Tech Stocks Rally and Nvidia Selloff: Navigating the Volatile Tech Market

2 Sources

2 Sources

[1]

What should investors do with tech stocks after a 21.5% H1 rally? By Investing.com

Tech stocks rally, which is largely driven by gains in semiconductor and computer hardware sectors benefiting from AI advancements, has outpaced the broader market by a significant margin in the first half of the calendar year. Tech stocks have surged 21.5% in the first half of 2024, and now present both opportunities and challenges for investors, as per Bernstein Private Wealth Management's note published on Monday. While the tech sector has recorded impressive gains, its performance has been highly concentrated, with Nvidia (NASDAQ:NVDA) alone accounting for a substantial portion of the outperformance. Only 30% of tech stocks have outperformed, marking the lowest figure since 2002, said Bernstein, adding that the concentration clearly points out the narrow nature of the tech rally. At the same time, valuation concerns loom large as well. Tech stocks are currently trading at a 49% premium to the market, nearing levels seen during the dot-com bubble, and well above historical averages, noted Bernstein. Bernstein also pointed out that while tech's expected growth premium remains higher than historical norms, driven particularly by the semiconductor sector, elevated valuations pose risks, especially considering the potential for an AI digestion period and ongoing uncertainties in global markets. However, the momentum in tech is receiving continuous support with expectations of rising AI adoption and potential economic recovery. Lower anticipated interest rates could further buoy growth stocks, including tech, though the risk of overvaluation persists, as per Bernstein. Bernstein recommended that investment strategies going forward should focus on a balanced approach, adding that investors should maintain a market-weight allocation to tech. It also suggested investors adopt a barbell strategy between growth and value-oriented tech stocks. Opportunities may also lie in selectively investing in SMID cap names where valuations are more attractive and performance has lagged behind, it added.

[2]

Will the selloff in Nvidia, chip stocks extend? By Investing.com

Thursday marked a challenging day for much of the tech sector, particularly semiconductors. The popular Philadelphia Semiconductor Index (SOX) dropped 350 basis points, with well-owned and favored stocks falling 4-6% without any significant events. "No incremental and new negative newsflow or data points on the fundamental side of the equation to create a rush for the exits," analysts at Mizuho commented. "That is the good part," they added. Mizuho believes that the market experienced a rotation into rate-sensitive winners as the lower consumer price index (CPI) report fueled speculation that the Federal Reserve might cut rates as early as September. While active fund managers may not have been in a hurry to sell Big Cap Tech and Semiconductor Winners to invest in housing, biotech, utilities, real estate, small caps, and REIT stocks, quantitative and passive strategies were likely taking that action. The bigger question that now looms, according to analysts at Mizuho, is the impact of the upcoming PPI data release at 8:30 am ET. If it comes in weaker, it might trigger further rotation out of semiconductors and tech. Analysts believe that the Thursday sell-off was a "wake-up call", signaling it might be time to start taking profits in major tech and semiconductor AI winners. The past week saw significant gains in these stocks without any new developments. "It just did not seem healthy to me, as valuations just go higher ahead of earnings season to come 2H July. The big and fast rotation out of Software and into Semis this week only made yesterday more painful," analysts continued. The broader sell-off and rotation out of semiconductors yesterday could be a preview of what's to come when Nvidia (NASDAQ:NVDA) eventually guides only "inline" or misses expectations. "Yes, that day will eventually happen. Trust me on that. No clue how soon and what quarter. Not likely in CY24, or even early CY25 in my view," analysts at Mizuho added. "But it does happen, and the broad sell-off and rotation OUT OF SEMIS yesterday was a quick sneak preview. Think 'no place to hide' when an unwind starts. All semis will go lower." The meltdown in semiconductor equipment stocks, such as Applied Materials (NASDAQ:AMAT), KLA Corp (KLAC), and Lam Research (NASDAQ:LRCX), which dropped 450-600 basis points without bouncing back, exemplified the potential for an eventual semiconductor market unwind. These stocks, heavily owned by AI winner baskets and non-tech generalist investors viewing them as "picks and shovels of AI expansion," were sold off quickly. "So when those funds or momentum strategies see a potential break-down or rotation, they sell first, ask questions later," analysts at Mizuho noted. They speculate that the NVDA and AI semiconductor unwind might occur when major cloud hyperscalers discuss moderating their capex investment growth, rather than cutting it. Although they do not anticipate this happening through CY25, they caution that if investors begin to worry that 2025 or 2026 calendar years could represent a short-term peak, many will likely sell before any actual signals emerge.

Share

Share

Copy Link

Tech stocks have seen a significant rally in the first half of 2023, but recent selloffs in chip stocks, particularly Nvidia, have raised questions about the sector's stability. This story examines the current state of tech stocks and provides insights for investors.

