Super Micro's Q4 Results Miss Estimates, Shares Plunge Amid AI Server Competition

12 Sources

12 Sources

[1]

Super Micro's quarterly revenue misses estimates

Aug 5 (Reuters) - Super Micro (SMCI.O), opens new tab missed Wall Street estimates for fourth-quarter revenue on Tuesday, hit by intense competition from larger server makers for high-performance computers used to train artificial-intelligence models. Shares of the San Jose, California-based firm fell 11% in extended trading. The AI server market is becoming more competitive as many companies launch advanced servers and rack configurations. Revenue for the quarter was $5.76 billion, compared with analysts' average estimate of $5.89 billion, according to data compiled by LSEG. Reporting by Juby Babu in Mexico City; Editing by Sriraj Kalluvila Our Standards: The Thomson Reuters Trust Principles., opens new tab

[2]

Super Micro's quarterly results underwhelm, shares fall

Aug 5 (Reuters) - Super Micro (SMCI.O), opens new tab missed Wall Street estimates for fourth-quarter revenue and profit on Tuesday, as the company battles larger server makers for high-performance computers used to train artificial-intelligence models. Shares of the San Jose, California-based firm slumped 15% in extended trading. They have soared 91% this year, as investors bet on strong demand for its AI servers and its liquid cooling solutions. Super Micro has been gaining traction in the hyper-competitive server industry, but analysts have said larger rivals such as Dell Technologies (DELL.N), opens new tab and HP Enterprise (HPE.N), opens new tab have been able to leverage their vast customer base to boost sales. "Since we know the market for servers is very strong right now, it is safe to assume the disappointing results for Super Micro are due to share losses," said Gil Luria, managing director at D.A. Davidson & Co. "Their customers are very discerning right now and are choosing servers from Dell, HP and others," Luria added. Super Micro expects revenue of at least $33 billion for fiscal year 2026, compared to analysts' average estimate of $29.94 billion, according to data compiled by LSEG. The company, which is bouncing back from accounting-related issues, said revenue for the three months ended June 30 was $5.76 billion, compared with analysts' average estimate of $5.89 billion. Its adjusted earnings of 41 cents per share fell short of estimates of 44 cents. Reporting by Juby Babu in Mexico City; Editing by Sriraj Kalluvila Our Standards: The Thomson Reuters Trust Principles., opens new tab

[3]

Super Micro's quarterly results underwhelm, shares tumble

Aug 5 (Reuters) - Super Micro (SMCI.O), opens new tab missed Wall Street estimates for fourth-quarter revenue and profit on Tuesday, as the company battles larger server makers for high-performance computers used to train artificial-intelligence models. Shares of the San Jose, California-based company slumped nearly 15.5% in extended trading, as the results followed multiple cuts to its full-year guidance. Its forecast also fell short of its earlier lofty expectations. Super Micro projected revenue of at least $33 billion for fiscal year 2026. The company had predicted around $40 billion in annual sales in February. Analysts on average were expecting $29.94 billion, according to data compiled by LSEG. Super Micro has been gaining traction in the hyper-competitive server industry, but analysts have said larger rivals such as Dell Technologies (DELL.N), opens new tab and HP Enterprise (HPE.N), opens new tab have been able to leverage their vast customer base to boost sales. "Since we know the market for servers is very strong right now, it is safe to assume the disappointing results for Super Micro are due to share losses," said Gil Luria, managing director at D.A. Davidson & Co. "Their customers are very discerning right now and are choosing servers from Dell, HP and others," Luria added. Dell raised its annual profit forecast while Hewlett Packard Enterprise beat second-quarter revenue and profit estimates. Super Micro expects better chip availability for its fiscal year, when compared to the last two quarters, which will help it grow better, CEO Charles Liang said on a post-earnings call. Delays in the availability of Nvidia (NVDA.O), opens new tab processors had weighed on the company in the recent quarters. Super Micro's shares have climbed about 90% this year as of last close, as investors bet on strong demand for its AI servers and its liquid cooling solutions. "The expectations for all things related to AI, especially the large language and reasoning models, have captivated investors' attention. Any softness is met with deep disappointment, which means lower stock prices," said Kim Forrest, chief investment officer at Bokeh Capital Partners. Shares of Advanced Micro Devices (AMD.O), opens new tab fell in extended trading on Tuesday, after the chipmaker reported disappointing data center revenue. Super Micro, which is bouncing back from accounting-related issues, said revenue was $5.76 billion for the three months ended June 30, compared with analysts' average estimate of $5.89 billion. Its adjusted earnings of 41 cents per share fell short of estimates of 44 cents, primarily due to tariff impact. Reporting by Juby Babu in Mexico City; Editing by Sriraj Kalluvila Our Standards: The Thomson Reuters Trust Principles., opens new tab

