Nvidia's AI Chip Sales to China: A Complex Trade Deal Involving Rare Earth Elements

10 Sources

10 Sources

[1]

Nvidia's resumption of H20 chip sales related to rare earth element trade talks | TechCrunch

Rare earth elements appear to be behind Nvidia's stance on China. After announcing in June plans to essentially withdraw from the Chinese market, the semiconductor chip and AI giant reversed course and said it was filing an application to restart sales of its H20 AI chip to China. U.S. Commerce Secretary Howard Lutnick said Tuesday that Nvidia's plans to start selling its H20 AI chips are tied to ongoing trade discussions with China regarding rare earth elements, according to reporting from Reuters. AMD plans to restart sales of its MI308 AI chip in China too. Rare earth elements (REE) like lanthanum and cerium, and which are largely mined in China, are necessary components in technology, including rechargeable batteries for electric vehicles. These REEs have become a critical point in the current trade debates between the U.S. and China. Not everyone is happy with this trade development though. The decision "would not only hand our foreign adversaries our most advanced technologies, but is also dangerously inconsistent with this administration's previously-stated position on export controls for China," Congressman Raja Krishnamoorthi, said in a statement, according to Reuters. But Lutnick isn't concerned and told CNBC on Tuesday that China is only getting Nvidia's "fourth best" chip. "We don't sell them our best stuff, not our second best stuff, not even our third best," Lutnick said in the interview. This news comes less than a week after it was rumored that Nvidia would be designing and releasing a new AI chip specifically for the Chinese market to resume business in the country without violating U.S. chip export rules. The U.S. is still trying to figure out what its AI chip export rules are going to look like. The Trump administration formally rescinded the Biden administration's AI Diffusion Rule in May and there hasn't been a formal update since. The Trump administration was rumored to be considering further restrictions on AI chip exports to countries like Thailand and Malaysia, to prevent smuggling, Bloomberg reported last week. Malaysia implemented trade permits on U.S. made AI chips on Monday.

[2]

Nvidia's China return buys time for Beijing to boost its chip drive

However, they also said the trajectory for China to move to a more domestic tech stack has not changed.As semiconductors have become a geopolitical hot potato over the past few years, it's no surprise that Nvidia , the leader in artificial intelligence-related chips, has been caught up in escalating tensions between the U.S. and China. When Nvidia returned to the China market last week , seemingly with the blessing of Washington, it sparked debate over the strategic implications for the U.S.' dominance in AI and China's own focus on boosting its domestic chip and tech industry. For the U.S., Nvidia's return could help cement American strength in AI globally, experts told CNBC. For China, it could buy the country time as it continues on its own path to build Nvidia rivals and keep pace with AI software development. It's a tricky relationship, underscoring the strategic importance of the graphics processing units (GPUs) that Nvidia designs and that currently underpin the world's AI. "The relationship is symbiotic but I do believe China needs the U.S. technology more at this moment in time," Daniel Newman, CEO of Futurum, told CNBC's "The China Connection" last week. Nvidia's warnings Earlier this year, the U.S. government restricted exports of Nvidia's H20 chip to China. The product, a less-advanced version of Nvidia's leading hardware, had been created to comply with previous U.S. export restrictions. Washington has expressed concerned that these chips could be used in areas such as advancing the Chinese military and China's own AI industry. Nvidia took a $4.5 billion writedown on the unsold inventory and warned the China restrictions could impact billions of dollars of potential sales. Jensen Huang, the CEO of Nvidia, has been critical of export curbs . He has said it would be a "tremendous loss" for Nvidia not to participate in China and that rival Huawei would be able to fulfil the needs of the country in its absence. Huang has argued that the restrictions could boost China's domestic semiconductor industry and that it risks eroding America's technological edge. That message appears to have got through to the White House. Nvidia said last week that it received backing from the U.S. government to resume sales of H20 in China. How the move will benefit the U.S. From a business perspective, Nvidia is expected to gain. But for Washington, the move is more strategic. "We want to keep having the Chinese use the American technology stack, because they still rely upon it," Commerce Secretary Howard Lutnick told CNBC last week. Nvidia has managed to gain a formidable position in the market for semiconductors required to train and run AI applications, not just because of its hardware but also because of the popularity of its software platform known as CUDA, that developers build on. This creates an "ecosystem" around Nvidia's products which has proven sticky for its users. The return of the H20 to the world's second-largest economy will "buy China time" to boost its domestic industry, according to Pranay Kotasthane, deputy director at the Takshashila Institution. "But it will also buy the U.S. companies some respite. China is Nvidia's largest market and is home to 50 per cent of AI developers according to Jensen Huang. If that path is completely closed, American firms like Nvidia will find it difficult to raise revenues and re-invest them in the next round of research and development," Kotasthane said. "It might be justifiable to restrain access to the most advanced chips but to expand the scope of the restrictions doesn't make strategic sense." China domestic chips in focus Huawei has been China's leading player in developing AI-focused chips. The country's technology companies are using some of Huawei's hardware but the firm has yet to overtake the dominance of Nvidia's latest chips. One possible outcome is that U.S. export curbs will accelerate China's domestic efforts. China has been looking to boost its domestic semiconductor industry with a particular focus on AI chips. There are a whole host of startups working on new products in the country. Nvidia's return to China could slowdown that progress. "If Nvidia's chips are made available to Chinese firms, it could weaken momentum behind domestic chip projects, cut off capital, and delay progress in domestic Chinese hardware. This retains U.S. tech influence over global AI rails," Tejas Dessai, director of research at Global X ETFs, told CNBC by email. Ultimately, it all goes back to Nvidia's software which keeps developers locked into its hardware. "Chinese model developers still prefer to use Nvidia hardware, because the domestic alternative AI stack, particularly the software development environment from Huawei is still difficult to use and lacks the depth and flexibility of Nvidia's offering," Paul Triolo, a partner at DGA-Albright Stonebridge Group, told CNBC by email. Can China catch up to Nvidia? Still, China's direction of travel and its quest for domestic providers of AI chips is unlikely to change. "Eventually Chinese AI model developers will have to transitions to a domestic AI stack," Triolo said. Nvidia's chips have proved very effective at training huge AI models that require massive amounts of data to be processed. The actual running of those AI model in products like chatbots is known as inferencing. This process may require a different type of chip, which Chinese tech giants as well as startups are working on. "In chips, China's opportunity could come when the focus shifts to inference. That's when demand for lower cost, efficient processors could scale, and we believe custom chip programs from big Chinese tech companies could ultimately serve that demand," Dessai of Global X ETFs said.

