RAM Prices Explode 240% as AI Data Centers Drain Global DRAM Supply

4 Sources

4 Sources

[1]

RAM prices are exploding -- here's why and everything you need to know about surviving RAMageddon

As a writer, you do have to find humor in your work sometimes -- especially when you think the world is going crazy. For me, that comes with a good "ageddon" in your headline when the RAM pricing crisis truly sets in. You've heard a lot about it, plenty about how desktop PCs and components are rocketing up in cost. The average price of consumer RAM sticks on Amazon has climbed by over 240% in my check of over 100 listings. But there are levels to it, and next year, you could see the prices of laptops, games consoles, phones, tablets and more be inflated. And the cause of it? AI. Let me explain. Think of the production of RAM like an apple orchard. The critical chips at the center of all this are DRAM (the apples), and there are only three key orchards to buy apples from: Samsung Electronics, SK Hynix and Micron Technology control around 95% of the global DRAM production collectively. Things are ticking along well -- the weather has been perfect for growing plenty of apples for stable production with high yields, and the demand remained at a solid level from consumers to make a whole lot of apple pie. That means these companies can collectively decide a reasonable price for the apples and keep everyone happy. Now imagine that a global apple pie maker swoops in and buys all the apples. This is the AI data center boom, which is largely driven by the massive increase in demand from the likes of Oracle and AWS. To run AI as speedily as you see in the likes of ChatGPT-5 and Google Gemini 3, you need super-fast memory, which comes from RAM and SSDs (by the way, SSD chips will also be impacted, but that's a different story). These orchards are unable to keep up with the demand, which creates a massive seasonal drought and forces customers desperate for RAM to wave whatever money they have and beg for the few remaining apples. The cause is a supply and demand problem. As I said, these critical DRAM chips are being hoovered up in the AI data center boom, which doesn't leave a lot for consumer product makers to grab. That leaves the small group of chip fabrication plants with the ability to charge whatever they want in this drought, causing the prices to soar, as they decide whether the money they make off consumer RAM is even worth being in the business of furnishing consumer PCs. In fact, certain companies are considering pulling the plug entirely on the consumer side. I've heard a few are considering this behind closed doors, but the first public casualty is consumer RAM company Crucial, as Micron pivots to supply/make a ton of money off AI. Who else could make the jump? That'll be just me making predictions at the moment, but I highly doubt Micron is going to be the only company to go down this path. You're already seeing it happen in the desktop PC market. Both CyberpowerPC and Maingear issued warnings that global memory prices "surged by 500%," which will lead to price increases as early as December 7. You can also see it by just looking at The Camelizer on literally any Amazon RAM listing. But DRAM chips are needed for so many different categories of tech, and the nervousness of manufacturers talking to me behind closed doors is palpable. Because plans are set for all kinds of new laptops, tablets and more, but how much they will need to charge for them is in constant flux. As these prices continue to skyrocket, this will very likely impact the price of upcoming things like the Steam Machine, the iPhone 18 and more. But where will it end? In my mind, there are only two ways this price spike ends. Let me explain the scenarios. First, this drought is going to worsen. In the immediate future, industry analysts and manufacturers predict that prices for DRAM and NAND chips (RAM and SSD) will continue to rise throughout the first half of 2026. This is because of the long-term contracts these fabrication plants are continuing to fulfil -- to the point where in early next year, stockpiles for consumers to buy could run completely dry. If demand continues to be this high, new multi-billion-dollar chip fabrication plants will need to be made, and that will be a long wait until they can start shipping. PC Gamer is reporting Micron plans to invest nearly $10 billion into a new DRAM facility, but you'll have to wait until 2028 for that to start producing. That means in this scenario, the RAM price crisis could last well into 2028. I know I've been a doomer in saying that I think AI might be a bubble, with all the vendor financing agreements and promises of making money in exchange for burning a whole lot of cash. OpenAI has made $1.5 trillion in chip commitments, while Reuters reports the company has made $12 billion in annual revenue this year. That's a big tab, and very bubble-ish in my mind. So what would happen if all of this money is spent on buying all the apples, but companies and investors get a reality check that the pies just aren't good? What happens if the return on investment in this AI rollout doesn't materialize? Well, two things happen. First, tech companies will slam the brakes on new data center construction and AI scaling. The demand for DRAM and NAND chips will dry up overnight. And second, that will leave warehouses absolutely packed with these apples that the orchards are desperate to sell. At that point, the prices come crashing down to get rid of them all. It will be a systemic shock to the whole industry, and a sharp, severe, rapid end to the RAM pricing crisis. Which of these is true? I don't know. I can look at all the bubble-ish vibes I'm getting from the insane valuations of the Magnificent Seven (stock prices of Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla) on the back of AI and be scared. But if it is the life-changing tech that changes the world, then those prices would be warranted. However, one thing that cannot be ignored is that this rapid onward march into the future is hurting us. The people who want to buy cool tech and not be extorted at the expense of companies chasing this dream of artificial general intelligence (AGI).

