Nvidia scrambles to meet surging China demand for H200 chips as orders hit 2 million units

12 Sources

12 Sources

[1]

Nvidia says H200 demand in China is 'very high' as export licenses near completion -- a month after the green light, Huang has high hopes for China buy-in despite political sensitivity

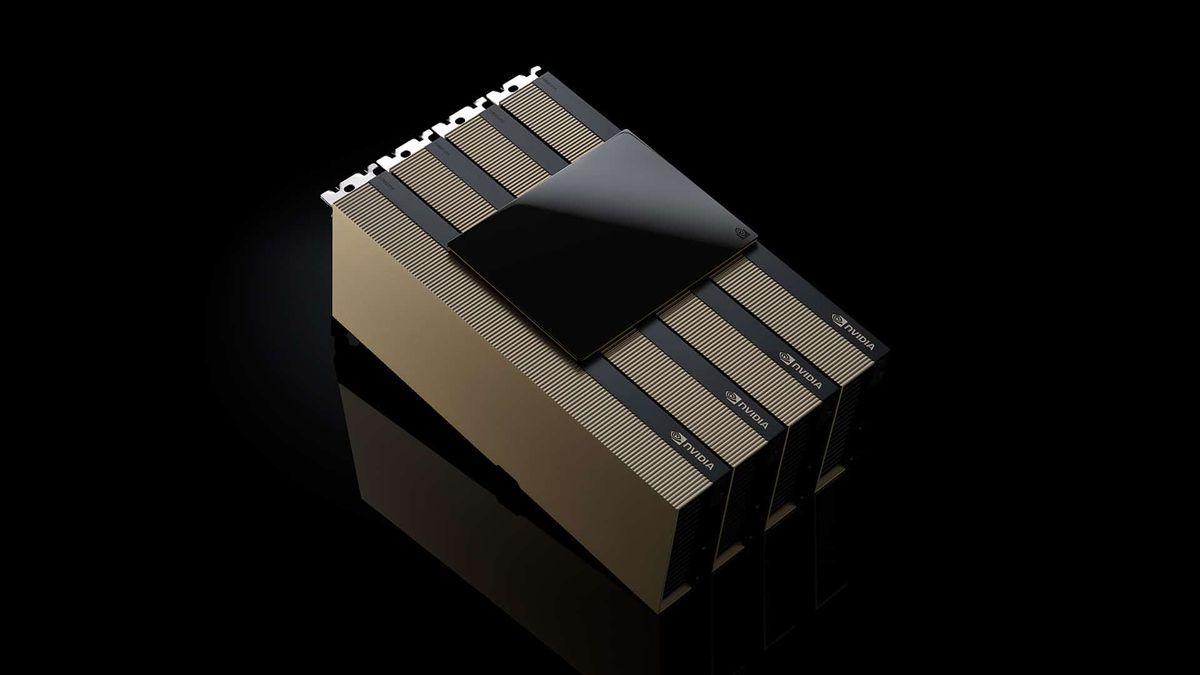

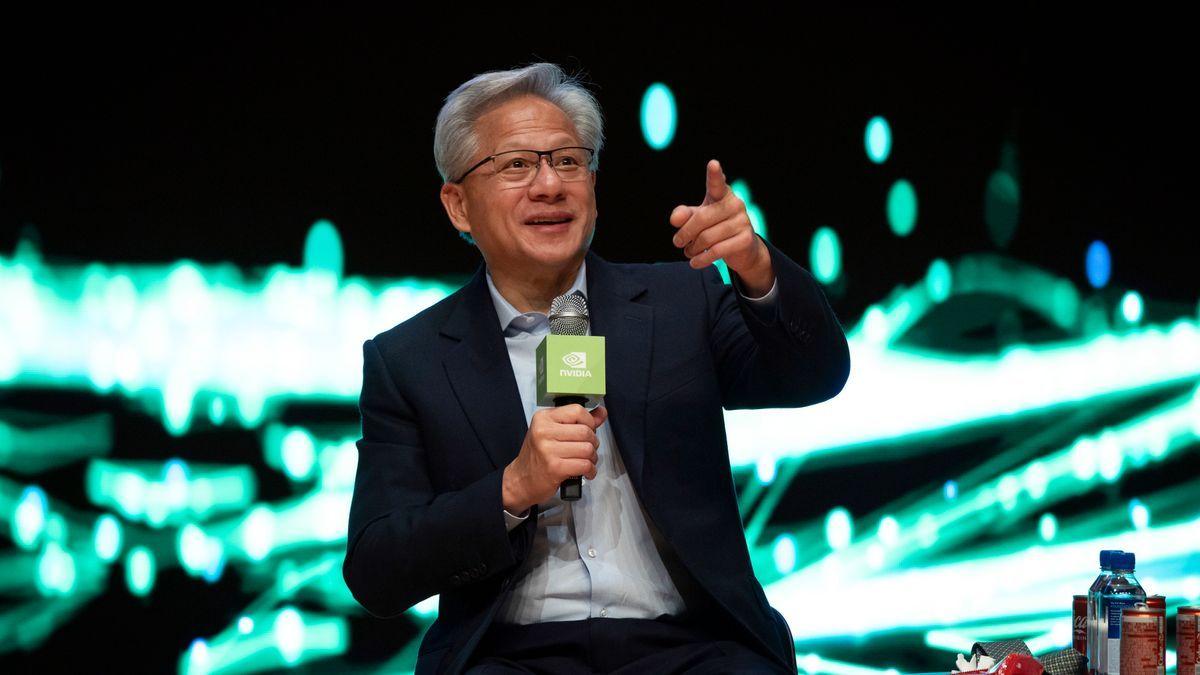

Jensen Huang tells CES that shipments hinge on final U.S. approvals, with purchase orders expected to be the real indicator. Nvidia says demand in China for its H200 data center GPU is "very high," but the company is deliberately avoiding timelines or announcements as it works through the final stages of U.S. export licensing, according to comments from CEO Jensen Huang at CES 2026. The remarks come nearly a month after the Trump administration said it would approve licenses allowing Nvidia to resume limited shipments of advanced AI accelerators to Chinese customers, subject to a 25% tax and additional oversight. Speaking during a CES 2026 Q&A session with journalists, including Tom's Hardware in Las Vegas, Huang confirmed that Nvidia has already restarted its supply chain for H200 and is preparing to ship once the remaining regulatory details are resolved. He declined to offer dates or volume targets, instead emphasizing that actual purchase orders will determine how much hardware ultimately moves into China. "The customer demand is high. It's quite high. It's very high," Huang said. He added that Nvidia has "fired up" its supply chain and that H200 systems are already flowing through production. The gating factor, he said, is the completion of licensing with the U.S. government, after which Nvidia expects orders to speak for themselves. The restrained tone is notable given the political sensitivity around advanced AI hardware exports. Under the revised policy announced in December, Nvidia can sell H200 GPUs into China, but only under a licensing regime that includes a 25% charge and government review of shipments. It's understood that Nvidia aims to begin shipments before Lunar New Year in mid-February, potentially using existing inventory to fulfil early orders while longer-term production ramps up. Those shipments, however, remain contingent on formal approvals. Huang also made clear that Nvidia does not plan to trumpet individual deals or frame the restart of China sales as a major corporate milestone. "We're not expecting any press releases or any large declarations," he said, adding that the company expects to learn about market uptake through normal commercial channels. This level of caution is understandable given the broader uncertainty surrounding the Chinese market. While Chinese customers are eager to regain access to high-end Nvidia accelerators, Beijing is heavily focused on promoting domestic alternatives. It has been suggested that Chinese authorities may consider conditions that encourage the use of locally produced chips alongside imported hardware, adding another layer of complexity for foreign suppliers. Technically, the H200 remains a highly attractive option for large-scale AI workloads. Based on Nvidia's Hopper architecture, it pairs the H100 GPU with 141GB of HBM3e memory and significantly higher memory bandwidth, making it particularly well-suited for training and inference of large language models. That capability gap is one reason Chinese customers have continued to pursue Nvidia hardware despite export controls and higher costs. For now, Nvidia's approach to China is to wait and see -- the supply chain is warming up, and customer interest is strong, but the outcome depends on whether regulators on both sides give the final stamp of approval.

[2]

Exclusive: Nvidia sounds out TSMC on new H200 chip order as China demand jumps, sources say

