Nvidia Shifts to Advanced CoWoS-L Packaging for Next-Gen AI Chips, Impacting TSMC and Supply Chain

6 Sources

6 Sources

[1]

Nvidia transitions to advanced CoWoS-L chip packaging, signaling a major shift for TSMC

Recap: Nvidia CEO Jensen Huang addressed concerns about the company's demand for advanced packaging from TSMC earlier this week, clarifying that while their technological needs are evolving, overall demand remains robust. Specifically, Nvidia is transitioning from CoWoS-S to CoWoS-L, representing a significant advancement in its chip architecture as well as a major shift for TSMC. Speaking on the sidelines of an event hosted by chip supplier Siliconware Precision Industries in Taichung, Taiwan, Huang explained the transition in Nvidia's chip packaging requirements. "As we move into Blackwell, we will use largely CoWoS-L. Of course, we're still manufacturing Hopper, and Hopper will use CoWoS-S. We will also transition the CoWoS-S capacity to CoWoS-L," he stated. Huang emphasized that this shift does not indicate a reduction in capacity but rather an increase in capacity for CoWoS-L technology. "So it's not about reducing capacity. It's actually increasing capacity into CoWoS-L," he said. CoWoS-L (Chip-on-Wafer-on-Substrate with Local Silicon Interconnect) represents a significant advancement over CoWoS-S in terms of performance and efficiency for high-end computing applications like AI and HPC. The main difference between the two lies in the incorporation of Local Silicon Interconnect (LSI) chips for die-to-die connections. This seemingly small change enables a dramatic increase in interconnect density, directly translating into improved bandwidth capabilities. The technology can also potentially support up to 12 HBM3 modules, surpassing the capabilities of CoWoS-S. Huang's comments were in response to recent speculation about Nvidia potentially reducing orders from TSMC. Tech analyst Ming-Chi Kuo had reported at one point that Nvidia was shifting its focus to the newer CoWoS-L technology, which could have implications for suppliers. Additionally, some Taiwanese media outlets suggested that Nvidia was cutting CoWoS-S orders from TSMC, potentially impacting the chip foundry's revenue. These concerns may have some merit. While Nvidia's overall demand from TSMC remains robust, the shift to CoWoS-L is prompting TSMC to adapt its production capabilities. TSMC is expected to double its CoWoS production capacity by 2025, with Nvidia projected to occupy more than half of this capacity. However, Nomura Securities projects that Nvidia's reduction in CoWoS-S orders could lead to a 1% to 2% decrease in TSMC's revenue, and some analysts predict that Nvidia might cut CoWoS-S orders at TSMC by as much as 80%. Meanwhile, other players in Nvidia's supply chain may also feel the effects as demand for CoWoS-S packaging decreases. In the broader context, Nvidia's shift to CoWoS-L is likely to accelerate the adoption of advanced packaging technologies across the semiconductor industry, setting new benchmarks for high-performance AI chips.

[2]

NVIDIA ordering more CoWoS-L advanced packaging from TSMC: ready for more Blackwell AI GPUs

In order for NVIDIA's continued AI GPU dominance it needs advanced packaging -- TSMC is the king of the semiconductor industry, and has the world's bleeding-edge advanced packaging technology -- but NVIDIA needs more, much more. NVIDIA's new Blackwell AI GPUs have multiple chips glued together using a complex chip on wafer on substrate (CoWoS) advanced packaging technology that TSMC makes, with NVIDIA CEO Jensen Huang making some new remarks on needing more CoWoS advanced packaging capacity. Huang said on the sidelines of an event by chip supplier Siliconware Precision Industries in Taiwan's central Taichung city: "As we move into Blackwell, we will use largely CoWoS-L. Of course, we're still manufacturing Hopper, and Hopper will use CowoS-S. We will also transition the CoWoS-S capacity to CoWos-L. So it's not about reducing capacity. It's actually increasing capacity into CoWoS-L". Until now, NVIDIA has relied on using only one style of CoWoS advanced packaging -- CoWoS-S -- but the shift to CoWoS-L is happening. Taiwan media is reporting that NVIDIA was cutting CoWoS-S orders from TSMC, and that it could be a "potential hit" to the TSMC revenue. NVIDIA CEO Jensen Huang added that the amount of advanced packaging capacity was "probably 4 times" the amount available less than two years ago now.

