "With many tech supply chains relocating to Mexico, including the AI servers supply chain, tariff-related uncertainty will likely continue to weigh on tech stocks," the firm wrote. "While we estimate the [earnings per share] risk based on effective tariffs so far in 2025 is manageable at a low-single digit earnings impact, there is a lack of clarity around tariffs on goods from Mexico and potential reciprocal tariffs." Nvidia's top-end chips are primarily produced by Taiwan Semiconductor Manufacturing Co. at its leading-edge semiconductor plants in Taiwan. Huang noted that Nvidia is working closely with TSMC on its sprawling manufacturing site in Arizona. "We're as enthusiastic about building in America as anybody," Huang told Jim. Bigger picture concerns about Nvidia also are in the air. Investors are worried about the potential for tougher U.S. government restrictions on Nvidia's chip sales into China, where already it can only sell throttled-back versions of its top-end AI processors. There's also uncertainty on whether the Trump administration will roll back -- or modify -- rules governing Nvidia's chip sales to a host of other countries around the world that are set to go into effect in May. President Joe Biden announced the framework, often referred to as "AI diffusion," in the waning days of his administration . When asked specifically about the impact of AI diffusion, Huang did not comment directly. The CEO responded, in part, by saying: "When you look around here, there's companies here from all over the world. AI has gone mainstream." The sustainability of AI infrastructure investments is another a question mark, particularly in light of Chinese startup DeekSeek's emergence in late January, which rattled the market with its claims of a more efficient model and raised the specter that less computing power would be needed to run AI applications in the future. Huang has praised DeepSeek's innovations and argued they will ultimately lead to more computing demand. He doubled down on that view in the interview with Jim, noting that so-called AI reasoning models like DeepSeek's R1 work differently than the kind of model that powered ChatGPT when it launched in late 2022. "There's a lot of different ways that the AI has now become much more reasonable and reasoning. And that requires a lot more computation, a hundred times more computation. So this new level of AI is going to demand a lot of chips." (Jim Cramer's Charitable Trust is long NVDA. See here for a full list of the stocks.) As a subscriber to the CNBC Investing Club with Jim Cramer, you will receive a trade alert before Jim makes a trade. Jim waits 45 minutes after sending a trade alert before buying or selling a stock in his charitable trust's portfolio. If Jim has talked about a stock on CNBC TV, he waits 72 hours after issuing the trade alert before executing the trade. THE ABOVE INVESTING CLUB INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY , TOGETHER WITH OUR DISCLAIMER . NO FIDUCIARY OBLIGATION OR DUTY EXISTS, OR IS CREATED, BY VIRTUE OF YOUR RECEIPT OF ANY INFORMATION PROVIDED IN CONNECTION WITH THE INVESTING CLUB. NO SPECIFIC OUTCOME OR PROFIT IS GUARANTEED.

[4]