Dec 31 (Reuters) - Nvidia (NVDA.O), opens new tab is scrambling to meet strong demand for its H200 artificial intelligence chips from Chinese technology companies and has approached contract manufacturer Taiwan Semiconductor Manufacturing Co (2330.TW), opens new tab to ramp up production, sources said. Chinese technology companies have placed orders for more than 2 million H200 chips for 2026, while Nvidia currently holds just 700,000 units in stock, two of the people said. The exact additional volume Nvidia intends to order from TSMC remains unclear, they said. A third source said Nvidia has asked TSMC to begin production of the additional chips, and work is expected to start in the second quarter of 2026. The moves raise concerns over whether there could be further tightening in global AI chip supplies as Nvidia now has to strike the right balance between meeting robust Chinese demand and addressing constrained supplies elsewhere. They could also intensify risks for Nvidia, as Beijing has yet to greenlight any shipments of H200 chips. The administration of U.S. President Donald Trump only recently allowed exports of the H200 to China. The talks between Nvidia and TSMC and details of the Chinese demand have not been reported before. The pricing has also not been reported earlier - Nvidia has decided which H200 variants it will offer to Chinese clients and price them around $27,000 per chip, the sources said. Nvidia said in response to a request for comment that it continuously manages its supply chain. "Licensed sales of the H200 to authorised customers in China will have no impact on our ability to supply customers in the United States," a spokesperson said. "China is a highly competitive market with rapidly growing local chip suppliers. Blocking all U.S. exports undercut our national and economic security and only benefited foreign competition." TSMC declined to comment and China's Ministry of Industry and Information Technology did not immediately respond to a request for comment. Reuters spoke to five people for this story, who declined to be named as the discussions are private. The potential order would mark a significant expansion of H200 production at a time when Nvidia has been focused on ramping up its newer Blackwell and upcoming Rubin chip lines. The H200, part of Nvidia's previous-generation Hopper architecture, uses TSMC's 4-nanometer manufacturing process. Nvidia plans to fulfil initial orders from existing stock with the first batch of H200 chips expected to arrive before the Lunar New Year holiday in mid-February, Reuters reported earlier this month. CHINESE TECH GIANTS DRIVE DEMAND The bulk of the orders of over 2 million chips for 2026 has come from major Chinese internet companies, which view the H200 as a significant upgrade over chips currently available to them, two of the people said. Of Nvidia's current 700,000-unit inventory, around 100,000 are GH200 Grace Hopper superchips, which combine Nvidia's Grace CPU with the Hopper GPU architecture, while the remainder are standalone H200 chips, one of them said. Both variants will be offered to Chinese clients, the person said. While Nvidia has indicated a pricing ballpark to the Chinese customers, it would vary based on purchase volume and specific customer arrangements, said two of the people. An eight-chip module is expected to cost around 1.5 million yuan, making it slightly more expensive than the now-unavailable H20 module, which previously sold for around 1.2 million yuan, they said. However, given that the H200 delivers roughly six times the performance of the H20 - a downgraded chip Nvidia designed specifically for the Chinese market that was later blocked by Beijing from being shipped into China - the sources said Chinese internet firms view the pricing as attractive. The price also represents a roughly 15% discount compared to grey-market alternatives, which currently retail at over 1.75 million yuan, according to the sources. ByteDance plans to spend about 100 billion yuan on Nvidia's chips in 2026, up from roughly 85 billion yuan in 2025, if China allows H200 sales, the South China Morning Post reported on Wednesday, citing sources. REGULATORY UNCERTAINTY PERSISTS The planned shipments follow Trump's decision earlier this month to allow H200 sales to China with a 25% fee, reversing the Biden administration's ban on advanced AI chip exports to China. However, Chinese officials are still deciding whether to allow H200 imports amid concerns that access to advanced foreign chips could slow development of the domestic AI semiconductor industry. But they have not signaled immediate opposition. While Chinese chipmakers have managed to come up with products that rival the H20 in performance, there are not yet any equivalents of the H200. One proposal under consideration would require bundling each H200 purchase with a certain ratio of domestically produced chips, Reuters previously reported. Reporting by Liam Mo, Wen-Yee Lee and Brenda Goh; Editing by Muralikumar Anantharaman Our Standards: The Thomson Reuters Trust Principles., opens new tab

