Nvidia's AI Chip Dominance Faces Growing Competition

4 Sources

4 Sources

[1]

Competition heats up to challenge Nvidia's AI chip dominance

The artificial intelligence (AI) revolution has whetted the appetites of Nvidia's competitors, who are seeking to close the gap on the chip giant, which has so far been the central playmaker in the AI revolution. Virtually unknown to the general public just three years ago, Nvidia now boasts the world's highest revenues, driven by sales of its graphics cards -- or GPUs (graphics processing units) -- the processors that are key to building the technology behind ChatGPT and its rivals. Why does Nvidia dominate? While it was not the first to develop GPUs, the California-based group made them its specialty starting in the late 1990s, at the very beginning of cloud computing, and thus has unique experience in the field. Moreover, Nvidia is "a three-headed dragon," as Dylan Patel, head of consultancy SemiAnalysis, recently put it on the "No Priors" podcast. It does not just design chips, but offers an entire infrastructure capable of making them work together with networking and software -- the dragon's two other heads. Nvidia can "satisfy every level of need in the datacenter with world-class product," according to Jon Peddie of Jon Peddie Research. Where is the competition? At a considerable distance from Nvidia, whose market share is estimated at roughly 80% depending on the source, American firm AMD had until now been considered the runner-up. But AMD generates the bulk of its revenue from CPU sales -- processors used for personal and business computers that are less powerful than GPUs -- and "can't divert resources from that golden egg," Peddie believes. Determined to reduce their dependence on Nvidia, the major cloud providers have developed their own processors. Google began using its Tensor Processing Unit (TPU) a decade ago, while Amazon Web Services (AWS)'s Trainium, the cloud-dedicated subsidiary, appeared in 2020. Today, Google and Amazon account for more than 10% of the market and have even overtaken AMD in terms of "performance, pricing, usability, reliability, and ability to produce enough chips to satisfy the biggest customers," argued Jordan Nanos of SemiAnalysis. Google is even offering its chips to third-party customers, according to several media reports. Contacted by AFP, it did not respond. Amazon, however, does not sell its Trainium to other players. Where do the Chinese stand? The only nation rivaling the United States in the sector, China is seeking to make up for lost time -- and is having to do so without the most advanced US chips, which are now subject to export restrictions. For Nanos, Huawei ranks among Nvidia's most credible competitors, alongside Google or Amazon, and ahead of AMD. Like Google and Amazon, their Chinese equivalents Baidu and Alibaba are also now having their own AI processors manufactured, though these remain merely substitutes for Nvidia's GPUs. "They can't catch up technically for a while using in-country" fabrication facilities, said Peddie. But "over time, with its huge and smart workforce, and subsidized investment, China will be able to make state-of-the-art fabrication systems." Is Nvidia under threat? No expert sees the Santa Clara, California, giant loosening its grip on the sector in the near future. "Nvidia underpins the vast majority of AI applications today," notes John Belton, analyst at Gabelli Funds. "And despite their lead, they keep their foot on the gas by launching a product every year, a pace that will be difficult for competitors to match." In early September, Nvidia announced that its new generation, Rubin, would be commercialized in late 2026, with performance for AI functions estimated at 7.5 times that of its flagship product currently on the market, Blackwell.

[2]