[4]

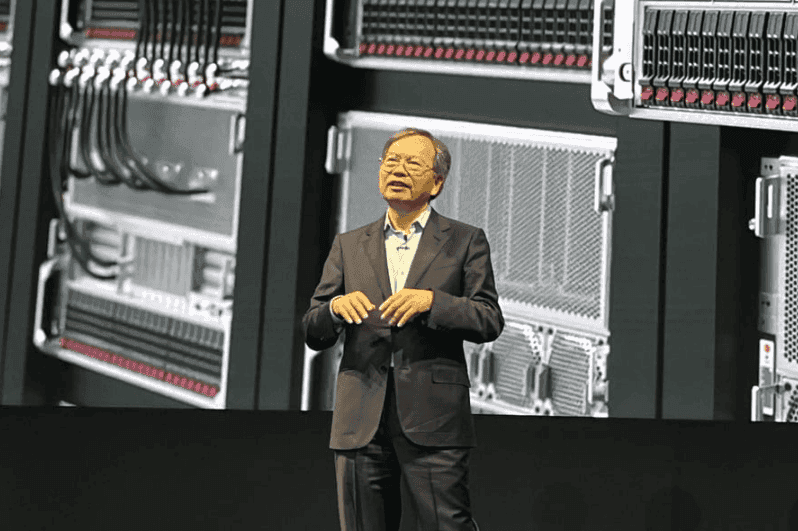

Super Micro shares plunge 15% on weak results, disappointing guidance

Charles Liang, CEO of Super Micro, speaks at the Computex conference in Taipei, Taiwan, on June 1, 2023. Super Micro Computer shares slid 15% in extended trading on Tuesday after the server maker reported disappointing fiscal fourth-quarter results and issued weak quarterly earnings guidance. Here's how the company did in comparison with LSEG consensus: Super Micro's revenue increased 7.5% during the quarter, which ended on June 30, according to a statement. For the current quarter, Super Micro called for 40 cents to 52 cents in adjusted earnings per share on $6 billion to $7 billion in revenue for the fiscal first quarter. Analysts surveyed by LSEG were looking for 59 cents per share and $6.6 billion in revenue. For the 2026 fiscal year, Super Micro sees at least $33 billion in revenue, above the LSEG consensus of $29.94 billion. Super Micro saw surging demand starting in 2023 for its data center servers packed with Nvidia for handling artificial intelligence models and workloads. Growth has since slowed. The company avoided being delisted from the Nasdaq after falling behind on quarterly financial filings and seeing the departure of its auditor. As of Tuesday's close, Super Micro shares were up around 88% so far in 2025, while the S&P 500 index has gained 7%. Executives will discuss the results on a conference call starting at 5 p.m. ET.

[5]

Super Micro stock sinks 20% after earnings, outlook disappoint

CEO Charles Liang told investors on a conference call that the company has "taken measures to reduce the impact" of the tariffs. The company has in recent years benefited from surging demand for AI servers packed with Nvidia chips, but has growth has since slowed. The server maker also offered guidance late Tuesday that fell short of consensus estimates. Super Micro said it expects 40 cents to 52 cents in adjusted earnings per share on $6 billion to $7 billion in revenue for the fiscal first quarter. Wall Street had projected 59 cents per share and $6.6 billion in revenue for the first quarter.

