Apple Ramps Up AI Investments and Considers Acquisitions to Catch Up in AI Race

42 Sources

42 Sources

[1]

Apple plans to 'significantly' grow AI investments, Cook says | TechCrunch

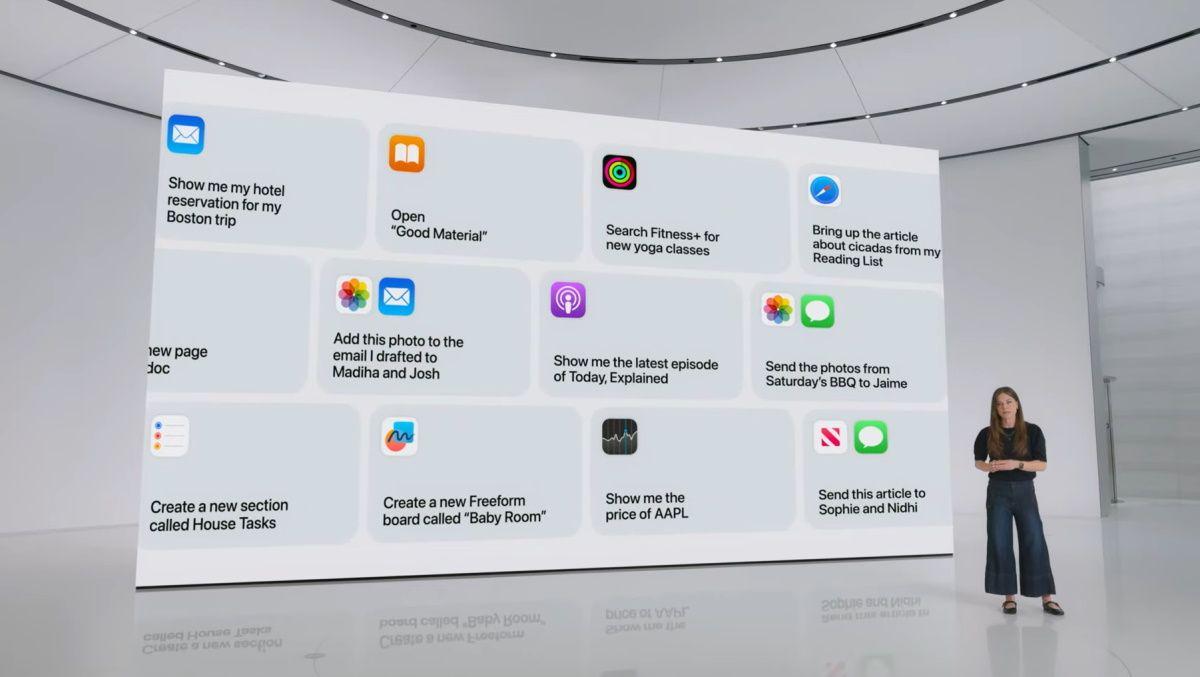

Apple on Thursday signaled that it's getting more serious about its plans to catch up in the AI race. "We see AI as one of the most profound technologies of our lifetime. We are embedding it across our devices and platforms and across the company. We are also significantly growing our investments," CEO Tim Cook said on the Q3 2025 earnings call with investors. "Apple has always been about taking the most advanced technologies and making them easy to use and accessible for everyone, and that's at the heart of our AI strategy," he added. Cook expanded on those comments on the call, noting that Apple was "reallocating a fair number of people" to focus on AI. "We have a great, great team and we're putting all of our energy behind it," he added. AI investments are also driving increased CapEx spending, which was up year-to-date, the company said. However, Apple pointed out that it still employed a hybrid model where it relies on third parties to make capital investments, which is why it won't grow exponentially. Ahead of its call, the company shared in an interview with CNBC that it's open to M&A to accelerate its AI plans. The company told the outlet that it has already acquired seven companies this year. None was "huge" in terms of dollar amount, Cook said. Apple has been criticized for having been caught off guard by the AI era; it has announced a number of AI features that it has, so far, failed to ship. The company was even accused of showing off an improved AI-powered version of Siri that wasn't close to being ready to launch. But Apple has defended itself by saying that it doesn't need to rush -- that launching the wrong features or the wrong products just to be first would be a mistake. That's especially true if those products don't work as promised. So far, Apple says it has launched more than 20 Apple Intelligence features, including visual intelligence, cleanup, and writing tools. Later this year, Apple plans to launch AI features like live translation and an AI-powered workout buddy, but the more personalized Siri's improvements have been delayed to 2026. On the call with investors, Cook said the company was "making good progress" on the Siri update. He also shared his thoughts on how AI may impact the iPhone business if new hardware were to emerge. For instance, Meta CEO Mark Zuckerberg earlier this week suggested that AI glasses would be the form factor for interacting with the new technology, and those without them would be left behind. Cook, naturally, disagreed. "It's difficult to see a world where iPhone's not living in it," he said. "That doesn't mean that we are not thinking about other things, as well, but I think that the [AI] devices are likely to be complementary devices, not substitutions." The exec declined to answer a question about what AI technologies it believed would ultimately believed would be commoditized, saying that would give away part of its strategy. Apple delivered better-than-expected iPhone sales and record revenue in Q3, which saw its stock pop in after-hours trading.

[2]

Apple plans to 'significantly' grow AI investments and is open to M&A | TechCrunch

Apple on Thursday signaled that it's getting more serious about its plans to catch up in the AI race. "We see AI as one of the most profound technologies of our lifetime. We are embedding it across our devices and platforms and across the company. We are also significantly growing our investments," CEO Tim Cook said on the Q3 2025 earnings call with investors. "Apple has always been about taking the most advanced technologies and making them easy to use and accessible for everyone, and that's at the heart of our AI strategy," he added. Ahead of its call, the company also shared in an interview with CNBC that it's planning to "significantly grow" its AI investments and is open to M&A to accelerate its AI plans. The company also noted that it has already acquired seven companies this year. None was "huge" in terms of dollar amount, Cook said. Apple has been criticized for having been caught off guard by the AI era; it has announced a number of AI features that it has, so far, failed to ship. The company was even accused of showing off an improved AI-powered version of Siri that wasn't close to being ready to launch. But Apple has defended itself by saying that it doesn't need to rush -- that launching the wrong features or the wrong products just to be first would be a mistake. That's especially true if those products don't work as promised. So far, Apple says it has launched more than 20 Apple Intelligence features, including visual intelligence, cleanup, and writing tools. Later this year, Apple plans to launch AI features like live translation and an AI-powered workout buddy, but the more personalized Siri's improvements have been delayed to 2026. Apple delivered better-than-expected iPhone sales and record revenue in Q3, which saw its stock pop in after-hours trading.

[3]

Tim Cook reportedly tells employees Apple 'must' win in AI | TechCrunch

Apple CEO Tim Cook held an hourlong all-hands meeting in which he told employees that the company needs to win in AI, according to Bloomberg's Mark Gurman. The meeting came after an earnings call in which Cook told investors and analysts that Apple would "significantly" increase its AI investments. It seems he had a similar message for Apple employees, reportedly telling them, "Apple must do this. Apple will do this. This is sort of ours to grab." Despite launching a variety of AI-powered features in the past year under the Apple Intelligence umbrella, the company's promised upgrades to its voice assistant Siri have been significantly delayed. And Cook seemed to acknowledge that the company has fallen behind its competitors. "We've rarely been first," he reportedly said. "There was a PC before the Mac; there was a smartphone before the iPhone; there were many tablets before the iPad; there was an MP3 player before iPod." But in his telling, that didn't stop Apple from inventing the "modern" versions of those products.

[4]

Tim Cook says Apple 'must' figure out AI and 'will make the investment to do it'

Apple CEO Tim Cook boasted about the potential of AI and the company's approach to developing it in a rare all-hands today that was reported on by Bloomberg. Apple has been slow to roll out some of its AI features and has stumbled with a planned AI-powered upgrade to Siri, which it delayed earlier this year. According to Bloomberg: The executive gathered staff at Apple's on-campus auditorium Friday in Cupertino, California, telling them that the AI revolution is "as big or bigger" as the internet, smartphones, cloud computing and apps. "Apple must do this. Apple will do this. This is sort of ours to grab," Cook told employees, according to people aware of the meeting. "We will make the investment to do it." Cook also apparently pointed to how the company has "rarely been first" in categories like personal computers, smartphones, tablets, and MP3 players but that Apple eventually made the "modern" versions of those. "This is how I feel about AI," Cook said, Bloomberg reports. Software chief Craig Federighi also spoke, discussing the Siri delay and how the company originally wanted to build it with a "hybrid architecture." Under that plan, one system would take care of things Siri can now, and the other would be powered by LLMs, but "we realized that approach wasn't going to get us to Apple quality," he said. The new plan is to move everything to a new architecture. The all-hands follows Cook's comments ahead of an earnings call yesterday where he said that the company is "open to" acquisitions to accelerate its roadmap. Apple has also lost some of its AI talent as part of Meta's "superintelligence" hiring spree.

