Samsung Delays HBM4 Production to 2026 Amid Yield Challenges, as SK Hynix Strengthens AI Memory Lead

2 Sources

2 Sources

[1]

Samsung delays HBM4 rollout to 2026 due to yield challenges, all while SK Hynix strengthens lead in AI memory

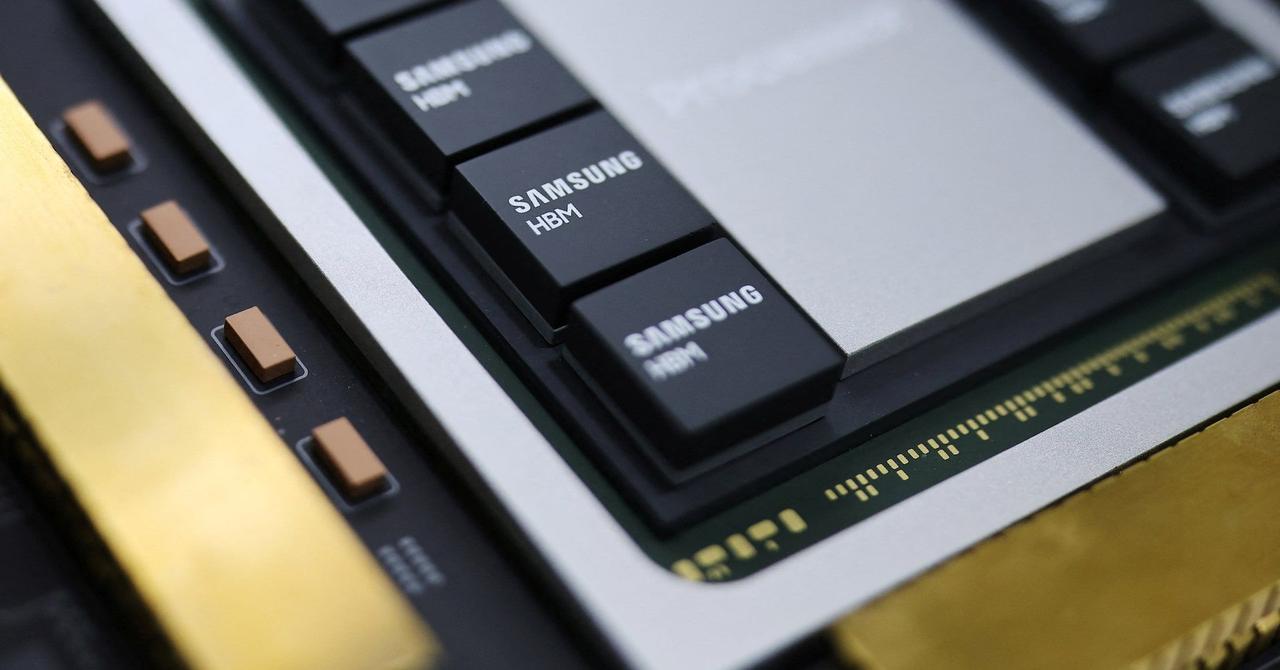

Samsung Electronics is reportedly pushing back the mass production of its next-gen high-bandwidth memory (HBM) chips to 2026, signaling a more cautious rollout amid ongoing DRAM redesign efforts. The company originally planned to start mass production of its 12-high HBM4 modules, which are based on 10nm-class sixth-generation 1c DRAM, in the second half of 2025. However, according to sources reported by the South Korean publication Deal Site, Samsung intends to deliver early samples to key customers in the third quarter of 2025, with full production readiness anticipated in the fourth quarter. The delay comes as Samsung works to improve the performance and yield of its redesigned 1c DRAM chips. Internal testing is reportedly showing progress, with limited wafer runs reaching yield rates of around 65% as of early July. These samples, however, were not specifically designed for HBM applications, and actual yields in mass production may vary. Two strategies for revising 1c DRAM Typically, memory makers develop DRAM chips for computing use first before adapting the technology to mobile or HBM products. Samsung previously reiterated during its first-quarter earnings call that HBM4 development remains aligned with customer roadmaps, targeting mass production in late 2025. Yet the latest internal signals indicate a likely shift to 2026. Despite the delay, Samsung's redesigned 1c DRAM appears to be making progress. According to industry sources, the company is pursuing two strategies to revise the 1c DRAM: one involves modifying previous 1a and 1b designs, while the other entails a complete redesign to create a new generation of chips. The full redesign, which results in larger chip sizes, has achieved higher production yields but incurs increased costs due to greater wafer usage and development efforts. The success of Samsung's HBM4 hinges on whether it can sustain the yield rates achieved during pilot runs through to mass production. Additional testing phases remain, and PRA clearance is not a definitive indicator of success, insiders warn. Yield challenges often surface during full-scale ramp-ups, and stabilizing both output and quality will require further time. SK Hynix posts record Q2 earnings SK Hynix reported record quarterly results on July 24, driven by strong demand for HBM and AI-related memory products. The company's operating profit for the second quarter increased 68% year-over-year to KRW9.21 trillion (approx. US$6.70 billion), while sales rose 35% to KRW22.23 trillion (approx. US$16.16 billion). Net income reached KRW6.99 trillion (approx. US$5.08 billion). HBM and related DRAM products represented 77% of total revenue, contributing to the memory division's strongest performance to date. SK Hynix reported operating profit figures that significantly exceed Samsung Electronics' preliminary group operating profit of KRW4.6 trillion (approx. US$3.34 billion) for the same timeframe. The company's operating margin rose to 41%, while its cash reserves grew to KRW17 trillion (approx. US$12.36 billion). Additionally, net debt decreased by KRW4.1 trillion (approx. US$2.98 billion) compared to the previous quarter. SK Hynix rides AI wave with bold HBM expansion SK Hynix is betting big on the AI boom to power continued growth through the second half of 2025. The South Korean chipmaker expects robust demand to persist, fueled by large-scale AI model training, sovereign AI projects, and new product launches. SK Hynix intends to double its sales of HBM in 2025, propelled by strong demand for its HBM3E chips, which have entered mass production. The company is also preparing for the next generation, HBM4, aiming for a commercial launch in 2026 after distributing early samples in March. In addition to HBM, SK Hynix plans to start shipments of LPDDR-based server modules later