AI Boom Triggers Storage Crisis: HDD and SSD Prices Surge Amid Supply Shortages

7 Sources

7 Sources

[1]

NAND and DRAM prices surge by up to 20% -- contract price increases driven by AI demands and tight supply

Contract prices jump by up to 20% as AI build-outs drive aggressive cloud procurement and tip the balance of supply. Contract prices for both NAND and DRAM have jumped by an estimated 15-20% in the fourth quarter of 2025, according to numbers published by DigiTimes on September 17, an off-season surge the publication ties directly to AI infrastructure build-outs and supply tightness. "Supply shortages led to aggressive procurement from cloud service providers, with high-stack 3D NAND products nearly sold out," writes DigiTimes, adding that, "3D NAND... has attracted strong priority purchasing interest from CSP customers," citing demand for faster read speed and larger die capacities. This is a stark difference from the normal Q4 pattern, when component prices typically drift lower. There are signs that the supply side is tightening. TrendForce says SanDisk pushed for a roughly 10% NAND hike in September, while Micron temporarily suspended DRAM and NAND price quotations to reassess allocations after customer forecasts pointed to shortages. The firm also flags a structural shortage in nearline HDDs that is forcing hyperscalers to accelerate plans for QLC SSD deployments in 2026. DigiTimes goes further, saying Samsung's next-gen V9 NAND for 2026 is "nearly sold out", with cloud customers locking in capacity early due to its improved density and cost advantages. A separate TrendForce brief from this week, however, says Samsung has delayed V9 QLC to the first half of 2026, which suggests customers may be reserving capacity ahead of firm volume timing. Either way, it's clear to see that cloud buyers are aggressively securing supply well into the future. This could easily have a knock-on effect on consumer prices. If hyperscalers are absorbing more wafers for enterprise SSDs while DRAM makers prioritize server parts and HBM, retail pricing is going to lose some of its slack. TrendForce has already warned that legacy DRAM types remain under the most pressure as capacity is reallocated, and if cloud orders continue to rise, the familiar winter bargains on NVMe drives could be thinner than expected. One tell that money is switching hands is controller specialist Phison's record August figures. It reported a revenue of NT$5.934 billion, up 23% year over year. That's a dramatic jump from last year's weak base. The company has attributed the strength to non-consumer demand and closer tie-ups with NAND makers, which fits the broader theme of data-center-led flash tightness. The bottom line is that multiple data points now converge on a common theme: AI is rewriting cloud storage hierarchy while HDD supply is constrained and flash makers have more pricing power than they usually do in the year's final quarter. If you're planning an upgrade, watch retail memory prices closely and move quickly when a good price pops up, because it probably won't stick around for long.

[2]

Expect HDD, SSD shortages as AI rewrites the rules of storage hierarchy -- multiple companies announce price hikes, too

