OpenAI vs Anthropic: Diverging Strategies in the AI Race

2 Sources

2 Sources

[1]

OpenAI's hype vs Anthropic's strategy: who's really winning the AI war?

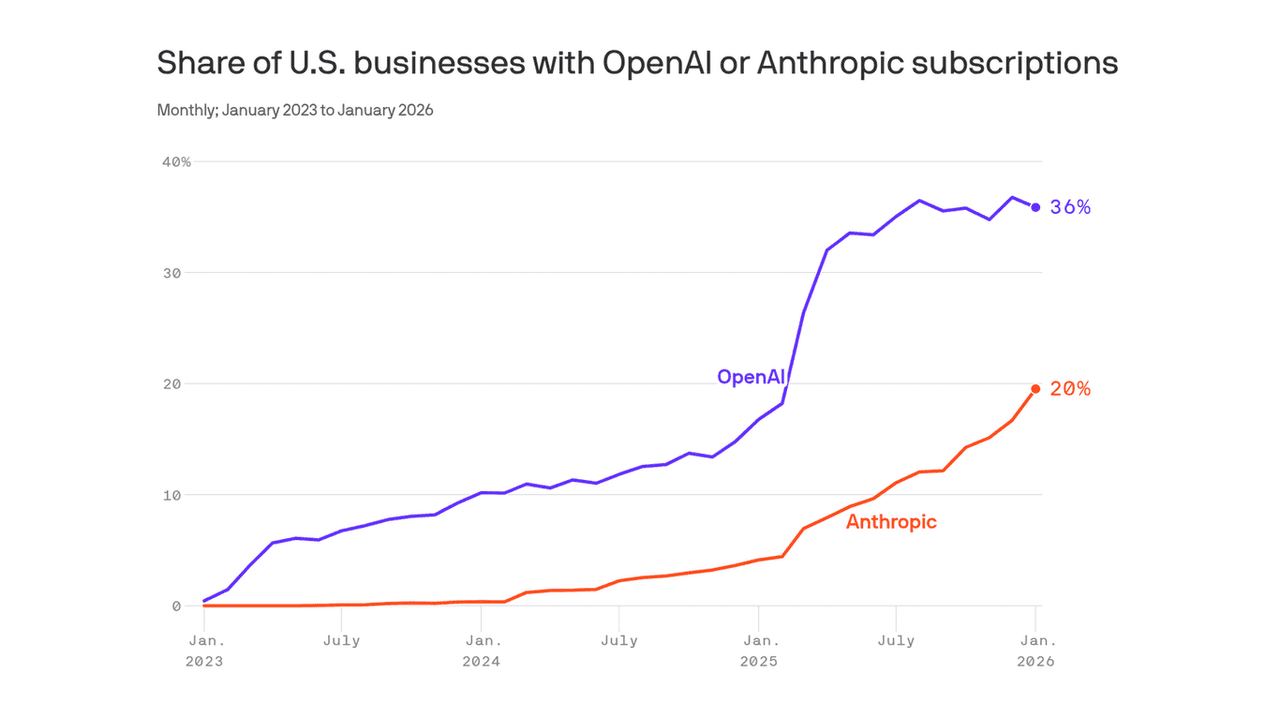

Serving tech enthusiasts for over 25 years. TechSpot means tech analysis and advice you can trust. TL;DR: While OpenAI continues to draw enormous attention for its technological pace and sweeping ambitions, Anthropic's disciplined enterprise strategy is earning increasing recognition from investors. In a market dominated by expensive infrastructure and public hype, its ability to translate AI performance into steady business demand may ultimately prove the more enduring success story. OpenAI has entered agreements worth hundreds of billions of dollars to build vast data centers packed with high-performance chips, designed to strengthen its grip on generative AI. Yet as it expands through costly construction and mass-market products, a quieter rival, Anthropic, is emerging as a more structurally sustainable business in the same field. Founded in 2021 by former OpenAI researchers, Anthropic develops large language models similar to OpenAI's GPT systems. Both companies sell access to these models, but their approaches to revenue diverge sharply. OpenAI earns most of its income through consumer subscriptions and partnerships tied to Microsoft's productivity software. Meanwhile, Anthropic has concentrated on enterprise applications, positioning itself as a technical supplier rather than a consumer brand. Anthropic co-founder and CEO Dario Amodei OpenAI's main consumer product, ChatGPT, remains the most widely used AI tool worldwide. The company reports that more than 800 million people use the chatbot weekly, replacing many traditional search queries with conversational exchanges. That broad adoption has pushed OpenAI's annual revenue run rate to about $13 billion, according to the company's data, with roughly 30% of that coming from corporate customers. Subscribers pay $20 per month for a "Plus" tier or $200 per month for a "Pro" package, which offers faster performance and greater reliability. However, much of the system's computing costs still exceed the revenue generated by these subscriptions. Anthropic has aimed instead at large corporate clients seeking measurable productivity gains from AI tools. The company says that about 80% of its revenue comes from enterprise accounts, with around 300,000 business customers as of late 2025. That focus appears to be paying off. A July study by the venture firm Menlo Ventures found that Anthropic's Claude models now lead the field in corporate AI adoption, claiming 32% market share compared with OpenAI's 25%. In specialized domains such as computer programming, the survey estimated Claude's share at roughly double that of GPT. The report credited Claude's accuracy in structured tasks such as coding and legal drafting, where precision in language and predictable behavior are prioritized over creativity. Those enterprise results have translated into solid financial performance. Anthropic is operating at a $7 billion annual revenue run rate and expects to reach $9 billion by year's end, far closer to OpenAI's figure than its smaller public profile might suggest. Analysts note that its per-customer income is markedly higher than OpenAI's, a sign that businesses are using Claude in mission-critical processes rather than as a supplemental research tool. The two developers also rely on distinct industrial alliances. OpenAI's infrastructure and distribution stem from its deep partnership with Microsoft, which provides Azure cloud computing and integrates OpenAI models into Word, Outlook, and other Office applications. Anthropic's computing resources, by contrast, come through investments from both Amazon and Google, giving it access to advanced cloud infrastructure and a broad cross-section of potential business clients. In September, Microsoft - despite its alignment with OpenAI - announced it would also include Anthropic's Claude model in its Copilot software suite, underscoring enterprise demand for Anthropic's systems. Those enterprise uses are expanding across industries. Businesses are adopting Claude to write and test software, process legal materials, analyze financial data, and accelerate back-office documentation, such as billing and compliance. Many of those applications offer direct cost savings, making the return on investment easy to quantify - something investors see as an advantage over OpenAI's consumer-driven revenue model. OpenAI's efforts to monetize mass adoption are less straightforward. Besides subscriptions, the company is exploring potential advertising strategies, though integrating ads into conversational products presents consumer and ethical challenges. Traditional search advertising - the primary driver of Google's profits - cannot be easily replicated in natural-language chat. Users may resist explicit brand placements or commercial suggestions within their AI