Nvidia Excludes China from Revenue Forecasts Amid US Export Controls

5 Sources

5 Sources

[1]

Nvidia to exclude China from its revenue and profit forecasts | TechCrunch

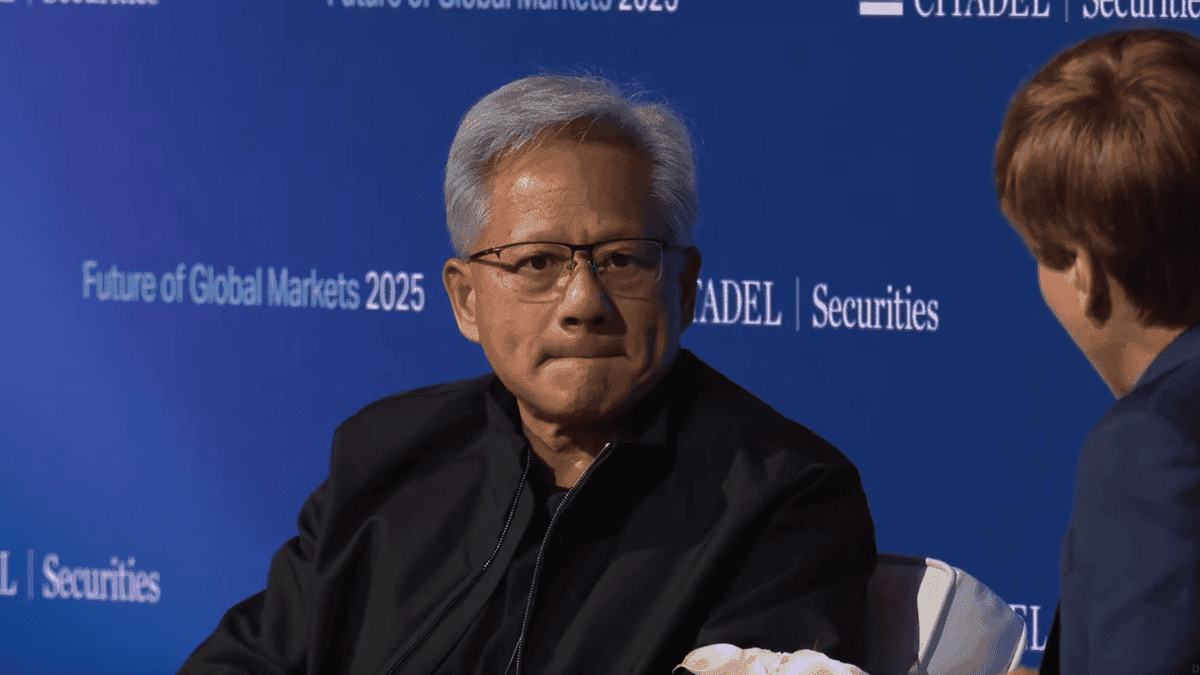

Nvidia doesn't think the U.S. will backpedal its chip export restrictions to China anytime soon. The chipmaker is so convinced of that fact that it's not going to include the Chinese market in its revenue and profit forecasts, CEO Jensen Huang told CNN on Thursday. Huang said he's not counting on the Trump administration reversing its chip export controls and that it would be a nice "bonus" if they did. The Trump administration introduced licensing requirements for Nvidia's H20 chips, the most advanced AI chip it could sell to China, in April. In its first-quarter results, the company said these restrictions would result in an $8 billion hit to its revenue in the second quarter. Nvidia did not immediately return requests for comment.

[2]

Nvidia CEO Jensen Huang Says Huawei 'Has Got China Covered' If US Backs Off, Despite American Tech Being 'Generation Ahead' - Baidu (NASDAQ:BIDU), Grocery Outlet Holding (NASDAQ:GO)

