US-China Tech War Escalates: AI and Semiconductor Restrictions Shake Global Markets

2 Sources

2 Sources

[1]

Morning Bid: Sea of red as US-China tech war ratchets up

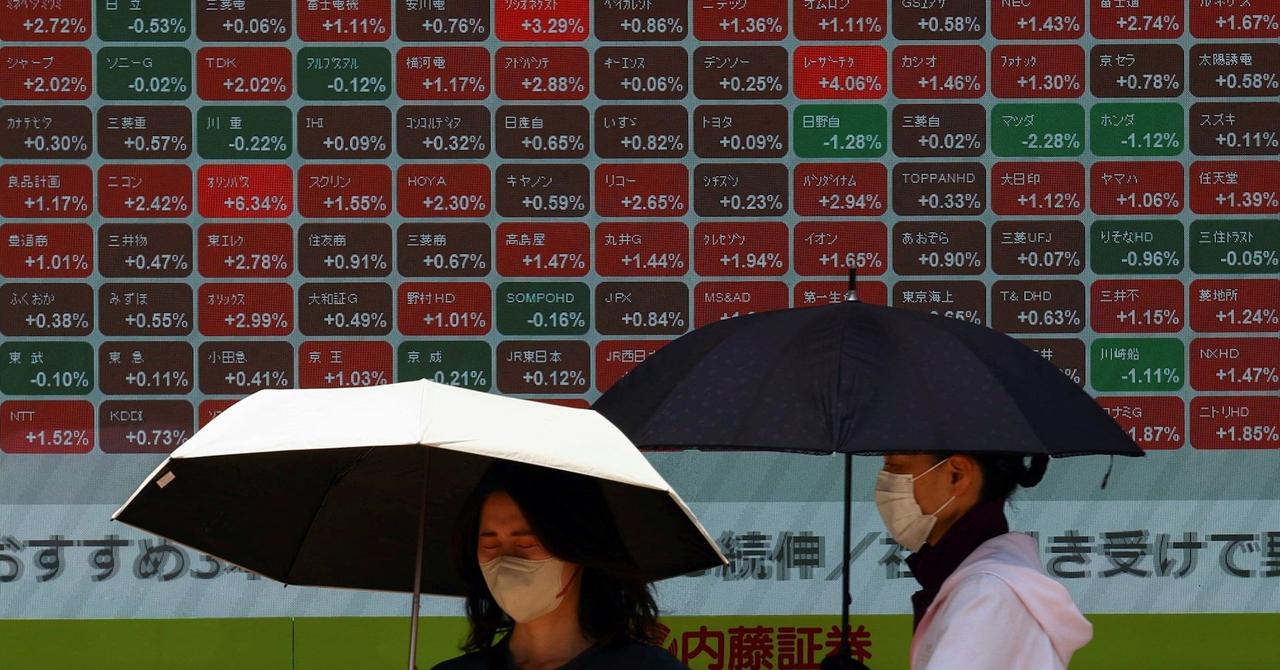

A look at the day ahead in European and global markets from Stella Qiu It is a sea of red in Asia as investors grapple with risk posed by the U.S. intensifying its technology war with China in areas as varied as artificial intelligence, quantum computing and aerospace. The U.S. also is seeking to toughen restrictions on the export of semiconductor technology to China - particularly chips from artificial intelligence leader Nvidia (NVDA.O), opens new tab - with the help of allies, Bloomberg reported. Hong Kong's Hang Seng index (.HSI), opens new tab initially fell as much as 2.7%, dragged down by an almost 8% plunge in tech giant Alibaba (9988.HK), opens new tab following a 10% drop in its American Depository Receipts. The sell-off abated, though, as investors chose to buy the dip given that stock's recent world-beating rally. The Hang Seng was last down 0.6% as Hong Kong-listed tech companies (.HSTECH), opens new tab recouped early loss with more talk of demand for low-cost AI models from DeepSeek. On Wall Street, investors continue to question whether massive spending on AI is justified, as evident in the cautious mood ahead of Nvidia's earnings on Wednesday where analysts expect a whopping 72% increase in quarterly revenue. Gold is benefiting from the U.S. presidency of Donald Trump who was busy with Russia advocating a quick end to war in the Ukraine while dialling up tariff rhetoric against Canada and Mexico. The old-world asset set a record overnight, drawing tantalisingly close to $3,000 an ounce. Curbing risk appetite is a series of soft U.S. economic data including retail sales, consumer confidence and surveys on the manufacturing and services sectors. They all came in weak and pointed to intensifying price pressure, eroding confidence in the exceptionalism of the U.S. economy. Market participants have now fully priced in the prospect of the Federal Reserve lowering its policy interest rate by 50 basis points this year rather than 40 bps seen just last week. Treasury yields duly touched fresh lows in the Asian trading session. Benchmark Treasury yields hit a two-month low of 4.377% while two-year yields touched 4.156%, the lowest since early December. Next up will be the Conference Board's U.S. Consumer Confidence survey where analysts are wary of a repeat of the slump seen in the University of Michigan's equivalent poll. Dallas Fed President Lorie Logan and Richmond Fed President Thomas Barkin speak later in the day with central bank watchers expecting them to echo the message that the Fed will be cautious in cutting rates. European Central Bank board member Isabel Schnabel is also set to speak in London about the future of the central bank balance sheet. Key developments that could influence markets on Tuesday: Conference Board's U.S. Consumer Confidence surveyManufacturing survey from the Richmond Federal ReserveEuropean Central Bank board member Isabel Schnabel speaksDallas Fed President Lorie Logan and Richmond Fed President Thomas Barkin speak By Stella Qiu; Editing by Christopher Cushing Our Standards: The Thomson Reuters Trust Principles., opens new tab Suggested Topics:European Markets