Nvidia's Huang says faster chips are the best way to reduce AI costs

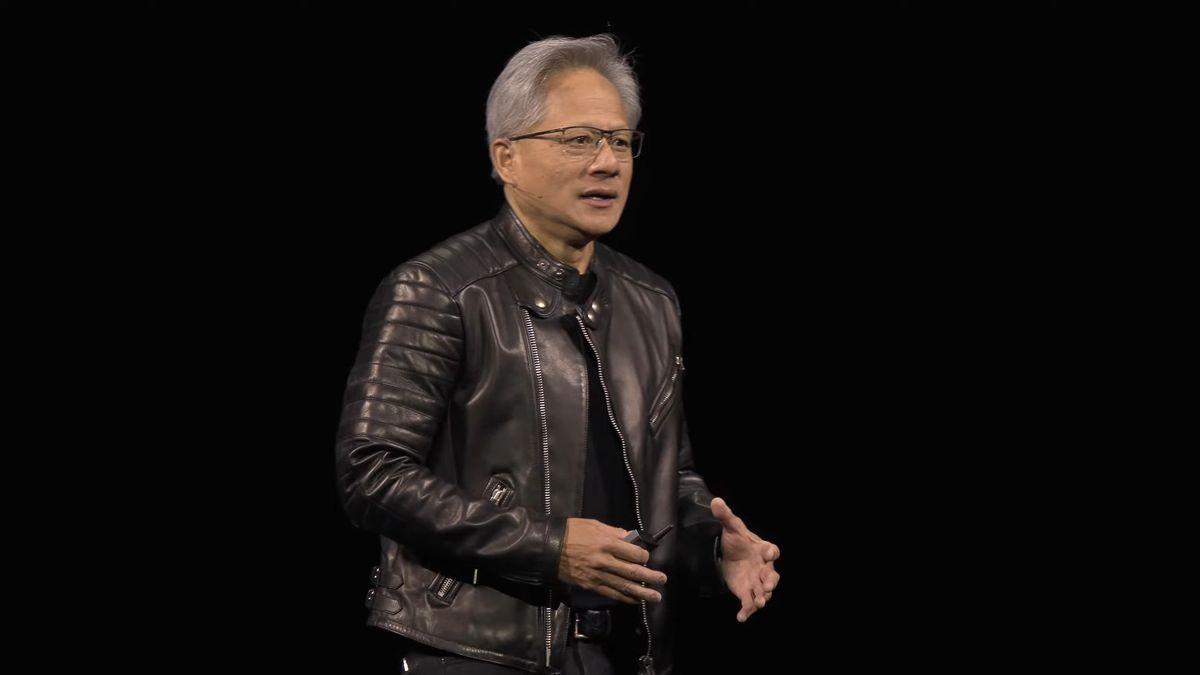

Nvidia CEO Jensen Huang introduces new products as he delivers the keynote address at the GTC AI Conference in San Jose, California, on March 18, 2025. At the end of Nvidia CEO Jensen Huang's unscripted two-hour keynote on Tuesday, his message was clear: Get the fastest chips that the company makes. Speaking at Nvidia's GTC conference, Huang said that questions clients have about the cost and return on investment the company's graphics processors, or GPUs, will go away with faster chips that can be digitally sliced and used to serve artificial intelligence to millions of people at the same time. "Over the next 10 years, because we could see improving performance so dramatically, speed is the best cost-reduction system," Huang said in a meeting with journalists shortly after his GTC keynote. The company dedicated 10 minutes during Huang's speech to explain the economics of faster chips for cloud providers, complete with Huang doing envelope math out loud on each chip's cost-per-token, a measure of how much it costs to create one unit of AI output. Huang told reporters that he presented the math because that's what's on the mind of hyperscale cloud and AI companies. The company's Blackwell Ultra systems, coming out this year, could provide data centers 50 times more revenue than its Hopper systems because it's so much faster at serving AI to multiple users, Nvidia says. Investors worry about whether the four major cloud providers -- Microsoft, Google, Amazon and Oracle -- could slow down their torrid pace of capital expenditures centered around pricey AI chips. Nvidia doesn't reveal prices for its AI chips, but analysts say Blackwell can cost $40,000 per GPU. Already, the four largest cloud providers have bought 3.6 million Blackwell GPUs, under Nvidia's new convention that counts each Blackwell as 2 GPUs. That's up from 1.3 million Hopper GPUs, Blackwell's predecessor, Nvidia said Tuesday. The company decided to announce its roadmap for 2027's Rubin Next and 2028's Feynman AI chips, Huang said, because cloud customers are already planning expensive data centers and want to know the broad strokes of Nvidia's plans. "We know right now, as we speak, in a couple of years, several hundred billion dollars of AI infrastructure" will be built, Huang said. "You've got the budget approved. You got the power approved. You got the land." Huang dismissed the notion that custom chips from cloud providers could challenge Nvidia's GPUs, arguing they're not flexible enough for fast-moving AI algorithms. He also expressed doubt that many of the recently announced custom AI chips, known within the industry as ASICs, would make it to market. "A lot of ASICs get canceled," Huang said. "The ASIC still has to be better than the best." Huang said his is focus on making sure those big projects use the latest and greatest Nvidia systems. "So the question is, what do you want for several $100 billion?" Huang said.

