Nvidia Plans Massive Investment in US Chip Production, Signaling Shift in Global Supply Chain

7 Sources

7 Sources

[1]

Nvidia to invest billions in US chip production over four years, FT reports

March 19 (Reuters) - Nvidia (NVDA.O), opens new tab plans to invest hundreds of billions of dollars in U.S.-made chips and electronics over the next four years, the Financial Times reported on Wednesday, quoting CEO Jensen Huang. The artificial intelligence chip giant expects to spend around half-a-trillion dollars on electronics during the four-year period, according to the report. "I think we can easily see ourselves manufacturing several hundred billion of it here in the U.S.," Huang told FT, adding that the Trump administration could help accelerate the expansion of the U.S. AI industry. Nvidia did not immediately respond to a Reuters request for comment. Reporting by Surbhi Misra in Bengaluru; Editing by Sherry Jacob-Phillips Our Standards: The Thomson Reuters Trust Principles., opens new tab Suggested Topics:Artificial Intelligence

[2]

Nvidia to spend hundreds of billions on US chipmaking over next 4 years, says chief

Nvidia will spend hundreds of billions of dollars on chips and other electronics manufactured in the US over the next four years, its chief executive has said, as the company tilts its supply chain back from Asia in the face of Donald Trump's tariff threats. The huge spending projection from the world's most valuable semiconductor group follows multibillion-dollar US investment plans announced by other technology companies including Apple, as the impact of Trump's "America First" trade policies ripples through the global economy. "Overall, we will procure, over the course of the next four years, probably half a trillion dollars worth of electronics in total," Jensen Huang, Nvidia's chief executive and co-founder, told the Financial Times. "And I think we can easily see ourselves manufacturing several hundred billion of it here in the US." In a wide-ranging interview, Huang said the leading artificial intelligence chipmaker was now able to manufacture its latest systems in the US through suppliers such as Taiwan Semiconductor Manufacturing Company and Foxconn, and that he saw a growing competitive threat from Huawei in China. This week, at Nvidia's annual GTC developer conference, Huang unveiled the next generation of its AI chip, Vera Rubin, outlining his plan to build clusters of millions of interconnected chips in giant data centres that will require a vast power supply. Huang said he believed the Trump administration could accelerate the development of America's AI industry. "Having the support of an administration who cares about the success of this industry and not allowing energy to be an obstacle is a phenomenal result for AI in the US," he said. This month, TSMC announced a $100bn investment in chip manufacturing facilities in Arizona, which came in addition to a $65bn investment agreed under the Biden administration. Nvidia's latest Blackwell systems are now being produced in the US, said Huang. "TSMC investing in the US provides for a substantial step up in our supply chain resilience." In recent years, America's biggest technology companies, including Nvidia and Apple, have become overwhelmingly reliant on TSMC's cutting-edge chipmaking facilities in Taiwan. That dependency has been clouded by the growing threat of aggression by China -- which claims Taiwan as part of its territory -- as well as the Trump administration's threats of tariffs on Taiwanese semiconductors. Taiwan also faces an ever-present risk of earthquakes. "The most important thing is to be prepared," said Huang. "At this point, we know that we can manufacture in the US, we have a sufficiently diversified supply chain." If any disaster were to threaten production in Taiwan, he said, "it will be uncomfortable but it should be OK". The US has clamped down on exports of Nvidia's market-leading chips that are used to train and run the most advanced AI models, with the industry decrying a Biden-era set of more expansive export controls scheduled to come into force in May. At the same time, Chinese chipmakers have been prevented from buying advanced chipmaking equipment such as ASML's lithography machines. But while Nvidia still makes billions of dollars in revenue from China, it has faced resurgent competition from Huawei, whose Ascend AI chips have made advances recently. "Huawei is the single most formidable technology company in China," said Huang. "They have conquered every market they've engaged." US-led efforts to constrain the Chinese tech conglomerate have been "done poorly" given Huawei's continued success. "I think that their presence in AI is growing every single year," he said. "We can't assume that they are not going to be a factor." Intel, the only US company that can in theory manufacture leading-edge chips similar to Nvidia's, has faced serious challenges with its foundry business. A leadership vacuum at Intel was resolved last week when Lip-Bu Tan was named as chief executive. Huang denied reports that Nvidia was involved in discussions to form a consortium with the likes of TSMC to invest in Intel and stopped short of committing to using its US chipmaking services as part of that onshoring. "We evaluate their foundry technology on a regular basis, and we are ongoing in doing that," he said, adding that Nvidia was also looking at Intel's chip packaging services. "We look for opportunities to be a customer of theirs." "I have every confidence that Intel has the ability to do it," said Huang, referring to Intel's ability to be competitive in advanced chip technologies. He added that the "success and welfare of Intel" was important. "But it takes a while to convince yourself and each other that a new supply chain ought to get built up."

