Nvidia CEO's Diplomatic Triumph: Resuming AI Chip Sales to China Amid Global Tech Race

14 Sources

14 Sources

[1]

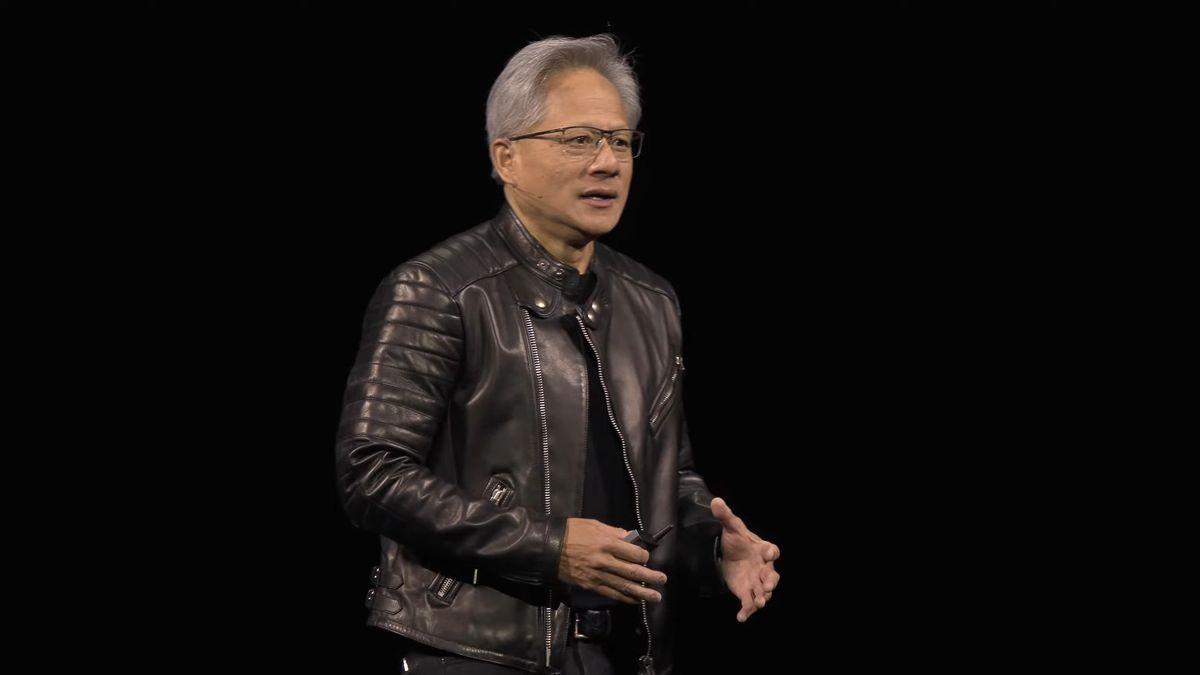

Nvidia CEO's China charm offensive underscores rock star status in key market

BEIJING/SHANGHAI, July 21 (Reuters) - Nvidia (NVDA.O), opens new tab CEO Jensen Huang is no stranger to Beijing, but his most recent visit, his third to China this year, cemented his rock star status in the country, where fans mingled freely with the AI titan on the streets of the capital. It was a rare sight for a chief executive of one of the world's most powerful companies to roam around Beijing, engage in wide-ranging interviews, take selfies with excited fans and even sign leather jackets - a signature clothing item of the billionaire - for his devoted followers. The tycoon at the helm of the world's most valuable company arrived in Beijing for a supply chain expo last week just days after meeting U.S. President Donald Trump and announced the AI giant would once again be able to sell its H20 chips in China following a U.S. ban in April on national security concerns. Huang's company is caught in the cross-hairs of a U.S.-China trade war that threatens to upend supply chains as both countries battle for global dominance in AI and other cutting-edge technologies, threatening Nvidia's $17 billion China business. While Huang appears to be navigating a delicate tightrope between Beijing and Washington well, the company remains subject to the ups and downs of Sino-U.S. tensions, analysts said. "Jensen Huang's visit aimed to demonstrate Nvidia's commitment to the Chinese market," said Lian Jye Su, a chief analyst at tech research firm Omdia. "However, this commitment must be balanced against potential U.S. government concerns about deepening ties with China." Huang described AI models from Chinese firms Deepseek, Alibaba (9988.HK), opens new tab and Tencent (0700.HK), opens new tab as "world class" and his official engagements included a "wonderful" meeting with Chinese trade tsar and Vice Premier He Lifeng and a face-to-face with Commerce Minister Wang Wentao. Demand for H20 chips surged in China following the launch of DeepSeek models in January. "Nvidia will still need to see the tide clearly and ride it at the right time to maximize the available benefits. But good for the company, I think it has a CEO who's very good at doing that," said Tilly Zhang, a technology analyst with Gavekal Dragonomics. Charlie Chai, an analyst with 86Research, said Nvidia's China market share was likely to slide in years to come. "The Chinese government will actively help or subsidize domestic rivals that can one day stand up to and, at least in some use cases, replace high-end Nvidia chips." SELFIES AND AUTOGRAPHS In an unusual sight for a global CEO visiting China, videos posted on social media platforms showed Huang wandering the streets of Beijing, drink in hand, signing notebooks and posing for selfies. In response to questions about how Washington would likely receive his latest visit to Beijing, the CEO said: "I told President Trump and his cabinet that I was coming to China. Told him about my trip here, and he said, 'Have a great trip'." At the opening of the China International Supply Chain Expo last Wednesday, Huang - who was born in Taiwan but moved to the U.S. at the age of nine - traded his signature leather jacket for a black, traditional Chinese-style jacket and referred to himself in a speech as "Chinese". In his Expo speech, as well as in later comments, Huang was effusive in his praise for Chinese tech giants' capabilities in bringing technology into applications, describing China's supply chain as "vast". Even arch rival Huawei Technologies (HWT.UL), a firm that Nvidia is locked in a strategic and intensifying battle for AI chip dominance with, was lauded. "I think the fact of the matter is, anyone who discounts Huawei and anyone who discounts China's manufacturing capability is deeply naive. This is a formidable company," Huang told reporters. Reporting by Che Pan, Liam Mo and Casey Hall; Editing by Anne Marie Roantree and Lincoln Feast. Our Standards: The Thomson Reuters Trust Principles., opens new tab * Suggested Topics: * China Casey Hall Thomson Reuters Casey has reported on China's consumer culture from her base in Shanghai for more than a decade, covering what Chinese consumers are buying, and the broader social and economic trends driving those consumption trends. The Australian-born journalist has lived in China since 2007.

