Nvidia's AI Valuation Surge: Bubble or Sustainable Growth?

3 Sources

3 Sources

[1]

Firm says Nvidia's skyrocketing AI valuation is in a 'bubble' and 'overhyped' -- Elliott says AI apps are not viable

Elliott Management, a hedge fund with approximately $70 billion in assets, has raised concerns about Nvidia and the AI industry, describing them as being in a 'bubble,' reports Financial Times. The firm doubts the sustainability of current AI investments and believes that many AI applications are not viable or cost-effective. The hedge fund expressed skepticism about the ongoing purchases of Nvidia's GPUs by large technology companies, stating that these companies may not continue to buy in such large quantities. Elliott Management questioned many AI technologies' practical utility and efficiency, suggesting that they may not deliver the promised returns. Elliot Management is certainly not the only one to express concerns about the AI industry as a partner of Sequoia Capital recently calculated that the AI industry needs to make at least $600 billion per year to pay for the already made investments. The AI industry is not even close to that number. Elliott's commentary comes amid a rally in AI-related stocks, driven by investor enthusiasm for generative AI, the FT says. Meanwhile, Nvidia has lost nearly $600 billion in market capitalization since early July, and that says something. Recent trends have shown a general pullback in semiconductor stocks, reflecting concerns about the durability of spending in this sector. For example, Intel shares dropped 30% after announcing significant layoffs, highlighting industry volatility. The hedge fund warns that a market correction could occur if Nvidia's financial results disappoint, potentially shaking investor confidence in the AI sector. Meanwhile, most AI sector companies are private, which almost wholly means there is no adequate view of their financial viability. Elliott notes that, so far, AI has not delivered the significant productivity boosts promised, with most applications limited to tasks like summarizing notes, generating reports, and assisting in coding. Even considering Elliott Management's cautious approach to its investment strategy (the firm has largely avoided what it calls 'bubble stocks'), according to FT, its stake in Nvidia is minimal, and it was worth about $4.5 million as of March.

[2]

Elliott says Nvidia is in a 'bubble' and AI is 'overhyped'

Hedge fund Elliott Management has told investors that Nvidia is in a "bubble", and the artificial intelligence technology driving the chipmaking giant's share price is "overhyped". The Florida-based firm, which manages about $70bn in assets, said in a recent letter to clients that the megacap technology stocks, particularly Nvidia, were in "bubble land" and it was "sceptical" that Big Tech companies would keep buying the chipmaker's graphics processing units in such high volumes. AI is "overhyped with many applications not ready for prime time", Elliott wrote in the letter sent this week and seen by the Financial Times. Many of AI's supposed uses are "never going to be cost efficient, are never going to actually work right, will take up too much energy, or will prove to be untrustworthy", it added. Elliott declined to comment. Its warning comes as chip stocks, which have enjoyed a huge rally driven by investor fervour over the potential for generative AI, take a tumble on concerns about whether big companies will continue to spend heavily on AI. Intel shares fell 20 per cent following the US market close on Thursday after the chipmaker revealed plans to cut about 15,000 jobs. Nvidia dominates the market for the powerful processors needed to build and deploy large AI systems such as the technology behind OpenAI's ChatGPT. Companies including Microsoft, Meta and Amazon have been spending tens of billions of dollars to build out AI infrastructure in recent months, with much of that capital going to Nvidia. At the same time, many of its biggest clients are also developing their own rival chips. Its stock has fallen more than 20 per cent since late June, when it briefly became the world's largest company with a market capitalisation of more than $3.3tn, as anxiety about the sustainability of AI investment took hold on Wall Street. However, the chipmaker is still up about 120 per cent this year and more than 600 per cent since the start of last year. Elliott told clients in the letter that it had largely steered clear of bubble stocks, for instance in the Magnificent Seven. Regulatory filings show Elliott owned a tiny position, worth about $4.5mn, in Nvidia at the end of March, although it is unclear how long it held it for. The hedge fund has also been wary of betting against high-flying big technology stocks, saying that shorting them could be "suicidal". Elliott, which was founded by billionaire Paul Singer in 1977, added in its client letter that, so far, AI had failed to deliver a promised huge uplift in productivity. "There are few real uses," it said, other than "summarising notes of meetings, generating reports and helping with computer coding". AI, it added, was in effect software that had so far not delivered "value commensurate with the hype". The firm, which gained about 4.5 per cent in the first half of this year, has only lost money in two calendar years since launch. As to when the market bubble may burst, Elliott said this could happen if Nvidia reported poor numbers and "breaks the spell".

[3]

AI bubble will burst if the number of AI servers doesn't increase rapidly: fund manager By Investing.com