[3]

Nvidia CEO says its advanced packaging technology needs are changing

TAICHUNG, Taiwan, Jan 16 (Reuters) - Nvidia's demand for advanced packaging from TSMC remains strong though the kind of technology it needs is changing, the U.S. AI chip giant's CEO Jensen Huang said on Thursday, after he was asked whether the company was cutting orders. Nvidia's most advanced artificial intelligence (AI) chip, Blackwell, consists of multiple chips glued together using a complex chip on wafer on substrate (CoWoS) advanced packaging technology offered by Taiwan Semiconductor Manufacturing Co (TSMC), Nvidia's main contract chipmaker. "As we move into Blackwell, we will use largely CoWoS-L. Of course, we're still manufacturing Hopper, and Hopper will use CowoS-S. We will also transition the CoWoS-S capacity to CoWos-L," Huang said on the sidelines of an event by chip supplier Siliconware Precision Industries in Taiwan's central Taichung city. "So it's not about reducing capacity. It's actually increasing capacity into CoWoS-L." Hopper refers to Nvidia's GPU architecture platform before it announced Blackwell in March 2024. Nvidia has so far relied mainly on one type of CoWoS technology, CoWoS-S, to combine its AI chips. TF International Securities analyst Ming-Chi Kuo on Wednesday said Nvidia was shifting its focus to a newer type of technology, CoWoS-L, and that suppliers would be affected. In addition, Taiwan media reported that Nvidia was cutting CoWoS-S orders from TSMC in a potential hit to the Taiwanese chip foundry's revenue. Nvidia has been selling its Blackwell chips as quickly as TSMC can make them but packaging has remained a bottleneck due to capacity constraints. Still, Huang said that the amount of advanced packaging capacity was "probably four times" the amount available less than two years ago. He declined to answer questions on the new U.S. export restrictions that limit AI chip exports to most countries except for a select group of close U.S. allies including Taiwan. Huang is also expected to attend Nvidia Taiwan's annual new year party this week in Taipei. Huang, who was born in the southern city of Tainan, Taiwan's historic capital, before emigrating to the United States at the age of nine, is hugely popular in Taiwan with his every move breathlessly followed by local media. Reporting by Wen-Yee Lee in Taichung; Writing by Ben Blanchard and Brenda Goh; Editing by Kate Mayberry Our Standards: The Thomson Reuters Trust Principles., opens new tab Suggested Topics:Technology

[4]

Nvidia CEO says its advanced packaging technology needs are changing

TAICHUNG, Taiwan (Reuters) - Nvidia's demand for advanced packaging from TSMC remains strong though the kind of technology it needs is changing, the U.S. AI chip giant's CEO Jensen Huang said on Thursday, after he was asked whether the company was cutting orders. Nvidia's most advanced artificial intelligence (AI) chip, Blackwell, consists of multiple chips glued together using a complex chip on wafer on substrate (CoWoS) advanced packaging technology offered by Taiwan Semiconductor Manufacturing Co (TSMC), Nvidia's main contract chipmaker. "As we move into Blackwell, we will use largely CoWoS-L. Of course, we're still manufacturing Hopper, and Hopper will use CowoS-S. We will also transition the CoWoS-S capacity to CoWos-L," Huang said on the sidelines of an event by chip supplier Siliconware Precision Industries in Taiwan's central Taichung city. "So it's not about reducing capacity. It's actually increasing capacity into CoWoS-L." Hopper refers to Nvidia's GPU architecture platform before it announced Blackwell in March 2024. Nvidia has so far relied mainly on one type of CoWoS technology, CoWoS-S, to combine its AI chips. TF International Securities analyst Ming-Chi Kuo on Wednesday said Nvidia was shifting its focus to a newer type of technology, CoWoS-L, and that suppliers would be affected. In addition, Taiwan media reported that Nvidia was cutting CoWoS-S orders from TSMC in a potential hit to the Taiwanese chip foundry's revenue. Nvidia has been selling its Blackwell chips as quickly as TSMC can make them but packaging has remained a bottleneck due to capacity constraints. Still, Huang said that the amount of advanced packaging capacity was "probably four times" the amount available less than two years ago. He declined to answer questions on the new U.S. export restrictions that limit AI chip exports to most countries except for a select group of close U.S. allies including Taiwan. Huang is also expected to attend Nvidia Taiwan's annual new year party this week in Taipei. Huang, who was born in the southern city of Tainan, Taiwan's historic capital, before emigrating to the United States at the age of nine, is hugely popular in Taiwan with his every move breathlessly followed by local media. (Reporting by Wen-Yee Lee in Taichung; Writing by Ben Blanchard and Brenda Goh; Editing by Kate Mayberry)