[2]

Clout wars: Jensen Huang eclipses Elon Musk and Tim Cook in Washington

The optics of Huang's political ascendancy have never been stronger, as Nvidia last week announced during its CEO's latest visit to Beijing that it expected to soon resume sales of its H20 AI chips to China. The exports of the H20 chip to China had been restricted earlier this year -- a move that Huang openly lobbied against. "It was a historic win for Nvidia and Jensen ... and I think it shows the increasing political influence that Huang's having within the Trump administration," Ives said. Huang had met with Trump in DC right before his China visit. The H20 reversal has been linked to trade negotiations between the U.S. and China. However, several experts told CNBC that Huang's lobbying played a large role in it. The Nvidia CEO has met with Trump many times this year, including joining him on a trip to the Middle East in May, which resulted in a massive AI deal that will see the delivery of hundreds of thousands of Nvidia's advanced AI chips to the United Arab Emirates. The Emirates deal had been seen as a way for America to push its global tech leadership, solidifying its technology stack in a new market over potential rivals like China's Huawei. After the trip, Huang increasingly began making a case against U.S. chip restrictions, arguing that they would erode America's tech leadership to the benefit of domestic Chinese players. According to a report from the New York Times, this had also been a narrative Huang had been pushing to Trump and his officials behind the scenes. Paul Triolo, senior vice president for China, and technology policy lead at DGA-Albright Stonebridge Group, told CNBC that Huang's arguments aligned with the thinking of influential White House AI and Crypto Czar David Sacks, further swaying the administration to lift restrictions on H20 chip exports. "Sacks and Huang both argue that limiting exports of U.S. technology such as select and non-cutting-edge GPUs to China risks pushing Chinese companies to use domestic alternatives ... At the end of the day, this argument likely carried the day on the H20 issue," he said. It's unclear when or if Nvidia will restart production lines of the H20, but if Nvidia is simply able to sell existing stocks of H20s, it will still be a "significant revenue boost and beneficial to Nvidia in terms of retaining clients' goodwill in China," Triolo added. Nvidia said it took a $4.5 billion writedown on its unsold H20 inventory in May. Huang said last week that every civil AI model should run on the U.S. technology stack, "encouraging nations worldwide to choose America," as Nvidia announced resuming H20 sales soon.

[3]

Nvidia seeks more China sales as banned AI chips sell on black market

The U.S. allowed Nvidia to resume sales of its downgraded H20 AI chip to Chinese clients on Monday. That's not enough for CEO Jensen Huang, who is already pushing for permission to sell more advanced processors to the world's second-largest economy. "Whatever we're allowed to sell in China will continue to get better and better over time," Huang said this week at the China International Supply Chain Expo in Beijing. "Technology is always moving." But while Washington debates easing restrictions on chip exports to China, there's already a thriving black market that has made the policy discussion largely academic. Research from the Center for a New American Security (CNAS) estimates that between 10,000 and several hundred thousand banned Nvidia chips may have been smuggled to China in 2024 alone. Chinese firms are already planning to install more than 115,000 restricted Nvidia AI chips in some three dozen data centers across the country's western deserts -- chips they cannot legally purchase without U.S. government licenses that haven't been granted. The smuggling operation appears sophisticated and widespread. One smuggler reportedly handled an order worth $120 million for servers containing 2,400 banned Nvidia H100s destined for China, according to The Information. Chinese businessmen have openly bragged online about obtaining hundreds of restricted H200 GPUs, while authorities in Singapore arrested three people suspected of diverting AI servers worth $390 million. Huang has consistently maintained there's "no evidence of any AI chip diversion," arguing that the massive servers are "nearly two tons" and easy to track. But Commerce Under Secretary Jeffrey Kessler directly contradicted those claims. "It's happening," he told lawmakers earlier this year. "It's a fact." The smuggling networks have become increasingly sophisticated. As of this month, more than 70 distributors were openly marketing restricted processors, with many offering delivery within weeks. The chips flow through a complex web of shell companies, third-party resellers, and intermediaries across Southeast Asia. Malaysia has emerged as a particular concern, with the country's imports of advanced GPUs surging over 3,400% in early 2025, prompting new permit requirements for AI chip exports. Malaysian authorities said they "will not tolerate the misuse of Malaysia's jurisdiction for illicit trading activities." Smugglers have used creative methods to move the hardware, including hiding chips in shipments labeled as tea or toys, and even packing them alongside live lobsters. Despite the logistical challenges, the evidence suggests the networks are moving substantial quantities of hardware across borders. The implications extend beyond trade policy. Chinese AI companies such as DeepSeek have already demonstrated impressive results that have caught Washington's attention, and Trump officials are now investigating whether the company accessed restricted chips through intermediaries to achieve those breakthroughs. Those Chinese-made tools are already gaining global traction: DeepSeek's models are now being tested internally by major banks, including HSBC and Standard Chartered, while Saudi Aramco has recently installed DeepSeek in its main data center. Even American cloud providers like Amazon Web Services, Microsoft, and Google offer DeepSeek to customers. If China's most advanced AI capabilities are already being built on smuggled top-tier chips while the government simultaneously funds development of domestic alternatives, it could undermine the entire rationale for export controls designed to preserve U.S. dominance in AI. Once the chips are out there, whether through legal or illegal channels, it becomes a new race to see whose AI models get adopted worldwide. "The No. 1 factor that will define whether the U.S. or China wins this race is whose technology is most broadly adopted in the rest of the world," Microsoft President Brad Smith said at a Senate hearing in May. "Whoever gets there first will be difficult to supplant."

[4]

Nvidia's power play: How Jensen Huang got Trump to rethink the China AI chip ban

Welcome to AI Decoded, Fast Company's weekly newsletter that breaks down the most important news in the world of AI. You can sign up to receive this newsletter every week here. Nvidia founder and CEO Jensen Huang has been active on the government relations and lobbying front, and now he's got something big to show for his efforts: the Trump Administration has agreed to lift a ban on selling Nvidia H20 AI chips to China. Huang met with leaders in both Washington and Beijing, arguing that the AI revolution is a tide that will lift all boats -- that AI technology can boost business productivity, raise the standard of living, and improve GDP for both the U.S. and China. He emphasized that the best way for America to maintain an edge in the AI race is to ensure the world's AI models and apps run best on chips made by a U.S.-based company. The U.S. (under Biden) initially began restricting sales of Nvidia's most powerful chips to China in an effort to slow Beijing's AI ambitions. The Trump Administration later doubled down, effectively banning sales of the H20 back in April. As a result, Nvidia reported a loss of about $2.5 billion in sales during its quarter ending in April, and projected it would miss out on another $8 billion in the quarter ending in July.

