Micron abandons Crucial consumer RAM after 29 years to prioritize AI data centers

26 Sources

26 Sources

[1]

After nearly 30 years, Crucial will stop selling RAM to consumers

On Wednesday, Micron Technology announced it will exit the consumer RAM business in 2026, ending 29 years of selling RAM and SSDs to PC builders and enthusiasts under the Crucial brand. The company cited heavy demand from AI data centers as the reason for abandoning its consumer brand, a move that will remove one of the most recognizable names in the do-it-yourself PC upgrade market. "The AI-driven growth in the data center has led to a surge in demand for memory and storage," Sumit Sadana, EVP and chief business officer at Micron Technology, said in a statement. "Micron has made the difficult decision to exit the Crucial consumer business in order to improve supply and support for our larger, strategic customers in faster-growing segments." Micron said it will continue shipping Crucial consumer products through the end of its fiscal second quarter in February 2026 and will honor warranties on existing products. The company will continue selling Micron-branded enterprise products to commercial customers and plans to redeploy affected employees to other positions within the company. Crucial launched in 1996 during the Pentium era as Micron's consumer brand for RAM and storage upgrades. Over the years, the brand expanded to encompass other memory-related products such as SSDs, flash memory cards, and portable storage drives. Micron Technology has been manufacturing RAM since 1981. Consumer RAM market squeezed by AI infrastructure The surprise announcement from Micron follows a period of rapidly escalating memory prices, as we reported in November. A typical 32GB DDR5 RAM kit that cost around $82 in August now sells for about $310, and higher-capacity kits have seen even steeper increases. DRAM contract prices have increased 171 percent year over year, according to industry data. Gerry Chen, general manager of memory manufacturer TeamGroup, warned that the situation will worsen in the first half of 2026 once distributors exhaust their remaining inventory. He expects supply constraints to persist through late 2027 or beyond. The fault lies squarely at the feet of AI mania in the tech industry. The construction of new AI infrastructure has created unprecedented demand for high-bandwidth memory (HBM), the specialized DRAM used in AI accelerators from Nvidia and AMD. Memory manufacturers have been reallocating production capacity away from consumer products toward these more profitable enterprise components, and Micron has presold its entire HBM output through 2026. At the moment, the structural imbalance between AI demand and consumer supply shows no signs of easing. OpenAI's Stargate project has reportedly signed agreements for up to 900,000 wafers of DRAM per month, which could account for nearly 40 percent of global production. The shortage has already forced companies to adapt. As Ars' Andrew Cunningham reported, laptop maker Framework stopped selling standalone RAM kits in late November to prevent scalping and said it will likely be forced to raise prices soon. For Micron, the calculus is clear: Enterprise customers pay more and buy in bulk. But for the DIY PC community, the decision will leave PC builders with one fewer option when reaching for the RAM sticks. In his statement, Sadana reflected on the brand's 29-year run. "Thanks to a passionate community of consumers, the Crucial brand has become synonymous with technical leadership, quality and reliability of leading-edge memory and storage products," Sadana said. "We would like to thank our millions of customers, hundreds of partners and all of the Micron team members who have supported the Crucial journey for the last 29 years."

[2]

Crucial is shutting down -- because Micron wants to sell its RAM and SSDs to AI companies instead

Micron is retiring the Crucial brand, marking the end of its line of budget-friendly solid-state drives (SSDs) and RAM kits, as reported earlier by VideoCardz. In an announcement on Wednesday, Micron says winding down its consumer-focused business will "improve supply and support for our larger, strategic customers in faster-growing segments" -- a.k.a. AI companies. The brand's shutdown is a huge blow for PC builders and hobbyists, who are already dealing with skyrocketing RAM prices linked to a surge in demand from AI companies. OpenAI, for example, struck a deal with SK Hynix and Samsung to make up to 900,000 DRAM per month for its Stargate project. Now, there's going to be one less brand selling consumer-focused memory for PCs, potentially intensifying the global memory shortage. Soaring demand for RAM is already impacting pricing at CyberPowerPC, Framework, and Raspberry Pi, while HP has even hinted at raising the prices of its devices or equipping them with less memory. Micron will keep shipping Crucial products until the end of February 2026 and provide "continued warranty service and support."

[3]

Days after killing the brand, Crucial shows up at Delhi Comic-Con -- As Micron pivots to AI, Crucial's presence likely booked out months in advance to event

Local partners display RAM and SSD inventories as the consumer brand enters its final year. Micron's plans to shutter its Crucial consumer business next year did not stop the brand from appearing on the show floor at Delhi Comic Con over the weekend. A visitor took to X to share images of the Micron and Crucial branded booth, only days after the company told investors it would wind down consumer products by February 2026. Micron's presence was likely planned months in advance in collaboration with Indian partners and doesn't represent a sudden U-turn on the decision to shutter its consumer business. Neither Micron nor Crucial is listed among the event's headline exhibitors, and while Micron's presence might seem unusual following last week's announcement, it's entirely understandable that the company wants to shift existing inventory ahead of February as the company reallocates its wafer supply to HBM and enterprise DRAM. Ultimately, distributors and retailers still have stock to move, and partner booths at events and gaming shows remain one of the most effective ways to reach buyers in India's growing PC market. Micron's timeline gives those partners ample time to clear their shelves of soon-to-be-retired stock. Micron's December 3 announcement described a consumer exit shaped by AI demand rather than short-term performance in the retail channel. The company said it would retire Crucial as a consumer-facing business and concentrate investment on HBM memory lines feeding enterprise customers. The shift is intended to support advanced data-center products during a period of constrained supply and rising AI requirements. HBM's engineering is nothing like the consumer memory Micron is stepping away from. The technology stacks multiple dies into a single package and links them through dense vertical interconnects, producing far higher bandwidth per watt than conventional DDR and turning memory into a performance enabler rather than a bottleneck. That is important at a time when hyperscalers are racing to stand up ever-larger AI clusters and where each new generation of GPUs pushes memory throughput harder than capacity. For Micron, the growth prospects and margins attached to HBM outstrip anything available in the price-sensitive retail channel, and the company's decision places its wafer supply squarely behind the memory technologies that now define competitiveness in AI infrastructure. In the meantime, consumer inventory remains, and resellers need to continue to promote it to shift inventory. The Delhi Comic Con booth is simply a reflection of that fact; a snapshot of a brand still active in public even as its parent company prepares to abandon consumers and concentrate on more lucrative memory technologies.

[4]

RIP Crucial: Memory Supplier Micron Exits Consumer Market to Chase AI

In a shocker, Micron is exiting the consumer market for memory products, including DRAM and SSD, which is poised to worsen amid an ongoing memory shortage. US-based Micron will retire memory products sold under the Crucial brand, which includes NVMe SSDs and external storage, as well as DDR4 and DDR5 RAM. Consumer shipments will continue until February 2026. Going forward, Micron will focus on supplying memory for AI data centers, a more lucrative business that has been hogging memory supply at the expense of consumer products. "Micron has made the difficult decision to exit the Crucial consumer business in order to improve supply and support for our larger, strategic customers in faster-growing segments," EVP Sumit Sadana said in the announcement. Research firm TrendForce reports that Micron was the third largest supplier of DRAM behind Samsung and SK Hynix. The three companies also dominated the DRAM market with a 92% market share. As a result, Micron's exit leaves a sizable hole in the consumer memory market, depriving PC builders of the trusted Crucial brand. It also remains unclear if any company can fill the gap when analysts are warning that the memory shortage could last for years. Samsung and SK Hynix are also reportedly prioritizing profitability over risky expansions. In addition, the news might not bode well for PC graphics cards since Micron supplied GDDR7 video memory to Nvidia's RTX 5000 series, in addition to Samsung and SK Hynix. We've reached out to Micron about what impact this might have on its GDDR7 business for consumer GPUs, and we'll update the story if we hear back. In NAND Flash, used for SSDs, Micron had a 13% share back in Q2, according to TrendForce, which looked at both shipments for consumer and enterprise systems.

