Huawei's Ascend 910C AI Chip Achieves Breakthrough in Yield Rates, Challenging NVIDIA's Dominance

3 Sources

3 Sources

[1]

Huawei's Ascend 910C Chip Reportedly Achieves Yield Rates Equal To NVIDIA's H100; Ready To Create The Next "DeepSeek Moment"

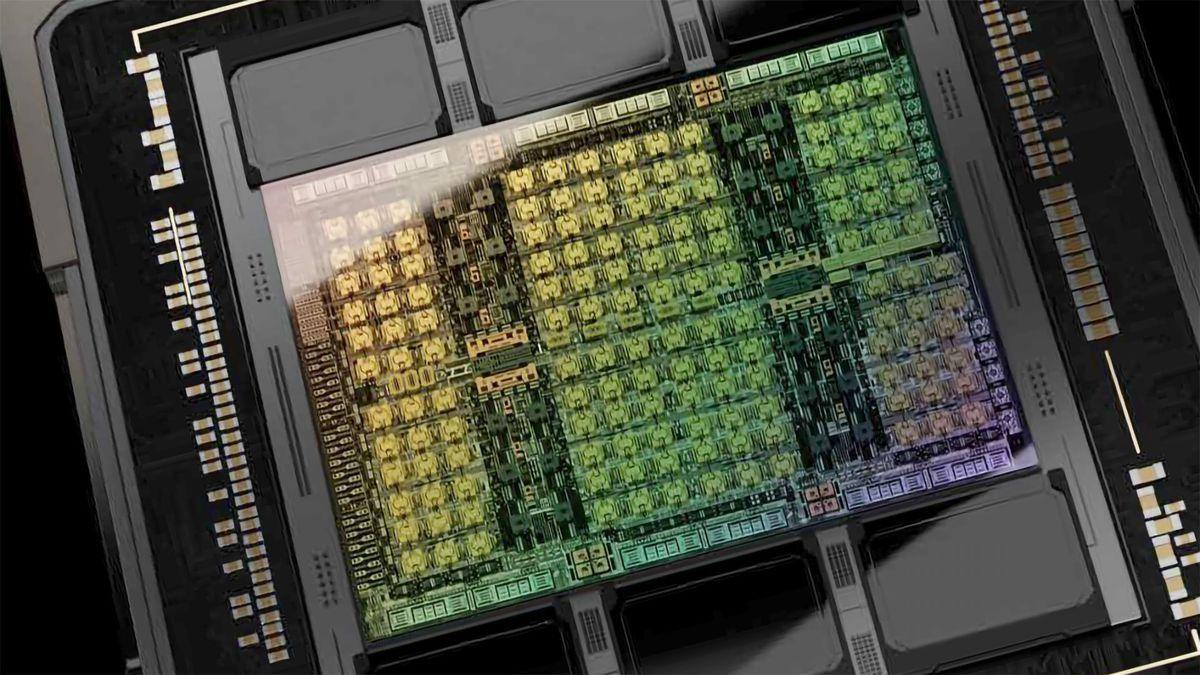

Huawei's Ascend 910C chip has reportedly achieved up to 40% yield rates, with plans to produce over 100,000 units this year, signaling a massive breakthrough for the domestic AI market. Well, Huawei's upcoming Ascend AI chip might be the next "DeepSeek moment" since the Chinese firm is on its way to disrupting the computing competition from the likes of NVIDIA. Huawei is set to unveil its Ascend 910C chip pretty soon, and based on what we know now, it is expected to compete with NVIDIA's H100 AI GPU in terms of raw performance. Now, according to a report by The Financial Times, it is claimed that Huawei's Ascend 910C has doubled down on yield rates in the span of a year, suggesting that mass-production is indeed close. The Chinese conglomerate has increased the "yield" -- the percentage of functional chips made on its production line -- of its latest AI chips to close to 40 per cent, according to two people with knowledge of the matter. That represents a doubling from 20 per cent about a year ago. - The Financial Times Now, this means that Huawei is one step closer to unleashing their newest Ascend AI product onto the markets. Based on what we disclosed in a previous report, it might be that Huawei will launch the 910C around NVIDIA's GTC 2025 conference to steer off the hype from it, but for now, this remains uncertain. It is said that with the improved yield figures, the Chinese firm will see massive profitability rates, allowing them to further scale up in this segment. Apart from this, Huawei plans to go big with the 910C production figures, since the firm is rumored to ramp up to 100,000 units by the end of 2025, and given the dominance of NVIDIA's CUDA in Chinese markets, Huawei also intends to break it by developing their "in-house" CANN software to compete with Team Green. It is indeed a long-term plan by the Chinese firm, but they surely look determined. We already know that Huawei's Ascend AI chip portfolio is employed by DeepSeek, Alibaba, and Baidu, but its use cases have been limited to low-to-mid workloads, mainly inference tasks. However, that looks to change with the 910C, allowing Huawei to expand into newer opportunities and, optimistically, steal NVIDIA's share in the domestic market.