[5]

Nvidia's Jensen Huang Just Got Trump to Reverse Course on AI Chips for China. Here's What It Means

Jensen Huang pulled off something of a political miracle this week for Nvidia shareholders. As the U.S. and China continue to growl at one another over tariffs and other elements of the trade war between the two countries and the race to attain AI superiority, Huang convinced Donald Trump to lift the ban on select AI chip sales to China. That has certainly given the company's share price a boost. The stock has jumped nearly 6 percent since Nvidia announced sales of the H20 chip would resume. And the company's market cap, which hit $4 trillion on July 9, is already up to nearly $4.2 trillion. While resuming sales in China will certainly make the next Nvidia earnings announcement one to watch, Huang's achievement could have a ripple effect in a number of other areas, including DeepSeek's prominence on the AI stage, military use of AI -- and the global battle for AI supremacy. Limitations on the sale of semiconductors to China began in 2023 with the Biden administration, but in April, the Trump administration announced it was banning sales of the H20 chip. The fear, at the time, was that while the chip wasn't as powerful as those sold in other parts of the world, it was still capable of processing complex requests. The U.S. currently leads the AI race, but China has been gaining ground quickly, with many banks and public universities in Europe, Asia, Africa, and the Middle East opting for Chinese-made large language models, rather than those from OpenAI or Perplexity. In part, that's because the pricing is considerably lower. By reopening the flow of Nvidia chipsets, that could give Chinese AI researchers a boost -- and the AI market is young enough that any player can still assume a dominant role. Nvidia declined to comment to Inc. about any of the possible ripple effects of the resumption of chip sales. The rollback of the sales ban came as China agreed to renew rare earth sales to the U.S., raising questions about whether China won a face-off with Trump. U.S. officials are playing that development down. Commerce Secretary Howard Lutnick told CNBC the reversal was indeed linked to the rare earths deal, but it also came because the chip was less powerful than the ones sold to U.S. companies. Government officials, said Lutnick, want China to be "addicted" to American technology. Under Secretary Jeffrey Kessler, however, told congressional staffers last month that the chip was not part of the deal, according to The Washington Post, which only adds to the confusion. Huang has learned how to court Trump, which, with the addition of the rare earth deal, seemingly resulted in the ban being lifted. But many in Washington were caught off guard by the announcement, with Senators Elizabeth Warren (D-Mass.) and Jim Banks (R-Ind.) expressing concerns in a letter to Huang sent on July 11. The Republicans are firmly in control of Washington right now, but the midterm elections could shift the balance of power. And the 2028 presidential election is, at present, wide open. That could result in another ban and could cost Nvidia some political capital. Worst case, it could make the company a political talking point in the elections. China's DeepSeek unleashed chaos in the AI world in January of this year with its claim that it was able to train its AI model at a much lower cost than GPT-4 and without access to Nvidia's top-tier chips. Sam Altman, CEO of OpenAI, called the model "impressive" and said that it was "legit invigorating" to have a competitor. With new access to chips, DeepSeek could become an even bigger competitive threat, says Rajiv Garg, a professor at Emory University's Goizueta Business School. "DeepSeek did an amazing job," he says. "If they want to build a bigger, better model, they can now buy H20s to create a new data center. ... With access to these chips, it can create even more powerful solutions for the world." The fear that China could use advanced chips, like those from Nvidia, was a major factor in the Biden administration's decision to restrict sales in 2023. Huang, in an interview with CNN's Fareed Zakaria last weekend, dismissed those concerns, saying "we don't have to worry about that, because the Chinese military, no different than the American military, won't seek [a hostile country's] technology out to be built on top of. They can't rely on it. It can be limited at any time. Not to mention, there's plenty of computing capacity in China already." Not everyone is so confident. In their letter to Huang, Warren and Banks wrote: "We are worried that your trip to [China] could legitimize companies that cooperate closely with the Chinese military or involve discussing exploitable gaps in U.S. export controls." A former Commerce Department official was more blunt in a discussion with the Washington Post, saying "It's very hard to disentangle China's AI ambitions for the commercial space from the military space." Garg, of the Goizueta Business School, says he's skeptical as well: "I think it would be dumb if a country says, 'I'm going to use this technology for consumer-facing things, but not to defend the country.' [Huang's comments] don't make sense to me." The final deadline for the 2025 Inc. Power Partner Awards is Friday, July 25, at 11:59 p.m. PT. Apply now.

[6]

Nvidia's Jensen Huang has done something that no other CEO or leader has done before - ease US-China tensions

Nvidia's $4 trillion move is making headlines after CEO Jensen Huang pulled off a major turnaround by resuming H20 chip sales to China. Just days after meeting President Donald Trump, Huang landed in Beijing, met Chinese trade officials, and announced the big win -- without causing friction on either side. While U.S.-China tensions remain high, Huang's strategy shows how quiet diplomacy and smart timing can unlock billion-dollar markets. By staying neutral and culturally fluent, Nvidia isn't just selling chips -- it's selling the future of AI infrastructure. This story isn't just about tech; it's about leadership in a divided world.

[7]

How Nvidia's Jensen Huang persuaded Trump to sell AI chips to China - The Economic Times

