Nvidia CEO Jensen Huang Reports Surge in AI Computing Demand

4 Sources

4 Sources

[1]

Nvidia's Huang says AI computing demand is up 'substantially' in the last 6 months

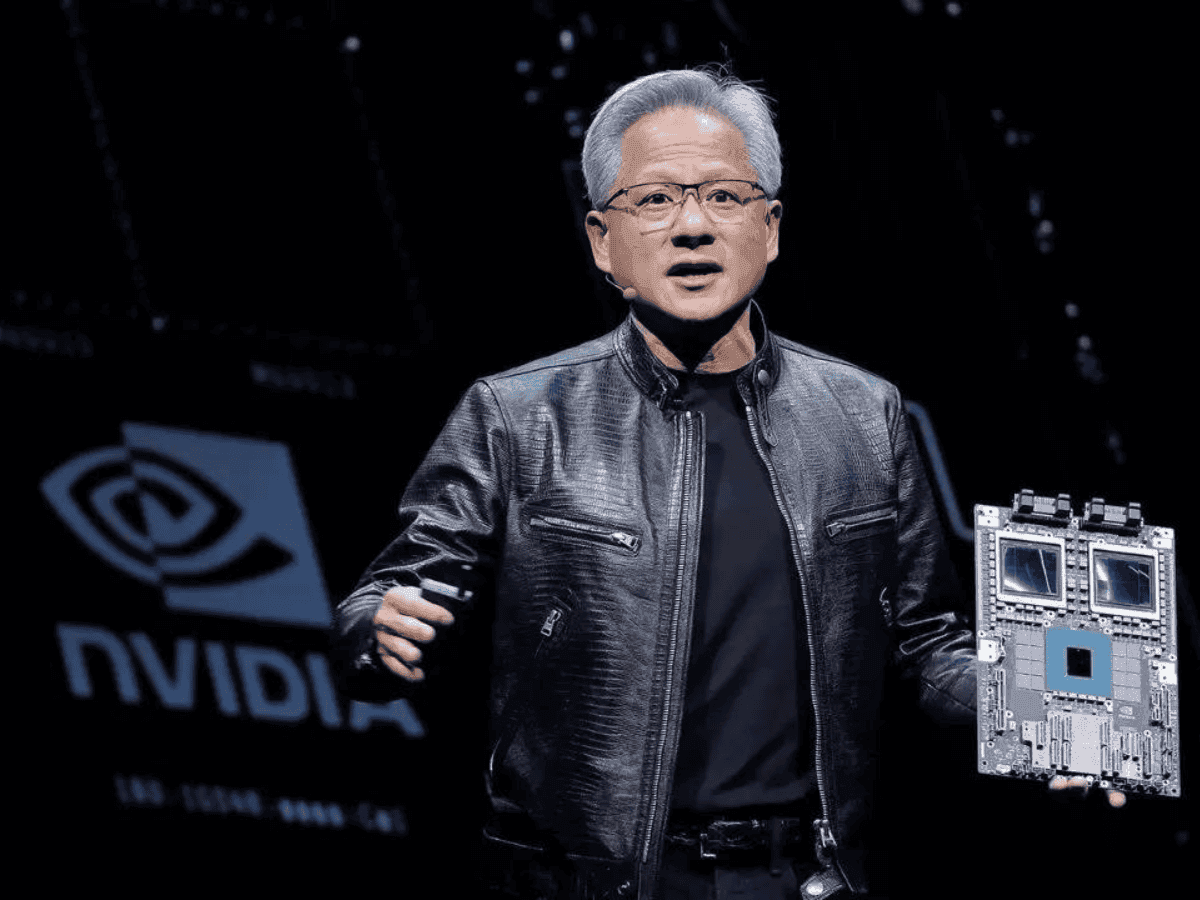

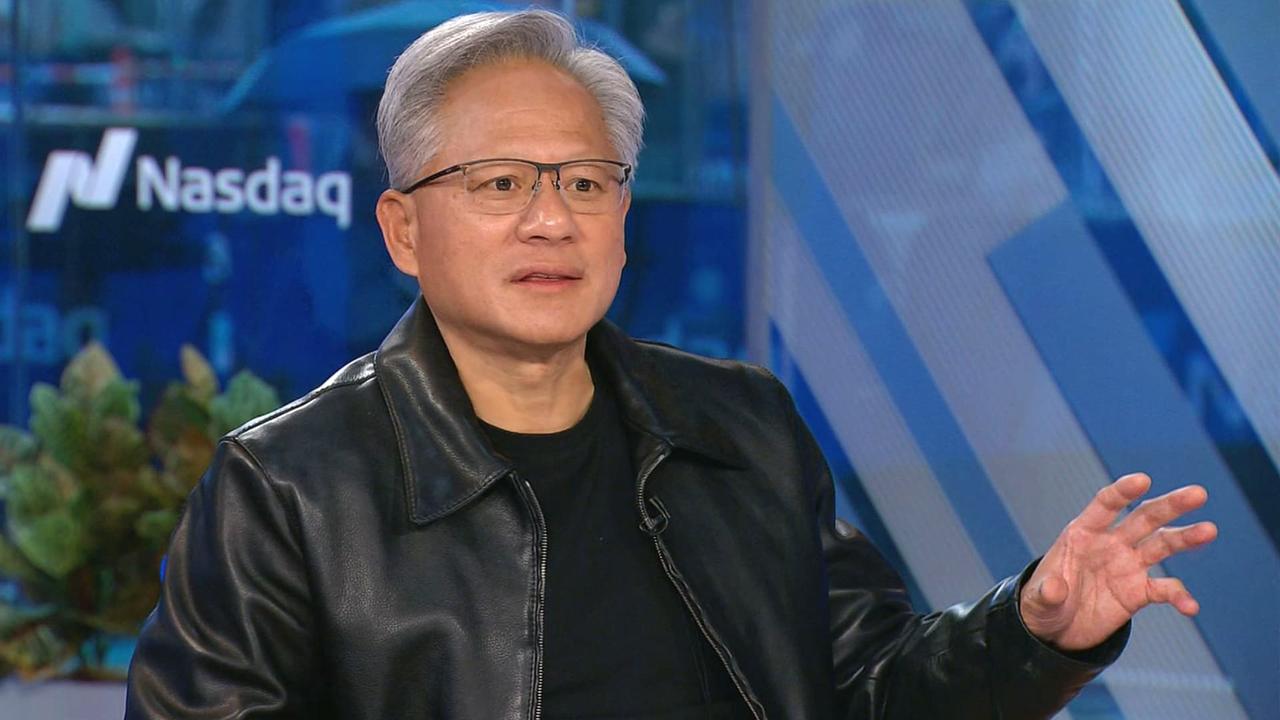

Jensen Huang, CEO of Nvidia, speaking on CNBC's Squawk Box on Oct. 8th, 2025. Nvidia CEO Jensen Huang said demand is up huge this year as artificial intelligence models develop further from answering simple questions to complex reasoning. "This year, particularly the last six months, demand of computing has gone up substantially," said Huang on CNBC's "Squawk Box." The CEO of the AI chip leader was answering a question about what investors ask him most about. Nvidia shares were higher in premarket trading as Huang gave his bullish comments.

[2]

Nvidia's Jensen Huang Says AI Demand Is Up 'Substantially' This Year, and Still Growing

The CEO also said he believes the AI boom is still in its early stages, with further room for growth. Demand for artificial intelligence is booming and only just getting started, according to Nvidia CEO Jensen Huang. "This year, particularly the last six months, demand of computing has gone up substantially," the CEO told CNBC in a televised interview Wednesday, adding that that he believes the AI boom is still in its early stages, leaving room for further growth. Shares of Nvidia (NVDA) were up 2% in recent trading, contributing to a rally in the tech sector. The chipmaker at the heart of the AI boom has seen its stock climb roughly 40% so far in 2025 as sales of its chips to power data centers surged