Tencent Boasts Strong GPU Stockpile, Adapts AI Strategy Amid US Restrictions

3 Sources

3 Sources

[1]

China's Tencent boasts 'strong stockpile' of GPUs - looking at alternative AI accelerators

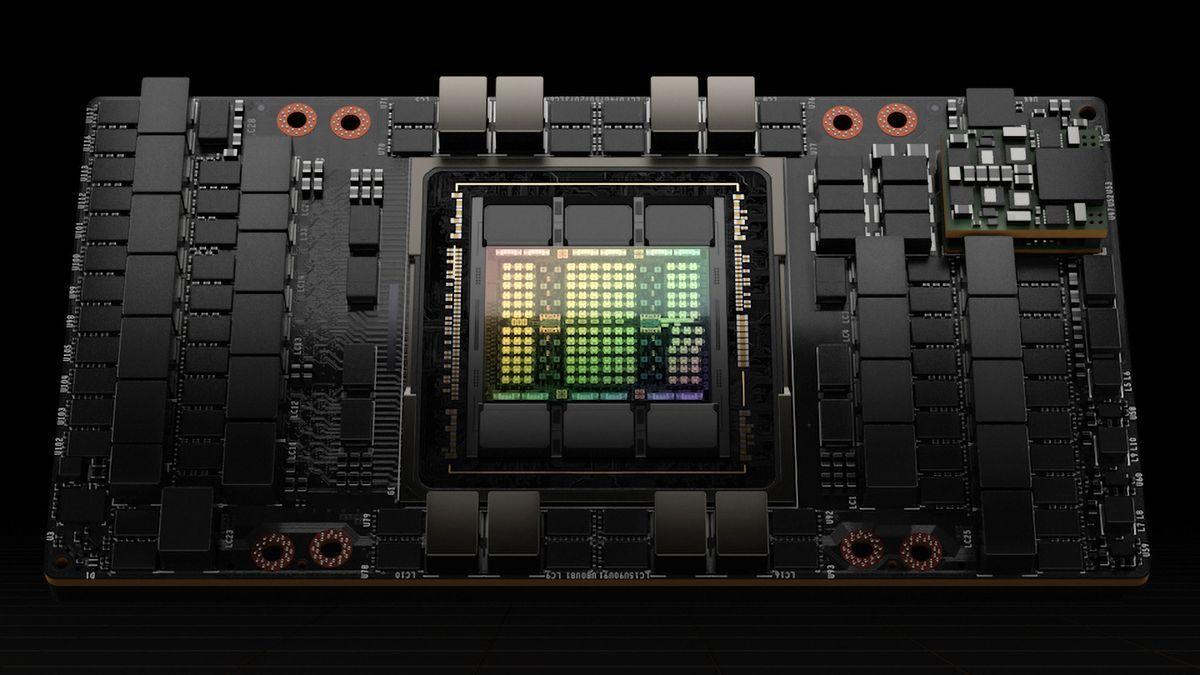

Company president shrugs off concerns about U.S. constraining GPU supplies. During an earnings call with investors on Wednesday, Tencent boasted of a "strong stockpile" of GPUs. Furthermore, when asked about how U.S. trade policy regarding advanced AI chips was impacting Tencent's product development and launch plans, company President Martin Lau seemed to shrug off investor concerns. In response to a question about high-end GPUs from Kevin Fong of international investment bank UBS, Lau started by characterizing the GPU situation as dynamic. Lau backed up his point by sharing the 'good news' that "I think we have a pretty strong stockpile of chips that we acquired previously and that would be very useful for us in executing our AI strategy." Right now, investors might be happy to hear that Tencent is leveraging these GPUs for the best immediate returns, in advertising, for example. However, an important point comes next, when Lau explains that Tencent is moving away from "the belief of the American tech companies, which they call the scaling law," and towards smaller clusters which can still get "very good results." Thanks to this adaptation, Tencent's Lau asserts that "we should have enough high-end chips to continue our training of models for a few more generations going forward." On the software side, things are also being optimized for Tencent's business. In his answer to Fong, Lau floated the idea of improving inference efficiency twofold, and "basically that means the amount of GPUs gets doubled in terms of capacity." Another important point raised concerned Tencent's potential use of "other chips." Its engineers appear to be looking at other AI accelerators, be they ASICs or GPUs, that can be sourced from within China, or can still be imported. Lau concluded by highlighting that Tencent had "a lot of ways to which we can fulfill the expanding and growing inference needs," and not just keep buying (Western tech) GPUs. Though Tencent is obviously being smart with its GPU purchases, it has still splurged a huge amount on them. In the financials released yesterday, it was notable that "Operating CapEx was RMB26.4 billion ($3.6 billion), up almost 300% year-on-year, driven by increased investments in GPUs and servers to ramp up our AI capabilities." This expenditure has had a sizable impact on free cash flow. GPUs are well known as the current lifeblood of the AI industry. But for years now, the U.S. and its allies have sought to restrict the supply of the most advanced GPUs to hostile nations like China. The big fear is that these advanced technologies could multiply the effectiveness of advanced enemy weaponry, which could be turned against its creators in places like the U.S. and Taiwan. The imposition of trade sanctions and export rules may have backfired, though. For a long time, the sanctions seem to have only loosely been enforced and have been easy to work around. Now, several years into the process, China appears to have established software and hardware that sidelines the requirement for AI tech from the Western allies. Now, here we are, with the Tencent boss seemingly unconcerned about U.S. trade restrictions, and a thriving domestic AI industry to help realize future plans.

[2]

Tencent says it has enough GPUs to train AI models for years