[5]

Nvidia increases demand for TSMC's advanced packaging By Investing.com

Investing.com -- Nvidia (NASDAQ:NVDA), the U.S. AI chip giant, continues to demand advanced packaging from Taiwan Semiconductor Manufacturing Co (TSMC), its main contract chipmaker, although the type of technology it requires is shifting, according to CEO Jensen Huang. Huang's comments came on Thursday in response to questions about potential order cuts from the company. Nvidia's most sophisticated AI chip, named Blackwell, is composed of several chips merged using a complex chip on wafer on substrate (CoWoS) advanced packaging technology provided by TSMC. Huang clarified that as Nvidia transitions into Blackwell, the company will primarily use CoWoS-L, a newer type of technology. However, the production of Hopper, Nvidia's GPU architecture platform preceding Blackwell, will continue using CoWoS-S. Huang noted that this shift in technology is not about reducing capacity but rather increasing capacity into CoWoS-L. Nvidia's focus on CoWoS-L was also confirmed by TF International Securities analyst Ming-Chi Kuo on Wednesday, who suggested that suppliers would be affected by this change. Despite reports from Taiwan media that Nvidia was reducing CoWoS-S orders from TSMC, potentially impacting the Taiwanese chip foundry's revenue, Nvidia's Blackwell chips continue to sell as quickly as TSMC can manufacture them. However, packaging has remained a bottleneck due to capacity constraints. Huang stated that the amount of advanced packaging capacity is approximately four times the amount available less than two years ago. Huang refrained from answering questions about the new U.S. export restrictions limiting AI chip exports to most countries, excluding a select group of close U.S. allies, including Taiwan. In related news, Huang is expected to attend Nvidia Taiwan's annual new year party this week in Taipei.

[6]

Nvidia Continues Strong Demand for Taiwan Semiconductor's Advanced Packaging Despite Technology Shifts - NVIDIA (NASDAQ:NVDA), Taiwan Semiconductor (NYSE:TSM)

TSM plans to double CoWoS production by 2025, with Nvidia expected to occupy over 50% of capacity to meet AI chip demand. Nvidia Corp's NVDA demand for advanced packaging from Taiwan Semiconductor Manufacturing Co TSM remains robust despite its evolving technology requirements, Reuters cites Nvidia chief Jensen Huang in response to its order cut plans. Huang voiced plans to employ Chip-On-Wafer-On-Substrate-L (CoWoS-L) for its Blackwell transition and gradually ramp up capacity into the technology despite depending on CowoS-S for its Hopper artificial intelligence (AI) chip. For context, Nvidia has relied mainly on CoWoS-S to combine its AI chips. Nvidia's Blackwell AI chip leverages Taiwan Semiconductor's CoWoS advanced packaging technology. Also Read: Taiwan Semiconductor Q4 Earnings: 3nm and 5nm Nodes Lead Topline Growth, Expands Margins, Issues Strong Q1 Outlook Recently, TF International Securities analyst Ming-Chi Kuo and the Taiwan media flagged Nvidia's shift to CoWoS-L, which is likely affecting the Taiwanese chipmaker's CowoS-S revenue. Due to capacity constraints, packaging has remained a bottleneck for the Blackwell chips, prompting Nvidia to employ Fan-Out Panel Level Packaging (FOPLP) technology for its GB200 AI server chips. Still, Huang said that the advanced packaging capacity was "probably four times" the amount available less than two years ago. Prior reports indicated Taiwan Semiconductor will likely double its CoWoS production capacity in 2025, with Nvidia likely to occupy over 50% of the capacity. Despite Taiwan Semiconductor's efforts to ramp up production, the demand for advanced packaging continues to exceed supply, prompting it to double its CoWoS production capacity by 2025. Price Actions: At last check on Thursday, NVDA stock was down 1.52% to $134.18. TSM is up 4.99%. Also Read: Microsoft Launches CoreAI Division: Ex-Meta Exec To Supercharge Copilot And AI Innovations Photo via Shutterstock NVDANVIDIA Corp$133.82-1.77%Overview Rating:Good75%Technicals Analysis1000100Financials Analysis600100WatchlistOverviewTSMTaiwan Semiconductor Manufacturing Co Ltd$215.384.15%Market News and Data brought to you by Benzinga APIs