[3]

Huang says Nvidia seeing 'very high' Chinese customer demand for H200 AI chips

Jensen Huang, chief executive officer of Nvidia Corp., speaks during the 2026 CES event in Las Vegas, Nevada, US, on Tuesday, Jan. 6, 2026. Nvidia CEO Jensen Huang on Tuesday said that the company is seeing "very high" customer demand in China for its H200 AI chips, which the U.S. government recently signaled that it would approve for export. Huang added that Nvidia has started producing the chips again and is working out the final details about export licenses with the U.S. government. Nvidia's chips are critical for companies developing artificial intelligence models. "We've fired up our supply chain and H200s are flowing through the line," Huang said at a press conference at the CES conference in Las Vegas. Investors see the Chinese market as a massive market opportunity for Nvidia as the country's tech companies develop their own AI models. Huang has previously said that the market could be worth $50 billion per year, and none of those sales are currently included in Nvidia's forecasts. In December, President Donald Trump said that Nvidia could export its H200 chip to China as long as the company paid 25% of those sales to the U.S. government. The H200 is a generation or two behind the latest Nvidia models, but unlike previous chips that Nvidia was approved to export to China, this model has not been slowed-down on purpose to comply with export restrictions. China must also approve the import of Nvidia's chips. Huang on Tuesday said that he is not expecting China to make an announcement that imports have been approved, and that Nvidia would know the regulatory status as purchase orders come in. "We're not expecting any press releases, or any large declarations," Huang said. "It's just going to be purchase orders." Huang added that any H200 sales would be in addition to the $500 billion two-year forecast the company provided last year. "It appears that we're going to be going back to China," Huang said.

[4]

Nvidia races to fill 2 million chip shortfall for Chinese tech giants

Following approval by the Trump administration, Nvidia is ramping up production of H200 AI chips after China ordered over 2 million units, while the company holds only 700,000 in stock and seeks TSMC's assistance to meet demand, according to Reuters. The U.S. approval enabled exports of Nvidia's H200 processors to China, prompting the immediate placement of a large order exceeding 2 million units by Chinese customers. This development occurs despite prior warnings from China and implementation of new measures aimed at preventing Nvidia chipsets from entering its market. Nvidia currently maintains inventory of 700,000 H200 chipset units. This stock encompasses 100,000 GH200 Grace Hopper superchips alongside the remaining standard H200 processors. The company intends to ship both types of chips to fulfill portions of the Chinese orders. To address the shortfall, Nvidia is engaging Taiwan Semiconductor Manufacturing Company (TSMC) to increase production capacity. TSMC plans to commence manufacturing the additional H200 chips in the second quarter of 2026. Nvidia has not revealed the precise quantity of extra H200 chipsets requested from TSMC. Each H200 chip carries a price of $27,000 from the U.S. chipmaker. This valuation applies to sales directed toward authorized customers in China under the licensed export framework. Nvidia addressed potential supply concerns in a statement: "Licensed sales of the H200 to authorized customers in China will have no impact on our ability to supply customers in the United States. China is a highly competitive market with rapidly growing local chip suppliers. Blocking all U.S. exports undercuts our national and economic security and only benefits foreign competition." Global customers of Nvidia have expressed worries regarding the company's capacity to allocate chips equitably between the United States and China amid the surge in Chinese demand. These concerns stem from the existing tight supply constraints highlighted by the current inventory levels. China has not granted approval for Nvidia's chipsets within its domestic AI market, leaving uncertain whether the accelerated H200 production efforts will ultimately assist Nvidia in penetrating that sector.