Partly because America does AI wrong and it can get more done with less Chinese web giant Tencent says it has enough high-end GPUs to train new AI models for years, in part because it's found more efficient ways to do so. Speaking on the company's Q1 2025 earnings call, company president Martin Lau said Tencent has "a pretty strong stockpile of chips that we acquired previously". The company will use some "for the applications that will generate immediate returns for us" - mostly advertising and content recommendation. We have enough high-end chips to continue training models for a few more generations Tencent will use others to train more large language models using techniques that mean it won't need to acquire more silicon. "Over the past few months, we start to move off the concept or the belief of the American tech companies, which they call the scaling law, which required continuous expansion of the training cluster," Lau told investors. "And now we can see even with a smaller cluster you can actually achieve very good training results." The company president added his view that "There's a lot of potential that we can get on the post-training side which do not necessarily meet very large clusters. So that actually help us to look at our existing inventory of high-end chips and say we should have enough high-end chips to continue our training of models for a few more generations going forward." Lau noted that agentic AI and chain of chain of thought workloads need more GPUs, but said software optimization offers Tencent "quite a bit of room for us to keep on improving the inference efficiency. So if you can improve inference efficiency 2x, then basically that means the amount of GPUs get doubled in terms of capacity." Tencent therefore intends to invest in efficiency initiatives, including training smaller models tuned to the needs of certain applications that require fewer resources. We need to spend more time on the software side rather than just force buying GPUs Lau also said Tencent is looking at alternatives to GPUs. "We can potentially make use of other chips, compliant chips available in China or available for us to be imported, as well as ASICs and GPUs in some cases for smaller models. We just need to sort of keep exploring these avenues and spend probably more time on the software side rather than just force buying GPUs. Lau's remarks suggest the US-led effort to stop the flow of high-end GPUs to China has not succeeded and instead have spurred Tencent to focus on innovation and optimization. The USA's GPU crimp was designed to preserve western tech companies' lead in AI, and to stop China putting the tech to work in its military. CEO Pony Ma also commented on GPUs in the context of Tencent's cloud business, with remarks that don't accord with Lau's. "GPU rental is directly related to cloud business and that's more like a reselling business mostly," Ma said. "And to a large extent right now, we are putting it on a lower priority because especially when there's a short supply of GPUs then the GPU rental is lower priority for us." Whatever the state of Tencent's GPU fleet, the company is in rude health. Q1 revenue rose 13 percent year-over-year to $25.1 billion, while gross profit rose 20 percent to $14 billion. The company has 1.4 billion monthly active users of its Weixin and WeChat services and is turning them into more cash with an upgraded advertising platform that uses Generative AI to generate ads and "to deepen our system's understanding of merchandise and of user interests across our apps and so deliver better ad recommendations." Those tools help merchants who operate "mini shops'" - e-commerce facilities embedded in messaging apps - to sell more stuff and helped to drive Tencent's own growth. The company is China's number one long-form video streamer, and its top audio streamer too. Games revenue surged for both new and old titles. Asked about future prospects, Lau told investors that he felt consumer spending "has bottomed out and [will] start to slowly recover." But then the US/China trade war happened. "I think we just have to see what will be happening in the next quarter. And it's very dynamic, right?" Lau said. "There's tariffs, but then what's the extent of the tariff?" Lau said China's government "is very supportive with stimulus" and "still has a lot of room for rolling out more stimulus." "So, I think tariff and the interplay of that, the impact of it on the economy and then the counter effect of the stimulus would be the two factors to watch." ®