Competition heats up to challenge Nvidia's AI chip dominance

New York (AFP) - The artificial intelligence (AI) revolution has whetted the appetites of Nvidia's competitors, who are seeking to close the gap on the chip giant, which has so far been the central playmaker in the AI revolution. Virtually unknown to the general public just three years ago, Nvidia now boasts the world's highest revenues, driven by sales of its graphics cards -- or GPUs (graphics processing units) -- the processors that are key to building the technology behind ChatGPT and its rivals. Why does Nvidia dominate? While it was not the first to develop GPUs, the California-based group made them its specialty starting in the late 1990s, at the very beginning of cloud computing, and thus has unique experience in the field. Moreover, Nvidia is "a three-headed dragon," as Dylan Patel, head of consultancy SemiAnalysis, recently put it on the "No Priors" podcast. It does not just design chips, but offers an entire infrastructure capable of making them work together with networking and software -- the dragon's two other heads. Nvidia can "satisfy every level of need in the datacenter with world-class product," according to Jon Peddie of Jon Peddie Research. Where is the competition? At a considerable distance from Nvidia, whose market share is estimated at roughly 80 percent depending on the source, American firm AMD had until now been considered the runner-up. But AMD generates the bulk of its revenue from CPU sales -- processors used for personal and business computers that are less powerful than GPUs -- and "can't divert resources from that golden egg," Peddie believes. Determined to reduce their dependence on Nvidia, the major cloud providers have developed their own processors. Google began using its Tensor Processing Unit (TPU) a decade ago, while Amazon Web Services (AWS)'s Trainium, the cloud-dedicated subsidiary, appeared in 2020. Today, Google and Amazon account for more than 10 percent of the market and have even overtaken AMD in terms of "performance, pricing, usability, reliability, and ability to produce enough chips to satisfy the biggest customers," argued Jordan Nanos of SemiAnalysis. Google is even offering its chips to third-party customers, according to several media reports. Contacted by AFP, it did not respond. Amazon, however, does not sell its Trainium to other players. Where do the Chinese stand? The only nation rivaling the United States in the sector, China is seeking to make up for lost time -- and is having to do so without the most advanced US chips, which are now subject to export restrictions. For Nanos, Huawei ranks among Nvidia's most credible competitors, alongside Google or Amazon, and ahead of AMD. Like Google and Amazon, their Chinese equivalents Baidu and Alibaba are also now having their own AI processors manufactured, though these remain merely substitutes for Nvidia's GPUs. "They can't catch up technically for a while using in-country" fabrication facilities, said Peddie. But "over time, with its huge and smart workforce, and subsidized investment, China will be able to make state-of-the-art fabrication systems." Is Nvidia under threat? No expert sees the Santa Clara, California, giant loosening its grip on the sector in the near future. "Nvidia underpins the vast majority of AI applications today," notes John Belton, analyst at Gabelli Funds. "And despite their lead, they keep their foot on the gas by launching a product every year, a pace that will be difficult for competitors to match." In early September, Nvidia announced that its new generation, Rubin, would be commercialized in late 2026, with performance for AI functions estimated at 7.5 times that of its flagship product currently on the market, Blackwell.

[3]

Competition heats up to challenge Nvidia's AI chip dominance

Nvidia continues to dominate the AI chip market, leveraging its integrated hardware and software ecosystem. While cloud giants like Google and Amazon are developing their own powerful processors, and Chinese firms are also entering the fray, experts assert Nvidia's lead remains unchallenged. The artificial intelligence (AI) revolution has whetted the appetites of Nvidia's competitors, who are seeking to close the gap on the chip giant, which has so far been the central playmaker in the AI revolution. Virtually unknown to the general public just three years ago, Nvidia now boasts the world's highest revenues, driven by sales of its graphics cards -- or GPUs (graphics processing units) -- the processors that are key to building the technology behind ChatGPT and its rivals. - Why does Nvidia dominate? - While it was not the first to develop GPUs, the California-based group made them its specialty starting in the late 1990s, at the very beginning of cloud computing, and thus has unique experience in the field. Moreover, Nvidia is "a three-headed dragon," as Dylan Patel, head of consultancy SemiAnalysis, recently put it on the "No Priors" podcast. It does not just design chips, but offers an entire infrastructure capable of making them work together with networking and software -- the dragon's two other heads. Nvidia can "satisfy every level of need in the datacenter with world-class product," according to Jon Peddie of Jon Peddie Research. Where is the competition? At a considerable distance from Nvidia, whose market share is estimated at roughly 80 percent depending on the source, American firm AMD had until now been considered the runner-up. But AMD generates the bulk of its revenue from CPU sales -- processors used for personal and business computers that are less powerful than GPUs -- and "can't divert resources from that golden egg," Peddie believes. Determined to reduce their dependence on Nvidia, the major cloud providers have developed their own processors. Google began using its Tensor Processing Unit (TPU) a decade ago, while Amazon Web Services (AWS)'s Trainium, the cloud-dedicated subsidiary, appeared in 2020. Today, Google and Amazon account for more than 10 percent of the market and have even overtaken AMD in terms of "performance, pricing, usability, reliability, and ability to produce enough chips to satisfy the biggest customers," argued Jordan Nanos of SemiAnalysis. Google is even offering its chips to third-party customers, according to several media reports. Contacted by AFP, it did not respond. Amazon, however, does not sell its Trainium to other players. Where do the Chinese stand? The only nation rivaling the United States in the sector, China is seeking to make up for lost time -- and is having to do so without the most advanced US chips, which are now subject to export restrictions. For Nanos, Huawei ranks among Nvidia's most credible competitors, alongside Google or Amazon, and ahead of AMD. Like Google and Amazon, their Chinese equivalents Baidu and Alibaba are also now having their own AI processors manufactured, though these remain merely substitutes for Nvidia's GPUs. "They can't catch up technically for a while using in-country" fabrication facilities, said Peddie. But "over time, with its huge and smart workforce, and subsidized investment, China will be able to make state-of-the-art fabrication systems." Is Nvidia under threat? No expert sees the Santa Clara, California, giant loosening its grip on the sector in the near future. "Nvidia underpins the vast majority of AI applications today," notes John Belton, analyst at Gabelli Funds. "And despite their lead, they keep their foot on the gas by launching a product every year, a pace that will be difficult for competitors to match." In early September, Nvidia announced that its new generation, Rubin, would be commercialised in late 2026, with performance for AI functions estimated at 7.5 times that of its flagship product currently on the market, Blackwell.

