Huawei Struggles to Break NVIDIA's AI Chip Dominance in China Despite Homegrown Push

2 Sources

2 Sources

[1]

China's Tech Titans Aren't Buying Huawei Chips Due To Overheating Issues And NVIDIA's Existing Ecosystem Lock-Ins Via CUDA

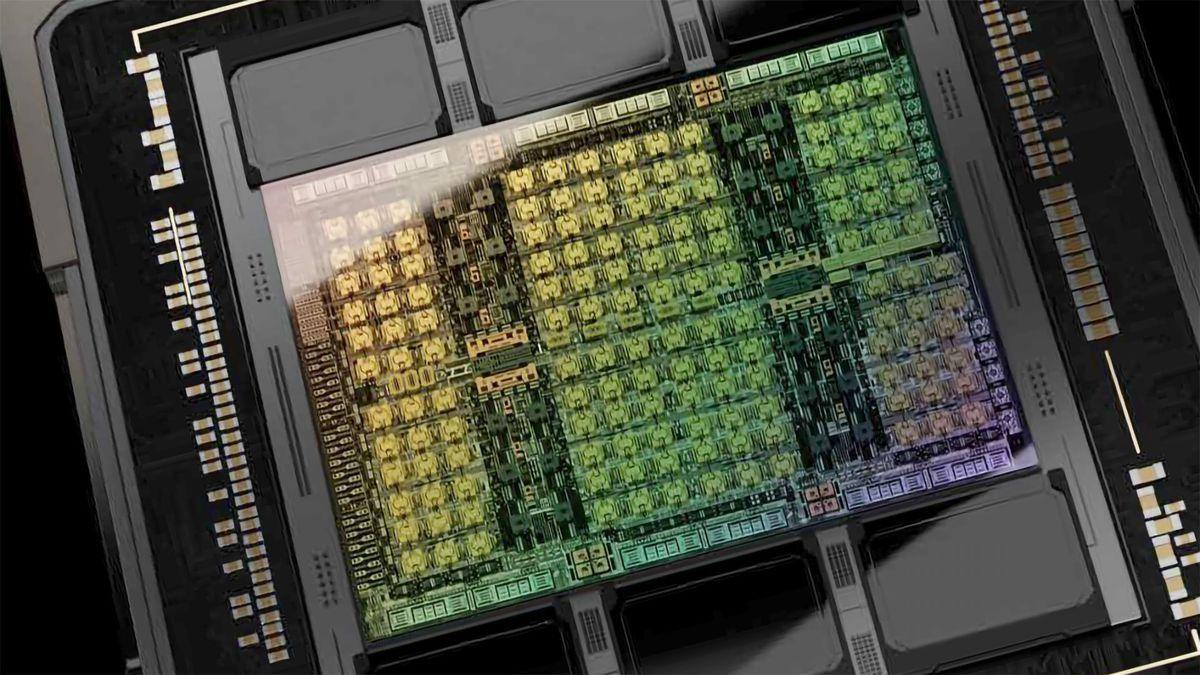

This is not investment advice. The author has no position in any of the stocks mentioned. Wccftech.com has a disclosure and ethics policy. Huawei hoped to wean off China from NVIDIA's dominance via its Ascend 910C GPUs, but continues to encounter substantial inertia in this endeavor, courtesy of NVIDIA's ecosystem lock-ins via the CUDA software and Huawei's own shortcomings. To wit, the Information is now reporting that China's tech titans, including TikTok's parent ByteDance, Alibaba, and Tencent, have yet to order Huawei's AI chips in large quantities. Several factors have coalesced to create a sizable inertia around Huawei's 910C GPUs, which are currently being directed towards China's large State-Owned Entities (SOEs) and local governments in the absence of a tech-driven order book momentum. First, many of China's tech titans have invested quite heavily in NVIDIA's CUDA ecosystem, and an eventual break from NVIDIA's proverbial shackles will likely entail a significant investment of time and resources. In fact, the Information reports that many of these tech companies expect Huawei to adapt to their platforms instead of the other way around. This issue becomes all the more prominent when one considers the fact that Huawei's alternative for CUDA, Compute Architecture for Neural Networks or CANN, is not as feature-rich as NVIDIA's bespoke software. Second, most of China's largest tech companies are competitors of Huawei and, as such, still feel reluctant to go all-in. Third, Huawei's Ascend 910C chips suffer from periodic overheating issues, which affects their perception of reliability in China's tech circles. Of course, if DeepSeek were to go all-in on Huawei's offerings, it would encourage a veritable army of open-source developers to build on Huawei's ecosystem. This eventuality has yet to occur, however. Fourth, many of China's largest tech companies stashed away a sizable repository of NVIDIA's GPUs over the years. This inventory has yet to run out, creating minimal inducement for these companies to make the costly switch. Fifth, the US Department of Commerce made Huawei's chips toxic in May when it issued sweeping guidance that any company that used those chips without prior authorization could be deemed to be in violation of US export controls. This guidance hit Chinese entities with a sizable overseas footprint quite hard. As we noted in a previous post, Huawei's Ascend 910C combines two older 910B chips to reportedly deliver 800 TFLOP/s of computing power at FP16, replete with a memory bandwidth of up to 3.2 TB/s. The chip is largely considered on par with NVIDIA's H100 GPU. Recently, to provide an alternate to NVIDIA's supercomputer that combines up to 72 Blackwell chips using its bespoke NVLink, Huawei has unveiled its CloudMatrix 384, which bundles up to 384 Ascend chips to provide comparable computing power but lacks direct support for memory-optimal calculation formats such as the FP8. When AI models are trained on the FP8 format, they typically consume a lot less memory. Of course, Huawei has created a translation tool to induce artificial compatibility with FP8, but this solution remains suboptimal. Meanwhile, NVIDIA appears to be doing quite well even without tailwinds from China. For instance, UBS recently highlighted NVIDIA's statement during its Q1'26 earnings call that it had visibility into "tens of gigawatts" of AI infrastructure projects. UBS then performed a theoretical exercise, one that assumed a 20GW pipeline and between $40 billion and $50 billion that NVIDIA has already stated it stands to gain for each GW of AI infrastructure. Assuming a realization timeline of between 2 and 3 years for these projects, this pipeline represents ~$400 billion per year in revenue for NVIDIA's AI-critical data center segment alone!