this year and to broaden its GDDR7 product lineup for AI graphics cards with the introduction of a new 24Gb chip. On the NAND memory front, the company will maintain a cautious investment approach, prioritizing profitability and the expansion of QLC-based enterprise solid-state drives (SSDs). SK Hynix has confirmed that its M15X fabrication facility is scheduled to open in the fourth quarter as planned, with production, including HBM, expected to commence next year. The Yongin Cluster 1 fabrication plant is projected to be completed by the second quarter of 2027. The company also indicated that its capex for 2025 is anticipated to exceed earlier forecasts.

[2]

Samsung's next-gen 1c DRAM test yields for its HBM4 rumored at 65%, delayed until 2026

TL;DR: Samsung has delayed mass production of its next-gen HBM4 memory with redesigned 1c DRAM to 2026, aiming for improved yields and performance. Despite increased costs and challenges, the 65% sample yield signals progress in competing with SK hynix and Micron in the AI memory market. Stable mass production remains a key focus. One of the key parts in Samsung returning to competitiveness in the HBM market lies with its new 1c DRAM, which will be an integral part of its next-gen HBM4 memory ready to fight SK hynix and Micron in the AI battle of 2026 with HBM4. In a new report from TheElec picked up by insider @Jukanrosleve on X, we're hearing that Samsung has delayed its 12-stack HBM4 memory based on its new 1c DRAM until 2026. Samsung had originally aimed for mass production in the second half of this year, but it is being more cautious with its HBM4 rollout, setting a new target for Production Readiness Approval (PRA) in Q4 2025. Samsung redesigned its 1c DRAM process, with performance improvements and yields that have reportedly reached 65%, with a source familiar with the matter adding: "the company has internally set the goal for HBM4 12-stack PRA in Q4. This means mass production is now targeting next year, not this year. Based on small-scale sample tests conducted at the R&D fab, the 1c DRAM yield recorded 65%, which is a hopeful situation. The new 65% yields are from recent 1c DRAM sample production tests that Samsung planned for this month, while mass production yields will change over time, so it's expected that Samsung will aim for a higher sample product yield before entering mass production. Samsung is expected to deliver mass production of its new HBM4 memory samples to key customers in the next few months. Samsung Electronics emphasized during its recent Q1 2025 earnings conference call: "For HBM4, we are developing it with the goal of mass production in the second half, as planned, to align with customer project schedules". Even with this delay, the industry sees this as a positive move for Samsung's next-gen HBM4 memory, with the positive direction in which its 1c DRAM redesign process in two ways. One of those involved newly developing 1c through similar designs of 1a and 1b, while the other involved redesigning both 1c and 1b to implement a completely new 1c. The latter approach is the method that reportedly won, with Samsung attempting both simultaneously, with analysis suggesting the by redesigning 1a and 1c, the chip size of the new 1c DRAM was increased, leading to yield improvements. Meanwhile, the increased scope of redesigning naturally led to increased costs. Another industry source commented: "the mere act of redesigning both 1c and 1b incurred enormous costs, and the number of chips that can be produced also decreased, leading to reduced margins". One of the main challenges for Samsung is whether it can maintain the yield achievements of its new 1c DRAM that it has seen during its sample test during mass production. Samsung still needs to perform additional tests to apply the newly developed 1c DRAM to the mass production stage. TheElec's source continued: "interpreting PRA passage as securing victory is an overstatement. Yield issues arise when moving into the mass production stage, it will still take time to stably secure yield alongside increasing HBM4 production".