[3]

As Trump Courts a More Assertive Beijing, China Hawks Are Losing Out

Ana Swanson reported from Washington and Tripp Mickle from San Francisco In recent years, one of China's biggest requests of American officials has been that the United States relax its strict controls on advanced artificial intelligence chips, measures that were put in place to slow Beijing's technological and military gains. Last week, the Trump administration did just that, as it allowed the world's leader in A.I. chips, the U.S.-based Nvidia, to begin selling a lower-level but still coveted chip known as H20 to China. The move was a dramatic reversal from three months ago, when President Trump himself banned China from accessing the H20, while also imposing triple-digit tariffs on Beijing. That set off an economically perilous trade clash, as China retaliated by clamping down on exports of minerals and magnets that are critical to American factories, including automakers and defense manufacturers. China's decision to cut off access to those materials upended the dynamic between the world's largest economies. The Trump administration, which came into office determined to bully China into changing its trade behavior with punishing tariffs, appeared to realize the perils of that approach. Now, the administration has resorted to trying to woo China instead. Officials throughout the government say the Trump administration is putting more aggressive actions on China on hold, while pushing forward with moves that the Chinese will perceive positively. That includes the reversal on the H20 chip. The H20 decision was primarily motivated by top Trump officials who agreed with Nvidia's arguments that selling the chip would be better for American technology leadership than withholding it, people familiar with the move say. But Trump officials have also claimed that it was part of the trade talks. After telling Congress in June that there was "no quid pro quo in terms of chips for rare earths," Scott Bessent, the Treasury secretary, reversed those comments on July 15, saying that the H20 move was "all part of a mosaic" of talks with China. "They had things we wanted, we had things they wanted, and we're in a very good place," he said. A Chinese Ministry of Commerce official seemed to reject that on Friday, saying that the United States had "taken the initiative" to approve the H20 sales. China believes the U.S. should continue to remove its trade and economic restrictions, the official said. A person familiar with the talks, who spoke on condition of anonymity because he was not authorized to speak publicly, said that the H20 chip was not specifically discussed in meetings between Chinese and American officials in Geneva and London this spring. But the reversal was part of a more recent cadence of warmer actions the United States and China have taken toward each other. For instance, Beijing agreed in recent weeks to block the export of several chemicals used to make fentanyl, an issue Mr. Trump has been concerned about. Recent events have underscored the influence that China has over the U.S. economy. When Mr. Trump raised tariffs on Chinese exports in April, some top Trump officials thought Beijing would quickly fold, given its recent economic weakness. Instead, Beijing called Mr. Trump's bluff by restricting rare earths needed by American makers of cars, military equipment, medical devices and electronics. As the flow of those materials stopped, Mr. Trump and other officials began receiving calls from chief executives saying their factories would soon shut down. Ford, Suzuki and other companies shuttered factories because of the lack of supply. Mr. Trump and his top advisers were surprised by the threat that Beijing's countermove posed, people familiar with the matter say. That brought the United States back to the negotiating table this spring to strike a fragile trade truce, which Trump officials are now wary of upsetting. That agreement dropped tariffs from a minimum 145 percent to 30 percent, with the Chinese agreeing to allow rare earths to flow as freely as before. The administration's caution when it comes to China has been amplified by Mr. Trump's desire for an invitation to Beijing later this year. The president, who has been feted on other foreign trips, wants to engage in face-to-face trade negotiations with Chinese leader Xi Jinping. Howard Lutnick, the commerce secretary, has begun recruiting chief executives for a potential delegation, setting off a competition over who will get to ride in Air Force One, according to people familiar with the plans. Craig Allen, a retired diplomat, said both countries were "clearly preparing for a summit meeting," adding, "that's bringing forth measures that the other side wants and it's also holding back measures that the other side doesn't want." "It's like a dance," Mr. Allen said. "One side makes a move, the other side makes a move to correspond to that." The Commerce Department declined to comment. The White House, the Treasury Department and the Office of the United States Trade Representative did not respond to a request for comment. "The government understands that forcing the world to use foreign competition would only hurt America's economic and national security," John Rizzo, a spokesman for Nvidia, said. A Chinese bargaining chip Opposition to China has fueled bipartisan action for the last decade. Now, Mr. Trump's more hawkish supporters are quietly watching as the president remakes the party's China strategy. Though few are willing to speak out publicly, officials in the Trump administration and in Congress have privately expressed concern that the trade war has given China an opening to finally bring U.S. technology controls onto the negotiating table. Christopher Padilla, a former export control official in the George W. Bush administration, said the fact that the United States was now negotiating over what were supposed to be security restrictions was "a significant accomplishment for the Chinese." Ana Swanson Times reporter covering the Trump tariffs "I have been reporting on economics, trade and international relations for over a decade, from both China and the U.S. I aim to underpin my work with data and numbers, as well as give voice to the personal stories of people I encounter in my reporting." Here's our latest reporting on economic policy and tariffs. "They've been after this for decades, and now they've succeeded," he said. "I assume the Chinese are going to demand more concessions on export controls in return for whatever we want next." Mr. Trump was the first to harness the power of U.S. export controls, by targeting Chinese tech giant Huawei and putting global restrictions on American technology in his first term. But the Biden administration expanded those rules. Concerned that China's growing A.I. capacity would advance its military, Biden officials cracked down on exports of Nvidia chips, seeing them as the most effective choke point over Chinese A.I. capabilities. Since then, when Chinese officials raised their objections to U.S. technology controls in meetings, U.S. officials had responded by insisting that the measures were national security matters and not up for debate. But in the meeting in Geneva in May, China finally had a powerful counterargument. Beijing insisted that its minerals and magnets, some of which go to fighter jets, drones and weaponry, were a "dual-use" technology that could be used for the military as well as civilian industries, just like A.I. and chips. It demanded reciprocity: If the United States wanted a steady flow of rare earths, Washington should also be ready to lessen its technology controls. It's not clear exactly what the United States agreed to in Geneva: The agreement has never been made public. But when the United States put out an unrelated export control announcement the day after the Geneva summit concluded, China responded angrily, saying the statement "undermined the consensus" the countries had reached. In a notice on May 13, the Commerce Department said that using Huawei's A.I. chips "anywhere in the world" was an export control violation. The notice was directed at other nations considering purchasing Huawei chips, people familiar with the move said, not the Chinese. The announcement appeared to take other parts of the Trump administration by surprise, and within hours, the language in the release was walked back, though no policy changes were made. Mr. Bessent and Jamieson Greer, the trade representative, expressed concerns that such moves could damage trade talks with China, people familiar with the incident said. China once again clamped down on rare earth exports. Trying to find its own leverage, the United States responded by restricting exports of semiconductor design software, airplane parts and ethane. The two sides restored their truce in a meeting in London in June. Since then, trade in those products has restarted. But U.S. companies complain that Chinese licenses for rare earth magnets are limited to six months, and that the Chinese government is requesting proprietary information to obtain those shipments. Beijing has also continued to build out its export controls. On June 15, the day after Nvidia said it would be permitted to sell the H20 in China, Chinese officials announced new restrictions on exports of battery technology. The United States has been trying to decrease its dependence on China for rare earths, but there is no quick solution. China has a powerful hold over numerous industries, ranging from pharmaceuticals to solar panels to drones. "The challenge for the Trump administration is, how do they get out of this quagmire?" said Jimmy Goodrich, a senior adviser for technology analysis to the RAND Corporation. "It appears some competitive U.S. actions are now at the whims of Beijing, who can now determine the time, place and nature of U.S. tech and trade policy toward China." Deal makers in the White House The change in the relationship with China has coincided with a separate shift in the administration, in which officials who favor technology controls on China have been sidelined in favor of those who support the tech industry's ambitions to sell abroad. Mr. Lutnick and Marco Rubio, the secretary of state who has long been an ardent China critic, have hewed closely to the position of the president, who is more of a deal maker than a national security hawk. And hawkish members of the National Security Council have been fired in recent months, after being accused of insufficient loyalty. Their absence has paved the way for officials like David Sacks, the White House A.I. czar, who has criticized export controls, to push for tech companies to have freer rein. Nvidia's chief executive, Jensen Huang, has gone on a lobbying blitz in Washington, pushing politicians to open China for A.I. chip sales. Mr. Huang has contended that blocking U.S. technology from China has backfired by creating more urgency for China to develop its own technology. He has argued that the Chinese military won't use Nvidia chips, and pushed back against Washington's consensus that China is an adversary, describing it a "competitor" but "not our enemy." Others have challenged those assertions, pointing to past research that the Chinese military has placed orders for Nvidia chips. Scientific papers published earlier this year also showed Chinese researchers with ties to military universities and a top nuclear weapons lab using Nvidia chips for general research. Mr. Rizzo, the Nvidia spokesman, said in a statement that "non-military papers describing new and beneficial ways to use U.S. technology promote America." In a letter on Friday, John Moolenaar, the Republican chairman of the House Select Committee on China, said the H20 chip had aided the rise of the Chinese A.I. model DeepSeek and would help China develop A.I. models to compete with American ones. These arguments do not appear to have persuaded the president. In an Oval Office meeting with Mr. Huang in July, Mr. Trump agreed with Nvidia that keeping American chips out of China would only help Huawei, and decided to reverse the H20 ban. People familiar with Mr. Trump's views say he has always viewed export controls more transactionally. In his first term, Mr. Trump agreed to roll back U.S. restrictions on ZTE at the urging of Mr. Xi. In this term, Mr. Trump and his advisers have begun using America's control over A.I. chips as a source of leverage in negotiations with governments from the Middle East to Asia. With China, Mr. Trump has his own longstanding aspirations. He believes that U.S. businesses have been getting ripped off for decades, and that he can be the one to fix it, particularly if he negotiates directly with Mr. Xi. His advisers have begun strategizing toward a more substantial trade negotiation with China focused on market opening, as well as the potential visit this fall.