interactions, leaving the company to experiment with indirect revenue models. At the same time, OpenAI's reputation as a freewheeling consumer platform could complicate its work with corporate clients that demand tighter governance. The company has permitted adult content functionality within ChatGPT and taken a lighter regulatory stance, which may limit its appeal among enterprises cautious about reputational risk. Anthropic, by contrast, promotes a safer and more structured approach focused on "constitutional AI," a technique that ensures predictable model behavior through predefined ethical guidelines. Independent model evaluations reinforce that contrast. Vals AI - a benchmarking startup ranking large language models on business-oriented tasks - currently lists Claude as the top-performing enterprise-grade model. "Anthropic is laser-focused on agentic enterprise use cases and they're playing a very competitive game with OpenAI right now," Vals co-founder Rayan Krishnan told The Wall Street Journal. Image credit: The Wall Street Journal

[2]

Anthropic is leading the AI race -- and it's all thanks to this one problem OpenAI can't solve

OpenAI and Anthropic are easily two of the largest companies in the world of AI right now. However, both of these giants have taken very different approaches when it comes to the emerging technology. On one side is OpenAI. It has become the face of chatbots, with ChatGPT dominating the market. It is the AI equivalent of a Jacuzzi to the world of hot tubs, and has continued its dominance by launching AI image and video generators, its own web browser, and, if reports are correct, soon a music generator. Anthropic, on the other hand, has kept a low profile. While it also has its own chatbot known as Claude, it hasn't spent much time on the bells and whistles. There is no AI image or video generation, and no involvement in the world of AI trends. It focuses on more serious sides of AI, like vibe coding (the ability to write code with AI prompts), logical understanding, and helping you perfect your academic writing. But it's not just the marketing approach that sets these two giants apart; they also approach business differently. As part of its immense popularity, OpenAI has leaned into its consumer side, focusing on getting people subscribed to its paid plans. According to the Wall Street Journal, it currently has roughly 800 million weekly users and an annual revenue of around $13 billion. Around 30% of this comes from businesses, making OpenAI very much a company relying on the public. Anthropic, on the other hand, has leaned fully into the corporate side of AI. It has a much smaller market appeal and has stated that roughly 80% of its revenue comes from corporate partners. A big part of this success for Anthropic is its focus on coding ability. A report on the current state of AI by Menlo Ventures stated that "Anthropic's Claude Opus 4 outperforms OpenAI's GPT-4.1 on many reasoning and factuality benchmarks, making it a preferred choice for enterprises". The report goes on to survey that Anthropic has a 42% market share for coding, compared to OpenAI's 21%. This success with businesses has meant that, despite being much less popular, Anthropic isn't far behind OpenAI when it comes to profits. It currently has an expected annual run rate of $7 billion, compared to OpenAI's $9 billion by the end of this year. While both also see success from big partnerships with tech companies -- Microsoft supporting OpenAI and Google and Amazon supporting Anthropic -- it seems that Anthropic could well be in a better position. OpenAI is relying heavily on public interest in chatbots. To continue to make money, this requires ChatGPT and its related tools to remain relevant and more popular than the competition. This involves OpenAI constantly developing new tools, features, and add-ons. Compared to Anthropic, the company is always releasing new features. This is both costly and relies heavily on consistent popularity. Anthropic, however, simply needs to consistently improve its tools in more corporate areas, building on coding, logic, and its ability to perform tasks like creating legal documents, billing, and organizing complicated tasks. This makes the most of a far more consistent means of funding, targeting companies with deep pockets and a reliable yearly need for AI tools. While OpenAI is continuing to try and market itself as the fun side of AI, especially through Sora 2, its AI video model, which has faced backlash in recent months, it makes it harder to market itself as a serious tool to businesses. Anthropic's success in this market has revolved around a clear focus on the business side. While Claude remains a popular tool to the public, it is clear that this is a secondary part for the company. It might not be a flashy approach, or one that will pull the same attention as OpenAI, but Anthropic might have the answer that many companies are looking for - how do you make money in the world of AI?

