SpaceX acquires xAI as Elon Musk bets big on 1 million satellite constellation for orbital AI

102 Sources

102 Sources

[1]

SpaceX acquires xAI, plans 1 million satellite constellation to power it

SpaceX has formally acquired another of Elon Musk's companies, xAi, the space company announced on Monday afternoon. "SpaceX has acquired xAI to form the most ambitious, vertically-integrated innovation engine on (and off) Earth, with AI, rockets, space-based internet, direct-to-mobile device communications and the world's foremost real-time information and free speech platform," the company said. "This marks not just the next chapter, but the next book in SpaceX and xAI's mission: scaling to make a sentient sun to understand the Universe and extend the light of consciousness to the stars!" The merging of what is arguably Musk's most successful company, SpaceX, with the more speculative xAI venture is a risk. But Musk strongly believes that artificial intelligence is central to humanity's future and wants to be among those leading in its development. With this merger, he plans to use SpaceX's deep expertise in rapid launch and satellite manufacturing and management to deploy a constellation of up to 1 million orbital data centers. This will provide the backbone of computing power needed to support xAI's operations. "This new constellation will build upon the well-established space sustainability design and operational strategies, including end-of-life disposal, that have proven successful for SpaceX's existing broadband satellite systems," Musk wrote in an email to employees on Monday. This is a developing story, and it will be updated.

[2]

Elon Musk is getting serious about orbital data centers | TechCrunch

On Friday, when SpaceX filed plans with the FCC for a million-satellite data center network, you might have thought Elon Musk was having a bit of fun with us. But a week later, it is clear that he is dead serious. The most obvious step, of course, is the formal merger between SpaceX and xAI that went forward on Monday, officially drawing together Musk's space and AI ventures in a way that makes a lot more sense if there's some kind of joint infrastructure project planned. But even beyond the merger, we're starting to see the idea of orbital AI data clusters -- essentially, networks of computers operating in space -- cohere into an actual plan. On Wednesday, the FCC accepted the filing and set a schedule seeking public comment. It's a pro forma step normally, but FCC chairman Brendan Carr took the unusual step of sharing the filing on X. Throughout his tenure as chairman, Carr has shown himself eager to help Trump's friends and punish his enemies -- so as long as Musk stays on Trump's good side, the proposal is likely to sail through without issue. At the same time, Elon Musk has started to flesh out the argument for orbital data centers in public. On a new episode of Stripe co-founder Patrick Collison's podcast "Cheeky Pint," which also featured guest Dwarkesh Patel, Musk laid out the basic case for moving most of our AI computing power into space. Essentially, solar panels produce more power in space, so you can cut down on one of the main operating expenses for data centers. "It's harder to scale on the ground than it is to scale in space," Musk said in the podcast. "Any given solar panel is going to give you about five times more power in space than on the ground, so it's actually much cheaper to do in space." Close listeners will note that there is a bit of a gap in the logic here! It's true that solar panels produce more power in space, but since power isn't the only cost in operating a data center and solar panels aren't the only way to power a data center, it doesn't follow that it's cheaper to do the whole thing in orbit, as Patel noted in the podcast. Patel also raised concerns about servicing GPUs that fail during AI model training, but you'll have to listen to the full episode for that. Overall, Musk was undeterred, marking 2028 as a tipping point year for orbital data centers. "You can mark my words, in 36 months but probably closer to 30 months, the most economically compelling place to put AI will be space," Musk said. He didn't stop there. "Five years from now, my prediction is we will launch and be operating every year more AI in space than the cumulative total on Earth," Musk continued. For context, as of 2030, global data center capacity will be an estimated 200 GW, which is roughly a trillion dollars' worth of infrastructure when you're just putting it on the ground. Of course, SpaceX makes its money by launching things into orbit, so all this is pretty convenient for Musk -- particularly now that SpaceX has an AI company attached to it. And with the new SpaceX-xAI conglomerate headed for an IPO in just a few months, you can expect to hear a lot more about orbital data centers in the months ahead. With tech companies still pouring hundreds of billions of dollars into data center spending each year, there's a real chance that not all the money will remain earthbound.