[4]

Opinion | America Will Come to Regret Selling A.I. Chips to China

Dr. Buchanan served as the White House special adviser for A.I. during the Biden administration. The Trump administration announced last week that it would allow China to purchase advanced artificial intelligence chips from the tech giant Nvidia. The decision, a reversal of the administration's past restriction on chip sales, is a profound mistake. It cedes the United States' greatest point of leverage in A.I.: control of the global computing power supply chain. Mr. Trump claims to champion American tech, releasing an "A.I. action plan" this week. But permitting these chip sales threatens American dominance in A.I., undermines U.S. tech companies and risks our national security -- all in favor of one chipmaker's near-term profits. Computer chips are the lifeblood of powerful A.I. systems. A.I. companies compete desperately to buy this hardware; many spend the vast majority of their funding on chips. (I do advisory work for some of these companies, including Anthropic.) American chipmakers, including Nvidia, sell more than 10 million of these chips annually. China relies on these chips to aid both its military and its A.I. companies, but can make only about 200,000 of its own per year, the Trump administration said last month. In other words, Nvidia's chips will give China's A.I. ecosystem, and its government, just what it needs to surpass the United States in the most critical arenas. A.I. technology could soon transform military operations, potentially enabling better hacking and sophisticated drone warfare. Ample evidence suggests that Chinese military suppliers prefer Nvidia chips and use A.I. systems trained on U.S. chips. The stakes are not hard to grasp: We should not allow American troops and intelligence officers to be targeted by Chinese A.I. trained on Nvidia chips. The first Trump administration understood these risks. Mr. Trump placed export controls on some chip-making equipment in order to hobble China's A.I. chip industry, while the Biden administration -- in which I served as the White House special adviser on A.I. -- went further, restricting the sale of additional equipment and of Nvidia's flagship chip, called the H100. Both administrations accused China of using advanced A.I. to modernize its military and to commit human rights abuses. Last year, in response to these restrictions, Nvidia created a chip called the H20, which is designed to elude U.S. export controls so it can be sold in China. The controls focused on processing power, so Nvidia gave the H20 chip mediocre processing but large amounts of high-bandwidth memory. That memory allows the H20 to outperform the H100 when running, as opposed to training, A.I. systems -- a process called inference. Inference is becoming increasingly important: One analysis suggests that it will make up more than 70 percent of A.I. needs by 2026. This memory, and other components of the H20, could have been used to make H100 chips for American companies. Before reversing itself, the Trump administration rightly blocked H20 sales to China in April. A White House official said that there was "bipartisan and broad concern" about how China would use the chips. The controls appeared to be working. DeepSeek, China's most impressive A.I. company, reportedly failed to follow through on a previous breakthrough because it was cut off from the H20. This weakness was no surprise: DeepSeek's chief executive had repeatedly admitted that restrictions on the export of U.S. chips were the greatest impediment to his company's future. But Nvidia's chief executive, Jensen Huang, lobbied hard for a reversal. To do so, he hyped China's Huawei chips, claiming they were on par with Nvidia's and that Huawei could produce them in competitive quantities. He urged the Trump administration to let Nvidia re-enter the Chinese market to stop Huawei from growing more powerful. China's state media trumpeted Mr. Huang's comments, as did Trump administration officials in justifying their reversal. But the claim that China's chips rival the United States' is false. Huawei simply has not shown that it can significantly increase A.I. chip manufacturing. Despite Chinese investments of hundreds of billions of dollars in chip manufacturing since 2014, U.S. export controls on chip-making equipment have held back Huawei's production capacity. The estimated number of chips Huawei can manufacture this year would hardly be enough to fill a single cutting-edge data center. Each of those Huawei chips also performs worse than advanced U.S. chips. Huawei chips account for only about 3 percent of global supercomputing power. If Huawei's chips were as good as Nvidia's, there wouldn't be the overwhelming demand in China for the H20. The H20 is a very capable chip. It performs substantially better than Huawei's best chip at inference. Opening the floodgates for H20s to flow into China will revitalize Chinese companies like DeepSeek as they try to supplant U.S. firms in the global market. Some other chipmakers may wonder why Nvidia gets to profit while their wares are subject to U.S. export controls. Worst of all, the H20 decision could fracture the hard-won bipartisan consensus on the need for American A.I. dominance over China. Mr. Trump's decision has drawn bipartisan opposition, but the A.I. industry senses weakness in his China policy. Mr. Huang, who visited China to laud its A.I. companies just after he lobbied Mr. Trump, told a Chinese audience, "I hope to get more advanced chips into China than the H20." As the world's first $4 trillion company, Nvidia doesn't need the Chinese market to thrive. The demand for A.I. chips from U.S. companies is enormous: Firms are poised to spend hundreds of billions of dollars in 2025 alone on A.I. technology and data centers. Amid the A.I. boom, Nvidia's stock price has increased by a factor of 10 over the last two and a half years, even as U.S. chip restrictions tightened. You'd be forgiven for assuming that the United States got something from China in exchange for giving away its advanced technology. Not from what I can tell. The day after the H20 reversal, China ratcheted up its own export controls on critical minerals and battery technologies -- areas where it has an advantage. It was a fitting and lamentable coda to a decision that benefited one company at the expense of America's A.I. leadership and its national security. Ben Buchanan is an assistant professor at the Johns Hopkins University School of Advanced International Studies and an adviser to A.I. and cybersecurity companies. The Times is committed to publishing a diversity of letters to the editor. We'd like to hear what you think about this or any of our articles. Here are some tips. And here's our email: [email protected]. Follow the New York Times Opinion section on Facebook, Instagram, TikTok, Bluesky, WhatsApp and Threads.

