SK hynix commits $10 billion to new U.S. AI solutions company as record profits surge on memory boom

15 Sources

15 Sources

[1]

SK hynix invests $10 billion in creating a U.S.-based 'AI solutions' company -- company to restructure California-based Solidigm enterprise SSD brand to bolster American investments

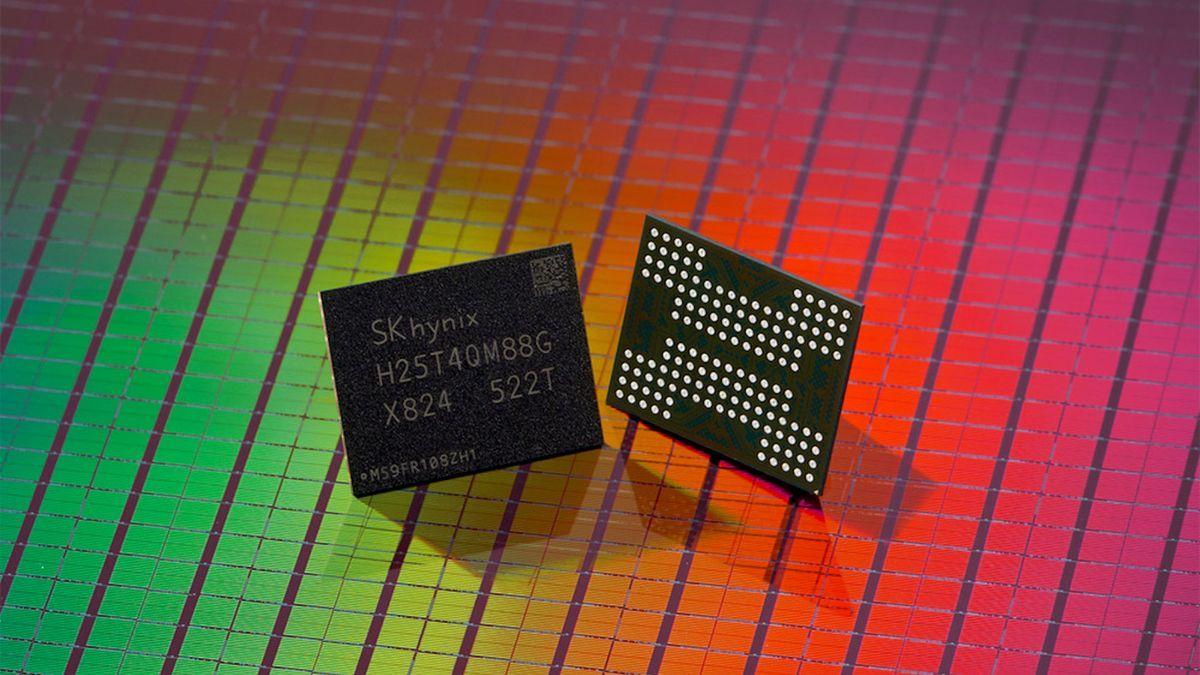

Solidigm brand to be spun off into a new subsidiary in the process Memory chip giant SK Hynix is investing $10 billion in a new AI solutions company in the U.S, tentatively named AI Company. The new firm will have full access to this new investment and will be able to deploy it as it sees fit to promote the AI industry, bolster new AI startups and developments, and encourage its own strength and competitiveness in memory chip development, the company detailed in a press release. Such investment could even mean granting easier access to key SK Hynix technologies, like High Bandwidth Memory (HBM). "Leveraging its unparalleled chip technologies, such as HBM, the memory chipmaker will try to play a pivotal role in delivering optimized AI systems for its customers in the AI datacenter sector," SK Hynix said in a statement. "The company will also continue making strategic investments in and collaborating with AI firms to strengthen its competitiveness in memory chips and provide a range of AI datacenter solutions." The new firm will be established by restructuring the California-based SSD manufacturing subsidiary, SK hynix NAND Product Solutions Corp, also known as Solidigm. It will retain its name under AI Company, but the new parent company will serve as its AI investment arm moving forward. Following Nvidia's lead One of the starkest stories of the past year in technology has been the sheer scale of investments in AI. Alongside the hundreds of billions in investment for data center projects, we've also seen Nvidia leveraging its vast stockpiles of cash to prop up other companies that are key to its ambitions for the AI industry and its ability to supply the hardware for it. Nvidia invested heavily in OpenAI, in Intel, in CoreWeave, and in a range of European companies, too. It announced $1.5 in Nscale, $600 million in Quantinuum, $300 million in Black Forest Labs, $100 million in CuspAI, $20 million in PhysicsX - and the list goes on. Although SK hynix can't quite offer the levels of investment Nvidia is throwing around, the AI Company certainly sounds like that kind of investment vehicle. If SK hynix can help build up a range of companies developing AI software and hardware, it may encourage the industry as a whole to keep growing, ensuring that it has more customers for its memory products for years to come. That kind of industry confidence could allow it to build up its own fabrication production without risking that capacity being wasted down the line if there's an AI industry contraction or bubble-bursting effect. A signal to Washington Alongside making the foundations of its own business dominance firmer with targeted investment, SK hynix's new AI Company is also a very public signal to the Trump Administration that it is investing in American companies. President Trump recently floated the idea of applying 100% tariffs to memory companies if they didn't fabricate their chips in the U.S. While such an idea would effectively cripple the American tech industry by eliminating its access to cutting-edge memory, the industry has nonetheless responded. Micron recently broke ground on a new fabrication facility in New York, with plans for it to produce some of the most cutting-edge memory products in America - and a huge portion of it by 2040. For its part, Samsung has been keen to highlight that it does already operate a semiconductor plant in Taylor, Texas, though whether that's enough to hold off any punitive actions from the government remains to be seen. It's not a NAND Flash fab, which is what the Trump Administration seems most keen on bringing to U.S. shores. SK hynix is building an advanced packaging facility in West Lafayette, Indiana, but doesn't actually fabricate memory in the U.S. It's quite possible that this latest AI investment initiative may be a way to claim that it plans to produce memory inside America, or at least to cement its interest in American investment. If either Samsung or SK hynix were to be hit with trade restrictions, but Micron was exempt, the effect on the memory industry would be dramatic