[2]

RAM prices are out of control. What does that mean for Apple devices?

Apple is uniquely positioned to whether the current RAM storm, but it can't hold out forever. You have undoubtedly heard about the recent massive spike in RAM prices. RAM for consumer devices like desktops, laptops, graphics cards, and smartphones (DDR, GDDR, and LPDDR memory) has skyrocketed in recent weeks. Prices are 50-100 percent higher than they were back in the summer, with some premium 32GB DDR5 kits going for as much as $400 at Amazon! The problem, as it so often is, traces back to AI. The massive rush to build more AI datacenters at all costs has already increased demand for water and electricity, and previously sucked up much of the supply chain for the chips we use in consumer devices. RAM appears to be the latest culprit -- AI data centers are using up a lot of the supply of DDR memory, but the GPUs they use often use a different kind of RAM called HBM -- high bandwidth memory. Manufacturers have begun shifting some production to keep up with demand, making the DDR memory used in consumer devices even more scarce. It has gotten so bad that Samsung reportedly can't even sell RAM to Samsung. The situation has caused prices to rise for PC desktops and laptops, graphics cards, and plenty of other consumer devices. But Apple products haven't been affected -- at least not yet. But will the surge in RAM pricing eventually make our iPhones and Macs more expensive? The situation is complicated. If nothing else, Apple is a big and popular monolithic producer of consumer goods with a locked-in supply chain. Apple doesn't buy RAM month-to-month; it negotiates big, long-term contracts for parts in extremely high volumes. So for Apple, RAM likely hasn't gotten more expensive yet, because they locked in prices months or even years ago for a huge long-term supply. What we don't know is when Apple negotiates its supply contracts and how long this surge in RAM pricing will last. A Citi report published on X last year revealed that Samsung, SK Hynix, and Micron supplied DRAM for iPhone 17, but it's unclear whether Apple negotiates contracts before each phone release or whether they are the same for Mac chips. Because the unified memory chips in Apple's processors are soldered to the chip, there aren't teardowns to reveal the make or model of the RAM. There's also the possibility that Apple's prices go up to cover the threat of additional costs. When airlines raise ticket prices due to a surge in the price of oil, that's usually an artificial increase. Major airlines buy fuel on long-term contracts and hedge prices by locking in rates well in advance of a price spike. Airlines are raising prices because they can, and we have seen many other industries use inflation and tariffs as cover to raise prices by a much larger amount than the increase in their actual costs. Also, prices rarely go down once costs stabilize, but that's another issue. In other words, even if Apple isn't paying more for RAM right now, it might have to in the near future, and it might raise prices regardless. There's just no way to know. Historically, increases in RAM prices affect products in which RAM is a huge part of the total cost. On an inexpensive smartphone, where RAM might be 10 or 15 percent of the total bill of materials (BOM), a doubling of RAM costs can completely destroy the slim margins it sells at. Apple's typical RAM cost is estimated to be more like 4 percent of the BOM cost, and Apple's margins are high -- in the 20-30 percent range for most products, and higher on high-end Macs. Apple also charges a lot for additional RAM in Macs -- you'll pay $200 more for 8GB, essentially $20 worth of RAM. Even if Apple's cost for RAM doubles, it still has margin to spare. Granted, Apple is very protective of its margins and doesn't ever want to make less profit on each sale. But it certainly has the ability to withstand a few months or even a year of a big DRAM price surge without losing money, even at current prices. The full retail price of an Apple product rarely changes. It has been known to happen, especially in specific regions where a big swing in the exchange rate and/or taxes that must be included in the price necessitate a shift. In general, though, Apple's pricing is incredibly steady. When the company raises prices, it does so with the introduction of a new product. For example, Apple likely wouldn't raise the price of the iPhone 17 due cover rising component costs, but would rather just raise the iPhone 18's price when it is introduced. One notable exception, however, was in March 2002, when it hiked the price of its new G4 iMac jus two months after its launch due to "significant increases in component costs for memory and LCD flat-panel displays." Of course, Apple was a much different company back then. Apple just released a number of its higher-priced products: the iPhone 17 line (including an overpriced iPhone Air), M5 MacBook Pro, and M5 iPad Pro. Its next big product lineup will be higher-priced M5 MacBook Pros (which have margin to spare), M5 MacBook Air, and perhaps some real budget value products like a low-cost MacBook and iPhone 17e. In other words, Apple's next products are a mix of some high-end, high-margin Macs and value products that by definition have to come in well under the rest of the product line. It would surprise me if we saw higher starting prices for those products due to the current RAM situation. Nobody really knows what Apple will do with pricing, and anyone who claims differently is as trustworthy as a magic 8-ball. But our educated guess is that Apple won't adjust its prices due to the RAM shortage in the short term. If this supply crunch lasts through the year to the fall 2026 product cycle, there's a very good chance we'll see some higher prices on specific SKUs to offset Apple's increased costs and preserve its overall margins.