[5]

The US squeezed Nvidia's AI chip export deal with China into negotiations over important rare earth elements, bizarrely claiming 'we put that in the trade deal with the magnets'

News broke earlier this week that Nvidia was filing applications to sell its H20 AI GPUs in China once more, and that the US government had assured it that a license to sell the high-powered hardware would be granted. Now we're learning a little more about how this arrangement might work, and it turns out it's part of a new US/China trade deal on the import and export of rare earths. Or, to quote US Commerce Secretary Howard Lutnick speaking to Reuters, "We put that in the trade deal with the magnets." While the agreement does appear to include the specific lifting of an export ban on magnets, it's the rare earth metals that are almost certainly the bigger prize on the table here. On June 11, US and Chinese representatives finalised the new deal, which, according to President Trump, includes an agreement from Beijing to resume exports of "any necessary rare earths" (and "full magnets") to the states, while the US would back off from its previous threats to revoke the visas of Chinese students. And, according to Lutnick, it would also enable China to buy Nvidia's high-end AI chips once more as part of the same package. China has an estimated reserve of 44 million metric tons of rare earths, a group of 17 metallic elements that are absolutely essential for the production of modern electronic devices. That makes the country the largest potential source of the precious elements behind Brazil, which is currently estimated to have a reserve of 21 million metric tons. The United States, however, is estimated to have a reserve of 1.9 million metric tons, provided by a single operational mine located in Mountain Pass, California. Here we reach something of a thorny point in the Trump administration's "America first" ideology: While the US is arguably capable of providing for itself in many respects, rare earths in relation to electronics manufacturing is not currently one of them. So, a deal appears to have been struck, which stands in stark contrast to both the Trump administration's tariff policy so far (China being hit far harder by the wave of tariffs than any other nation) and, it seems, the prior Biden administration's restrictions on the export of high-end AI hardware. Bundling the two together in the same deal makes a whole lot of sense, I suppose, particularly if a tit-for-tat arrangement is potentially underway. China wants high-end AI hardware, the US wants rare earths, and both, of course, want to prosper well into the future when it comes to cutting edge tech. Trump appears keen to revive the US electronics and chipmaking industry, but without the rare earth imports to do so, it'd likely be a plan that struggled to get off the ground. Commerce secretary Howard Lutnick, on the other hand, is believed to be one of the key architects behind the Trump administration's... unusual approach to tariff structuring. Previously known as an American businessman and philanthropist, he was recently criticised during a congressional hearing for steadfastly holding to his view that building and producing products in America would result in paying no tariffs, despite protestations from congresswoman Madeleine Dean that "we can't produce bananas in America." For the purpose of balance, I will point out that a relatively small number of bananas are grown in Hawaii [PDF warning]. Anyway, aside from being listed this year as one of the world's 100 most influential people, Lutnick was endorsed by Elon Musk to be Trump's US treasury secretary after his election, before instead being picked as commerce secretary. It is believed that Lutnick was a key factor in negotiating behind the scenes with China and a number of other countries in the early days of the current administration, although some reports have indicated that many of Trump's allies are less than pleased with his current level of influence regarding the President. So, what does all this have to do with the price of fish? Well, many have speculated that Trump's apparent hardball tactics may have been an attempt to force China to the negotiating table, and rare earths in exchange for AI chips seems to be at least part of the new deal between the two. Tech really does make the world go round these days, it seems, and while Nvidia CEO Jensen Huang seems pleased as punch at the opportunity to sell to China once more, it's the rare earth side of the trade deal that might have the biggest impact on the future of the industry as whole.

[6]

Selling US-made AI chips to China sacrifices America's global standing

In what Bloomberg termed "a dramatic reversal," the Trump administration will grant licenses to Nvidia Corp. so that it can sell its H20 chips to Chinese parties. In April, Trump officials had prohibited the sale of H20s to that country. At the same time, Advanced Micro Devices announced plans to resume sales of its MI308 artificial intelligence chip to China. The sale of advanced microchips to China is a mistake, almost certainly a grave one, but it is a mistake that the industry is determined to make. Not satisfied with exporting just the H20, Nvidia Chief Executive Jensen Huang said at a press conference in Beijing this month that he wanted to sell even more advanced chips. "The reason for that is because technology is always moving on," he explained. "It's not like wood." "Today, [the NVIDIA Hopper GPU architecture] is terrific, but some years from now we will have more and more and better and better technology, and I think it's sensible that whatever we're allowed to sell in China will continue to get better and better over time as well," Huang said. Nvidia said it will develop for export to China a new chip based on its Blackwell design. The chip will allow users to integrate AI into manufacturing. Commerce Secretary Howard Lutnick justified the reversal of the export ban by pointing out that the H20 was only Nvidia's "fourth best" chip. "We don't sell them our best stuff -- not our second-best stuff, not even our third-best," he told CNBC on the 15th. "You want to sell the Chinese enough that their developers get addicted to the American technology stack." "The idea is the Chinese are more than capable of building their own," the Commerce secretary said. "You want to keep one step ahead of what they can build, so they keep buying our chips." The problem with this thinking is that it is based on the false premise that China does not at its core need American chips, so there's no harm in selling them to prolong Chinese dependence. "Despite Beijing pouring significant subsidies into its domestic semiconductor industry, China cannot produce chips capable of training leading AI models, leaving Chinese firms reliant on American suppliers," wrote Jack Burnham and Miles Kershner of the Foundation for Defense of Democracies after the H20 announcement. "This reliance has led to significant computing shortages. Even DeepSeek, a leading Chinese AI developer, has publicly stated that its models' power remains constrained due to American export controls on advanced AI chips." So will China be able to develop comparable chips to America's best? "China's Communist Party has always been known for lying, and we need look no further than its tech leviathan Loongson Technology," Blaine Holt, a retired U.S. Air Force general and now China commentator, told me this month. "Loongson, we were told, was 'better than Intel' and powered everything electronic in China. The discovery that their flagship chip, the 3C6000, was barely on par with Intel chips from 13 generations ago has consequences for users, especially the People's Liberation Army." Huang assures Americans that China will not use the H20 for its military. "We don't have to worry about it," he told CNN's Fareed Zakaria earlier this month. Despite what Huang says, we must worry. According to Burnham and Kershner, giving China the H20 "will allow it to rapidly integrate AI into its military while it continues to pursue self-sufficiency." The H20, significantly more powerful than Nvidia's export-compliant H100 line, will be "essential for AI deployment due to its memory capabilities," the Foundation for Defense of Democracies scholars point out. "The Trump administration," they note, "is giving China a much-needed boost in the race for artificial intelligence." And that boost comes at a crucial time for AI development. "The No. 1 factor that will define whether the U.S. or China wins this race is whose technology is most broadly adopted in the rest of the world," said Brad Smith, Microsoft's president, in congressional testimony. "Whoever gets there first will be difficult to supplant." "According to Jensen Huang, China is going to defeat the United States in the push for AI supremacy," Brandon Weichert, senior national security editor of The National Interest, told me. Weichert said since the Trump administration's first attempt at slowing the sale of high-end chips to China "Beijing's AI development has been slower than that of America's because they lacked direct and easy access to those high-end chips. Authorizing Huang's Nvidia to sell these chips to China will ensure that China does, in fact, outpace the Americans." So why would Trump allow the sale of the H20 to China? Many suspect the permission was part of a deal: China resumes sales of rare earths to the U.S. and America removes chip restrictions. Lutnick confirmed the outlines of this arrangement. China certainly got the better of the bargain. America can source rare earths elsewhere or even buy them surreptitiously from Chinese parties -- these minerals are actually so rare -- but China must buy American chips, from Nvidia, AMD, or some other U.S. company. It is true that, up to now, Chinese parties have been able to buy Nvidia chips through black market channels, but now they will be able to get more chips at cheaper prices and at a faster pace because they will be buying from Nvidia directly. Speed, as Smith noted, is critical in the race to develop artificial intelligence. Beijing has been touting its technological supremacy, and nothing would undercut its grand claims more than if its AI development visibly stalled because the Chinese could not get microchips from American companies. Xi Jinping in June said that high tech is a main area of global competition. "The Commerce Department made the right call in banning the H20," Rep. John Moolenaar, the Michigan Republican who chairs the House Select Committee on the Chinese Communist Party, posted on X last week. "Now it must hold the line. We can't let the Chinese communists use American chips to train AI models that will power its military, censor its people and undercut American innovation." Gordon G. Chang is the author of "Plan Red: China's Project to Destroy America" and "The Coming Collapse of China."