[5]

Apple Is Open to Buying Companies to Get Ahead in the AI Race

Apple's CEO Tim Cook has used the company's latest earnings call to tell customers and investors it is "significantly" increasing its investment in AI technologies. Cook said, "We are embedding it across our devices and platforms and across the company. We are also significantly growing our investments." He also confirmed the brand is reallocating a "fair number of" employees to work on Apple Intelligence features. This came as part of a celebratory earnings call for the company where the brand beat expectations for the third fiscal quarter. It saw results up 10% from the same period a year ago, bringing in a revenue of $94 billion between April and June 2025. Apple has been criticized for being slow to act on artificial intelligence features with a false start to an AI-powered version of Siri highlighting its struggles. The brand has also reportedly lost numerous AI engineers is recent months with four experts moving to rival Meta. Ahead of the earnings call, Apple told CNBC it was open to acquiring companies that may help it get ahead in the AI race. Apple says it has made seven acquisitions this year, but it confirmed none of them were "huge in terms of dollar amount." Cook said, "We're open to M&A that accelerates our roadmap." He didn't share any of the targets in Apple's sights, but a previous report in June, from Bloomberg, said Apple was reportedly considering a purchase of AI search tool Perplexity. Another report in July said the brand was considering partnering with Anthropic or OpenAI to help power some of Siri's features. None of these reports have been confirmed by Apple. This new earnings call is the first time Apple has publicly noted it is open to buying new companies to help its work in the AI space. In the meantime, the brand is working hard on new Siri features, which Apple execs have said won't be launching until 2026. The earnings call also saw Cook note the impact of US tariffs on its business. He shared that Apple has spent $800 million on tariffs during the last quarter, and he believes with no further changes to charges, Apple will see $1.1 billion added between July and September. That period will likely involve the launch of a new iPhone 17 series, and the brand may introduce other gadgets alongside it. Apple also confirmed on the earnings call that the iOS 26, macOS 26, and iPadOS 26 developer betas were the most popular trials it has ever run. Apple is also celebrating a major milestone of becoming the second company ever to sell over three billion phones. Analysts believe Samsung hit that target between 2014 and 2024, but it has likely sold far more as the brand also made handsets before 2014.

[6]

Apple's Tim Cook 'very open to M&A that accelerates our road map' for AI' -- company increasing spending on AI initiatives, reorganizing teams to address expansion

Being considerably behind other major high-tech companies with its artificial intelligence (AI) technologies, Apple is open to acquiring third-party companies to accelerate its AI roadmap as its management gets that gradual expanding its internal AI initiatives won't cut in to become competitive with Google, Microsoft, OpenAI, or xAI. "We are very open to M&A (Mergers and Acquisitions) that accelerates our road map," said Apple CEO Tim Cook during the company's earnings call with financial analysts and investors, when asked about possible acquisitions of AI companies. "We are not stuck on a certain size company, although the ones that we have acquired thus far this year are small in nature. But we basically ask ourselves whether a company can help us accelerate our roadmap and if they do, then we are interested. But we do not have anything to share specifically today." During the call, Cook confirmed the company is increasing spending and reorganizing teams to address expansion of its AI initiatives. Apple is moving a significant number of employees to AI-related work and these teams are tasked with developing new features that leverage machine learning and related technologies across Apple's hardware and software ecosystem. "The way that we look at AI is that it is one of the most profound technologies of our lifetime, and I think it will affect all devices in a significant way," Cook said. "We are embedding it across our devices and platforms and across the company. We are also significantly growing our investments. Apple has always been about taking the most advanced technologies and making them easy to use and accessible for everyone, and that is at the heart of our AI strategy." Cook stated that Apple intends to grow its AI investment substantially, which is proven by the company's increased CapEx (more on this later). This includes not only organic growth of the Apple's existing teams and efforts, but also acquisitions of other companies of different sizes. In fact, the company has already made around seven takeovers this year, though not all were related to AI, according to Cook. Historically, Apple has made numerous high-profile acquisitions that either expanded its market presence, or strenghtened its vertical integration. Apple's most notable acquisition remains Beats Electronics, purchased in 2014 for $3 billion. This transaction brought both the popular Beats headphone brand and the Beats Music streaming service, which became the foundation for Apple Music. For now, the Beats-branded portfolio clearly helps Apple to maintain the No.1 position on the market of wireless headsets and justifies development of custom silicon for these devices. Other acqusitions were mostly focused on enhancing the company's vertical integration. In 2019, Apple expanded its hardware capabilities by acquiring Intel' smartphone modem business for $1 billion, gaining key patents and over 2,000 employees to accelerate the development of its own 5G modems in a bid to reduce dependence on Qualcomm. This year the company finally released its first smartphone with its in-house developed modem inside and said that eventually it would use its own modems inside its devices. Earlier, in 2018, Apple spent $600 million to acquire a portion of Dialog Semiconductor, including licensing power management technologies and hiring over 300 Dialog engineers, helping Apple bring more of its chip design in-house. In the early 2010s, the company broght Anobit Technologies to bring development of NAND controllers in house; fingerprint sensor company AuthenTec (Touch ID), and 3D sensing designer PrimeSense (Face ID). Despite this renewed focus on AI, Apple's infrastructure spending remains modest compared to other major high-tech companies. Apple allocated $3.46 billion on CapEx in Q3 FY2025, a rise from $2.15 billion in the same period last year. So far this fiscal year the company has spent $9.473 billion on 'acquisition of property, plant, and equipment,' which is how it calls its capital expenditures. Even if the company spends another $3.46 billion in Q4 FY2025 (which ends on September 29), its CapEx for the fiscal year 2025 will total $12.933 billion. If we annualize Apple's CapEx to calendar year, its spendings will be between $13 billion and $14 billion, which is far behind Google's $85 billion forecast for fiscal 2025, Meta's projected $72 billion, and Microsoft's $80 billion for calendar 2025, according to CNBC estimates. Apple posted total revenue of $94.0 billion for the third fiscal quarter ending June 28, 2025, a 10% increase from the $85.8 billion reported a year earlier. Net income for the quarter reached $23.4 billion, an increase from $21.4 billion in the third quarter of 2024. Gross margin for the quarter came in at 46.5%, compared to $46.27 billion last year. As for product categories, iPhone remains the company's No. 1 product with $44.6 billion in revenue, a notable rise from $39.3 billion at the same quarter last year Sales of Mac PCs generated $8.0 billion, compared to $7.0 billion last year. iPad revenue was $6.6 billion, slightly down from $7.2 billion in the prior year, which is a surprise as the company introduced an inexpensive iPad earlier this year. The Wearables, Home, and Accessories category brought in $7.4 billion, a decline from $8.1 billion in Q3 2024. Meanwhile, Services revenue continued its upward trajectory, reaching $27.4 billion, up from $24.2 billion in Q3 FY2024.

[7]

Apple CEO: AI Is 'As Big or Bigger' Than the Internet, Smartphones

If the hundred-million-dollar AI investments at Microsoft, Google, and Amazon -- and NFL-level salaries for AI talent -- weren't enough to confirm the big tech AI race is on, Apple's CEO has just addressed any remaining doubt. Apple CEO Tim Cook told employees at an all-hands meeting at its main campus in Cupertino, California that the AI revolution is "as big or bigger" than the internet, smartphones, cloud computing, and apps. According to Bloomberg's Power On newsletter, Cook told employees that "Apple must do this," adding that this is "ours to grab." Cook expressed hopes that, though Apple has been relatively late in rolling out AI tools -- Apple Intelligence was only unveiled in June -- it could still dominate its rivals. "We've rarely been first," the CEO told staff. "There was a PC before the Mac; there was a smartphone before the iPhone; there were many tablets before the iPad; there was an MP3 player before iPod." But Cook argued that Apple invented the "modern" versions of those products, adding: "This is how I feel about AI." He also discussed practical steps Apple is taking to make these plans a reality. Cook said Apple is investing in AI in a "big way," and that 40% of the 12,000 employees hired last year are set to work on research and development. These comments about a big AI push from Apple are unlikely to be just talk. Bloomberg reported earlier this week that the company is working on a new cloud-computing chip, code-named Baltra, to power new AI features. Meanwhile, Cook told CNBC earlier this week the company was open to acquiring companies to help it get ahead in the AI race. Dramatic ultimatums to staff about AI pivots are cropping up more and more among Apple's competitors. Former Google CEO Sergey Brin, who recently returned to the company, told employees that 60-hour weeks, mostly in the office, would be expected to win the AI race. Allegations about boiler-room-level pressure are becoming increasingly common across big-name AI firms. Three weeks after leaving his role at OpenAI, former engineer Calvin French-Owen recently went public about widespread burnout at the company. He described a high-pressure, secretive environment so intense that leadership recently gave the entire company a week to recharge, according to Wired. Disclosure: Ziff Davis, PCMag's parent company, filed a lawsuit against OpenAI in April 2025, alleging it infringed Ziff Davis copyrights in training and operating its AI systems.

