Samsung denies ending SATA SSD production as AI-driven demand reshapes memory markets

2 Sources

2 Sources

[1]

Samsung denies ending consumer SATA SSD production amid AI-driven NAND squeeze

Serving tech enthusiasts for over 25 years. TechSpot means tech analysis and advice you can trust. In context: Samsung has denied reports suggesting it plans to phase out production of consumer SATA SSDs, pushing back against claims in the hardware community. The clarification follows a flurry of speculation originating from the YouTube channel Moore's Law Is Dead, which claimed Samsung was preparing to wind down its SATA SSD business due to tightening NAND flash supply. The controversy comes amid escalating demand for semiconductor memory driven by the growth of artificial intelligence infrastructure. Much of the industry's available NAND flash, once destined for consumer hardware such as SSDs, is now being redirected toward hyperscalers and AI labs. That shift has created one of the most constrained storage environments in years, with major component suppliers reallocating production and inventories. According to Moore's Law Is Dead (MLID), multiple distribution and retail sources indicated that Samsung was planning to halt SATA III SSD production permanently. The outlet suggested that the company's newer NAND facilities - particularly in Pyeongtaek and Hwaseong - were being retooled for DRAM production. Those facilities include the upcoming Pyeongtaek Fab 4, expected to manufacture memory chips on Samsung's advanced 1c process node, with a focus exclusively on DRAM. The move, if true, would mark a notable shift for a company long regarded as one of the world's leading suppliers of both NAND and DRAM technologies. Samsung's denial casts doubt on the notion of an imminent exit from SATA SSDs, but the broader pressures on the storage market remain very much real. A persistent shortage of NAND flash has driven dramatic price increases, with reports noting that the cost of a 1-terabit TLC NAND chip jumped from $4.80 in July 2025 to $10.70 by November - more than doubling in under six months. Prices for MLC and QLC NAND have followed similar trajectories, creating a ripple effect across manufacturers and resellers. The shortage has already disrupted supply chains for several brands. Transcend, for example, has reportedly not received a NAND flash shipment since October. It expects relief only after another three to five months of constrained availability. Those interruptions highlight just how steep the demand for AI applications has become, siphoning resources from consumer segments like PC storage and general-purpose DRAM even as global inventories continue to shrink. While interest in SATA-based drives among enthusiasts has declined in recent years, the format still accounts for a meaningful portion of SSD sales in the mainstream market. Data cited by MLID suggests that around one-fifth of Amazon's best-selling SSDs remain SATA models, with Samsung's 870 EVO among the most prominent. Pulling that supply out of circulation, the channel warned, could elevate prices across the entire SSD landscape, including NVMe-based products that rely on the same NAND components. Industry analysts have also predicted that this imbalance may persist for years. As AI infrastructure expands, hyperscale data centers continue absorbing the lion's share of both NAND and DRAM output. Some forecasts suggest production will not fully rebalance toward consumer demand until the next hardware cycle - likely around 2027 - when local AI workloads and new console generations renew demand for high-speed flash storage. For now, Samsung remains a cornerstone of the consumer SSD market, and its denial offers short-term reassurance to system builders and PC upgraders. Yet even if SATA drives stay in production, the pressure from AI-driven component demand continues to reshape priorities within the world's largest memory suppliers.

[2]

Samsung will reportedly announce the end of SATA SSD production next year, multiple industry sources suggest, adding to our memory pricing woes