[5]

Nvidia sounds out TSMC on new H200 chip order as China demand jumps: Report

Nvidia faces a massive demand for its H200 AI chips from Chinese tech giants. The company is reportedly seeking to boost production with TSMC to meet orders for over two million chips in 2026. This move comes as regulatory approval from Beijing for these shipments remains pending. Chinese firms see the H200 as a significant upgrade, driving this substantial interest. Nvidia is scrambling to meet strong demand for its H200 artificial intelligence chips from Chinese technology companies and has approached contract manufacturer Taiwan Semiconductor Manufacturing Co to ramp up production, sources said. Chinese technology companies have placed orders for more than 2 million H200 chips for 2026, while Nvidia currently holds just 700,000 units in stock, two of the people said. The exact additional volume Nvidia intends to order from TSMC remains unclear, they said. A third source said Nvidia has asked TSMC to begin production of the additional chips, and work is expected to start in the second quarter of 2026. The moves raise concerns over whether there could be further tightening in global AI chip supplies as Nvidia now has to strike the right balance between meeting robust Chinese demand and addressing constrained supplies elsewhere. They could also intensify risks for Nvidia, as Beijing has yet to greenlight any shipments of H200 chips. The administration of U.S. President Donald Trump only recently allowed exports of the H200 to China. The talks between Nvidia and TSMC and details of the Chinese demand have not been reported before. The pricing has also not been reported earlier - Nvidia has decided which H200 variants it will offer to Chinese clients and price them around $27,000 per chip, the sources said. Nvidia said in response to a request for comment that it continuously manages its supply chain. "Licensed sales of the H200 to authorised customers in China will have no impact on our ability to supply customers in the United States," a spokesperson said. "China is a highly competitive market with rapidly growing local chip suppliers. Blocking all U.S. exports undercut our national and economic security and only benefited foreign competition." TSMC declined to comment and China's Ministry of Industry and Information Technology did not immediately respond to a request for comment. Reuters spoke to five people for this story, who declined to be named as the discussions are private. The potential order would mark a significant expansion of H200 production at a time when Nvidia has been focused on ramping up its newer Blackwell and upcoming Rubin chip lines. The H200, part of Nvidia's previous-generation Hopper architecture, uses TSMC's 4-nanometer manufacturing process. Nvidia plans to fulfil initial orders from existing stock with the first batch of H200 chips expected to arrive before the Lunar New Year holiday in mid-February, Reuters reported earlier this month. Chinese tech giants drive demand The bulk of the orders of over 2 million chips for 2026 has come from major Chinese internet companies, which view the H200 as a significant upgrade over chips currently available to them, two of the people said. Of Nvidia's current 700,000-unit inventory, around 100,000 are GH200 Grace Hopper superchips, which combine Nvidia's Grace CPU with the Hopper GPU architecture, while the remainder are standalone H200 chips, one of them said. Both variants will be offered to Chinese clients, the person said. While Nvidia has indicated a pricing ballpark to the Chinese customers, it would vary based on purchase volume and specific customer arrangements, said two of the people. An eight-chip module is expected to cost around 1.5 million yuan, making it slightly more expensive than the now-unavailable H20 module, which previously sold for around 1.2 million yuan, they said. However, given that the H200 delivers roughly six times the performance of the H20 - a downgraded chip Nvidia designed specifically for the Chinese market that was later blocked by Beijing from being shipped into China - the sources said Chinese internet firms view the pricing as attractive. The price also represents a roughly 15% discount compared to grey-market alternatives, which currently retail at over 1.75 million yuan, according to the sources. ByteDance plans to spend about 100 billion yuan on Nvidia's chips in 2026, up from roughly 85 billion yuan in 2025, if China allows H200 sales, the South China Morning Post reported on Wednesday, citing sources. Regulatory uncertainty persistsThe planned shipments follow Trump's decision earlier this month to allow H200 sales to China with a 25% fee, reversing the Biden administration's ban on advanced AI chip exports to China. However, Chinese officials are still deciding whether to allow H200 imports amid concerns that access to advanced foreign chips could slow development of the domestic AI semiconductor industry. But they have not signaled immediate opposition. While Chinese chipmakers have managed to come up with products that rival the H20 in performance, there are not yet any equivalents of the H200. One proposal under consideration would require bundling each H200 purchase with a certain ratio of domestically produced chips, Reuters previously reported.

[6]

NVIDIA CEO Doesn't Rule Out 'Rubin' for China, Says Newer Chips Will Become Available Once U.S. Export Restrictions Ease

NVIDIA's China business has been booming recently following the H200 export approval, and now Jensen says there's a prospect of introducing Rubin chips in the region as well. It appears that Jensen is more confident in exerting a greater influence in China's AI industry, given that with the approval of selling its H200 chips in the region, NVIDIA's market share has grown from 0% to a significantly higher percentage. In the CES Financial Analyst Q&A, Jensen was asked about the company's future in China and how NVIDIA would keep up with the competitiveness, and interestingly, Jensen claims that his company isn't ruling out the introduction of Blackwell and Rubin chips in the region, saying that they will come "in time". H200 is competitive in the market. It won't be competitive forever. To remain competitive in China, Nvidia will need to release other products including Blackwell and Rubin generation chips "in time," Huang said, adding U.S. regulation also needs to evolve if Washington wants American technologies to stay globally competitive. - Nikkei Asia We do know that after the initial H20 export controls were implemented, NVIDIA's CEO stated that the firm would no longer enter China with Hopper and that Team Green would look to introduce Blackwell in China. However, President Trump eventually ruled out the prospect of Blackwell chips, forcing NVIDIA to stick with the Hopper. The lifting of H200 export control proved to be a delight for Team Green, given that, relative to H200, the newer chip offers almost six times the performance in training workloads, which is why Chinese hyperscalers are highly seeking after it. NVIDIA's CEO recognizes that the H200 won't remain relevant forever, and given the advancements being made by companies like Huawei and other domestic chip manufacturers, Jensen sees the need to move quickly. The next step would likely be Blackwell for China, but that would require a new round of Jensen-Trump negotiations, and how it plays out. I have every belief that the Chinese technology market will continue to thrive and continue to advance. And for us to make a contribution and to offer something to Chinese market, we will have to compete, and we will have to continue to advance our technology. - NVIDIA's CEO Jensen Huang It appears that NVIDIA views China as a core part of its chip business, which is why Jensen emphasizes that American technology should be accessible in the region. As for when Rubin could be accessible to China, there isn't a specific timeline, but considering what we saw with Hopper, a fair bet would likely be two to three years after Rubin becomes mainstream globally.