[4]

Competition heats up to challenge Nvidia's AI chip dominance

The artificial intelligence (AI) revolution has whetted the appetites of Nvidia's competitors, who are seeking to close the gap on the chip giant, which has so far been the central playmaker in the AI revolution. Virtually unknown to the general public just three years ago, Nvidia now boasts the world's highest revenue, driven by sales of its graphics cards -- or GPUs (graphics processing units) -- the processors that are key to building the technology behind ChatGPT and its rivals. While it was not the first to develop GPUs, the California-based group made them its specialty starting in the late 1990s, at the very beginning of cloud computing, and thus has unique experience in the field.

Share

Share

Copy Link

Nvidia's stronghold on the AI chip market is being challenged by tech giants and emerging players. While Nvidia maintains a significant lead, competitors are developing their own processors to reduce dependence on the chip giant.

Nvidia's Unrivaled Dominance in AI Chips

Nvidia, a company virtually unknown to the general public just three years ago, has emerged as the central player in the artificial intelligence (AI) revolution. The California-based tech giant now boasts the world's highest revenues, driven by sales of its graphics processing units (GPUs) – the key processors behind technologies like ChatGPT and its rivals

1

2

.

Source: France 24

Nvidia's dominance in the AI chip market is estimated at roughly 80%, a testament to its unique position in the industry. The company's success can be attributed to its early specialization in GPUs, dating back to the late 1990s when cloud computing was in its infancy. This head start has given Nvidia unparalleled experience in the field

3

.The Three-Headed Dragon

Dylan Patel, head of consultancy SemiAnalysis, aptly described Nvidia as a "three-headed dragon"

1

. The company's strength lies not just in chip design, but in offering a comprehensive infrastructure that integrates hardware, networking, and software. This holistic approach allows Nvidia to "satisfy every level of need in the datacenter with world-class product," according to Jon Peddie of Jon Peddie Research2