Share

Share

Copy Link

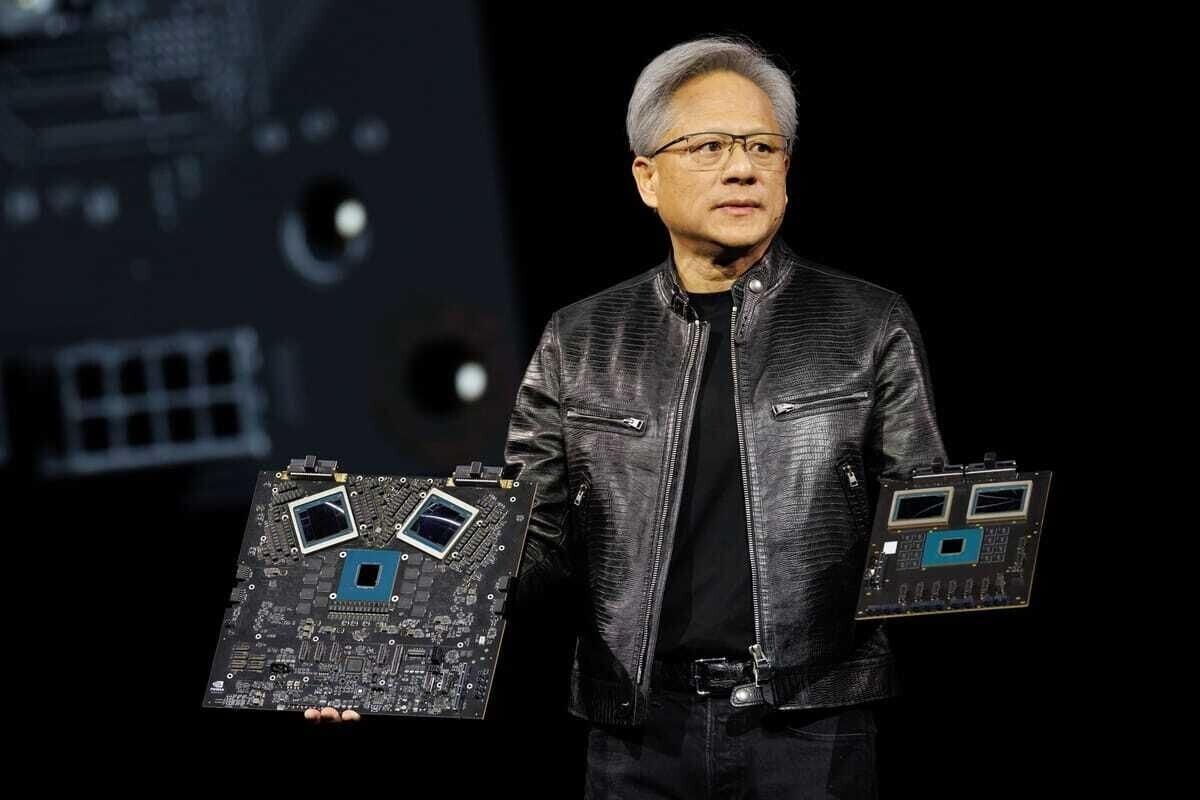

Nvidia CEO Jensen Huang announces a transition from CoWoS-S to CoWoS-L advanced packaging technology for their upcoming Blackwell AI GPUs, signaling increased demand for TSMC's advanced manufacturing capabilities and potential impacts on the semiconductor supply chain.