[7]

Nvidia CEO Jensen Huang Says Chinese Approval For H200 AI Chips Will Show Up Quietly In Purchase Orders: 'Not Expecting Any Press Releases' - NVIDIA (NASDAQ:NVDA), Taiwan Semiconductor (NYSE:TSM)

On Tuesday, Nvidia Corporation (NASDAQ:NVDA) CEO Jensen Huang said Chinese government approval for importing the company's H200 AI chips will become evident through customer orders rather than any formal public announcement. Nvidia Watches For China H200 Orders, Not Official Statements Speaking at a press conference during the Consumer Electronics Show in Las Vegas, Huang said Nvidia does not expect Beijing to publicly confirm whether Chinese companies are allowed to import the H200 chips, reported Reuters. Instead, approval will be reflected quietly in buying activity. "We're not expecting any press releases or any large declarations," Huang said, adding that it's just going to be purchase orders. See Also: Nvidia Takes On Robotaxis With Chips, Software And Big Ambitions Export Licenses Pending For Nvidia H200 Sales To China The comments come as Nvidia awaits U.S. government export licenses required to ship the advanced chips to China. Earlier Tuesday, Nvidia CFO Colette Kress said the U.S. government is "working feverishly" on the applications, though approvals have not yet been granted. "We're going to wait and see what will happen," Kress said. Last year, President Donald Trump reversed a prior ban, allowing Nvidia to sell the H200 -- a predecessor to Blackwell chips -- to Chinese customers, subject to licensing. The decision was criticized by former U.K. Prime Minister Rishi Sunak and U.S. lawmakers, including Sen. Elizabeth Warren (D-Mass.), Sen. Chuck Schumer (D-N.Y.) and former GOP presidential candidate Nikki Haley. Despite the regulatory uncertainty, Huang said interest from Chinese firms remains high. Nvidia Showcases Vera Rubin AI Chips At CES 2026 Nvidia also used CES to highlight new chips for its next-generation Vera Rubin platform, which the company says are already in production. Huang said demand remains strong across Nvidia's portfolio and forecasts a "really giant year" alongside manufacturing partner Taiwan Semiconductor Manufacturing Co. (NYSE:TSM). The company is targeting up to $500 billion in combined sales from its Blackwell and Vera Rubin platforms by year-end. Price Action: Nvidia shares fell 0.47% in Tuesday's regular session, but edged up 0.49% in after-hours trading, according to Benzinga Pro. Benzinga Edge Stock Rankings place Nvidia in the 94th percentile for Growth and the 98th percentile for Quality. Click here to see how it compares to competitors and peers. Photo Courtesy: jamesonwu1972 from Shutterstock Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors. NVDANVIDIA Corp$188.160.49%OverviewTSMTaiwan Semiconductor Manufacturing Co Ltd$327.910.15%Market News and Data brought to you by Benzinga APIs

[8]

Nvidia said to approach Taiwan Semi to boost H200 production amid China surge: reports (NVDA:NASDAQ)

Nvidia (NVDA) has approached Taiwan Semiconductor (TSM) about increasing production of its H200 GPUs amid a surge in demand from China, Reuters reported. Chinese technology companies have placed orders to the tune of 2M H200 GPUs, whereas Nvidia only has 700,000 Increased production could enhance Nvidia's ability to fulfill large Chinese orders, which has already driven shares modestly higher in premarket trading. Chinese companies like ByteDance and Alibaba are investing heavily in AI compute, and orders for H200 GPUs reflect surging demand for advanced chips despite supply constraints and regulatory uncertainties. US and Chinese approvals or restrictions, including export controls, sales cuts, and potential import decisions by China, create significant regulatory risk for Nvidia's ability to sell and deliver these GPUs to Chinese clients.