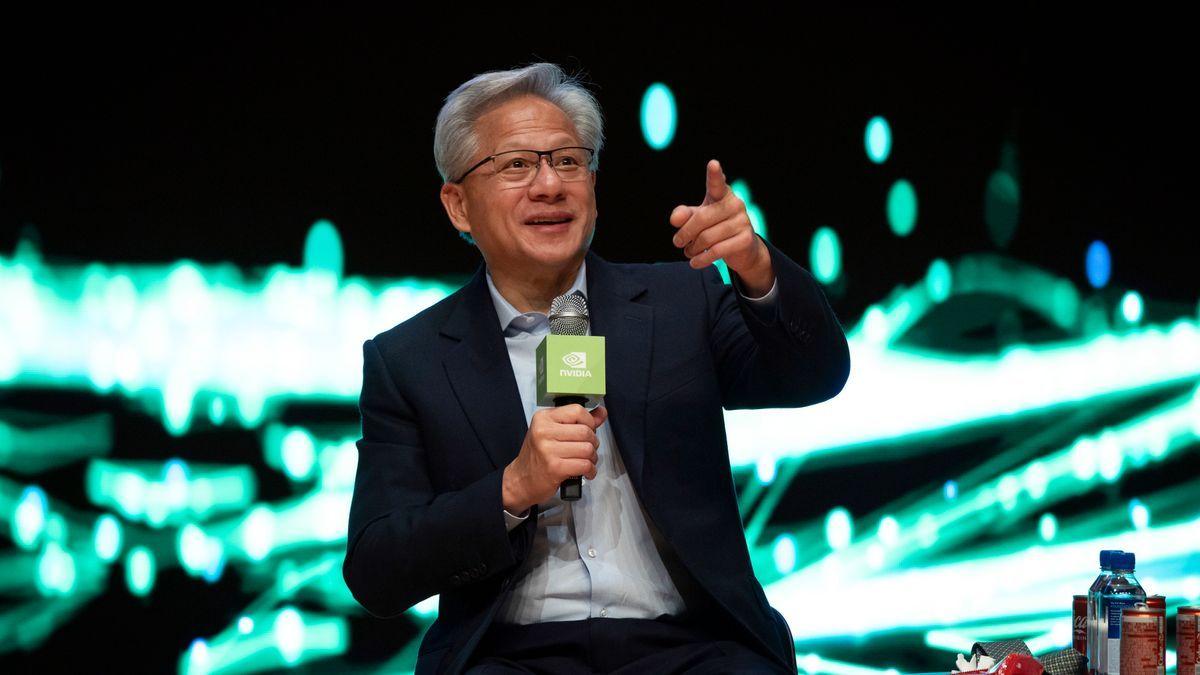

Nvidia NVDA CEO Jensen Huang commented on Huawei's growing influence in China and predicted that robotics and autonomous vehicles will dominate the coming years. What Happened: Huang shared his insights at the Viva Tech conference in Paris, as reported by CNBC on Thursday. Huang expressed concern that if the U.S. continues to enforce AI semiconductor restrictions on China, Huawei could leverage its position in the world's second-largest economy. "Our technology is a generation ahead of theirs," Huang told CNBC, but warned that Huawei could dominate if the U.S. chooses not to engage with China. Huang stressed the importance of global AI developers using the American technology stack rather than China's. He warned of potential long-term implications if the U.S. loses a significant portion of the world's AI researchers. He further emphasized that the 2020s will be defined by the rapid growth of autonomous vehicles (AVs), robotics, and autonomous machines. Nvidia, a major player in the driverless vehicle market, provides hardware as well as software solutions for AVs. This market is seeing increased activity, with Alphabet's GOOG GOOGL Waymo operating robotaxi services in several U.S. cities and Chinese companies like Baidu BIDU and Pony.ai running their own robotaxi fleets. SEE ALSO: Trump Family-Backed Bitcoin Mining Firm Mines $23 Million Worth Of BTC, Signals More Accumulation In The Future Today's Best Finance Deals Why It Matters: The Nvidia CEO also praised the European AI market and stated that it "EU is going to be a very large market for AI". Just a day before Huang's statement, the company announced the launch of an AI factory and cloud marketplace in Europe, partnering with major players like BMW and Mercedes. This expansion is a clear indication of Nvidia's commitment to AI and robotics development in the region. Moreover, Nvidia is also playing a key role in the global AI landscape. The company is sponsoring the ambitious UK plan to train 7.5 million workers in AI by 2030, as unveiled by U.K. Prime Minister Keir Starmer. This initiative further solidifies Nvidia's position as a leader in the AI and robotics industry, aligning with Huang's vision of the upcoming decade. Benzinga's Edge Rankings place Nvidia in the 99th percentile for growth and 70th percentile for value, reflecting its strong performance in both areas. Check the detailed report here. On a year-to-date basis, Nvidia stock climbed 3.27%. READ MORE: Boeing Dreamliner Carrying Over 200 Passengers Crashes Shortly After Takeoff Near India's Ahmedabad: BA Stock Falls Over 7% In Thursday Pre-Market (UPDATED) Image via Shutterstock Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors. BIDUBaidu Inc$87.34-0.24%Stock Score Locked: Edge Members Only Benzinga Rankings give you vital metrics on any stock - anytime. Unlock RankingsEdge RankingsMomentum38.97Growth88.87Quality10.13Value95.00Price TrendShortMediumLongOverviewGOGrocery Outlet Holding Corp$13.340.30%GOOGAlphabet Inc$178.04-0.42%GOOGLAlphabet Inc$176.56-0.44%NVDANVIDIA Corp$141.38-1.02%Market News and Data brought to you by Benzinga APIs