[2]

Huawei struggles to break Nvidia's AI chip grip in China, says The Information By Investing.com

Investing.com -- Recently, Huawei Technologies has emerged as NVIDIA Corporation's (NASDAQ:NVDA) most high-profile rival in the race to power artificial intelligence development in China. But according to a report from The Information, the Chinese tech giant is struggling to gain traction with major domestic customers despite rising interest in homegrown solutions. Nvidia CEO Jensen Huang has publicly warned of Huawei's growing capabilities and the broader acceleration of China's chip development efforts due to U.S. export restrictions. Yet ByteDance, Alibaba (NYSE:BABA), and Tencent Holdings Ltd (HK:0700) (F:NNND) ADR (OTC:TCEHY), three of China's AI leaders, have yet to place significant orders for Huawei's Ascend chips, even as supplies of Nvidia's products tighten under U.S. trade controls. Multiple employees across leading firms told The Information that Huawei is "having a hard time convincing some of the biggest tech companies in China to use its chips." Engineers and executives at Chinese firms have voiced concerns over performance shortcomings with Huawei's hardware, as well as fear of violating American trade laws. Tests by firms such as ByteDance and Alibaba revealed issues with overheating in Huawei's Ascend 910C chip and limitations in its software stack, Cann, compared with Nvidia's industry-standard Cuda platform. Transitioning from Nvidia to Huawei would also involve a high switching cost, requiring a redesign of data center infrastructure, software, and engineering workflows. If the firms are to switch over to Huawei chips en masse, executives say that the company must adapt to its platform. Some developers, like DeepSeek, may play a pivotal role in shaping Huawei's trajectory as others watch closely to see whether an ecosystem can form around its chips. "If DeepSeek is willing to adopt Huawei's chips and software in AI training extensively, it will attract many open-source developers to build their models on Huawei's ecosystem. But at the moment, that isn't the case," said Bernstein semiconductor analyst Qingyuan Lin, cited by The Information. Huawei's new AI compute system, CloudMatrix 384, attempts to compensate for individual chip performance by linking as many as 384 Ascend processors together. But the system faces technical roadblocks, including high power consumption and lack of native support for FP8, a low-precision number format essential to cutting-edge AI training. A further complication is geopolitical: a recent U.S. Department of Commerce warning puts companies using Huawei's advanced AI chips at risk of "substantial criminal and administrative penalties." This has already led at least one Chinese data center firm to cancel a tentative order for Huawei hardware. Despite these obstacles, Huawei has secured meaningful sales to state-owned enterprises and local governments. But for now, top-tier Chinese tech firms show no sign of abandoning Nvidia, whose products still dominate high-performance AI systems, even as the regulatory pressure tightens on both sides of the Pacific.