[6]

Supermicro's earnings, revenue and guidance all fall short, and its stock craters - SiliconANGLE

Supermicro's earnings, revenue and guidance all fall short, and its stock craters Artificial intelligence server maker Super Micro Computer Inc. posted a declining profit today as it missed expectations on both earnings and revenue, sending its stock south in extended trading. The company reported fourth-quarter earnings before certain costs such as stock compensation of 41 cents per share, trailing Wall Street's estimate of 45 cents. Revenue for the period came to $5.8 billion, up 8% compared to the previous year, but below the $6 billion analyst forecast. All told, Supermicro posted net income of $195.2 million in the quarter, down from the $297.2 million profit it posted in the year-ago quarter. The company said the lower profit was partly due to the impact of U.S. President Donald Trump's tariffs on goods imported into the country. "We have taken measures to reduce the impact and we will see results," Supermicro Chief Executive Charles Liang (pictured) told analysts on a conference call. That may be so, but investors were likely disappointed to see Supermicro also fell short of targets on its adjusted gross margin. It reported a figure of 9.6%, versus the 10% hoped for by analysts. On the call, Liang told analysts that the company lacked the working capital it needed to ramp up production as quickly as he would have liked. He said that's why the company took the unusual step of issuing convertible note offering worth $2 billion, following a similar $700 million funding initiative in February. For the current quarter, Supermicro is calling for earnings of between 40 cents and 52 cents per share on revenue of between $6 billion and $7 billion. That compares poorly with the Street's forecast, which calls for earnings of 59 cents per share on $6.6 billion in sales. Supermicro's revenue guidance for fiscal 2026 was better, with the company saying it's targeting $33 billion in total sales at the midpoint of its range. Wall Street is looking for just $20 billion. However, it's notable that Supermicro's forecast falls someway short of a lofty target of $40 billion that was given by Liang in February. After digesting the results, investors decided that things aren't looking so great for Supermicro, and the company's stock took a nosedive in the extended trading session, falling more than 16%. Supermicro has had a topsy-turvy ride of late. Latching onto the coattails of the artificial intelligence boom, its server sales have exploded over the last two years as enterprises race to build out their data center infrastructure. The company takes the very expensive components of AI servers, such as Nvidia Corp.'s graphics processing units, and then assembles them into complete servers that are ready to roll. It saw sales increase by 110% in fiscal 2024, and then by 47% in fiscal 2025. However, Supermicro now faces challenges, for the AI server industry is becoming more commoditized and it's being forced to compete for business on price. That explains why its gross-profit margin fell from just 18% at the end of fiscal 2023 to under 10% in the prior quarter. D.A. Davison & Co. analyst Gil Luria said the company's profit struggles aren't going away anytime soon. "Since we know the market for AI servers is very strong right now, it is safe to assume the disappointing results for Supermicro are due to [market] share losses," he told Reuters. "Customers are very discerning right now and are choosing servers from Dell, HP and others." Bank of America analyst Ruplu Bhattacharya told Barron's that while he believes Supermicro has the ability to regain lost market share, it can only do this at the cost of margin. Bhattacharya currently has an "underperform" rating on Supermicro's stock, and warned that its shareholders face a long list of risks. These include the fact that just two of its customers represented 64% of its accounts receivable at the end of March. He also pointed to it doing a significant amount of business with two companies owned by Liang's brother, which hints at the possibility of "self-dealing". Moreover, Bhattacharya warned that it still has accounting control weaknesses that linger from the last fiscal year, which saw it file its annual report late after its independent auditor walked away. The company narrowly avoided being delisted from the Nasdaq stock exchange by filing its annual report just before a deadline set by regulators. Despite all of these issues and today's after-hours slump, Supermicro's stock continues to be one of the better performers in the technology world, and is up 88% in the year to date. In contrast, the broader S&P 500 Index is up just 7%.

[7]

SMCI stock tumbles after Super Micro's earnings miss Wall Street targets, sparking margin fears and investor sell-off

Super Micro Computer stock dropped sharply after the company missed Wall Street's earnings and revenue estimates for Q4 FY2025. The tech giant, known for its AI server systems, reported lower-than-expected EPS and shrinking gross margins, sparking a steep after-hours selloff. Investors were further disappointed by weaker Q1 FY2026 guidance, signaling near-term challenges despite strong AI-driven growth. While Super Micro reaffirmed its $33 billion full-year target, the results showed growing pressure on profitability. As the AI boom continues, Super Micro's latest performance reminds investors that even top players can stumble.