[5]

Micron cuts consumer memory Crucial to chase AI riches

The lure of AI spending was too much for Micron to ignore. On Wednesday, the US chipmaker announced it's abandoning its Crucial memory and storage lineup to bolster its supply of enterprise-focused chips, including those used in AI systems. "The AI-driven growth in the data center has led to a surge in demand for memory and storage. Micron has made the difficult decision to exit the Crucial consumer business in order to improve supply and support for our larger, strategic customers in faster-growing segments," Sumit Sadana, EVP and chief business officer at Micron, said in a canned statement. Micron will continue shipping Crucial products through the end of February 2026 and will continue to provide warranty service and support for the products after that date. While the Crucial brand may be on death's door, there's still a chance your next laptop, prebuilt desktop, or workstation could end up having Micron-made memory on board. The chipmaker says it will continue to supply enterprise memory products to commercial channel customers going forward. "We would like to thank our millions of customers, hundreds of partners and all of the Micron team members who have supported the Crucial journey for the last 29 years," Sadana said in a statement to his customers who will soon have even fewer choices for memory amid a global shortage of DRAM and NAND. Over the past few weeks, DRAM and NAND memory prices have skyrocketed in the face of unrelenting AI server demand. The market watchers at TrendForce place the blame on DRAM makers like Samsung, SK Hynix, and Micron, which it says are allocating advanced process capacity to high-end server DRAM and HBM, leaving only the spare bits for customer chips. And it's not hard to see why. Consumer platforms at most might have 256 GB of DDR5, with most falling well below that. By comparison, GPU servers like Nvidia's HGX B300 can have more than 4 TB of memory between the CPU's DDR5 and GPU's HBM. Counterpoint Research now expects DRAM prices could soon double as chipmakers continue to prioritize the AI market, leaving a shortfall in their wake. It's not just DRAM either. AI is also being blamed for a shortage of NAND flash modules used in solid state media. In November, TrendForce reported that average prices jumped by 20 to more than 60 percent across the various product categories with additional price hikes predicted for this month. ®

[6]

Micron ditches consumer memory brand Crucial to chase AI riches - General Chat

The lure of AI spending was too much for Micron to ignore. On Wednesday, the US chipmaker announced it's abandoning its Crucial memory and storage lineup to bolster its supply of enterprise-focused chips, including those used in AI systems. "The AI-driven growth in the data center has led to a surge in demand for memory and storage. Micron has made the difficult decision to exit the Crucial consumer business in order to improve supply and support for our larger, strategic customers in faster-growing segments," Sumit Sadana, EVP and chief business officer at Micron, said in a canned statement. Micron will continue shipping Crucial products through the end of February 2026 and will continue to provide warranty service and support for the products after that date. While the Crucial brand may be on death's door, there's still a chance your next laptop, prebuilt desktop, or workstation could end up having Micron-made memory on board. The chipmaker says it will continue to supply enterprise memory products to commercial channel customers going forward.

[7]

Crucial will no longer sell you RAM as Micron goes business-only

Summary Micron will stop selling Crucial consumer products after February 2026; the brand is shifting to business-only. AI demand from data centers has driven global RAM price spikes as companies hoover up sticks. Crucial, a consumer DDR RAM pioneer since 2000, exits retail -- highlighting the market's AI pivot. For decades, PC builders have used Crucial RAM sticks to power their PCs. However, as we've entered the AI era, said PC builders have been struggling to find specific components as interested parties begin hoovering up hardware to power their LLMs. At the start of the year, we saw a big GPU shortage to the point that new GeForce RTX cards were selling for ridiculous prices. The graphics card market has cooled down since then, with RTX 50 cards now selling for more reasonable prices. However, the ever-hungry AI market has set its gaze on another component: RAM. Prices have spiked worldwide as companies buy up sticks en masse, and it has gotten so bad that Micron is removing the Crucial brand from its consumer-facing products to supply businesses instead. Related The budget CPU is dead -- and no one seems to miss it Budget CPUs still exist, but only in name Posts 19 By Tanveer Singh Oct 15, 2025 Crucial becomes a business-focused product as Micron removes it from consumer stores As reported by Reuters, Micron has announced that Crucial will no longer be sold to consumers. It'll continue to ship out products to people until February 2026, after which it'll become a business-only channel. Sumit Sadana, chief business officer at Micron, said the following: "The AI-driven growth in the data center has led to a surge in demand for memory and storage. Micron has made the difficult decision to exit the Crucial consumer business in order to improve supply and support for our larger, strategic customers in faster-growing segments." The loss of Crucial is a huge blow to the consumer market. As per the company's own timeline, the company was one of the first to offer DDR RAM to consumers back in 2000, with the intent to make it easier for people to upgrade their PCs at home. Now that Crucial has withdrawn from the market 25 years later, it shows just how the market has changed to support the AI industry. This isn't the first time we've seen the RAM shortage affect how a business operates. Just a couple of days ago, we saw Raspberry Pi raise the prices of the Pi 4 and Pi 5 SBCs in response to RAM becoming harder to purchase. While older models of the SBC were left unaffected, newer models got some nasty price spikes related to the amount of RAM they have, with the 16 GB models getting up to a $25 increase. And while everyone is keen to point the finger at the AI industry as the number one cause, some people believe that things don't quite add up.

[8]

Micron is killing Crucial SSDs and memory in AI pivot -- company refocuses on HBM and enterprise customers

In keeping with the spirit of times, Micron on Wednesday announced plans to wind down its Crucial consumer business worldwide by the end of February 2026. The company is reallocating its output and investments to enterprise-grade DRAM and SSD products amid growing demand from the AI sector. Micron will continue shipping Crucial-badged consumer products through retailers, online stores, and distributors until the end of its fiscal second quarter, which concludes in late February 2026. After that point, Micron will no longer supply the consumer channel with products under the Crucial name, but will continue to ship its Micron-branded enterprise portfolio, which will remain available through commercial and server-focused partners. After Micron ceases to ship its Crucial devices, it will continue honoring warranty obligations and technical support for existing Crucial products. Customers who already own Crucial-branded memory modules, SSDs, and other products will continue to receive service coverage well after shipments stop, so the decision will not leave installed hardware unsupported. As expected, Micron is abandoning its consumer business due to reallocation of its 3D NAND and DRAM output and production capacity to enterprise-grade SSDs, high-bandwidth memory (HBM) for AI accelerators, and server-grade memory modules. "The AI-driven growth in the data center has led to a surge in demand for memory and storage," said Sumit Sadana, EVP and Chief Business Officer at Micron Technology. "Micron has made the difficult decision to exit the Crucial consumer business in order to improve supply and support for our larger, strategic customers in faster-growing segments." Micron established its Crucial brand some 29 years ago, in 1996, when the enthusiast-grade hardware market began its rapid growth. Over time, Crucial got particularly successful in retail, where its name became synonymous "with technical leadership, quality and reliability," as Micron puts it. However, the current market situation is by far not favorable for these types of products, so instead of shrinking its Crucial portfolio, the company decided to wind it down entirely, albeit without selling off the Crucial brand (at least for now). There are several reasons behind Micron's decision. Firstly, client memory modules and SSDs sit at the lowest-margin end of Micron's portfolio as they compete in highly volatile, price-competitive, and promotion-driven market. Even though the Crucial and Ballistix brands still matter, they are squeezed between high-end enthusiast brands and low-end consumer brands, which makes their evolution difficult. By contrast, data center and enterprise products lock in long-term contracts, higher ASPs, and more predictable demand. Secondly, the supply environment has changed permanently. AI infrastructure requires every single wafer with memory it can consume, something that has never happened with any industry megatrend previously. This means that every wafer Micron assigns to consumer parts is a wafer not going to a hyperscaler or enterprise contract. As a result, keeping a consumer line would directly limit Micron's ability to fulfill orders from its largest customers, which is a risk for profits and strategic relationships. Thirdly, even a small consumer business would still require a minimum viable supply chain, including product development, firmware validation, compliance testing, sales teams, retail relationships, and global warranty operations. Such fixed costs barely shrink when volume shrinks, so a reduced consumer business would still burn resources while losing the economies of scale that make the segment viable. As a result, it strategically makes far more sense to wind down consumer operations entirely and free production capacity, R&D, and product engineering resources for premium products like HBM4/HBM4E/C-HBM4E, enterprise drives, and high-density server memory modules. Micron indicated it will try to reduce the impact of the decision on employees through internal reassignments into existing vacancies elsewhere in the company.