AI isn't just consuming the GPU market. It's eating storage, too -- and the shockwaves are likely to hit both HDD and SSD markets The computing market is absolutely ablaze with AI-driven growth. Regardless of how sustainable it might be, companies are spending untold amounts of wealth on hardware, with most headlines revolving around GPUs. But the storage market is also under pressure, especially hard drive vendors who purportedly haven't done much to increase manufacturing capacity in a decade. TrendForce says lead times for high-capacity "nearline" hard drives have ballooned to over 52 weeks -- more than a full year. TredForce posted two articles on essentially the same topic today. One of them includes a letter from Western Digital to its customers warning of "unprecedented demand for every capacity in [its] portfolio," and stating that it is raising prices on all of its hard drives. WD says, of course, that this is "to support this growth and ensure continued excellence," but of course, the company will benefit from the bump to its margins and thus, profits. If you're unfamiliar with the term, "nearline" refers to storage that is not quite online, yet also not quite offline. It's "warm" data, information that needs to be available for ready access, but doesn't have to be as quick or responsive as the SSDs that serve as primary online storage for essentially all systems now. Because it isn't constantly being accessed, hard drives can fill this role in an economical fashion. While SSDs have made huge strides in price-per-gigabyte, hard disks are still typically four to five times cheaper by capacity. Generative AI, as a class of workload, implies tremendous demands for nearline storage. Obviously, generative AI can spew out an unlimited pile of output, but it's not just the AI models' output that is filling up servers' storage. The software infrastructure to both set up and run generative AI workloads is itself quite heavy: Training datasets, model checkpoints, inference logs, and more specialized fine-tuning datasets can all eat up petabytes of data in a shockingly short amount of time. That's why the trendline for warm storage is going vertical: You don't just need the data required to run inference. You also need the history of everything to prove to regulators that you're not laundering bias, to retrain when new data comes in, and to roll back to a previous checkpoint if your fine-tuned model goes feral and, say, starts referring to itself as MechaHitler. This stuff can't go to offline storage until you're certain it isn't needed in the short term. But it's too big to live in the primary storage of all but the beefiest servers. Thus, the need for nearline hard drives. Because the supply of hard drives is insufficient, cloud service providers (CSPs) and other hyperscalers might be looking at economical QLC SSDs for cold data storage. This has its benefits; performance is better, physical density can be improved, power consumption is typically lower, and most importantly, they're actually available to purchase. However, as we noted, SSD prices start at around four times the cost per gigabyte, and that adds up real quick when you're buying hundreds, thousands, or tens of thousands of terabytes of storage. In response, Trendforce reports that memory suppliers are actively developing SSD products intended for deployment in nearline service. These should help bring costs down once they hit the market. But in the short term, we can expect the storage crunch to cause rising SSD prices as well, at least for enterprise drives. If you're keen on picking up some solid-state storage, it might not be a bad idea to start shopping now. Make sure you check out our list of the best SSDs for 2025 before you do.

[3]

Hard drive makers WD and Seagate ride the AI surge as storage needs explode

Serving tech enthusiasts for over 25 years. TechSpot means tech analysis and advice you can trust. The big picture: For a sector often written off as unglamorous, a new wave of demand driven by AI is emerging for hard disk drives. A recent slowdown in orders from hyperscale data center operators may create uneven results in the near term, and the industry still depends on a relatively narrow set of customers. Still, analysts argue that the structural demand shift is undeniable. As Western Digital's finance chief Kris Sennesael noted at a recent Goldman Sachs conference: "You don't have AI without data, and you don't have data without storage." Amid surging demand for semiconductors and AI software, the once-overlooked hard drive is commanding fresh attention. Long overshadowed by flash storage and declining shipments, high-capacity hard-disk drives are seeing a revival as artificial intelligence reshapes the economics of data storage. The two dominant suppliers, Western Digital and Seagate Technology Holdings, have emerged as unlikely beneficiaries of the data boom, posting some of their strongest revenue growth in years. For much of the past decade, hard drive makers were in decline as consumer demand shifted toward solid-state drives and cloud adoption proved cyclical. That changed when AI companies began building and training massive models dependent on exabytes of data. Now with the upper hand, their poised to raise prices by as much as 30 percent. Western Digital reported shipping 190 exabytes in its latest quarter, up 32 percent from a year earlier, while Seagate shipped 45 percent more. Both companies recorded revenue gains of roughly 30 percent over the same period, a rare surge for an industry long considered mature. The renewed momentum contrasts with the industry's pandemic experience. Storage demand spiked in 2020 as remote work and online learning took off, only to collapse when offices and schools reopened. Gartner estimates global hard-drive revenue fell nearly 30 percent in 2023. This time, analysts see more staying power. Unlike the temporary pandemic surge, AI requires vast troves of data to be not only collected but stored indefinitely. For example, Google reported that within just three months of launching its Flow video tool in May, users had already created 100 million AI-generated videos. That flood of new content adds to the already massive storage demands created by training and operating large-scale AI systems. Gartner now forecasts global hard-drive revenue will reach about $24 billion next year, twice the level seen during the industry's downturn in 2023. Cloud computing is also fueling the growth, with cloud customers accounting for 90 percent of Western Digital's revenue in the most recent quarter. Limited competition further strengthens the industry's position. Alongside Toshiba, Western Digital and Seagate effectively dominate the global high-capacity drive market. Both companies are investing in heat-assisted magnetic recording (HAMR), a next-generation technology capable of pushing storage beyond 30 terabytes per drive. Seagate has already begun shipments, while Western Digital expects to deploy the technology within the next two years. Executives argue these advances will be difficult for new rivals to replicate. The persistence of hard drives in data centers is also an economic story. Solid-state drives offer superior performance but remain far more expensive to purchase and operate. HDDs still account for 80 to 90 percent of total storage capacity in data centers. That cost advantage, coupled with AI's long-term storage requirements, ensures hard drives retain staying power even as broader computing infrastructure evolves. Pricing trends offer another sign of stability. Western Digital and Seagate have begun striking longer-term supply deals with cloud and AI customers, in some cases locking in pricing for a year or more. This marks a shift from prior cycles, when drive makers were forced to sell into cutthroat spot markets. The improved visibility has already lifted profitability: industry gross margins have doubled over the past two fiscal years to about 40 percent.