[8]

Apple CEO Tells Staff AI Is 'Ours to Grab' in Hourlong Pep Talk

Apple Inc. Chief Executive Officer Tim Cook, holding a rare all-hands meeting following earnings results, rallied employees around the company's artificial intelligence prospects and an "amazing" pipeline of products. The executive gathered staff at Apple's on-campus auditorium Friday in Cupertino, California, telling them that the AI revolution is "as big or bigger" as the internet, smartphones, cloud computing and apps. "Apple must do this. Apple will do this. This is sort of ours to grab," Cook told employees, according to people aware of the meeting. "We will make the investment to do it."

[9]

Apple CEO Tells Staff AI 'Ours to Grab'

Apple Inc. Chief Executive Officer Tim Cook, holding a rare all-hands meeting following earnings results, rallied employees around the company's artificial intelligence prospects and an "amazing" pipeline of products. The executive gathered staff at Apple's on-campus auditorium Friday in Cupertino, California, telling them that the AI revolution is "as big or bigger" as the internet, smartphones, cloud computing and apps. "Apple must do this. Apple will do this. This is sort of ours to grab," Cook told employees, according to people aware of the meeting. "We will make the investment to do it." The iPhone maker has been late to AI, debuting Apple Intelligence months after OpenAI, Alphabet Inc.'s Google, Microsoft Corp. and others flooded the market with products like ChatGPT. And when Apple finally released its AI tools, they fell flat. Bloomberg's Mark Gurman reports. (Source: Bloomberg)

[10]

CEO Tim Cook says Apple ready to open its wallet to catch up in AI

SAN FRANCISCO, July 31 (Reuters) - Apple (AAPL.O), opens new tab CEO Tim Cook signaled on Thursday the iPhone maker was ready to spend more to catch up to rivals in artificial intelligence by building more data centers or buying a larger player in the segment, a departure from a long practice of fiscal frugality. Apple has struggled to keep pace with rivals such as Microsoft (MSFT.O), opens new tab and Alphabet's Google (GOOGL.O), opens new tab, both of which have attracted hundreds of millions of users to their AI-powered chatbots and assistants. That growth has come at a steep cost, however, with Google planning to spend $85 billion over the next year and Microsoft on track to spend more than $100 billion, mostly on data centers. Apple, in contrast, has leaned on outside data center providers to handle some of its cloud computing work, and despite a high-profile partnership with ChatGPT creator OpenAI for certain iPhone features, has tried to grow much of its AI technology in-house, including improvements to its Siri virtual assistant. The results have been rocky, with the company delaying its Siri improvements until next year. During a conference call after Apple's fiscal third-quarter results, analysts noted that Apple has historically not done large deals and asked whether it might take a different approach to pursue its AI ambitions. CEO Cook responded that the company had already acquired seven smaller companies this year and is open to buying larger ones. "We're very open to M&A that accelerates our roadmap. We are not stuck on a certain size company, although the ones that we have acquired thus far this year are small in nature," Cook said. "We basically ask ourselves whether a company can help us accelerate a roadmap, and if they do, then we're interested." Apple has tended to buy smaller firms with highly specialized technical teams to build out specific products. Its largest deal ever was its purchase of Beats Electronics for $3 billion in 2014, followed by a $1 billion deal to buy a modem chip business from Intel. But now Apple is at a unique crossroads for its business. The tens of billions of dollars per year it receives from Google as payment to be the default search engine on iPhones could be undone by U.S. courts in Google's antitrust trial, while startups like Perplexity are in discussions to try to dislodge Google with an AI-powered browser that would handle many search functions. Apple executives have said in court they are considering reshaping the firm's Safari browser with AI-powered search functions, and Bloomberg News has reported that Apple executives have discussed buying Perplexity, which Reuters has not independently confirmed. Apple also said on Thursday it plans to spend more on data centers, an area where it typically spends only a few billion dollars per year. Apple is currently using its own chip designs to handle AI requests with privacy controls that are compatible with the privacy features on its devices. Kevan Parekh, Apple's chief financial officer, did not give specific spending targets but said outlays would rise. "It's not going to be exponential growth, but it is going to grow substantially," Parekh said during the conference call. "A lot of that's a function of the investments we're making in AI." Reporting by Stephen Nellis in San Francisco; Editing by Sayantani Ghosh and Tom Hogue Our Standards: The Thomson Reuters Trust Principles., opens new tab

[11]

Apple is facing pressure from Wall Street to figure out its AI strategy

Apple CEO Tim Cook and Senior Vice President of Software Engineering Craig Federighi speak during Apple's annual World Wide Developers Conference at the company's headquarters in Cupertino, California, U.S., June 9, 2025. While its megacap tech peers are bragging about building island-sized data centers filled with Nvidia chips to power artificial intelligence devices of the future, Apple remains largely on the sidelines. Wall Street is getting concerned. The iPhone maker is the second-worst performer this year among the so-called Magnificent Seven, with its stock down over 15% as of Tuesday's close. Tesla, down 20%, is the only other member of the group that's lost value in 2025. Apple has disappointed its users and investors by declining to share more about its AI strategy, despite delaying the next generation of Siri until at least next year. Making matters worse, longtime Apple design chief Jony Ive in May sold his nascent startup IO for $6.5 billion to OpenAI. In the announcement, OpenAI CEO Sam Altman said his company is currently working on new hardware devices. OpenAI's aggressive move underscores Apple's unclear role in the future of AI and its lack of a clear strategy when it comes to competing. Analysts worry that Apple's position could start to hurt iPhone sales, which are still happening in historic volumes. "The incomplete AI strategy is still the biggest overhang, but we think Apple still has approximately 1.5 years to effect a compelling solution," TD Cowen analyst Krish Sankar wrote in a note on Monday. He recommends buying the shares. Don't expect Apple to dwell on its AI problem when it reports fiscal third-quarter earnings on Thursday. The company will likely be too busy talking about the $40 billion in iPhones it's expected to sell, per a FactSet estimate, and its profitable services business. Revenue in the services division is expected to show growth of about 11% to $26.8 billion, more than double the growth rate for the whole company.

[12]

Facing questions on AI strategy, Tim Cook says Apple is 'very open' to acquisitions

Tim Cook arrives for the annual Allen and Co. Sun Valley Media and Technology Conference at the Sun Valley Resort in Sun Valley, Idaho, on July 8, 2025. Apple's AI strategy and investment was on the mind of analysts on an earnings call after the company reported third-quarter earnings that showed overall revenue grew by 10% year over year. While Apple was never going to announce major acquisitions or initiatives on an earnings call, CEO Tim Cook's remarks on Thursday confirm that the company is going to invest more heavily in the technology. Cook said Apple is going to "significantly" grow the company's investments in AI. He added that Apple was always looking to buy companies of any size that could help it develop its AI offerings. "We're very open to M&A that accelerates our roadmap," Cook said. "We are are not stuck on a certain size company, although the ones that we have acquired thus far this year are small in nature." Cook said that Apple had acquired "around" seven companies so far this year, although not all of them were focused on AI. While Cook has said in the past that Apple is always evaluating potential acquisitions of all sizes, its largest purchase of all time was Beats Electronics in 2014 for $3 billion. He made the remarks Thursday as Apple has faced growing pressure from Wall Street to catch up to its Silicon Valley peers, all of whom have dedicated tens of billions of dollars toward the infrastructure necessary to power AI. Apple has never been the biggest spender on capital expenditures among big tech companies. It only reported $3.46 billion in capital expenditures in the June quarter, up from $2.15 billion in the year ago period. Its expenses this past quarter are the highest they have been since the quarter ending December 2022. If Apple spent as much as it did this quarter for a full year, that would be about $14 billion annually. That hardly compares to Google projecting $85 billion in capital expenditures for its fiscal 2025 last week, Meta's estimate of as much as $72 billion in annual capital expenditure spending, and Microsoft's $30 billion capital expenditures guide for the current quarter.