to say the least. Bolstering sustained growth SK hynix may well find it easy to find new investment opportunities for its AI Company once it's established. It said in its announcement that it will leverage its "unparalleled chip technologies, such as HBM," to help it deliver "optimized AI systems for its customers." That sounds an awful lot like gaining SK hynix investment could give a faster pipeline to access the latest HBM technologies. In an environment where critical components and material shortages are bottlenecks to AI growth, having the backing of one of only three key memory producers in the world could be hugely beneficial. SK hynix is making hay while the sun shines, too. It just posted forecast-beating profits in the recent quarter, increasing 137% year on year. That's off the back of similarly impressive results this time last year, too. It's using this new financial muscle to invest $13 billion in a new chip packaging plant in South Korea. This latest $10 billion AI Company fund is just one more example of that. Like Nvidia and many other top tech companies, SK hynix is investing in the future of AI to give its current trajectory as long a tail as possible before any eventual contraction curtails it.

[2]

Flush with cash, SK hynix spawns mysteriously named 'AI Co.'

Memory boom funds $10B punt on 'solutions' outfit that's still light on details SK hynix is surfing the AI hype wave by setting up what it nebulously describes as a solutions biz to further exploit the hysteria. The chipmaker is already flying high on the back of booming demand for datacenters. Its share price has quadrupled in the past year as it supplies a vital component, one now in tight supply. Judging by its financials published today, the AI gravy train isn't slowing. The Korean corp is launching a new subsidiary in February, referred to only as "AI Company" (AI Co.) at this point. It aims to become "a key partner" in the AI datacenter ecosystem to "proactively seize opportunities." The market is now seeing demand for integrated AI solutions that combine hardware, software, and services rather than just standalone products, SK says. The Register asked for more information, but a spokesperson told us: "AI Co. aims to serve as an optimized AI solutions provider for various industries by investing in the AI datacenter ecosystem." The plan is to focus first on software for AI system optimization, then gradually expand investments within the datacenter arena, we're told. Investment in other companies and technologies is also part of the circular AI economy. SK hynix says that "solutions commercialization" is one of the proposed business activities too. SK hynix says it is committing $10 billion to starting the new operation. An interim management team and a board of directors will be named next month. It will establish the biz by restructuring Solidigm, the existing California-based SSD subsidiary. Solidigm will change its name to AI Co. before transferring SSD manufacturing operations to a new subsidiary named Solidigm Inc. One of the aims seems to be to continue promoting the "chip technologies such as HBM" that have helped propel SK hynix into the AI hype cycle. Memory demand is "materially outpacing supply," according to analysts at IDC, with chipmakers reallocating production capacity to favor components for servers and GPUs rather than consumer devices as prices rise across the board. The effect of the memory crisis can be seen in the Korean company's latest financial results, with revenue for 2025 up 47 percent to ₩97.14 trillion ($67.9 billion) and Q4 revenue up 66 percent on a year ago to ₩32.8 trillion ($22.9 billion) It's also good news for Netherlands tech giant ASML, which develops photolithography machines needed for chip production. Its calendar Q4 revenue of €9.7 billion ($11.6 billion) came in toward the higher end of previous forecasts, but the firm expects demand for its most advanced extreme ultraviolet (EUV) systems to increase significantly this year. None of this, however, seems to be good news for end users who face paying significantly more for anything that incorporates memory, including PCs and smartphones as well as servers and GPUs. Analysts predict that PC shipments will fall this year simply because there won't be enough memory chips to go round and prices will jump as a result. ®

[3]

South Korea's SK Hynix to establish a special 'AI Company' in the U.S.

