Nvidia CEO Jensen Huang Loses $10 Billion as Stock Plummets Amid Antitrust Concerns

7 Sources

7 Sources

[1]

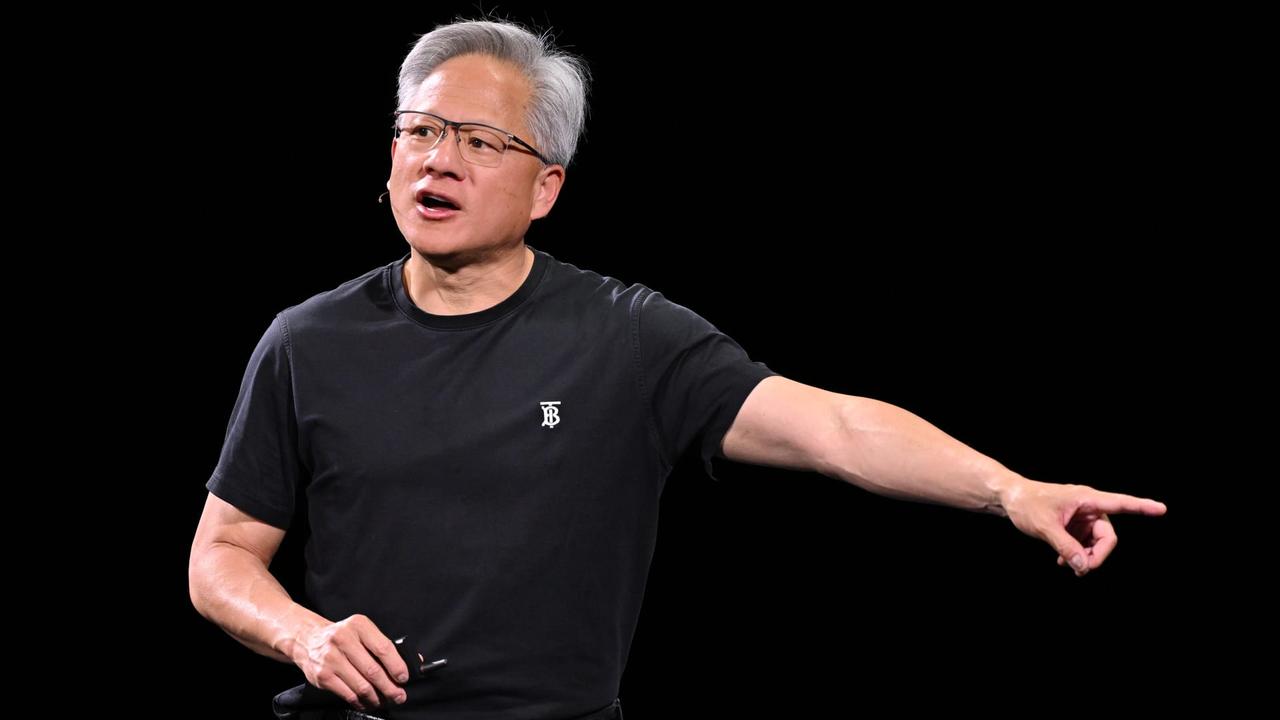

Nvidia CEO Jensen Huang loses $10B as company's stock plummets

Nvidia CEO Jensen Huang's net worth fell by around $10 billion on Tuesday after the AI chip leader's stock plummeted by nearly 10% amid a global selloff. Huang, the 61-year-old Taiwanese-born executive who cleaned bathrooms and worked as a busboy at Denny's before co-founding Nvidia more than 30 years ago, saw his fortune shrinkto $94.9 billion, according to Bloomberg Billionaires Index. His fortune, which has soared by $51 billion just this year, declined after the largest one-day loss in Nvidia's history, shaving nearly $280 billion off of its market capitalization. As of Tuesday, Nvidia's market cap was $2.6 trillion, putting it behind Apple ($3.35 trillion) and Microsoft ($3.02 trillion). Nvidia's stock tumbled after Bloomberg News reported that the Justice Department served the company with a subpoena as part of its ongoing investigation into alleged antitrust violations. The Santa Clara, Calif.-based company, which is notorious for its demanding workplace culture where employees labor for up to seven days per week and at times until 1 or 2 a.m., is alleged to have strong-armed customers by penalizing them if they didn't exclusively buy their chips. The investigation is looking into whether Nvidia charges its customers more for networking gear if they want to buy AI chips from rivals such as Advanced Micro Devices (AMD) and Intel. Intel's stock fell nearly 9% after Reuters reported CEO Pat Gelsinger and key executives are expected to present a plan to the company's board of directors to slice off unnecessary businesses and revamp capital spending at the struggling chipmaker. DOJ is taking the lead in probing Nvidia as the agency divvies up Big Tech scrutiny with the Federal Trade Commission, according to Reuters. The FTC is headed by Lina Khan, whose aggressive antitrust crackdowns on big business have prompted several titans of industry such as media mogul Barry Diller and tech billionaire Reid Hoffman to demand that Vice President Kamala Harris oust her from the position if she wins the White House in 2024. Nvidia, whose chips are used both for artificial intelligence and for computer graphics, has seen demand for its products jump following the release of the generative AI application ChatGPT. But the company's business practices have prompted regulators in the US as well as in Europe to look into alleged monopolistic