Nvidia's AI Market Share in China Plummets to Zero Amid Geopolitical Tensions

5 Sources

5 Sources

[1]

Jensen says Nvidia's China AI GPU market share has plummeted from 95% to zero -- the Chinese market previously amounted to 20% to 25% of the chipmaker's data center revenue

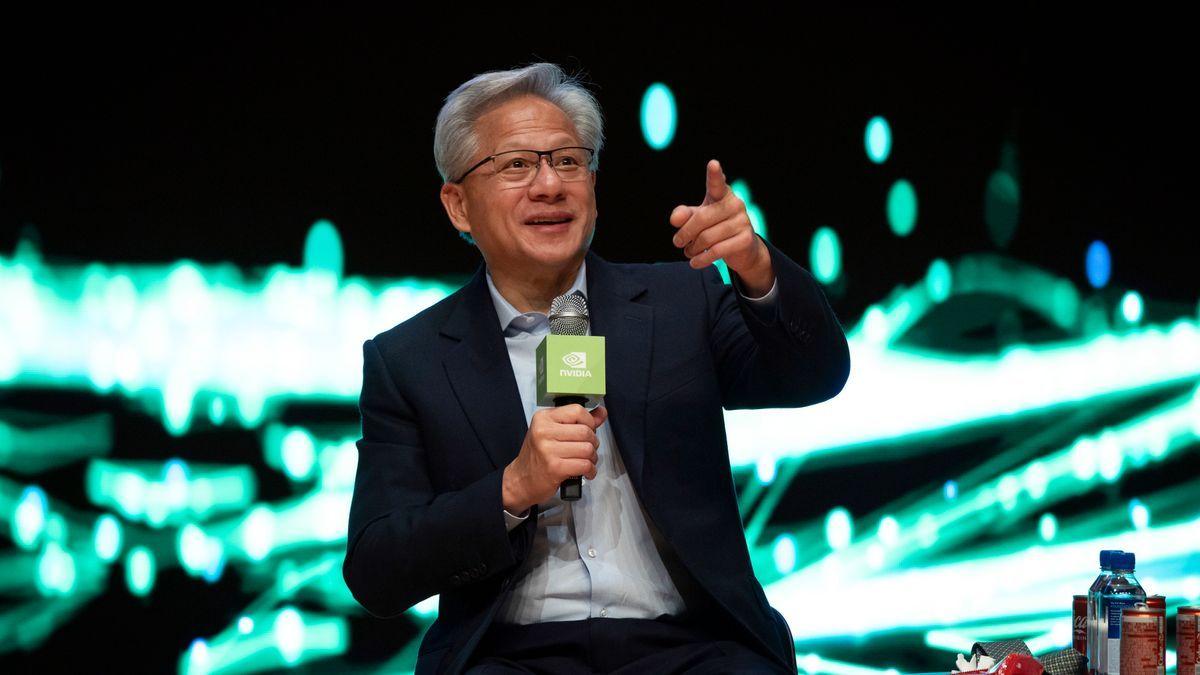

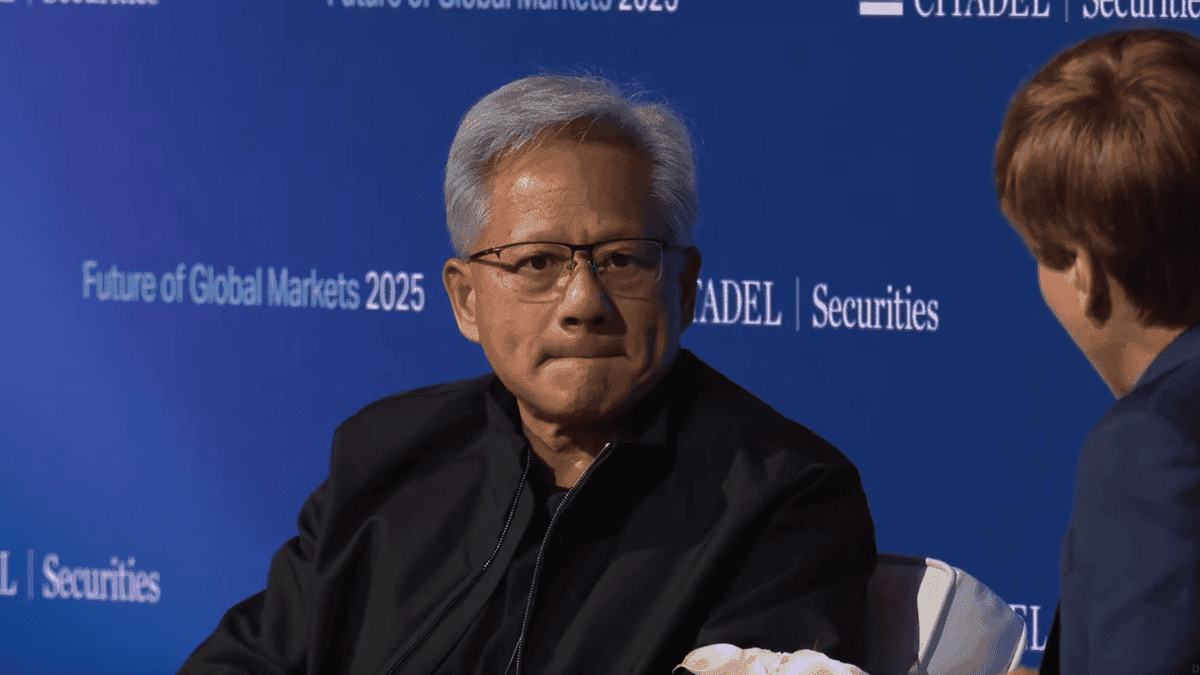

Speaking at a Citadel Securities event on October 6, the Nvidia CEO blamed U.S. export controls and said the company now assumes no revenue from China in its forecasts. Nvidia CEO Jensen Huang said last week that the company's share of China's advanced AI accelerator market has collapsed from roughly 95% to zero as US export controls continue to bite. The comment came during a live interview at Citadel Securities' Future of Global Markets 2025 event in New York on October 6, in which Huang said, "At the moment, we are 100% out of China," adding, "We went from 95% market share to 0%." A full video of the interview was published on YouTube this week by Citadel Securities and marks the first time Nvidia has publicly quantified the scale of its retreat. Huang didn't name specific products, but his remarks point squarely to Nvidia's data center GPU line, which has faced rolling waves of export restrictions since October 2022. The company's China-focused A800 and H800 parts were rendered noncompliant by export prohibitions in 2023, while a newer design -- the H20 -- has faced licensing hurdles of its own. "I can't imagine any policymaker thinking that's a good idea, that whatever policy we implemented caused America to lose one of the largest markets in the world to 0%," Huang said of the outcome. Nvidia has previously disclosed that China represented between 20% and 25% of its data center revenue -- a segment that generated more than $41 billion in its most recent financial results, representing a 56% year-over-year increase. While that figure includes cloud customers across a wide range of workloads, AI infrastructure remains the company's growth engine. A prolonged clampdown could reshape both demand and supply chains. The US government has tightened controls over AI accelerators sold to China as part of a broader strategy to limit Beijing's access to cutting-edge semiconductors. But Huang's comments highlight how quickly the dynamic has shifted on the ground. "In all of our forecasts... we're assuming 0% for China," he said. "If anything happens in China... it will be a bonus." Nvidia's cautious guidance comes amid signs of deeper fragmentation in the AI stack. China's hyperscalers and AI labs have increasingly turned to domestic silicon or alternative hardware in response to the export curbs, accelerating efforts to localize compute infrastructure. That's a trend Huang flagged earlier this year, when he warned that blanket restrictions could spur the development of competitive substitutes. While Huang said that he has hopes that Nvidia's business can return to China in the future, the company has effectively written off the country for the moment.