[9]

Micron stops selling memory to consumers as demand spikes from AI chips

A person walks by a sign for Micron Technology headquarters in San Jose, California, on June 25, 2025. Micron said on Wednesday that it plans to stop selling memory to consumers to focus on meeting demand for high-powered artificial intelligence chips. "The AI-driven growth in the data center has led to a surge in demand for memory and storage," Sumit Sadana, Micron business chief, said in a statement. "Micron has made the difficult decision to exit the Crucial consumer business in order to improve supply and support for our larger, strategic customers in faster-growing segments." Micron's announcement is the latest sign that the AI infrastructure boom is creating shortages for inputs like memory as a handful of companies commit to spend hundreds of billions in the next few years to build massive data centers. Memory, which is used by computers to store data for short periods of time, is facing a global shortage. Micron shares are up about 175% this year, though they slipped 3% on Wednesday to $232.25. AI chips, like the GPUs made by Nvidia and Advanced Micro Devices, use large amounts of the most advanced memory. For example, the current-generation Nvidia GB200 chip has 192GB of memory per graphics processor. Google's latest AI chip, the Ironwood TPU, needs 192GB of high-bandwidth memory. Memory is also used in phones and computers, but with lower specs, and much lower quantities -- many laptops only come with 16GB of memory. Micron's Crucial brand sold memory on sticks that tinkerers could use to build their own PCs or upgrade their laptops. Crucial also sold solid-state hard drives. Micron competes against SK Hynix and Samsung in the market for high-bandwidth memory, but it's the only U.S.-based memory supplier. Analysts have said that SK Hynix is Nvidia's primary memory supplier. Micron supplies AMD, which says its AI chips use more memory than others, providing them a performance advantage for running AI. AMD's current AI chip, the MI350, comes with 288GB of high-bandwidth memory. Micron's Crucial business was not broken out in company earnings. However, its cloud memory business unit showed 213% year-over-year growth in the most recent quarter. Analysts at Goldman on Tuesday raised their price target on Micron's stock to $205 from $180, though they maintained their hold recommendation. The analysts wrote in a note to clients that due to "continued pricing momentum" in memory, they "expect healthy upside to Street estimates" when Micron reports quarterly results in two weeks. A Micron spokesperson declined to comment on whether the move would result in layoffs. "Micron intends to reduce impact on team members due to this business decision through redeployment opportunities into existing open positions within the company," the company said in its release.

[10]

Crucial is a casualty of AI's hunger for RAM

Micron Technology is winding down its consumer-facing Crucial brand to focus on providing RAM and other components to the AI industry, The Wall Street Journal reports. The company plans to continue shipping Crucial RAM and storage through February 2026, and will honor warranty service and support for its existing Crucial products even after it stops selling directly to consumers. "The AI-driven growth in the data center has led to a surge in demand for memory and storage. Micron has made the difficult decision to exit the Crucial consumer business in order to improve supply and support for our larger, strategic customers in faster-growing segments," Sumit Sadana, Micron Technology's EVP and Chief Business Officer said in an announcement to investors. Micron Technology didn't share how many jobs could be impacted by shuttering Crucial, but did note that it hoped to soften the blow via "redeployment opportunities into existing open positions within the company." The majority of generative AI products used today are supported by a growing network of data centers that train and host large language models. The rapid buildout of servers at these data centers has been a boon to PC parts makers like NVIDIA, who provide the GPUs used to power them, but also companies like Micron, who build the memory components these computers need to run. It's not surprising the company would want to focus on where growing demand is, but it does put considerable strain on the remaining companies who continue to service both businesses and hobbyist PC-builders. There were next to no true deals on memory or pre-built PCs for Black Friday due to how costly RAM has become now that AI companies are buying it in bulk. PC maker CyberPowerPC even went as far to say that "global memory (RAM) prices have surged by 500 percent and SSD prices have risen by 100 percent," forcing it to raise prices on its products. Losing another source of RAM like Crucial likely won't make things any better.

[11]

After nearly 30 years, Micron is shutting down Crucial and leaving the consumer RAM market

Serving tech enthusiasts for over 25 years. TechSpot means tech analysis and advice you can trust. What just happened? Micron has been selling RAM modules and other memory devices to DIY enthusiasts and end consumers for 29 years. Now, the Idaho-based corporation has made the "difficult" decision to retire the Crucial brand, discarding its own history in favor of cashing in on the ongoing AI spending boom. Micron is exiting the consumer RAM market, retiring the Crucial brand, and restructuring its business around the needs of enterprise AI customers. According to the company's official press release, the US-based memory manufacturer will continue selling Crucial products until the end of its second fiscal quarter in February 2026. After that, Micron plans to "transition" its consumer business. Warranty and support services will remain in place, while sales of enterprise products under the Micron brand will continue as usual. According to Sumit Sadana, executive vice president and chief business officer at Micron Technology, the company was compelled to leave the consumer market because AI data centers have effectively absorbed most of the global demand for new memory and storage products. Sadana also noted that the Crucial brand endured for 29 years thanks to a passionate community of consumers that embraced its high-quality memory products. Crucial began selling RAM modules in 1996 during the Pentium era and became one of the most recognized brands in the DIY PC space. Over time, Micron expanded the Crucial portfolio to include SSDs, flash memory cards, and portable storage devices. Judging from discussions across online forums, users aren't exactly thrilled over the development. The most common sentiment we've seen is frustration - many argue that the AI financial bubble cannot burst "soon enough" to expose what they view as Micron's "stupid" decision to abandon its consumer business entirely. From a business standpoint, however, Micron's move is more than justified. Enterprise, cloud, and AI companies buy in massive bulk and spend far more than the millions of end users who purchase an occasional RAM upgrade. Micron is far from alone in shifting its focus exclusively toward enterprise and data center customers. The enormous - and, some say, financially irrational - flow of capital into building ever-larger AI infrastructure is reshaping the entire IT landscape. After draining the GPU supply chain, the AI bubble has now turned its attention to memory vendors. AI accelerators and hyperscale data centers rely on HBM and other high-performance memory types that cost far more than consumer-grade DDR4 or DDR5 modules. As a result, manufacturers are reorganizing production lines to prioritize HBM output for the foreseeable future. Micron recently confirmed that its entire HBM production for 2026 has already been pre-sold.

[12]

Micron will end Crucial consumer brand in another AI casualty

Micron didn't specifically say that it would target AI companies, but who wouldn't right now? The AI boom has claimed another victim: Crucial, Micron's consumer storage brand that the company says will wind down in 2026 to focus on its enterprise businesses. Micron said that it will close Crucial in February 2026, though it will continue to support Crucial products and provide warranty support. (The company did not say for how long, however.) If this feels familiar, it should. AI hyperscalers have sucked up the available supply of many components that also feature inside the PC; two of those are DRAM and storage, both of which Micron's Crucial business sold to consumers. Black Friday may have been literally the last chance for deals on DRAM and SSDs, as prices in DRAM are skyrocketing and SSD prices have begun to increase as well. Some PC makers are warning that they will increase prices later in December because of rising component costs. Meanwhile, many of those same components are in high demand by enterprise AI businesses. The logic is simple: Either compete to sell those same products at the lowest margin for consumers, or sell memory and storage at whatever prices well-funded enterprise businesses are willing to pay to build out their own AI deployments. "The AI-driven growth in the data center has led to a surge in demand for memory and storage," Sumit Sadana, executive vice president and chief business officer at Micron Technology, said in a statement. "Micron has made the difficult decision to exit the Crucial consumer business in order to improve supply and support for our larger, strategic customers in faster-growing segments. Thanks to a passionate community of consumers, the Crucial brand has become synonymous with technical leadership, quality and reliability of leading-edge memory and storage products. We would like to thank our millions of customers, hundreds of partners and all of the Micron team members who have supported the Crucial journey for the last 29 years." "By concentrating on core enterprise and commercial segments, Micron aims to improve long-term business performance and create value for strategic customers as well as stakeholders," Micron added, implying that there is more value in selling to businesses than consumers. Micron will continue to sell Micron-branded products to enterprises, it added. Micron's decision means that there's some small, faint hope that retailers might discount the company's products to clear their own shelves and expand relationships with competitors, such as Kingston. Still, Micron's decision reflects the reality of the business right now: Selling into consumer PCs simply won't make as much money for component makers as relationships with hyperscalers will, and we're all going to pay the price.