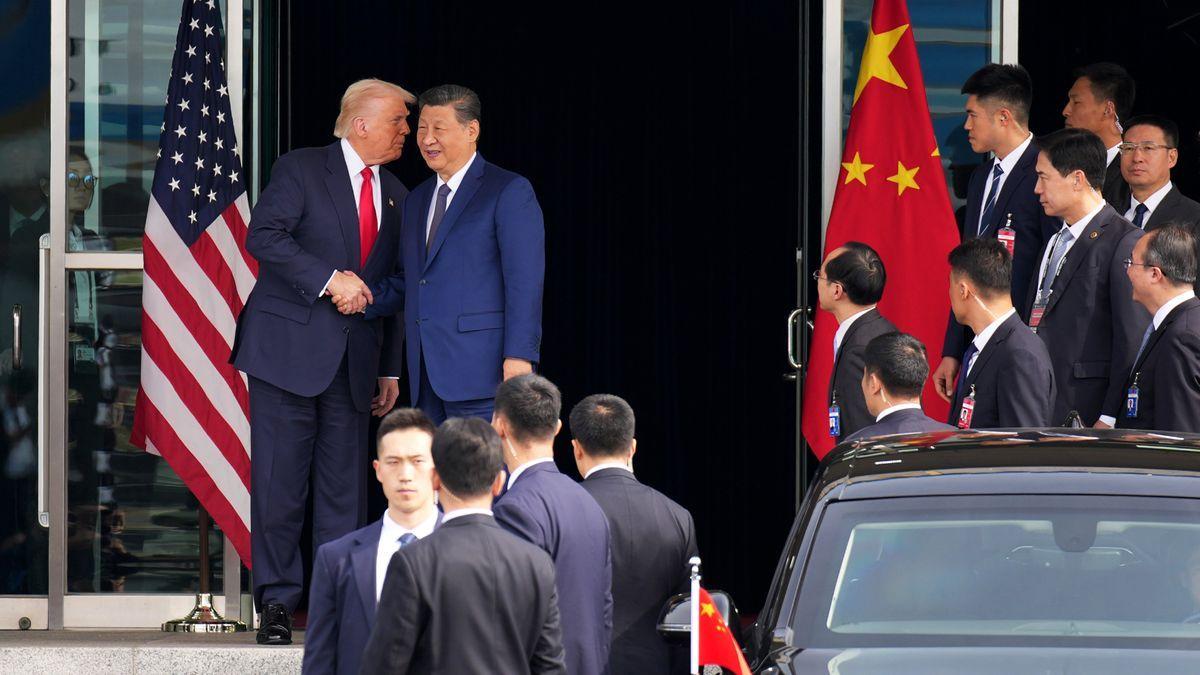

Nvidia CEO Jensen Huang, once apolitical, emerged as a key geopolitical player after US restrictions threatened chip sales to China. Lobbying Trump and navigating Washington, he helped reverse the ban, reopening Nvidia's access to China. His efforts underscored Nvidia's rise as an AI powerhouse and global tech influencer.In April, Jensen Huang, the CEO of chipmaker Nvidia, received a blunt welcome to the world of geopolitics when the Trump administration shut down sales of an artificial intelligence chip the company had designed specifically for China. Since then, Huang has turned himself into a globe-trotting negotiator as he has tried to persuade President Donald Trump to reverse course. He has traveled with Trump, testified before Congress and charmed reporters in Washington. And he has courted allies in the White House who have quietly supported global business interests despite Trump's tough talk on trade with China. That work has started to pay off for Nvidia. Last week, Huang met with Trump in the Oval Office and pressed his case for restarting sales of his specialized chips, said two people familiar with the meeting, who spoke on the condition of anonymity. He argued that American chips should be the global standard and that the United States was making a grave mistake by ceding the giant Chinese market to homegrown rivals. Within days, Nvidia said the administration was changing course. It was a remarkable reversal that punctuated Huang's arrival as the tech industry's leading geopolitical player. It also underscored Nvidia's quick rise from little-known Silicon Valley chipmaker to the most valuable public company in the world as well as the linchpin to the tech industry's AI boom. Just last week, Nvidia, which controls more than 90% of the market for chips needed to build AI systems, became the first public company worth more than $4 trillion. Since then, it has raced past that milestone, thanks largely to its return to China. Huang "makes the same argument, even where it is unpopular, because he believes deep in his bones that winning developer mind-share in China and depriving Huawei of a monopoly market is the best way for the American AI to win around the world," said Brad Gerstner, the founder of Altimeter Capital Management, a major Nvidia investor. A White House spokesperson, Kush Desai, said Trump's "America first policies" had led to trillions of dollars in investments in U.S. manufacturing and technology, which "will create thousands of quality jobs and safeguard our country's national and economic security." "Everything the president does is aimed at protecting America and American workers," Desai added. The Commerce Department did not respond to requests for comment. The Wall Street Journal previously reported on the White House meeting. Huang has paired his courtship of the Trump administration with a steadfast determination to keep a foothold in China, often baffling colleagues with trips across the Pacific to meet with officials as trade war rhetoric between the countries escalated. Ultimately, Huang's campaign was also aided by Chinese pressure in ongoing trade negotiations with the United States. On Wednesday, Huang signed autographs in an appearance in Beijing while demurring about his influence on Trump's decision. "I don't think I changed his mind," Huang said. "It's my job to inform the president about what I know very well, which is the technology industry, artificial intelligence, the developments of AI around the world." Huang, 62, was a reluctant lobbyist. An electrical engineer by training, he used to consider government affairs trivial, said two former employees, who asked to be anonymous because they still work in the tech industry. But he had to jump into Washington politics when the company's AI chips became enmeshed in global politics. Fearing the chips could be used to coordinate military strikes and develop weapons, the Biden administration approved rules restricting sales to China. The Trump administration promised to crack down further. After the inauguration, Huang visited the White House and met Trump for the first time. Huang talked about AI policy and semiconductors, but afterward, the president told reporters that he couldn't say whether he would ban more of Nvidia's chip sales to China. Like officials in the Biden administration, Trump's advisers were concerned that the chips would help Chinese businesses match American AI technology. In April, the Trump administration warned Nvidia that it planned to shut down sales of the last AI chip it offered in China, said four people familiar with the plans. Commerce Secretary Howard Lutnick, who oversees export restrictions, invited Huang to Mar-a-Lago to meet with the president and make a last-ditch appeal, the people said. On the sidelines of a $1-million-a-head candlelight dinner, Huang tried to persuade Trump not to curb chip sales to China, the four people said. He explained that Nvidia's chip in question, known as the H20, was far less powerful than what the company sold to the rest of the world. Losing access to China would hurt U.S. companies and help Chinese rivals. Administration officials who were briefed later on the conversation thought Huang had undersold his chips' usefulness. The H20 was packed with memory capable of processing complex requests, and Chinese customers were spending billions of dollars for it. Two weeks later, the administration sent Nvidia a letter shutting down sales of the chip to China. But David Sacks, a longtime Silicon Valley investor who had become the White House's AI czar, was more receptive to Huang's position about China than others in the administration, two people familiar with his thinking said. Sacks disliked another Biden administration rule that controlled AI chip sales around the world. He also questioned Washington's consensus that selling AI chips abroad would be bad for the United States. Huang began speaking regularly with Sacks and Sriram Krishnan, who works on AI in the administration, these people said. His concerns about Chinese company Huawei began to resonate with Sacks after Huawei announced a new AI system, which it called the CloudMatrix 384, that delivered performance competitive with U.S. products. At a conference in Washington in April, Huang urged the administration to loosen restrictions on chip sales. "China is not behind," he said. "Are they ahead of us? China is right behind us. We're very, very close." Huang later appeared alongside Trump at a White House announcement of a $500 billion investment by Nvidia in U.S. manufacturing. In what Nvidia executives later said were unplanned remarks, Trump smirked as Huang laughed and said, "Without the president's leadership, his policies, his support and very importantly his strong encouragement -- and I mean his strong encouragement -- frankly, manufacturing in the United States wouldn't have accelerated to this pace." The next day, Huang spoke to the House Foreign Affairs Committee, which has responsibility for overseeing limits on chip sales abroad. He criticized the Biden administration's rules limiting chip sales and warned that banning sales to China would harm, not help, the United States. He also parried questions about whether DeepSeek, a Chinese startup that shocked the tech industry this year when it unveiled an AI system comparable to American-made systems, had used Nvidia technology, said two legislative aides familiar with the meeting. "His objective is to always fundamentally provide the information, whether it's policymakers or others in the Beltway, need to hear or want to hear and answer their questions," said Tim Teter, Nvidia's general counsel, who joined Huang in Washington during that visit. "He did exactly that." In the weeks that followed, Sacks helped dismantle the Biden rule that put caps on the number of chips Nvidia could sell to every country in the world, four people familiar with the process said. The maneuver cleared the way for Sacks to help Nvidia sell chips to Saudi Arabia and the United Arab Emirates. In May, Huang traveled to the Middle East with Trump. Sacks, by now Huang's ally, negotiated a blockbuster deal to deliver hundreds of thousands of today's most advanced chips from Nvidia annually to build one of the world's largest data center hubs in the UAE. During the sales process, Sacks and Huang began advancing the same rationale for selling AI chips, two people said. To win the AI race, they said, the U.S. government should encourage purchases of U.S. technology rather than create a reason for countries to buy similar Chinese technology. At Nvidia, it felt like a major breakthrough when Trump called Huang a "friend" during the trip. But Huang wasn't satisfied with winning the Middle East. He wanted a return to China as well. Shortly after securing the multibillion-dollar deal with the UAE, Huang traveled to Taiwan for an annual computer conference. He spoke to reporters on the sidelines and said Washington's regulation of chip sales to China had only made Chinese companies stronger. "All in all, the export control was a failure," Huang said. Last week, Huang returned to Washington to meet with think tank leaders, political reporters and White House officials. His message was similar to the one he and Sacks promoted after their trip to the Middle East: Countries around the world should be encouraged to build on U.S. chips and software. "The American tech stack should be the global standard, just as the American dollar is the standard by which every country builds on," Huang said during a podcast recorded last week in Washington with the Special Competitive Studies Project, a think tank. Huang delivered that same message to Trump last week in the Oval Office, two people familiar with the meeting said. Sacks was seated nearby, lending his support. By the end of the nearly hourlong meeting, Trump said Nvidia's chips could return to China. Lutnick said on CNBC that the approval was linked to ongoing trade talks with China, which recently agreed to supply rare earth magnets to American companies. The idea was to sell Chinese businesses Nvidia's fourth-best chip, he said, so that "they get addicted to the American technology stack." Days later, Huang traveled to Beijing and held a news conference to tell customers that Nvidia was open for business. Huang, now the world's sixth-wealthiest man, amiably chatted with reporters about his relationship with Trump. The atmosphere was jubilant.