[2]

Jensen Huang says Nvidia's China business is down to 'zero'

Jensen Huang says Nvidia has gone from running China's AI chip table to being shut out of the casino entirely. At a Citadel Securities event last week, the Nvidia CEO said the company's China business is now "100% out," describing a collapse from "95% market share to 0%" as U.S. and Chinese policy slammed the door on the company from both sides. "In all of our forecasts, we assume zero for China," he added. "If anything happens there -- which I hope it will -- that will be a bonus." The remarks mark Huang's bluntest acknowledgment yet that tightening controls on the company's advanced chip sales have effectively erased one of Nvidia's biggest markets. Washington first banned exports of Nvidia's most powerful AI accelerators, then extended the rules to neutered "A-series" chips designed specifically for China that came after a revenue deal. Beijing then warned state-linked firms not to buy Nvidia products over national-security concerns and urged procurement of domestic alternatives such as Huawei's Ascend line. The result: A market once responsible for roughly a quarter of Nvidia's data-center revenue has vanished almost overnight. Huang's frustration seems as much economic as political. "I can't imagine any policymaker thinking that [the policy is] a good idea," he said, referring to U.S. policy that has excluded Nvidia from the country and calling China the world's second-largest market for computing with a "vibrant ecosystem." The company has long argued that cutting off U.S. suppliers will only accelerate China's domestic push to build its own AI-grade silicon -- and in doing so, erode U.S. leverage over the global tech supply chain. Still, Nvidia's stock barely flinched last week. Investors have largely already priced in the China loss, viewing it as the cost of doing business in an era where industrial policy sets the boundaries of growth. The company's share price has more than tripled in the past two years as hyperscalers in the U.S., Europe, and the Middle East race to build "AI factories" and keep ordering chips by the gigawatt. For now, Huang seems to be treating China as an empty column on the spreadsheet -- and betting that, even if nothing changes in the country, the rest of the world's appetite for compute will keep the lights on. "Zero" may simply be the new baseline for doing good business in an age of tech protectionism.

[3]

Jensen Huang says Nvidia went from 95% market share in China to 0% -- 'I can't imagine any policymaker thinking that that's a good idea' | Fortune

Nvidia CEO Jensen Huang urged nuance when it comes to regulating China's access to U.S. technologies that are critical to developing artificial intelligence. In an interview with Citadel Securities on Tuesday, he warned that what harms China can often harm the U.S., and sometimes even in worse ways. "Before we leap towards policies that are hurtful to other people, take a step back and maybe reflect on what are the policies that are helpful to America," Huang said. His words of caution come as Nvidia processors have become hot commodities in the AI race as well as political bargaining chips in the U.S.-China trade war. Huang said he'd like the world to run on U.S. know-how, but noted about half the world's AI researchers are in China. "I think it's a mistake to not have those researchers build AI on American technology," he added. Trying to strike a balance between his goal of maintaining U.S. tech supremacy along with access to China will require nuance rather than an all-or-nothing approach, Huang said. But that's not the case now, as Nvidia is "100% out of China." "We went from 95% market share to 0%, and so I can't imagine any policymaker thinking that that's a good idea, that whatever policy we implemented caused America to lose one of the largest markets in the world," he said. He didn't name names, or administrations. But the Biden administration imposed rules in 2022 to restrict the export of Nvidia's most advanced AI chips to China, leading the company to design a processor that met the new limits. In April, Nvidia said the Trump administration blocked the sale of some of its AI chips to China without licenses and would require them for future sales. Then in August, the administration granted export licenses for certain Nvidia and AMD chips to China in exchange for 15% of the revenues. But Chinese regulators have reportedly told domestic tech companies not to buy Nvidia chips that were designed to meet U.S. export requirements. Meanwhile, Beijing placed strict limits on exports of rare earths, a critical input for a wide range of advanced technologies, mimicking U.S. export rules on AI chips. That prompted President Donald Trump to fire back with an additional 100% tariff on Chinese goods. Officials from both sides are due to resume talks this week, ahead of a planned meeting with Trump and his Chinese counterpart later this month. For now, Huang told Citadel that all of Nvidia's financial forecasts assume China will remain out of the picture. "If anything happens in China, which I hope it will, it'll be a bonus," he said. "But it's a large market. China is the second largest computer market in the world. It is a vibrant ecosystem. I think it's a mistake for the United States to not participate. So hopefully we'll continue to explain and inform and hold out hope for a change in policy."