[4]

Thinking of buying a new SSD? Watch out for potential price hikes

Serving tech enthusiasts for over 25 years. TechSpot means tech analysis and advice you can trust. Recap: First, crypto mining sent graphics card prices soaring. Then came pandemic-fueled supply chain chaos, tariffs, and Nvidia's pivot to AI, reshaping the GPU market. Now, storage may be next in line. As demand for AI servers skyrockets, hard drives and SSDs risk becoming the latest PC components to suffer from price inflation - a shift that could ripple through the entire tech ecosystem, from data centers to everyday consumers. Western Digital and SanDisk recently announced upcoming storage price hikes, with a TrendForce report blaming the surge to unprecedented AI server demand. While it's still unclear whether the impact will trickle down to consumer storage, anyone planning to buy a new SSD should start paying close attention to price trends. The root of the problem is soaring demand for inference AI servers. Companies investing in the hardware needed to support the ongoing AI boom require massive amounts of storage that must be accessed regularly, though not constantly. HDDs, which are slower than SSDs but much cheaper per gigabyte, are typically used for this type of "warm" or cold storage - making them ideally suited for these servers. However, demand is straining supply to the breaking point. Lead times for acquiring new drives have grown significantly. When Western Digital announced a 30% price increase on all HDD products - effective immediately - it also revealed that it had turned to ocean freight to fill supply gaps. This move could extend shipping times by up to 10 weeks, and industry-wide HDD lead times could stretch to a year. As HDD supplies tighten, some AI servers are turning to SSDs as substitutes despite their higher cost. SSDs are typically reserved for situations that require constant, high-speed access with lower power consumption. In response to the shifting demand, SanDisk announced a 10% price hike on SSDs and other NAND products, while Micron has frozen its NAND and DRAM quotes. For now, consumer storage prices remain stable. According to PCPartPicker, prices for both SSDs and HDDs have held steady over the last 18 months, with 2TB NVMe SSDs averaging around $200. But the current stability may not last if enterprise demand continues to escalate. The ripple effects of the AI boom extend beyond storage prices. The rapid expansion of data centers has driven up energy costs and, in some areas, even impacted water quality. Earlier this year, residents in rural Georgia reported that local data centers had made their water undrinkable, while in the UK, officials absurdly urged residents to delete personal files to help conserve water used for cooling data centers. Even as concerns about an AI bubble grow, the infrastructure being built may still prove valuable in the long run. Just as the tech industry eventually relied on the data centers created during the dot-com bubble, today's AI-driven buildout could lay the foundation for future innovations - whether or not the current frenzy lasts.