[8]

How Nvidia's Jensen Huang persuaded Trump to sell AI chips to China

Huang's efforts, aided by Chinese pressure, led to this breakthrough. He emphasized the importance of American tech in the global market. In April, Jensen Huang, the CEO of chipmaker Nvidia, received a blunt welcome to the world of geopolitics when the Trump administration shut down sales of an artificial intelligence chip the company had designed specifically for China. Since then, Huang has turned himself into a globe-trotting negotiator as he has tried to persuade President Donald Trump to reverse course. He has traveled with Trump, testified before Congress and charmed reporters in Washington. And he has courted allies in the White House who have quietly supported global business interests despite Trump's tough talk on trade with China. That work has started to pay off for Nvidia. Last week, Huang met with Trump in the Oval Office and pressed his case for restarting sales of his specialized chips, said two people familiar with the meeting, who spoke on the condition of anonymity. He argued that American chips should be the global standard and that the United States was making a grave mistake by ceding the giant Chinese market to homegrown rivals. Within days, Nvidia said the administration was changing course. It was a remarkable reversal that punctuated Huang's arrival as the tech industry's leading geopolitical player. It also underscored Nvidia's quick rise from little-known Silicon Valley chipmaker to the most valuable public company in the world as well as the linchpin to the tech industry's AI boom. Just last week, Nvidia, which controls more than 90% of the market for chips needed to build AI systems, became the first public company worth more than $4 trillion. Since then, it has raced past that milestone, thanks largely to its return to China. Huang "makes the same argument, even where it is unpopular, because he believes deep in his bones that winning developer mind-share in China and depriving Huawei of a monopoly market is the best way for the American AI to win around the world," said Brad Gerstner, the founder of Altimeter Capital Management, a major Nvidia investor. A White House spokesperson, Kush Desai, said Trump's "America first policies" had led to trillions of dollars in investments in U.S. manufacturing and technology, which "will create thousands of quality jobs and safeguard our country's national and economic security." "Everything the president does is aimed at protecting America and American workers," Desai added. The Commerce Department did not respond to requests for comment. The Wall Street Journal previously reported on the White House meeting. Huang has paired his courtship of the Trump administration with a steadfast determination to keep a foothold in China, often baffling colleagues with trips across the Pacific to meet with officials as trade war rhetoric between the countries escalated. Ultimately, Huang's campaign was also aided by Chinese pressure in ongoing trade negotiations with the United States. On Wednesday, Huang signed autographs in an appearance in Beijing while demurring about his influence on Trump's decision. "I don't think I changed his mind," Huang said. "It's my job to inform the president about what I know very well, which is the technology industry, artificial intelligence, the developments of AI around the world." Huang, 62, was a reluctant lobbyist. An electrical engineer by training, he used to consider government affairs trivial, said two former employees, who asked to be anonymous because they still work in the tech industry. But he had to jump into Washington politics when the company's AI chips became enmeshed in global politics. Fearing the chips could be used to coordinate military strikes and develop weapons, the Biden administration approved rules restricting sales to China. The Trump administration promised to crack down further. After the inauguration, Huang visited the White House and met Trump for the first time. Huang talked about AI policy and semiconductors, but afterward, the president told reporters that he couldn't say whether he would ban more of Nvidia's chip sales to China. Like officials in the Biden administration, Trump's advisers were concerned that the chips would help Chinese businesses match American AI technology. In April, the Trump administration warned Nvidia that it planned to shut down sales of the last AI chip it offered in China, said four people familiar with the plans. Commerce Secretary Howard Lutnick, who oversees export restrictions, invited Huang to Mar-a-Lago to meet with the president and make a last-ditch appeal, the people said. On the sidelines of a $1-million-a-head candlelight dinner, Huang tried to persuade Trump not to curb chip sales to China, the four people said. He explained that Nvidia's chip in question, known as the H20, was far less powerful than what the company sold to the rest of the world. Losing access to China would hurt U.S. companies and help Chinese rivals. Administration officials who were briefed later on the conversation thought Huang had undersold his chips' usefulness. The H20 was packed with memory capable of processing complex requests, and Chinese customers were spending billions of dollars for it. Two weeks later, the administration sent Nvidia a letter shutting down sales of the chip to China. But David Sacks, a longtime Silicon Valley investor who had become the White House's AI czar, was more receptive to Huang's position about China than others in the administration, two people familiar with his thinking said. Sacks disliked another Biden administration rule that controlled AI chip sales around the world. He also questioned Washington's consensus that selling AI chips abroad would be bad for the United States. Huang began speaking regularly with Sacks and Sriram Krishnan, who works on AI in the administration, these people said. His concerns about Chinese company Huawei began to resonate with Sacks after Huawei announced a new AI system, which it called the CloudMatrix 384, that delivered performance competitive with U.S. products. At a conference in Washington in April, Huang urged the administration to loosen restrictions on chip sales. "China is not behind," he said. "Are they ahead of us? China is right behind us. We're very, very close." Huang later appeared alongside Trump at a White House announcement of a $500 billion investment by Nvidia in U.S. manufacturing. In what Nvidia executives later said were unplanned remarks, Trump smirked as Huang laughed and said, "Without the president's leadership, his policies, his support and very importantly his strong encouragement -- and I mean his strong encouragement -- frankly, manufacturing in the United States wouldn't have accelerated to this pace." The next day, Huang spoke to the House Foreign Affairs Committee, which has responsibility for overseeing limits on chip sales abroad. He criticized the Biden administration's rules limiting chip sales and warned that banning sales to China would harm, not help, the United States. He also parried questions about whether DeepSeek, a Chinese startup that shocked the tech industry this year when it unveiled an AI system comparable to American-made systems, had used Nvidia technology, said two legislative aides familiar with the meeting. "His objective is to always fundamentally provide the information, whether it's policymakers or others in the Beltway, need to hear or want to hear and answer their questions," said Tim Teter, Nvidia's general counsel, who joined Huang in Washington during that visit. "He did exactly that." In the weeks that followed, Sacks helped dismantle the Biden rule that put caps on the number of chips Nvidia could sell to every country in the world, four people familiar with the process said. The maneuver cleared the way for Sacks to help Nvidia sell chips to Saudi Arabia and the United Arab Emirates. In May, Huang traveled to the Middle East with Trump. Sacks, by now Huang's ally, negotiated a blockbuster deal to deliver hundreds of thousands of today's most advanced chips from Nvidia annually to build one of the world's largest data center hubs in the UAE. During the sales process, Sacks and Huang began advancing the same rationale for selling AI chips, two people said. To win the AI race, they said, the U.S. government should encourage purchases of U.S. technology rather than create a reason for countries to buy similar Chinese technology. At Nvidia, it felt like a major breakthrough when Trump called Huang a "friend" during the trip. But Huang wasn't satisfied with winning the Middle East. He wanted a return to China as well. Shortly after securing the multibillion-dollar deal with the UAE, Huang traveled to Taiwan for an annual computer conference. He spoke to reporters on the sidelines and said Washington's regulation of chip sales to China had only made Chinese companies stronger. "All in all, the export control was a failure," Huang said. Last week, Huang returned to Washington to meet with think tank leaders, political reporters and White House officials. His message was similar to the one he and Sacks promoted after their trip to the Middle East: Countries around the world should be encouraged to build on U.S. chips and software. "The American tech stack should be the global standard, just as the American dollar is the standard by which every country builds on," Huang said during a podcast recorded last week in Washington with the Special Competitive Studies Project, a think tank. Huang delivered that same message to Trump last week in the Oval Office, two people familiar with the meeting said. Sacks was seated nearby, lending his support. By the end of the nearly hourlong meeting, Trump said Nvidia's chips could return to China. Lutnick said on CNBC that the approval was linked to ongoing trade talks with China, which recently agreed to supply rare earth magnets to American companies. The idea was to sell Chinese businesses Nvidia's fourth-best chip, he said, so that "they get addicted to the American technology stack." Days later, Huang traveled to Beijing and held a news conference to tell customers that Nvidia was open for business. Huang, now the world's sixth-wealthiest man, amiably chatted with reporters about his relationship with Trump. The atmosphere was jubilant.