[13]

RAM crisis continues to worsen -- Micron kills Crucial consumer memory in favor of AI data centers

Micron will no longer offer Crucial-branded memory to consumers in favor of enterprise clients An impending RAM crisis is only just beginning to disrupt the world of tech. This week, the first real casualty was revealed when Micron announced that it will stop selling its Crucial-branded memory and storage in 2026 and "exit the Crucial consumer business in order to improve supply and support for [its] larger, strategic customers in faster-growing segments." Simply put: Micron is abandoning the consumer market (PC builders, PC gamers) in favor of AI data centers that have been gobbling up memory and storage at a staggering rate. If you're familiar with gaming PCs or building computers, you're more likely to be familiar with the Crucial brand over Micron. Crucial is Micron's consumer-focused brand that sold RAM, SSDs, SD cards and other storage for years, though according to the company's announcement it will stop bringing new Crucial products to store shelves in February 2026 Despite continuing claims that we are in an AI bubbles, it's clear that Micron believes the AI-generated memory shortage won't end anytime soon. If it did, it's likely Crucial would survive in some form, even if products were delayed. Despite what you may have heard about AI bubbles, major tech companies from OpenAI and Google to Apple and Microsoft are moving full steam ahead in pursuit of an AI future. This has coalesced in a tidal wave of demand for new data centers and the silicon needed to run those server farms. As chatbots like ChatGPT and Gemini have become more capable, they've equally demanded more computing power and more memory and storage. It's part of the reason Nvidia is currently a behemoth astride the world of tech. The critical pieces running these centers include the sort of memory hardware that is also used to produce RAM and SSD storage. As demand for these chips skyrockets, companies like Micron have deprioritized NAND flash chips and cheaper, older memory chips in favor of chips meant for AI companies. It's caused drastic silicon shortages and absurd prices not just for consumers but PC and smartphone manufacturers. Less than six months ago, a Crucial Pro 64GB DDR RAM kit could be purchased for around $75 new, $90 on the high end. Amazon's own price tracking tool shows that number started creeping up in August before plateauing around $250 in October. As of this writing, that same kit costs $469 on Amazon. A version on Best Buy is priced at $687. The cheapest one we could find was via Microcenter where you can get the most barebones variant for $291, a $168 discount off the listed $459 price. It's only available for in-store pickup and limited to two per person (I'm sure to avoid selling to scalpers). The closest Microcenter to me is in Tustin, California, a nearly three-hour drive and I'm in one of the few states that has this retailer. This isn't an isolated issue, either. Before Thanksgiving, CyberpowerPC and Maingear released statements saying that their prices would have to go up as RAM prices have surged 500% while SSD prices went up 100%. This problem isn't going away anytime soon. PC Gamer reported this week that "sky-high DRAM prices could run past 2028." That report was in response to Samsung and SK Hynix (makers of 70% of the DRAM market) announcing that neither company has the current capacity to sufficiently expand memory production. In some cases, new production or facilities won't come online until 2028, but whatever additional production they provide is already spoken for. On Tuesday, Reuters reported that several Chinese phone companies, including Xiaomi and Realme, are already warning customers that price hikes between 20% and 30% are likely to occur by June of 2026. And just as Black Friday was kicking into gear, a report from the Korean publication SEDaily claimed that even Samsung's own internal divisions are unable to lock down long-term contracts with one another. Samsung's Electronics Device Solutions (DS) division apparently rejected a request from the Mobile eXperience (MX) division, the company's smartphone producer, to sign a long-term memory supply contract. Instead, the MX division is facing a sudden profitability concern for next year's S26 series and had to negotiate a quarterly deal with the DS division just to get through the end of 2025. Samsung is reportedly favoring profitability in this "memory super cycle" over supporting a different arm of the same company. Micron's Crucial brand is the first real casualty in this memory boom but we doubt it will be the only company to pull out of selling consumer-grade RAM and SSDs in favor of AI.

[14]

Micron Gives Crucial the Lexar Treatment, Shutters Memory Brand

Micron, the maker of Crucial memory, including SSDs, has announced that it will shutter the Crucial brand and exit the consumer memory business to focus on supplying AI data centers. "The AI-driven growth in the data center has led to a surge in demand for memory and storage. Micron has made the difficult decision to exit the Crucial consumer business in order to improve supply and support for our larger, strategic customers in faster-growing segments," explains Sumit Sadana, EVF and Chief Business Officer of Micron Technology. Sadana continues, expressing Micron's thanks for nearly three decades of Crucial memory products. When the fiscal Q2 ends in February 2026, Micron will stop supplying Crucial consumer products to retailers. The company says it will continue to provide warranty service and support for Crucial products, but no new ones will enter the market once February arrives. Micron says its decision to shutter Crucial and focus on AI reflects the company's commitment to profitability. Put another way, Micron is chasing the AI money, as many technology companies are these days. Despite concerns that AI might be a bubble, and that AI technology is primarily just costing companies billions of dollars, some, like Nvidia, are making money hand over fist. Micron wants a piece of that pie, and Crucial is dying because of it. That said, it's not immediately clear if the loss of Crucial is as bad as it may seem. Over extended use, PetaPixel has experienced bad luck with recent Crucial SSDs, which are failing at a near-100% rate. As a result of this, PetaPixel will no longer be including Crucial SSDs on comparison charts. Granted, given that Crucial SSDs are soon to be a thing of the past, this is perhaps no great loss. However, as The Verge writes, the Crucial brand going the way of the dodo is still bad news for PC builders and hobbyists, who face "skyrocketing RAM prices" already, thanks to other companies catering to the demands of AI companies rather than consumers. Micron, following this trend, will only make a bad situation worse. Failing Crucial SSDs are not the first time that Micron has run afoul. The company ticked off many photographers back in 2017 when it, bafflingly, decided to kill Lexar memory cards. Fortunately, Longsys stepped up the following year to revive Lexar, and the brand continues to this day in good standing. "I believe Micron has made a series of bad decisions in recent years, and this appears to be the latest," says PetaPixel editor-in-chief Jaron Schneider. "Dumping Lexar was a particularly poor choice and I don't think Micron will look back at this decision to do the same with Crucial particularly fondly."

[15]

The RAM crisis is just getting started: Micron makes the 'difficult decision' to abandon the consumer memory business to focus on supplying AI data centers

Micron's Crucial brand will no longer offer DDR for PC users starting in February 2026. Citing a "surge in demand for memory and storage" driven by AI data centers, Micron announced on Wednesday that it's made the "difficult decision to exit the Crucial consumer business in order to improve suply and support for [its] larger, strategic customers in faster-growing segments." In other words: sorry, PC gamers, but you're no longer worth selling RAM to. The server farm next door has way more cash to burn. Just yesterday we were reporting that high memory prices may well continue into 2028, as Samsung and SK Hynix, who produce roughly 70% of the DRAM currently on the market, are focusing on supplying the enterprise business without dramatically increasing their production capacity. In that same story we reported that Micron, the other big player in memory, is planning to ramp up production that won't be online until late 2028. But now it sounds like those new assembly lines won't be sending any RAM our way even when they're online. You may know the Crucial brand name better than Micron, despite the tech company being established in the United States way back in 1978. Crucial is Micron's consumer-focused brand and has been used on RAM, SSDs, even SD cards for years and years. A quick look at the Crucial website reveals just how much RAM it still sells to everyday computer users. That will end in February 2026, Micron said today. "This decision reflects Micron's commitment to its ongoing portfolio transformation and the resulting alignment of its business to secular, profitable growth vectors in memory and storage," the company said in a press release. "By concentrating on core enterprise and commercial segments, Micron aims to improve long-term business performance and create value for strategic customers as well as stakeholders." Presumably this means Micron will also cease selling Crucial-branded NVMe and SATA SSDs, which have so far not been as affected as RAM by the increase in memory prices but are certainly also on the rise. How bad will this be for the ongoing memory supply crisis? Well, that's about 25% of the world's DRAM production capacity now fully devoted to enterprise, and Crucial also makes our favorite budget SSD. So I would say: Not good for us! Good for Micron's shareholders, though. The stock has gained 180% in value this year on the strength of its HBM (high bandwidth memory) business used to supply GPUs and other tech in high demand due to, you guessed it, AI.