[8]

Trump Tariffs Challenge SMCI's AI Business, But Global Supply Chain Eases Blow After Weak Q4 - Invesco QQQ Trust, Series 1 (NASDAQ:QQQ), Super Micro Computer (NASDAQ:SMCI)

Super Micro Computer Inc. SMCI reported a challenging fourth quarter for fiscal year 2025, with management attributing a decline in earnings per share primarily to the impact of tariffs imposed by President Donald Trump. Check out the current price of SMCI stock here. What Happened: Despite the weak financial results, the company is strategically mitigating future risk by leveraging its diversified global supply chain, a critical move as it positions itself at the heart of the booming AI infrastructure market. During the earnings call, CEO Charles Liang directly addressed the issue, stating that non-GAAP earnings per share were "down year over year... primarily due to the tariff impact." The significance of this comment becomes clear when viewed alongside the company's core business. The CFO, David Wiegand, noted that demand for "next-generation air-cooled and liquid-cooled GPU AI platforms... represented over 70% of Q4 revenues." By linking the tariff impact to the company's overall financial performance and noting that the majority of its business is AI-related, the earnings call implied the direct threat tariffs pose to the AI supply chain. In response to these challenges, Supermicro is highlighting its robust manufacturing presence in key global regions. Liang emphasized that the company's "large and versatile manufacturing campus across the U.S., Taiwan, Malaysia and the Netherlands" enables it to "respond to dynamic regional demands, support cost sensitive customers... mitigate tariff exposure, and maintain a reliance global supply chain." This strategy is designed to make the company more resilient to geopolitical trade fluctuations. Looking forward, the company remains optimistic about its long-term strategy and growth. Liang projects "at least $33 billion total revenue" for fiscal year 2026, supported by its expanding customer base and the introduction of its new higher-margin "data center building block solution" (DCBBs). These solutions, along with a focus on the enterprise, IoT, and telco markets, are expected to gradually improve gross margins and lessen the dependence on high-volume, lower-margin business. See Also: S&P 500 Primed For Correction, But It Comes With Major Buying Opportunity: Here's What Beth Kindig's Analysis Suggests Why It Matters: SMCI reported a fourth-quarter net sales of $5.76 billion, up from $4.6 billion in the previous quarter and $5.4 billion in last year's fourth quarter. However, it missed the consensus estimate of $5.88 billion. The earnings per share of $0.41 missed the Street consensus estimate of $0.44. Price Acton: On Tuesday, the SMCI stock dropped 16.29% after-hours following its earnings results. The stock has surged by 90.55% year-to-date but is down 7.18% over the past year. Benzinga's Edge Stock Rankings indicate that SMCI maintains a strong price trend across the short, medium, and long term. However, the stock scores moderately on value rankings. Additional performance details are available here. Price Action: The SPDR S&P 500 ETF Trust SPY and Invesco QQQ Trust ETF QQQ, which track the S&P 500 index and Nasdaq 100 index, respectively, declined on Tuesday. The SPY was down 0.51% at $627.97, while the QQQ declined 0.68% to $560.27, according to Benzinga Pro data. On Wednesday, the futures of Dow Jones, S&P 500, and Nasdaq 100 indices were trading higher. Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors. Photo courtesy: CryptoFX / Shutterstock.com QQQInvesco QQQ Trust, Series 1 $562.200.34% Stock Score Locked: Want to See it? Benzinga Rankings give you vital metrics on any stock - anytime. Reveal Full Score Edge Rankings Momentum 74.19 Price Trend Short Medium Long Overview SMCISuper Micro Computer Inc $47.22-17.5% SPYSPDR S&P 500 $631.170.51% Market News and Data brought to you by Benzinga APIs

[9]

Super Micro Stock Is Facing Heavy Selling Pressure Today: What's Fueling The Sell-Off? - Super Micro Computer (NASDAQ:SMCI)