[7]

As Trump courts a more assertive Beijing, China hawks are losing out - The Economic Times

The Trump administration has reversed a ban on Nvidia's H20 AI chip sales to China, easing tensions in a complex trade dispute. This shift follows China's restrictions on rare earth exports. Both nations are cautiously rebuilding ties, with potential trade talks and a summit between Trump and Xi Jinping expected.In recent years, one of China's biggest requests of US officials has been that the United States relax its strict controls on advanced artificial intelligence chips, measures that were put in place to slow Beijing's technological and military gains. Last week, the Trump administration did just that, as it allowed the world's leader in AI chips, US-based Nvidia, to begin selling a lower-level but still coveted chip known as H20 to China. The move was a dramatic reversal from three months ago, when President Donald Trump banned China from accessing the H20, while also imposing triple-digit tariffs on Beijing. That set off an economically perilous trade clash, as China retaliated by clamping down on exports of minerals and magnets that are critical to American factories, including automakers and defence manufacturers. China's decision to cut off access to those materials upended the dynamic between the world's largest economies. The Trump administration, which came into office determined to bully China into changing its trade behavior with punishing tariffs, appeared to realize the perils of that approach. Now, the administration has resorted to trying to woo China instead. Officials throughout the government say the Trump administration is putting more aggressive actions on China on hold, while pushing forward with moves that the Chinese will perceive positively. That includes the reversal on the H20 chip. The H20 decision was primarily motivated by top Trump officials who agreed with Nvidia's arguments that selling the chip would be better for American technology leadership than withholding it, people familiar with the move say. But Trump officials have also claimed that it was part of the trade talks. After telling Congress in June that there was "no quid pro quo in terms of chips for rare earths," Scott Bessent, the treasury secretary, reversed those comments Tuesday, saying that the H20 move was "all part of a mosaic" of talks with China. "They had things we wanted, we had things they wanted, and we're in a very good place," he said. A Chinese Ministry of Commerce official seemed to reject that Friday, saying that the United States had "taken the initiative" to approve the H20 sales. China believes the US should continue to remove its trade and economic restrictions, the official said. A person familiar with the talks, who spoke on condition of anonymity because he was not authorized to speak publicly, said that the H20 chip was not specifically discussed in meetings between Chinese and US officials in Geneva and London this spring. But the reversal was part of a more recent cadence of warmer actions the United States and China have taken toward each other. For instance, Beijing agreed in recent weeks to block the export of several chemicals used to make fentanyl, an issue Trump has been concerned about. Recent events have underscored the influence that China has over the US economy. When Trump raised tariffs on Chinese exports in April, some top Trump officials thought Beijing would quickly fold, given its recent economic weakness. Instead, Beijing called Trump's bluff by restricting rare earths needed by American makers of cars, military equipment, medical devices and electronics. As the flow of those materials stopped, Trump and other officials began receiving calls from CEOs saying their factories would soon shut down. Ford, Suzuki and other companies shuttered factories because of the lack of supply. Trump and his top advisers were surprised by the threat that Beijing's countermove posed, people familiar with the matter say. That brought the United States back to the negotiating table this spring to strike a fragile trade truce, which Trump officials are now wary of upsetting. That agreement dropped tariffs from a minimum 145% to 30%, with the Chinese agreeing to allow rare earths to flow as freely as before. The administration's caution when it comes to China has been amplified by Trump's desire for an invitation to Beijing later this year. The president, who has been feted on other foreign trips, wants to engage in face-to-face trade negotiations with Chinese leader Xi Jinping. Howard Lutnick, the commerce secretary, has begun recruiting CEOs for a potential delegation, setting off a competition over who will get to ride in Air Force One, according to people familiar with the plans. Craig Allen, a retired diplomat, said both countries were "clearly preparing for a summit meeting," adding, "that's bringing forth measures that the other side wants and it's also holding back measures that the other side doesn't want." "It's like a dance," Allen said. "One side makes a move, the other side makes a move to correspond to that." The Commerce Department declined to comment. The White House, the Treasury Department and the Office of the United States Trade Representative did not respond to a request for comment. "The government understands that forcing the world to use foreign competition would only hurt America's economic and national security," said John Rizzo, a spokesperson for Nvidia. A Chinese bargaining chip Opposition to China has fueled bipartisan action for the past decade. Now, Trump's more hawkish supporters are quietly watching as the president remakes the party's China strategy. Though few are willing to speak out publicly, officials in the Trump administration and in Congress have privately expressed concern that the trade war has given China an opening to finally bring US technology controls onto the negotiating table. Christopher Padilla, a former export control official in the George W. Bush administration, said the fact that the United States was now negotiating over what were supposed to be security restrictions was "a significant accomplishment for the Chinese." "They've been after this for decades, and now they've succeeded," he said. "I assume the Chinese are going to demand more concessions on export controls in return for whatever we want next." Trump was the first to harness the power of US export controls, by targeting Chinese tech giant Huawei and putting global restrictions on American technology in his first term. But the Biden administration expanded those rules. Concerned that China's growing AI capacity would advance its military, Biden officials cracked down on exports of Nvidia chips, seeing them as the most effective choke point over Chinese AI capabilities. Since then, when Chinese officials raised their objections to US technology controls in meetings, US officials had responded by insisting that the measures were national security matters and not up for debate. But in the meeting in Geneva in May, China finally had a powerful counterargument. Beijing insisted that its minerals and magnets, some of which go to fighter jets, drones and weaponry, were a "dual-use" technology that could be used for the military as well as civilian industries, just like AI and chips. It demanded reciprocity: If the United States wanted a steady flow of rare earths, Washington should also be ready to lessen its technology controls. It's not clear exactly what the United States agreed to in Geneva: The agreement has never been made public. But when the United States put out an unrelated export control announcement the day after the Geneva summit concluded, China responded angrily, saying the statement "undermined the consensus" the countries had reached. In a notice May 13, the Commerce Department said that using Huawei's AI chips "anywhere in the world" was an export control violation. The notice was directed at other nations considering purchasing Huawei chips, people familiar with the move said, not the Chinese. The announcement appeared to take other parts of the Trump administration by surprise, and within hours, the language in the release was walked back, though no policy changes were made. Bessent and Jamieson Greer, the trade representative, expressed concerns that such moves could damage trade talks with China, people familiar with the incident said. China once again clamped down on rare earth exports. Trying to find its own leverage, the United States responded by restricting exports of semiconductor design software, airplane parts and ethane. The two sides restored their truce in a meeting in London in June. Since then, trade in those products has restarted. But US companies complain that Chinese licenses for rare earth magnets are limited to six months, and that the Chinese government is requesting proprietary information to obtain those shipments. Beijing has also continued to build out its export controls. On July 15, the day after Nvidia said it would be permitted to sell the H20 in China, Chinese officials announced new restrictions on exports of battery technology. The United States has been trying to decrease its dependence on China for rare earths, but there is no quick solution. China has a powerful hold over numerous industries, ranging from pharmaceuticals to solar panels to drones. "The challenge for the Trump administration is, how do they get out of this quagmire?" said Jimmy Goodrich, a senior adviser for technology analysis to the Rand Corp. "It appears some competitive US actions are now at the whims of Beijing, who can now determine the time, place and nature of US tech and trade policy toward China." Dealmakers in the White House The change in the relationship with China has coincided with a separate shift in the administration, in which officials who favor technology controls on China have been sidelined in favor of those who support the tech industry's ambitions to sell abroad. Lutnick and Marco Rubio, the secretary of state who has long been an ardent China critic, have hewed closely to the position of the president, who is more of a dealmaker than a national security hawk. And hawkish members of the National Security Council have been fired in recent months, after being accused of insufficient loyalty. Their absence has paved the way for officials like David Sacks, the White House AI czar, who has criticized export controls, to push for tech companies to have freer rein. Nvidia's CEO, Jensen Huang, has gone on a lobbying blitz in Washington, pushing politicians to open China for AI chip sales. Huang has contended that blocking US technology from China has backfired by creating more urgency for China to develop its own technology. He has argued that the Chinese military won't use Nvidia chips, and pushed back against Washington's consensus that China is an adversary, describing it a "competitor" but "not our enemy." Others have challenged those assertions, pointing to past research that the Chinese military has placed orders for Nvidia chips. Scientific papers published earlier this year also showed Chinese researchers with ties to military universities and a top nuclear weapons lab using Nvidia chips for general research. Rizzo, the Nvidia spokesperson, said in a statement that "non-military papers describing new and beneficial ways to use US technology promote America." In a letter Friday, John Moolenaar, the Republican chair of the House Select Committee on China, said the H20 chip had aided the rise of the Chinese AI model DeepSeek and would help China develop AI models to compete with American ones. These arguments do not appear to have persuaded the president. In an Oval Office meeting with Huang in July, Trump agreed with Nvidia that keeping American chips out of China would only help Huawei, and decided to reverse the H20 ban. People familiar with Trump's views say he has always viewed export controls more transactionally. In his first term, Trump agreed to roll back US restrictions on ZTE at the urging of Xi. In this term, Trump and his advisers have begun using America's control over AI chips as a source of leverage in negotiations with governments from the Middle East to Asia. With China, Trump has his own long-standing aspirations. He believes that US businesses have been getting ripped off for decades, and that he can be the one to fix it, particularly if he negotiates directly with Xi. His advisers have begun strategizing toward a more substantial trade negotiation with China focused on market opening, as well as the potential visit this fall.