[3]

NVIDIA Becomes Gloomy About Its AI Business Prospects in China; Team Green Will No Longer Include the Region in Revenue Forecasts If US Export Controls Remain

NVIDIA's CEO is no longer optimistic about the company's future in China, as Jensen has revealed that the firm will not include Beijing in its revenue forecasts. With the growing influence of US export controls, NVIDIA's business in China hasn't been flourishing much compared to the rest of the world. Not only is the firm barred from selling its high-end chips to the region, but even the cut-down solutions, such as the H20 AI accelerator, are no longer available. With NVIDIA's prospects in China getting trimmed down, the firm no longer sees the country as a place for "consistent" business, which is why CEO Jensen Huang has revealed that the firm won't include China in revenue forecasts if US export controls don't get lifted. I've told all of our investors and shareholders that, going forward, our forecasts will not include the China market. - Reuters Jensen didn't stop there; he also criticized the US export controls and their effectiveness, claiming that the policies failed to reach their goals. Previously, NVIDIA's CEO had called the AI Diffusion rule nonsensical, and when the H20 AI restriction came into place, Jensen was also against it. It seems like when it comes to China, NVIDIA wants complete autonomy in the market, simply because the region has contributed so much to the company's revenue in the past, that without it, the firm would likely need to write off billions in profits, which they have already done. NVIDIA's stance towards US restrictions on China is simple. If American tech isn't in the region, China would ultimately develop alternatives that could later on challenge the US's global AI dominance, but at the same time, if Beijing gets the compute power it needs, it would speed up the country's AI progress much faster. If China could develop models like the DeepSeek R1 without "supposedly" having cutting-edge AI chips, then the possibility of creating something much more superior increases even further if there are no US restrictions. For now, NVIDIA doesn't seem to be getting much regulatory relaxation by the Trump administration, given that after the recent Geneva deal, US Commerce Secretary Howard Lutnick clearly stated that high-end chips won't be given to China. It would be interesting to see how the prospects of NVIDIA-China unfold moving into the future.

[4]

Nvidia Drops China From Guidance After $2.5 Billion Q1 Revenue Hit, CEO Jensen Huang Says He's 'Not Counting' On US Lifting Export Controls, 'But If It Happens, It Will Be A Great Bonus' - NVIDIA (NASDAQ:NVDA)

Chip giant Nvidia Corporation NVDA has revised its financial strategy after U.S. export controls blocked AI chip sales to China, resulting in a multibillion-dollar revenue shortfall in the first quarter of 2025. What Happened: Speaking to CNN in Paris on Thursday, Nvidia CEO Jensen Huang said the company will no longer include China in its revenue or profit forecasts due to ongoing U.S. export restrictions. "I'm not counting on it, but if it happens, then it will be a great bonus," Huang said, referring to the possibility of loosened trade rules. "I've told all our investors and shareholders that, going forward, our forecasts will not include the China market." Earlier this year, Nvidia was forced to halt shipments of its China-specific H20 AI chips after the U.S. government determined a special license was required. That decision cost the company $2.5 billion in potential revenue in the first quarter. Although Nvidia expected a $5.5 billion hit from excess inventory, it ultimately recorded a $4.5 billion charge. See Also: Nvidia's Jensen Huang Meets Japanese PM To Discuss AI's Growing Energy Needs "The goals of the export controls are not being achieved," Huang told the publication. "Whatever those goals are that were being discussed initially, (they) are apparently not working. And so I think, with all export controls, the goals have to be well-articulated and tested over time." Why It's Important: Speaking at the Viva Tech conference in Paris on Thursday, Huang also cautioned that continued U.S. restrictions on AI chip exports to China could allow Huawei Technologies to strengthen its position within China. Today's Best Finance Deals On Monday, Kevin Hassett, who heads the U.S. National Economic Council, told CNBC that the Donald Trump administration could consider easing some export limits on microchips deemed essential by China for its manufacturing needs, the report noted. However, he said that the U.S. will continue to restrict access to "very, very high-end" Nvidia chips designed to support artificial intelligence systems. Price Action: Nvidia shares have gained 4.84% year-to-date and are up 15.81% over the past 12 months. On Thursday, the stock climbed 1.52%, closing at $145, according to Benzinga Pro. Benzinga's Edge Stock Rankings show Nvidia maintaining strong upward momentum across short, medium and long-term periods. Further performance details are available here. Read More: 'Most People Don't Have The B**ls To Do It,' Says Mark Cuban, Praising Musk For Going 'All In' With His Own Money For His Startups Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors. Image via Shutterstock NVDANVIDIA Corp$144.501.17%Stock Score Locked: Want to See it? Benzinga Rankings give you vital metrics on any stock - anytime. Reveal Full ScoreEdge RankingsMomentum76.16Growth98.64QualityNot AvailableValue7.00Price TrendShortMediumLongOverviewMarket News and Data brought to you by Benzinga APIs