[3]

Why is RAM so expensive right now? It's more complicated than you think

Yes, AI is partly to blame for surging prices and DRAM shortages, but that's not the whole story RAM used to be one of the easiest PC components to ignore. You picked a capacity that matched your needs and budget, checked the speed corresponded with your motherboard, bought what you needed, dropped it into your computer, and forgot all about it. If you've been following the news lately, and I'm sure you have, you'll know memory prices have surged so fast that RAM is now one of the most volatile and confusing parts of the entire PC market, and the effects are spreading well beyond desktop builds. What appears to be a simple price spike is actually the result of several overlapping shifts in how memory is manufactured, for whom it's made, and where manufacturers expect to generate revenue over the next few years. At the center of the problem is DRAM, the type of memory used in PCs, laptops, phones, consoles, servers, and cars. Although most people just call it RAM, nearly all modern system memory is DRAM, including DDR4, DDR5, LPDDR, GDDR, and HBM. Those different formats serve different roles, but they come from the same production ecosystem, and that is controlled by just three memory giants: SK Hynix, Samsung, and Micron. Together they account for more than 90% of the total random-access-memory (RAM) market (Counterpoint, October 2025). All three happen to be major players in NAND as well, the building block of SSDs. There are a handful of other DRAM players: CXMT, Nanya being the two main ones with smaller brands located in mainland China. For years, that concentration didn't feel like it was a problem as production was steady, demand was predictable, and price swings were usually gradual enough for consumers and OEMs to plan around. Prices went up, they went down. If you needed some more RAM and weren't in a rush, you could wait for a Black Friday deal. That all started to change before most people even noticed. Well before the AI boom reached the crazy heights it's at now, DRAM makers were already preparing for a transition away from older memory types. DDR4 and LPDDR4 were built on aging process nodes that manufacturers wanted to retire. Those older nodes were less profitable and blocked capacity that could be used for newer, higher-margin products. Micron and others issued end of life notices for several DDR4 and LPDDR4 parts, pushing customers to secure supply while they still could. That had the knock on of creating early shortages and price spikes in memory that should have been getting cheaper. Then AI spending exploded. Training large models and running inference at scale requires huge pools of fast memory, and not just storage. GPUs used for AI rely heavily on High Bandwidth Memory, which is still DRAM, just stacked vertically and tuned for extreme throughput. Every wafer that goes into HBM is a wafer that can't be used for standard DDR5, LPDDR5X, or GDDR6. Once hyperscalers and AI firms started signing massive contracts, memory makers inevitably followed the demand... and the money. HBM and server DDR5 offered long term deals, predictable volume, and far better margins than selling consumer DIMMs through retail channels. Consumer memory didn't disappear overnight, of course, but it stopped being the priority, something that is clearly visible in today's pricing. DDR5 kits for PCs that sold for reasonable prices only months ago are now listed at amounts that feel closer to high end GPUs than the supporting components they are. (There are deals to be found, but they are becoming increasingly rare). Even individual DRAM chips traded on the spot market have multiplied in price over a short span, reflecting panic buying and constrained supply rather than organic consumer demand. Spot prices refer to short term trades of individual chips between suppliers and buyers, not the finished sticks people buy for PCs. Contract prices reflect longer term agreements between manufacturers and OEMs. When both move sharply upward at the same time, it's a sign that supply is tight across the board and that no segment is insulated. And that's exactly what's happening now, as you can see at DRAMeXchange. Contract prices for notebook memory have jumped by double-digit percentages in a single quarter. Spot prices for common DDR5 chips have risen several times faster than typical seasonal fluctuations. Even older RAM types like DDR3 and DDR4, which should be going gentle into that good night, are getting more expensive as supply is cut faster than demand fades. The result is a market where nothing feels especially safe, let alone cheap. Then when things were looking bad for consumers, Micron made them much worse by announcing plans to exit the consumer memory and storage market, killing production of its Crucial branded RAM and SSDs. Crucial was one of the few consumer facing arms of a major DRAM manufacturer, often acting as a price anchor that kept competitors