[9]

NVIDIA Needs a Supply Chain 'Miracle' From TSMC as China's H200 AI Chip Orders Overwhelm Supply, Triggering a Bottleneck

NVIDIA is reportedly facing gigantic demand for its Hopper H200 AI chips from Chinese customers, and the firm is now prompting TSMC to take 'desperate' supply chain measures. We have reported in the past on how newer solutions introduced in China by NVIDIA/AMD are garnering massive attention within Chinese hyperscalers, mainly because the region is in desperate need of compute power to fuel advancements in frontier AI models. According to a report by Reuters, NVIDIA has received orders for up to 2 million H200 chips for next year, while the company's current inventory stands at just 700,000 units. This suggests that NVIDIA and its supply chain partners will likely need to restart Hopper production, placing significant constraints on companies like TSMC. The moves raise concerns over whether there could be further tightening in global AI chip supplies as Nvidia now has to strike the right balance between meeting robust Chinese demand and addressing constrained supplies elsewhere. - Reuters NVIDIA's reliance on TSMC for foundry needs is biting them right now, given that the Taiwan chip giant is already facing bottlenecks in addressing demand for Blackwell and related products from hyperscalers worldwide. More importantly, the primary constraint for TSMC right now might not be semiconductor production, since the H200 does utilize TSMC's 4nm node, which is being produced in both Taiwan and the US, but the main bottleneck comes from CoWoS packaging, since the technology has been dominantly adopted by Hopper, Blackwell, and Blackwell Ultra products. Reuters estimates that the ASP of an H200 AI chip in China is around $27,000, which means that for a two-million shipment figure, you could estimate a revenue of $54 billion from China, far exceeding what NVIDIA had written off earlier when the export restrictions were implemented. The demand from Chinese customers is something that NVIDIA cannot ignore at present, but a more pressing question is whether the AI supply chain can actually meet the efforts needed to satisfy global demand. TSMC already faces an explosion in CapEX and labor shortages, yet partners are demanding more from the Taiwan giant. H200 AI chips are known to be six times more powerful compared to the H20 in training workloads, which is one of the reasons why China's AI industry is rushing to place orders. It would be interesting to see how the NVIDIA-China story evolves moving forward, as the current demand will induce massive pressure on the supply chain.

[10]

China's AI Appetite Pushes Nvidia Into A Supply Crunch - NVIDIA (NASDAQ:NVDA)

Global demand for artificial intelligence hardware is tightening supply across the industry, and Nvidia Corp. (NASDAQ:NVDA) is increasingly squeezed by strong Chinese demand, limited chip capacity, and regulatory uncertainty. China Demand Pressures H200 Supply Nvidia is racing to meet surging orders from Chinese technology companies for its H200 AI chips. To ease the strain, the company has urged Taiwan Semiconductor Manufacturing Co. (NYSE:TSM) to increase production. Chinese customers have reportedly ordered more than 2 million H200 chips for 2026, creating a supply crunch for Nvidia, which had only 700,000 units available. Also Read: Nvidia Fuels Taiwan's High-Stakes AI Push Nvidia has already asked Taiwan Semiconductor to start building additional chips, with production work expected to begin in the second quarter of 2026, Reuters reported on Wednesday, citing unnamed sources familiar with the matter. Pricing, Policy, And ByteDance's Spending Plans Nvidia has set pricing for China-bound H200 variants at about $27,000 per chip, with prices varying by volume and customer terms. An eight-chip module could cost around 1.5 million yuan, above the prior H20 module's roughly 1.2 million yuan, but Chinese buyers view the price as attractive given the performance jump. TikTok parent ByteDance is ramping up its artificial intelligence spending and plans to allocate about 100 billion yuan ($14 billion) to Nvidia chips in 2026. Wall Street Stays Bullish On Nvidia's AI Lead Despite China-related uncertainty, Nvidia continues to draw strong backing from Wall Street. Bank of America Securities analyst Vivek Arya reiterated his bullish view following a recent investor meeting. Arya called Nvidia his top pick in the space. He said Nvidia maintains a full-generation advantage in AI, with today's large language models still trained on its Hopper GPUs and next-generation Blackwell systems expected to deliver a 10x-15x performance jump when they roll out in early 2026. The analyst said Nvidia has visibility into at least $500 billion in cumulative sales across 2025-26. While uncertainty remains around potential H200 GPU exports to China under evolving U.S. policy, Arya said it is too early to gauge the impact. He added that Nvidia's mid-70% gross margin outlook remains intact. In October, Nvidia became the first company to top the $4.5 trillion market cap, leapfrogging the likes of Apple Inc. (NASDAQ:AAPL) and Microsoft Corp. (NASDAQ:MSFT). NVDA Price Action: Nvidia shares were down 0.31% at $186.95 during premarket trading on Wednesday, according to Benzinga Pro data. Read Next: Nvidia Open-Sources AI That Helps Self-Driving Cars Think Like Humans Image by Saulo Ferreira Angelo via Shutterstock NVDANVIDIA Corp$186.84-0.37%OverviewAAPLApple Inc$272.13-0.35%MSFTMicrosoft Corp$487.28-0.04%TSMTaiwan Semiconductor Manufacturing Co Ltd$301.540.65%Market News and Data brought to you by Benzinga APIs

[11]

ByteDance Plans $14 Billion NVIDIA H200 Chip Purchase to Expand AI Capacity

The Chinese giant also plans broader AI infrastructure spending of about 160 billion yuan in 2026. This expense covers data centers, networking gear, and AI servers for training and utility. The 2026 purchase plan depends on access to in China. The US administration said it will allow H200 exports under a new sales framework that includes a 25% fee on H200 revenue and a buyer approval process. At the same time, Chinese regulators review and discuss demand with major firms. Officials have also weighed conditions that pair H200 orders with domestic chips. This approach aims to grow AI capacity while supporting local chip suppliers. NVIDIA has started planning for 2026 demand by seeking higher output from TSMC. It builds the H200 chips on its Hopper platform using TSMC's 4nm process. Order books indicate over two million H200 units for 2026, while NVIDIA currently holds about 700,000 units. The tech firm expects additional production to begin in Q2 2026. NVIDIA has priced H200 at $27,000 per chip for China-bound sales. This means an eight-chip module would cost approximately 1.5 million yuan. The H200 offers a step up from the H20, the prior China-focused option. Performance comparisons put the H200 at about six times the H20 level. Chinese buyers want the H200 because it supports faster training for large AI models. Domestic chips can cover many inference workloads, but they still lag in peak capability. Developers also rely on , so switching hardware can force code changes and model retraining. Beijing continues to promote local chips so that firms may balance both supply paths. NVIDIA has also outlined plans to start H200 shipments by mid-February 2026, pending approvals. Initial deliveries could use 5,000 to 10,000 modules from existing stock.