behavior. The European Union, France and China have all sought information from Nvidia about its graphic cards. Government regulators have grown wary of Nvidia's market dominance, which is predicated on companies' reliance on its CUDA chip programming software -- the only system that is 100% compatible with the graphics processing units (GPUs) that power gaming, content creation, AI and scientific research.

[2]

Nvidia's stock plunge reportedly cost CEO Jensen Huang $9.8 billion in a day

Despite another record quarter that beat earnings estimates, shares of Nvidia have suffered -- and the latest sell-off reportedly cost its chief executive almost $10 billion. The chipmaker's shares closed down 9.5% on Tuesday, resulting in a market capitalization loss of $279 billion -- the largest-ever single-day drop in market value for a U.S. company, according to Reuters. Meanwhile, Nvidia chief executive Jensen Huang lost an estimated $9.8 billion from the plunge, according to Bloomberg. Nvidia's shares continued falling in after-hours trading, after a report said the chipmaker had been subpoenaed by the U.S. Department of Justice over complaints that it is violating antitrust laws. The Justice Department also subpoenaed other companies for evidence after initially sending questionnaires about Nvidia's business practices, Bloomberg reported, citing unnamed people familiar with the matter. In June, the Justice Department and the Federal Trade Commission reached a deal to carry out antitrust investigations into Nvidia and fellow artificial intelligence industry leaders Microsoft and OpenAI. U.S. officials are reportedly concerned by complaints that include how Nvidia has made it difficult for customers to switch chip providers. "Nvidia wins on merit, as reflected in our benchmark results and value to customers, who can choose whatever solution is best for them," Nvidia said in a statement shared with Quartz. The chipmaker's shares were up around 0.9% during mid-day trading on Wednesday. So far this year, the company's stock has climbed around 126.3%. Nvidia's shares likely reflect unimpressed investors who want more from the king of AI chips. The chipmaker reported record second-quarter revenue of $30 billion for fiscal year 2025 -- up 122% from a year ago. However, Nvidia set its third-quarter revenue guidance at $32.5 billion, plus or minus 2% -- slightly above the average analysts were expecting, but below top-end estimates.

[3]

Nvidia's Jensen Huang loses $10 billion in a day after historic stock rout -- and more pain may be in store