South Korean memory giant SK Hynix announced Wednesday that it will set up a new U.S.-based company focused on artificial intelligence solutions, committing at least $10 billion as it seizes on new AI growth engines. The new U.S. entity, tentatively named "AI Company or AI Co.," will serve as a hub for SK Group's AI strategies and work to accelerate the technology in global markets, the company said. SK Hynix has emerged as a major AI player in recent years due to its leadership in high-bandwidth memory (HBM) chips, a type of memory used in AI chipsets like those from Nvidia. The company's U.S. expansion comes as other tech giants intensify investments in AI, driving intense demand for memory chips. SK Hynix said that it will create the new "AI Company" by restructuring its California-based subsidiary Solidigm, an enterprise solid-state drive (SSD) manufacturer created in 2021. Solidigm's operations will then be transferred to a new entity named Solidigm Inc. The planned investments in AI Co. are expected to be deployed on a capital-call basis, with plans for further strategic investments in American AI firms to boost synergies across SK Group affiliates.

[4]

SK Hynix smashes earnings estimates as AI memory demand drives record profit

South Korea's SK Hynix on Wednesday posted record quarterly revenue and profit, boosted by surging memory prices and demand from generative AI chipsets, as it battles rival Samsung for the status as the world's top memory producer. Here are the company's results versus LSEG SmartEstimates, which are weighted toward forecasts from analysts who are more consistently accurate: * Revenue: 32.827 trillion won ($23 billion) vs. 32.132 trillion won expected * Operating profit: 19.17 trillion won vs. 17.729 trillion won expected Revenue rose about 66% in the December quarter compared with the same period a year earlier, while operating profit surged 137% over the same period. SK Hynix makes memory chips used to store data, which are found in everything from servers to consumer devices such as smartphones and laptops. The company has benefited from a boom in artificial intelligence as a key supplier of high-bandwidth memory, or HBM chips, used to power AI data center servers. HBM falls into the broader category of dynamic random access memory, or DRAM -- a type of semiconductor memory used to store data and program code that can be found in PCs, workstations and servers. "HBM revenue more than doubled year-on-year, making a significant contribution to the company's record performance [last year]," it said in its earnings report. Demand for HBM has far outpaced what memory makers have been able to supply, with the impacts on manufacturers' capacity also triggering shortages for less advanced memory chips used in consumer electronics and EVs. As a result of this environment, memory prices have been surging, with shortages expected to last into next year as companies like SK Hynix wait for more capacity expansions to come online. SK Hynix also announced on Wednesday plans to cancel treasury shares worth 12.24 trillion won, a move aimed at boosting shareholder value. The announcement followed a surge in the memory maker's share price on Tuesday after local media reported that it had become the exclusive supplier of advanced memory chips for a new AI processor developed by Microsoft. SK Hynix will hold an earnings call with investors on Thursday. Samsung, SK Hynix's leading competitor in the memory market, including HBM, is also set to report earnings today.

[5]

Memory chip specialist SK Hynix reports record-breaking profits but doesn't have a word to say about almost anything apart from AI

2025 was a bumper year for Korean memory specialist SK Hynix. In fact, the latest financial results show it was the company's best year ever. Do I even have to explain why? OK, it's AI, of course. But first, the bald numbers. SK Hynix raked in 97 trillion KRW in revenues in 2025. That's about $67 billion dollars in old money. Profits, meanwhile, hit $33 billion, giving the company stellar operating margins of 49%. Compared to 2024, revenues climbed by 47%. However, profits slightly more than doubled. Long story short, SK Hynix didn't just sell more stuff. It made more money on every sale. This does not exactly come as a surprise. The prices of pretty much all memory-related products have been spiralling upwards of late. But the cost of producing memory products has surely not increased as much. The result, pretty obviously from SK Hynix's published results, is that a lot more money is being made on each memory chip. So, apart from the obvious upside for SK Hynix's shareholders, is there any good news here? The company did talk about the investments it is making in production capacity. "Having successfully completed the preparation stages to mass produce HBM4 - for the first time in the industry - in September last year, the large-scale production of the next-generation HBM has been underway to meet customer requests," SK Hynix said. Of course, HBM is really only relevant for servers and AI farms, so what about regular old DRAM as used in PCs? "For conventional DRAM, SK Hynix intends to accelerate the transition to the 1 cnm process [that's essentially a 10nm class node], expanding its AI memory product portfolio to include solutions like SOCAMM2 and GDDR7," it said. Again, that's mostly an AI and enterprise message, albeit Nvidia uses GDDR7 for gaming graphics cards. As for NAND flash memory for SSD, SK Hynix says it, "plans to maximize product competitiveness by transitioning to 321-layer technology, while actively addressing AI data center storage demand by leveraging Solidigm's QLC eSSD." Yet again, it's AI, AI, AI. Indeed, the final sentiment in SK Hynix's press release covering the financial results pretty much says it all: "We will strengthen our role not merely as a product supplier, but as a core infrastructure partner in the AI era, enabling customers to meet their AI performance requirements." In other words, not a word about consumer computing platforms, including the PC. That really doesn't bode at all well. Incidentally, if you're wondering what SK Hynix is going to do with all that cash, it also announced a roughly $700 million special dividend for shareholders, which works out to about $1 per share. Add to that the regular quarterly dividend that's also being paid and the year-end payout amounts to $1.45 billion or about $1.30 per share. In a word, kerching!