Tech Stocks' Impressive Rally in H1 2023

The first half of 2023 has been exceptionally bullish for tech stocks, with the Nasdaq 100 index surging by an impressive 21.5%

1

. This remarkable performance has been driven by several factors, including the growing excitement around artificial intelligence (AI) and its potential to revolutionize various industries.The AI Boom and Its Impact

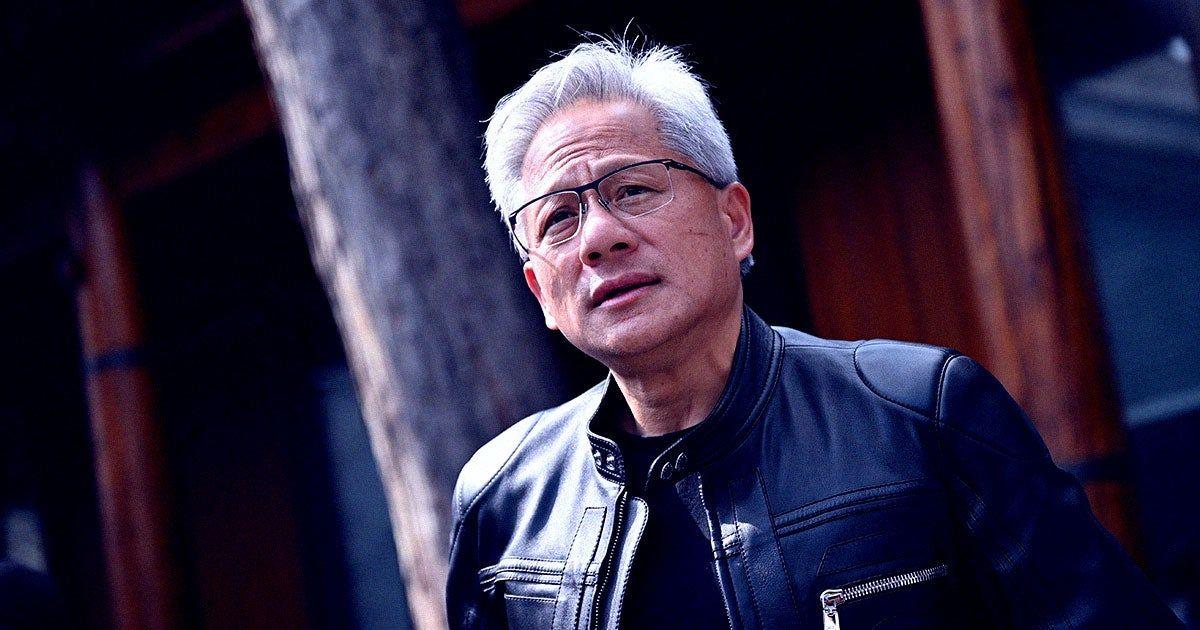

The AI boom has been a significant catalyst for the tech sector's growth. Companies at the forefront of AI development and implementation have seen their stock prices soar. Nvidia, in particular, has been a standout performer, with its stock price more than doubling in 2023 alone

1

. The company's chips, which are crucial for AI applications, have been in high demand, fueling investor enthusiasm.Recent Selloff in Chip Stocks

Despite the overall positive trend, recent days have seen a notable selloff in chip stocks, with Nvidia experiencing a significant decline

2

. This downturn has raised concerns among investors about the sustainability of the tech rally and whether it signals a broader market correction.Factors Contributing to the Selloff

Several factors have contributed to the recent selloff in chip stocks:

- Profit-taking: After the substantial gains in the first half of the year, some investors may be cashing in on their profits.

- Valuation concerns: The rapid rise in tech stock prices has led to questions about whether these valuations are justified.

- Geopolitical tensions: Ongoing issues between the U.S. and China, particularly regarding chip exports, have added uncertainty to the sector

2

.

Related Stories

Investor Strategies Moving Forward

As the tech sector experiences volatility, investors are faced with important decisions. Some key strategies to consider include:

- Diversification: Avoiding overexposure to a single sector or stock can help mitigate risk.

- Long-term perspective: Despite short-term fluctuations, the tech sector's long-term growth potential remains strong.

- Selective investing: Focusing on companies with solid fundamentals and clear growth prospects may be prudent.

The Road Ahead for Tech Stocks

While the recent selloff has caused some concern, many analysts remain optimistic about the tech sector's future. The continued advancements in AI, cloud computing, and other emerging technologies are expected to drive growth in the coming years

1

. However, investors should remain vigilant and be prepared for potential market corrections as the sector continues to evolve.References

Summarized by

Navi

[2]

Related Stories

Recent Highlights

1

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

2

Demis Hassabis predicts AGI in 5-8 years, sees new golden era transforming medicine and science

Technology

3

Nvidia and Meta forge massive chip deal as computing power demands reshape AI infrastructure

Technology