[5]

Nvidia's CEO did a Q&A with analysts. What he said and what Wall Street thinks about it

Investors have closely watched Nvidia 's week-long GPU Technology Conference (GTC) for news and updates from the dominant maker of chips that power artificial intelligence applications. The event comes at a pivotal time for Nvidia shares. After two years of monster gains, the stock is down 15% over the past month and 22% below the January all-time high. As part of the event, CEO Jensen Huang took questions from analysts on topics ranging from demand for its advanced Blackwell chips to the impact of Trump administration tariffs. Here's a breakdown of how Huang responded -- and what analysts homed in on -- during some of the most important questions: Blackwell demand Huang said he "underrepresented" demand in a slide that showed 3.6 million in estimated Blackwell shipments to the top four cloud service providers this year. While Huang acknowledged speculation regarding shrinking demand, he said the amount of computation needed for AI has "exploded" and that the four biggest cloud service clients remain "fully invested." Morgan Stanley analyst Joseph Moore noted that Huang's commentary on Blackwell demand in data centers was the first-ever such disclosure. "It was clear that the reason the company made the decision to give that data was to refocus the narrative on the strength of the demand profile, as they continue to field questions related to Open AI related spending shifting from 1 of the 4 to another of the 4, or the pressure of ASICs, which come from these 4 customers," Moore wrote to clients, referring to application-specific integrated circuits. Piper Sandler analyst Harsh Kumar said the slide was "only scratching the surface" on demand. Beyond the four largest customers, he said others are also likely "all in line looking to get their hands on as much compute as their budgets allow." Physical AI Another takeaway for Moore was the growth in physical AI, which refers to the use of the technology to power machines' actions in the real world as opposed to within software. At previous GTCs, Moore said physical AI "felt a little bit like speculative fiction." But this year, "we are now hearing developers wrestling with tangible problems in the physical realm." Truist analyst William Stein, meanwhile, described physical AI as something that's "starting to materialize." The next wave for physical AI centers around robotics, he said, and presents a potential $50 trillion market for Nvidia. Stein highliughted Jensen's demonstration of Isaac GR00T N1 , a customizable foundation model for humanoid robots. Macroeconomic concerns Several analysts highlighted Huang's explanation of what tariffs mean for Nvidia's business. "Management noted they have been preparing for such scenarios and are beginning to manufacture more onshore," D.A. Davidson analyst Gil Luria said. "It was mentioned that Nvidia is already utilizing [Taiwan Semiconductor's'] Arizona fab where it is manufacturing production silicon." Bernstein analyst Stacy Rasgon said Huang's answer made it seem like Nvidia's push to relocate some manufacturing to the U.S. would limit the effect of higher tariffs. Rasgon also noted that Huang brushed off concerns of a recession hurting customer spending. Huang argued that companies would first cut spending in the areas of their business that aren't growing, Rasgon said.

[6]