Let's say you have this friend, right? And let's say they took one look at the current memory pricing apocalypse, and the knock-on effect it's having on NVMe SSDs, before scoffing, "Well, I'll just pick up some SATA drives -- I'll save money, then!" Well, this friend of ours might want to get a hustle on, as these may become pricier and harder to find very soon. Why? Samsung may announce as soon as January that it will be ceasing production of SATA SSDs -- at least, according to the multiple industry sources that gaming and tech news channel Moore's Law Is Dead claims to have spoken to. This report predicts that the winding down of SATA SSD production will contribute to already rising storage prices over the next two years. The Moore's Law Is Dead report reasons that, with so much of system and storage memory stock being eaten up by the rapidly expanding AI industry, it makes sense that Samsung would move away from more budget consumer fare like SSDs with a SATA interface. In fact, Samsung announced it was partnering with Nvidia on an 'AI Megafactory' back in October. But besides the current AI-dominated landscape, NVMe SSDs can also be cheaper to produce while also reaching speeds unimpeded by their interface of choice. SATA interfaces enjoy a theoretical top speed of 550 MB/s or so, effectively bottlenecking any speedier NAND that may be housed within. With AI taking a bite out of the NAND apple, it's not hard to see why Samsung would rather put its supply to better, more profitable use elsewhere. Along similar lines, SATA shells are just one more manufacturing cost for companies like Samsung to worry about. On the other hand, the 'what you see is what you get' design of NVMe drives may be more fragile, but it is also vastly more appealing to a manufacturer's bottom line. Samsung isn't the only company that's made the headlines by bailing out of a much-loved market, either. Just a few weeks ago, Micron announced that it will shut down its Crucial consumer product line (DRAM, NVMe SSDs, and SATA SSDs) early next year. However, the Moore's Law Is Dead report says it's not all doom and gloom, positing that the memory apocalypse won't necessarily continue past 2028 like some other predictions suggest, with prices potentially dropping towards the very end of 2026. The reasoning is that locally hosted AI apps will become much more in-demand and widespread around 2027, therefore requiring all the beefy memory hardware currently experiencing a shortage to be redirected to the production of consumer devices once more. Either that or AI fails to make this consumer-focused pivot, and the swirling bubble of circular investments pops very dramatically. However, if this latter scenario plays out with a bubble one market analyst described as four times the size of the subprime mortgage bubble that led to the 2008 global crash, then a memory shortage may be the least of anyone's concerns.

Share

Share

Copy Link

Samsung has pushed back against reports claiming it plans to phase out consumer SATA SSD production, despite mounting pressure from AI infrastructure. The controversy highlights how artificial intelligence is redirecting NAND flash memory away from consumer hardware, creating supply constraints and driving dramatic price increases across the storage market.

Samsung Refutes SATA SSD Production Shutdown Claims

Samsung has denied reports suggesting it plans to end consumer SATA SSD production, countering speculation that swept through the hardware community following claims by YouTube channel Moore's Law Is Dead

1

. The channel cited multiple distribution and retail sources indicating Samsung was preparing to permanently halt SATA III SSD manufacturing due to constrained NAND flash supply2

. According to the report, Samsung's newer NAND facilities in Pyeongtaek and Hwaseong were allegedly being retooled for DRAM production, with the upcoming Pyeongtaek Fab 4 expected to focus exclusively on advanced 1c process node memory chips1

. While Samsung's denial offers reassurance to system builders, the broader tensions affecting the storage market remain acute.

Source: TechSpot

AI-Driven Demand Reshapes Memory Supply Chains

The controversy emerges as AI-driven demand fundamentally alters semiconductor memory allocation priorities. Much of the industry's available NAND flash memory, once destined for consumer hardware like SSDs, is now being redirected toward hyperscalers and AI labs

1

. This shift has created one of the most constrained storage environments in years, with major memory suppliers reallocating production and inventories to serve the rapidly expanding AI industry2

. The pressure extends beyond NAND to encompass DRAM as well, as AI infrastructure absorbs the lion's share of both memory types. Samsung's partnership with Nvidia on an 'AI Megafactory' announced in October underscores how deeply AI is influencing manufacturing priorities2

.Rising Prices and Supply Chain Disruptions Hit Storage Market

Memory pricing woes have intensified dramatically as the shortage persists. The cost of a 1-terabit TLC NAND chip jumped from $4.80 in July 2025 to $10.70 by November, more than doubling in under six months

1

. Prices for MLC and QLC NAND have followed similar trajectories, creating ripple effects across manufacturers and resellers. Supply chains have faced severe disruptions, with Transcend reportedly receiving no NAND flash shipment since October and expecting relief only after another three to five months1

. These interruptions demonstrate how steep demand for AI applications has become, siphoning resources from consumer segments even as global inventories shrink. The shortage affects both NVMe SSDs and SATA models, with rising prices threatening affordability across the entire storage landscape.Related Stories