[16]

Micron announces its exit from Crucial consumer SSD and RAM business, pushes all-in for AI

TL;DR: Micron is exiting its Crucial consumer SSD and RAM business by mid-2026 to focus entirely on AI-driven memory and storage solutions amid a global DRAM shortage. This shift will intensify consumer RAM price hikes as Micron reallocates production to high-demand AI products like HBM3 and GDDR7 memory. Micron has just announced suddenly that it is closing its Crucial consumer SSD and RAM business, as it is pushing all-in for AI, in the middle of the crazy-expensive RAM crisis. In a press release, the US-based memory company -- only one of three major DRAM manufacturers between Samsung and SK hynix -- has said that it will continue shipments of its Crucial consumer products into the channel until the end of Q2 2026. After that, Micron will work with its partners and customers through the transition, providing continued warranty service and support for Crucial-branded products. Sumit Sadana, EVP and Chief Business Officer at Micron Technology, said: "The AI-driven growth in the data center has led to a surge in demand for memory and storage. Micron has made the difficult decision to exit the Crucial consumer business in order to improve supply and support for our larger, strategic customers in faster-growing segments". He added: "Thanks to a passionate community of consumers, the Crucial brand has become synonymous with technical leadership, quality and reliability of leading-edge memory and storage products. We would like to thank our millions of customers, hundreds of partners and all of the Micron team members who have supported the Crucial journey for the last 29 years". Starting in Q3 2026, Micron will allocate all of its DRAM production into AI products and customers, which is exactly the problem. The AI industry is eating up all of the high-speed memory it can get, with TSMC, SK hynix, and Samsung all fabbing and making as much DRAM as it can, with the likes of NVIDIA requesting that TSMC increase its 3nm semiconductor production capacity by 50% so it can make (and sell) more AI GPUs, with the ever-important DRAM-based HBM3E and HBM4 memory. DRAM production being increased and allocated towards AI chips has seen the price of consumer RAM (single sticks, kits of all sizes) rapidly increase in price over the last few months. We've seen 64GB kits of DDR5 memory skyrocket from around $150, to over $500, making 64GB of RAM for your PC cost more than a PlayStation 5 console... and it's not slowing down, and it's not going to stop for the foreseeable future. It's not just DDR5 RAM for your system, as DRAM is inside of many tech products, including your GPU (up to 32GB of ultra-fast GDDR7 memory on the flagship GeForce RTX 5090), and many other products and devices that are sold. Anything with DRAM in it will cost more in 2026, as AI is unfortunately gobbling up all DRAM production, and some. This is why Micron has decided to axe its Crucial consumer memory business, as it can use its vast semiconductor production capacity into DRAM-based HBM3, HBM3E, HBM4, and more for the AI industry. Micron was one of three of the biggest DRAM suppliers, leaving SK hynix and Samsung in South Korea to keep up DRAM production for consumer devices, as the technology world would crumble without consumer-focused DRAM production. 2026 is going to be a bumpy year, with CES 2026 right around the corner, it'll be interesting about what's said, what products are sold (in enough quantities, especially with higher amounts of RAM, SSDs, etc), and what the outlook is for next year regarding the consumer RAM and SSD space with Micron's exit from the Crucial consumer business.

[17]

Micron to Shut Down Crucial Amid Global RAM Shortage

Shutting down Crucial could adversely impact the ongoing RAM shortage Micron Technology, a US-based chipmaker, announced on Wednesday that it will wind down its consumer-facing business under the Crucial brand. The decision marks the end of nearly 30 years of selling RAM modules, solid-state drives (SSDs), and other memory and storage products directly to end users. The company said Crucial-branded products will continue to be shipped through retail, e-commerce and distributor channels until the end of its fiscal second quarter in February 2026. Micron also said existing products will remain eligible for warranty service and support. Notably, the chipmaker is shutting shop to focus on supplying components for AI companies. Micron Shuts Down Crucial to Focus on AI Supply In a press release, the company highlighted that the decision was made to prioritise "faster-growing segments" in enterprise and data-centre memory, driven by surging demand for memory and storage in AI data centres and other infrastructure. The firm said the move is aimed at improving supply and support for its larger, strategic customers rather than the retail consumer base. "The AI-driven growth in the data centre has led to a surge in demand for memory and storage. Micron has made the difficult decision to exit the Crucial consumer business in order to improve supply and support for our larger, strategic customers in faster-growing segments," said Sumit Sadana, EVP and Chief Business Officer at Micron Technology. Micron will continue to sell its enterprise-grade memory and storage products under its own brand to commercial customers globally. The exit effectively means that Crucial, once a household name among PC builders, gamers, and casual users upgrading laptops or desktops, will no longer get new product releases after retail shipments end. It is said that despite being a big name among consumers, Crucial's revenue contribution towards Micron was not significant, which could have played a role in shutting down the business. However, the timing of the move is unfortunate as the market deals with a global RAM shortage. Fuelled by AI demands, end users have been witnessing volatile pricing, which has tripled in some regions in just a couple of months. According to research firm TrendForce, Micron is the third largest supplier of DRAM after SK Hynix and Samsung, capturing about 25 percent of the market (Q3 2025 data). With the memory scarcity expected to continue for years, the chipmaker's exit will deal a big blow to the consumer markets. Micron said it will reduce the impact on its workforce via redeployment opportunities into existing open positions within the company.

[18]

Crucial could have been the brand to help consumers with RAM and storage costs, not make them worse

Of the big three RAM manufacturers, Micron could have been the one to help consumers, but it chose otherwise This week, Micron announced that it was shuttering the Crucial brand to focus all of its efforts on AI manufacturing. If you've not been keeping up to speed, DRAM and NAND tech are in such high demand right now due to AI data center needs and an increase in AI-boosted technology, that prices are skyrocketing. Instead of weathering the storm and supporting consumers who are looking for the best RAM for gaming though, Micron has chosen to abandon them entirely. In my eyes, as someone who has covered RAM and storage for years, Crucial was actually the brand that was most primed to help out consumers in this trying time. There are three main suppliers of DRAM in the current market. There's Samsung, there's SK Hynix, and there's Micron (the parent company of Crucial). These three brands don't just sell RAM and SSD tech themselves; they manufacture it and supply it to other consumer brands. Names like Corsair, Adata, PNY, and more will release memory under their own brands, but they use Samsung, Micron, Nanya, and SK Hynix memory chips in their products. Of those big three, Micron was the one with the lowest market share, according to CounterPointResearch. We already know that Samsung is bound in a contract with OpenAI to supply an unholy amount of DRAM wafers and NAND parts to them (900,000 wafers per month, to be exact). SK Hynix services a lot of different consumer brands both in storage and memory, but arguably has the weakest consumer brand of its own compared to those big three manufacturers. Micron and Crucial already had a leg up on them all, in my opinion, because despite having a lower market share, they've been aptly targeting gamers with minimal fuss products like Crucial Pro DDR5, which was priced super reasonably, removed from the extra expense of RGB flair, and saw discounts and bundles often. The same goes for Crucial's storage products. I regularly got emails from Crucial's PR folks in the UK to tell me about new bundles, deals, and gaming freebies consumers were getting as incentives to buy the brand's gear. While it's clear now that this was an attempt to increase market share, to me, it signalled that it already had a creative approach to servicing the gaming community, which would be more than welcome in times like these. Sure, it maybe didn't make the best components, but it absolutely made viable ones that were worth considering when the more premium options were too expensive. While Samsung is busy manufacturing with OpenAI, and with SK Hynix only really servicing other consumer brands, Crucial could have doubled down on this approach. Again, Micron makes its own RAM and SSD tech, it doesn't have to make up for enormous manufacturing costs from other suppliers like smaller brands do. It could have seen the demand for gamers, expanded its output, offered even somewhat reasonable pricing, and stolen so much of the market share in 2026. Of course, it's easy to see why this didn't happen. Micron clearly saw the AI writing on the wall and knew where it'd be easier to make profits instead of scrap for more consumer attention. Instead, Micron's press release read as though it had been run through AI to disguise what it was truly saying: "The AI-driven growth in the data center has led to a surge in demand for memory and storage. Micron has made the difficult decision to exit the Crucial consumer business in order to improve supply and support for our larger, strategic customers in faster-growing segments." ...Which translates in my mind to: "You didn't buy enough of our stuff, so we're off to make money on AI instead". With Crucial's deals, products, and cleverly crafted gaming bundles now disappearing entirely, it's not just removing itself from the market, it's making things even worse for consumers by taking a clear product to consider out of the race. Now, there will be even fewer RAM kits to choose from - and one less reasonably priced option to consider. We can only hope that, alongside the already apparent supply issues and massive price inflation, more brands don't follow in Micron's footsteps. Like any emergent, booming part of the economy, AI is a bubble, so I'll be very curious to see if the Crucial brand returns cap in hand should that bubble pop in the coming years.