Super Micro Computer Inc SMCI shares are falling Wednesday after the company reported worse-than-expected financial results for the fourth quarter of fiscal 2025 and issued weak earnings guidance. What Happened: Super Micro reported fiscal fourth-quarter revenue of $5.76 billion, missing analyst estimates of $5.88 billion, according to Benzinga Pro. The company reported fourth-quarter adjusted earnings of 41 cents per share, missing estimates of 44 cents per share. Gross margin came in at 9.5% in the quarter, down from 10.2% in the comparable quarter last year. Super Micro generated $864 million of cash flow from operations during the quarter. The company ended the period with $5.2 billion of cash and cash equivalents and $4.8 billion of total bank debt and convertible notes. "With support from our expanding global operations that help mitigate tariffs and regional costs, combined with a growing enterprise customer base, AI product innovations, and robust DCBBS-powered total solutions, we're on track to grow more large-scale datacenter customers from four in FY25 to six to eight in FY26," said Charles Liang, founder, president and CEO of Super Micro. Super Micro guided for first-quarter revenue of $6 billion to $7 billion versus estimates of $6.6 billion. The company said it expects first-quarter adjusted earnings of 40 cents to 52 cents per share versus estimates of 60 cents per share. Super Micro also lowered its fiscal 2026 revenue guidance from approximately $40 billion to at least $33 billion versus estimates of $29.8 billion. The lowered full-year outlook and soft earnings guidance for the first quarter combined with the top and bottom line miss in the fourth quarter appears to be weighing on shares. Following the print, Needham analyst N. Quinn Bolton maintained Super Micro with a Buy rating and raised the price target from $39 to $60. SMCI Price Action: Super Micro shares were down 21.4% at $45.06 at the time of publication Wednesday, according to Benzinga Pro. Read Next: Palantir CEO Warns US Could Lose AI Race Despite Record $1 Billion Quarter: Being Ahead Is the 'Danger Zone' Photo: Shutterstock. SMCISuper Micro Computer Inc$45.41-20.7%Stock Score Locked: Edge Members Only Benzinga Rankings give you vital metrics on any stock - anytime. Unlock RankingsEdge RankingsMomentum90.73Growth89.25Quality94.01Value58.03Price TrendShortMediumLongOverviewMarket News and Data brought to you by Benzinga APIs

[10]

Why Is Super Micro Computer Stock Falling Today - Super Micro Computer (NASDAQ:SMCI)