[3]

Nvidia will spend hundreds of billions on US manufacturing, says CEO

Comments by chipmaker's boss Jensen Huang are a sign Trump's 'America First' policy is affecting investment The boss of the world's biggest computer chipmaker, Nvidia, has promised the company will shell out "several hundred billion" dollars to make semiconductors and other electronics in the US over the next four years. The comments from Jensen Huang illustrate how the California-headquartered AI chipmaker is remodelling its supply chain away from Asia amid unpredictable tariff threats by Donald Trump. The chief executive, who also co-founded Nvidia, told the Financial Times: "Overall, we will procure, over the course of the next four years, probably half a trillion dollars worth of electronics in total. And I think we can easily see ourselves manufacturing several hundred billion of it here in the US." The remarks are the latest example of how Trump's "America First" policy is having an impact on business investment, even forcing groups such as Nvidia - which is the world's most valuable companies - to rethink their global footprint. The Silicon Valley company, founded in 1993, has been the engine of the AI market boom, with hype around the technology propelling its valuation to a stratospheric $2.9tn (£2.2tn). But in recent years it and other big US tech scompanies such as Apple have become increasing dependent reliant on chipmaking facilities in Taiwan run by TSMC and Foxconn - a supply chain under threat from trade wars and China's territorial designs on its neighbour, which it claims as part of its territory. Huang said he was confident Nvidia was well positioned to deal with any worsening situation in Taiwan, which is also vulnerable to earthquakes. "At this point, we know that we can manufacture in the US, we have a sufficiently diversified supply chain," he added. He said the Trump administration could be in a position to bolster the US AI industry, at a time of growing competition from China. Huawei, for example, had become the "single most formidable technology company in China" having "conquered every market they've engaged". Huang argued US efforts to constrain the Chinese company had been "done poorly", as evidenced by Huawei's continued success. For now, "having the support of an administration who cares about the success of this industry and not allowing energy to be an obstacle is a phenomenal result for AI in the US", Huang said, referring to the mass amount of electricity needed to power its chips in datacentres. Efforts to onshore manufacturing have been helped by a recent $100bn US investment by TSMC. The Taiwanese semiconductor firm's investment means that Nvidia's Blackwell chips - its top-of-the-line graphics processing unit - are being produced in the US, providing for "a substantial step up in our supply chain resilience".

[4]

Nvidia Considers Massive US Supply Chain Expansion, Report Says

Huang's comments come as President Donald Trump's administration pushes for more goods, especially of semiconductors, to be made domestically. Nvidia (NVDA) could spend "several hundred billion" dollars on making chips and other electronics in the U.S. over the next four years, CEO Jensen Huang said in an interview with the Financial Times, becoming the latest company to consider plans to expand in the country as the Trump administration pushes forward with tariffs. Nvidia "will procure, over the course of the next four years, probably half a trillion dollars worth of electronics in total," Huang told the FT in an interview. He went on to say, "I think we can easily see ourselves manufacturing several hundred billion of it here in the U.S." The CEO of the leading artificial intelligence chipmaker told the FT that supplier Taiwan Semiconductor Manufacturing Co. (TSM) "investing in the U.S. provides for a substantial step up in our supply chain resilience." He also called Huawei "the single most formidable technology company" in its key China market, according to the newspaper. Huang's comments come as President Donald Trump's administration pushes for more goods, especially of semiconductors, to be made domestically. Last month, Apple (AAPL) announced plans to spend more than $500 billion in the U.S. over the next four years. Nvidia is in the midst of its week-long GTC conference, where the company said its Blackwell Ultra chips will launch later this year, followed by its next-generation Vera Rubin platform in 2026, and Rubin Ultra in 2027. Huang's highly anticipated GTC keynote failed to deliver a significant share price boost, however. Nvidia shares are falling less than 1% premarket trading and have lost more than 12% of their value this year entering Thursday.

[5]

Nvidia to invest billions in US chip production over four years: Report

The artificial intelligence chip giant expects to spend around half-a-trillion dollars on electronics during the four-year period, according to the report.Nvidia plans to invest hundreds of billions of dollars in U.S.-made chips and electronics over the next four years, the Financial Times reported on Wednesday, quoting CEO Jensen Huang. The artificial intelligence chip giant expects to spend around half-a-trillion dollars on electronics during the four-year period, according to the report. "I think we can easily see ourselves manufacturing several hundred billion of it here in the U.S.," Huang told FT, adding that the Trump administration could help accelerate the expansion of the U.S. AI industry. Huang has been working to allay investor concerns over demand for Nvidia's expensive AI chips, which have made the company one of the world's most valuable, following China's DeepSeek launching a competitive chatbot with allegedly fewer AI chips. Nvidia declined to comment on the FT report. Huang said Nvidia can now manufacture its latest systems in the United States through suppliers such as Taiwanese chipmaking giants TSMC and Foxconn, while also noting a growing competitive threat from Chinese telecoms firm Huawei, according to the report. "TSMC investing in the U.S. provides for a substantial step up in our supply chain resilience," Huang said. Earlier on Wednesday, Huang told analysts at the company's developer conference in California that orders for 3.6 million Blackwell chips from four major cloud firms underestimated overall demand, as they excluded Meta Platforms, smaller cloud providers, and startups.