[19]

Micron to exit consumer memory business amid global supply shortage

Micron's move to dissolve its consumer business comes against a backdrop of worldwide strain in memory supply chains, with tight availability of semiconductors ranging from flash chips used in smartphones to advanced high-bandwidth memory, or HBM, employed in AI data centers. Memory chipmaker Micron Technology said on Wednesday it will exit its consumer business, as it doubles down on advanced memory chips used in artificial intelligence data centers amid a global supply shortage of the essential semiconductors. Shares of the company were down 2.6% in afternoon trading. Micron's move to dissolve its consumer business comes against a backdrop of worldwide strain in memory supply chains, with tight availability of semiconductors ranging from flash chips used in smartphones to advanced high-bandwidth memory, or HBM, employed in AI data centers. It will halt the sale of the "Crucial" unit's consumer-branded products at retailers, e-tailers and distributors worldwide, but will continue product shipments through the consumer channel until February 2026, Micron said. This consumer memory unit is not an important driver of Micron's business, said Summit Insights analyst Kinngai Chan. Micron has long been shifting focus to its HBM business, which has emerged as the most competitive area between the world's three largest memory suppliers: Micron and South Korea's SK Hynix and Samsung. "The AI-driven growth in the data center has led to a surge in demand for memory and storage," said Sumit Sadana, chief business officer at Micron. "Micron has made the difficult decision to exit the Crucial consumer business in order to improve supply and support for our larger, strategic customers in faster-growing segments." HBM - a type of dynamic random access memory - involves stacking chips vertically to reduce power consumption, helping process large volumes of data, making it invaluable in AI development. These chips are pricier than consumer memory and generally fetch lucrative margins. In the August quarter, Micron's HBM revenue grew to nearly $2 billion, implying an annualized run rate of nearly $8 billion, CEO Sanjay Mehrotra said in September.

[20]

Micron closing down consumer brand Crucial after almost 30 years

Crucial, a well known, stable, well performing and very reasonably priced memory and storage brand, made by OEM manufacturer Micron, has decided to close down the business entirely with the last shipments going out February 2026 according to a press release. This is in full due to demands from AI data centers, and Micron is surprisingly honest about the closure of the brand. "The AI-driven growth in the data center has led to a surge in demand for memory and storage. Micron has made the difficult decision to exit the Crucial consumer business in order to improve supply and support for our larger, strategic customers in faster-growing segments". "Thanks to a passionate community of consumers, the Crucial brand has become synonymous with technical leadership, quality and reliability of leading-edge memory and storage products. We would like to thank our millions of customers, hundreds of partners and all of the Micron team members who have supported the Crucial journey for the last 29 years." - Sumit Sadana, EVP and Chief Business Officer at Micron Technology We do have Crucial products we use at Gamereactor - and they havn't failed us a single time. A brand that will be missed.

[21]

Micron Is Abandoning Consumer SSDs & RAM; Crucial Products Are Being Killed Off as the Company Shifts Everything Toward AI

Micron has announced its exit from the Crucial consumer business, marking a significant blow to consumers and highlighting the intense demand for memory from the AI sector. [Press Release]: Micron Technology, Inc. (Nasdaq: MU), a leader in innovative memory and storage solutions, today announced its decision to exit the Crucial consumer business, including the sale of Crucial consumer-branded products at key retailers, e-tailers and distributors worldwide. Micron will continue Crucial consumer product shipments through the consumer channel until the end of fiscal Q2 (February 2026). The company will work closely with partners and customers through this transition and will provide continued warranty service and support for Crucial products. Micron will continue to support the sale of Micron-branded enterprise products to commercial channel customers globally. The AI-driven growth in the data center has led to a surge in demand for memory and storage. Micron has made the difficult decision to exit the Crucial consumer business in order to improve supply and support for our larger, strategic customers in faster-growing segments. Thanks to a passionate community of consumers, the Crucial brand has become synonymous with technical leadership, quality and reliability of leading-edge memory and storage products. We would like to thank our millions of customers, hundreds of partners and all of the Micron team members who have supported the Crucial journey for the last 29 years. -Sumit Sadana, EVP and Chief Business Officer at Micron Technology This decision reflects Micron's commitment to its ongoing portfolio transformation and the resulting alignment of its business to secular, profitable growth vectors in memory and storage. By concentrating on core enterprise and commercial segments, Micron aims to improve long-term business performance and create value for strategic customers as well as stakeholders. Micron intends to reduce impact on team members due to this business decision through redeployment opportunities into existing open positions within the company. [Journalist Note]: It's important to note that Micron will continue to satisfy demand moving up to Q2 of next year, but after that, all DRAM production will be allocated towards AI customers, which is one of the reasons why we are highlighting the 'intensity' of the memory demand coming from the AI industry. Right now, CSPs and tech giants are willing to pay a 'premium' on DRAM production allocations, which is why companies like Micron are exiting the consumer business to ensure profitability in such times. Of course, from a gamer's perspective, this is indeed disappointing news, but it reflects the current state of the industry. Not just Micron, but both Samsung and SK hynix are targeting 'long-term' profitability over balanced supply to the consumer/AI sectors.

[22]

Micron Kills 'Crucial' Consumer Unit To Chase AI Gold Rush - Micron Technology (NASDAQ:MU)

Micron Technology, Inc. (NASDAQ:MU) stock slid after it announced that it will exit the Crucial consumer business, ending sales of Crucial-branded products through global retailers, e-tailers, and distributors. The company will continue shipping Crucial consumer products through the end of the fiscal second quarter (February 2026) and will work closely with partners and customers throughout the transition. Micron will also maintain warranty service and support for Crucial products and will keep selling Micron-branded enterprise products to commercial channel customers worldwide. Also Read: Micron Unveils New Memory Tech For AI Data Centers, Nvidia Team Up Strategic Shift Toward AI Demand Sumit Sadana, Micron's EVP and Chief Business Officer, said the surge in AI-driven data-center demand has forced the company to focus its resources. Micron said the move aligns its portfolio with long-term, profitable growth opportunities in memory and storage and allows it to sharpen its focus on enterprise and commercial segments. The company also plans to minimize the impact on employees by offering redeployment opportunities into open roles within Micron. Micron stock has gained over 178% year-to-date as its high-bandwidth memory (HBM) chips gain traction, powered by the AI frenzy. Automotive AI Momentum Micron is also unlocking new value in automotive AI by shipping qualification samples of its high-speed UFS 4.1 storage to customers worldwide. The new solution doubles bandwidth to 4.2 GB/s, enabling faster AI data access for voice assistants, personalized infotainment, safety alerts, ADAS, and autonomous systems. Built on Micron's ninth-generation 3D NAND, the UFS 4.1 sets a new benchmark for performance and reliability in next-gen vehicles. MU Price Action: Micron Technology shares were down 2.42% at $233.69 at the time of publication on Wednesday, according to Benzinga Pro data. Read Next: Samsung Hikes Key Chip Prices 60% To Keep Up With AI Boom' Panic Ordering' Photo via Shutterstock MUMicron Technology Inc$233.99-2.30%OverviewMarket News and Data brought to you by Benzinga APIs

[23]

Amidst a pricing apocalypse, one of gaming's best memory and storage brands "has made the difficult decision" to abandon its consumers