Super Micro Computer SMCI shares are trading lower on Wednesday after the company reported worse-than-expected fourth-quarter financial results. The semiconductor maker issued first-quarter EPS and adjusted EPS guidance below estimates, and cut its fiscal 2026 sales guidance on Tuesday. Wall Street analysts raised their price forecasts on the stock. Needham analyst N. Quinn Bolton maintained Super Micro with a Buy and raised the price forecast from $39 to $60. Wedbush analyst Matt Bryson reiterated Super Micro with a Neutral and raised the price forecast from $30 to $48. Also Read: Can Super Micro's AI Demand Outpace Profit Margin Fears? Needham Bolton stated that Super Micro reported fiscal fourth-quarter 2025 results that fell short of expectations. Revenue was $5.76 billion, up 25.2% sequentially but below Bolton's $6.00 billion and the Street's $6.01 billion estimates. Adjusted EPS landed at $0.41, missing Bolton's $0.45 and the Street's $0.44 due to weaker-than-expected revenue and gross margin performance. Bolton attributed the miss to Supermicro's limited access to capital, which delayed volume production. The delay stemmed from the company's late 10-K filing, which is now resolved. In addition, changes in a key customer's product specification further pushed back revenue recognition. Management does not expect these headwinds to persist into fiscal first-quarter 2026. Adjusted gross margin came in at 9.6%, below Bolton's and the Street's 10% estimates. The company guided first-quarter revenue to $6.5 billion, below Bolton's $7.25 billion estimate but slightly ahead of the Street's $6.59 billion. Gross margin is expected to remain at 9.6%, again under Street expectations. Bolton sees EPS for the quarter at $0.46, below its prior $0.64 forecast. Despite short-term pressures from large deals and tariffs, Bolton remains optimistic about margin recovery. Super Micro has begun deploying its Data Center Building Block Solutions (DCBBS), which should drive margin expansion over time and could account for 20-30% of future revenue. The company is also increasing investment in enterprise, IoT, and telecom, with product launches targeting servers, storage, and edge systems. Bolton raised its price forecast to $60, based on 16x fiscal 2027 EPS of $3.70. Wedbush Bryson noted that Super Micro's fiscal fourth-quarter 2025 results and fiscal first-quarter 2026 guidance came in slightly below expectations, with revenue falling short while EPS and gross margins aligned with prior forecasts. Management's fiscal 2026 revenue outlook of at least $33 billion exceeded the prior consensus of $29.94 billion by more than $2 billion. Bryson sees this divergence as reinforcing both bullish and bearish narratives. Bears may point to underwhelming fourth-quarter revenue, cautious first-quarter guidance, and the lack of gross margin rebound, especially given ongoing competitive pressures and tariff concerns. Bulls, on the other hand, will likely focus on the strong fiscal 2026 sales guide, suggesting rising demand from large AI customers. Management highlighted an increase in 10% customers -- from two last year to four in fiscal 2025 -- as evidence of growing momentum. While Bryson remains concerned about long-term gross margin sustainability due to high Nvidia NVDA content and limited product differentiation, he acknowledged the rapidly expanding opportunity for OEMs, particularly in enterprise AI, neocloud, and sovereign spending. Super Micro's strong positioning may allow it to capture a meaningful share of this expanding total addressable market. Bryson raised his price forecast to $48, applying a 13x P/E multiple to fiscal 2027 EPS estimates of $3.68. Price Action: SMCI shares were trading lower by 21.5% to $44.97 at last check on Wednesday. Read Next: Disney Focuses On Content Deals, Raises Annual Profit Outlook Image via Shutterstock SMCISuper Micro Computer Inc$45.11-21.2%Stock Score Locked: Edge Members Only Benzinga Rankings give you vital metrics on any stock - anytime. Unlock RankingsEdge RankingsMomentum90.73Growth89.25Quality94.01Value58.03Price TrendShortMediumLongOverviewNVDANVIDIA Corp$178.11-0.08%Market News and Data brought to you by Benzinga APIs

[11]

Super Micro Computer Likely To Report Lower Q4 Earnings; These Most Accurate Analysts Revise Forecasts Ahead Of Earnings Call - Super Micro Computer (NASDAQ:SMCI)

Super Micro Computer, Inc. SMCI will release earnings results for the fourth quarter, after the closing bell on Tuesday, Aug. 5. Analysts expect the San Jose, California-based company to report quarterly earnings at 44 cents per share, down from 62 cents per share in the year-ago period. Super Micro Computer projects to report quarterly revenue at $5.91 billion, compared to $5.31 billion a year earlier, according to data from Benzinga Pro. The server manufacturer's upcoming results are seen as a critical barometer of its ability to navigate a challenging landscape for AI hardware suppliers. Super Micro Computer shares rose 2.8% to close at $58.23 on Monday. Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables. Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period. Trending Investment OpportunitiesAdvertisementArrivedBuy shares of homes and vacation rentals for as little as $100. Get StartedWiserAdvisorGet matched with a trusted, local financial advisor for free.Get StartedPoint.comTap into your home's equity to consolidate debt or fund a renovation.Get StartedRobinhoodMove your 401k to Robinhood and get a 3% match on deposits.Get Started Wedbush analyst Matt Bryson reiterated a Neutral rating with a price target of $30 on Aug. 4, 2025. This analyst has an accuracy rate of 83%. JP Morgan analyst Samik Chatterjee maintained a Neutral rating and increased the price target from $35 to $46 on July 17, 2025. This analyst has an accuracy rate of 74%. Citigroup analyst Asiya Merchant maintained a Neutral rating and boosted the price target from $37 to $52 on July 11, 2025. This analyst has an accuracy rate of 82%. B of A Securities analyst Ruplu Bhattacharya initiated coverage on the stock with an Underperform rating and a price target of $35 on July 9, 2025. This analyst has an accuracy rate of 60%. Mizuho analyst Vijay Rakesh maintained a Neutral rating and raised the price target from $40 to $47 on July 3, 2025. This analyst has an accuracy rate of 78%. Considering buying SMCI stock? Here's what analysts think: Read This Next: Top 2 Financial Stocks That May Collapse This Month Photo via Shutterstock SMCISuper Micro Computer Inc$57.40-1.43%Stock Score Locked: Want to See it? Benzinga Rankings give you vital metrics on any stock - anytime. Reveal Full ScoreEdge RankingsMomentum90.73Growth89.25Quality94.01Value58.03Price TrendShortMediumLongOverviewMarket News and Data brought to you by Benzinga APIs