[13]

Apple is 'open to' acquisitions to boost its AI roadmap

Apple leadership discussed results and updates today in its third-quarter conference call, including some statements about its AI endeavors. As reported by CNBC, CEO Tim Cook said that the company is "significantly growing out investments" in artificial intelligence, which shouldn't be much of a surprise for any players in the tech space. However, Cook did acknowledge that an acquisition to boost its work in AI wasn't out of the question. "We're open to M&A that accelerates our roadmap," he said. Cook said that Apple is "not stuck on a certain size company" as a possible target for an AI-related purchase. He noted that Apple has acquired "about" seven businesses so far this year across multiple disciplines but that none were "huge in terms of dollar amount." The company also has been pretty quiet on its to overhaul the Siri voice assistant with more AI features. The news is still sparse on that subject; according to Reuters, Cook simply stated that the team is "making good progress on a personalized Siri." Despite hopes that Siri improvements would be unveiled at WWDC 2025, the latest projections are that the AI-powered update to that service might not be ready until . Apple did announce a few at WWDC, but the general consensus is that the company's AI efforts have been flagging behind other big tech businesses. That has led to speculation that it may look externally to improve its standing in the race to build the best AI features. Most recently, some execs within Apple have allegedly been as a potential acquisition.

[14]

Tim Cook says AI is now Apple's top priority, "bigger than the internet"

Big quote: In a rare all-hands meeting at Apple's Cupertino headquarters, CEO Tim Cook made it clear to thousands of employees that AI now stands at the forefront of the company's ambitions. Addressing a packed auditorium following a stronger-than-expected earnings report, Cook called the AI transformation "as big or bigger" than the internet, the smartphone, cloud computing, and apps. "Apple must do this. Apple will do this. This is sort of ours to grab," Cook told staff, vowing, "We will make the investment to do it." Tim Cook's remarks come as Apple finds itself trailing some of its rivals in the AI race. Microsoft, Google, and Amazon have funneled hundreds of millions into AI tools and infrastructure, while Apple's own Apple Intelligence suite was (soft) launched later than similar offerings from competitors. Even so, Cook noted that Apple's history shows it rarely arrives first, yet frequently becomes the dominant force. "There was a PC before the Mac; there was a smartphone before the iPhone; there were many tablets before the iPad; there was an MP3 player before the iPod," he said. Nevertheless, Apple has gone on to define the modern era of each category. "This is how I feel about AI," Cook said. "All of us are using AI in a significant way already, and we must use it as a company as well," Cook said. "To not do so would be to be left behind, and we can't do that." During the hour-long meeting, Cook emphasized Apple's commitment to investing more heavily in AI research and development. Of the 12,000 new hires last year, he said, 40 percent were recruited for R&D positions. Craig Federighi said Siri is switching to a unified system with a larger upgrade than first planned. He also highlighted Apple's willingness to consider acquisitions to accelerate its AI roadmap, telling staff, "We are very open to mergers and acquisitions that will expedite our development plans." The company, he said, is eager to "allocate the resources necessary to accomplish it." Part of this effort includes a new AI-focused cloud chip, codenamed Baltra, which is expected to power Apple's backend AI processing. Developed in collaboration with Broadcom and Apple's in-house team, the chip will enable more advanced AI features for products like Siri while safeguarding user privacy by anchoring computation within Apple's private cloud infrastructure. Craig Federighi, Apple's software chief, also addressed the assembly, discussing the company's delayed Siri overhaul. Originally envisioned as a "hybrid architecture" combining legacy command processing with generative AI, the update fell short of Apple's high standards. "We understood that this strategy wouldn't achieve Apple's quality standards," Federighi acknowledged. As a result, the team is transitioning Siri to a new, unified system with a more substantial upgrade than initially planned. "There is no project people are taking more seriously," he said. Beyond technology, Cook also touched on the company's carbon neutrality goals, ongoing efforts in healthcare, and Apple's plans to expand retail in emerging markets, including India, China, and Saudi Arabia. But the central message was clear: Apple cannot afford to fall behind in AI. "All of us are using AI in a significant way already, and we must use it as a company as well," Cook said. "To not do so would be to be left behind, and we can't do that."

[15]

Apple CEO Tim Cook Calls AI 'Bigger Than the Internet' in Rare All-Hands Meeting

Can Apple catch up to peers in the AI race? Tim Cook seems to think so. In a global all-hands meeting hosted from Apple’s headquarters in Cupertino, California, CEO Tim Cook seemed to admit to what analysts and Apple enthusiasts around the world had been raising concerns about: that Apple has fallen behind competitors in the AI race. And Cook promised employees that the company will be doing everything to catch up. “Apple must do this. Apple will do this. This is sort of ours to grab,†Cook said, according to Bloomberg, and called the AI revolution “as big or bigger†than the internet. The meeting took place a day after Apple reported better than expected revenue in its quarterly earnings report, and that sent the company’s stock soaring. The report came in a week already marked by great tech earnings results, partially driven by AI. But unlike Meta and Microsoft, Apple’s rise in revenue was attributable to iPhone sales and not necessarily a strength in AI. In the earnings call following the report, Cook told investors that Apple was planning to “significantly†increase its investments in AI and was open to acquisitions to do so. He also said that the company is actively “reallocating a fair number of people to focus on AI features.†Cook echoed those sentiments in Friday’s meeting, saying that the company will be making the necessary investments in AI to catch up to the moment. Apple has been working on integrating advanced AI into its product lineup for the past year or so under its Apple Intelligence initiative, which the company unveiled at the June 2024 Worldwide Developers Conference. The move was met by celebration and criticism even then: Apple's big bet on AI was coming a good year or so after competitors like OpenAI, Google, Microsoft, and Meta scaled up their offerings. Even so, the company’s progress on Apple Intelligence has been slow. Apple was supposed to unveil an AI-enhanced Siri earlier this year, and even released ads for the new iPhone with AI-enhanced Siri capabilities, but the Cupertino giant pushed that reveal back at the last minute, reportedly to next spring, though nothing is officially confirmed. The switch-up caused major backlash from investors and customers, two major lawsuits, and a complete corporate overhaul. Cook said on Friday that 12,000 workers were hired in the last year, with 40% of them joining research and development teams. The leadership overhaul following the fallout of LLM Siri has “supercharged†the company’s work in AI development, senior vice president of software engineering Craig Federighi said at the meeting. According to Federighi, the main problem with the LLM Siri rollout was that Apple tried to build a “hybrid architecture†that utilized two different software systems. That plan has now been scratched, and Federighi seemed confident in LLM Siri’s future this time around, claiming that the new “end-to-end revamp of Siri†will now be delivering “a much bigger upgrade than we envisioned.†Also key to the new AI strategy, according to Cook, is chip development. Apple has been working on designing in-house AI chips for some time now, according to a Wall Street Journal report from last year, in a project internally code-named ACDC (standing for Apple Chips in Data Center). The tech giant has reportedly teamed up with Broadcom to develop its first AI chip code-named Baltra, according to a report last year in The Information, and Apple is expecting to begin mass production by 2026. Despite being a global leader in tech and a household name in consumer electronics, Apple is nowhere near the top when it comes to the AI race. But while that scares some Apple fans and investors, others think it’s actually kind of on-brand. Tim Cook indicated Friday that he belongs to the latter camp. “We’ve rarely been first,†Cook said at the meeting. “There was a PC before the Mac; there was a smartphone before the iPhone; there were many tablets before the iPad; there was an MP3 player before iPod.†Cook has a point. Apple isn’t necessarily known for spearheading new technology, but the company’s strength comes from perfecting said technology and making products that become highly dominant in their respective markets. And if Apple makes the right moves in developing and scaling its AI product offerings, Cook could potentially add AI to that list as well.