[3]

After Trump Administration's Ban On Huawei AI Chips Goes Global, Tencent Says It Has Enough High-End AI Chips To Train Models For 'Generations' - Alibaba Gr Hldgs (NYSE:BABA), NVIDIA (NASDAQ:NVDA)

Following a new U.S. directive banning the use of Huawei Technologies AI chips globally, Tencent Holdings TCEHY said it has sufficient stockpiles of high-end chips, like Nvidia Corporation's NVDA H20, to continue training large language models for "a few more generations." What Happened: "So it's a very dynamic situation," Tencent president Martin Lau told analysts on a conference call on Wednesday, reported Nikkei Asia. "We just ... have to manage the situation," not only in a compliant way, but also by making sure our AI strategy can still be executed. The U.S. Bureau of Industry and Security this week barred the use of Huawei chips for AI, even outside American borders. This comes as Washington tightens export controls amid growing concerns over military applications of AI technology. See Also: Elon Musk Says Will Come As A 'Surprise To Most' As China's Economy Surpasses US And EU Amid Rising Tariffs And Growing Recession Fears Lau noted that while GPU supply is tight, Tencent has prioritized internal use, focusing first on revenue-generating AI products like advertising and content recommendations, with model training following. He added that Tencent is optimizing software for inference, effectively doubling GPU capacity, the report noted. Why It's Important: Tencent's first-quarter earnings beat analyst expectations, with revenue rising 13% year-over-year to 180 billion yuan ($24.9 billion), driven by strong AI-enhanced ad performance and gaming growth. Previously, it was reported that Chinese tech giants, including Tencent, Alibaba Group BABA and ByteDance increased their orders for Nvidia's H20 chips to meet rising demand for affordable AI solutions, particularly from emerging startups like DeepSeek. Get StartedStart Futures Trading Fast -- with a $200 Bonus Join Plus500 today and get up to $200 to start trading real futures. Practice with free paper trading, then jump into live markets with lightning-fast execution, low commissions, and full regulatory protection. Get Started Subscribe to the Benzinga Tech Trends newsletter to get all the latest tech developments delivered to your inbox. Since January, Nvidia has reportedly received H20 chip orders totaling around $18 billion. However, in March, Chinese server manufacturer H3C cautioned about a potential shortage of these chips. Last week, it was reported that Nvidia is redesigning its H20 AI chip for the Chinese market, with plans to release the revised version as soon as July. The decision followed a notification from the Donald Trump administration informing Nvidia that the original H20 chip would require an export license. Nvidia received an impressive growth score of 95% from Benzinga Edge Stock Rankings. Click here to see how it compares to other leading tech giants such as Alibaba and Tencent. Photo Courtesy: Tada Images on Shutterstock.com Read Next: JPMorgan CEO Jamie Dimon Warns Recession Is Best-Case Outcome Of Trump Trade War Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors. BABAAlibaba Group Holding Ltd$135.042.58%Stock Score Locked: Want to See it? Benzinga Rankings give you vital metrics on any stock - anytime. Reveal Full ScoreEdge RankingsMomentum95.16Growth73.63Quality47.24Value78.32Price TrendShortMediumLongOverviewNVDANVIDIA Corp$136.214.83%TCEHYTencent Holdings Ltd$67.883.46%Market News and Data brought to you by Benzinga APIs