[8]

Trump's fab plan to let Nvidia chip into China again hides a 'rare' agenda

The US, under President Trump, is allowing Nvidia to resume H20 AI chip sales to China, reversing earlier export bans. This decision is linked to negotiations regarding rare earth element supplies, critical for US manufacturing. The move reflects a strategy of using export controls as bargaining tools in trade talks, securing rare earths in exchange for AI chips. In April, the US banned Nvidia from selling even its watered-down H20 AI chips to China, doubling down on a strategy aimed at choking Beijing's AI ambitions. But just three months later, those same chips are headed back to China. What changed? A lot, if you're following Donald Trump's logic. The green light for Nvidia's H20 shipments is now directly linked to rare earth negotiations. Treasury Secretary Scott Bessent told Bloomberg on Tuesday that the export controls on Nvidia have become a "negotiating chip" in broader US-China trade talks, which recently led to a deal to reduce mutual tariffs. After Nvidia CEO Jensen Huang met Donald Trump last week, Commerce Secretary Howard Lutnick told Reuters, "We put that in the trade deal with the magnets." That one line says it all: export controls aren't just policy anymore; they're bargaining tools. Also Read: Nvidia's Huang says China's open-source AI a 'catalyst for progress' Additionally, Huang said on Wednesday that the company is "doing our best" to serve China's massive semiconductor market, following meetings with top officials in Beijing. Huang is in the city for the China International Supply Chain Expo, an event where China is positioning itself as a champion of global free trade, in sharp contrast to the trade turbulence triggered by US President Donald Trump. Nvidia, the world's most valuable company and the first publicly traded firm to hit a $4 trillion valuation (which it did last week), said Monday it is applying for US licenses to resume H20 GPU sales to China. The company said it has received assurances from the US government that the licenses will be approved. AMD, another major chipmaker, said on Tuesday that it too was planning to restart sales of its AI chips to China. This is a big reversal. Under the Biden administration, Washington had first built a firewall of export controls in October 2022, and then progressively raised it higher and higher. First came a ban on Nvidia's top-of-the-line H100 chips, followed by curbs on less powerful variants like the H20. Though technically compliant, the H20 was still seen as dangerous because it worked with Nvidia's CUDA software stack, the backbone of most AI development globally. In April 2025, Trump's Commerce Department formally blocked H20 shipments to China unless Nvidia obtained a special license, forcing the company to halt sales. CEO Jensen Huang had warned the move could cost Nvidia $15 billion. Also Read: Nvidia's Huang hails Chinese AI models as "world class" China generated $17 billion for Nvidia last fiscal year, 13% of its total revenue. But behind the scenes, the administration was already laying the groundwork for a trade-off. China retaliated against Trump's "Liberation Day" tariffs by halting rare earth exports to the US These 17 critical elements are essential for EVs, smartphones, and weapons, and China controls more than 80% of the global supply. That gave Beijing leverage, and now Trump is using Nvidia's pain as a bargaining chip. The outcome: a tacit agreement to allow Nvidia's chips in exchange for reopening rare earth supply lines. It's textbook Trump: maximise leverage, bend the rules when needed, and go straight for the deal. The trade détente followed China's March 2025 halt to rare earth exports, a direct response to Trump's new tariffs. The chip ban lift, in return, appears to be part of a broader deal to reopen the rare earth spigot. Reports now suggest Beijing has pledged to resume those exports. The White House, for its part, is signalling de-escalation, even as it insists that national security remains the guiding principle. The move sparked immediate backlash. Rep. Raja Krishnamoorthi, top Democrat on the House China committee, called it a betrayal of national security, reported Reuters. "This decision would hand our foreign adversaries our most advanced technologies," he said. His Republican counterpart, Rep. John Moolenaar, also demanded answers from the Commerce Department. He pointed to Chinese startup DeepSeek, an emerging AI powerhouse, as proof that even H20-level chips can tip the balance. "The H20 is a powerful chip... and played a significant role in the rise of PRC AI companies like DeepSeek," he warned. Nvidia CEO Jensen Huang defended the company's position in an interview with China's CCTV: "The Chinese market is massive, dynamic, and highly innovative... It's really important that American companies are able to compete and serve the market here." Also Read: Chinese firms scramble to buy Nvidia AI chips as it plans to resume sales The H20 is widely believed to have contributed to DeepSeek, an advanced Chinese AI model. This isn't just about chips. It's about who leads the next industrial revolution. In January 2025, DeepSeek stunned the global AI community by releasing a ChatGPT rival built on cheap hardware. By January 27, DeepSeek-R1 surpassed ChatGPT as the most downloaded freeware app on the iOS App Store in the United States, causing an 18% drop in Nvidia's share price on that day. Washington took notice, not because DeepSeek had caught up, but because it had done so without top-tier chips. Nvidia designed the H20 specifically for the Chinese market, a "second-tier" chip meant to comply with earlier export rules. But its real power lies in its software compatibility. The H20 works seamlessly with Nvidia's CUDA tools, which dominate global AI development. That makes it far more valuable than its specs suggest. Even with reduced power, it gives Chinese firms access to a world-class AI development ecosystem and allows them to piggyback on global infrastructure. Not surprisingly, demand in China is spiking. ByteDance and Tencent are reportedly applying to purchase H20 chips. However, ByteDance, in a statement to Reuters, denied that it is currently submitting applications. Nvidia hasn't confirmed details but is said to have set up an "approved list" system for Chinese buyers. Nvidia's case isn't an outlier. The US has a long history of using tech as leverage in global power plays: ASML export ban: Since 2019, Washington has pressured the Dutch government to block ASML from selling its cutting-edge EUV lithography machines to China--tools essential for advanced chipmaking. It's a textbook example of the U.S. controlling chokepoints in the global semiconductor supply chain. Also Read: Faced with geopolitics and trade war, US companies in China report record-low new investment plans Huawei and 5G: The U.S. blacklisted Huawei and ZTE, cutting off their access to American tech, and lobbied allies to exclude Huawei from their 5G infrastructure, citing security threats. Middle East "chiplomacy": In May 2025, during trips to Saudi Arabia, Qatar, and the UAE, U.S. officials reportedly offered access to advanced chips in exchange for defence deals and tech investments. It was tech used as currency. India sanctions: The U.S. recently sanctioned 19 Indian firms for allegedly supplying dual-use goods to Russia, showing how export controls are being used extraterritorially to enforce foreign policy. Export controls are no longer just about national security. They're now integral to American foreign policy. The Nvidia saga isn't just a US-China story. For India, it's a mirror, and a warning. On one side, it echoes India's past run-ins with Trump-era trade pressure. Take the Harley-Davidson dispute: Trump repeatedly criticised India's steep import duties, calling them "very unfair." The result? India lowered tariffs on premium bikes, and Harley partnered with Hero MotoCorp for local production. A trade threat turned into a manufacturing pivot. Apple offers another case in point. During Trump's presidency, the U.S. pushed Apple CEO Tim Cook to scale back overseas manufacturing and invest more at home. India, instead of backing down, doubled down, rolling out targeted Production Linked Incentive (PLI) schemes and state-level benefits. Also Read: Trump student visa curbs spark hiring push by China quant funds The result: India is now Apple's second-largest iPhone production base after China--and a major exporter to global markets. Despite political noise, India secured its place in Apple's shifting supply chain. Now, India is taking those lessons and running with them. It's racing to reduce dependence on Chinese rare earths, accelerating exploration, reopening old mines, and forging global joint ventures. At the same time, its PLI schemes are evolving into a geopolitical playbook, offering incentives to chipmakers, semiconductor toolmakers, and electronics firms to anchor supply chains in India. Nvidia's story, however, seemingly cuts both ways. It shows that compliance doesn't guarantee certainty -- that even when companies follow the rules, policies can flip overnight; export licenses can vanish, and access to entire markets can disappear with a single memo. Trump's approach to tech trade, while not exactly subtle, appears to be working. This wasn't a concession to Nvidia; it was a deal -- AI chips for magnets, under which China gets access back to Jensen Huang's GPUs, and Trump gets rare earths flowing back into US factories.