[16]

Tim Cook: Apple is 'significantly growing' AI spend, M&A could accelerate roadmap

Today Apple reported its quarterly earnings, far exceeding Wall Street expectations with a huge 10% YoY revenue increase. CEO Tim Cook also signaled strong AI ambitions for the company in quotes made to CNBC. Apple's AI investments are growing, but much more could be ahead Kif Leswing writes at CNBC: "We are significantly growing our investments," Cook said about AI. "We're embedding it across our devices, across our platforms and across the company." Cook said that Apple had acquired "around" seven companies so far this year although none had been "huge in terms of dollar amount." "We're open to M&A that accelerates our roadmap," Cook said. Cook also said that Apple views AI as "one of the most profound technologies of our lifetime." The quotes come at a critical time for Apple, with Wall Street well aware of various reports that have made Apple's AI efforts seem troubled. Just this week, Bloomberg reported on another high-profile departure from Apple for Meta's "superintelligence" division. This is the fourth such loss from Apple's foundation models team very recently. Apple Intelligence first launched last year, and is getting a variety of new features in iOS 26. But by and large, fueled especially by Siri feature delays, consensus in the tech world is that Apple has a lot of catching up to do to match the AI output that companies like OpenAI, Google, and others have achieved.

[17]

Apple 'very open' to AI acquisitions to speed up its roadmap - 9to5Mac

Whenever there's talk of Apple making a big, splashy acquisition to help catch up in AI, someone inevitably points out that "Apple doesn't acquire big companies like that". Today, Apple CEO Tim Cook offered his view: company size doesn't matter. During today's Q3 2025 earnings call, Citi analyst Atif Malik asked whether Apple needed to accelerate its AI roadmap, despite historically not resorting to big acquisitions. Cook noted that Apple has acquired seven companies this year, although not all of them were AI companies. Then, he added: "We're very open to M&A that accelerates our roadmap. We're not stuck on a certain size company. (...) we basically ask ourselves whether a company can help us accelerate a roadmap. If they do, then we are interested. But we don't have anything to share specifically today." Cook's answer comes about a month after Bloomberg reported that Apple had held internal talks about acquiring AI search startup Perplexity, which reportedly just closed a $1 billion funding round, pegging its value at more than $18 billion, and pushing any potential sale price even higher. An acquisition would not just make it Apple's biggest to date, well beyond the $3 billion Beats deal, it could arguably eclipse the combined value of every other acquisition Apple has ever made. At the same time, Morgan Stanley recently published a report that classified as "misguided" the idea that Apple needed to acquire an AI search startup. Be it as it may, Cook's remarks today offered both a different perspective, and a roadmap of companies hoping to break with Apple's precedent: for this particular case, if the technology is right, Apple may be willing to pay a price as massive as its own shortcomings in the AI game.

[18]

Tim Cook holds company-wide meeting to address Apple's AI woes - 9to5Mac

Just one day after revealing its financial results and fielding questions about Apple's lag in AI, Tim Cook turned inward, holding what Bloomberg described as an 'hourlong pep talk' during a company-wide all-hands meeting. Here are the details. As reported by Mark Gurman, Tim Cook held a company-wide meeting today at the Steve Jobs Theater at Apple Park, and stated that "the AI revolution is 'as big or bigger' as the internet, smartphones, cloud computing and apps," as he promised to make the investment to do it: "'Apple must do this. Apple will do this. This is sort of ours to grab,' Cook told employees, according to people aware of the meeting. "We will make the investment to do it.' The meeting comes as Apple faces high-profile defections to Meta's Superintelligence Labs initiative. Internally, teams have also faced setbacks, including leadership shakeups, competing priorities, and disagreements over strategic directions. The Siri team, for instance, was reportedly blindsided by the delay of its AI revamp, and equally surprised to learn that Apple was pursuing partnerships with OpenAI and Anthropic, rather than continuing in-house development. The company has also held internal discussions about acquiring AI search startup Perplexity, a possibility that was lightly alluded to during yesterday's earnings call. Craig Federighi also took the stage briefly during today's meeting to speak directly to those issues." "Federighi explained that the problem was caused by trying to roll out a version of Siri that merged two different systems: one for handling current commands -- like setting timers -- and another based on large language models, the software behind generative AI. "We initially wanted to do a hybrid architecture, but we realized that approach wasn't going to get us to Apple quality," Federighi said." Back to Cook, he reportedly leaned on a familiar counter-argument when addressing concerns about Apple's late entry into the AI race: "'We've rarely been first,' the executive told staffers. 'There was a PC before the Mac; there was a smartphone before the iPhone; there were many tablets before the iPad; there was an MP3 player before iPod.' But Apple invented the 'modern' versions of those product categories, he said. 'This is how I feel about AI.'" During the meeting, Cook also reportedly addressed the upcoming retirement of long-time COO Jeff Williams, as well as matters such as Apple's recent investments in health-related initiatives, and Apple TV+ performance. When talking about regulatory pressure, he said: "The reality is that Big Tech is under a lot of scrutiny around the world," Cook said. "We need to continue to push on the intention of the regulation and get them to offer that up, instead of these things that destroy the user experience and user privacy and security." As Bloomberg noted, today's meeting marked a rare departure from Apple's typical small, town hall-style gatherings. More than anything, it signaled that Apple felt the need to rally its troops, take control of its AI strategy, and hopefully stem the ongoing brain drain to rival companies.

[19]

Apple 'Open' to Acquisition That Accelerates AI Roadmap

Apple is "open" to an acquisition that would accelerate its AI roadmap, Apple CEO Tim Cook told CNBC today. Cook said that Apple sees AI as one of the "most profound technologies of our lifetime," and that the company is "significantly growing" its AI investments. "We're embedding it across our devices, across our platforms and across the company," Cook said. Apple has already purchased seven companies in 2025. "We're open to M&A that accelerates our roadmap," Cook added. Apple has been losing key members of its AI team to Meta in recent weeks, and the company is already far behind competitors in AI development. There have been rumors that Apple is considering working with Anthropic or OpenAI to develop an LLM version of Siri rather than using its own AI technology, but Apple hasn't moved forward with a partnership as of yet. Many of the high profile AI companies would not be feasible for Apple to purchase, but the company has considered purchasing Perplexity AI. Perplexity is valued at $18 billion, so if Apple did acquire the company, it would mark Apple's largest acquisition to date.

[20]

Apple says it's ready to spend big on AI -- that Perplexity acquisition rumor is a good place to start

Apple exceeded Wall Street expectations in its latest earnings call, but perhaps the Achilles' heel for the tech giant so far has been its approach to AI. Apple has been seen by many -- including Tom's Guide -- as trailing the likes of Google, OpenAI and even Microsoft when it comes to implementing useful AI solutions into its products. Well, that could be about to change. According to CNBC, Tim Cook told investors the company plans to "significantly grow our investments" when it comes to AI. Considering Apple posted a total revenue of $94 billion last quarter, that remark carries about the same weight as a silverback gorilla casually eyeing up a few neighboring patches of rainforest. "We're open to M&A [mergers and acquisitions] that accelerate our roadmap," Cook said, noting that Apple had acquired around seven companies so far this year. He qualified that by saying none had been "huge in terms of dollar amount." The bullish comments come at a time when other companies are spending huge amounts on AI acquisitions. For instance, Meta has paid $14.3 billion -- its largest ever investment -- to acquire a 49% stake in Scale AI, a San Francisco data annotation company. Meanwhile, Microsoft has become only the second company after Nvidia hitting hit a $4 trillion valuation. Largely thanks to Azure and AI. Forrester's VP principal analyst Dipanjan Chatterjee said that Apple getting serious on AI spend is an admission that it's fallen behind the tech pack. And he suggests that Perplexity could be in the company's sights. This is something we've heard before, specifically from a Bloomberg report claiming Apple's head of M&A, Adrian Perica, is interested in the AI company. "Apple's AI urgency is palpable, and there is a quiet admission of its sluggishness in the acknowledgement that it may have to lean heavily on acquisition to compress timelines," Chatterjee said. "Rumors swirl about a Perplexity deal, and if that were to happen, it may greatly accelerate the elusive promise of a more effective Siri." Acquiring or partnering with Perplexity would make sense for Apple as it could integrate Perplexity's tech into making Siri smarter now that Apple's planned AI revamp for its assistant has been pushed into 2026. If the deal came, it'd be Apple's biggest ever acquisition. Perplexity is valued at around $14 billion, which towers above Apple's biggest deal to date: buying Beats for $3 billion back in 2014.