[6]

Nvidia plans massive outlay on U.S.-made electronics, FT says

Nvidia Corp. aims to spend several hundred billion dollars to procure U.S.-made chips and electronics over the next four years, the Financial Times reported. Chief Executive Officer Jensen Huang told the FT that the latest chips designed by his company, and Nvidia-powered servers for data centers, can now be produced at U.S.-based factories operated by Taiwan Semiconductor Manufacturing Co. and Foxconn Technology Group. It marked a major step forward in supply chain resilience for the Santa Clara, California-based chipmaker, Huang added. Nvidia this week hosted its GTC developer conference, where Huang, 62, said his company ultimately plans to shift manufacturing onshore. It's already using TSMC's Arizona factory to help produce some of its highly prized graphics processing units, which have become the most essential component for the current wave of AI investment. Shares in TSMC and other Nvidia suppliers, such as SK Hynix Inc. in South Korea, rose in the wake of the report. In its 2024 annual report, Nvidia said it had $20 billion in total future purchase commitments as of January 28, 2024. Huang, who in January met President Donald Trump, lauded the new administration's support for the developing artificial intelligence sector and told the FT it was "a phenomenal result for AI in the US." He also praised TSMC -- the sole manufacturer for Nvidia's most advanced AI chips -- for expanding its investment in the US. TSMC, Taiwan's most valuable company, and its peers are rapidly making the US the top priority of their expansion plans, as tariff threats by the Trump administration hasten plans to set up in the country. TSMC CEO C.C. Wei this month announced an additional $100 billion in investment in the U.S., alongside Trump in the White House, and Foxconn is working with Apple Inc. to add an AI server assembly site in Texas.

[7]

Nvidia to spend hundreds of billions on US chipmaking, CEO Huang tells FT By Investing.com

Investing.com-- NVIDIA Corporation (NASDAQ:NVDA) will spend hundreds of billions of dollars on U.S.-made chips and electronics components over the next four years, CEO Jensen Huang said in an interview with the FInancial times. Huang said Nvidia will procure "probably half a trillion dollars worth of electronics in total" over the next four years, and that the company sees itself manufacturing "several hundred billion of it here in the U.S. Huang told the FT that Nvidia was now able to manufacture its latest systems through U.S. suppliers such as TSMC (NYSE:TSM) and Foxconn, and that he saw a growing competitive threat from Chinese electronics giant Huawei. Huang's comments mirror commitments from several other major tech CEOs to spend more money in the U.S. and wean off foreign supply chains in compliance with President Donald Trump's America-first policies. Earlier in March, Apple (NASDAQ:AAPL) had vowed to spend hundreds of billions of dollars to bolster its U.S. operations. Shifting supply chains also come as Trump imposes steep trade tariffs on several major U.S. trading partners, sending local firms scrambling to find alternative supply chains. Huang told the FT that he believed the Trump administration could support the U.S. AI industry, and that Nvidia's Blackwell line of chips were being produced in the U.S. TSMC- a major Nvidia supplier- has invested heavily in its U.S. production capacity, with a bulk of its investment coming under the Biden-era CHIPs act. Huang had earlier this week unveiled Nvidia's next-generation line of AI chips, called Vera Rubin.