29 years of excellent computer memory and storage products have just given way to AI slop Crucial, one of the best brands making storage and memory products for gamers and PC builders, is being shut down by its parent company, all in the name of AI. This comes after 29 years of Crucial supplying consumers with some of the best RAM for gaming and some of the best SSDs for gaming available. If you've been keeping up with the news of late, you'll know that RAM and SSDs are seeing an enormous pricing spike, which all comes down to AI data centers stealing up the world's supply of RAM wafers and NAND tech. This is projected to continue until the end of 2028, and while the majority of brands seem content to weather the storm, Micron is choosing to close its consumer arm down to focus on "faster-growing segments". "The AI-driven growth in the data center has led to a surge in demand for memory and storage", said Sumit Sadana, EVP and Chief Business Officer at Micron Technology. "Micron has made the difficult decision to exit the Crucial consumer business in order to improve supply and support for our larger, strategic customers in faster-growing segments. "Thanks to a passionate community of consumers, the Crucial brand has become synonymous with technical leadership, quality and reliability of leading-edge memory and storage products. We would like to thank our millions of customers, hundreds of partners and all of the Micron team members who have supported the Crucial journey for the last 29 years." According to a press release from Micron, this decision reflects Micron's commitment to its stakeholders, as well as "profitable growth sectors in memory and storage". While it hasn't announced any redundancies or loss of employment as a result of this massive strategic change, Micron says it plans to redeploy its current Crucial workers to existing open positions at the company. The press release later admits that this is subject to uncertainties. And who said AI would steal all of our jobs? As for consumers, Micron is promising forward support for its existing Crucial product portfolio, so this shouldn't impact warranties from any of the brand's memory or storage you've bought recently. Micron is also committing to Crucial product shipments until February 2026 - so there's still time to grab some SSD and memory from this brand until then (if you can stomach massively inflated RAM prices, at least). This could also have a bearing on other memory and storage brands, since Micron supplies components to some of its rivals, and along with Samsung and SK Hynix, it's one of the biggest sources of SODIMM, NAND flash memory, and CUDIMM parts out there. I've used and loved Crucial products for years, so beyond the simmering rage I feel for the very corporate decision to follow AI surges for profit as soon as it becomes more convenient, I'm saddened by this news. Crucial hasn't just made strong quality products; it's provided consumers with really great value for money in the last few years, with mid-range SSDs like the Crucial T500, and RAM like Crucial Pro DDR5. As Gen 5 SSDs have entered the playing field, Crucial was one of the first leaders in this new super-fast technology - hell, the Crucial T700 and T705 are two superb options in terms of price to performance, and I use one as my gaming PC's main drive. I sincerely hope that this doesn't inspire more storage and memory brands to shut up shop in the name of fueling AI data centers, which are very clearly harmful to our environment and our collective privacy.

[24]

Crucial Is Leaving the Consumer Market to Meet AI Data Center Demand - IGN

Micron is pulling Crucial, its consumer products business - not because people aren't buying it, but because shoveling the products directly into the insatiable maw of AI data centers is more profitable. The company announced today (via The Verge) that it will be winding down the sale of Crucial consumer products - think high-quality budget RAM and SSDs - at the end of February 2026. "The AI-driven growth in the data center has led to a surge in demand for memory and storage," EVP and chief business officer of Micron Sumit Sadana said, "Micron has made the difficult decision to exit the Crucial consumer business in order to improve supply and support for our larger, strategic customers in faster-growing segments." To quote Ronny Cox's Dick Jones, the main corporate villain of the 1987 movie Robocop, "Good business is where you find it." Micron's announcement is just further heartbreak for PC builders, especially those who have relied for years on Crucial parts' quality and affordability to upgrade or assemble their computers. (The Crucial MX500 has been our go-to budget SSD for years, while the T500 is our favorite value SSD for PS5.) But Crucial may only be the first big casualty of the massive and growing memory demand of the AI industry, which has already lead to unpredictable catch-of-the-day style price swings in RAM, as PCWorld reported last month. And the pressure on components prices could reverberate across high-end gaming for years to come. For instance, rumors last month suggested that Microsoft will yet again raise prices on its Xbox Series X/S consoles - or that they could become unavailable altogether - due to the cost of RAM.

[25]

Micron to Wind Down Crucial Brand to Focus on AI, Data-Center Market

Micron Technology is shutting down its Crucial consumer business, a move that would allow the company to redirect resources toward large artificial-intelligence and data-center customers demanding more of its memory and storage products. "Micron has made the difficult decision to exit the Crucial consumer business in order to improve supply and support for our larger, strategic customers in faster-growing segments," Chief Business Officer Sumit Sadana said Wednesday. Surging demand from hyperscalers investing in AI and cloud infrastructure has lifted Micron's revenue. It has also prompted the company to ramp up production capacity, as surging AI workloads have tightened supplies across the memory industry. Micron said it would stop selling Crucial-branded consumer memory products at the end of February 2026, though it would continue to honor warranties and provide support for existing products. The company would continue supplying Micron-branded enterprise products to commercial-channel customers globally. The Boise, Idaho, company didn't disclose how many jobs would be affected by the exit, but said it would attempt to minimize layoffs through redeployment opportunities into existing open roles.

[26]

Crucial RAM is dead, blame it on AI: Why Micron is shifting its memory priorities

Consumer workloads no longer are a defining factor for memory requirements For years, Crucial RAM sat on the shelves of college hostels, repair shops, and DIY workbenches as the dependable upgrade that made old machines feel new again. Its green sticks of memory were almost a rite of passage for first-time builders. Which is why Micron's decision to shut down the entire Crucial consumer line feels bigger than a routine corporate exit. It captures a moment when the memory business is being pulled away from the everyday user and toward something far more demanding. What pushed Micron to walk away from a beloved consumer brand is not falling demand for RAM, but rising demand for a very different kind of memory. AI systems place extraordinary pressure on DRAM and storage architectures. Training and inference workloads depend on enormous parallel throughput that only high-bandwidth memory and next-gen DRAM can deliver. Producing these components requires advanced packaging, more complex manufacturing steps, and significantly more wafer allocation. Also read: Claude 4.5 Opus 'soul document' explained: Anthropic's instructions revealed In other words, every chip Micron turns into consumer RAM is a chip it cannot turn into AI memory. With HBM shortages visible across the industry, allocating supply to the consumer market now brings lower reward and higher opportunity cost. Crucial was always the friendly face of Micron, a way to translate the company's manufacturing muscle into something students, freelancers, and small creators could buy. But it never drove revenue the way enterprise products do. Selling RAM kits and SSDs through retail channels meant marketing costs, distribution complexity, and margins that barely justified the effort. Inside Micron, a different reality was forming. Data center clients were asking for more capacity, more bandwidth, and more consistency. AI clusters needed memory with characteristics Crucial products could never offer. Backing away from the consumer shelf became less about abandoning a brand and more about focusing on where the company's engineering mattered most. For people who build or fix their own machines, Crucial's disappearance removes a reliable choice from a market that is already consolidating. Fewer vendors in consumer RAM could mean more price swings and fewer midrange options. Crucial was often the part you picked when you didn't want to overthink it. That safety net is gone. It also affects system builders who depended on Crucial's consistent supply. Small repair shops and local PC assemblers, especially in markets like India, often relied on Crucial because it balanced affordability with predictable performance. Losing that option places more weight on competitors who may not match Crucial's mix of price, availability, and brand trust. Also read: Trainium 3 explained: Amazon's new AI chip and its NVIDIA-ready roadmap The deeper story is a shift in priorities across the semiconductor world. AI has become the center of gravity, pulling resources away from consumer segments and toward data centers. Micron is not alone in rewriting its roadmap around training clusters, accelerators, and model-centric compute stacks. Memory is no longer defined by consumer workloads. It is defined by whatever keeps AI systems fed. Crucial's end is a reminder of where the industry stands today. Companies once built memory for millions of personal devices. Now they build it for thousands of machines that run the world's most demanding models. The pivot is logical. It is profitable. But it also marks the quiet fading of a brand that helped countless users learn, repair, build, and tinker. Crucial RAM is gone, and AI didn't just play a part. It set the direction for the entire memory landscape, leaving consumers to adjust as the industry chases a future built for machines that think.

Share

Share

Copy Link

Micron Technology announced it will shut down its Crucial consumer brand by February 2026, ending nearly three decades of selling RAM and SSDs to PC builders. The company is reallocating production capacity to meet surging AI demand, particularly for high-bandwidth memory used in data centers. The decision comes amid a global memory shortage that has already driven RAM prices up 171 percent year over year.

Micron Exits Consumer Market After 29 Years

Micron Technology announced on Wednesday that it will discontinue its Crucial consumer brand by the end of February 2026, marking the end of a 29-year run in the DIY PC market

1

. The decision removes one of the most recognizable names in consumer memory products, leaving PC builders with fewer options for RAM and SSDs at a time when supply shortages are already squeezing the market.