[9]

NVIDIA's H20 Ban Lifted in High-Stakes Trade Talks For China's Rare Earths, Says US Commerce Secretary Howard Lutnick; But Was It Worth It?

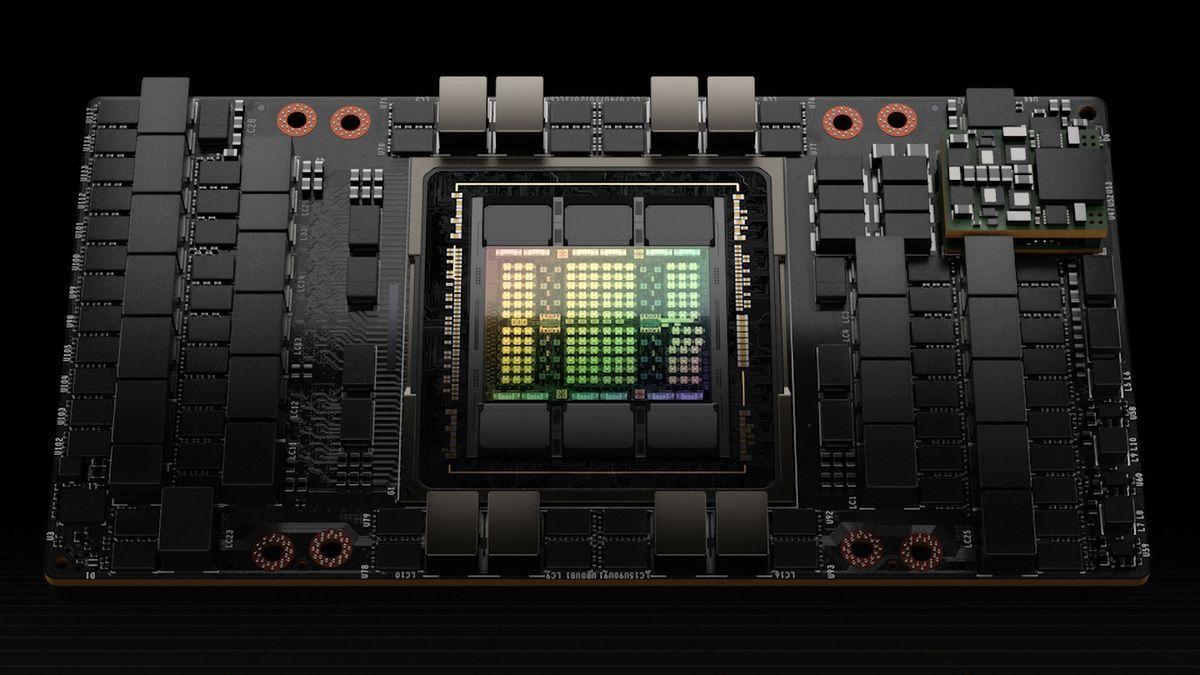

NVIDIA's H20 AI accelerator was permitted for export to China in a trade-off with rare earth metals, reveals the US Commerce Secretary, but was the deal worth it? Well, last week, NVIDIA's CEO Jensen Huang immediately announced while being in Beijing that the Trump administration would lift the ban on the H20 AI accelerator, and it was seen as a decision to ease off the pressure on Team Green and its business in China. However, this move has a far bigger reason, which Howard Lutnick revealed to the public recently. In an interview with CNBC, the US Commerce Secretary verified that AI chips were part of the recent trade talks, and that the decision on the H20 AI accelerator was made according to it. SULLIVAN: Well, I'm watching CNBC, as well as being on CNBC, and I'm looking at Nvidia getting a deal to be allowed to sell certain chips and do more business into China. That's coming from this administration. Is that a change of heart?. LUTNICK: Well, it's funny, because the Biden administration allowed China to buy these chips last year. So, then we held it up, and then, in the magnets deal with the Chinese, we told them that we would start to resell them Well, this is a fairly important detail to check out, considering that the markets perceived it as a "change of heart" decision. In reality, the US did use NVIDIA's AI chips as leverage for the trade deal. This shows that the Trump administration knows how important the H20 AI accelerator is for Chinese AI companies and that Beijing is ready to trade it for one of their most "prized possessions," the supply of rare earths to the US. Of course, there were other talks involved, but it seems like AI chips saw a far more greater influence over the deal than what is perceived. For Beijing, now that NVIDIA has entered the domestic markets once again, the pursuit of localized AI solutions, such as those from Huawei, will see a relative decline since local tech giants are more interested in what NVIDIA offers. The Trump administration has sided with Jensen's narrative that populating American tech in China is what would allow them to maintain their AI dominance. According to Lutnick, NVIDIA must be able to "sell the Chinese enough that their developers get addicted to the American technology stack". Interestingly, China's Ministry of Commerce recently responded to the H20 ban lifted by the Trump administration, and they expressed appreciation for the initiative. The Chinese government hasn't confirmed yet if the rare earths deal involved AI chips. Here's what they had to say: We have noticed that the US has recently taken the initiative to approve the sale of Nvidia H20 chips to China. China believes that the US should abandon its zero-sum mentality. For now, NVIDIA is gearing up for its entry back into the China AI market. While there are many complications with the H20, particularly concerning inventory levels and how suppliers like TSMC need to re-adjust production lines for further supply of the H20 AI chip, NVIDIA has suddenly become optimistic about its future in China. However, it would be interesting to see how the situation evolves ahead, especially considering that apart from the H20, would NVIDIA get the chance to sell new and advanced chips?

