Nvidia's Market Dominance: A Double-Edged Sword for S&P 500

3 Sources

3 Sources

[1]

Nvidia's influence on markets: When tail wags the dog

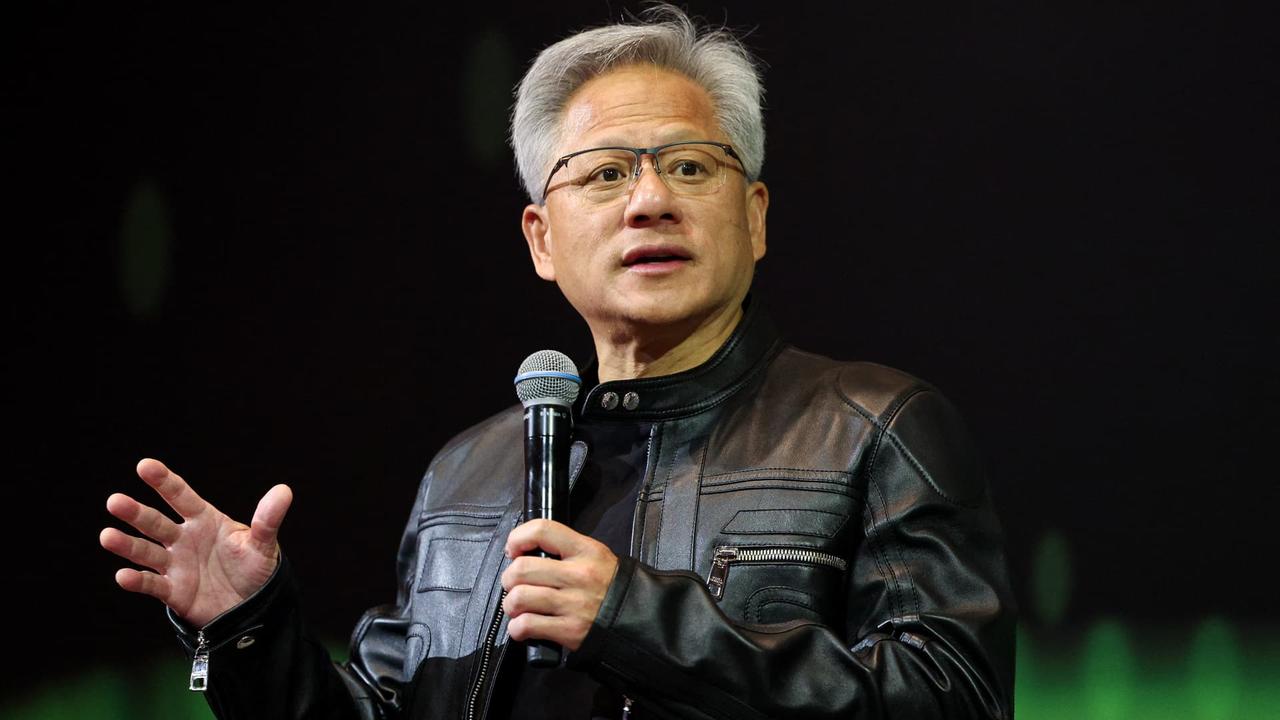

Never have so many depended so much on so few (just one company) - that was how we had termed the dependence of the global stock market rally hinged to the fortunes of Nvidia in our article 'Nvidia and its parabolic growth' published in February this year. Fast forward to today, this theme has only got stronger. In the first week of September, the S&P 500 was down by 4 per cent and lost around $2 trillion in market capitalisation. In the second week, it was up 4 per cent and almost made up for the $2 trillion in wealth lost. See this as against the movements in the stock of Nvidia which was down 16 per cent in the first week losing around $400 billion in market cap in just five trading days. That's almost the entire market cap of Reliance Industries and TCS combined. As such there was no significant new fundamental news that triggered this rout. One can speculate whether it was further unwinding of the yen carry trade, or some profit booking or anything else. Nevertheless, following that rout, Nvidia was up 16 per cent last week adding back the $400 billion it had lost. The interesting thing to note here is what triggered the rally in Nvidia and US markets last week. The US markets had actually started the week on a cautious note and into early trading hours on Wednesday was down heavily following the release of August CPI inflation data that indicated core inflation was slightly above estimates, thereby dampening hopes of a 50 bps cut in the upcoming Fed policy meet. At lows of the day, the Dow Jones, S&P 500 and Nasdaq Composite were down by 1.8 per cent, 1.6 per cent and 1.4 per cent respectively. However, around mid-day, just a few comments by Jensen Huang, CEO of Nvidia at the Goldman Sachs Communacopia and Technology conference was enough to trigger a massive rally that continued through the week. 'Demand is so great that delivery of our components, our technology, infrastructure, and software is really emotional for people'; 'Everybody is counting on us'; 'It directly affects their (Nvidia customers) revenues, it directly affects their competitiveness' were the few comments from him that triggered the $2 trillion rally in the S&P 500 last week. On Wednesday alone, the Down Jones, S&P 500 and Nasdaq Composite rallied 2.17 per cent, 2.74 per cent and 3.62 per cent from lows of the day, while Nvidia was up by 9 per cent. The rally followed through to Asian markets too the next day, including in India, and most markets ended on a very positive note on Thursday. Begging for GPUs And if you had the slightest of doubts that Jensen Huang might be exaggerating, his comments are well corroborated by Nvdia's recent performance and also comments from his customers. For example in Oracle's financial analyst meet last week, founder and CEO Larry Ellison mentioned how he and Elon Musk recently went for dinner with Jensen Huang and 'begged him' for Nvidia GPUs! It does appear demand for Nvidia GPUs and Big Tech's rush to invest in AI is quite strong. Thus it is not for no reason that Goldman Sachs calls Nvidia 'the most important stock' of 2024, with its share performance driving market's fortunes as well. An analysis by bl.portfolio indicates how the correlation between Nvidia and S&P 500/Nasdaq Composite so far in 2024, at 0.96, is significantly higher than that of any of the other mega-cap Magnificent Seven company (see chart). Further, out of 177 trading sessions this year, Nvidia has had 24 sessions in which the stock has moved by 5 per cent and above, or -5 per cent and lower. Most of these sessions have had a significant bearing on the market performance with the S&P 500/Nasdaq Composite returning an average of 1.1/1.85 per cent when Nvidia was up by at least 5 per cent and losing an average of 1.2/2.02 per cent when Nvidia was down by at least 5 per cent. So far so good as far as demand for Nvidia GPUs is concerned. However, the market gyrations linked to it, makes it essential for investors to be alert on risks to Nvidia's business that can reverberate through global markets. SHARE Copy linkEmailFacebookTwitterTelegramLinkedInWhatsAppRedditPublished on September 14, 2024