Source: Digit

"The AI-driven growth in the data center has led to a surge in demand for memory and storage," said Sumit Sadana, EVP and chief business officer at Micron Technology. "Micron has made the difficult decision to exit the Crucial consumer business in order to improve supply and support for our larger, strategic customers in faster-growing segments"

1

.Crucial launched in 1996 during the Pentium era as Micron's consumer-facing brand for RAM and storage upgrades. Over the years, the brand expanded to include NAND flash products, NVMe SSDs, external storage, and both DDR4 and DDR5 memory modules

4

. Micron will continue shipping Crucial consumer products through February 2026 and honor warranties on existing products, while affected employees will be redeployed to other positions within the company1

.AI Demand Drives Production Capacity Reallocation

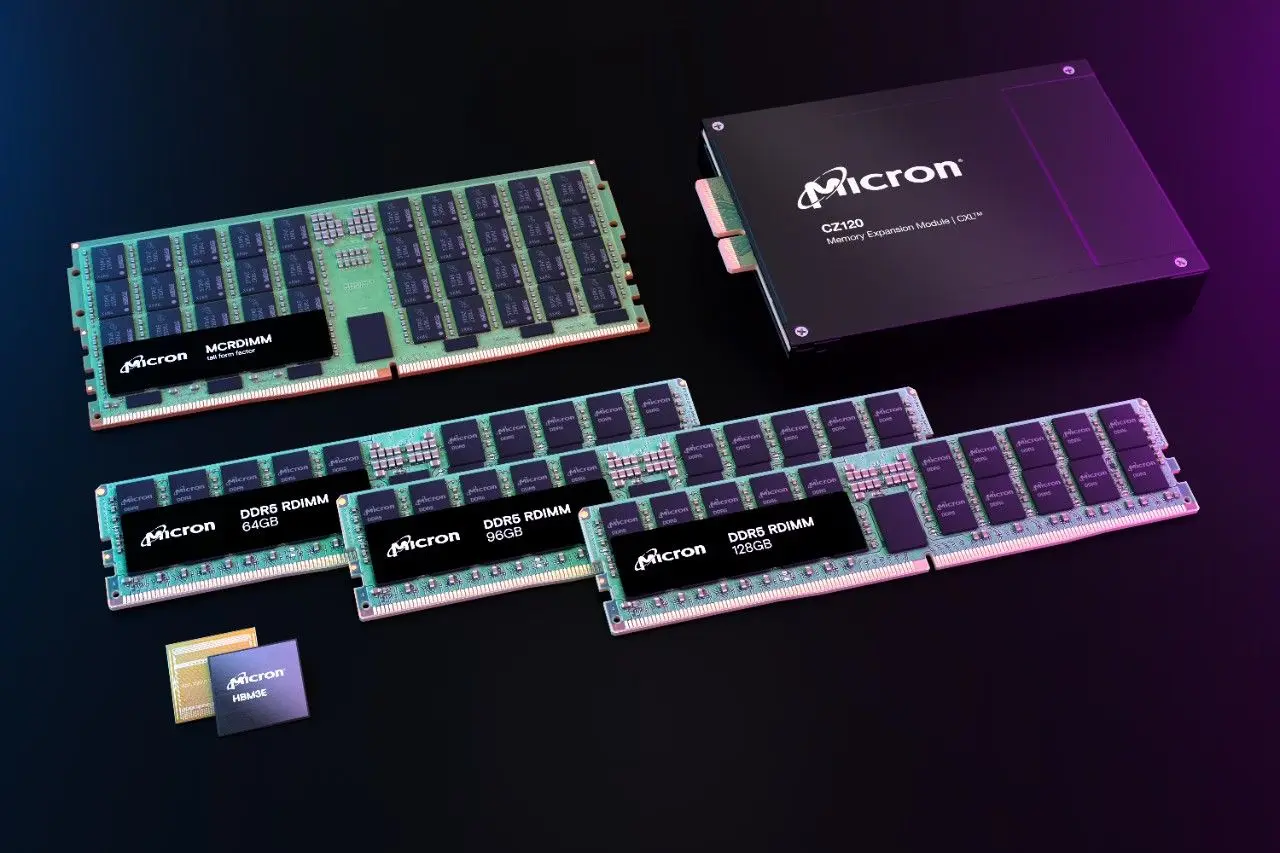

The construction of AI infrastructure has created unprecedented demand for High Bandwidth Memory (HBM), the specialized DRAM used in AI accelerators from Nvidia and AMD

1

. Memory manufacturers have been reallocating production capacity away from consumer products toward these more profitable enterprise components. Micron has presold its entire HBM output through 2026, underscoring the scale of demand from AI data centers1

.

Source: Wccftech

HBM technology stacks multiple dies into a single package and links them through dense vertical interconnects, producing far higher bandwidth per watt than conventional DDR memory

3

. This engineering advantage makes HBM critical for AI clusters, where each new generation of GPUs pushes memory throughput harder than capacity. For Micron, the growth prospects and margins attached to HBM outstrip anything available in the price-sensitive retail channel3

.OpenAI's Stargate project has reportedly signed agreements for up to 900,000 wafers of DRAM per month with SK Hynix and Samsung, which could account for nearly 40 percent of global production

1

2

. GPU servers like Nvidia's HGX B300 can have more than 4 TB of memory between the CPU's DDR5 and GPU's HBM, dwarfing consumer platforms that typically max out at 256 GB5

.Memory Shortage Intensifies with Higher RAM Prices

The announcement follows a period of rapidly escalating prices that has hit the entire memory market. A typical 32GB DDR5 RAM kit that cost around $82 in August now sells for about $310, and higher-capacity kits have seen even steeper increases . DRAM contract prices have increased 171 percent year over year, according to industry data

1

.Gerry Chen, general manager of memory manufacturer TeamGroup, warned that the situation will worsen in the first half of 2026 once distributors exhaust their remaining inventory. He expects supply constraints to persist through late 2027 or beyond

1

. Counterpoint Research now expects DRAM prices could soon double as chipmakers continue to prioritize the AI market5

.TrendForce places the blame on DRAM makers like Samsung, SK Hynix, and Micron, which are allocating advanced process capacity to high-end server DRAM and HBM, leaving only spare bits for customer chips

5

. Research firm TrendForce reports that Micron was the third largest supplier of DRAM behind Samsung and SK Hynix, with the three companies dominating the DRAM market with a 92 percent market share4

.Related Stories

Impact on DIY PC Market and Enterprise DRAM Supply

The shortage has already forced companies to adapt. Laptop maker Framework stopped selling standalone RAM kits in late November to prevent scalping and said it will likely be forced to raise prices soon

1

. Soaring demand for RAM is already impacting pricing at CyberPowerPC, Framework, and Raspberry Pi, while HP has even hinted at raising the prices of its devices or equipping them with less memory2

.Micron's exit as a consumer brand leaves a sizable hole in the consumer memory market, depriving PC builders of a trusted name

4

. It remains unclear if any company can fill the gap when analysts are warning that the memory shortage could last for years, and Samsung and SK Hynix are also reportedly prioritizing profitability over risky expansions4

.

Source: IGN

The news might also impact PC graphics cards since Micron supplied GDDR7 video memory to Nvidia's RTX 5000 series, in addition to Samsung and SK Hynix

4

. In NAND Flash, used for SSDs, Micron had a 13 percent share back in Q2, according to TrendForce4

. Average NAND prices jumped by 20 to more than 60 percent across various product categories in November, with additional price hikes predicted5

.While the Crucial brand may be on death's door, Micron will continue to supply enterprise memory products to commercial channel customers going forward

5

. For Micron, the calculus is clear: Enterprise customers pay more and buy in bulk. But for the DIY PC community, discontinuing consumer memory will leave builders with one fewer option when reaching for memory components. Days after the announcement, a Micron and Crucial branded booth appeared at Delhi Comic Con, likely booked months in advance in collaboration with Indian partners to shift existing inventory ahead of the February 2026 deadline3

.References

Summarized by

Navi

[2]

[3]

[5]

Related Stories

Memory suppliers caught between AI boom and consumer DRAM shortages as market dynamics shift

16 Jan 2026•Business and Economy

AI Demand Triggers Component Shortage as Dell and Lenovo Plan 15% Price Increases for Servers

03 Dec 2025•Business and Economy

Memory prices spike up to 400% as AI demand creates global shortage lasting through 2026

14 Dec 2025•Business and Economy

Recent Highlights

1

Pentagon threatens Anthropic with Defense Production Act over AI military use restrictions

Policy and Regulation

2

Google Gemini 3.1 Pro doubles reasoning score, beats rivals in key AI benchmarks

Technology

3

Anthropic accuses Chinese AI labs of stealing Claude through 24,000 fake accounts

Policy and Regulation