Share

Share

Copy Link

Huawei faces challenges in convincing China's tech giants to adopt its AI chips, as NVIDIA's ecosystem lock-in and technical issues hinder widespread adoption.

Huawei's Struggle to Gain Traction in China's AI Chip Market

Huawei Technologies, China's tech giant, is facing significant challenges in its attempt to break NVIDIA's stronghold on the AI chip market in China. Despite rising interest in homegrown solutions, major Chinese tech companies are hesitant to adopt Huawei's AI chips, according to recent reports

1

2

.Technical Challenges and Ecosystem Lock-in

Huawei's Ascend 910C chip, which combines two older 910B chips to deliver 800 TFLOP/s of computing power at FP16, is considered comparable to NVIDIA's H100 GPU

1

. However, the chip has encountered several technical issues:- Overheating problems affecting reliability perceptions

- Limitations in Huawei's software stack, CANN (Compute Architecture for Neural Networks), compared to NVIDIA's industry-standard CUDA platform

- Lack of native support for memory-optimal calculation formats like FP8

These technical shortcomings have made it difficult for Huawei to convince major Chinese tech companies like ByteDance, Alibaba, and Tencent to place significant orders for its AI chips

2

.NVIDIA's Ecosystem Advantage

NVIDIA's dominance in the AI chip market is largely attributed to its well-established ecosystem:

- Many Chinese tech companies have heavily invested in NVIDIA's CUDA ecosystem

- Switching to Huawei's chips would require significant time and resources to redesign data center infrastructure, software, and engineering workflows

- NVIDIA's existing inventory among Chinese tech companies reduces the urgency to switch

Geopolitical Factors and Export Controls

The situation is further complicated by geopolitical tensions and US export controls:

- The US Department of Commerce issued guidance in May, potentially deeming companies using Huawei's chips without authorization in violation of US export controls

1

- This has particularly affected Chinese entities with significant overseas presence

- At least one Chinese data center firm has canceled a tentative order for Huawei hardware due to these concerns

2

Related Stories

Huawei's Response and Future Prospects

Huawei is not giving up on its AI chip ambitions:

- The company has unveiled CloudMatrix 384, bundling up to 384 Ascend chips to provide comparable computing power to NVIDIA's supercomputers

1

- Huawei has created a translation tool to induce artificial compatibility with FP8, although this solution remains suboptimal

- The company has secured sales to state-owned enterprises and local governments in China

2

The Role of Open-Source Developers

The future of Huawei's AI chip ecosystem may depend on the support of open-source developers:

- Companies like DeepSeek could play a pivotal role in shaping Huawei's trajectory

- If DeepSeek adopts Huawei's chips and software extensively, it could attract many open-source developers to build on Huawei's ecosystem

2

As the AI chip race continues, Huawei faces an uphill battle to break NVIDIA's dominance in China's tech sector. The company's success will depend on addressing technical challenges, building a robust ecosystem, and navigating complex geopolitical factors.

References

Summarized by

Navi

Related Stories

Huawei's Ascend 910D AI Chip Challenges NVIDIA Amid US Export Restrictions

21 Apr 2025•Technology

Nvidia CEO Urges AI Export Rule Revision Amid Global Competition and China's AI Advancements

01 May 2025•Technology

Huawei Challenges Nvidia's AI Chip Dominance in China, Focusing on Inference Tasks

22 Jan 2025•Technology

Recent Highlights

1

Pentagon threatens to cut Anthropic's $200M contract over AI safety restrictions in military ops

Policy and Regulation

2

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

3

OpenAI closes in on $100 billion funding round with $850 billion valuation as spending plans shift

Business and Economy