Nvidia CEO Jensen Huang says tariff impact won't be meaningful in the near term

Nvidia CEO Jensen Huang delivers a keynote address at the Consumer Electronics Show on Jan. 6.Artur Widak / Anadolu via Getty Images file Nvidia CEO Jensen Huang downplayed the negative impact from President Donald Trump's tariffs, saying there won't be any significant damage in the short run. "We've got a lot of AI to build ... AI is the foundation, the operating system of every industry going forward. ... We are enthusiastic about building in America," Huang said Wednesday in a CNBC "Squawk on the Street" interview. "Partners are working with us to bring manufacturing here. In the near term, the impact of tariffs won't be meaningful." Trump has launched a new trade war by imposing tariffs against Washington's three biggest trading partners, drawing immediate responses from Mexico, Canada and China. Recently, Trump said he would not change his mind about enacting sweeping "reciprocal tariffs" on other countries that put up trade barriers to U.S. goods. The White House said those tariffs are set to take effect April 2. "We're as enthusiastic about building in America as anybody," Huang said. "We've been working with TSMC to get them ready for manufacturing chips here in the United States. We also have great partners like Foxconn and Wistron, who are working with us to bring manufacturing onshore, so long-term manufacturing onshore is going to be something very, very possible to do, and we'll do it." Shares of Nvidia have fallen more than 20% from their record high reached in January. The stock suffered a massive sell-off earlier this year due to concerns sparked by Chinese artificial intelligence lab DeepSeek that companies could potentially get greater performance in AI on far-lower infrastructure costs. Huang has pushed back on that theory, saying DeepSeek popularized reasoning models that will need more chips. Nvidia, which designs and manufactures graphics processing units that are essential to the AI boom, has been restricted from doing business in China due to export controls that were increased at the end of the Biden administration. Huang previously said the company's percentage of revenue in China has fallen by about half due to the export restrictions, adding that there are other competitive pressures in the country, including from Huawei.

[7]

Nvidia chief confident chip maker can weather US tariffs

San José (United States) (AFP) - Nvidia boss Jensen Huang expressed confidence Wednesday that the artificial intelligence (AI) chip giant can handle US President Donald Trump's trade war. "We have a really agile network of suppliers; they are not just in Taiwan or Mexico or Vietnam," Huang said while meeting with journalists at Nvidia's annual developers conference in San Jose, California. "If we add onshore manufacturing by the end of this year, we should be quite good." Nvidia is not expecting tariffs to significantly affect its financial performance in the short term, according to Huang. He noted that the tariff situation is evolving, and that what it does to Nvidia costs will depend on which countries are targeted by Trump. Trump has threatened to slap extra tariffs on imports of computer chips to the United States, which will heap pressure on Nvidia's business, which depends on imported components mainly from Taiwan. Since returning to power in January, Trump has imposed tariffs on Washington's three main trading partners, Mexico, Canada, and China. Trump has talked of imposing "reciprocal tariffs" against other countries in early April, creating uncertainty for businesses and financial markets. The White House recently put out a release saying Trump is intent on making the US a "manufacturing superpower," ramping up pressure to shift production back to this country. However, chip fabrication facilities can take years to build. Since its founding in 1993, Nvidia has specialized in graphics processing units (GPUs) coveted by video game enthusiasts. GPUs are also ideally suited for AI and the rise of that technology has catapulted the Silicon Valley-based chip maker into the spotlight. "We're not making chips anymore; those were the good old days," Huang quipped. "What we do now is build AI infrastructure." High-end versions of Nvidia's chips face US export restrictions to the major market of China, part of Washington's efforts to slow its Asian adversary's advancement in the strategic technology. Asked about this, Huang replied that his company is not alone in needing to respect each country's laws.

[8]

Nvidia's CEO did a Q&A with analysts. What he said and what Wall Street thinks about it