Tuesday's sell-off in the Nasdaq marked a difficult day for the world's wealthiest tech entrepreneurs. Elon Musk, Mark Zuckerberg and Jeff Bezos all saw billions of dollars in net worth go up in smoke -- but none lost as much as Jensen Huang. the Nvidia founder and CEO was still a centibillionaire when this week started. Yet the biggest single-day plunge in a stock ever recorded cost Huang $9.8 billion, according to estimates by Bloomberg and Forbes that track the fortunes of the ultra-rich. Nvidia's $279 billion drop in market cap on Tuesday eclipsed even Meta's $251 billion from February 2022, driving heavy losses in the broader equity market which notched its worst day since August 5, a session so brutal it was compared with 1987's Black Monday crash. Huang's loss in wealth is not likely to end there. Shares are expected to open lower on Wednesday following a Bloomberg report that broke after the market closed saying the U.S. Department of Justice has escalated an investigation into possible antitrust behavior by Nvidia. When reached by Fortune for comment, Huang's spokespeople did not deny the report citing anonymous sources that the company had been served a subpoena. "Nvidia wins on merit, as reflected in our benchmark result and value to customers, who can choose," it said in a statement sent on request late on Tuesday. Huang is considered a rock star in the tech community. The Taiwanese immigrant started from humble beginnings before founding Nvidia in a Denny's, where he once worked washing dishes. Initially, he set out to make superior processors for video game graphics by performing calculations in parallel rather than in sequence. Since Nvidia's graphics processing units (GPUs) crunched vast amounts of data more quickly and efficiently than rivals' central processing units (CPUs), it became the favored choice of Bitcoin miners and AI companies training large language models like OpenAI's GPT-4. Huang's company currently controls roughly 90% of the AI chip market. Any company serious about developing artificial general intelligence, like OpenAI or Elon Musk's xAI, needs his chips to realize their ambitions. That's why former Google CEO Eric Schmidt recommended last month that no investor take a pass on Nvidia, since it will vacuum up the lion's share of hardware spending in the space. Whether this domination is the result of illegal anticompetitive behaviour or the legitimate fruits of superior manufacturing is a judgement call Lina Khan's Federal Trade Commission and the U.S. Department of Justice will now have to make. "If they can't show that the consumers are being harmed, then they really don't have a case," said Silicon Valley-based analyst Ray Wong of Constellation Research in an interview with Bloomberg Television. Nvidia briefly became the world's most valuable company this summer amid a frenzy in AI stocks. But sentiment has begun to wane following overextended valuations and disappointing fiscal third-quarter guidance and delays in its next generation Blackwell AI chip architecture. Two Wall Street buy-side analysts fueled fears on Tuesday that near-term productivity gains may not justify the gold rush sentiment in the sector. The global head of research at BlackRock, the world's largest asset manager, warned recent research had cast some doubt on whether revenues from AI would catch up with capital investments. "We think it will take some time for big tech company revenues to reflect their AI capital spending. The AI buildout will take years -- not quarters -- to complete," wrote BlackRock's Jean Boivin. Similarly, JPMorgan worried that MIT economist Daron Acemoglu may be right with his warning not the believe the AI hype. The latter predicted that productivity gains from AI could be a meager 0.06% per year, far from what's needed to justify current spending. "It's probably too soon to worry that there's no killer generative AI app yet," Michael Cembalest, the chairman of market and investment strategy at the bank's asset management arm, wrote on Tuesday. "But the clock is ticking."

[4]

Nvidia CEO Jensen Huang Lost $10 Billion in 1 Day

CEO Jensen Huang, the company's largest individual shareholder, lost $10 billion in personal wealth. Nvidia's stock faced an unprecedented drop on Tuesday, wiping off $279 billion in market value, the largest one-day loss in U.S. history. The loss is worth more than all of the shares of many major U.S. businesses, including McDonald's and Chevron, per CNN. Nvidia's shares tumbled over 9% in regular U.S. trading and continued the descent post-market by an additional 2%, after a report of a subpoena from the Department of Justice relating to an antitrust investigation, per Bloomberg. Related: Why Are Nvidia Earnings So Important? They Could Be a 'Market Mover,' Says Expert Jensen Huang, the CEO and Nvidia's top individual shareholder, also took a personal hit with a $10 billion drop in his wealth. Shares were up about 1% Wednesday afternoon, according to CNBC. Nvidia has about 80% of the market for AI chips. In response to the DOJ antitrust investigation, a company spokesperson told the outlet that Nvidia "wins on merit, as reflected in our benchmark results and value to customers, who can choose whatever solution is best for them."

[5]

$10 billion wiped out: Why Nvidia CEO Jensen Huang suffered his biggest-ever wealth loss - Times of India