[12]

Should You Buy Super Micro Stock After Its 20% Post-Earnings Drop? Wall Street Says This Will Happen Next. | The Motley Fool

Super Micro stock crashed after its latest financial report, but most Wall Street analysts now see shares as slightly undervalued. Super Micro Computer (SMCI -0.39%) shares tumbled nearly 20% on Aug. 6, because of disappointing financial results. But most Wall Street analysts think the selling was slightly overdone. The median target price of $50 per share implies 8% upside from the current share price of $46. Some analysts are more optimistic. Ananda Baruah at Loop Capital values Super Micro at $70 per share, implying 52% upside, because of its strong presence in the artificial intelligence (AI) server market. He expects the company to benefit as Nvidia Blackwell GPU shipments increase in the coming months. Other analysts are more pessimistic. Mike Ng at Goldman Sachs values Super Micro at $24 per share, implying 48% downside, because margins are narrowing as competing hardware companies take share in the AI server market. Here's what investors should know about Super Micro Computer. Super Micro manufacturers data center storage systems and servers, including rack-scale products built for artificial intelligence (AI) and other high-performance computing workloads. The company credits its "building block" architecture and internal design expertise for its ability to rapidly assemble a broad portfolio of computing products featuring the latest technologies from its suppliers. Hans Mosesmann at Rosenblatt Securities last year wrote: "Super Micro has developed a model that is very, very quick to market. They usually have the widest portfolio of products when a new product comes out from Nvidia or AMD or Intel." Those advantages helped the company achieve an early leadership position in AI servers. Super Micro further cemented itself as a leader in AI servers by developing liquid cooling solutions, which make data centers more efficient by reducing energy consumption and space requirements compared with traditional air cooling. Nevertheless, there is nothing unique about Super Micro, and narrowing margins hint at intensifying competition. Super Micro stock had returned 88% year to date before releasing its earnings results for the fourth quarter of fiscal 2025, which ended in June. That was partly because it filed overdue financial reports ahead of a deadline that would have led to delisting from the Nasdaq Stock Exchange. But it also reflected excitement about the company's forecasted $40 billion in revenue in fiscal 2026. Unfortunately, Super Micro not only missed the consensus sales estimate in the fourth quarter but also cut its fiscal 2026 outlook. Revenue rose just 7% to $5.8 billion in the fourth quarter, while gross margin fell 70 basis points to 9.5% and GAAP earnings dropped 33% to $0.31 per diluted share. CEO Charles Liang previously told analysts gross margin would return to normal (14% to 17%) by the end of fiscal 2025, but margin pressure actually intensified. Super Micro also provided disappointing first-quarter guidance that implies revenue will increase 10% to $6.5 billion and GAAP earnings will decline 46% to $0.36 per diluted share. Management also dramatically cut its full-year outlook, such that revenue is now projected to increase 50% to $33 billion in fiscal 2026. The previous forecast said revenue would soar more than 80% to $40 billion. Here's the bottom line: AI server sales are forecast to increase 55% this year, and Cognitive Market Research says the market will expand at 38% annually to reach $2.3 trillion by 2033. But Super Micro's lackluster revenue growth and weakening gross margins are signs the company is losing market share, and that trend may continue as its largest competitor Dell Technologies builds momentum. Among 19 Wall Street analysts that follow Super Micro, the stock has a median 12-month target price of $50 per share. That implies 8% upside from the current share price of $46, which suggests investors should at least consider buying the post-earnings dip. Also, the current valuation of 25 times earnings is reasonable for a company whose earnings are forecast to grow at 23% annually over the next three years. But I would caution investors: Super Micro missed consensus earnings estimates by an average of 10% over the last six quarters, and that trend could continue as the AI server space becomes more competitive. To that end, I think investors should focus their attention elsewhere. Dozens of companies are well positioned to benefit from the artificial intelligence revolution, and many have far more durable competitive advantages than Super Micro Computer.