Nvidia's Shift to Advanced Packaging Technology

Nvidia, the leading AI chip manufacturer, is transitioning to a more advanced packaging technology for its next-generation AI GPUs. CEO Jensen Huang announced that the company will primarily use CoWoS-L (Chip-on-Wafer-on-Substrate with Local Silicon Interconnect) for its upcoming Blackwell architecture, moving away from the current CoWoS-S technology used in its Hopper GPUs

1

2

.Understanding CoWoS-L Technology

CoWoS-L represents a significant advancement over CoWoS-S in terms of performance and efficiency for high-end computing applications like AI and HPC. The main difference lies in the incorporation of Local Silicon Interconnect (LSI) chips for die-to-die connections, enabling a dramatic increase in interconnect density and improved bandwidth capabilities

1

.Impact on TSMC and Supply Chain

This transition has implications for Taiwan Semiconductor Manufacturing Co (TSMC), Nvidia's primary contract chipmaker, and the broader semiconductor supply chain:

-

Increased Demand: Nvidia's demand for advanced packaging from TSMC remains strong, with Huang stating that the amount of advanced packaging capacity is "probably 4 times" what was available less than two years ago

3

4

. -

Production Shift: TSMC will need to adapt its production capabilities to meet the demand for CoWoS-L technology

1

. -

Potential Revenue Impact: Some analysts project that Nvidia's reduction in CoWoS-S orders could lead to a 1% to 2% decrease in TSMC's revenue

1

. -

Supply Chain Adjustments: Other players in Nvidia's supply chain may feel the effects as demand for CoWoS-S packaging decreases

1

.

Related Stories

Nvidia's Strategy and Market Position

Nvidia's move to CoWoS-L is part of its strategy to maintain its dominance in the AI chip market:

-

Capacity Increase: Huang emphasized that this shift is not about reducing capacity but increasing capacity for CoWoS-L technology

2

3

. -

Meeting Demand: Nvidia has been selling its Blackwell chips as quickly as TSMC can make them, although packaging has remained a bottleneck due to capacity constraints

4

. -

Future Projections: TSMC is expected to double its CoWoS production capacity by 2025, with Nvidia projected to occupy more than half of this capacity

1

.

Industry Implications

The shift to CoWoS-L is likely to have broader implications for the semiconductor industry:

-

Technology Adoption: Nvidia's move may accelerate the adoption of advanced packaging technologies across the industry, setting new benchmarks for high-performance AI chips

1

. -

Competition: Other chip manufacturers may need to follow suit to remain competitive in the high-performance computing and AI markets.

-

Export Restrictions: The transition comes amid new U.S. export restrictions limiting AI chip exports to most countries except for a select group of close U.S. allies, including Taiwan

4

5

.

As Nvidia continues to push the boundaries of AI chip technology, its strategic decisions, like the shift to CoWoS-L, will likely have far-reaching effects on the global semiconductor industry and the future of AI computing.

References

Summarized by

Navi

[2]

[4]

Related Stories

TSMC Advances Chip Packaging Technology to Boost AI Performance by 2027

16 Apr 2025•Technology

Nvidia CEO warns TSMC must double capacity as AI demand threatens to overwhelm chip supply

01 Feb 2026•Business and Economy

NVIDIA CEO Jensen Huang Secures 50% Production Boost from TSMC Amid Soaring AI Chip Demand

09 Nov 2025•Business and Economy

Recent Highlights

1

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

2

Demis Hassabis predicts AGI in 5-8 years, sees new golden era transforming medicine and science

Technology

3

Nvidia and Meta forge massive chip deal as computing power demands reshape AI infrastructure

Technology