[2]

Huawei improves production of AI chips in breakthrough for China's tech goals

Huawei has significantly improved the amount of advanced artificial intelligence chips it can produce, in a key breakthrough that supports China's push to create its own advanced semiconductors. The Chinese conglomerate has increased the "yield" -- the percentage of functional chips made on its production line -- of its latest AI chips to close to 40 per cent, according to two people with knowledge of the matter. That represents a doubling from 20 per cent about a year ago. The move represents an important advance for Huawei, which has been rolling out its latest Ascend 910C processors, which offer better performance than its previous 910B product. The improved yield means that Huawei's production line for Ascend chips has become profitable for the first time, according to the people with knowledge of its business. The company has a goal to further improve yields to 60 per cent, in line with the industry standard for similar chips. The breakthrough is a step forward for China's hopes to build computing infrastructure that can support its burgeoning AI industry, despite US export controls designed to hamper the country's ability to develop sensitive technologies. The effort has state support, with Beijing urging local tech companies to buy more of Huawei's AI chips and shift away from $3.3tn US chipmaker Nvidia, which remains the market leader in China by far. Huawei founder Ren Zhengfei told Chinese President Xi Jinping last week that the worries China had about a "lack of core and soul" had eased, adding "I firmly believe a greater China will rise faster", the People's Daily reported. The phrase "lack of core and soul" dates back to a 1999 comment by a former China technology minister about the country's information industry, with "core" referring to semiconductors and "soul" referring to operating systems. Huawei's recent progress is also significant to achieving China's goal of reaching full independence for advanced chip production. The world's leading chip manufacturer, Taiwan Semiconductor Manufacturing Company, was forced to stop making Ascend chips and advanced smartphone chips in 2020, after Washington blocked Huawei from accessing manufacturing that used US technology. Austin Lyons, semiconductor analyst with consultancy Creative Strategies, compared Huawei's production milestone to TSMC's estimated 60 per cent yield for production of Nvidia's H100 AI processor, a similarly sized chip. On that basis, it is possible that a rival product such as Huawei's would be commercially viable at a 40 per cent yield, he said. Huawei partnered with the sanctioned Chinese fabrication group Semiconductor Manufacturing International Corp to relaunch its Ascend chip. SMIC currently uses its so-called N+2 process, which is capable of producing advanced chips without extreme ultraviolet technology. China is currently banned from purchasing EUV lithography machines, the most cutting-edge chipmaking equipment from Dutch group ASML. Shenzhen-based Huawei plans to produce 100,000 910C processors and 300,000 910B chips this year, said people with knowledge of its plans. This compares with 200,000 910B and no mass production of 910C in 2024. The figures suggest that Nvidia will still sell more AI chips in China than Huawei, despite the US company only being able to sell Chinese customers its H20 chips, a less powerful version of its H100 chips designed to adhere to Washington export controls. The consultancy SemiAnalysis has estimated that Nvidia made $12bn selling 1mn of its H20 chips to China last year. Huawei faces challenges to convince more customers to abandon Nvidia. One person close to the business pointed to Nvidia's Cuda software, which is known for being easier to use and capable of faster data processing than Huawei's offerings. AI companies and Huawei researchers have also said that the Ascend 910B did not work well for large-scale model training, because of problems with inter-chip connectivity and memory issues. Huawei has been trying to improve these issues by working with partners to resolve software bugs and increase memory capacity in its latest 910C series. However, Huawei has still emerged as the frontrunner to challenge Nvidia in the market for so-called "inference" chips, the hardware used to run AI models once they have been trained. Prospective customers for the Ascend chip have also cited difficulties securing supplies, with Huawei prioritising orders for large state-run cloud providers like China Mobile. Huawei currently accounts for more than three-quarters of the overall output of AI chips in China, said one of the people with knowledge of its business. The smaller rivals have struggled to compete with Huawei to get enough capacity at SMIC's leading nodes, the person added.

[3]

Huawei Boosts AI Chip Production Despite Taiwan Semi And ASML Ban, Aims to Challenge Nvidia In China - NVIDIA (NASDAQ:NVDA), ASML Holding (NASDAQ:ASML)