[10]

Nvidia Chips Are Flowing to China Again -- What That Means for AI Adoption Trends | The Motley Fool

Nvidia (NVDA -0.42%) has had an almost unreal ascent over the past few years. It crossed the $1 trillion market cap threshold in 2023 and became the fifth-largest company in the world. And it has skipped over the front-runners in two years, increasing by 329%, to become the most valuable company in the world, as well as the first to reach $4 trillion in value. The stock got a further boost this week when President Donald Trump relaxed the government's stance on selling Nvidia's chips to China. Let's see why this is important for Nvidia and what it means about artificial intelligence (AI) adoption trends globally. Nvidia is the premier graphics processing unit (GPU) company, making the most powerful chips for several industries. Before OpenAI changed the tech landscape with the launch of ChatGPT a few years ago, Nvidia was most known for its gaming chips. Today, its greatest growth and potential are in generative AI. Nvidia is based in California, and as a U.S. company, it's subject to government rules and guidelines. Both the Biden administration and today's Trump administration have leveraged the U.S. lead in AI in its favor and attempted to curtail some of the country's best technology outside of the U.S., specifically in China. The situation has changed several times, and from this past April until this week, the U.S. had implemented new restrictions on what chips Nvidia could export to China. In the short term, the company had to take a $4.5 billion charge on its fiscal first-quarter (ended April 27) financial statements related to its H2O chips for orders it couldn't fulfill in China. CEO Jensen Huang has been outspoken in his disagreement with these policies and how he sees this working against the U.S. in the long term. Without Nvidia's products, he believes, Chinese tech companies will figure out how to build their own AI chips and models. "General-purpose, open-source research and foundation models are the backbone of AI innovation," Huang said. "We believe that every civil model should run best on the U.S. technology stack, encouraging nations worldwide to choose America." On Monday, the company announced that the government would grant it licenses to resume selling chips in China. Nvidia notes its commitment to open-source research and democratizing AI globally. The company's explosive growth is itself a testament to how AI continues to flourish, and it's only serving a portion of the global market. As the top chip company, Nvidia's chips are in high demand from the largest companies, like Amazon and Microsoft, that are building out huge AI businesses. They themselves are serving other giants with AI tools and services in partnership with Nvidia, offering access to the chipmaker's powerful technology. They also service many smaller companies that would like to participate in generative AI but don't have the funds or scale to develop potent AI apps. According to Motley Fool research, AI adoption is only 9.2% today in the U.S., up from 3.7% nearly two years ago when the U.S. Census Bureau started collecting data on the subject. Huang envisions his company's technology supporting a global infrastructure for the proliferation of AI to companies of all sizes worldwide. He says that benefits the U.S. as the source of the infrastructure, and of course, it benefits Nvidia acutely. Even with the relaxing of regulations, the company could still be highly affected by increased tariffs, and the laws could keep changing. But there doesn't seem to be any way to stop AI at this point. According to Statista, the AI market is expected to more than triple over the next five years, and like most other technology, it will eventually become cheaper and easier to use. As Nvidia reaches more markets and supports more AI efforts, it's likely to keep growing and rewarding shareholders.

Share

Share

Copy Link

The Trump administration's decision to allow Nvidia to resume sales of its H20 AI chips to China is part of a broader trade deal involving rare earth elements, highlighting the intricate relationship between technology, geopolitics, and global supply chains.

Nvidia's Return to the Chinese Market

In a significant policy shift, the Trump administration has allowed Nvidia to resume sales of its H20 AI chips to China

1

. This decision, which reverses previous export restrictions, is part of a complex trade negotiation involving rare earth elements crucial for technology manufacturing2

.The Trade Deal: AI Chips for Rare Earths

U.S. Commerce Secretary Howard Lutnick revealed that Nvidia's plans to sell H20 AI chips are tied to ongoing discussions with China regarding rare earth elements

1

. These elements, primarily mined in China, are essential for various technologies, including electric vehicle batteries. The deal also includes China's agreement to resume exports of "any necessary rare earths" and "full magnets" to the United States5

.

Source: Wccftech

Strategic Implications for Both Nations

For the U.S., allowing Nvidia's return to China could help cement American strength in AI globally

2

. It keeps Chinese firms using the American technology stack, maintaining U.S. influence over global AI development. For China, access to Nvidia's chips buys time as it continues efforts to build domestic alternatives and keep pace with AI software development2

.Concerns and Criticisms

The decision has faced criticism from some U.S. officials. Congressman Raja Krishnamoorthi expressed concern that this move could provide advanced technologies to foreign adversaries

1

. Others worry that it might undermine U.S. tech companies and pose national security risks4

.Nvidia's Position and China's AI Landscape

Source: TechCrunch

Nvidia has argued that selling the H20 chip would be better for American technology leadership than withholding it

3

. The company's CEO, Jensen Huang, has been critical of export curbs, stating that restrictions could boost China's domestic semiconductor industry and erode America's technological edge2

.Related Stories

The H20 Chip and Its Capabilities

The H20 is a lower-level but still coveted chip, designed to elude U.S. export controls

4

. It features mediocre processing but large amounts of high-bandwidth memory, making it particularly effective for AI inference tasks4

. This capability could significantly boost Chinese AI companies like DeepSeek, potentially allowing them to compete more effectively with U.S. firms in the global market4

.Broader Geopolitical Context

Source: ET

This development is part of a larger shift in the Trump administration's approach to China. After initially taking a more aggressive stance, the administration now appears to be pursuing a strategy of engagement and negotiation

3

. This change in tactics comes after China's retaliatory measures, such as restricting rare earth exports, demonstrated the interconnectedness of the two economies and the potential risks of an escalating trade war3

.Future Implications

The decision to allow H20 chip sales to China could have far-reaching consequences for the global AI landscape. While it may provide short-term benefits for Nvidia and maintain U.S. influence in China's AI development, critics argue it could ultimately strengthen China's AI capabilities and military applications

4

. The move also highlights the delicate balance between economic interests, technological leadership, and national security concerns in the ongoing U.S.-China relationship.References

Summarized by

Navi

[1]

Related Stories

Nvidia's Global AI Chip Sales Spark Geopolitical Tensions and Regulatory Concerns

20 Dec 2024•Business and Economy

Trump's Controversial AI Chip Deal with Nvidia and AMD Reshapes US-China Tech Relations

16 Aug 2025•Technology

Nvidia Set to Resume AI Chip Sales to China Amid Regulatory Shifts

10 Jul 2025•Technology

Recent Highlights

1

Pentagon threatens to cut Anthropic's $200M contract over AI safety restrictions in military ops

Policy and Regulation

2

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

3

OpenAI closes in on $100 billion funding round with $850 billion valuation as spending plans shift

Business and Economy