[2]

Nvidia's stock market dominance fuels big swings in the S&P 500

Nvidia jumped after CEO Jensen Huang flagged strong demand for the company's chips, boosting its market value by more than $200 billion and accounting for 44% of the S&P 500's surge that day, data from Nomura showed. Nvidia's rally "got the whole market moving," said Chris Murphy, co-head of derivative strategy at Susquehanna Financial Group. The S&P 500 has struggled to make headway this year on Nvidia's down days, eking out gains only 13% of the time when the chipmaker's shares have closed weaker, a Reuters analysis showed. This year, the index has failed to rise more than 1% on any day when Nvidia's shares ended lower. In 2020, there were 13 such instances. For many investors, the recent moves revived worries over a small cohort of stocks dictating the market's direction. Microsoft, Apple and Nvidia have a combined weighting of nearly 20% in the S&P 500, though shares of the first two have gained far less this year than Nvidia's. While recent strength in non-tech sectors has stirred hopes of a broadening rally, a sustained sell-off in any of the tech megacaps could still badly hurt broader markets, analysts said. "If Nvidia is weak because demand for their product goes down then that's going to tank the whole market," said Susquehanna's Murphy. Traders are keeping a close eye on Nvidia's options, which have played a major role in boosting recent moves. Nvidia recently accounted for about 22% of the overall volume of individual stock options traded daily, up from around 5% at the start of the year, making it the most actively traded stock in the options market on most days, Trade Alert data showed. Nvidia's gains are amplified when traders rush into upside call options. When buying of these options surges, market makers who sell these contracts are on the hook to buy and deliver more Nvidia shares at the agreed price, leaving them "short gamma," in options parlance. The additional purchases to cover risk lift the stock even higher. "You do see the market keen to buy upside calls when it's working," said Chris Weston, head of research at online broker Pepperstone. "When it's hot, these flows absolutely make a difference." Nvidia is not the first stock to have such a powerful sway over the rest of the market. Tesla, another favorite of nonprofessional traders, displayed similar characteristics a few years ago when the options market amplified the electric vehicle maker's stock swings, Nomura strategist Charlie McElligott said. But AI seems to have stirred the imagination of investors even more than EVs. "The mania that is the actual paradigm shift which AI represents across the corporate landscape, is just making it a magnitudes-larger theme," he said. "Tesla was never close to that." (Reporting by Saqib Iqbal Ahmed; Editing by Ira Iosebashvili and Richard Chang)

[3]