in check. Many of the PCs I've built or upgraded over the years have had Crucial RAM. The desktop beast I'm writing this on still does. Explaining its decision, Micron said: "The AI-driven growth in the data center has led to a surge in demand for memory and storage. Micron has made the difficult decision to exit the Crucial consumer business in order to improve supply and support for our larger, strategic customers in faster-growing segments." Micron will continue shipping Crucial products until February 2026, but after that, the brand will become a distant, much loved memory. In practical terms, this leaves Samsung and SK Hynix as the only major suppliers feeding the consumer DRAM market at scale and as most people know, less competition almost always means higher prices, especially when demand elsewhere is stronger. Samsung's recent strategy shows how distorted the incentives have become. Facing intense competition in HBM, where SK Hynix has led for several generations, Samsung reportedly shifted large chunks of DRAM production toward DDR5 RDIMM modules. These are server memory sticks, not consumer DIMMs, and they currently offer huge margins. Contract pricing for high capacity DDR5 RDIMMs has climbed to levels that make them more profitable than HBM, without the same technical risk or certification hurdles. Spot prices have gone even higher, suggesting - oh joy! - there's further room for yet more increases. From Samsung's perspective, allocating wafers to DDR5 server memory instead of discounted HBM or consumer DDR5 makes financial sense. From a consumer perspective, however, it means less supply and higher prices across the rest of the market. SK Hynix has said it plans to ramp DRAM production in 2026, but most of that output is inevitably aimed at AI and enterprise customers. Very little of it is expected to relieve the pressure on consumer PCs, and certainly not in the near term. The knock-on effects are spreading quickly. Graphics cards rely on GDDR memory, which comes from the same manufacturers. As DRAM capacity tightens, GDDR6 pricing is climbing, pushing costs up for mid range and entry level GPUs. Mobile devices use LPDDR, and those parts are seeing steady increases that phone makers will eventually pass on. Storage isn't immune either. NAND flash, used in SSDs and memory cards, is also being pulled toward enterprise and AI workloads. Contract demand for NAND wafers has surged, and consumer SSD prices are starting to creep upward after a long period of decline. Not too worried yet? You should be. OEMs are already preparing customers for what comes next. TrendForce reports Dell is planning double digit PC price increases and Lenovo has warned that existing quotes won't hold. HP has said that if memory conditions don't improve, the second half of 2026 could bring even higher system prices. This isn't just about enthusiasts paying more for upgrades either, as it affects schools buying laptops, businesses refreshing fleets, and anyone relying on what should be affordable hardware. There are ideas for easing the pressure of course, but none are simple. One approach gaining attention in data centers is memory expansion over CXL. As we reported here, devices like Marvell's Structera cards allow operators to attach pools of older DDR4 memory to servers over PCIe, effectively reusing retired modules. Compression can stretch capacity even further, turning existing hardware into a larger usable pool, and reducing the need to buy new DDR5 - at least for certain workloads. It doesn't help consumers directly, but it could slow enterprise demand enough to free up some supply. The longer term fix is new fabrication capacity, but building a DRAM fab costs billions and takes years. Micron has announced a $10 billion investment in a new facility in Japan, but it isn't expected to produce chips until at least the second half of 2028. Samsung and SK Hynix, ahead of the curve as always, have their own expansion plans, but none of them will offer quick relief. The other way out of the current mess relies on memory demand cooling. If AI spending slows, or the economics of large scale training change, the rush for memory could ease. That would leave manufacturers with excess capacity and drive prices back down, just as has happened after past boom cycles. But betting on that outcome means betting on a shift in one of the largest investment waves the tech industry has ever seen. AI might be a bubble, as a number of analysts have claimed, but for now, the trajectory points the other way. Memory makers are being rewarded for serving AI and enterprise customers, older standards are being retired faster than demand disappears and consumer brands are shrinking, not growing. Prices are rising not because everyone suddenly needs more RAM at home, but because the same factories are feeding a very different kind of customer. RAM has gone from commodity to constraint and until supply, demand, and priorities change, it's very likely to stay that way.

