Goldman Sachs Survey: AI Not Yet Driving Mass Layoffs, But Major Job Cuts Expected Within Three Years

3 Sources

3 Sources

[1]

AI is not to blame for labor market woes (yet)

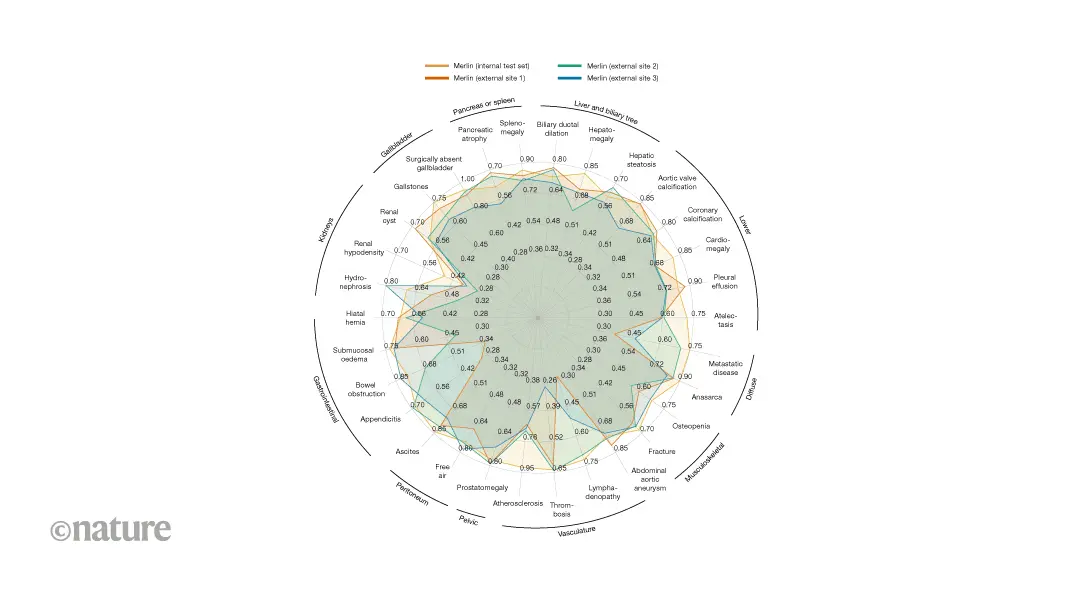

Why it matters: Research is piling up that indicates that AI is not the culprit for the current weakness in the labor market. What they're saying: There is a "clear skew for companies using AI to drive productivity and revenue as opposed to cut costs," Joseph Briggs, a senior global economist at Goldman Sachs, tells Axios. * An internal survey of 100 Goldman Sachs investment bankers on how their clients use AI shows the technology is not taking jobs just yet. By the numbers: 37% of companies are already using AI, higher than the Census Bureau's 10% estimate, according to the Wall Street firm's analysis. * 11% of the companies surveyed are using AI to reduce headcount, while 47% said they are using AI to boost revenue and fuel productivity gains. Threat level: Any job losses from AI are expected to come as a slow drip over the next decade. * Tech-driven disruption fades within a couple of years, Briggs says, with about a 0.5 percentage point bump in employment within a given year. * Over the course of the AI transition, Goldman estimates 6% to 7% of workers displaced by the technology over the course of a decade. * "That seems like a relatively benign labor market outcome, and probably not large enough to lead to a significant reduction in aggregate demand," Briggs says. Zoom in: The technology and information services industries are at 63% adoption and expected to reach 90% adoption within three years. * Financial institutions are now the second-largest adopters of AI, with more than 80% adoption expected over the next three years. The bottom line: AI will shake up the labor market, but not shatter it.