[6]

SKorean chip giant SK hynix posts record operating profit for 2025

Seoul (AFP) - South Korean chip giant SK hynix said on Wednesday its operating profit doubled last year to a record high after a surge in global demand for technology powering artificial intelligence. SK hynix and rival Samsung are among the world's leading producers of memory chips, supplying high‑performance components that are essential for AI products and the data centres powering the fast‑evolving sector. It said in a statement that "2025 marked a year in which the company once again demonstrated its world-class technological leadership". The firm said its operating profit soared 101 percent to 47.2 trillion won ($33 billion) last year. Net profit came to 42.9 trillion won last year, up 117 percent from 2024. Sales for 2025 stood at 97.1 trillion won, up 47 percent from the previous year. The AI boom has pushed up prices and shipments of conventional NAND and DRAM memory semiconductors, while demand for high‑bandwidth memory (HBM) chips, used in AI servers, has soared. That has helped SK hynix's shares surge around 220 percent over the past six months. Fourth-quarter net profit came to 15.24 trillion won, a 90.4 percent year-on-year increase. SK hynix "plans to further strengthen its proven quality, technological leadership and mass-production capabilities", by "stably supplying both HBM3E and HBM4" chips. The company also said it plans to set up an "AI solutions firm" in the United States, committing $10 billion, and is weighing investments in innovative US companies. AI power TrendForce memory analyst Ellie Wang said HBM chips were essential for advanced processors used in AI systems. "For Samsung and SK hynix, while AI has driven a meaningful increase in memory demand, the technical barriers for HBM have also risen," she told AFP. "How capacity is allocated across different products has become an increasingly critical issue" for the companies, she said, adding that current memory chip "supply tightness is partly due to suppliers concentrating production lines on HBM". The huge demand for memory chips in AI systems has caused a shortage for those used in consumer electronics -- threatening higher prices for phones, laptops and other devices. "As HBM's share of total production continues to rise, supply shortages are difficult to alleviate," Wang said. TrendForce predicts that memory chip industry revenue will surge to a global peak of more than $840 billion in 2027. South Korea has said it will triple spending on artificial intelligence this year, aiming to join the United States and China as one of the top three AI powers.

[7]

SK hynix will establish US arm that is specialized in AI solutions tentatively named AI Company

TL;DR: SK hynix plans to launch a US-based AI solutions firm, "The AI Company," backed by $10 billion to enhance AI data center offerings. Leveraging advanced memory chip technologies like HBM, it aims to strengthen competitiveness and collaborate globally, securing growth opportunities in the expanding AI memory market. SK hynix has just announced plans to establish a US-based "AI solutions" firm that will be called "The AI Company" that will look for opportunities in the future of data center clients in the US. The company will continue making strategic investments in and working with AI companies to strengthen their competitiveness in memory chips, while providing a range of AI data center solutions. SK hynix hasn't provided many concrete details about its US-based "AI Company" but the South Korean memory giant has $10 billion USD ready to fund its AI Company operations. SK hynix said in its press release that it's: "leveraging its unparalleled chip technologies, such as HBM, the memory chipmaker will try to play a pivotal role in delivering optimized AI systems for its customers in the AI data center sector. The company will also continue making strategic investments in and collaborating with AI firms to strengthen its competitiveness in memory chips and provide a range of AI data center solutions".

[8]

SK Hynix posts record quarterly profit on huge AI demand, trounces expectations

South Korea's SK Hynix said on Wednesday that quarterly profit more than doubled to a record, comfortably beating forecasts on relentless demand for artificial intelligence that has lifted prices for both advanced and conventional memory chips. The Nvidia supplier logged a 137% surge in operating profit to 19.2 trillion won ($13.5 billion) for the fourth quarter, according to Reuters calculations. That compared with 8.1 trillion won a year earlier and a 17.7 trillion won consensus prediction from LSEG SmartEstimate, which is weighted toward analysts with a more consistent track record. SK Hynix will hold a briefing on its fourth-quarter earnings results on Thursday. SK Hynix has managed to carve out an enviable lead in high bandwidth memory (HBM) used in artificial intelligence chipsets designed by the likes of Nvidia, commanding a 61% share of the HBM market, according to Macquarie Equity Research. It is also benefiting as tight supply and rising AI demand push up prices for commodity DRAM and NAND chips used in servers, personal computers and mobile devices. For example, contract prices for 16 gigabyte DDR5, a popular type of DRAM chip, more than quadrupled last quarter from a year earlier, according to market tracker TrendForce. TrendForce expects conventional DRAM contract prices to rise a further 55% to 60% in the current quarter from the previous one.