[4]

Why RAM Prices Are Going Way, Way Up (and Why You Should Care)

RAM, also known as random-access memory (or just memory for short), is an important part of most electronics these days. It essentially allows programs to keep key information at the ready so they don't have to dig through your storage (like your hard drive or solid state drive) to find it. RAM is in laptops, phones, tablets, gaming consoles, and even cars, and all apps rely on it at least a little bit. Essentially, if your device has a computer in it, it probably comes with RAM equipped, or it'll want you to install some before it'll boot up. But that dependency has become a big problem recently. While RAM has historically been one of the cheaper components for home techies to buy, over the past few months, RAM has gotten much more expensive, going from an afterthought on many people's budgets to something you have to save for. There are a few reasons for that, but even if you're not a hardcore PC builder and you're not buying RAM outright, these price jumps could still affect you in the long term. Like with most tech shakeups these days, the big reason for the sudden explosion in RAM pricing is AI. Citing trade research firm TrendForce and Korean publication The Chosun Daily, Lifehacker sister site PCMag started reporting on shifting RAM prices in October, and it's only gotten worse since. According to these analysts and industry insiders, manufacturers have slowly been focusing more of their attention on RAM specifically meant for AI data centers, with Samsung and SK Hynix in particular prioritizing production of high bandwidth memory that consumer goods don't use. Tom's Hardware backed this up with its own reporting in October, saying that these companies have devoted what may be around 40% of global RAM output to a single AI project -- OpenAI's Stargate project. Those are two out of the three biggest RAM makers right now, and while all this was followed by a bombshell last week, the situation already didn't look good as we entered fall, with a shortage beginning to affect consumer prices. "This is insanity," wrote one Reddit user in October, with more pessimism coming around Black Friday, when other users and even publications like other Lifehacker sister site Mashable noticed that some RAM was selling for as high as four-figures, during what was supposedly a sales season. But the largest RAM price hikes hit at the start of December, following an announcement from the last remaining major RAM producer -- Micron. The company, long known for its consumer-focused Crucial series, said it would be leaving the consumer RAM business in 2026 to focus on AI, bringing an end to Crucial's 30-year history in the process. Since then, RAM prices across several products have jumped even higher, even as RAM producers report doubled profits over last year. Essentially, as Gartner analyst Shrish Plant told The Verge, "If you are not a server customer, you will be considered a second priority for memory vendors." While all computer component prices fluctuate, RAM has usually been among the cheaper ones, generally coming in under $100 for a respectable amount from a good brand, or closer to $150 for an upgrade. Those days, it seems, have gone out the window. A streamer and TikToker I follow, Christian Divyne, recently posted that a RAM kit he bought in April for $90 is now over $400, and he's not alone. I've seen this sentiment all over social media lately, so to check it myself, I went through PCMag's list of the best RAM for gaming in 2025, and here are the price differences I found from August of 2025 to now. While this is a small selection of RAM, it's clear these higher prices are present across the whole industry. PCPartPicker, a popular site where PC building enthusiasts rate parts for their machines, currently says its highest rated RAM is $407, with competing memory often hitting similar highs. Essentially, it's now difficult to find any RAM below $100, and most likely, you'll need to pay two or three times more than you might have earlier in the year. These price jumps are most apparent when buying RAM directly, which mostly affects PC builders, but others will likely feel the crunch soon. So far, I've only focused on higher prices for people buying RAM outright, which mostly affects PC builders. But if you prefer to buy your tech pre-built, don't