[12]

Nvidia sounds out TSMC on new H200 chip order as China demand jumps

Nvidia is scrambling to meet strong demand for its H200 artificial intelligence chips from Chinese technology companies and has approached contract manufacturer Taiwan Semiconductor Manufacturing Co to ramp up production, sources said. Chinese technology companies have placed orders for more than 2 million H200 chips for 2026, while Nvidia currently holds just 700,000 units in stock, two of the people said. The exact additional volume Nvidia intends to order from TSMC remains unclear, they said. A third source said Nvidia has asked TSMC to begin production of the additional chips, and work is expected to start in the second quarter of 2026. The moves raise concerns over whether there could be further tightening in global AI chip supplies as Nvidia now has to strike the right balance between meeting robust Chinese demand and addressing constrained supplies elsewhere. They could also intensify risks for Nvidia, as Beijing has yet to greenlight any shipments of H200 chips. The administration of U.S. President Donald Trump only recently allowed exports of the H200 to China. The talks between Nvidia and TSMC and details of the Chinese demand have not been reported before. The pricing has also not been reported earlier - Nvidia has decided which H200 variants it will offer to Chinese clients and price them around US$27,000 per chip, the sources said. Nvidia said in response to a request for comment that it continuously manages its supply chain. "Licensed sales of the H200 to authorized customers in China will have no impact on our ability to supply customers in the United States," a spokesperson said. "China is a highly competitive market with rapidly growing local chip suppliers. Blocking all U.S. exports undercut our national and economic security and only benefited foreign competition." TSMC declined to comment and China's Ministry of Industry and Information Technology did not immediately respond to a request for comment. Reuters spoke to five people for this story, who declined to be named as the discussions are private. The potential order would mark a significant expansion of H200 production at a time when Nvidia has been focused on ramping up its newer Blackwell and upcoming Rubin chip lines. The H200, part of Nvidia's previous-generation Hopper architecture, uses TSMC's 4-nanometer manufacturing process. Nvidia plans to fulfill initial orders from existing stock with the first batch of H200 chips expected to arrive before the Lunar New Year holiday in mid-February, Reuters reported earlier this month. The bulk of the orders of over 2 million chips for 2026 has come from major Chinese internet companies, which view the H200 as a significant upgrade over chips currently available to them, two of the people said. Of Nvidia's current 700,000-unit inventory, around 100,000 are GH200 Grace Hopper superchips, which combine Nvidia's Grace CPU with the Hopper GPU architecture, while the remainder are standalone H200 chips, one of them said. Both variants will be offered to Chinese clients, the person said. While Nvidia has indicated a pricing ballpark to the Chinese customers, it would vary based on purchase volume and specific customer arrangements, said two of the people. An eight-chip module is expected to cost around 1.5 million yuan, making it slightly more expensive than the now-unavailable H20 module, which previously sold for around 1.2 million yuan, they said. However, given that the H200 delivers roughly six times the performance of the H20 - a downgraded chip Nvidia designed specifically for the Chinese market that was later blocked by Beijing from being shipped into China - the sources said Chinese internet firms view the pricing as attractive. The price also represents a roughly 15 per cent discount compared to grey-market alternatives, which currently retail at over 1.75 million yuan, according to the sources. ByteDance plans to spend about 100 billion yuan on Nvidia's chips in 2026, up from roughly 85 billion yuan in 2025, if China allows H200 sales, the South China Morning Post reported on Wednesday, citing sources. The planned shipments follow Trump's decision earlier this month to allow H200 sales to China with a 25 per cent fee, reversing the Biden administration's ban on advanced AI chip exports to China. However, Chinese officials are still deciding whether to allow H200 imports amid concerns that access to advanced foreign chips could slow development of the domestic AI semiconductor industry. But they have not signaled immediate opposition. While Chinese chipmakers have managed to come up with products that rival the H20 in performance, there are not yet any equivalents of the H200. One proposal under consideration would require bundling each H200 purchase with a certain ratio of domestically produced chips, Reuters previously reported.

Share

Share

Copy Link

Chinese technology companies have ordered over 2 million H200 chips for 2026, but Nvidia holds only 700,000 units in stock. CEO Jensen Huang confirms demand is "very high" as the company works with TSMC to ramp up production while navigating U.S. export licensing and awaiting Beijing's approval for shipments.

Nvidia Faces Massive H200 Chip Orders From Chinese Technology Companies

Nvidia is confronting an unprecedented supply challenge as Chinese technology companies have placed orders for over 2 million units of its H200 chip for 2026, while the company currently holds just 700,000 units in stock

2

. Speaking at CES 2026, CEO Jensen Huang confirmed that Nvidia H200 demand in China is "very high," describing customer interest as exceptionally strong1

. The situation highlights the delicate balance Nvidia must strike between serving this massive market opportunity and managing constrained global AI chip supply.The bulk of these orders for over 2 million units has come from major Chinese internet companies, which view the H200 as a significant upgrade over chips currently available to them

2

. ByteDance alone plans to spend about 100 billion yuan on Nvidia's chips in 2026, up from roughly 85 billion yuan in 2025, if China allows H200 sales5

. Of Nvidia's current 700,000-unit inventory, around 100,000 are GH200 Grace Hopper superchips, which combine Nvidia's Grace CPU with the Hopper architecture, while the remainder are standalone H200 chips .

