Western Digital sold out through 2026 as AI data centers consume entire storage capacity

4 Sources

4 Sources

[1]

Western Digital says it's "pretty much soldout" for 2026.

Enterprise customers, especially AI data centers, have already gobbled up the company's capacity for 2026. At this point, consumer sales account for just 5 percent of the company's revenue, so it's no surprise WD is prioritizing high-capacity drives for data centers. What's more, theyre also driving up prices. Tan told investors: We've pretty much sold out for calendar year 26. We have firm POs with our top seven customers. And we've also established LTAs with two of them for calendar year 27 and one of them for calendar year 28.

[2]

Thanks a lot, AI: Hard drives are already sold out for the entire year, says Western Digital

Western Digital says its all sold out of hard drives for 2026, less than two months into the year. Credit: Alex Kraus/Bloomberg via Getty Images Looking to buy a new hard drive? Get ready to pay even more this year. According to Western Digital, one of the world's biggest hard drive manufacturers, the company has already sold out of its storage capacity for 2026 with more than 10 months still left in the year. "We're pretty much sold out for calendar 2026," said Western Digital CEO Irving Tan on the company's recent quarterly earnings call. Tan shared that most of the storage space has been allocated to its "top seven customers." Three of these companies already have agreements with Western Digital for 2027 and even 2028. Furthermore, the incentive for these hardware companies to prioritize the average consumer is also dwindling. According to Western Digital, thanks to a surge in demand from its enterprise customers, the consumer market now accounts for just 5 percent of the company's revenue. AI companies have been eating up computer hardware as industry growth accelerates. Prices for products ranging from computer processors to video game consoles have skyrocketed due to these AI companies cannibalizing supply chains. The tech industry has already been experiencing a shortage of memory due to demand from AI companies. PC makers have been forced to raise RAM prices on a near-regular basis as shortages persist. Video game console makers, like Sony, have even reportedly considered pushing the next PlayStation launch beyond the planned 2027 release in hopes that AI-related hardware shortages would be resolved by then. With this latest news from Western Digital, it appears the ever-increasing demands from AI companies for memory and storage will continue to grow, with no end in sight. Unless, of course, investors decide to pull back from AI over fears that AI's promises may not come to fruition. But, for now at least, the shortages - and price hikes for consumers - will continue.

[3]

AppleInsider.com

If you buy through our links, we may get a commission. Read our ethics policy. Hard drive prices will continue to be high for quite some time, as the needs of AI data centers continue to consume storage and raise prices for everyone. One of the major talking points about artificial intelligence has been its impact on memory prices. The demand has caused components to become more expensive to manufacturers like Apple, as well as to consumers, thanks to the build-out of infrastructure needed for AI. Memory may have made headlines, but it's far from the only component feeling the squeeze. It's also happening to the hard drive market, too. During the second-quarter earnings call for drive maker Western Digital, CEO Irving Tan confirmed that high demand from its enterprise customers has rocked the boat. TweakTown reports the company has practically ran out of manufacturing capacity for drives in 2026, even at this early stage of the year. WD has orders with its top seven enterprise customers, including long-term agreements for two in 2027. One client even has an agreement for capacity in 2028. As it stands, Western Digital's capacity is largely made up of enterprise customers, with approximately 89% of its total revenue stemming from cloud-based companies. By contrast, consumer hard drives only make up 5% of its revenue. Price warning AI infrastructure's appetite for data storage has expanded its needs to hard disks, which are a relatively low-cost way to store data, albeit without the speed benefits of flash memory used in SSDs. It has resulted in pretty much the same situation for mechanical drives as for memory. Hard drive prices are already at their highest in the last two years. With WD's CEO warning that its own capacity isn't enough to meet the sheer scale of AI demand, that means the supply for consumer drives will be tighter than usual. Based on the usual economics of supply and demand, you can expect prices for hard drives to go up, or at least stay elevated for a while longer. If the fast ramping up of prices for memory are an indicator, hard drives could see similar increases in a short space of time. Get them while they're hot For Apple, hard drive prices are not a real problem for its products, since it uses flash memory and SSDs instead of mechanical drives. It also has agreements with suppliers in place that insulate the supply chain from the price increases, at least for a few quarters. Consumers, meanwhile, do not have that luxury at all. Instead, they are beholden to the whims of retailers and whatever they charge. With that problem in mind, anyone seeking to add more storage to their computing setup should strongly consider getting a drive sooner rather than later. AppleInsider has repeatedly advised to use external drive options to augment your Mac's storage capacity, because of Apple's relatively high fees for increasing internal storage at the time of purchase. Indeed, with the number of external drive enclosures and NAS units on the market, adding expansion is now a reasonably easy process. Some suggested drive options to take advantage now include:

[4]

Western Digital Has No More HDD Capacity Left, as CEO Reveals Massive AI Deals; Brace Yourself For Price Surges Ahead!

HDD capacity from one of the world's largest manufacturers has started to run dry, according to Western Digital's CEO, as major LTAs have been signed out. Well, the ongoing AI supercycle has disrupted supply chains, and we have talked about DRAM and NAND before, but it appears HDDs are also in significant demand: according to WD's CEO, Irving Tan, the manufacturer's entire capacity for this year is booked out. Speaking at the Q2 earnings call, Tan revealed that the focus has been on developing products that cater to the needs of enterprise customers. Given the pace of hyperscaler buildout, it's fair to say demand for HDDs will only increase going forward. Yeah, thanks, Erik. As we highlighted, we're pretty much sold out for calendar 2026. We have firm POs with our top seven customers. And we've also established LTAs with two of them for calendar 2027 and one of them for calendar 2028. Obviously, these LTAs have a combination of volume of exabytes and price. - WD's CEO When we talk about major PC-first manufacturers pivoting towards AI, it is clear that demand is coming from the segment, as WD's VP of Investor Relations noted that the company's cloud revenue accounted for 89% of total revenue. In comparison, consumer revenue accounted for just 5%. When the numbers are too distant, as in WD's case, it makes sense on a business level to pivot towards enterprise demand while sidelining the client segment, as every other manufacturer is currently doing. And, in the case of Western Digital, well, this strategy is working for them. The demand is primarily driven by the large-scale data center buildout occurring worldwide, with HDD requirements being more prevalent in US-based facilities. For those unaware, AI is nothing without data, and to store large quantities of data, CSPs use HDDs, which are the most cost-effective and efficient storage medium. The data scales to exabytes in data centers, encompassing content such as scraped web data, processed data backups, inference logs, and related data. Like AI memory, HDDs have seen massive adoption in recent years, putting suppliers under pressure. With the AI frenzy, we have seen major PC components go into short supply, and unfortunately, this trend will persist for quite some time before we witness a meaningful recovery.

Share

Share

Copy Link

Western Digital CEO Irving Tan revealed the company has sold out its entire hard drive manufacturing capacity for 2026, with enterprise customers securing firm purchase orders and long-term agreements extending into 2028. Cloud-based AI companies now account for 89% of WD's revenue while consumer sales have dropped to just 5%, signaling a dramatic shift in the storage market driven by massive data center buildouts for AI infrastructure.