assume that means you won't end up paying more, too. Laptop, tablet, and phone makers all need to get RAM from somewhere, and as prices increase, they'll also be affected. Already, prices at companies like CyberPowerPC, which offers pre-built desktops, have gone up, and modular laptop maker Framework has announced that it will soon follow suit. Even Raspberry Pi, known for making cheap single board computers for home projects, was forced to raise prices on its most recent flagship, while calling out memory costs as the reason. All of those products are aimed more at enthusiasts, sure, but consider them the canary in the coal mine. Leaker Moore's Law is Dead recently suggested RAM prices could lead to another price hike for the Xbox, while Dell COO Jeff Clarke said in a recent earnings call that "the fact is, the cost basis is going up across all products." Some companies are doing their best to keep consumers from feeling the effects of the shortage. Bloomberg recently reported that Lenovo is currently stockpiling RAM to try to "strike a balance between price and availability" for consumers in 2026, while HP said it might limit the memory inside its devices, but could still end up having to raise prices. In short, it's a tough time to be buying tech, even if you're more casual with your devices. And it might affect more than RAM, too -- speaking to The Verge, Research VP at IDC Jeff Janukowicz suggested some companies might skimp on other components, like battery or display, to help avoid raising prices due to increased memory costs. He also suggested that more affordable devices, where corners have already been cut as much as possible, could end up seeing more price increases than others. As Dell COO Jeff Clarke mentioned in that earnings call, this isn't the first time RAM prices have fluctuated, but he did admit this particular bump is "unprecedented." While I'd agree that's true for memory, it does remind me of the graphics card price hikes that happened around the early 2020s. Graphics card demand is still not a solved problem, as those components are also very useful for AI, but towards the start of the decade, it became very difficult for gamers to get their hands on GPUs, especially for close to MSRP. That was thanks to demand from cryptocurrency miners, which was high enough that Nvidia actually started making its cards worse at mining. Manufacturers reported thereafter that demand was drying up, largely in response to changes in how cryptocurrency works and lowered interest in cryptocurrency overall. While the AI bubble hasn't popped (yet), it's possible RAM could follow a similar cycle if interest in AI starts to cool. Otherwise, it'll be up to manufacturers to balance supply and demand. Going back to Clarke's comments, he said "I'd categorize it as demand is way ahead of supply." On that note, while Micron is supposedly getting out of the consumer RAM game, Samsung and SK Hynix haven't stayed silent on the issue. As reported by Korean outlet Seoul Economic Daily, SK Hynix is planning to spend $500 billion to build new production plants, with the first set to open in 2027. The company also told The Verge that, concerning consumer products, it "is not considering to discontinue the related business." So, supply could see a boost in coming years. At the same time, it's difficult to know for sure when the RAM shortage will clear up. Contrasting SK Hynix, Samsung recently said during an investor relations call (as translated by PCGamer and originally reported on by Tech Insight) that it won't be "rapidly expanding facilities," and will instead pursue a much harder to define plan of "maintaining long-term profitability." Tech Insight took the opportunity to speculate that RAM prices could remain high through 2028. In short, it's clear that the market is still volatile, and that companies are still figuring out ways to address pricing. I can't say for certain when RAM prices will drop again, but going on what those in the industry are saying, as well as similar issues with GPUs in the past, it seems like the key indicators here would be a reduced interest in AI, or increased production capacity. In the meantime, because so many electronics need RAM, you may find yourself needing to bite the bullet and buy during the shortage. If that's the case, here are the best ways to buy RAM right now.