[9]

Trump's U-turn on Nvidia spurs talk of grand bargain with China

Only a few years ago, the administration of former U.S. President Joe Biden declared export controls a "new strategic asset" to help the U.S. maintain "as large a lead as possible" over China in advanced technology. U.S. President Donald Trump is now upending that approach. In a reversal this week, the White House told chipmaker Nvidia it could soon resume sales of its less advanced China-focused H20 artificial intelligence accelerator. Advanced Micro Devices received similar assurances from the U.S. Commerce Department. Explaining the decision, Commerce Secretary Howard Lutnick said the administration wanted Chinese developers "addicted" to American technology, while insisting the U.S. wouldn't sell China "our best stuff." That, he said, required a more balanced policy that would keep the U.S. "one step ahead of what they can build so they keep buying our chips."

[10]

NVIDIA's CEO Has Replaced Musk As A Go-Through Between US & China, Says Report

This is not investment advice. The author has no position in any of the stocks mentioned. Wccftech.com has a disclosure and ethics policy. NVIDIA CEO Jensen Huang has replaced Tesla's Elon Musk as one of China's top mediators to the US, suggests a report from the Nikkei. Huang scored a major win earlier when he successfully lobbied the Trump administration to grant export licenses for NVIDIA's H20 AI chips designed specifically for Chinese companies. The easing restrictions and NVIDIA's position in the AI ecosystem have made Huang favorable to Beijing as it hopes to rely on business leaders to act as mediators in the US. NVIDIA CEO Gains Favor With China To Act As Bridge With US, Says Report 2025 was off to a tough start for Huang and his firm as the outgoing Biden administration introduced the AI Diffusion rules, which prevent advanced AI GPUs from being freely sold to most countries except a list of 12 nations. Huang and NVIDIA were sharp in their criticism of the rules, but they were dealt another blow after the Trump administration decided to limit NVIDIA from selling its China-specific H20 GPU as well. The H20 ban forced NVIDIA to write off its inventory, and according to reports, also shut down the GPU's production lines. Huang then proceeded on a charm offensive, which convinced the US government to grant the H20 export licenses as he was visiting China. In China, the NVIDIA CEO continued his charm offensive and praised the country's strengths in AI and NVIDIA's business there. Huang's connections to the US government and his success in having procured the H20 export licenses have also won him favor with the Chinese and led him to replace Elon Musk as a bridge between the US and China, says the Nikkei. The centerpiece of Huang's argument to convince the US government to grant H20 export licenses is keeping China dependent on American hardware for its AI needs. The approach has yielded results and allowed him to become a conduit between the US and China and an alternative to the security hawks in Washington. US AI chip restrictions against China are motivated by national security concerns, according to policymakers, due to worries of the equipment used by the Chinese military to bolster its capabilities. These concerns have also led to the sales of advanced chips manufactured by Taiwan's TSMC to Chinese technology giant Huawei and the sale of high-end EUV chip lithography equipment from Dutch firm ASML being restricted to Chinese chip manufacturer SMIC. Amidst these tensions, Huang " is viewed by some Chinese analysts as Beijing's favored bridge to the US, combining star power with strategic relevance," says Lizzi Lee, a fellow at the Asia Society Policy Institute's Center for China Analysis, according to the Nikkei. However, Huang is relatively insulated from business interests in China when compared to Musk, whose firm not only generates a large portion of its revenue from the country but also has a sizable manufacturing presence there.