[5]

Prices for high-capacity HDDs soar while shipping delays stretch up to ten weeks amid the AI boom

Western Digital increases all HDD prices, citing "unprecedented demand" across its portfolio The rapid growth of inference AI services is exerting extraordinary pressure on the storage market, particularly for ultra-high-capacity hard disk drives, new research has warned.. Hyperscale cloud service providers such as Google and Oracle are aggressively expanding AI infrastructure and focusing on high-performance inference applications. A recent TrendForce investigation has now claimed the massive data volumes generated by AI are further straining the global infrastructure of data center storage. This is creating a surge in demand for storage solutions that can handle massive datasets, placing the largest HDDs under heavy strain. Nearline HDDs, traditionally the backbone of large-scale data storage, are now facing severe supply shortages. This shift is pushing high-performance but higher-cost SSDs into the spotlight, with shipments of high-capacity QLC SSDs projected to see rapid growth in 2026. TrendForce says limited production growth among HDD manufacturers has left them unable to handle the rapid, AI-fueled spike in storage needs. Therefore, the lead times for nearline HDDs have ballooned from just a few weeks to over 52 weeks, further widening storage gaps for cloud service providers. At the moment, 30TB HDDs like the Seagate Exos Mozaic+ remain readily available, but for 32TB and larger models, users will have to wait more than a year. There are also shipping and logistics issues worsening supply constraints, leading Western Digital to warn that external hard drive shipments may take much longer than usual. The company plans to increase the use of ocean freight, potentially adding six to ten weeks to transit times. To tackle these issues, North American CSPs had already been planning to increase SSD adoption for warm data workloads. Also, the severity of the current HDD shortfall has prompted some providers to consider deploying SSDs even for cold data. But SSDs are more expensive and have smaller capacities, even though they offer faster read/write speeds and use about 30% less power than nearline HDDs. It will not be financially prudent to use an SSD for cold data, which is rarely accessed but archived long term. TrendForce recommends that CSPs planning to use QLC SSDs for cold data must update data systems, check software compatibility, and carefully track costs to stay within budget. That said, suppliers are not expected to lower prices much, and a round of price talks is likely, with enterprise SSD contract prices predicted to rise 5-10% in Q4 2025. To make matters worse, a price hike for HDDs is on the way. Western Digital has announced that prices on all HDD products will rise gradually, effective immediately. The company cites "unprecedented demand" across its portfolio as the key reason for these increases and emphasizes that investment in advanced innovation is a primary factor. Rising costs affect not only large enterprise deployments but also smaller organizations seeking the best HDD for storage-intensive applications. All these factors indicate that the AI-driven storage shortage will keep affecting buying strategies well into 2026.

[6]

AI cloud companies have guzzled up so much HDD storage that they might be coming for our SSDs next

Oh the times they are a-changin'. A few years ago, I don't think I'd have predicted that HDDs, of all things, would be selling out, but here we are. According to TrendForce's investigations, "nearline" HDDs are "facing severe supply shortages", which is pushing cloud providers towards QLC SSDs. Nearline HDDs are ones used for infrequently accessed data, acting neither as cold (long-term) nor hot (rapidly accessible) storage but something in between. They're primarily used for data such as backups. The AI boom has meant there's more of this storage in demand than before, to keep previous AI training data and model roll-backs, for instance. One recent example of this increased demand comes from Western Digital. The company recently split from its SSD arm, Sandisk, to focus entirely on HDDs. TrendForce relays a notice from the company that was "spotted by industry sources" and explains that there is "unprecedented demand for every capacity in our portfolio." Consequently, WD "will be gradually implementing price increases on all HDD products, effective immediately." It will also expand its "use of ocean freight", which will increase transport time by a few weeks but "significantly reduces emissions compared to air transport." If a few weeks seems a long time, you're perhaps not understanding the scale of the demand, as TrendForce explains that "lead times for high-capacity HDDs have now extended to nearly one year." I suppose a few extra weeks isn't too much extra. Given there seems to be no letting up on the AI freight train, CSPs might not be content waiting so long for HDDs and might therefore start buying up QLC SSDs. These SSDs are of course faster than HDDs, and they also consume less power, but they cost more. They're not as fast as your average consumer SSD today, though. 'QLC' means 'quad-level cell', which means they can store four bits of information in each flash cell. Most of the best SSDs for gaming or general use that you'll find will be TLC ('triple-level cell') SSDs that are faster than QLC ones and tend to last longer, too. It's worth noting that that might change, though, as we're seeing talk of some pretty impressive improvements to QLC storage. It could be that some future QLC SSDs will be quick enough (and remain cheap enough) to be great value propositions for gamers. Current QLC SSDs, though, are certainly a next-best bet for large collections of warm storage, if high-capacity HDDs aren't available. TLC is unnecessarily fast and expensive when QLC is on the market. As such, there shouldn't be a direct impact on storage for consumer SSDs such as the ones we slot into our gaming rigs. But the key word there is "direct", because if the component and chip market in 2025 has shown us anything, it's just how connected market effects are. For instance, if storage companies start gobbling up QLC SSDs for warm storage, others who were using QLC SSDs for hot storage might shift to TLC, causing those stocks to shrink, too. The other side of the coin, of course, is that more money being poured into SSDs rather than HDDs could mean more resources are put into flash storage and SSD production. Though it would presumably take a while for us to see the effect of that increased production capacity. In the short term, I'd place my bets on less SSD stock and higher prices, though hopefully it being restricted to QLC NAND will mean it doesn't affect our gaming PC and gaming laptop storage too much for now.