and trade policy headwinds eased. Its move this year has helped propel Nvidia into the top spot as the world's most valuable public company, and made its CEO one of the richest people in the world. Shares of Nvidia partners such as Micron Technology (MU) and Super Micro Computer (SMCI) also climbed Wednesday, adding to gains earlier in the week on a massive OpenAI deal with Advanced Micro Devices (AMD), which also collaborates with the companies. AMD's deal came just weeks after Nvidia announced its own deal with OpenAI. OpenAI CEO Sam Altman said in a social media post Monday that the startup views its AMD deal as incremental to the ChatGPT maker's work with Nvidia, and that "the world needs much more compute." The move raised speculation more high-profile partnerships could be in the works, affecting a growing number of companies, with several Wall Street analysts likening the signal of strong demand for AI to a rising tide that lifts all boats. Huang said Wednesday that his only regret is not investing more in major AI players like OpenAI and CoreWeave (CRWV), an AI data center provider in which Nvidia holds a stake. The CEO also gave a shoutout to Tesla (TSLA) CEO Elon Musk, saying Nvidia is investing in Musk's xAI and that "almost everything that Elon is part of, you really want to be part of as well." Shares of the EV maker, which were up about 1% Wednesday, have been on a tear in recent weeks, adding roughly a third of their value since the start of September as bulls have shifted more of their focus to the company's developments in autonomous driving, robotics, and AI.