[11]

NVIDIA's H20 AI Chip Ban Was Reportedly Lifted to Counter Huawei's Rising Influence in China and Beyond, Threatening U.S. Dominance

NVIDIA's H20 restriction uplift had a much deeper purpose than relieving Team Green, as AI czar David Sacks says it was a move to counter competition from China. NVIDIA's CEO, Jensen Huang, recently disclosed that the company expects its H20 AI chip to be available for China once again following the easing of US export controls. Now, when you talk about why this move happened apart from the trade deal between China and the US, AI czar David Sacks has disclosed a pretty interesting reason, one which Jensen has been discussing for several months. In an interview to Bloomberg Business, Sacks revealed that one of the reasons for lifting the H20 AI chip ban was to counter the growing influence of Huawei in Chinese markets. You just don't want to hand Huawei the entire Chinese market when NVIDIA is capable of competing for a big slice of it with a less capable chip. Again, we are not selling our latest, greatest chips to China, but we can deprive Huawei of the market share in China, which can be used to scale up to compete with the U.S. globally. Sacks previously mentioned that Huawei's CloudMatrix rack-scale solution is capable of competing with NVIDIA and that Chinese alternatives are a growing threat to the US's AI dominance. Interestingly, Sacks agreed to Huang's narrative that if US chips aren't being offered to the world, China would ultimately take over, and this does show that NVIDIA's CEO's opposition against the recent rounds of US export controls has worked out, since the Trump administration has adopted his narrative. The H20 AI chip ban getting lifted is just an example of how the U.S. sees an emerging threat from China's AI progress. Now that NVIDIA is expected to have access to China, domestic CSPs see more interest in American AI technology, despite Huawei's efforts to expand its market share. Sacks also supports the idea of Gulf states getting access to America's AI chips, claiming that if NVIDIA and others are deprived of the GCC market, China would ultimately take over, similar to the telecom sector. So, it's clear that the Trump administration had to make a choice here, whether to let Chinese tech flow into global markets, or ease the export controls on NVIDIA. It would be interesting to see how the markets evolve once NVIDIA resumes its business in China, since the firm is expected to introduce multi solutions for Beijing, in an attempt to regain lost market share.

[12]

Nvidia's CEO Hits Beijing Like A Rockstar, Stirs Jensen-Mania In China - NVIDIA (NASDAQ:NVDA)

NVIDIA Corp. NVDA CEO Jensen Huang received a rockstar reception in Beijing during his most recent visit last week which marked his third this year and solidified his celebrity status in China. What To Know: Huang, CEO of the world's most valuable company, was seen strolling the streets of the capital city, mingling with fans and signing autographs -- including on his trademark leather jackets. He was also seen taking selfies and being widely recognized by a devoted fanbase. Read Next: Opendoor Stock Frenzy Continues -- Is $40 Per Share The Next Stop? During his visit, Huang attended the China International Supply Chain Expo and described Chinese AI models from companies like DeepSeek, Alibaba Group Holding Ltd. BABA and Tencent as "world class" and praised the scale and sophistication of the Chinese supply chain. Huang even applauded the capabilities of Nvidia's strategic rival Huawei. "I think the fact of the matter is, anyone who discounts Huawei and anyone who discounts China's manufacturing capability is deeply naive. This is a formidable company," Huang told reporters, according to Reuters. Why It Matters: Huang's trip came as Nvidia resumed sales of its advanced H20 AI chips to China, after a temporary U.S. ban was reversed. Trending Investment OpportunitiesAdvertisementArrivedBuy shares of homes and vacation rentals for as little as $100. Get StartedWiserAdvisorGet matched with a trusted, local financial advisor for free.Get StartedPoint.comTap into your home's equity to consolidate debt or fund a renovation.Get StartedRobinhoodMove your 401k to Robinhood and get a 3% match on deposits.Get Started The H20 is a less advanced and specially designed chip to comply with U.S. export rules that limit certain technologies from being sent to China. Huang also held meetings with top Chinese officials, including Vice Premier He Lifeng and Commerce Minister Wang Wentao, solidifying Nvidia's commitment to the Chinese market as it navigates the current U.S.-China trade tensions. Huang said that he communicated transparently with U.S. officials prior to his visit and informed President Donald Trump and his cabinet about the planned trip. Huang said that President Trump told him to, "Have a great trip." Read Next: Rare Earth Royalty: Meet The Power Players Shaping The Industry Photo: Shutterstock NVDANVIDIA Corp$172.24-0.10%Stock Score Locked: Edge Members Only Benzinga Rankings give you vital metrics on any stock - anytime. Unlock RankingsEdge RankingsMomentum87.46Growth98.66QualityN/AValue6.48Price TrendShortMediumLongOverviewBABAAlibaba Group Holding Ltd$120.780.46%Market News and Data brought to you by Benzinga APIs

[13]

Nvidia's Jensen Huang Charms China With AI Diplomacy as Tariff Tensions Linger Nvidia's Jensen Huang Charms China With AI Diplomacy as Tariff Tensions Linger - NVIDIA (NASDAQ:NVDA)

Jensen Huang, CEO of Nvidia Corp. NVDA, made a high-profile appearance at the China International Supply Chain Expo this week, delivering a message of cooperation amid lingering trade tensions between the United States and China. During his third visit to China in less than a year, Huang donned a traditional Chinese tang suit and greeted audiences with a few lines in Mandarin. His presence, alongside a surge in U.S. company participation, highlighted tentative progress in cross-border diplomacy, South China Morning Post reports. Also Read: Microsoft Ends China-Based Tech Support For Pentagon Projects Amid National Security Backlash Huang announced that the Biden administration had cleared Nvidia to ship its H20 chip to China -- a customized, less powerful alternative to the firm's top-tier AI processors blocked by prior sanctions. The gesture was framed as part of broader efforts to ease commercial strains between the two nations. American firms represented the largest foreign group at the event, with attendance up by 15% over last year. Trending Investment OpportunitiesAdvertisementArrivedBuy shares of homes and vacation rentals for as little as $100. Get StartedWiserAdvisorGet matched with a trusted, local financial advisor for free.Get StartedPoint.comTap into your home's equity to consolidate debt or fund a renovation.Get StartedRobinhoodMove your 401k to Robinhood and get a 3% match on deposits.Get Started Despite the positive optics, underlying worries about tariff escalations and fractured supply chains still haunted participants, especially in the agricultural and raw materials sectors, the report adds. A Chinese buyer at the U.S. Grains Council booth said ongoing duties -- including a 10% tariff on rice bran -- have devastated profits. According to a U.S. state trade official based in China, many Republican and swing states have shuttered their in-country offices, leaving just a handful of Democrat-led states with an active footprint. Prospective Chinese investors, too, have put plans on ice due to bureaucratic delays and fears of retaliatory policies. One Chinese firm in the raw materials space canceled plans to build warehousing infrastructure in the U.S. after zoning and documentation issues compounded post-tariff uncertainties. Read Next: Cathie Wood Dumps Palantir As Stock Touches Peak Prices, Bails On Soaring Flying-Taxi Maker Archer Aviation Image: Shutterstock/jamesonwu1972 NVDANVIDIA Corp$172.36-0.37%Stock Score Locked: Want to See it? Benzinga Rankings give you vital metrics on any stock - anytime. Reveal Full ScoreEdge RankingsMomentum87.29Growth98.63QualityN/AValue6.24Price TrendShortMediumLongOverviewMarket News and Data brought to you by Benzinga APIs