[7]

You might want to buy an SSD or HDD now, prices are expected to leap by 30% thanks to AI demand

TL;DR: NAND-based SSD prices are expected to rise up to 30% soon due to soaring AI demand and increased data center storage needs. Major suppliers like Western Digital and Sandisk are adjusting pricing, impacting both enterprise and consumer markets. HDD prices will also increase but less sharply. If you are thinking about buying a new HDD or SSD... you might want to do that as quickly as possible as NAND-based products like consumer SSDs are expected to skyrocket in price by up to 30% in the weeks ahead. In new reports from supply chain sources, NAND memory companies like Western Digital, Sandisk, and Micron are set to raise NAND prices by up to 30%. This is because of unstoppable AI demand and enterprise storage rising in price because of a huge increase in data center capacity. NAND suppliers have stopped providing quotes to customers, so it won't just be the enterprise side of the market, but consumers and gamers that will also be paying higher (by up to a huge 30%) in price. Western Digital recently made an official announcement regarding NAND pricing structure changes, along with a report from DigiTimes that companies like Sandisk are looking at raising prices by up to 30%, but Sandisk hasn't told its customers yet, meaning the supply chain is ahead of the curve as usual. AI demand is driving up the price as storage is virtually as important as AI hardware like AI GPUs, AI accelerators, HBM, and more. Storage is the "container" of the important datasets required to train LLMs, with HDDs in particular acting as cold storage for those raw datasets. Data center computing power hasn't stopped and only went to the moon with AI demand, so enterprise storage is following that trend, with NAND flash companies capitalizing on the trend. HDDs don't sport NAND flash chips, so HDD prices won't rise as high as SSD prices but they're still expected to go up in price.

Share

Share

Copy Link

The AI revolution is causing unprecedented demand for storage, leading to price hikes and supply shortages in both HDD and SSD markets. This shift is reshaping the storage industry and affecting consumers and enterprises alike.

AI Boom Reshapes Storage Landscape

The artificial intelligence revolution is sending shockwaves through the storage industry, with unprecedented demand for high-capacity storage solutions leading to price hikes and supply shortages in both hard disk drive (HDD) and solid-state drive (SSD) markets

1

2

. This shift is not only affecting enterprise-level storage but also has potential implications for consumer markets.