Share

Share

Copy Link

Samsung pushes back mass production of next-gen HBM4 memory chips to 2026, while SK Hynix reports record earnings driven by AI-related memory demand. The delay highlights the intense competition in the AI chip market.

Samsung's HBM4 Production Delay

Samsung Electronics has announced a delay in the mass production of its next-generation high-bandwidth memory (HBM) chips, pushing the timeline to 2026. This decision comes as the company grapples with yield challenges in its DRAM redesign efforts. Initially planned for the second half of 2025, the production of 12-high HBM4 modules based on 10nm-class sixth-generation 1c DRAM has been postponed

1

.

Source: TweakTown

The company now aims to deliver early samples to key customers in the third quarter of 2025, with full production readiness anticipated in the fourth quarter. Internal testing has shown progress, with limited wafer runs reaching yield rates of around 65% as of early July

2

.Samsung's DRAM Redesign Strategies

Samsung is pursuing two strategies to revise its 1c DRAM:

- Modifying previous 1a and 1b designs

- Complete redesign for a new generation of chips

The full redesign approach, resulting in larger chip sizes, has achieved higher production yields but incurs increased costs due to greater wafer usage and development efforts

1

.SK Hynix's Strong Performance

In contrast to Samsung's challenges, SK Hynix reported record quarterly results on July 24, driven by strong demand for HBM and AI-related memory products. The company's Q2 2025 financial highlights include:

- Operating profit: KRW9.21 trillion (US$6.70 billion), up 68% year-over-year

- Sales: KRW22.23 trillion (US$16.16 billion), up 35%

- Net income: KRW6.99 trillion (US$5.08 billion)

- HBM and related DRAM products: 77% of total revenue

1

Related Stories

SK Hynix's AI-Driven Expansion

SK Hynix is capitalizing on the AI boom to fuel continued growth through the second half of 2025. The company's strategic moves include:

- Doubling HBM sales in 2025

- Mass production of HBM3E chips

Source: DIGITIMES

- Preparing for HBM4 commercial launch in 2026

- Introducing LPDDR-based server modules and expanding GDDR7 product lineup

- Cautious investment in NAND memory, focusing on profitability and QLC-based enterprise SSDs

1

Implications for the AI Memory Market

The contrasting fortunes of Samsung and SK Hynix highlight the intense competition in the AI chip market. Samsung's delay in HBM4 production could potentially impact its market position, while SK Hynix's strong performance and aggressive expansion plans position it favorably in the rapidly growing AI memory sector.

As both companies invest heavily in next-generation memory technologies, the race to meet the increasing demand for high-performance AI chips is likely to intensify. The success of these efforts will play a crucial role in shaping the future of AI hardware and could have significant implications for the broader tech industry.

References

Summarized by

Navi

[1]

Related Stories

Next-Gen HBM Memory Race Heats Up: SK Hynix and Micron Prepare for HBM3E and HBM4 Production

22 Dec 2024•Technology

Samsung and SK hynix Unveil Next-Gen HBM4 Memory, Intensifying AI Chip Competition

22 Oct 2025•Technology

Samsung gains ground in HBM4 race as Nvidia production ignites AI memory battle with SK Hynix, Micron

02 Jan 2026•Technology

Recent Highlights

1

Pentagon threatens to cut Anthropic's $200M contract over AI safety restrictions in military ops

Policy and Regulation

2

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

3

OpenAI closes in on $100 billion funding round with $850 billion valuation as spending plans shift

Business and Economy