[14]

Nvidia CEO's China charm offensive underscores rock star status in key market

BEIJING/SHANGHAI (Reuters) -Nvidia CEO Jensen Huang is no stranger to Beijing, but his most recent visit, his third to China this year, cemented his rock star status in the country, where fans mingled freely with the AI titan on the streets of the capital. It was a rare sight for a chief executive of one of the world's most powerful companies to roam around Beijing, engage in wide-ranging interviews, take selfies with excited fans and even sign leather jackets - a signature clothing item of the billionaire - for his devoted followers. The tycoon at the helm of the world's most valuable company arrived in Beijing for a supply chain expo last week just days after meeting U.S. President Donald Trump and announced the AI giant would once again be able to sell its H20 chips in China following a U.S. ban in April on national security concerns. Huang's company is caught in the cross-hairs of a U.S.-China trade war that threatens to upend supply chains as both countries battle for global dominance in AI and other cutting-edge technologies, threatening Nvidia's $17 billion China business. While Huang appears to be navigating a delicate tightrope between Beijing and Washington well, the company remains subject to the ups and downs of Sino-U.S. tensions, analysts said. "Jensen Huang's visit aimed to demonstrate Nvidia's commitment to the Chinese market," said Lian Jye Su, a chief analyst at tech research firm Omdia. "However, this commitment must be balanced against potential U.S. government concerns about deepening ties with China." Huang described AI models from Chinese firms Deepseek, Alibaba and Tencent as "world class" and his official engagements included a "wonderful" meeting with Chinese trade tsar and Vice Premier He Lifeng and a face-to-face with Commerce Minister Wang Wentao. Demand for H20 chips surged in China following the launch of DeepSeek models in January. "Nvidia will still need to see the tide clearly and ride it at the right time to maximize the available benefits. But good for the company, I think it has a CEO who's very good at doing that," said Tilly Zhang, a technology analyst with Gavekal Dragonomics. Charlie Chai, an analyst with 86Research, said Nvidia's China market share was likely to slide in years to come. "The Chinese government will actively help or subsidize domestic rivals that can one day stand up to and, at least in some use cases, replace high-end Nvidia chips." SELFIES AND AUTOGRAPHS In an unusual sight for a global CEO visiting China, videos posted on social media platforms showed Huang wandering the streets of Beijing, drink in hand, signing notebooks and posing for selfies. In response to questions about how Washington would likely receive his latest visit to Beijing, the CEO said: "I told President Trump and his cabinet that I was coming to China. Told him about my trip here, and he said, 'Have a great trip'." At the opening of the China International Supply Chain Expo last Wednesday, Huang - who was born in Taiwan but moved to the U.S. at the age of nine - traded his signature leather jacket for a black, traditional Chinese-style jacket and referred to himself in a speech as "Chinese". In his Expo speech, as well as in later comments, Huang was effusive in his praise for Chinese tech giants' capabilities in bringing technology into applications, describing China's supply chain as "vast". Even arch rival Huawei Technologies, a firm that Nvidia is locked in a strategic and intensifying battle for AI chip dominance with, was lauded. "I think the fact of the matter is, anyone who discounts Huawei and anyone who discounts China's manufacturing capability is deeply naive. This is a formidable company," Huang told reporters. (Reporting by Che Pan, Liam Mo and Casey Hall; Editing by Anne Marie Roantree and Lincoln Feast.)

Share

Share

Copy Link

Nvidia CEO Jensen Huang successfully lobbies for the resumption of H20 AI chip sales to China, navigating complex U.S.-China relations and potentially reshaping the global AI landscape.

Nvidia's Diplomatic Breakthrough

In a significant turn of events, Nvidia CEO Jensen Huang has successfully lobbied for the resumption of H20 AI chip sales to China, marking a pivotal moment in the ongoing U.S.-China tech relations. This development comes after Huang's strategic meetings with both U.S. President Donald Trump and Chinese officials, demonstrating his growing influence in shaping international tech policy

1

2

.

Source: CNBC

The H20 Chip Saga

The H20 chip, a less powerful variant of Nvidia's advanced AI processors, had been banned from sale to China earlier this year due to national security concerns. However, Huang's persistent efforts, including multiple visits to China and meetings with high-ranking officials, have led to a reversal of this decision

1

4

.Diplomatic Balancing Act

Huang's approach involved a delicate balancing act between U.S. and Chinese interests. In Beijing, he praised Chinese tech giants and even referred to himself as "Chinese" during a speech, while simultaneously emphasizing to U.S. officials the importance of maintaining America's technological edge

1

3

.

Source: Reuters

Global AI Competition

The resumption of H20 chip sales to China has significant implications for the global AI race. Huang argues that allowing sales of U.S. technology to China will encourage nations worldwide to choose American tech stacks, potentially solidifying U.S. leadership in AI

2

4

.Economic Impact and Market Dynamics

Nvidia stands to benefit substantially from this decision, with the company previously reporting losses of billions due to the sales restrictions. The move has already boosted Nvidia's stock price and market capitalization

5

.Related Stories

Concerns and Criticisms

Despite the apparent diplomatic success, concerns remain about the potential military applications of these chips. Some U.S. officials and lawmakers have expressed worries about legitimizing companies that cooperate with the Chinese military

5

.Black Market and Smuggling Issues

Complicating the situation is the existence of a thriving black market for banned AI chips in China. Reports suggest that thousands of restricted Nvidia chips may have already been smuggled into the country, raising questions about the effectiveness of export controls

3

.

Source: ET

Future Implications

This development could have far-reaching consequences for the AI industry. Chinese AI companies like DeepSeek, which have already demonstrated impressive capabilities, may now have access to more advanced hardware, potentially accelerating their progress

3

5

.As the global AI landscape continues to evolve, Huang's diplomatic achievement may prove to be a defining moment in the tech industry's history, potentially reshaping the balance of power in the ongoing race for AI supremacy.

References

Summarized by

Navi

Related Stories

Nvidia Set to Resume AI Chip Sales to China Amid Regulatory Shifts

10 Jul 2025•Technology

Nvidia CEO Jensen Huang Pushes for China Market Access Amid Ongoing Trade Restrictions

29 Oct 2025•Business and Economy

Nvidia CEO Jensen Huang Emphasizes Global Cooperation in AI Amid Potential Trump Administration Restrictions

23 Nov 2024•Technology

Recent Highlights

1

Pentagon threatens to cut Anthropic's $200M contract over AI safety restrictions in military ops

Policy and Regulation

2

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

3

OpenAI closes in on $100 billion funding round with $850 billion valuation as spending plans shift

Business and Economy