[2]

Goldman Sachs survey says only 11% of companies are actively linking layoffs to AI -- but the real shock is yet to come | Fortune

While the latest wave of AI-linked layoffs has put job seekers -- and even the Federal Reserve -- on high alert, a new survey from Goldman Sachs suggests the real AI labor meltdown is still to come. The report, which surveyed more than 100 Goldman Sachs investment bankers, found that only 11% of their clients across industries such as tech, industrials, and finance were actively cutting employees due to AI. Instead, 47% of the bankers reported their clients were disproportionately using AI to boost productivity and revenue, while only a fifth were mostly using the tech to cut costs. "AI use has so far been more skewed toward raising productivity/revenue than reducing costs," wrote analysts led by Goldman Sachs Chief Economist and Head of Global Investment Research Jan Hatzius. The catch: a much higher percentage (31%) of tech, media, and communications companies were cutting jobs because of AI. This caveat is reflected in the spate of mass layoffs that large tech companies have conducted over the past couple of months. Amazon earlier this week was the latest -- laying off 14,000 middle managers as the company prepares for a new world of advanced AI with a "leaner" work force. Other companies such as Salesforce and tech-focused consultancy Accenture have together added tens of thousands of workers to the pile of AI layoffs in the past few months. The headlines have been so bleak that Fed Chairman Jerome Powell said the Federal Reserve is watching carefully. While companies may not be laying off workers now, bankers believe more layoffs could occur in the next few years. Over the next year, the bankers predict their clients will push forward a 4% general decrease in headcount, while over the next three years, those headcount reductions could skyrocket to 11%. The worst-affected category for future layoffs is financial institutions, which bankers predict could see a 14% reduction in general headcount over the next three years. Tech, which has been among the quickest to adopt AI, could see slightly lower cuts of 10%. "The relatively fast increase in expected adoption and headcount reductions over the next three years highlights that AI impacts on the US labor market could arrive sooner than expected," wrote the Goldman analysts.

[3]

Goldman Sachs Survey Finds Only 11% Of Companies Cutting Jobs As AI Adoption Rises: Report - Goldman Sachs Group (NYSE:GS)

A survey by Goldman Sachs Group Inc. (NYSE:GS) found that just 11% of clients in the technology, industrial, and finance sectors are actively cutting jobs as a result of AI adoption. The report gathered insights from more than 100 Goldman Sachs investment bankers. AI Drives Productivity Overcuts Bankers told analysts led by Jan Hatzius, chief economist and head of global investment research at Goldman Sachs, that 47% of their clients are using AI to increase productivity and revenue rather than reduce staff, while only one-fifth are using it to cut costs, Fortune reported. "AI use has so far been more skewed toward raising productivity/revenue than reducing costs," the analysts wrote. Tech Sector Leading Job Cuts According to Fortune, among tech, media, and communications companies, 31% were cutting jobs because of AI. This week, Amazon.com Inc. (NASDAQ:AMZN) let go of 14,000 middle managers in anticipation of "a leaner workforce." However, Chamath Palihapitiya, founder of Social Capital, offered a contrasting view, saying these layoffs are "not AI job loss" but instead reflect the unwinding of the "DEI-fueled hiring bonanza" of the past decade. Tens of thousands of employees have also been let go by Salesforce Inc. (NYSE:CRM) and Accenture PLC (NYSE:ACN) in recent months. See Also: Mohamed El-Erian Warns Some AI Names Will 'End Up In Tears' But Supports Limited Winners In AI's 'Rational Bubble' The impact has been felt most sharply by young tech workers. According to an August report, unemployment among 20- to 30-year-olds in the sector rose nearly 3 percentage points since early 2024, which is four times the increase in the overall jobless rate. The Federal Reserve is keeping an eye on how AI affects jobs, Federal Reserve Chair Jerome Powell said, according to Fortune. Financial Sector Faces Largest Future Cuts Over the course of the upcoming year, Goldman Sachs bankers anticipate that their clients will implement a 4% general headcount reduction. Those cuts might amount to 11% over a three-year period. The largest drop is 14% for financial institutions, and 10% for the technology industry. "The relatively fast increase in expected adoption and headcount reductions over the next three years highlights that AI impacts on the U.S. labor market could arrive sooner than expected," the Goldman analysts wrote. Read Next: Why Amazon Shares Are Trading Higher By Over 12%; Here Are 20 Stocks Moving Premarket Photo courtesy: Shutterstock Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors. GSThe Goldman Sachs Group Inc$786.50-0.46%OverviewACNAccenture PLC$247.02-0.89%AMZNAmazon.com Inc$251.2612.7%CRMSalesforce Inc$256.50-0.06%Market News and Data brought to you by Benzinga APIs