[21]

Tim Cook Defends Apple's AI Delay: 'We've Rarely Been First'

Apple CEO Tim Cook spoke to employees at an all-hands meeting today, providing some insight into Apple's work on AI. According to Bloomberg, Cook said that AI is going to be bigger than smartphones and the internet, and that it's a priority for the company. "Apple must do this. Apple will do this. This is sort of ours to grab. We will make the investment to do it," Cook told employees. Cook pointed out that Apple has dominated several markets even when the company wasn't first to the technology. "We've rarely been first. There was a PC before the Mac; there was a smartphone before the iPhone; there were many tablets before the iPad; there was an MP3 player before iPod," Cook said, suggesting that Apple will play a major role in transforming AI in the future. The all-hands meeting comes a day after Apple's earnings call, where Cook made similar remarks about Apple's plan to make significant investments in AI. During the call, Cook said Apple was open to making an acquisition that would accelerate its roadmap. Apple has held talks with Perplexity and Mistral about a potential major AI acquisition, and the company has also discussed using technology from OpenAI or Anthropic for an LLM-based version of Siri. Apple software chief Craig Federighi was also on hand to discuss Siri, and he said the company's efforts to overhaul the underlying Siri architecture are promising. Apple is getting the "needed" results from the Siri overhaul. "This has put us in a position to not just deliver what we announced, but to deliver a much bigger upgrade than we envisioned. There is no project people are taking more seriously," Federighi said. Cook and Federighi may have been aiming to reassure employees about Apple's dedication to AI due to Meta's efforts to poach AI experts. Several Apple AI engineers have left Apple for Meta because Meta has been offering massive pay packages, and morale at Apple has been falling.

[22]

'Apple must do this, Apple will do this' - Tim Cook rallies staff in face of AI delays

The delays and issues around Apple Intelligence have been well documented, but Apple CEO Tim Cook says his company isn't giving up an AI - and in fact has said the AI market is "ours to grab" in a recent all-hands meeting. As per the usually reliable Mark Gurman at Bloomberg, the hour-long meeting was held right after Apple's most recent earnings call, and both Tim Cook and senior vice president of software engineering Craig Federighi were apparently upbeat about Apple's AI future. "Apple must do this," Cook apparently said on AI. "Apple will do this. This is sort of ours to grab." The CEO reportedly went on to say that while Apple hasn't always been first in product categories, it's usually able to catch up and surpass its rivals. According to Gurman, Cook also encouraged Apple employees to use more AI in their day-to-day work, to avoid being "left behind" in the field. The CEO is predicting AI will be bigger than smartphones, apps, and the internet. As for Federighi, he reportedly told staff that Apple was overcoming the initial challenges it had faced with adding Apple Intelligence on top of Siri. Rather than merging two systems, engineers are now working on building an entirely new architecture. "The work we've done on this end-to-end revamp of Siri has given us the results we needed," said the exec. "This has put us in a position to not just deliver what we announced, but to deliver a much bigger upgrade than we envisioned." Apple has clearly rushed its AI efforts in an attempt to catch up to the likes of OpenAI and Google - having to pull adverts promising features that have yet to materialize - but it would appear that Apple remains fully committed to the technology. The all-hands meeting is said to have covered other topics including Apple TV+, AirPods, and the impact of regulations. Cook also mentioned that there's an "amazing" series of Apple products in the pipeline - which may include a folding iPhone.

[23]

Apple is ready to catch up in the AI market, CEO Tim Cook says

Apple has alluded to wanting to increase spending on artificial intelligence and data centers to catch up with rivals after early Apple Intelligence features have left users wanting more in the shadow of Microsoft and Google systems. CEO Tim Cook expressed an interest in acquiring larger AI companies after the company bought out seven smaller companies in 2025, marking a shift from the iPhone maker's typical strategy of low-key acquisitions. The news came as Apple announced its third-quarter financial results, revealing a 10% year-over-year quarterly revenue of $94.0 billion. Speaking about double-digit growth across iPhone, Mac, and Services, Cook said: "We were excited to introduce a beautiful new software design that extends across all of our platforms, and we announced even more great Apple Intelligence features." The company has fallen behind the likes of Microsoft and Google, who are spending around $85-100 billion annually on AI and data centers. Currently, Apple mostly relies on third-party data centers and has built a handful of AI tools in house, however users have been left facing disappointing launches and delays. All of this could be about to change if Bloomberg reporting suggesting that Apple could buy Perplexity turns out to be true. Speaking about data center spend on the earnings call, CFO Kevan Parekh explained: "It's not going to be exponential growth, but it is going to grow substantially." However, Apple's cautious approach has proven valuable in terms of the company's environmental impact, where other companies have seen significant impacts from rapid data center expansion. In its 2024 Environmental Progress Report, the company highlighted its own proprietary server designs, which have boosted energy efficiency and reduced water consumption - they've also been powered by renewable energy since 2018.

[24]

Dan Ives slams Apple's tech showcase as 'an episode out of 'Back to the Future'' and turns up the heat on Tim Cook over 'elephant in the room'

While fellow tech titans are racing to put AI front and center, Apple's WWDC presentation was notable for its near silence on the subject. "Barely no mention of AI," Ives remarked in his latest report, calling it "the elephant in the room." He noted this was a stark contrast to the fever pitch seen at rival developer events. Analysts, investors, and developers tuned in with expectations of a grand reveal that would clarify Apple's ambitions for the "AI Revolution." Instead, they watched as the company leaned on traditional strengths -- hardware updates and a strong services story -- leaving the future of Siri and Apple's broader AI roadmap conspicuously vague. This omission has become a growing concern for analysts like Ives, who believe Apple is at a crossroads. "It's becoming crystal clear that any innovation around AI at Apple is not coming from inside the walls of Apple Park," he wrote, referencing the company's famed Cupertino headquarters. While Apple has historically prided itself on building transformative technology in-house, Ives argues those days may be over. "The time has come" for a big acquisition, he wrote, singling out Perplexity as a "no brainer" acquisition target -- even if it costs upwards of $40 billion. According to Ives, such a move could instantly supercharge Apple's lagging AI platform and help reposition Siri as the "next AI gateway for consumers." To date, Apple's biggest acquisition remains Beats, a $3 billion deal in 2014 -- an order of magnitude smaller than the types of deals transforming the AI sector today. Apple's traditionally cautious approach to M&A, Ives suggests, may be holding it back at a time when speed is everything. "AI technology on the enterprise and consumer landscape is happening at such a rapid pace Apple will not be able to catch up with an internally built solution," he warned. The stakes, Ives estimates, are high: A successful AI monetization strategy could add as much as $75 per share to Apple's valuation. "We believe [CEO Tim] Cook needs to rip the band-aid off and finally do an M&A deal," he wrote. The muted AI narrative at WWDC comes during a broader period of transition for Apple. While demand for iPhones -- a bellwether for the company -- remains globally robust, with particular improvement in China after a year of tough competition, the company faces mounting headwinds. Trade tensions, evolving supply chain risks, and increasing pressure from lower-priced rivals in Asia have stressed Apple's core markets. For now, analysts are keeping faith with Apple's near-term performance. Wedbush maintains its "Outperform" rating, with a 12-month price target of $270 per share, citing expected growth driven by the upcoming iPhone 17 and continued strength in services. The stock was trading at $211.27 at the time of writing. But Ives is steadfast: the next chapter -- centered on AI -- will define Apple's future. To be clear, Cook has had a legendary run after succeeding Steve Jobs in 2011. Over the ensuing 14 years, Cook has led Apple through a period of extraordinary shareholder value creation -- transforming a $300 billion company into a $3.2 trillion titan. Under his stewardship, Apple refined its operational efficiency, reinvigorated its services division, and delivered massive profits through established hits like the iPhone, AirPods, and Apple Watch. But as Fortune's Geoff Colvin reported, "suddenly his weaknesses are on display in the AI era." A chorus of analysts has joined Ives in arguing that Cook's operational excellence and supply-chain mastery may not be enough to win the future, as the AI era upends the tech industry's priorities. The first half of 2025, furthermore, has been bruising. The company's stock is down about 16%, while rivals like Microsoft and Alphabet have soared on aggressive bets in generative AI. Apple's "Apple Intelligence" initiative, which was supposed to position Siri and other features at the forefront of consumer AI, has failed to capture investor or developer enthusiasm. Meanwhile, key AI executives have left: Apple's top AI executive Ruoming Pang recently defected to Meta, just weeks after another top Apple AI scientist, Tom Gunter, resigned. Simultaneously, Chief Operating Officer Jeff Williams -- a long-touted Cook successor -- is set to retire, forcing a broader management overhaul. These departures have intensified debate about Apple's innovation pipeline. Critics argue that under Cook, Apple has not delivered any genuinely transformative new product since the Jobs era, with most recent hits -- like AirPods or the Apple Watch -- refining rather than redefining product categories. The risk, analysts warn, is existential: If smart devices shift into new AI-centric paradigms and Apple fails to respond forcefully, the company's platform risks obsolescence. Research firm LightShed Partners rocked investors and the tech press in July by calling for a regime change. Analysts Walter Piecyk and Joe Galone insisted Apple needs a product-focused CEO, not one centered on logistics. They warned Apple's lack of compelling innovation in AI and the relatively stagnant progression of Siri could irreversibly erode its competitive edge as Google, Microsoft, and OpenAI press forward. Cook's defenders argue Apple has a unique position: its platform lock-in gives it time to execute a measured AI response. And historically the company has rarely been first-mover -- its success derives from perfecting existing technologies, not inventing them. Nevertheless, with AI's foundational impact compared to the internet or electricity, allowing the competition to set the pace could be dangerous. Ives is still backing Cook, with reservations. "Patience is wearing thin among investors and importantly developers," he warned. The coming months, particularly as Apple's product cycle heats up in September and beyond, may prove pivotal -- not just for the company's balance sheet. Ives said Wedbush believes Cook will be Apple CEO for another five years, at least, but there are mounting challenges, from the "tariff iPhone quagmire," with Apple's manufacturing operations in China directly exposed to trade uncertainty, to President Donald Trump's displeasure with India as an alternate supply chain solution, to "missing the AI foundational strategy." He concluded, "this chapter will define Cook's legacy." "It's time for Cook and Cupertino to face the new reality of this quickly morphing AI-driven tech landscape," Ives wrote. "Because if they do not change, it will be a historic strategic black eye for Apple in our view."