Share

Share

Copy Link

RAM prices have surged over 240% as AI data centers consume global DRAM supply, leaving consumer electronics starved for memory. The three major manufacturers—Samsung, SK Hynix, and Micron—control 95% of production and are pivoting to high-margin AI contracts. Micron's Crucial brand is exiting consumer markets entirely, while analysts predict the supply shortage could extend into 2028.

RAM Prices Skyrocket as AI Demand Reshapes Memory Markets

The cost of consumer RAM sticks on Amazon has climbed over 240% in recent months, marking one of the most dramatic price surges in the history of computer components

1

. What was once an afterthought in PC building budgets has transformed into a major expense, with premium 32GB DDR5 kits now selling for as much as $4002

. The RAM price surge stems from a fundamental shift in how memory manufacturers allocate their production capacity, driven primarily by AI demand from hyperscalers and data center operators.

Source: Lifehacker

AI Data Centers Create Unprecedented Supply Shortage

The explosive growth of AI data centers has created an unprecedented drain on global DRAM production. Major players like Oracle and AWS are consuming massive quantities of memory to power services like ChatGPT-5 and Google Gemini 3, which require super-fast memory for optimal performance

1

. According to industry reports, Samsung and SK Hynix have devoted approximately 40% of global RAM output to a single AI project—OpenAI's Stargate initiative4

. This concentration of resources on AI infrastructure has left consumer RAM markets struggling for supply, creating what some are calling "RAMageddon."The shift toward high bandwidth memory (HBM) production has intensified the crisis. HBM, a vertically stacked DRAM variant tuned for extreme throughput, is essential for AI training and inference operations. Every wafer allocated to HBM production means one less wafer available for standard DDR5, LPDDR5X, or GDDR6 used in consumer devices

3

. Memory manufacturers have followed the money, prioritizing long-term contracts with AI firms that offer predictable volume and significantly better margins than consumer DIMM sales.Three Memory Manufacturers Control 95% of Global Production

The DRAM market operates under a tight oligopoly, with Samsung, SK Hynix, and Micron controlling more than 90-95% of global production

1

3

. This concentration gives these companies significant pricing power, especially during supply constraints. As Gartner analyst Shrish Plant told The Verge, "If you are not a server customer, you will be considered a second priority for memory vendors"4

.The situation has become so severe that Samsung reportedly can't even sell RAM to Samsung's own divisions

2

. This internal supply crunch illustrates how deeply AI demand has disrupted traditional allocation patterns. Both contract prices and spot prices for DRAM production have moved sharply upward simultaneously, indicating that no segment remains insulated from the shortage3

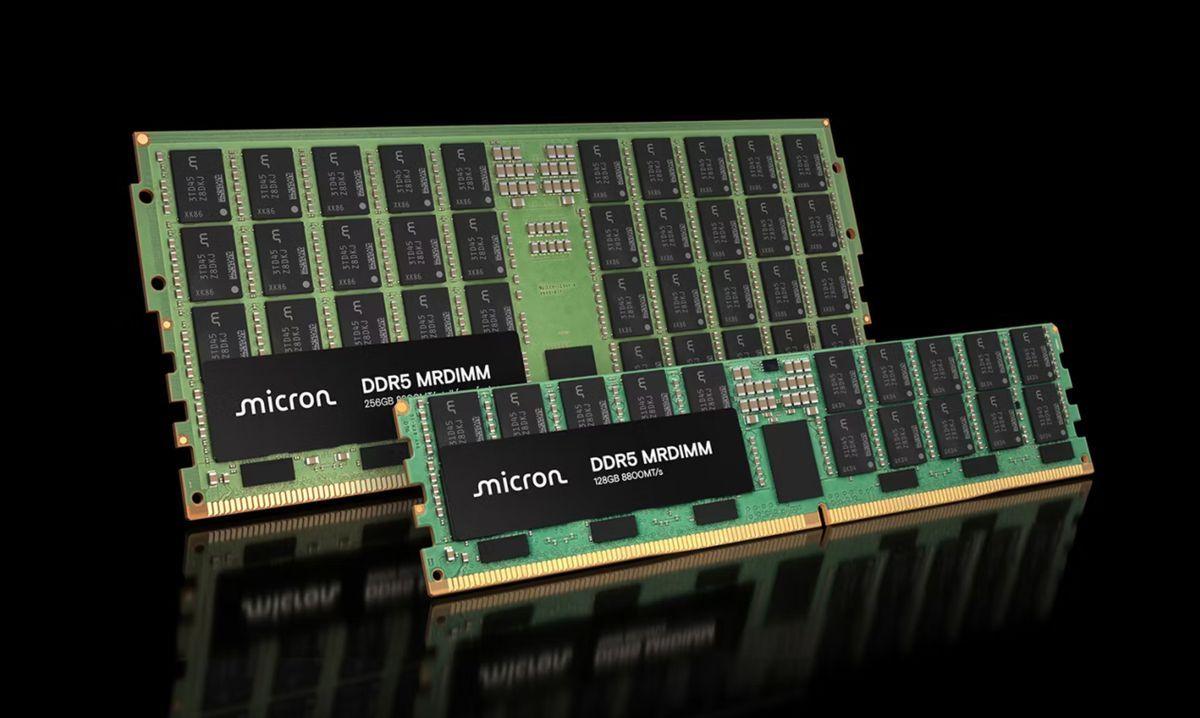

. Contract prices for notebook memory have jumped by double-digit percentages in a single quarter, while spot prices for common DDR5 chips have risen several times faster than typical seasonal fluctuations.Micron Exits Consumer Markets as Crucial Brand Disappears

