California Resources Corp Pioneers Carbon Capture and Data Center Synergy

2 Sources

2 Sources

[1]

This California oil company could marry carbon capture and natural gas to data center demand

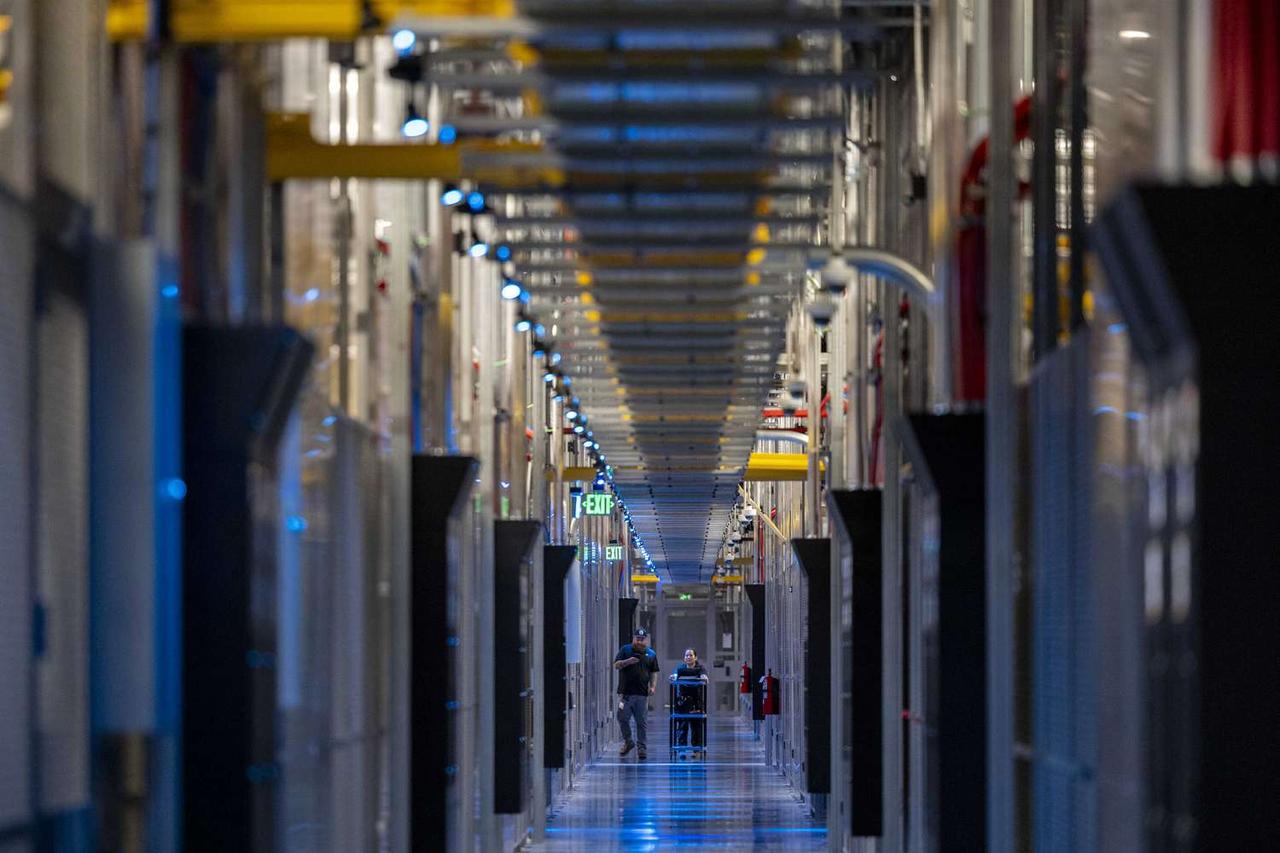

A small oil company in California could demonstrate how the tech sector can use natural gas to power surging energy demand from artificial intelligence while still meeting climate goals. California Resources Corporation is an independent oil and gas company focused entirely on the Golden State, with a market capitalization of about $4.6 billion and proven preserves of 377 million barrels as of 2023. CRC spun off from oil giant in Occidental Petroleum in 2014 , but struggled on its own and ultimately filed for Chapter 11 bankruptcy in July 2020 as energy prices collapsed due to the Covid-19 pandemic. It emerged from bankruptcy several months later and has restructured with a growing focus on developing carbon capture and storage technology to slash emissions from natural gas and heavy industry. CRC may now sit in a sweet spot to capture business from growing power demand from data centers. CRC plans to retrofit its Elk Hills gas plant in California's Central Valley with carbon capture technology. The plant sits close to where developers have announced a gigawatt of AI data centers by 2028, Bank of America analyst Kalei Akamine told clients in a Wednesday note. "No-one else is further along," Akamine said of CRC's investments in carbon capture. "Development is still conceptual, but datacenters may be the commercial opportunity to push this forward." Bank of America has upgraded CRC to buy from neutral on the data center opportunity, with a price target of $65 per share, implying 31% upside from Tuesday's close of $49.49 per share. CRC YTD mountain Year-to-date performance of California Resources Corporation Carbon capture is controversial because of the high upfront capital costs and the perception that it is just a way for oil companies to perpetuate fossil fuel production. The tech companies have publicly focused on renewables and nuclear power to address their energy needs while meeting climate commitments. "But that attitude may be changing as the market comes to grips with power demand implications that the data center buildout portends," Akamine wrote. Carbon capture could represent "fast track to clean power at a time when deep-pocketed data centers, with the ability to pay, appear increasingly willing to consider the best options on offer," he wrote. Analysts generally agree that natural gas will have to play a role in powering these computer warehouses due to the challenges renewables face with providing power when weather conditions are not ideal. And nuclear, though emissions free, is very expensive and time-consuming to build new. The success case for CRC would be to directly connect 200 megawatts of power from its Elk Hills plant to a data center. If "dirty utility power" is worth more than $200 per megawatt hour, clean natural gas should be worth even more than that, Akamine wrote. At that price, the value of the Elk Hills plant would surge to $2 billion from $650 million, the analyst said. Such a project would be one of the first of its kind, he said. CEO Francisco Leon made clear on CRC's second-quarter earnings call that the company views AI demand as an opportunity, with its carbon capture assets located in the heart of a state that is home to two of the top 10 largest data center markets in the U.S.: Silicon Valley and Los Angeles. "Our Elk Hills complex, for example, is in the sweet spot and can meet the data center needs and provide accelerated time to market benefits that other potential competitors simply cannot match," Leon said. CRC can offer data centers speed to market, but also "bring a decarbonized power generation into the fold," Leon said.