Share

Share

Copy Link

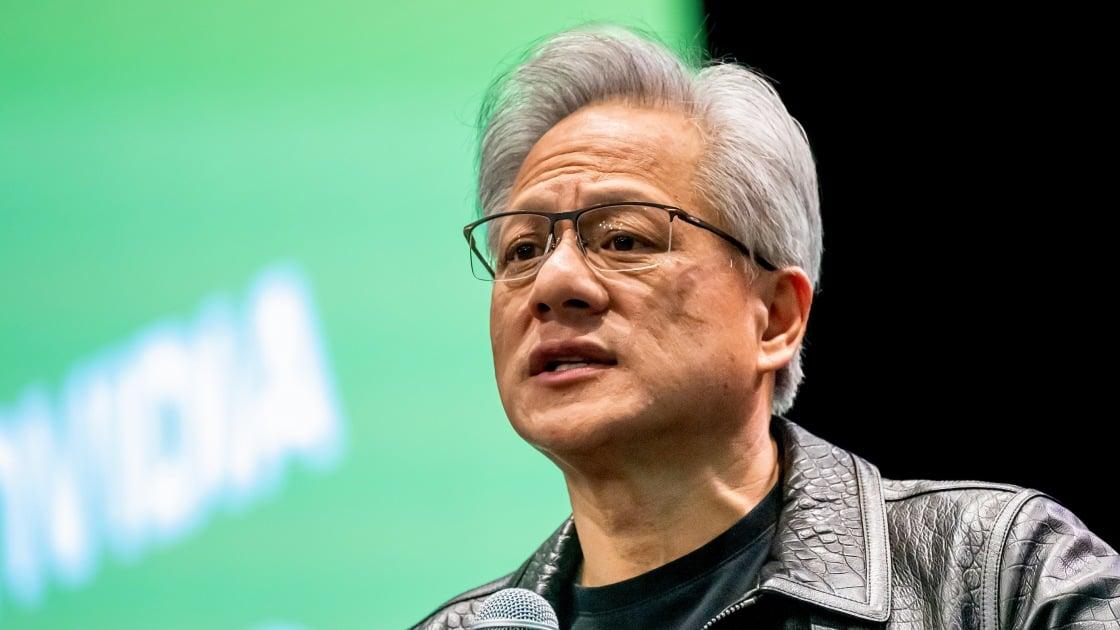

Nvidia CEO Jensen Huang announces plans to invest hundreds of billions in US-made chips and electronics over the next four years, reflecting a significant shift in the company's supply chain strategy amidst geopolitical tensions and the Trump administration's "America First" policy.

Nvidia's Ambitious US Investment Plan

Nvidia, the world's most valuable semiconductor company, is set to make a significant shift in its supply chain strategy. CEO Jensen Huang has announced plans to invest "several hundred billion" dollars in US-made chips and electronics over the next four years

1

. This move comes as part of a broader trend of tech companies responding to geopolitical tensions and the Trump administration's "America First" trade policies.Scale of Investment and Production

The scale of Nvidia's planned investment is staggering. Huang stated that the company expects to procure approximately half a trillion dollars worth of electronics in total over the four-year period

2

. A significant portion of this – "several hundred billion" dollars – is earmarked for manufacturing in the United States. This represents a major shift for the AI chip giant, which has previously relied heavily on Asian suppliers.Factors Driving the Decision

Several factors are influencing Nvidia's decision to invest heavily in US production:

-

Geopolitical tensions: Growing concerns over China's territorial claims on Taiwan, where many of Nvidia's key suppliers are based

3

. -

Trade policies: The Trump administration's tariff threats and push for domestic semiconductor production

4

. -

Supply chain resilience: The need to diversify and strengthen the company's supply chain in the face of potential disruptions

2

.

Impact on US AI Industry and Competition

Huang believes that the Trump administration could accelerate the development of America's AI industry. He stated, "Having the support of an administration who cares about the success of this industry and not allowing energy to be an obstacle is a phenomenal result for AI in the US"

2

.However, Nvidia still faces significant competition, particularly from Chinese tech giant Huawei. Huang acknowledged Huawei as "the single most formidable technology company in China," noting their growing presence in the AI sector

4

.Related Stories

Collaboration with US-based Manufacturers

Nvidia's plans are bolstered by recent investments from key suppliers in US-based manufacturing. Taiwan Semiconductor Manufacturing Company (TSMC) has announced a $100 billion investment in chip manufacturing facilities in Arizona

2

. This development allows Nvidia to manufacture its latest Blackwell systems in the US, which Huang says provides "a substantial step up in our supply chain resilience"5

.Market Response and Future Outlook

Despite these ambitious plans, Nvidia's stock has seen a slight decline, falling less than 1% in premarket trading and losing over 12% of its value this year

4

. However, the company remains optimistic about future demand, with Huang stating that current orders for 3.6 million Blackwell chips from major cloud firms underestimate overall demand5

.References

Summarized by

Navi

[4]

Related Stories

Nvidia Shifts AI Chip Production to US Amid Tariff Uncertainty

14 Apr 2025•Business and Economy

Nvidia CEO Jensen Huang Redefines Company as 'AI Factory,' Addresses Market Concerns

20 Mar 2025•Business and Economy

Nvidia's Strong Earnings Overshadowed by Potential Trump Trade Policies

21 Nov 2024•Business and Economy

Recent Highlights

1

Pentagon threatens to cut Anthropic's $200M contract over AI safety restrictions in military ops

Policy and Regulation

2

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

3

OpenAI closes in on $100 billion funding round with $850 billion valuation as spending plans shift

Business and Economy