[9]

SK Hynix Plans to Establish a Dedicated US-Focused Wing, Ironically Called the "AI Company," to Capitalize on Memory Demand

SK hynix, the Korean memory giant, now plans to establish a U.S. "AI solutions" firm, interestingly called "The AI Company", intending to take DC opportunities to new heights. SK Hynix's New Venture Plans to Reap More Profits From the DRAM Frenzy, By Directly Addressing US Clientele Demand The ongoing DRAM supercycle has brought massive opportunities for the likes of Samsung and SK hynix, and now they are looking to build on the demand for DRAM products. Apart from the extensive DRAM price hike, SK hynix has also decided to establish a dedicated wing in the US, planning to find "new growth engines". It appears that the Korean giant is looking to expand the revenue frontier it has opened, from DRAM to the entire AI supply chain. The company will also continue making strategic investments in and collaborating with AI firms to strengthen its competitiveness in memory chips and provide a range of AI datacenter solutions. The planned establishment of AI Co. is aimed at securing opportunities in the emerging AI era. The company will continue to work closely with global partners while proactively creating value for customers - SK hynix SK hynix's details on the new venture aren't as detailed, aside from the fact that the Korean giant is looking to compete with US companies in AI buildout. To stand out, the AI Company also looks to "invest in innovative companies," but, yet again, no names have been disclosed. This new firm will replace the NAND business, Solidigm, which shut down a few months ago, as AI became a priority over all other business ventures. Initially, SK hynix will commit a total of $10 billion to the AI Co. There had been rumors a few weeks ago that SK hynix was looking toward a US IPO, and it seems the new division might be a replacement for that move. By creating a dedicated wing, the Korean giant aims to directly address US customers, potentially competing with the likes of Micron in its home market. But for now, execution will determine how the "AI Company" will pan out, and we could expect new fab projects, collaborations with US manufacturers, and efforts to establish a presence early on. Follow Wccftech on Google to get more of our news coverage in your feeds.

[10]

SK hynix's profit surges on AI memory demand; to form AI firm in US

SK hynix (HXSC.F) reported record revenue and operating profit for the fourth quarter of 2025 as the rapid development of AI infrastructure boosted demand for memory chips. The South Korean company's fourth quarter operating profit surged 137% year-over-year to 19.17T won. The SK hynix reported record revenue and profits as rapid AI infrastructure development increased demand for memory chips, especially high-bandwidth memory (HBM) and server DRAM. In the fourth quarter, SK hynix achieved record-high revenue (32.83T won) and operating profit (19.17T won). For the full year, revenue was 97.15T won and operating profit reached 47.21T won. The company will pay a total year-end dividend of 3,000 won per share (2.1T won total) and will cancel about 15.3M treasury shares worth 12.2T won. SK hynix will launch an AI solutions firm (AI Co.) in the U.S., committing $10B, restructuring its subsidiary Solidigm, and seeking further investments and partnerships to strengthen its AI datacenter solutions and memory chip leadership.

[11]

SK hynix's US unit plan raises concerns over hollowing out affiliates' AI ambition - The Korea Times