Nvidia CEO Jensen Huang delivers the keynote address during the Nvidia GTC 2025 at SAP Center on Tuesday in San Jose, Calif.Justin Sullivan / Getty Images Investors have closely watched Nvidia's week-long GPU Technology Conference (GTC) for news and updates from the dominant maker of chips that power artificial intelligence applications. The event comes at a pivotal time for Nvidia shares. After two years of monster gains, the stock is down 15% over the past month and 22% below the January all-time high. As part of the event, CEO Jensen Huang took questions from analysts on topics ranging from demand for its advanced Blackwell chips to the impact of Trump administration tariffs. Here's a breakdown of how Huang responded -- and what analysts homed in on -- during some of the most important questions: Blackwell demand Huang said he "underrepresented" demand in a slide that showed 3.6 million in estimated Blackwell shipments to the top four cloud service providers this year. While Huang acknowledged speculation regarding shrinking demand, he said the amount of computation needed for AI has "exploded" and that the four biggest cloud service clients remain "fully invested." Morgan Stanley analyst Joseph Moore noted that Huang's commentary on Blackwell demand in data centers was the first-ever such disclosure. "It was clear that the reason the company made the decision to give that data was to refocus the narrative on the strength of the demand profile, as they continue to field questions related to Open AI related spending shifting from 1 of the 4 to another of the 4, or the pressure of ASICs, which come from these 4 customers," Moore wrote to clients, referring to application-specific integrated circuits. Piper Sandler analyst Harsh Kumar said the slide was "only scratching the surface" on demand. Beyond the four largest customers, he said others are also likely "all in line looking to get their hands on as much compute as their budgets allow." Physical AI Another takeaway for Moore was the growth in physical AI, which refers to the use of the technology to power machines' actions in the real world as opposed to within software. At previous GTCs, Moore said physical AI "felt a little bit like speculative fiction." But this year, "we are now hearing developers wrestling with tangible problems in the physical realm." Truist analyst William Stein, meanwhile, described physical AI as something that's "starting to materialize." The next wave for physical AI centers around robotics, he said, and presents a potential $50 trillion market for Nvidia. Stein highliughted Jensen's demonstration of Isaac GR00T N1, a customizable foundation model for humanoid robots. Macroeconomic concerns Several analysts highlighted Huang's explanation of what tariffs mean for Nvidia's business. "Management noted they have been preparing for such scenarios and are beginning to manufacture more onshore," D.A. Davidson analyst Gil Luria said. "It was mentioned that Nvidia is already utilizing [Taiwan Semiconductor's'] Arizona fab where it is manufacturing production silicon." Bernstein analyst Stacy Rasgon said Huang's answer made it seem like Nvidia's push to relocate some manufacturing to the U.S. would limit the effect of higher tariffs. Rasgon also noted that Huang brushed off concerns of a recession hurting customer spending. Huang argued that companies would first cut spending in the areas of their business that aren't growing, Rasgon said.

[9]

NVIDIA CEO On DeepSeek Selloff: Our GPUs Are Expensive, But They Help Make Money Too

This is not investment advice. The author has no position in any of the stocks mentioned. Wccftech.com has a disclosure and ethics policy. NVIDIA CEO Jensen Huang believes that while his firm's AI chips might be expensive, they allow users to save money by saving time and also generate tokens that can be monetized. Huang made the remarks in an interview given to CNBC earlier today after he unveiled new GPUs and products at the firm's GTC conference yesterday. His firm bled billions of dollars in value in January during the DeepSeek selloff as investors fled the stock on worries of lower demand for NVIDIA's AI GPUs. When asked by CNBC's Jim Cramer how AI has evolved over a year, Huang outlined that "In one year, we made AI better. It's smarter now; it can reason. We made AI more useful. Just about every industry and every company." He believes that not only are companies "building AI into their systems," but more energy and investment are available for building AI infrastructure. NVIDIA bled nearly $600 billion in market value during the DeepSeek selloff in January. Investors shunned the shares after China's DeepSeek demonstrated that it was possible to train and develop leading AI models at a fraction of the cost of its Western counterparts. DeepSeek's products also brought the high prices of NVIDIA's products into the limelight, with investors worrying that the price, along with DeepSeek's efficiency demonstrations, would reduce the demand for NVIDIA's AI GPUs. In response, Huang admitted "these processors and these computers are quite expensive," adding that they're "quite expensive to make." He explained that the reason why his GPUs are expensive are because they are the largest chips and the most complex computers in the world. However, he believes that the GPUs save "you a mountain of money. . .because the amount it takes, the amount of time it saves you. . .the processing time it reduces is incredible." The NVIDIA CEO added that the product also generates monetizable tokens. Consequently, he believes the "amount of money it helps you make is incredible." As for AI, it is the "foundation, the operating system of every single industry going forward," he believes. The reason behind the foundational aspect is "everything that we do in life is underpinned by intelligence." NVIDIA builds "the infrastructure for manufacturing digital intelligence," he shared, and added that the firm's silicon photonics can connect millions of GPUs together to create the "factory of the future." Huang also shared that NVIDIA is working with TSMC and Foxconn, among others, to bring manufacturing onshore. As for whether US chip restrictions against most countries in the world will affect his firm, he pointed out that "there are companies from all over the world. AI's gone mainstream. AI isn't some magical technology. It's incredible technology. But it's used for everything. It's used for healthcare and education and agriculture." As per Huang, the near-term impact of tariffs will "not be meaningful " on his firm. AI advances have also enabled robotics, believes the NVIDIA CEO. The "technology finally arrived where we could create the AIs, we build em in the data centers," he shared. Once the data center training is complete, "you move the AI brain if you will, download it digitally into the physical robot," he added.