Share

Share

Copy Link

A Goldman Sachs survey of investment bankers reveals that only 11% of companies are currently cutting jobs due to AI, with most firms using the technology to boost productivity rather than reduce costs. However, significant layoffs are projected over the next three years.

Current AI Impact on Employment Remains Limited

A comprehensive survey conducted by Goldman Sachs reveals that artificial intelligence is not yet the primary driver of job losses across major industries, contradicting widespread concerns about immediate AI-driven unemployment. The survey, which gathered insights from more than 100 Goldman Sachs investment bankers across technology, industrial, and finance sectors, found that only 11% of companies are actively cutting jobs as a direct result of AI adoption

1

.

Source: Benzinga

Joseph Briggs, a senior global economist at Goldman Sachs, emphasized that there is a "clear skew for companies using AI to drive productivity and revenue as opposed to cut costs." The data shows that 47% of surveyed companies are leveraging AI to boost productivity and revenue generation, while only about 20% are primarily using the technology for cost reduction purposes

2

.Tech Sector Shows Higher AI-Related Job Cuts

While the overall picture appears relatively benign, the technology sector presents a different narrative. Among tech, media, and communications companies, 31% are actively reducing their workforce due to AI implementation, significantly higher than the cross-industry average

3

.Recent high-profile layoffs underscore this trend. Amazon announced the elimination of 14,000 middle management positions as the company prepares for "a leaner workforce" in an AI-driven future. Other major technology companies, including Salesforce and Accenture, have collectively laid off tens of thousands of workers in recent months, contributing to a concerning trend that has caught the attention of Federal Reserve Chairman Jerome Powell

2

.

Source: Fortune

Rapid AI Adoption Across Industries

The survey reveals significantly higher AI adoption rates than previously estimated. Goldman Sachs found that 37% of companies are already implementing AI technologies, substantially higher than the Census Bureau's estimate of 10%. The technology and information services industries lead adoption at 63%, with expectations to reach 90% adoption within three years. Financial institutions represent the second-largest adopters, with more than 80% adoption projected over the next three years

1

.Related Stories

Projected Future Impact on Employment

While current job losses remain limited, Goldman Sachs analysts predict a significant acceleration in AI-related workforce reductions. Over the next year, bankers anticipate their clients will implement a 4% general headcount reduction. This figure could escalate to 11% over a three-year period, with financial institutions facing the steepest projected cuts at 14%, followed by the technology sector at 10%

2

.Goldman Sachs estimates that over the course of a decade-long AI transition, approximately 6% to 7% of workers could be displaced by the technology. However, economists suggest this represents a "relatively benign labor market outcome" that is unlikely to significantly reduce aggregate demand. The disruption is expected to unfold as a "slow drip" rather than sudden mass displacement

1

.

Source: Axios

References

Summarized by

Navi

Related Stories

AI's Impact on the Job Market: More Retraining Than Layoffs, For Now

05 Sept 2025•Business and Economy

Goldman Sachs says AI delivered 'basically zero' GDP growth despite massive tech spending

25 Feb 2026•Business and Economy

AI's Impact on Entry-Level Jobs: A Growing Concern for Recent Graduates

30 Jul 2025•Business and Economy

Recent Highlights

1

OpenAI secures $110 billion funding round from Amazon, Nvidia, and SoftBank at $730B valuation

Business and Economy

2

Trump bans Anthropic from government as AI companies clash with Pentagon over weapons and surveillance

Policy and Regulation

3

ChatGPT Health fails to recognize half of medical emergencies in first independent safety test

Health