[25]

Is Apple's AI Redemption Finally In Sight? | AIM

Rarely been first to anything, the tech giant has advanced existing products instead, says Tim Cook. Apple Inc. has recalibrated its action points to catch up with competition in the AI race. It is building an 'answer engine' that responds to general queries by curating information from web sources. To develop this ChatGPT-esque application, the company has established a new 'Answers, Knowledge and Information' team, as per a Bloomberg report, which notes that this marks a shift from the company's previous strategy of not building a standalone chatbot application, and instead partnering with OpenAI to integrate ChatGPT into Siri. CEO Tim Cook held a 'rare all-hands meeting' following the earnings call, as revealed by another Bloomberg report. He reportedly told employees that the AI revolution is "as big, or bigger than the internet, smartphones," and w

[26]

Apple AI investments grow as Tim Cook teases more acquisitions - Phandroid

Apple AI investments are ramping up fast. In its latest earnings call, Apple announced a 10% year-over-year revenue increase and made it clear that AI is going to be a big part of its future. Speaking to CNBC, Tim Cook said the company is "significantly growing" its investments and embedding AI across its devices, platforms, and teams. So far this year, Apple has acquired around seven companies. While none were massive deals, Cook hinted that Apple is open to more acquisitions if they help accelerate its roadmap. This lines up with rumors that Apple is considering buying Perplexity, an AI search startup that's been gaining attention lately. Cook called AI "one of the most profound technologies of our lifetime," but Apple still has a long way to go. Just this week, Bloomberg reported that another high-level researcher has left Apple's AI team for Meta. That marks the fourth major defection in a short span, and it raises questions about internal challenges. Apple Intelligence, its main AI initiative, first launched last year and is expected to expand with new features in iOS 26. But Siri's delays have cast a shadow over the rollout, and many in the industry feel Apple's AI still lags behind leaders like OpenAI and Google. Despite that, Apple's strong financials and growing AI focus could mean big things ahead. Whether it's more acquisitions or internal upgrades, one thing's clear: Apple's not sitting still anymore.

[27]

Tim Cook Says Apple Is Investing 'Significantly' in AI and Could Buy Another Company

Kara Greenberg is a senior news editor for Investopedia, where she does work coordinating, writing, assigning, and publishing multiple daily and weekly newsletters. Prior to joining Investopedia, Kara was a researcher and editor at The Wire. Earlier in her career, she worked in financial compliance and due diligence at Loomis, Sayles & Company, and The Bank of New York Mellon. Apple wants investors to know it's taking bigger steps to catch up in the AI race. The iPhone maker is "significantly growing" its investments and reallocating employees to focus on AI, CEO Tim Cook told investors on the company's quarterly earnings call Thursday. Shares of Apple (AAPL) climbed over 2% in after-hours trading following the call, after Apple reported better-than-expected earnings with record services revenue. The shares were down about 17% for 2025 through Thursday's close, making it the only Magnificent Seven member in negative territory for the year besides Tesla (TSLA) amid worries about its AI progress. Apple, which has lagged many of its Big Tech peers in AI, faces growing pressure to prove it can keep up after delaying the rollout of highly anticipated features such as an AI-enhanced Siri, disappointing investors. The more personalized, AI-powered version of Apple's Siri is now expected to launch in 2026, Cook said Thursday. Apple previously suggested a more powerful Siri would come this spring. Cook also said Apple would consider buying other companies to raise its AI capabilities -- something Wall Street analysts have suggested could give Apple's AI efforts a bigger boost. "We're very open to M&A that accelerates our roadmap," Cook said, noting Apple has already acquired around seven companies this year, though "not all AI oriented." Earlier this month, Wedbush analyst and longtime Apple bull Dan Ives suggested AI startup Perplexity could be a target. Apple has also reportedly held talks with ChatGPT maker OpenAI and Claude developer Anthropic about relying on their AI models instead of in-house ones.

[28]

Apple 'Very Open' to Acquire AI Companies, Increase Funds: Report

Apple reported a 10 percent revenue growth YoY between April and June Apple CEO Tim Cook reportedly highlighted that the company is planning to "significantly" increase its investments in artificial intelligence (AI) technology. The statements were made on Thursday as part of the CEO's remarks alongside Apple's third-quarter earnings report. As per the report, the Cupertino-based tech giant is also open to the merger and acquisition route to catch up in the AI race. These comments indicate that the iPhone maker has not given up building an in-house AI tech stack despite several setbacks. According to a CNBC report, Cook said that Apple has acquired seven companies this year so far, and remains "very open" to further acquisitions that can help the tech giant grow faster. "We're very open to M&A that accelerates our roadmap. We are not stuck on a certain size company, although the ones that we have acquired thus far this year are small in nature," he was quoted as saying. Apart from this, the Apple CEO reportedly also stated that the company was "significantly" growing its investment in AI. Alongside resource allocation, the tech giant is also said to be reallocating its staff to ensure more employees are working on AI features. While the company did not mention how it intends to utilise these resources, Cook reportedly mentioned that some of the capital expenditure this quarter will go towards Private Cloud Compute, the company's private servers for on-cloud AI processing. "Our focus, from an AI point of view, is on putting AI features across the platform that are deeply personal, private and seamlessly integrated[..]The way that we look at AI is that it's one of the most profound technologies of our lifetime. It will affect all devices in a significant way," CNBC quoted Cook as saying. Apple CEO's statements on AI highlight that the company still intends to compete with the likes of Google, OpenAI, and Anthropic. The iPhone maker has already partnered with OpenAI to bring ChatGPT's capabilities to its devices, and is rumoured to structure a similar deal with Anthropic. Separately, according to a report, the tech giant has held internal discussions considering the possibility of acquiring Perplexity. However, no bids have been reported so far.

[29]

What Analysts Are Saying About Apple's AI Ambitions After Strong Quarterly Results

Apple (AAPL) CEO Tim Cook made it clear that Apple is growing its AI investments, both in infrastructure and personnel, and multiple analysts raised their price target following the iPhone maker's quarterly results. JPMorgan analysts called out Cook's "aggressive tone on investments to catch up and support Al competitiveness." On Apple's earnings call, Cook said the iPhone maker is ramping up its investments and reallocating employees to focus on AI. The bank maintained an "overweight" rating and raised its price target to $255 from $250, suggesting 22% upside with Apple stock down 2% Friday at about $204. Whether it reaches that target could depend on features like an AI-enhanced Siri, which Cook confirmed is coming in 2026, after extensive delays. Citi raised its target to $240 from $235, noting that growing AI spending, including a potential acquisition in the sector, could position Apple for a strong iPhone cycle in 2026. Cook said on the earnings call Apple would consider buying other companies to raise its AI capabilities -- something Wall Street analysts have suggested could give Apple's AI efforts a bigger boost. Wedbush analyst Dan Ives, a longtime Apple bull, last month suggested AI startup Perplexity may be a target. And according to reports, Apple had discussions with Claude developer Anthropic and ChatGPT maker OpenAI about utilizing their models versus using in-house options. Jefferies meanwhile raised its price target to about $191, which still implies downside to Apple's current share price. The broker maintained a "hold" rating, adding, it's "hard to get excited," at the company's current valuation. UBS similarly kept a "neutral" rating and raised its target to $220 from $210.