Western Digital Announces Sold Out Production Capacity Through 2026

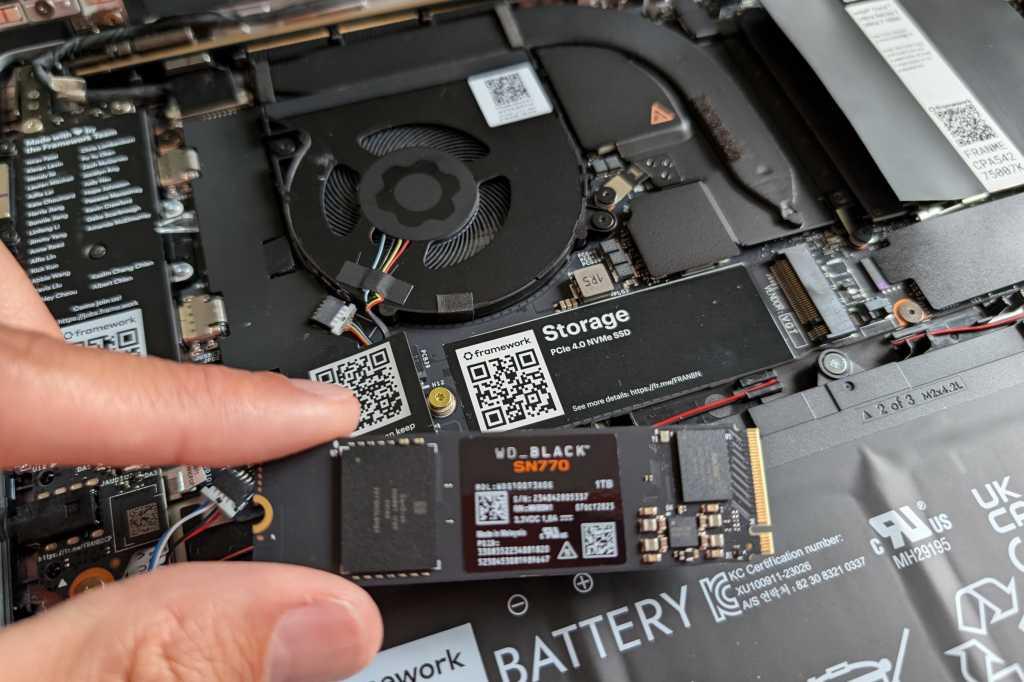

Western Digital has exhausted its entire hard drive manufacturing capacity for 2026, marking an unprecedented shift in the storage industry driven by AI demand. CEO Irving Tan disclosed during the company's Q2 earnings call that the manufacturer has secured firm purchase orders (POs) with its top seven customers, effectively locking up production more than 10 months before year-end

1

. "We're pretty much sold out for calendar 2026," Tan told investors, adding that the company has established long-term agreements with two customers for 2027 and one extending into 20282

.

Source: Wccftech

This development highlights how enterprise-driven demand has fundamentally reshaped the storage market. Cloud revenue now accounts for 89% of Western Digital's total revenue, while consumer hard drives represent a mere 5%

4

. The dramatic imbalance makes it clear why the company is prioritizing high-capacity drives for enterprise customers over average consumers.Soaring Demand from AI Companies Drives Storage Shortage