Share

Share

Copy Link

Super Micro Computer reported disappointing Q4 results and weak guidance, causing its shares to tumble. The company faces intense competition in the AI server market from larger rivals.

Super Micro's Q4 Performance Falls Short

Super Micro Computer, a prominent player in the server industry, reported disappointing fourth-quarter results for the fiscal year 2025, causing its shares to plummet in extended trading. The San Jose, California-based company missed Wall Street estimates for both revenue and profit, primarily due to intense competition from larger server manufacturers in the high-performance computing market, particularly for artificial intelligence (AI) model training

1

.

Source: Benzinga

Financial Results and Market Reaction

Super Micro's revenue for the quarter ended June 30, 2025, stood at $5.76 billion, falling short of analysts' average estimate of $5.89 billion

2

. The company's adjusted earnings of 41 cents per share also missed the expected 44 cents per share. This underperformance led to a sharp decline in Super Micro's stock price, with shares tumbling by approximately 15.5% in after-hours trading3

.Competitive Landscape and Market Dynamics

The AI server market has become increasingly competitive, with many companies launching advanced servers and rack configurations. Larger rivals such as Dell Technologies and HP Enterprise have leveraged their vast customer base to boost sales, potentially leading to market share losses for Super Micro

2

. Gil Luria, managing director at D.A. Davidson & Co., commented on the situation, stating, "Since we know the market for servers is very strong right now, it is safe to assume the disappointing results for Super Micro are due to share losses"3

.Related Stories

Future Outlook and Challenges

Despite the disappointing quarterly results, Super Micro provided an optimistic outlook for the fiscal year 2026, projecting revenue of at least $33 billion. This forecast surpasses analysts' average estimate of $29.94 billion

3

. However, it's worth noting that this projection falls short of the company's earlier, more ambitious forecast of around $40 billion in annual sales made in February3

.CEO Charles Liang expressed optimism about improved chip availability for the upcoming fiscal year, which he believes will contribute to better growth

3

. The company had previously faced challenges due to delays in the availability of Nvidia processors.

Source: SiliconANGLE

Market Impact and Investor Sentiment

The disappointing results and guidance have had a significant impact on investor sentiment. Kim Forrest, chief investment officer at Bokeh Capital Partners, noted, "The expectations for all things related to AI, especially the large language and reasoning models, have captivated investors' attention. Any softness is met with deep disappointment, which means lower stock prices"

3

.

Source: Motley Fool

Super Micro's stock performance had been strong throughout 2025, with shares climbing about 90% year-to-date before the earnings announcement

4

. The recent setback highlights the volatile nature of the AI-related technology sector and the high expectations placed on companies operating in this space.References

Summarized by

Navi

Related Stories

Super Micro Computer Faces Setback as Revenue Forecast Cut Sparks AI Spending Concerns

30 Apr 2025•Business and Economy

Super Micro Computer: Navigating Market Volatility Amid Strong Growth

13 Aug 2024

Super Micro Computer's AI Server Business Thrives Amid Accounting Concerns

19 Nov 2024•Business and Economy

Recent Highlights

1

ByteDance Faces Hollywood Backlash After Seedance 2.0 Creates Unauthorized Celebrity Deepfakes

Technology

2

Microsoft AI chief predicts artificial intelligence will automate most white-collar jobs in 18 months

Business and Economy

3

Google reports state-sponsored hackers exploit Gemini AI across all stages of cyberattacks

Technology