AI Co. set to enable agile investment, improve Solidigm valuation SK hynix's plan to set up an artificial intelligence (AI) solutions firm in the United States is raising questions about how other SK Group units' AI-related businesses will proceed, as the upcoming company, tentatively named AI Co., aims to become the group's hub for AI data center solutions. Currently, SK Telecom, SK Square and a number of other SK Group companies are pursuing separate ventures in the AI data center sector, as well as AI-related investment activities. Once AI Co. is established, however, concerns are growing that their strategic and investment functions could be centralized under the new entity, leaving existing units focused mainly on downstream services. SK hynix announced its plan to set up AI Co. last week, describing the new entity as a company that will strengthen SK hynix's memory competitiveness while providing comprehensive solutions across the AI data center sector. To support the plan, SK hynix has committed $10 billion in capital, which will be held as a reserve and injected into AI Co. when there are suitable investment opportunities. The company said it will restructure its NAND-focused U.S. unit Solidigm into AI Co., while establishing a new subsidiary under Solidigm to continue its existing business. Industry officials said SK hynix appears to have two main objectives in setting up AI Co.: establishing a key base for AI-related investments in the U.S., a core market for the industry, and finding new ways to use Solidigm. Solidigm's manufacturing operations are under SK hynix's China unit, while its sales arm remains in the U.S., effectively limiting the company's sales role as Washington increases restrictions on Chinese-made products. This has made it difficult for Solidigm to secure a proper market valuation. By establishing AI Co. as the parent of Solidigm, SK Group's key functions related to AI data center solutions would be consolidated under the new entity. This, in turn, could significantly boost the company's valuation in the event of a future listing. For this to happen, however, key functions and assets currently spread across SK Group affiliates, particularly those related to SK Telecom's AI data center businesses, would need to be transferred to AI Co. SK hynix said nothing has been determined regarding the potential transfer of AI-related functions and assets. However, given that AI Co. has been designated to lead the expansion of the SK Group's data center ecosystem and the push into the global AI market, SK Telecom's vision of becoming a global player in AI data centers could be affected. In recent years, SK Telecom has been striving to transform itself into an AI infrastructure company, pushing large-scale AI data center projects in Korea in partnerships with global tech firms. In November, SK Telecom CEO Jung Jai-hun revealed plans to build AI datacenters in Vietnam and other Asian markets in collaboration with energy affiliate SK Innovation. The move also raises questions about SK Telecom's equity investments into promising AI companies. In 2023, SK Telecom invested $100 mil. in Anthropic to secure a stake of approximately 2 percent, now around 1 percent, which is currently valued at around $3.5 billion. SK Telecom also holds stakes in Lambda and Perplexity. SK Group's investment unit, SK Square, could also face questions as its role in key business domains such as overseas AI infrastructure, AI chips and AI data center solutions could overlap with that of AI Co., potentially prompting the group to shift decision-making functions to the new entity. During last week's earnings call, SK hynix said it decided to establish AI Co. to "proactively respond to the evolving AI business environment" and "the investment size is not large relative to the company's earnings and cash-generating capacity."

[12]

SK's US AI unit plan raises questions about affiliates' ambitions - The Korea Times

SK hynix's plan to set up an artificial intelligence (AI) solutions firm in the United States is raising questions about how other SK Group units' AI-related businesses will proceed, as the upcoming company, tentatively named AI Co., aims to become the group's hub for AI data center solutions. Currently, SK Telecom, SK Square and a number of other SK Group companies are pursuing separate ventures in the AI data center sector, as well as AI-related investment activities. Once AI Co. is established, however, concerns are growing that their strategic and investment functions could be centralized under the new entity, leaving existing units focused mainly on downstream services. SK hynix announced its plan to set up AI Co. last week, describing the new entity as a company that will strengthen SK hynix's memory competitiveness while providing comprehensive solutions across the AI data center sector. To support the plan, SK hynix has committed $10 billion in capital, which will be held as a reserve and injected into AI Co. when there are suitable investment opportunities. The company said it will restructure its NAND-focused U.S. unit Solidigm into AI Co., while establishing a new subsidiary under Solidigm to continue its existing business. Industry officials said SK hynix appears to have two main objectives in setting up AI Co.: establishing a key base for AI-related investments in the U.S., a core market for the industry, and finding new ways to use Solidigm. Solidigm's manufacturing operations are under SK hynix's China unit, while its sales arm remains in the U.S., effectively limiting the company's sales role as Washington increases restrictions on Chinese-made products. This has made it difficult for Solidigm to secure a proper market valuation. By establishing AI Co. as the parent of Solidigm, SK Group's key functions related to AI data center solutions would be consolidated under the new entity. This, in turn, could significantly boost the company's valuation in the event of a future listing. For this to happen, however, key functions and assets currently spread across SK Group affiliates, particularly those related to SK Telecom's AI data center businesses, would need to be transferred to AI Co. SK hynix said nothing has been determined regarding the potential transfer of AI-related functions and assets. However, given that AI Co. has been designated to lead the expansion of the SK Group's data center ecosystem and the push into the global AI market, SK Telecom's vision of becoming a global player in AI data centers could be affected. In recent years, SK Telecom has been striving to transform itself into an AI infrastructure company, pushing large-scale AI data center projects in Korea in partnerships with global tech firms. In November, SK Telecom CEO Jung Jai-hun revealed plans to build AI datacenters in Vietnam and other Asian markets in collaboration with energy affiliate SK Innovation. The move also raises questions about SK Telecom's equity investments into promising AI companies. In 2023, SK Telecom invested $100 mil. in Anthropic to secure a stake of approximately 2 percent, now around 1 percent, which is currently valued at around $3.5 billion. SK Telecom also holds stakes in Lambda and Perplexity. SK Group's investment unit, SK Square, could also face questions as its role in key business domains such as overseas AI infrastructure, AI chips and AI data center solutions could overlap with that of AI Co., potentially prompting the group to shift decision-making functions to the new entity. During last week's earnings call, SK hynix said it decided to establish AI Co. to "proactively respond to the evolving AI business environment" and "the investment size is not large relative to the company's earnings and cash-generating capacity."