Share

Share

Copy Link

A comparison of OpenAI and Anthropic's contrasting approaches to AI development and monetization. While OpenAI focuses on consumer-facing products, Anthropic targets enterprise solutions, leading to different market positions and revenue models.

OpenAI vs Anthropic: Contrasting Strategies in the AI Race

In the rapidly evolving world of artificial intelligence, two companies have emerged as frontrunners: OpenAI and Anthropic. While both develop large language models, their approaches to market dominance and revenue generation differ significantly, leading to an intriguing battle for AI supremacy

1

2

.

Source: Tom's Guide

OpenAI's Consumer-Centric Approach

OpenAI has become synonymous with consumer AI, largely due to the immense popularity of its ChatGPT platform. With a reported 800 million weekly users, OpenAI has achieved an annual revenue run rate of approximately $13 billion

1

. The company's strategy revolves around:- Mass-market appeal: ChatGPT has become the go-to AI tool for millions of users worldwide.

- Diverse product offerings: OpenAI continues to expand its portfolio with AI image and video generators, and potentially a music generator in the future

2

. - Microsoft partnership: This collaboration provides OpenAI with Azure cloud computing resources and integration into Microsoft's Office suite

1

.

Anthropic's Enterprise-Focused Strategy

In contrast, Anthropic has taken a more subdued yet potentially more sustainable approach:

- Corporate clientele: About 80% of Anthropic's revenue comes from enterprise accounts, with around 300,000 business customers

1

. - Specialized applications: Anthropic's Claude models excel in structured tasks like coding, legal drafting, and financial analysis

1

2

. - Multi-cloud support: Investments from Amazon and Google provide Anthropic with diverse cloud infrastructure and potential business clients

1

.

Related Stories

Performance and Market Share

Despite its lower public profile, Anthropic is gaining ground in crucial areas:

- Corporate AI adoption: A Menlo Ventures study found that Anthropic's Claude models lead with 32% market share compared to OpenAI's 25%

1

. - Coding dominance: In programming applications, Claude claims a 42% market share, nearly double OpenAI's 21%

2

. - Revenue growth: Anthropic is operating at a $7 billion annual revenue run rate, expected to reach $9 billion by year-end, approaching OpenAI's figures

1

.

Challenges and Future Prospects

Both companies face unique challenges in their respective strategies:

- OpenAI's monetization hurdles: The company struggles to translate its massive user base into sustainable revenue, with subscription costs often not covering computing expenses

1

. - Anthropic's focus on ROI: By targeting enterprise clients, Anthropic offers solutions with quantifiable cost savings, making its value proposition clearer to investors

1

. - Ethical considerations: OpenAI's consumer-facing approach may complicate its efforts to position itself as a serious enterprise tool, while Anthropic maintains a more professional image

2

.

As the AI landscape continues to evolve, the contrasting strategies of OpenAI and Anthropic offer a fascinating case study in technology commercialization. While OpenAI's broad appeal has captured public imagination, Anthropic's focused approach on enterprise solutions may prove more financially sustainable in the long run

1

2

.References

Summarized by

Navi

Related Stories

Anthropic's Meteoric Rise: Tripling Revenue to $3 Billion in Just 5 Months

31 May 2025•Business and Economy

Anthropic Surpasses OpenAI in Enterprise AI Market, Dominates Coding Sector

01 Aug 2025•Technology

Anthropic doubles funding target to $20B as enterprise AI revenue surges toward $18B in 2026

27 Jan 2026•Business and Economy

Recent Highlights

1

Google Gemini 3.1 Pro doubles reasoning score, beats rivals in key AI benchmarks

Technology

2

Pentagon Summons Anthropic CEO as $200M Contract Faces Supply Chain Risk Over AI Restrictions

Policy and Regulation

3

Canada Summons OpenAI Executives After ChatGPT User Became Mass Shooting Suspect

Policy and Regulation