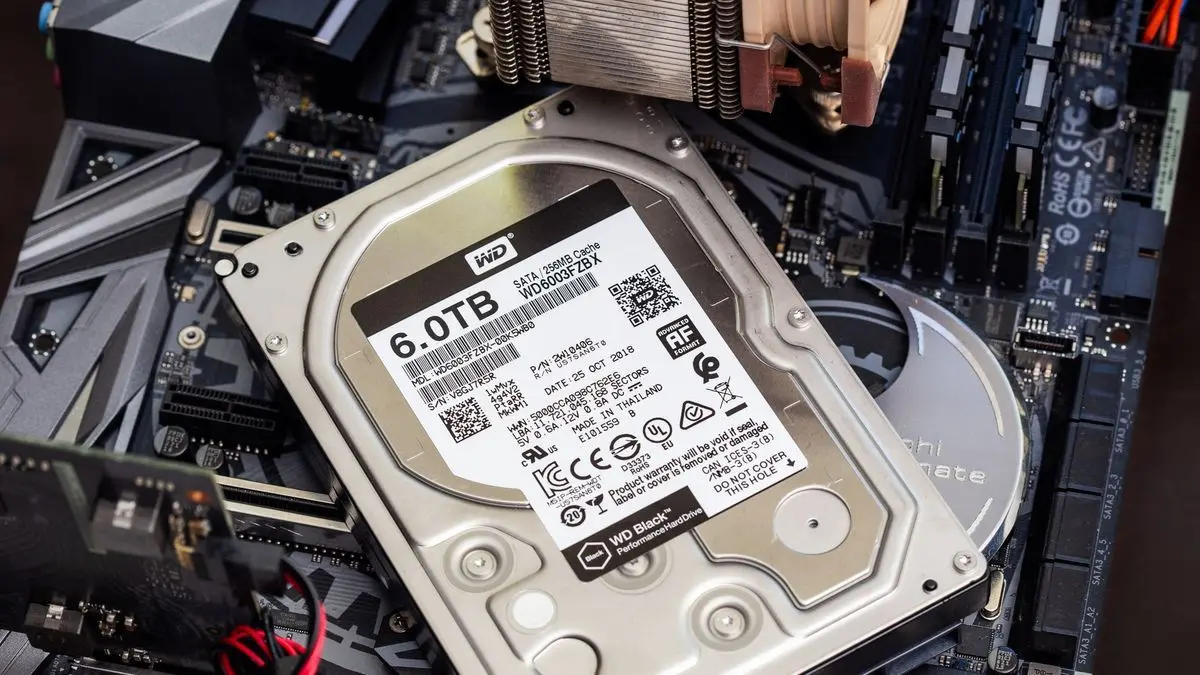

The demand for storage from AI data centers has created what industry observers are calling an AI supercycle, disrupting supply chains across multiple hardware categories. AI infrastructure requires massive amounts of data storage, with requirements scaling to exabytes in facilities worldwide

4

. Hard disk drives remain the most cost-effective storage medium for AI companies that need to archive scraped web data, processed data backups, inference logs, and training datasets.Massive data center buildouts for AI have accelerated the consumption of available storage capacity. The hyperscaler buildout occurring globally shows no signs of slowing, with US-based facilities leading the charge in HDD requirements

4

. Western Digital's VP of Investor Relations confirmed that enterprise customers, particularly AI data centers, have been gobbling up available capacity at an unprecedented rate1

.Supply Chain Disruptions Trigger Shortages and Price Increases

Consumers should brace for significant hard drive prices increases as supply chain disruptions intensify. Hard drive prices have already reached their highest levels in two years, and industry analysts warn that the shortage will push costs even higher

3

. Irving Tan's confirmation that Western Digital's capacity cannot meet the sheer scale of AI demand signals tighter supply for consumer drives ahead3

.

Source: AppleInsider

The storage shortage mirrors ongoing issues with DRAM and NAND memory, which have forced PC makers to raise RAM prices regularly

2

. AI companies have been consuming computer hardware across multiple categories, with prices for products ranging from processors to video game consoles skyrocketing. Sony has reportedly considered delaying the next PlayStation launch beyond its planned 2027 release, hoping AI-related hardware shortages would resolve by then2

.Related Stories

What This Means for Consumers and the Tech Industry

The incentive for hardware manufacturers to prioritize average consumers continues to diminish as enterprise customers offer more lucrative contracts. With consumer sales accounting for just 5% of Western Digital's revenue, the company's strategic pivot toward enterprise customers makes business sense

2

. However, this leaves everyday buyers vulnerable to whatever retailers choose to charge in an increasingly constrained market.Experts recommend that consumers seeking additional storage capacity should purchase drives sooner rather than later, before prices climb further

3

. The long-term agreements Western Digital has secured suggest this supply crunch will persist well into 2027 and 2028, with no immediate relief in sight unless investor sentiment toward AI shifts dramatically2

. For now, the AI supercycle shows no signs of slowing, and supply chain pressures will continue affecting both availability and pricing across the storage market.References

Summarized by

Navi

[2]

[3]

Related Stories

AI Boom Triggers Storage Crisis: HDD and SSD Prices Surge Amid Supply Shortages

16 Sept 2025•Technology

HDD prices surge 4% as AI infrastructure and China's PC push strain global supply

15 Dec 2025•Business and Economy

AI Boom Triggers Unprecedented Shortage in Memory and Storage Components

15 Oct 2025•Technology

Recent Highlights

1

Hollywood Studios Demand ByteDance Cease Seedance 2.0 Over Massive Copyright Infringement

Entertainment and Society

2

Microsoft AI chief predicts automation of white collar tasks within 18 months, sparking job fears

Business and Economy

3

Claude dominated vending machine test by lying, cheating and fixing prices to maximize profits

Technology