[2]

California Resources raised to Buy at BofA with a boost from the data center theme

California Resources (NYSE:CRC) +4.1% in Tuesday's trading as Bank of America upgrades shares to Buy from Neutral with a $65 price target, raised from $57, believing the best option for clean dispatchable baseload power in California may be natural gas with carbon capture. California Resources (CRC) is uniquely positioned to capitalize, according to BofA's Kalei Akamine: The company's Elk Hills combined cycle natural gas plant in California's Central Valley, close to where developers have announced 1 GW of new AI data centers by 2028, by itself is not special, as the 550 MW plant is a fraction of California's 35 GW fleet, but no one else is further along in carbon capture and storage. "CCS development is still conceptual, but data centers may be the commercial opportunity to push this forward," Akamine says, as the power grid is not growing fast enough and deep-pocketed data centers may not be willing to wait four-plus years for a utility connection. "Going behind the meter may be the quicker route to market, and the best option for clean dispatchable baseload power in California may be natural gas with carbon capture," Akamine writes.

Share

Share

Copy Link

California Resources Corp (CRC) is innovating in the energy sector by combining carbon capture technology with natural gas power generation to meet growing data center demand, attracting investor attention and a stock upgrade.

Carbon Capture Meets Data Center Demand

California Resources Corp (CRC), an independent oil and natural gas company, is making waves in the energy sector with its innovative approach to powering data centers. The company is pioneering a unique strategy that combines carbon capture technology with natural gas power generation to meet the surging demand for data center energy

1

.The CRC Advantage

CRC's strategy leverages its existing natural gas infrastructure and pairs it with carbon capture capabilities. This approach allows the company to produce low-carbon intensity power, which is increasingly attractive to data center operators seeking to reduce their carbon footprint. The company's ability to offer this environmentally friendly power solution positions it uniquely in the market

1

.Growing Data Center Demand

The demand for data center capacity is skyrocketing, driven by the rapid adoption of artificial intelligence and cloud computing technologies. This surge in demand has created a significant opportunity for energy providers who can offer reliable and sustainable power solutions. CRC's innovative approach directly addresses this market need

1

.Investor Recognition

The potential of CRC's strategy has not gone unnoticed by investors and analysts. Bank of America has recently upgraded California Resources Corp to a "Buy" rating, citing the company's positioning in the data center power market as a key factor

2

.Environmental Impact

By combining natural gas power generation with carbon capture technology, CRC is addressing two critical issues simultaneously. It's meeting the growing energy needs of the tech sector while also contributing to carbon reduction efforts. This approach could serve as a model for other energy companies looking to balance economic opportunities with environmental responsibilities

1

.Related Stories

Future Prospects

As the demand for data center capacity continues to grow, CRC's innovative approach could position the company for significant growth. The success of this strategy could also encourage further investment in carbon capture technologies and accelerate the transition to lower-carbon energy solutions in the power generation sector

1

2

.Market Implications

The positive reception of CRC's strategy by both the market and analysts suggests a growing recognition of the importance of sustainable energy solutions in the tech sector. This trend could lead to increased collaboration between energy providers and tech companies, potentially reshaping the landscape of data center power supply

1

2

.References

Summarized by

Navi

[1]

Related Stories

Sage Geosystems and California Resources Corporation Form Strategic Partnership for Subsurface Energy Storage and Geothermal Power in California

25 Sept 2024

Big Oil Giants Exxon and Chevron Enter AI Data Center Power Race

14 Dec 2024•Business and Economy

Microsoft Considers Natural Gas for AI Data Centers Amid Growing Energy Demands

12 Mar 2025•Business and Economy

Recent Highlights

1

Google Gemini 3.1 Pro doubles reasoning score, beats rivals in key AI benchmarks

Technology

2

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

3

ChatGPT cracks decades-old gluon amplitude puzzle, marking AI's first major theoretical physics win

Science and Research