The AI gold rush is in full swing, but a leading expert is sounding the alarm as the managing partner of LIAN Group warns that the frenzy could turn to dust if the industry doesn't increase its computing power. The managing partner issued this warning in response to recent market volatility surrounding chipmaker NVIDIA (NASDAQ:NVDA), a major player in the AI sector. Concerns regarding a potential AI bubble bursting have also been voiced by analysts at Goldman Sachs (NYSE:GS), raising concern about the future health of the AI market. However, the managing partner says that the true threat to the AI sector is not an inherent bubble, but rather a lack of digital infrastructure - a shortage of data centers specifically designed to handle the immense computational demands of AI. This lack of capacity, the managing partner suggests, could very well cause the bubble to burst. "Many servers in data centers worldwide are currently inadequate for supporting AI compute," said the managing partner. "We must bolster our bespoke digital infrastructure and build cutting-edge facilities to host dedicated GPUs to fuel the AI industry." The managing partner adds that the current market enthusiasm for AI, with significant investments from institutions, retailers, and Big Tech, is a positive indicator. They believe the market has strong growth potential, but warns that significant compute capacity increase is essential to sustain this growth. "Investors have to be convinced AI will see long-term sustainable growth," said the managing partner. "That's the key to supporting AI's growth. We must plan ahead and build speculatively." The managing partner contends that the AI bubble is not driven by inflated expectations but by the real risk that the necessary infrastructure for AI innovation will be insufficient. This shortage of servers could result in demand for AI processing far exceeding supply, leading to a market crash. The managing partner believes that by rapidly increasing the number of AI-specific servers, the AI sector can ensure long-term stability and avoid the risk of a bubble burst.

Share

Share

Copy Link

Nvidia's soaring stock prices due to AI demand have sparked debates about a potential bubble. While some experts warn of overvaluation, others see sustained growth potential in the AI market.

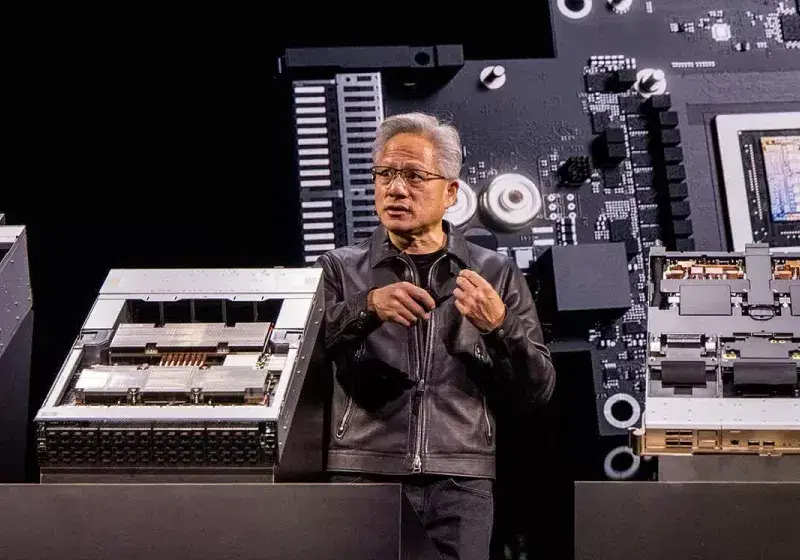

Nvidia's Unprecedented Growth

Nvidia, the chip manufacturer at the forefront of the artificial intelligence (AI) revolution, has seen its stock price skyrocket in recent months. The company's market capitalization has surged to over $1 trillion, making it one of the most valuable companies in the world

1

. This meteoric rise has been primarily attributed to the increasing demand for AI-capable hardware, particularly in data centers and cloud computing infrastructure.Warnings of a Potential Bubble

Despite the enthusiasm surrounding Nvidia's growth, some experts are sounding alarm bells. Analysts at Structura, a UK-based research firm, have warned that Nvidia's valuation may be entering bubble territory

1

. They argue that the current AI hype cycle is leading to unrealistic expectations and potentially unsustainable valuations.The AI Server Bottleneck

One of the key factors that could burst the AI bubble, according to some fund managers, is the limited number of AI servers currently available

3

. The demand for AI processing power is growing exponentially, but the infrastructure to support this growth may not be keeping pace. This bottleneck could potentially lead to a slowdown in AI adoption and, consequently, a correction in Nvidia's stock price.Counterarguments and Growth Potential

However, not all analysts share this pessimistic view. Proponents of Nvidia's valuation argue that the company's dominant position in the AI chip market, coupled with the vast potential of AI applications across various industries, justifies its current market value

2

. They point to the ongoing digital transformation of businesses and the increasing integration of AI into everyday products and services as indicators of sustained long-term growth.Related Stories

The Role of Competition

While Nvidia currently holds a commanding lead in the AI chip market, competition is intensifying. Companies like AMD, Intel, and various startups are working to develop their own AI-focused chips

2

. This growing competition could potentially challenge Nvidia's market dominance and impact its valuation in the future.Investor Sentiment and Market Dynamics

The debate surrounding Nvidia's valuation reflects broader discussions about the state of the tech industry and the role of AI in driving economic growth. Investor sentiment remains largely positive, with many betting on the transformative potential of AI technologies

1

. However, market dynamics can shift rapidly, and the sustainability of current valuations will likely depend on Nvidia's ability to maintain its technological edge and capitalize on the growing demand for AI solutions.References

Summarized by

Navi

[1]

Related Stories

AI Investment Bubble Concerns Intensify as Industry Leaders Warn of 'Irrationality' Despite Nvidia's Strong Earnings

18 Nov 2025•Business and Economy

Nvidia's Tepid Forecast Sparks AI Slowdown Concerns Amid Rising Chinese Competition

28 Aug 2025•Business and Economy

Nvidia Faces Growing Skepticism from Prominent Short Sellers Over AI Boom Sustainability

20 Nov 2025•Business and Economy

Recent Highlights

1

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

2

Demis Hassabis predicts AGI in 5-8 years, sees new golden era transforming medicine and science

Technology

3

Nvidia and Meta forge massive chip deal as computing power demands reshape AI infrastructure

Technology