[30]

CEO Tim Cook says Apple ready to open its wallet to catch up in AI - The Economic Times

Apple CEO Tim Cook said the company is ready to spend more on AI, including building data centres or buying larger firms. Unlike rivals Microsoft and Google, Apple has been cautious with spending. However, delays with Siri and rising AI competition may push Apple to change its approach.Apple CEO Tim Cook signalled on Thursday that the iPhone maker was ready to spend more to catch up to rivals in artificial intelligence by building more data centres or buying a larger player in the segment, a departure from a long practice of fiscal frugality. Apple has struggled to keep pace with rivals such as Microsoft and Alphabet's Google, both of which have attracted hundreds of millions of users to their AI-powered chatbots and assistants. That growth has come at a steep cost, however, with Google planning to spend $85 billion over the next year and Microsoft on track to spend more than $100 billion, mostly on data centres. Apple, in contrast, has leaned on outside data centre providers to handle some of its cloud computing work, and despite a high-profile partnership with ChatGPT creator OpenAI for certain iPhone features, has tried to grow much of its AI technology in-house, including improvements to its Siri virtual assistant. The results have been rocky, with the company delaying its Siri improvements until next year. During a conference call after Apple's fiscal third-quarter results, analysts noted that Apple has historically not done large deals and asked whether it might take a different approach to pursue its AI ambitions. CEO Cook responded that the company had already acquired seven smaller companies this year and is open to buying larger ones. "We're very open to M&A that accelerates our roadmap. We are not stuck on a certain size company, although the ones that we have acquired thus far this year are small in nature," Cook said. "We basically ask ourselves whether a company can help us accelerate a roadmap, and if they do, then we're interested." Apple has tended to buy smaller firms with highly specialized technical teams to build out specific products. Its largest deal ever was its purchase of Beats Electronics for $3 billion in 2014, followed by a $1 billion deal to buy a modem chip business from Intel. But now Apple is at a unique crossroads for its business. The tens of billions of dollars per year it receives from Google as payment to be the default search engine on iPhones could be undone by U.S. courts in Google's antitrust trial, while startups like Perplexity are in discussions with handset makers to try to dislodge Google with an AI-powered browser that would handle many search functions. Apple executives have said in court they are considering reshaping the firm's Safari browser with AI-powered search functions, and Bloomberg News has reported that Apple executives have discussed buying Perplexity, which Reuters has not independently confirmed. Apple also said on Thursday it plans to spend more on data centres, an area where it typically spends only a few billion dollars per year. Apple is currently using its own chip designs to handle AI requests with privacy controls that are compatible with the privacy features on its devices. Kevan Parekh, Apple's chief financial officer, did not give specific spending targets but said outlays would rise. "It's not going to be exponential growth, but it is going to grow substantially," Parekh said during the conference call. "A lot of that's a function of the investments we're making in AI."

[31]

Tim Cook Says Apple Is 'Very Open' To AI Acquisitions Amid Mounting Pressure To Catch Up With Google, Meta And Microsoft - Alphabet (NASDAQ:GOOG), Apple (NASDAQ:AAPL)

On Thursday, Apple Inc. AAPL CEO Tim Cook said the company is open to considering artificial intelligence acquisitions. During Apple's third-quarter earnings call, Citi analyst Atas Malik asked whether the company would accelerate its AI roadmap through major mergers and acquisitions. Check out the current price of AAPL stock here. Cook responded that Apple has already acquired around seven companies this year and remains "very open to M&A that accelerates our roadmap." Trending Investment OpportunitiesAdvertisementArrivedBuy shares of homes and vacation rentals for as little as $100. Get StartedWiserAdvisorGet matched with a trusted, local financial advisor for free.Get StartedPoint.comTap into your home's equity to consolidate debt or fund a renovation.Get StartedRobinhoodMove your 401k to Robinhood and get a 3% match on deposits.Get StartedApple Is Open To M&A, Says Tim Cook "We are not stuck on a certain size company," Cook said. "Although the ones that we have acquired thus far this year are small in nature... we basically ask ourselves whether a company can help us accelerate a roadmap. If they do, then we're interested." See Also: Apple Faces 18-Month Deadline To Deliver On AI, Says Analyst Apple's M&A History Lags Behind Meta, Google While Cook's comments reflect a willingness to act, Apple's past tells a different story. Its largest-ever acquisition remains the $3 billion Beats Electronics deal in 2014. By contrast, peers like Facebook-parent Meta Platforms, Inc. META acquired WhatsApp for $19 billion, Alphabet Inc.'s GOOG GOOGL Google bought Motorola Mobility for $12.5 billion and Microsoft Corporation MSFT spent a staggering $69 billion on Activision Blizzard. Apple Trails Rivals Like Meta, Microsoft In AI Spending Apple also remains a relatively modest spender on capital expenditures compared to other big tech firms. In the June quarter, it reported $3.46 billion in capex -- its highest since December 2022 -- up from $2.15 billion a year earlier. At that pace, annual spending would total around $14 billion, according to CNBC. In comparison, Meta, Google and Microsoft have spent tens of billions to dominate the AI arms race. Meta alone projects up to $72 billion in annual CapEx, while Google expects $85 billion. Apple Reportedly Eyes Perplexity AI, Mistral And Others Meanwhile, it has been reported that Apple is evaluating Perplexity AI as a possible acquisition. Apple has also reportedly looked at other smaller AI companies like Cohere, Mistral and Thinking Machines Lab. Apple Beats Earnings Expectations In Q3 Revenue Apple posted fiscal third-quarter revenue of $94 billion, surpassing expectations of $89.04 billion. The company closed the quarter with $36.27 billion in cash and cash equivalents. Price Action: Apple shares rose 2.42% in after-hours trading, according to Benzinga Pro. Benzinga's Edge Stock Rankings show that AAPL continues to display strong upward momentum in the short and medium term, though it trends downward over the long term. More detailed performance insights are available here. Read Next: Cathie Wood Dumps Palantir As Stock Touches Peak Prices, Bails On Soaring Flying-Taxi Maker Archer Aviation Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors. Photo courtesy: jamesteohart/Shutterstock AAPLApple Inc$212.591.69%Stock Score Locked: Want to See it? Benzinga Rankings give you vital metrics on any stock - anytime. Reveal Full ScoreEdge RankingsMomentum29.03Growth32.89Quality74.53Value9.60Price TrendShortMediumLongOverviewGOOGAlphabet Inc$191.64-2.94%GOOGLAlphabet Inc$190.50-3.07%METAMeta Platforms Inc$768.8010.6%MSFTMicrosoft Corp$537.544.73%Market News and Data brought to you by Benzinga APIs

[32]

Apple Is Ready to Go on an AI Startup Shopping Spree to Compete

This could come as a response to the company's leading AI talents jumping over to Meta. It's no secret that Apple is struggling to compete in the current AI landscape. Now, the company's CEO, Tim Cook, has confirmed that the Cupertino giant is "open" to acquisitions to accelerate its roadmap. In an interview with CNBC, discussing Apple's third-quarter earnings, Cook said that Apple views AI as "one of the most profound technologies of our lifetime." And as a result, "We are significantly growing our investments," further adding, "We're open to M&A that accelerates our roadmap". "We are significantly growing our investments. We're open to M&A that accelerates our roadmap." Apple's previous attempts with Apple Intelligence, especially its ambitions with Siri, has not come to fruition as expected. And in turn, the company received a lot of backlash, as well as lawsuits. Most of Apple's top AI talents are switching sides to Meta while some of its biggest competitors are thriving in the same space. This leaves Apple in a desperate position, where acquiring another AI startup would be its only option. There were rumors that the company is in talks with Anthropic or OpenAI to create an LLM version of Siri. But it doesn't seem like Apple is moving forward with the partnership. There were also plans to acquire Perplexity AI, which is currently valued at $18 billion. Acquiring Perplexity sounds like the only viable option, since some of the other well-known AI startups may not be interested in acquisition. But the time is not on Apple's side, and if they take too long, then they might get left behind in the growing AI race.

[33]

Apple CEO Admits the Firm Has 'Rarely Been First' with Newer Technologies, Reassures Employees an 'AI Breakthrough' Is Coming Soon in an Hour-Long Pep Talk