Nvidia CEO Jensen Huang has suffered his biggest personal loss after shares of the US-based chip-making company's stocks took a $279 million hit. The stocks of the chip-making giant tumbled after a report claimed that the US Department of Justice (DoJ) sent the company subpoenas as part of an escalating antitrust probe. How much Huang lost According to a report by Bloomberg, Huang's wealth reduced by nearly $10 billion to $94.9 billion, marking his personal largest single-day decrease since 2016.This decline coincided with a 9.5% drop in Nvidia's stock price. Despite the recent decline in his net worth, Huang remains the 18th richest person in the world. The report claims that even after the drop, his wealth has increased by $51 billion year-to-date. Huang came to the US and co-founded Nvidia in 1993. The company has since become the world's third-largest by market value. Why DoJ is investigating Nvidia The US DOJ has reportedly stepped up its investigation against Nvidia as it is concerned that the chipmaker's market dominance may be blocking competition and making it difficult for customers to switch to alternative suppliers. The DOJ has reportedly sent legally binding requests to various companies seeking information related to Nvidia's business practices. This action suggests that the government may be nearing the filing of a formal antitrust complaint. Nvidia's shares, which recently experienced a record decline of $279 billion, continued to drop after reports of subpoenas from the DoJ. Despite this setback, this year Nvidia's stock has more than doubled in value, which was driven by strong sales growth. What Nvidia said about the investigation into its 'market dominance' Responding to inquiries about investigations into Nvidia's market dominance, the company attributed its success to the superior performance and quality of its products. "Nvidia wins on merit, as reflected in our benchmark results and value to customers, who can choose whatever solution is best for them," the company said in an emailed statement to Bloomberg. The TOI Tech Desk is a dedicated team of journalists committed to delivering the latest and most relevant news from the world of technology to readers of The Times of India. TOI Tech Desk's news coverage spans a wide spectrum across gadget launches, gadget reviews, trends, in-depth analysis, exclusive reports and breaking stories that impact technology and the digital universe. Be it how-tos or the latest happenings in AI, cybersecurity, personal gadgets, platforms like WhatsApp, Instagram, Facebook and more; TOI Tech Desk brings the news with accuracy and authenticity.

[6]

Nvidia's Jensen Huang just crashed out of the $100 billion club after his net worth plunged by almost $10 billion

This story is available exclusively to Business Insider subscribers. Become an Insider and start reading now. Have an account? Log in. The wealth decline dropped Huang from 14th on the rich list to 18th, behind Indian industrialist Gautam Adani (worth $102 billion) and Walmart founder Sam Walton's three surviving children: Jim (worth $99.9 billion), Rob (worth $97.6 billion), and Alice (worth $96.9 billion). The chipmaker's chief sunk to an eight-digit net worth because Nvidia stock tumbled 9.5% on Tuesday. The sell-off slashed Nvidia's market value by $279 billion -- close to the entire value of Netflix ($290 billion), and the biggest one-day decline for a US company in history. Nvidia shares tumbled amid a wider rout in chip stocks, and after Bloomberg reported the semiconductor titan had received subpoenas from the Department of Justice as part of an antitrust probe. Nvidia has become the preeminent supplier of microchips to the artificial-intelligence boom, counting Elon Musk's Tesla and Mark Zuckerberg's Meta among its customers. Even after Tuesday's hit, Huang has still added about $51 billion to his net worth this year. That's been fueled by a 118% rise in Nvidia stock since the start of this year, which has boosted the company's market value to $2.65 trillion. Only Apple ($3.4 trillion) and Microsoft ($3 trillion) are worth more. Huang cofounded Nvidia more than 30 years ago in 1993, but the company's value has only really taken off since late 2022, when ChatGPT's release sparked the AI craze. Nvidia's split-adjusted stock price has skyrocketed by over 600% since then, from below $15 to $108 at Tuesday's close.

[7]

Jensen Huang's Net Worth Drops Below $100B As Nvidia Stock Plummets 14% Over 3 Sessions After Earnings Fail To Impress Investors - NVIDIA (NASDAQ:NVDA)