Source: Analytics Insight

TSMC Partnership Critical to Ramp Up Production Amid Supply Constraints

To address the massive shortfall, Nvidia has approached contract manufacturer TSMC to significantly expand H200 production capacity

2

. A third source indicated that Nvidia has asked TSMC to begin production of the additional chips, with work expected to start in the second quarter of 20264

. The exact additional volume Nvidia intends to order from TSMC remains unclear, but the potential order would mark a significant expansion of H200 production at a time when Nvidia has been focused on ramping up its newer Blackwell and upcoming Rubin chip lines2

.Huang confirmed at CES 2026 that Nvidia has already restarted its supply chain for H200 and is preparing to ship once the remaining regulatory details are resolved. "We've fired up our supply chain and H200s are flowing through the line," Huang said during a Q&A session with journalists in Las Vegas

3

. The H200, part of Nvidia's previous-generation Hopper architecture, uses TSMC's 4-nanometer manufacturing process2

. Nvidia plans to fulfill initial orders from existing stock with the first batch of H200 chips expected to arrive before the Lunar New Year holiday in mid-February5

.

Source: Wccftech

U.S. Export Licensing and Regulatory Risks Create Uncertainty

The planned shipments follow the Trump administration's decision to allow H200 sales to China with a 25% fee, reversing the Biden administration's ban on advanced AI chip exports to China

2

. Under the revised policy announced in December, Nvidia can sell advanced AI accelerators into China, but only under a licensing regime that includes a 25% charge and government review of shipments1

. Huang emphasized that the gating factor is the completion of U.S. export licensing with the government, after which Nvidia expects purchase orders to speak for themselves1

.However, regulatory risks persist as Beijing has yet to greenlight any shipments of H200 chips

2

. Chinese officials are still deciding whether to allow H200 imports amid concerns that access to advanced foreign chips could slow development of the domestic AI semiconductor industry5

. One proposal under consideration would require bundling each H200 purchase with a certain ratio of domestically produced chips2

. Huang made clear that Nvidia does not plan to trumpet individual deals or frame the restart of China sales as a major corporate milestone. "We're not expecting any press releases or any large declarations," he said, adding that the company expects to learn about market uptake through normal commercial channels1

.

Source: Benzinga

Related Stories

Pricing Strategy and Performance Advantages Drive Strong Market Interest

Nvidia has decided which H200 variants it will offer to Chinese clients and price them around $27,000 per chip, sources said

2

. An eight-chip module is expected to cost around 1.5 million yuan, making it slightly more expensive than the now-unavailable H20 module, which previously sold for around 1.2 million yuan . However, given that the H200 delivers roughly six times the performance of the H20—a downgraded chip Nvidia designed specifically for the Chinese market that was later blocked by Beijing from being shipped into China—Chinese internet firms view the pricing as attractive5

.The price also represents a roughly 15% discount compared to grey-market alternatives, which currently retail at over 1.75 million yuan

2

. Technically, the H200 remains a highly attractive option for large-scale AI workloads. Based on Nvidia's Hopper architecture, it pairs the H100 GPU with 141GB of HBM3e memory and significantly higher memory bandwidth, making it particularly well-suited for training and inference of large language models1

. That capability gap is one reason Chinese customers have continued to pursue Nvidia hardware despite export controls and higher costs.Global Supply Implications and Future Market Outlook

The moves raise concerns over whether there could be further tightening in global AI chip supplies as Nvidia now has to strike the right balance between meeting robust China demand and addressing constrained supplies elsewhere

2

. Global customers of Nvidia have expressed worries regarding the company's capacity to allocate data center GPUs equitably between the United States and China amid the surge in Chinese demand4

. However, Nvidia addressed these concerns directly, stating that "licensed sales of the H200 to authorized customers in China will have no impact on our ability to supply customers in the United States"2

.Huang has previously said that the Chinese market could be worth $50 billion per year, and none of those sales are currently included in Nvidia's forecasts

3

. He added that any H200 sales would be in addition to the $500 billion two-year forecast the company provided last year3

. While Chinese chipmakers have managed to come up with products that rival the H20 in performance, there are not yet any equivalents of the H2002

. For now, Nvidia's approach to China is to wait and see—the supply chain is warming up, and customer interest is strong, but the outcome depends on whether regulators on both sides give the final stamp of approval1

.References

Summarized by

Navi

[2]

Related Stories

Nvidia Set to Resume AI Chip Sales to China Amid Regulatory Shifts

10 Jul 2025•Technology

Nvidia prepares to ship up to 80,000 H200 AI chips to China as political hurdles loom

22 Dec 2025•Policy and Regulation

Nvidia CEO Confirms No Plans to Ship Blackwell GPUs to China Amid Ongoing Trade Restrictions

07 Nov 2025•Business and Economy

Recent Highlights

1

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

2

Demis Hassabis predicts AGI in 5-8 years, sees new golden era transforming medicine and science

Technology

3

Nvidia and Meta forge massive chip deal as computing power demands reshape AI infrastructure

Technology