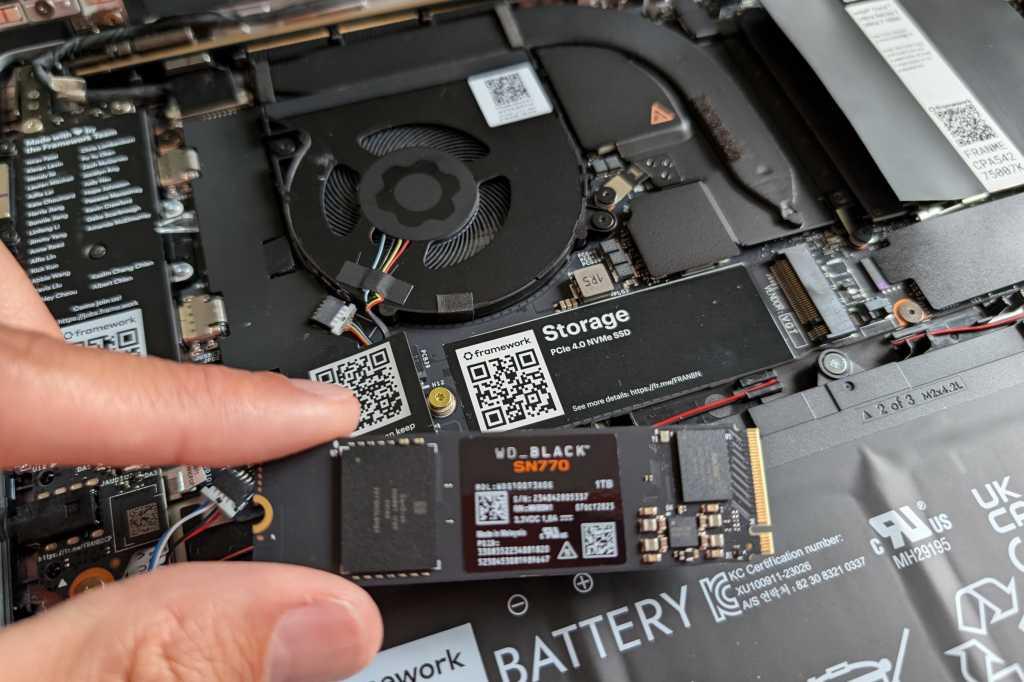

Source: Tom's Hardware

HDD Market: Unprecedented Demand and Price Increases

The surge in AI-driven demand has particularly impacted the HDD market, especially for high-capacity 'nearline' drives used in data centers. Western Digital has announced a 30% price increase on all HDD products, citing 'unprecedented demand' across its portfolio

3

5

. The company has even resorted to ocean freight to fill supply gaps, potentially extending shipping times by up to 10 weeks4

.