Wedbush's Daniel Ives says underlying enterprise demand for AI is way outstripping supply, and this bodes well for the chipmaker. Nvidia Corp. NVDA shares have tumbled 14% over three sessions following the artificial intelligence stalwart's quarterly results. What Happened: Santa Clara, California-based Nvidia reported Wednesday after the close of fiscal year 2025 second-quarter earnings and revenue that exceeded expectations. The guidance for the third quarter was also upbeat. Notwithstanding the stellar results, investors sold off, potentially due to the guidance exceeding the consensus by the smallest margin in several quarters. Investors are also worried about the lack of visibility into the Blackwell 200 AI accelerators amid the rumors about a potential delay. The stock fell 6.4% on Friday and recouped some of the losses on Friday amid the broader market rally orchestrated by tame inflation data. Selling resumed on Tuesday, as the market reopened after Monday's Labor Day holiday, dragged by the broader market weakness and a Bloomberg report that said the company received subpoenas from the Department of Justice over monopoly trade practices. The stock plunged 9.5% by the close. Nvidia's market cap eroded by $279 billion on Tuesday alone. Intraday, the valuation plunged about $300 billion, marking the biggest one-day loss for any stock, according to a post on X by trading platform TrendSpider. See Also: Best AI Stocks Stock Plunge Leaves Huang Poorer: Nvidia founder Jensen Huang holds 0.86 million shares in the company he co-founded, giving him a 3.5% stake in the company. The 61-year-old entrepreneur, the son of Taiwanese immigrants, is positioned 18th in the Bloomberg Billionaires Index, boasting $94.9 billion in wealth, down $9.8 billion from Friday. At the peak, his net worth was at $119 billion in mid-June. Analysts are confident that the near-term weakness is only a fleeting thing. Wedbush's Daniel Ives said in a note that the underlying enterprise demand for AI is way outstripping supply. "With Blackwell delay fears allayed we do not see anything getting in the way of this AI Revolution heading into year-end despite some throwing around the "R-word" the last few weeks," he said. Nvidia, though ending down 9.53% at $108 on Tuesday, is up 118% so far this year, according to Benzinga Pro data. Read Next: Nvidia Takes A Page From Apple's Playbook: Jensen Huang Wants AI Stalwart To Go Beyond Chips And Be One-Stop Shop For Data Center Clients Image via Flickr/ Hillel Steinberg Market News and Data brought to you by Benzinga APIs

Share

Share

Copy Link

Nvidia's stock price tumbled, causing CEO Jensen Huang to lose $10 billion in a single day. The drop was triggered by antitrust concerns and potential new regulations in the AI chip market.

Nvidia's Stock Plunge

On September 4, 2024, Nvidia Corporation, the leading AI chip manufacturer, experienced a significant stock price drop, causing its CEO Jensen Huang to lose approximately $10 billion in net worth in a single day

1

. The company's shares plummeted by 10%, marking the most substantial decline since May 20242

.Antitrust Concerns and Regulatory Pressures

The primary catalyst for this dramatic drop was the emergence of antitrust concerns and potential new regulations in the AI chip market. Reports surfaced that China was considering restrictions on the export of gallium and germanium, two crucial materials used in semiconductor production

3

. This news raised fears about potential supply chain disruptions and increased scrutiny of Nvidia's dominant position in the AI chip industry.Impact on Jensen Huang's Wealth

Jensen Huang, who co-founded Nvidia in 1993, saw his net worth decrease from $42.2 billion to $32.3 billion following the stock price decline

4

. Despite this significant loss, Huang remains one of the wealthiest individuals in the technology sector, with his net worth still reflecting Nvidia's overall success in the AI boom.Nvidia's Market Position and Future Outlook

Nvidia has been at the forefront of the AI revolution, with its graphics processing units (GPUs) being essential for training large language models and other AI applications. The company's market capitalization had soared to over $1 trillion earlier in the year, making it one of the most valuable companies globally

5

.Related Stories

Industry-wide Implications

The stock plunge and regulatory concerns surrounding Nvidia have broader implications for the tech industry. As governments worldwide grapple with the rapid advancement of AI technology, increased scrutiny of market leaders like Nvidia is expected. This event highlights the volatile nature of the AI sector and the potential risks associated with market concentration.

Investor Sentiment and Market Reaction

While the stock drop was significant, some analysts view it as a potential buying opportunity, citing Nvidia's strong fundamentals and continued demand for AI chips. However, others caution that regulatory challenges could pose long-term risks to the company's growth trajectory and market dominance.

As the AI industry continues to evolve, the incident serves as a reminder of the delicate balance between innovation, market leadership, and regulatory compliance in the fast-paced world of technology.

References

Summarized by

Navi

[1]

[4]

Related Stories

Nvidia CEO Jensen Huang's Net Worth Surges, Rivaling Warren Buffett's as Company Hits $4 Trillion Valuation

11 Jul 2025•Business and Economy

NVIDIA CEO Jensen Huang's Net Worth Surpasses Intel's Market Cap Amid AI Boom

06 Oct 2024•Business and Economy

Nvidia's Record $279 Billion Market Value Loss Highlights Big Tech's Market Influence

04 Sept 2024

Recent Highlights

1

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

2

Demis Hassabis predicts AGI in 5-8 years, sees new golden era transforming medicine and science

Technology

3

Nvidia and Meta forge massive chip deal as computing power demands reshape AI infrastructure

Technology