In December, Micron announced plans to exit the consumer memory and storage market entirely, ending production of its Crucial branded RAM and SSDs after 30 years

3

4

. Crucial had served as a price anchor in consumer markets, often keeping competitors in check. The company's departure removes a stabilizing force and signals that other manufacturers may follow suit. Industry sources suggest that several companies are considering similar moves behind closed doors, prioritizing AI-focused production over consumer RAM1

.

Source: TechRadar

Micron plans to invest nearly $10 billion into a new DRAM facility, but production won't begin until 2028

1

. This timeline suggests that relief for consumer markets remains years away. Industry analysts predict that prices for DRAM and NAND chips will continue rising throughout the first half of 2026 as manufacturers fulfill long-term contracts with AI customers. In early 2026, stockpiles for consumer RAM could run completely dry if demand continues at current levels.Impact on Consumer Devices Spreads Across Categories

The RAM price crisis extends far beyond PC builders. Desktop PC manufacturers CyberpowerPC and Maingear issued warnings that global memory prices "surged by 500%," leading to price increases as early as December 7

1

. Framework, the modular laptop maker, announced imminent price increases, while Raspberry Pi raised prices on its most recent flagship, citing memory costs4

.

Source: Macworld

Laptops, tablets, smartphones, and gaming consoles all rely on DRAM, making them vulnerable to the supply shortage. Industry insiders report that nervousness among manufacturers is palpable, as plans for new devices face constant pricing flux

1

. Upcoming products like the Steam Machine and iPhone 18 may see inflated prices due to memory costs. Even older memory types like DDR3 and DDR4, which should be declining in price, are becoming more expensive as supply is cut faster than demand fades3

.Related Stories

Apple's Unique Position Offers Temporary Insulation

Apple appears uniquely positioned to weather the current storm, at least temporarily. The company negotiates large, long-term contracts for parts in extremely high volumes, likely locking in prices months or years in advance

2

. Apple's typical RAM cost represents approximately 4% of bill of materials costs, compared to 10-15% for inexpensive smartphones. Combined with Apple's high profit margins of 20-30% on most products, the company has cushion to absorb temporary price increases without losing money.However, Apple's insulation won't last indefinitely. When current contracts expire, the company will face the same market realities as other manufacturers. Historically, Apple raises prices with new product introductions rather than adjusting existing product lines, suggesting any impact might appear with future iPhone or Mac releases rather than current models.

Questions About AI Bubble and Future Outlook

The sustainability of current AI spending patterns remains uncertain. OpenAI has made $1.5 trillion in chip commitments while generating $12 billion in annual revenue, raising questions about return on investment

1

. If the AI bubble bursts and demand from data centers collapses, memory manufacturers could find themselves with excess capacity and falling prices. However, this scenario offers little comfort to consumers facing immediate shortages.In the near term, watch for continued price increases across consumer electronics categories. PC builders should consider securing RAM now rather than waiting, as prices show no signs of stabilizing. The supply chain dynamics suggest that 2026 will bring intensifying shortages before any potential relief arrives. Whether through new fabrication capacity coming online in 2028 or a correction in AI spending, the current crisis will reshape how consumers think about memory costs for years to come.

References

Summarized by

Navi

[1]

Related Stories

AI Demand Triggers Component Shortage as Dell and Lenovo Plan 15% Price Increases for Servers

03 Dec 2025•Business and Economy

AI Demand Triggers Memory Shortage That Could Push Phone Prices Up 8% and Delay Consoles

16 Feb 2026•Business and Economy

Memory prices could surge 95% by early 2026 as AI hardware demand reshapes the global chip market

23 Feb 2026•Business and Economy

Recent Highlights

1

Google Gemini 3.1 Pro doubles reasoning score, beats rivals in key AI benchmarks

Technology

2

Meta strikes up to $100 billion AI chips deal with AMD, could acquire 10% stake in chipmaker

Technology

3

Pentagon threatens Anthropic with supply chain risk label over AI safeguards for military use

Policy and Regulation