[3]

Nvidia CEO Jensen Huang says AI computing demand surged in past six months

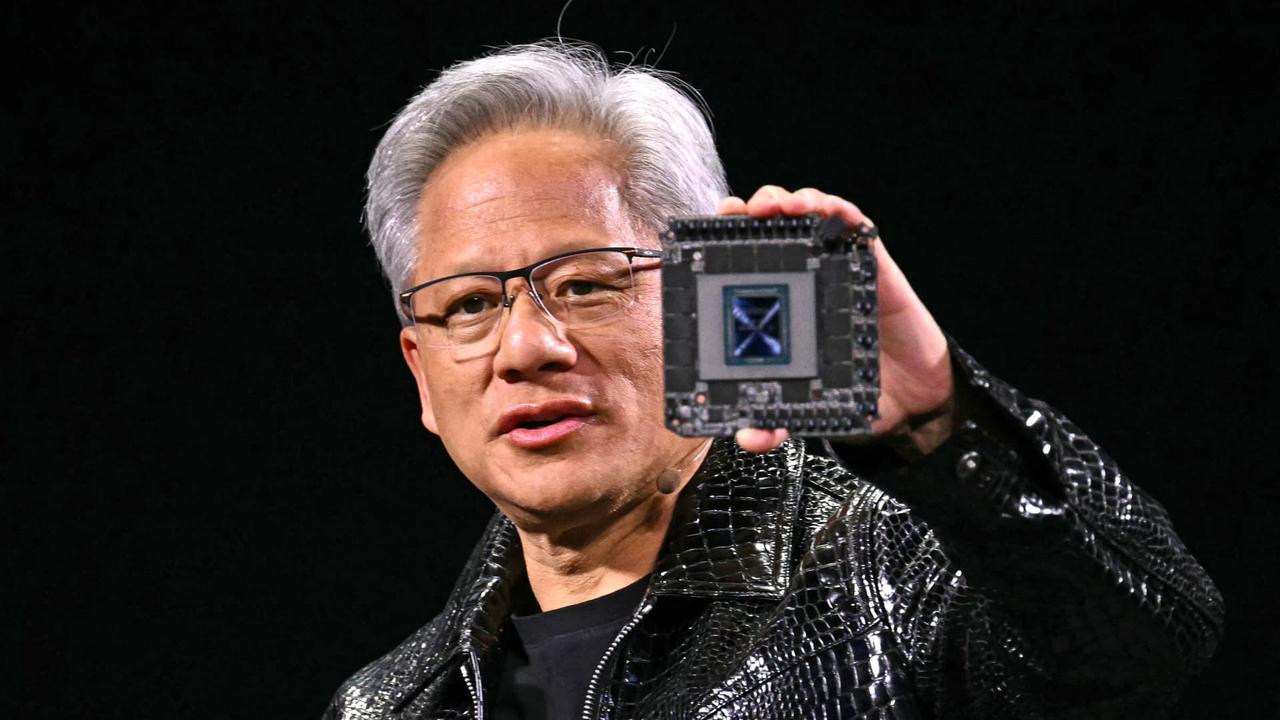

This follows infrastructure investments increasing across the AI sector. But industry analysts are worried that billion-dollar circular deals happening in the AI space could result in a bubble. Nvidia CEO Jensen Huang said on Wednesday that artificial intelligence (AI) computing demand has surged "substantially" over the past six months, as models move from just answering questions to reasoning. Speaking to CNBC, Huang said AI models are evolving and consuming vast amounts of computing power. "The AIs are intelligent enough that everyone wants to utilise them," he said, describing "two exponentials happening at the same time," i.e., AI systems requiring more compute power and demand skyrocketing because of their impressive capabilities. "I think we're at the beginning of a new build-out, the beginning of a new industrial revolution, and it's going to be exciting times," he said. The surge in demand centres around Nvidia's latest Blackwell architecture. Huang said the "demand for Blackwell is incredibly high." The advanced chips, featuring 208 billion transistors and new AI acceleration technologies, have become the backbone of data centres powering everything from OpenAI's ChatGPT to smaller models. The computing demand surge comes as infrastructure investments are increasing across the AI sector. Nvidia announced plans to invest up to $100 billion in OpenAI in September to deploy 10 gigawatts of AI systems. "This is an enormous undertaking," Huang said of the OpenAI deal, which represents between four and five million GPUs and marks "the biggest AI infrastructure project in history." The first phase will launch in 2026 using Nvidia's next-generation Vera Rubin platform. Earlier this month, Advanced Micro Devices (AMD) announced a landmark multi-billion-dollar agreement with OpenAI and turned up the heat on Nvidia, which currently dominates the chip space. The partnership sent AMD shares rallying over 25% in early trading. Also Read || ETtech Explainer: OpenAI deals with AMD, Nvidia spark bubble concerns Industry analysts project global AI infrastructure spending could reach $2 trillion by 2026. Several billion-dollar circular deals in the AI space have them worried about a bubble. Most of these deals are centred around Nvidia and OpenAI, raising concerns that an increasingly complex and interconnected web of business transactions is artificially propping up the trillion-dollar AI boom. Also Read: Doomsday or new dawn: what will Nvidia, OpenAI's circular dealmaking bring