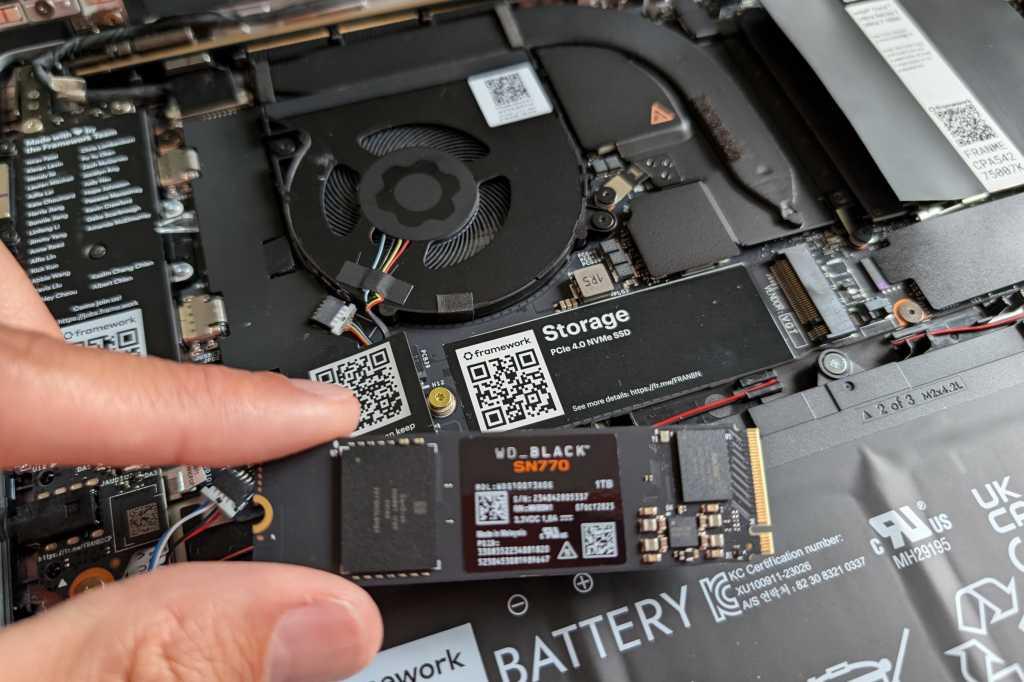

SATA SSD Market Remains Significant Despite NVMe Growth

While enthusiast interest in SATA-based drives has declined, the format still accounts for meaningful sales in the mainstream market. Data suggests around one-fifth of Amazon's best-selling SSDs remain SATA models, with Samsung's 870 EVO among the most prominent

1

. SATA interfaces reach theoretical top speeds of 550 MB/s, effectively bottlenecking speedier NAND compared to NVMe SSDs2

. From a manufacturing perspective, NVMe drives can be cheaper to produce without SATA shells representing an additional cost2

. Samsung isn't alone in reconsidering consumer product lines—Micron announced it will shut down its Crucial consumer product line, including DRAM, NVMe SSDs, and SATA SSD, early next year2

.

Source: PC Gamer

Future Outlook for Memory Markets and Consumer Impact

Industry analysts predict this imbalance may persist for years as AI infrastructure expands and data centers continue absorbing the majority of both NAND and DRAM output

1

. Some forecasts suggest production will not fully rebalance toward consumer demand until the next hardware cycle, likely around 2027, when locally hosted AI applications and new console generations renew demand for high-speed flash storage1

. Moore's Law Is Dead posits that prices could potentially drop towards the very end of 2026, reasoning that locally hosted AI apps will become more widespread and require memory hardware to be redirected back to consumer device production2

. For now, Samsung remains a cornerstone of the consumer SSD market, but even with continued SATA drive production, pressure from AI continues reshaping priorities within the world's largest memory suppliers1

.References

Summarized by

Navi

Related Stories

Memory prices surge 300% as AI demand creates supply shortage for consumers and PC makers

26 Jan 2026•Business and Economy

AI Boom Triggers Unprecedented Shortage in Memory and Storage Components

15 Oct 2025•Technology

Memory suppliers caught between AI boom and consumer DRAM shortages as market dynamics shift

16 Jan 2026•Business and Economy

Recent Highlights

1

Pentagon threatens Anthropic with Defense Production Act over AI military use restrictions

Policy and Regulation

2

Google Gemini 3.1 Pro doubles reasoning score, beats rivals in key AI benchmarks

Technology

3

Anthropic accuses Chinese AI labs of stealing Claude through 24,000 fake accounts

Policy and Regulation