[2]

Sea of red as US-China tech war ratchets up

A look at the day ahead in European and global markets from Stella Qiu It is a sea of red in Asia as investors grapple with risk posed by the U.S. intensifying its technology war with China in areas as varied as artificial intelligence, quantum computing and aerospace. The U.S. also is seeking to toughen restrictions on the export of semiconductor technology to China - particularly chips from artificial intelligence leader Nvidia - with the help of allies, Bloomberg reported. Hong Kong's Hang Seng index initially fell as much as 2.7%, dragged down by an almost 8% plunge in tech giant Alibaba following a 10% drop in its American Depository Receipts. The sell-off abated, though, as investors chose to buy the dip given that stock's recent world-beating rally. The Hang Seng was last down 0.6% as Hong Kong-listed tech companies recouped early loss with more talk of demand for low-cost AI models from DeepSeek. On Wall Street, investors continue to question whether massive spending on AI is justified, as evident in the cautious mood ahead of Nvidia's earnings on Wednesday where analysts expect a whopping 72% increase in quarterly revenue. Gold is benefiting from the U.S. presidency of Donald Trump who was busy with Russia advocating a quick end to war in the Ukraine while dialling up tariff rhetoric against Canada and Mexico. The old-world asset set a record overnight, drawing tantalisingly close to $3,000 an ounce. Curbing risk appetite is a series of soft U.S. economic data including retail sales, consumer confidence and surveys on the manufacturing and services sectors. They all came in weak and pointed to intensifying price pressure, eroding confidence in the exceptionalism of the U.S. economy. Market participants have now fully priced in the prospect of the Federal Reserve lowering its policy interest rate by 50 basis points this year rather than 40 bps seen just last week. Treasury yields duly touched fresh lows in the Asian trading session. Benchmark Treasury yields hit a two-month low of 4.377% while two-year yields touched 4.156%, the lowest since early December. Next up will be the Conference Board's U.S. Consumer Confidence survey where analysts are wary of a repeat of the slump seen in the University of Michigan's equivalent poll. Dallas Fed President Lorie Logan and Richmond Fed President Thomas Barkin speak later in the day with central bank watchers expecting them to echo the message that the Fed will be cautious in cutting rates. European Central Bank board member Isabel Schnabel is also set to speak in London about the future of the central bank balance sheet. Key developments that could influence markets on Tuesday: * Conference Board's U.S. Consumer Confidence survey * Manufacturing survey from the Richmond Federal Reserve * European Central Bank board member Isabel Schnabel speaks * Dallas Fed President Lorie Logan and Richmond FedPresident Thomas Barkin speak

Share

Share

Copy Link

The US intensifies its technology war with China, focusing on AI and semiconductor restrictions, causing market turbulence and raising questions about AI spending amid economic uncertainties.

US Intensifies Tech War with China

The United States has escalated its technology war with China, targeting crucial areas such as artificial intelligence (AI), quantum computing, and aerospace. This move has sent shockwaves through Asian markets, creating a "sea of red" as investors grapple with the potential risks and implications

1

2

.Semiconductor Restrictions and Market Impact

The US is reportedly seeking to tighten restrictions on the export of semiconductor technology to China, with a particular focus on chips from AI leader Nvidia. This effort, which involves collaboration with allies, aims to limit China's access to advanced AI capabilities

1

2

.The news has had a significant impact on Asian markets:

- Hong Kong's Hang Seng index initially fell by 2.7%

- Tech giant Alibaba experienced an 8% plunge in Hong Kong, following a 10% drop in its American Depository Receipts

- The broader market recovered slightly, with the Hang Seng closing down 0.6%

- Hong Kong-listed tech companies recouped early losses amid discussions of demand for low-cost AI models from DeepSeek

1

2

AI Spending and Nvidia's Earnings

As the tech war intensifies, investors are questioning the justification for massive AI spending. This cautious sentiment is evident in the lead-up to Nvidia's earnings report, expected on Wednesday. Analysts anticipate a staggering 72% increase in quarterly revenue for the AI chip leader

1

2

.Related Stories

Economic Indicators and Federal Reserve Outlook

Recent US economic data has shown weakness across various sectors:

- Soft retail sales figures

- Declining consumer confidence

- Weak manufacturing and services sector surveys

These indicators point to intensifying price pressures and are eroding confidence in the US economy's exceptionalism

1

2

.In response, market participants have fully priced in a 50 basis point cut in the Federal Reserve's policy interest rate this year, up from the 40 basis points expected last week. Treasury yields have touched fresh lows, with the benchmark yield hitting a two-month low of 4.377% and the two-year yield reaching 4.156%, its lowest since early December

1

2

.Global Market Implications

The escalating tech war and economic uncertainties are having far-reaching effects:

- Gold prices are benefiting from geopolitical tensions, approaching $3,000 an ounce

- The Conference Board's US Consumer Confidence survey is anticipated, with analysts wary of a potential slump

- Federal Reserve officials are expected to maintain a cautious stance on rate cuts

- European Central Bank board member Isabel Schnabel is set to discuss the future of the central bank's balance sheet

1

2

As the US-China tech war ratchets up, global markets remain on edge, balancing the promise of AI advancements against geopolitical risks and economic challenges.

References

Summarized by

Navi

[2]

Related Stories

Recent Highlights

1

OpenAI secures $110 billion funding round from Amazon, Nvidia, and SoftBank at $730B valuation

Business and Economy

2

Anthropic stands firm against Pentagon's demand for unrestricted military AI access

Policy and Regulation

3

Pentagon Clashes With AI Firms Over Autonomous Weapons and Mass Surveillance Red Lines

Policy and Regulation