Share

Share

Copy Link

Tencent claims to have enough high-end GPUs for years of AI model training, adapting its strategy to work around US trade restrictions and exploring alternative AI accelerators.

Tencent's GPU Stockpile and AI Strategy

Chinese tech giant Tencent has revealed it possesses a "strong stockpile" of GPUs, positioning itself to continue AI development despite U.S. trade restrictions. During a recent earnings call, Tencent's President Martin Lau expressed confidence in the company's ability to execute its AI strategy, stating they have "enough high-end chips to continue our training of models for a few more generations going forward"

1

2

.Adapting to Restrictions and Optimizing Resources

Tencent is adapting its approach to AI development, moving away from the "scaling law" favored by American tech companies. The company claims it can achieve "very good training results" with smaller clusters, optimizing its use of existing GPU inventory

1

. This shift in strategy allows Tencent to maximize the efficiency of its current resources and potentially sidestep some of the impacts of U.S. trade policies.Software Optimization and Alternative Technologies

To further extend the capabilities of its GPU stockpile, Tencent is focusing on software optimization. Lau mentioned the potential to improve inference efficiency twofold, effectively doubling GPU capacity

1

2

. The company is also exploring alternative AI accelerators, including ASICs and GPUs sourced from within China or those still available for import1

.Financial Impact and Investment in AI

Tencent's commitment to AI development is reflected in its financial reports. The company's operating CapEx increased by almost 300% year-on-year to RMB26.4 billion ($3.6 billion), primarily driven by investments in GPUs and servers to enhance AI capabilities

1

. This significant expenditure has impacted Tencent's free cash flow but underscores the company's dedication to maintaining its competitive edge in AI technology.U.S. Trade Restrictions and Their Effects

The U.S. and its allies have implemented trade sanctions and export rules to restrict the supply of advanced GPUs to countries like China, citing concerns over potential military applications

1

. However, these measures may have had unintended consequences. Tencent's apparent unconcern about the restrictions suggests that China's domestic AI industry has made significant strides in developing alternative solutions1

3

.Related Stories

Tencent's Market Position and Future Outlook

Despite the challenges posed by trade restrictions, Tencent remains in a strong market position. The company reported a 13% year-over-year increase in Q1 revenue, reaching $25.1 billion, with gross profit rising 20% to $14 billion

2

. Tencent's vast user base of 1.4 billion monthly active users across its Weixin and WeChat services provides a solid foundation for monetization through AI-enhanced advertising and e-commerce initiatives2

.Global Implications and Industry Response

The situation highlights the ongoing technological competition between the U.S. and China. While U.S. policies aim to maintain Western tech companies' lead in AI, they appear to have spurred innovation and optimization efforts within Chinese firms like Tencent. The company's ability to adapt and thrive under these conditions may have far-reaching implications for the global AI industry and international tech relations.

References

Summarized by

Navi

[1]

[2]

Related Stories

Tencent Unfazed by US AI Chip Import Uncertainty, Reports Strong Q2 Results

14 Aug 2025•Business and Economy

Tencent Slows GPU Rollout as DeepSeek Breakthrough Reshapes AI Landscape

21 Mar 2025•Technology

Chinese Tech Giants Invest $16 Billion in NVIDIA's H20 AI GPUs Amid US Export Restrictions

03 Apr 2025•Business and Economy

Recent Highlights

1

Pentagon threatens to cut Anthropic's $200M contract over AI safety restrictions in military ops

Policy and Regulation

2

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

3

OpenAI closes in on $100 billion funding round with $850 billion valuation as spending plans shift

Business and Economy