[10]

NVIDIA's CEO Says "Trump Tariffs" Won't Have a Meaningful Impact In The Near Term, Says Production In The US Is a Priority

NVIDIA's CEO Jensen Huang says that the Trump tariffs won't have a meaningful impact in the "near term", claiming that they are working with partners to bring production to the US. Well, the imposition of new tariffs did put the markets in a bit of a panic state, given that it was assumed that the global supply chain would see disruptions. Out of all the companies being affected by Trump's new policies, NVIDIA was the one that was said to see a huge influence, given its presence in markets like China. However, according to Jensen Huang in an interview with CNBC, the tariffs won't have much of an impact on what NVIDIA is doing. We are enthusiastic about building in America anyway. We are working with TSMC to get them ready to manufacture chips in the US. In the near-term, the impact of tariffs won't be meaningful. - NVIDIA's CEO One of the aims of Trump's tariff policy is to bring semiconductor glory back to the US, and the administration's efforts have worked out, given that firms like TSMC have announced significant investments in the country. This indicates that the AI supply chain will ultimately see its dependence on nations like Taiwan reduced massively, which not only guarantees companies protection from regional conflicts like China-Taiwan but also a much broader supply chain. For NVIDIA, well, China is a key partner, and a huge contributor to the firm's DC and AI revenue, but with the US trade restrictions, Team Green is allowed to do limited business. This includes selling "cut-down" variants of its AI GPUs, like the H20, and restrictions on the volume of units sold to the nation. Team Green's position in the Chinese market isn't sustainable, considering the change in US policies, along with how counterparts like Huawei are stepping into the competition. NVIDIA has to realize this, whether it means taking a massive hit in revenue. Team Green's GTC 2025 keynote was a massive achievement for the firm's AI ambitions. Despite all the global conflicts that the company has been forced into, NVIDIA is still thriving.

[11]

Nvidia chief confident chip maker can weather US tariffs

AFP - Nvidia boss Jensen Huang expressed confidence on Wednesday that the artificial intelligence (AI) chip giant can handle United States (US) President Donald Trump's trade war. "We have a really agile network of suppliers; they are not just in Mexico or Vietnam," Huang said while meeting with journalists at Nvidia's annual developers conference in San Jose, California. "If we add onshore manufacturing by the end of this year, we should be quite good." Nvidia is not expecting tariffs to significantly affect its financial performance in the short term, according to Huang. He noted that the tariff situation is evolving, and that what it does to Nvidia costs will depend on which countries are targeted by Trump. Trump threatened to slap extra tariffs on imports of computer chips to the US, which will heap pressure on Nvidia's business, which depends on imported components. Since returning to power in January, Trump has imposed tariffs on Washington's three main trading partners, Mexico, Canada and China. Trump has talked of imposing "reciprocal tariffs" against other countries in early April, creating uncertainty for businesses and financial markets. The White House recently put out a release saying Trump is intent on making the US a "manufacturing superpower", ramping up pressure to shift production back to this country. However, chip fabrication facilities can take years to build. Since its founding in 1993, Nvidia has specialised in graphics processing units (GPUs) coveted by video game enthusiasts. GPUs are also ideally suited for AI and the rise of that technology has catapulted the Silicon Valley-based chip maker into the spotlight. "We're not making chips anymore; those were the good old days," Huang quipped. "What we do now is build AI infrastructure."