[4]

Nvidia CEO Jensen Huang: 'At the moment we are 100% out of China... it's important to be mindful that what harms China could oftentimes also harm America'

Nvidia CEO Jensen Huang spoke at the Citadel Securities Future of Global Markets 2025 conference last week, and would you believe it, most of the conversation centred around AI. However, the NV head honcho also had some comments to make on China's role within AI development, and Nvidia's efforts to sell its AI hardware within the country -- along with some commentary on US trade policy between the two. "It's important to be mindful that what harms China could oftentimes also harm America, and even worse," said Huang (via Wccftech). "And so before we leap towards policies that are hurtful to other people, take a step back and maybe reflect on what are the policies that are helpful to America." "China has about 50% of the world's AI researchers, incredible schools, incredible focus in AI, lots of passion around AI. And I think it's a mistake to not have those researchers build AI on American technology," he continued. "We are 100% out of China... we went from 95% market share to 0%, and so I can't imagine any policy maker thinking that's a good idea, that whatever policy we implemented caused America to lose one of the largest markets in the world." Certainly, Nvidia looks to have found itself at the centre of trade frictions between the two countries. While pre-existing US AI chip export bans to China appeared to be loosening earlier this year, in the form of Nvidia's US government-approved licenses to sell its H20 AI GPUs in the country, progress has since appeared to stall, as the two countries engage in a protracted trade dispute. Nvidia's CFO recently described the stalled progress as "a little geopolitical situation between the two governments", but little or not, it still appears that Nvidia remains in AI chip limbo in regards to the Chinese market. For China's part, production was also reportedly paused on H20 GPUs as a result of security concerns from the Chinese authorities halting their sale, and potential buyers were left waiting to purchase chips that have yet to make it past the restrictions. Huang has also previously expressed his disappointment at the news that China's internet regulator had banned some of the country's largest tech firms from buying the China-specific RTX Pro 6000D. And all the while Nvidia watches as the two geopolitical giants battle it out, its Chinese competitors, like Huawei, look to be making great progress in its absence. Last week, Trump announced a new 100% tariff on Chinese goods in relation to a rare earth metal dispute, alongside new export controls on "any and all critical software", which suggests that trade friction between the two superpowers isn't likely to calm any time soon. While AI hardware has slipped from the headlines in the recent disputes, it's never far from the frame -- and Nvidia's AI chips still remain unobtainable by legitimate means on Chinese shores. In short, the ongoing trade disputes between the US and China have been a real headache for Nvidia, and while Huang and the Trump administration appear to be on good terms, even the considerable weight of the most valuable company in the world doesn't appear to have made much of a dent on current US or Chinese government policy. It looks like Nvidia will just have to wait to see how things play out -- because as relations between the two countries currently stand, the company's Chinese market aspirations appear to be well outside of its control.

[5]

"Our Market Share Dropped From 95% to 0%," Says NVIDIA CEO Jensen Huang in a 'Temporary Goodbye' to China's AI Market

NVIDIA's CEO Jensen Huang has commented on the firm's 'desperate' position in China, claiming that its market share has now plunged to 0%. The situation for Jensen & Co. in Beijing hasn't been optimal at all, especially in recent weeks, when China is pursuing a complete shift to a domestic AI tech stack, pivoting away from NVIDIA's options. It has now come to a point where NVIDIA doesn't have any AI solution to offer to Chinese tech giants, which is why, at the Citadel Securities Future Of Global Markets 2025, Jensen Huang claims that his company's share in China has dropped to 0%, claiming that America has lost one of the largest AI markets in the world. At the moment, we are 100% out of China, and so China is 0%. We went from a 95% market share to 0%, and so I can't imagine any policymaker thinking this is a good idea. In all our forecasts, we assume zero for China. If anything happens in China, it will be a bonus. There's no doubt that NVIDIA's presence in China's AI market has dropped dramatically, partly due to geopolitical tensions between the two global superpowers. However, this isn't the only concerning aspect for Team Green, as the increasing competition from companies like Huawei and Cambricon means that NVIDIA's re-entry into the region will become significantly more challenging. Huawei has already announced plans to compete with the Vera Rubin rack-scale lineup through an advanced AI chip roadmap, indicating that competition is intensifying. For now, NVIDIA's plans for China are uncertain, as they await regulatory approval from both sides. Jensen has expressed in the past that the next solution for Beijing will be a Blackwell-based chip, likely the B40. However, the primary constraint remains that the Trump administration won't allow a powerful solution to flow into a hostile nation. This narrows down NVIDIA's options to the point where the firm is limited to Hopper and below generations, and that won't do much to cater to the rivalry the company sees. Whether or not NVIDIA manages to see a restoration of China revenue is a question for the future, but for now, Jensen's statement indicates that Beijing is indeed off the table.