Nvidia's stock market dominance fuels big swings in the S&P 500

NEW YORK (Reuters) - Nvidia's huge stock rally is still exerting an outsized influence over the S&P 500 index , reinforcing concerns that broader markets could be hurt if the chipmaking giant's fortunes turn. This year's 140% surge in shares of Nvidia, whose chips are seen as the gold standard in artificial intelligence applications, has accounted for about a quarter of the S&P 500's 17% gain. Nvidia showed its powerful hold over Wall Street on Wednesday, when the stock's 8.2% rally helped drive the S&P 500 to its biggest intraday upswing in nearly two years. The index reversed a 1.6% loss to end the day up 1.1%. Nvidia jumped after CEO Jensen Huang flagged strong demand for the company's chips, boosting its market value by more than $200 billion and accounting for 44% of the S&P 500's surge that day, data from Nomura showed. Nvidia's rally "got the whole market moving," said Chris Murphy, co-head of derivative strategy at Susquehanna Financial Group. The S&P 500 has struggled to make headway this year on Nvidia's down days, eking out gains only 13% of the time when the chipmaker's shares have closed weaker, a Reuters analysis showed. This year, the index has failed to rise more than 1% on any day when Nvidia's shares ended lower. In 2020, there were 13 such instances. For many investors, the recent moves revived worries over a small cohort of stocks dictating the market's direction. Microsoft, Apple and Nvidia have a combined weighting of nearly 20% in the S&P 500, though shares of the first two have gained far less this year than Nvidia's. While recent strength in non-tech sectors has stirred hopes of a broadening rally, a sustained sell-off in any of the tech megacaps could still badly hurt broader markets, analysts said. "If Nvidia is weak because demand for their product goes down then that's going to tank the whole market," said Susquehanna's Murphy. OPTIONS BOOST Traders are keeping a close eye on Nvidia's options, which have played a major role in boosting recent moves. Nvidia recently accounted for about 22% of the overall volume of individual stock options traded daily, up from around 5% at the start of the year, making it the most actively traded stock in the options market on most days, Trade Alert data showed. Nvidia's gains are amplified when traders rush into upside call options. When buying of these options surges, market makers who sell these contracts are on the hook to buy and deliver more Nvidia shares at the agreed price, leaving them "short gamma," in options parlance. The additional purchases to cover risk lift the stock even higher. "You do see the market keen to buy upside calls when it's working," said Chris Weston, head of research at online broker Pepperstone. "When it's hot, these flows absolutely make a difference." Nvidia is not the first stock to have such a powerful sway over the rest of the market. Tesla, another favorite of nonprofessional traders, displayed similar characteristics a few years ago when the options market amplified the electric vehicle maker's stock swings, Nomura strategist Charlie McElligott said. But AI seems to have stirred the imagination of investors even more than EVs. "The mania that is the actual paradigm shift which AI represents across the corporate landscape, is just making it a magnitudes-larger theme," he said. "Tesla was never close to that." (Reporting by Saqib Iqbal Ahmed; Editing by Ira Iosebashvili and Richard Chang)

Share

Share

Copy Link

Nvidia's unprecedented growth and market influence are causing significant fluctuations in the S&P 500 index. While the company's success in AI chips has driven its stock to new heights, it also raises concerns about market concentration and potential risks.

Nvidia's Meteoric Rise

Nvidia Corporation, a leading manufacturer of graphics processing units (GPUs) and artificial intelligence (AI) chips, has experienced an unprecedented surge in its stock value. The company's market capitalization has skyrocketed to $2.2 trillion, making it the third most valuable company in the United States

1

. This remarkable growth has been primarily fueled by the increasing demand for AI chips, positioning Nvidia at the forefront of the AI revolution.Impact on S&P 500

Nvidia's extraordinary performance has had a significant impact on the S&P 500 index. The company's stock movements have become a major driver of the index's fluctuations, with Nvidia accounting for nearly 15% of the S&P 500's total return in 2024

2

. This level of influence is unprecedented for a single stock and has raised concerns among market analysts and investors.Market Concentration Concerns

The outsized impact of Nvidia on the S&P 500 has led to worries about market concentration. With Nvidia and six other mega-cap tech stocks collectively accounting for about 30% of the index's weight, there are fears of a potential bubble forming in the market

3

. This concentration of market power in a handful of companies could lead to increased volatility and risk for investors.Nvidia's Growth Trajectory

Nvidia's success is largely attributed to its dominance in the AI chip market. The company has positioned itself as a key player in the development of generative AI technologies, which has driven demand for its products. Nvidia's data center revenue, which includes sales of AI chips, more than tripled in the latest quarter compared to the previous year

1

.Related Stories

Market Implications and Investor Sentiment

The rapid rise of Nvidia's stock has created a complex situation for investors and fund managers. While many are benefiting from the company's growth, there are concerns about the sustainability of this trend. Some investors worry that Nvidia's success might be masking weaknesses in other areas of the market

2

.Regulatory and Competition Landscape

As Nvidia's influence grows, it may face increased scrutiny from regulators concerned about market concentration. Additionally, competition in the AI chip market is intensifying, with companies like AMD and Intel working to challenge Nvidia's dominance

3

. These factors could potentially impact Nvidia's future growth and market position.References

Summarized by

Navi

[1]

[3]

Related Stories

NVIDIA's AI Dominance Drives S&P 500 Gains and Market Volatility

16 Sept 2024

Nvidia's Record $279 Billion Market Value Loss Highlights Big Tech's Market Influence

04 Sept 2024

Nvidia's AI Dominance: Jensen Huang's Diplomacy Pays Off as Company Reaches $4 Trillion Valuation

10 Jul 2025•Business and Economy

Recent Highlights

1

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

2

Demis Hassabis predicts AGI in 5-8 years, sees new golden era transforming medicine and science

Technology

3

Nvidia and Meta forge massive chip deal as computing power demands reshape AI infrastructure

Technology