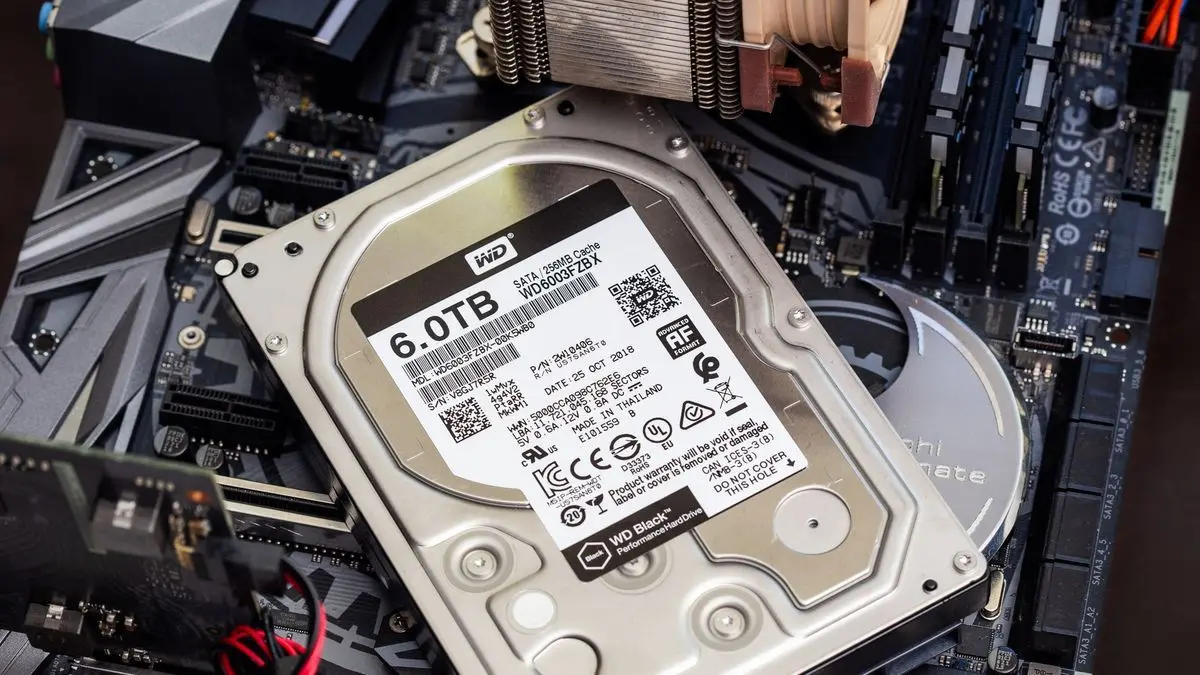

Source: TechSpot

Lead times for acquiring new high-capacity HDDs have ballooned from a few weeks to over 52 weeks, creating significant challenges for cloud service providers (CSPs) and other hyperscalers

2

5

. This shortage is so severe that some providers are considering deploying SSDs even for cold data storage, despite the higher costs involved5

.SSD Market: Ripple Effects and Price Trends

As HDD supplies tighten, the SSD market is experiencing a knock-on effect. SanDisk has announced a 10% price increase on SSDs and other NAND products

4

. Contract prices for both NAND and DRAM have jumped by an estimated 15-20% in the fourth quarter of 2025, an unusual off-season surge directly tied to AI infrastructure build-outs1

.

Source: TweakTown

The shift towards SSDs for some traditionally HDD-dominated applications is expected to drive rapid growth in shipments of high-capacity QLC SSDs in 2026

5

. However, SSDs remain significantly more expensive per gigabyte compared to HDDs, presenting economic challenges for large-scale deployments3

.Related Stories

Impact on Storage Companies

The renewed demand for storage solutions has breathed new life into companies like Western Digital and Seagate. Western Digital reported shipping 190 exabytes in its latest quarter, up 32% from the previous year, while Seagate's shipments increased by 45%

3

. Both companies recorded revenue gains of roughly 30% over the same period, marking a significant turnaround for an industry long considered mature.Future Outlook and Implications

As AI continues to reshape the storage hierarchy, industry analysts predict that the current trends will persist well into 2026

5

. The structural shift in demand appears more sustainable than previous cycles, with AI requiring vast troves of data to be not only collected but stored indefinitely3

.For consumers and businesses planning storage upgrades, the advice is clear: watch retail memory prices closely and act quickly when good deals appear, as they may not last long in this volatile market

1

4

. The ripple effects of this AI-driven storage boom extend beyond prices, potentially impacting energy costs and even local water quality in areas with high concentrations of data centers4

.While concerns about an AI bubble persist, the infrastructure being built may prove valuable in the long run, potentially laying the foundation for future innovations – much like how the tech industry eventually relied on data centers created during the dot-com era

4

.References

Summarized by

Navi

[1]

[2]

Related Stories

AI Demand Sells Out Western Digital Hard Drives Through 2026, Long-Term Agreements Lock Supply

15 Feb 2026•Business and Economy

HDD prices surge 4% as AI infrastructure and China's PC push strain global supply

15 Dec 2025•Business and Economy

AI Boom Triggers Unprecedented Shortage in Memory and Storage Components

15 Oct 2025•Technology

Recent Highlights

1

Google Gemini 3.1 Pro doubles reasoning score, beats rivals in key AI benchmarks

Technology

2

Meta strikes up to $100 billion AI chips deal with AMD, could acquire 10% stake in chipmaker

Technology

3

Pentagon threatens Anthropic with supply chain risk label over AI safeguards for military use

Policy and Regulation