Share

Share

Copy Link

Nvidia CEO Jensen Huang reveals the company's complete exit from the Chinese AI market due to U.S. export controls. The tech giant's market share has dropped from 95% to 0%, raising concerns about the impact on both American and Chinese tech industries.

Nvidia's Dramatic Exit from China's AI Market

Jensen Huang, CEO of Nvidia, has revealed a startling development in the company's global operations: Nvidia's market share in China's advanced AI accelerator market has plummeted from approximately 95% to zero

1

2

. This dramatic shift comes as a result of ongoing U.S. export controls and geopolitical tensions between the United States and China.The Impact of Export Controls

The collapse of Nvidia's presence in the Chinese market can be traced back to a series of U.S. government actions. In October 2022, the Biden administration imposed restrictions on the export of Nvidia's most advanced AI chips to China

3

. These restrictions were further tightened in 2023, rendering even Nvidia's China-focused A800 and H800 chips non-compliant with export regulations1

.Nvidia's Response and Financial Implications

In response to these challenges, Nvidia has taken a cautious approach to its financial forecasts. Huang stated, "In all of our forecasts... we're assuming 0% for China. If anything happens in China... it will be a bonus"

2

. This conservative outlook reflects the significant impact of losing access to a market that previously accounted for 20% to 25% of Nvidia's data center revenue1

.Geopolitical Tensions and Policy Concerns

Huang expressed his concerns about the current policy approach, stating, "I can't imagine any policymaker thinking that's a good idea, that whatever policy we implemented caused America to lose one of the largest markets in the world to 0%"

3

. He emphasized the need for a more nuanced approach to regulating China's access to U.S. technologies critical for AI development.Related Stories

The Broader Impact on the AI Industry

The situation has led to a deeper fragmentation in the AI stack, with Chinese companies increasingly turning to domestic silicon or alternative hardware solutions

1

. This shift could potentially accelerate China's efforts to localize its compute infrastructure and develop competitive substitutes for U.S. technology.Future Outlook and Global Implications

While Nvidia remains hopeful about potentially returning to the Chinese market in the future, the company has effectively written off the country for the moment

1

. The ongoing trade disputes between the U.S. and China, including recent tariffs and export controls, suggest that the situation is unlikely to resolve quickly4

.As the global AI industry continues to evolve, the absence of Nvidia from the Chinese market could have far-reaching consequences for technological development and competition in both countries. Huang's comments highlight the complex interplay between national security concerns, economic interests, and the rapid advancement of AI technology in an increasingly interconnected world.

References

Summarized by

Navi

Related Stories

Nvidia CEO Urges AI Export Rule Revision Amid Global Competition and China's AI Advancements

01 May 2025•Technology

Nvidia Set to Resume AI Chip Sales to China Amid Regulatory Shifts

10 Jul 2025•Technology

Nvidia Excludes China from Revenue Forecasts Amid US Export Controls

13 Jun 2025•Business and Economy

Recent Highlights

1

Pentagon threatens to cut Anthropic's $200M contract over AI safety restrictions in military ops

Policy and Regulation

2

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

3

OpenAI closes in on $100 billion funding round with $850 billion valuation as spending plans shift

Business and Economy