[13]

SK Hynix posts $13.5 billion quarterly profit on AI chip demand By Investing.com

Investing.com -- South Korean chipmaker SK Hynix reported an operating profit of 19.2 trillion won ($13.5 billion) for the fourth quarter of 2025, exceeding analyst expectations. The strong performance represents a significant increase from the 8.1 trillion won profit recorded in the same period a year earlier. Analysts had forecast a profit of 17.7 trillion won, according to LSEG SmartEstimate. SK Hynix, a key supplier to Nvidia, benefited from robust demand for artificial intelligence technologies, which drove up prices for both advanced and conventional memory chips during the October-December period. The company's quarterly results highlight the continued growth in the AI chip sector, with memory manufacturers seeing increased revenue as AI applications expand across various industries. This article was generated with the support of AI and reviewed by an editor. For more information see our T&C.

[14]

SK hynix posts record 2025 profit, driven by AI memory boom - The Korea Times

A display showing high-bandwidth memory 4 is visible at SK hynix's booth at CES 2026 in Las Vegas, Jan. 8 (local time). Yonhap SK hynix posted an operating profit of 47.2 trillion won ($33.13 billion) and sales of 97.15 trillion won ($68.17 billion) in 2025, marking a record performance driven by strong demand for high-performance memory used in artificial intelligence (AI) servers and data centers. The company announced its 2025 financial results on Wednesday, a day before its scheduled earnings call. Operating profit more than doubled to 47.2 trillion won from a year earlier, while sales rose 46.8 percent to 97.15 trillion won. In the fourth quarter alone, the company posted 19.17 trillion won in operating profit and 32.83 trillion won in sales, up 137.1 percent and 66.1 percent year on year, respectively. The figures exceeded brokerages' earnings consensus of 44.5 trillion won in operating profit and 95.23 trillion won in sales. The record numbers were driven by strong demand for advanced memory products used in AI accelerators, such as high-bandwidth memory (HBM), as well as a subsequent increase in prices for legacy memory products. According to market tracker TrendForce, the average price of a 16-gigabyte DDR5 DRAM module for PCs stood at $32.4, up nearly fourfold from October last year. This upcycle in legacy products is believed to have boosted sales and operating profits for SK hynix. In the DRAM segment, the company said HBM sales more than doubled from a year earlier, contributing to record-breaking results. Legacy DRAM products also delivered strong growth as it ramped up mass production of 1c DDR5 DRAM, which refers to the sixth-generation 10-nanometer-class, as well as developing advanced server modules. The company's NAND segment also posted record-high revenue in 2025, as demand for enterprise solid-state drives soared in the second half of the year. The uptrend is expected to continue for the time being, as the company appears to be gradually consolidating its influence in the industry. According to industry officials, SK hynix is believed to have secured more than two-thirds of the HBM4 supply volume for Nvidia's next-generation Vera Rubin platform. The company said it is now mass-producing HBM4 at volumes requested by customers. SK hynix was also reported to be supplying HBM3E chips for Microsoft's next-generation inference chip, Maia 200. Microsoft has already deployed the chip at its data center in Iowa and is expected to install the chip at its other sites, including facilities in Arizona. SK hynix said the strong performance was "the result of a strategic response focused on strengthening technological competitiveness and expanding the share of high-value products in line with demand shifting toward AI." Analysts said the results indicate that the memory industry is breaking free from its traditional supply-chain-driven ups and downs and moving toward more stable growth. "The memory industry will no longer be confined to traditional cycles, as it is shifting toward a structure based on long-term supply contracts, where orders come first and capacity expansion follows," SK Securities analyst Han Dong-hee said. "For customers, the top priority will be securing stable volumes through long-term contracts, while suppliers will seek to maximize profits and achieve stable growth by optimizing the share of such agreements." The company also announced plans to cancel treasury shares worth 12.24 trillion won to enhance shareholder value. "Based on our strong technological competitiveness, we will pursue sustainable growth while maintaining an optimal balance between future investment, financial stability and shareholder returns," said Song Hyun-jong, head of SK hynix's corporate center.

[15]

SK Hynix: Will establish an AI solutions firm, tentatively named a company (AI Co.), in the US to find new AI growth engines

SK Hynix Inc is a Korea-based company mainly engaged in the production and sale of semiconductor memories. The Companyâs major products include dynamic random access memory (DRAM), NAND flashes, as well as multi-chip packages (MCP), among others. In addition, the Company manufactures and sells complementary metal oxide semiconductor image sensors (CISs). CISs is used in mobile phones, notebooks, tablets, medical devices, digital single lens reflex (DSLR) cameras, camcorders, automobiles, security equipments, game machines, and home appliances. The Company distributes its products within the domestic market and to overseas markets, including America, Germany, United Kingdom, Japan, Singapore, India, and China.