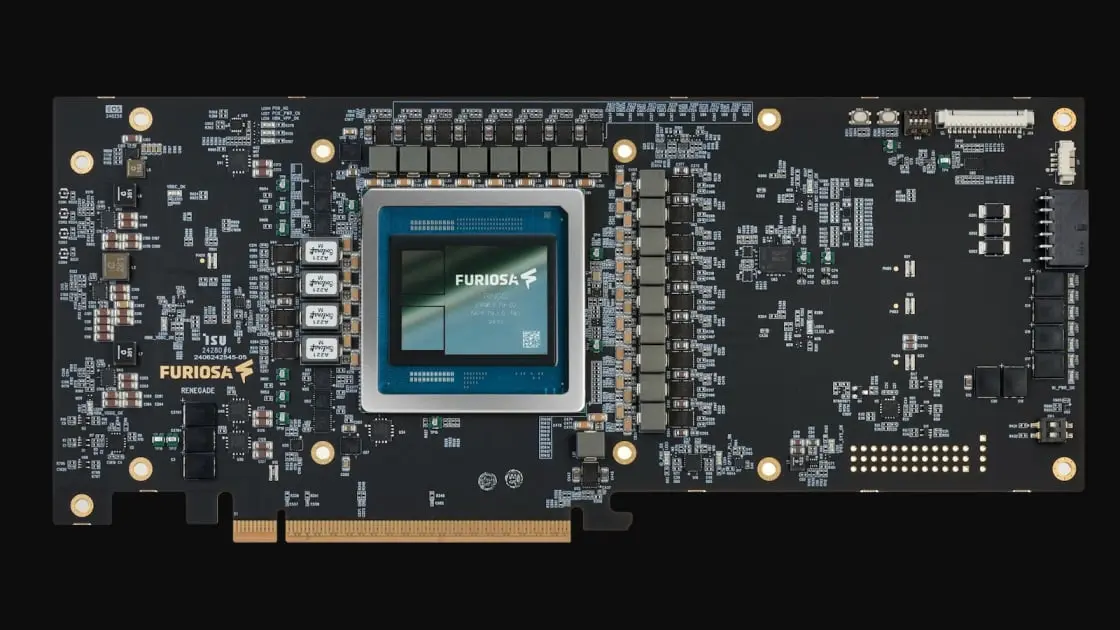

.Rising Competition from Tech Giants

While Nvidia maintains a significant lead, major tech companies are developing their own AI processors to reduce dependence on the chip giant. Google introduced its Tensor Processing Unit (TPU) a decade ago, while Amazon Web Services (AWS) launched Trainium in 2020

3

.These efforts have paid off, with Google and Amazon now accounting for more than 10% of the market. Jordan Nanos of SemiAnalysis argues that these tech giants have even overtaken AMD – previously considered Nvidia's runner-up – in terms of "performance, pricing, usability, reliability, and ability to produce enough chips to satisfy the biggest customers"

2

.Related Stories

China's AI Chip Ambitions

China, the only nation rivaling the United States in the semiconductor sector, is making significant strides in AI chip development. Despite facing export restrictions on advanced US chips, Chinese companies are working to close the gap

1

.Huawei has emerged as one of Nvidia's most credible competitors, alongside Google and Amazon. Chinese tech giants Baidu and Alibaba are also manufacturing their own AI processors, although these currently remain substitutes for Nvidia's GPUs

3

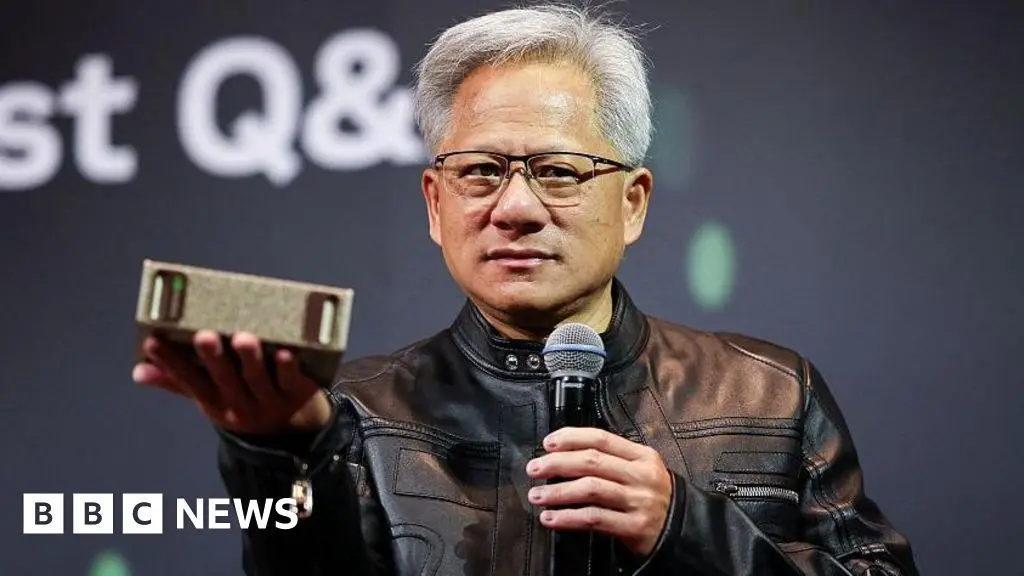

.Nvidia's Future Outlook

Despite the growing competition, experts do not foresee Nvidia losing its grip on the sector in the near future. John Belton, an analyst at Gabelli Funds, notes that "Nvidia underpins the vast majority of AI applications today"

2

.

Source: Japan Times

Nvidia continues to innovate at a rapid pace, launching new products annually. The company recently announced its next-generation chip, Rubin, set for commercialization in late 2026. This new chip is expected to deliver AI performance 7.5 times greater than its current flagship product, Blackwell

1

.References

Summarized by

Navi

[1]

[4]

Related Stories

Recent Highlights

1

OpenAI secures $110 billion funding round from Amazon, Nvidia, and SoftBank at $730B valuation

Business and Economy

2

Anthropic stands firm against Pentagon's demand for unrestricted military AI access

Policy and Regulation

3

Pentagon Clashes With AI Firms Over Autonomous Weapons and Mass Surveillance Red Lines

Policy and Regulation