[4]

Jensen Huang welcomes an explosion in demand for artificial intelligence computing

Nvidia CEO Jensen Huang said on Wednesday that global demand for computing power for artificial intelligence has accelerated dramatically over the past six months. Speaking on CNBC, he explained that the rise of AI models capable of moving from simple text exchange to more advanced forms of reasoning is fueling exponential growth in infrastructure needs. These statements boosted Nvidia's stock price in pre-market trading on Wall Street. According to Huang, the new models consume unprecedented computing power, but market interest is growing at the same rate. "AI has become smart enough that everyone wants to use it," he summarized, referring to "two exponentials crossing." He highlighted the strong demand for the latest Blackwell architecture, the core of the new generation of processors designed for artificial intelligence applications. The executive presented this phase of expansion as the beginning of a "new industrial revolution," marked by the construction of massive AI-dedicated infrastructure. Nvidia recently invested $100bn in OpenAI's mega data center project, designed to deploy up to 10 gigawatts of computing power based on its chips. This initiative confirms the group's central position in the global artificial intelligence ecosystem.

Share

Share

Copy Link

Nvidia CEO Jensen Huang announces a substantial increase in AI computing demand over the past six months, driven by advancements in AI models. The surge is fueling massive infrastructure investments and partnerships in the AI industry.

AI Computing Demand Surges

Nvidia CEO Jensen Huang reported a significant increase in AI computing demand over the last six months, attributing it to the advancement of AI models capable of complex reasoning

1

2

. Huang noted two concurrent exponential trends: escalating computational needs of AI and surging demand due to impressive AI capabilities3

.

Source: Market Screener

Nvidia's Dominance and Investment

Nvidia's Blackwell architecture, with its 208 billion transistors and advanced AI acceleration, is central to this boom, powering data centers for systems like OpenAI's ChatGPT

3

.

Source: ET

Nvidia's stock has risen approximately 40% in 2025, making it the world's most valuable public company and Huang one of the richest individuals

2

.

Source: CNBC

The industry is witnessing massive infrastructure investments. Nvidia plans a $100 billion investment in OpenAI to deploy 10 gigawatts of AI systems, dubbed "the biggest AI infrastructure project in history" by Huang

3

4

. Advanced Micro Devices (AMD) is also a key player, with its own multi-billion-dollar agreement with OpenAI, intensifying competition in AI chip development3

.Related Stories

Future Outlook and Concerns

Huang views the AI boom as just the beginning, describing it as a "new industrial revolution"

2

4

. Global AI infrastructure spending could hit $2 trillion by 2026. However, some analysts express concern about a potential market bubble, given the increasingly complex and interconnected business transactions, particularly involving Nvidia and OpenAI3

.References

Summarized by

Navi

[2]

Related Stories

NVIDIA's Dominance in AI Infrastructure: Record Earnings and Future Projections

29 Aug 2025•Technology

Nvidia CEO Jensen Huang Challenges DeepSeek's AI Efficiency Claims, Predicts Surge in Computing Demand

20 Mar 2025•Technology

Nvidia CEO Jensen Huang Praises DeepSeek's R1 Model, Remains Bullish on AI Chip Demand

22 Feb 2025•Business and Economy

Recent Highlights

1

Samsung unveils Galaxy S26 lineup with Privacy Display tech and expanded AI capabilities

Technology

2

Anthropic refuses Pentagon's ultimatum over AI use in mass surveillance and autonomous weapons

Policy and Regulation

3

AI models deploy nuclear weapons in 95% of war games, raising alarm over military use

Science and Research