Share

Share

Copy Link

South Korean memory giant SK hynix is establishing a $10 billion AI solutions company in the U.S., restructuring its California-based Solidigm subsidiary in the process. The move comes as the chipmaker posts record quarterly profits, with operating income surging 137% year-over-year driven by explosive demand for high-bandwidth memory chips used in AI data centers.

SK hynix Launches $10 Billion AI Solutions Company in Strategic U.S. Expansion

SK hynix announced plans to invest $10 billion in establishing a new U.S.-based entity tentatively named AI Company, positioning itself as a comprehensive provider of AI solutions rather than just a memory chips supplier

1

3

. The South Korean memory giant will create this new subsidiary by restructuring Solidigm, its California-based enterprise SSD manufacturer, with Solidigm operations transferring to a newly formed entity that retains the Solidigm Inc. name2

. The company stated it will leverage its "unparalleled chip technologies, such as HBM" to deliver optimized AI systems for customers in the AI data center sector while making strategic investments in American AI firms1

.

Source: Seeking Alpha

Record Profit Signals Sustained AI Memory Demand

The timing of this U.S. investment aligns with SK hynix posting record-breaking financial results, with fourth-quarter revenue reaching 32.8 trillion won ($23 billion), exceeding analyst estimates, and operating profit hitting 19.17 trillion won—a 137% surge year-over-year

4

. Full-year 2025 revenues climbed 47% to 97 trillion won ($67 billion), while profits more than doubled to $33 billion, delivering stellar operating margins of 49%5

. High Bandwidth Memory (HBM) revenue more than doubled year-on-year, making a significant contribution to the company's record performance as demand from AI chipsets like those from Nvidia continues to outpace supply4

. The company also announced it had become the exclusive supplier of advanced memory chips for a new AI processor developed by Microsoft, further cementing its position in the AI boom4

.

Source: Korea Times

Strategic Positioning in the AI Industry Ecosystem

The market now demands integrated AI solutions that combine hardware, software, and services rather than standalone products, according to SK hynix

2

. The new AI Company will focus initially on software for AI system optimization before gradually expanding investments within the datacenter arena, with plans to deploy the $10 billion on a capital-call basis2

3

. This approach mirrors Nvidia's investment strategy, which has seen the GPU giant pour billions into companies like OpenAI, CoreWeave, and numerous European AI firms to strengthen its ecosystem1

. By helping build up companies developing AI software and hardware, SK hynix aims to encourage sustained growth in the AI industry, ensuring continued demand for memory chips while building production capacity without risking waste if market conditions shift1

.Related Stories

Implications for Memory Prices and Supply Constraints

Memory demand is "materially outpacing supply," according to IDC analysts, with chipmakers reallocating production capacity to favor components for servers and GPUs rather than consumer devices as memory prices rise across the board

2

. SK hynix plans to accelerate mass production of HBM4 following its industry-first production launch in September, while transitioning conventional DRAM to the 1 cnm process and expanding NAND to 321-layer technology5

. The supply shortage is expected to persist into next year as companies wait for capacity expansions to come online, with analysts predicting PC shipments will fall simply because there won't be enough memory chips available2

. End users face paying significantly more for anything incorporating memory, including PCs, smartphones, servers, and GPUs2

. The company also announced plans to cancel treasury shares worth 12.24 trillion won to boost shareholder value, alongside a special dividend totaling approximately $1.45 billion4

5

.

Source: PC Gamer

Navigating U.S. Trade Policy and Competitive Dynamics

The U.S. investment also serves as a signal to the Trump Administration, which recently floated applying 100% tariffs to memory companies not fabricating chips domestically

1

. While SK hynix is building an advanced packaging facility in West Lafayette, Indiana, it doesn't actually fabricate memory in the U.S., making this AI solutions investment a potential way to cement its interest in American operations1

. Competitors are responding similarly—Micron broke ground on a New York fabrication facility targeting cutting-edge memory production by 2040, while Samsung has highlighted its semiconductor plant in Taylor, Texas1

. If either Samsung or SK hynix faced trade restrictions while Micron remained exempt, the effect on the memory industry would be dramatic, given that only three key memory producers dominate the global market1

.References

Summarized by

Navi

[2]

Related Stories

SK Hynix Reports Record Q2 Profit, Boosts Investment in AI Chip Production

24 Jul 2025•Business and Economy

SK Hynix Dramatically Expands Yongin Semiconductor Investment to $410 Billion Amid AI Memory Chip Surge

18 Nov 2025•Business and Economy

SK Hynix Forecasts 30% Annual Growth in AI Memory Market Through 2030

11 Aug 2025•Technology

Recent Highlights

1

Pentagon threatens Anthropic with Defense Production Act over AI military use restrictions

Policy and Regulation

2

Google Gemini 3.1 Pro doubles reasoning score, beats rivals in key AI benchmarks

Technology

3

Anthropic accuses Chinese AI labs of stealing Claude through 24,000 fake accounts

Policy and Regulation