[5]

Nvidia to stop including China in forecasts amid US chip export controls, CNN reports

(Reuters) -Nvidia will exclude the Chinese market from its revenue and profit forecasts following the imposition of tough U.S. restrictions on chip sales to the region, CEO Jensen Huang told CNN on Thursday. When asked whether the U.S. will lift export controls after trade talks with China in London this week, Huang said that he was not counting on it. "But, if it happens, then it will be a great bonus. I've told all of our investors and shareholders that, going forward, our forecasts will not include the China market," Huang said. He also criticized U.S. chip export controls again in his interview with CNN. "The goals of the export controls are not being achieved," Huang added. "And so I think, with all export controls, the goals have to be well-articulated and tested over time." Huang had in May criticized the new export curbs the U.S. imposed in April, which prevented Nvidia from selling its H20 chip made for the Chinese market, which he called "a springboard to global success." Nvidia did not immediately respond to a Reuters request for comment. Nvidia for the first time in May said restrictions on the use of open-source Chinese AI models, such as DeepSeek and Qwen, could hurt its business, as could U.S. rules barring connected-vehicle technology from China, where Nvidia's long-struggling car chip business has finally flourished. The export limits cost Nvidia $2.5 billion in sales during its fiscal first quarter, and it expects another $8 billion sales hit in the second quarter. It reported $4.6 billion in revenue from H20 sales in China as customers stockpiled the chips before the curbs set in, with the China business accounting for 12.5% of overall revenue. Nvidia will launch a new artificial intelligence chipset for China at a significantly lower price than its recently restricted H20 model. It plans to start mass production as early as June, Reuters exclusively reported in May. (Reporting by Juby Babu in Mexico City; Editing by Alan Barona)

Share

Share

Copy Link

Nvidia CEO Jensen Huang announces the company will no longer include China in its revenue and profit forecasts due to ongoing US chip export restrictions, resulting in significant financial impacts and strategic shifts.

Nvidia's Strategic Shift in Response to US Export Controls

Nvidia, the leading AI chip manufacturer, has announced a significant change in its financial strategy in response to ongoing US export restrictions on chip sales to China. CEO Jensen Huang revealed that the company will no longer include China in its revenue or profit forecasts, marking a notable shift in Nvidia's approach to one of its largest markets

1

.

Source: Market Screener

Financial Impact and Market Challenges

The decision comes in the wake of substantial financial repercussions for Nvidia. In the first quarter of 2025, the company faced a $2.5 billion revenue shortfall due to the export controls

4

. The restrictions, which were introduced by the Trump administration in April, prevented Nvidia from selling its advanced H20 AI chips to China without a special license1

.Criticism of US Export Controls

Huang has been vocal in his criticism of the US export controls, stating that "the goals of the export controls are not being achieved"

5

. He argues that the policies have failed to reach their intended objectives and may have unintended consequences for the global AI landscape3

.Potential Implications for Global AI Development

Source: Wccftech

The Nvidia CEO has expressed concerns about the long-term implications of these restrictions. He warns that if the US continues to enforce AI semiconductor restrictions on China, it could lead to Huawei leveraging its position in the world's second-largest economy

2

. Huang emphasized the importance of global AI developers using the American technology stack rather than China's, cautioning about potential consequences if the US loses a significant portion of the world's AI researchers2

.Related Stories

Nvidia's Future Plans and Global Expansion

Despite the challenges in the Chinese market, Nvidia is actively pursuing opportunities in other regions. The company recently announced the launch of an AI factory and cloud marketplace in Europe, partnering with major players like BMW and Mercedes

2

. Additionally, Nvidia is sponsoring an ambitious UK plan to train 7.5 million workers in AI by 20302

.

Source: TechCrunch

Looking Ahead

While Huang maintains that he's "not counting on" the US lifting export controls, he acknowledges that such a change would be "a great bonus"

4

. In the meantime, Nvidia is reportedly planning to launch a new artificial intelligence chipset for China at a significantly lower price than its recently restricted H20 model, with mass production expected to start as early as June5

.References

Summarized by

Navi

Related Stories

Recent Highlights

1

Pentagon threatens to cut Anthropic's $200M contract over AI safety restrictions in military ops

Policy and Regulation

2

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

3

OpenAI closes in on $100 billion funding round with $850 billion valuation as spending plans shift

Business and Economy