Share

Share

Copy Link

Nvidia CEO Jensen Huang discusses the company's evolution into an AI infrastructure provider, addresses concerns about tariffs and market competition, and emphasizes the importance of faster chips in reducing AI costs.

Nvidia's Transformation into an 'AI Factory'

Jensen Huang, CEO of Nvidia, has redefined the company's role in the tech industry, declaring Nvidia as an "AI infrastructure company" and "AI factory"

1

. This shift represents a significant evolution from Nvidia's traditional image as a graphics card manufacturer for PC builders. Huang emphasized that Nvidia is no longer just about "buy chips, sell chips," but rather about constructing massive AI factories1

.Unprecedented Product Roadmap Unveiling

In a bold move, Huang introduced four GPU architectures that will form Nvidia's AI portfolio through 2028

1

. This unusual step of revealing long-term product plans underscores the company's commitment to aligning with customer needs and industry planning. Huang explained, "Everybody's information has to be aligned and we have to plan together to build infrastructure for the world"1

.Surging Demand and Financial Impact

The AI boom has led to a significant increase in Nvidia's GPU sales. Huang revealed that Nvidia has sold 3.6 million Blackwell GPUs to the top four US-based cloud service providers this year, up from 1.3 million Hopper-based GPUs last year

1

. This surge in demand has sent Nvidia's financials soaring, but also increased scrutiny from customers and competitors1

.Addressing Tariff Concerns and Manufacturing Strategy

Amid concerns about the impact of tariffs on Nvidia's business, Huang downplayed the immediate threat. He stated, "In the near-term based on what we know, we are not expecting a significant impact to our outlook and our financials"

2

. Nvidia's strategy involves a diverse network of suppliers across multiple countries, providing flexibility in the face of potential tariffs1

.Long-term U.S. Manufacturing Plans

Huang expressed enthusiasm about expanding Nvidia's manufacturing presence in the United States. The company is working closely with TSMC on its Arizona manufacturing site and collaborating with partners like Foxconn and Wistron to bring manufacturing onshore

2

3

. This aligns with the broader trend of tech companies seeking to diversify their supply chains and reduce dependence on overseas manufacturing.Related Stories

The Economics of Faster Chips

Huang emphasized that faster chips are the key to reducing AI costs over the next decade. During his GTC keynote, he dedicated time to explaining the economics of faster chips for cloud providers, including cost-per-token calculations

4

. Nvidia's upcoming Blackwell Ultra systems are projected to provide data centers with 50 times more revenue than its current Hopper systems due to increased speed and efficiency4

.Addressing Market Concerns and Competition

Investors have expressed concerns about potential slowdowns in capital expenditures from major cloud providers and the threat of custom chips from these same companies. Huang dismissed the notion that custom chips could challenge Nvidia's GPUs, arguing they lack the flexibility required for rapidly evolving AI algorithms

4

. He also noted that many announced custom AI chips may not make it to market, stating, "A lot of ASICs get canceled"4

.Future Outlook and Physical AI

Looking ahead, Nvidia is focusing on the growing field of physical AI, which involves using AI to power machines' actions in the real world. Analysts noted that this area, once considered speculative, is now becoming a tangible market with significant potential

5

. Nvidia's demonstration of Isaac GR00T N1, a foundation model for humanoid robots, highlights the company's ambitions in this space5

.As Nvidia navigates its transformation into an AI infrastructure powerhouse, the company faces both unprecedented opportunities and challenges. With its strong market position, innovative product roadmap, and strategic manufacturing plans, Nvidia appears well-positioned to maintain its leadership in the rapidly evolving AI landscape.

References

Summarized by

Navi

[1]

Related Stories

Recent Highlights

1

Pentagon threatens to cut Anthropic's $200M contract over AI safety restrictions in military ops

Policy and Regulation

2

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

3

OpenAI closes in on $100 billion funding round with $850 billion valuation as spending plans shift

Business and Economy