Huawei Technologies Co has significantly improved the amount of advanced artificial intelligence chips it can produce. The Chinese information and communications technology (ICT) infrastructure and smart devices provider has increased the "yield" or the percentage of functional chips made on the production line of its latest AI chips to ~40%, doubling from 20% about a year ago, the Financial Times reported, citing unnamed sources familiar with the matter. The improved yield means that Huawei's production line for Ascend chips has become profitable for the first time, the FT cited unnamed sources familiar with the matter. Also Read: Not Just DeepSeek, China's AI Landscape Heats Up As Baidu Launches Free Ernie Bot The company aims to improve yields to 60%, the industry standard for similar chips. Huawei currently accounts for more than three-quarters of the overall output of AI chips in China, the FT cited unnamed sources familiar with the matter. Beijing urged local tech companies to buy more of Huawei's AI chips and shift away from the U.S. chipmaker Nvidia Corp NVDA, which remains the market leader in China by far. Nvidia dominates the AI chip market as Huawei struggles to match CUDA's efficiency despite efforts to compete with its Ascend series. Washington forced contract chip manufacturer Taiwan Semiconductor Manufacturing Co TSM to stop making Ascend and advanced smartphone chips in 2020 after the country blocked Huawei from accessing U.S. technology manufacturing. Austin Lyons of Creative Strategies compared Huawei's production to Taiwan Semiconductor's estimated 60% yield for producing Nvidia's H100 AI processor. Huawei tapped the sanctioned Chinese fabrication group Semiconductor Manufacturing International Corp to relaunch its Ascend chip. The U.S. sanctions prohibited China from procuring advanced chipmaking equipment from the Dutch group ASML Holding ASML. Huawei plans to produce 100,000 910C processors and 300,000 910B chips this year, the FT cited unnamed sources familiar with the matter. Read Next: Taiwan Semiconductor Poised For Surge, Goldman Sachs Predicts Rising Demand For Taipei-Traded Stock: Report Image via Shutterstock ASMLASML Holding NV$731.87-0.56%OverviewNVDANVIDIA Corp$126.97-2.54%TSMTaiwan Semiconductor Manufacturing Co Ltd$189.73-1.00%Market News and Data brought to you by Benzinga APIs

Share

Share

Copy Link

Huawei's Ascend 910C AI chip has reportedly achieved yield rates of up to 40%, signaling a significant advancement in China's AI chip production capabilities and potentially challenging NVIDIA's market leadership.

Huawei's Ascend 910C Achieves Significant Yield Rate Improvement

Huawei Technologies Co. has made a substantial breakthrough in the production of its advanced artificial intelligence chips. The Chinese tech giant has reportedly increased the yield rate of its latest Ascend 910C AI processors to approximately 40%, doubling from 20% a year ago

1

2

. This improvement marks a significant milestone for Huawei and China's semiconductor industry, potentially challenging the dominance of U.S. chipmaker NVIDIA in the AI chip market.Production Plans and Market Impact

With the improved yield rates, Huawei's Ascend chip production line has become profitable for the first time

2

. The company aims to further increase yields to 60%, aligning with industry standards for similar chips. Huawei has ambitious production plans for 2025, targeting the manufacture of 100,000 910C processors and 300,000 910B chips1

2

. This production scale could position Huawei as a formidable competitor to NVIDIA, especially in the Chinese market.Technological Advancements and Challenges

The Ascend 910C is reported to offer performance comparable to NVIDIA's H100 AI GPU

1

. However, Huawei faces challenges in competing with NVIDIA's CUDA software, which is known for its ease of use and faster data processing capabilities2

. To address this, Huawei is developing its in-house CANN software and working with partners to resolve software bugs and increase memory capacity in the 910C series1

2

.Related Stories

Geopolitical Context and Industry Impact

Huawei's progress comes amid ongoing U.S. export controls designed to limit China's access to advanced semiconductor technologies. The company has partnered with Semiconductor Manufacturing International Corp (SMIC) to produce its Ascend chips, using SMIC's N+2 process

2

. This collaboration is crucial for China's goal of achieving independence in advanced chip production, especially after Taiwan Semiconductor Manufacturing Company (TSMC) was forced to stop making chips for Huawei in 2020 due to U.S. restrictions2

3

.Market Dynamics and Future Outlook

Despite Huawei's advancements, NVIDIA remains the market leader in China's AI chip sector. NVIDIA reportedly sold approximately 1 million H20 chips to China in 2023, generating an estimated $12 billion in revenue

2

. However, Huawei's progress positions it as a frontrunner to challenge NVIDIA, particularly in the market for inference chips used to run AI models post-training2

.Huawei currently accounts for over three-quarters of the overall AI chip output in China

2

. The Chinese government is actively encouraging local tech companies to shift towards Huawei's AI chips and reduce reliance on NVIDIA3

. This support, combined with Huawei's technological advancements, could reshape the AI chip landscape in China and potentially impact the global market in the coming years.References

Summarized by

Navi

Related Stories

Huawei's Ascend 910C Challenges Nvidia's AI Dominance with 60% H100 Inference Performance

05 Feb 2025•Technology

Nvidia's AI Chip Dominance Challenged as China Accelerates Domestic Production

23 Sept 2025•Technology

Huawei's Ascend 910D AI Chip Challenges NVIDIA Amid US Export Restrictions

21 Apr 2025•Technology

Recent Highlights

1

Pentagon threatens to cut Anthropic's $200M contract over AI safety restrictions in military ops

Policy and Regulation

2

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

3

OpenAI closes in on $100 billion funding round with $850 billion valuation as spending plans shift

Business and Economy