[3]

Elon Musk fuses SpaceX with xAI

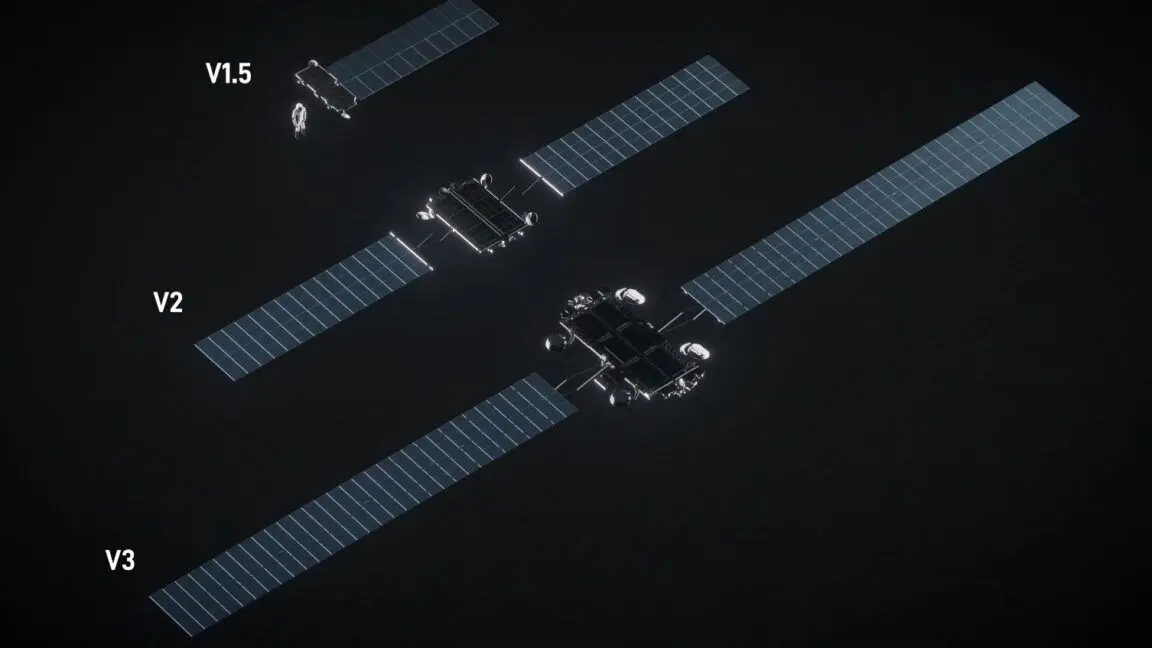

I agree my information will be processed in accordance with the Scientific American and Springer Nature Limited Privacy Policy. We leverage third party services to both verify and deliver email. By providing your email address, you also consent to having the email address shared with third parties for those purposes. Elon Musk's SpaceX has acquired xAI, the artificial intelligence startup behind chatbot Grok also owned by the tech billionaire. The move consolidates several of Musk's major ventures, bringing his rockets, social media company X, Grok, and SpaceX's satellite internet offshoot Starlink under a single umbrella. The merger could boost Musk's plans to power next-generation AI from space using an orbital data center made up of as many as one million satellites. It also catapults the worth of the combined entity to a reported $1.25 trillion. "Current advances in AI are dependent on large terrestrial data centers, which require immense amounts of power and cooling," a memo posted to SpaceX's website on Monday and signed by Musk reads. "Global electricity demand for AI simply cannot be met with terrestrial solutions, even in the near term, without imposing hardship on communities and the environment." If you're enjoying this article, consider supporting our award-winning journalism by subscribing. By purchasing a subscription you are helping to ensure the future of impactful stories about the discoveries and ideas shaping our world today. The memo touts SpaceX's still in-development Starship, which Musk claims will one day enable hourly launches, each carrying as much as 200 tons of material into orbit. But Starship's ability to launch satellites into orbit is largely unproven, and the spacecraft's development is behind schedule. And it remains unclear what form SpaceX's proposed satellites would take. Regardless of how SpaceX plans to launch and operate its orbital data center -- the firm has offered scant details -- the idea has a grand advantage over Earth-based facilities: the abundance of solar energy. "It's always sunny in space!" Musk wrote.

[4]

Elon Musk Rolls His AI Startup Into SpaceX, Creating the World's Most Valuable Company

Elon Musk's rocket and satellite company SpaceX is acquiring his AI startup xAI, the centibillionaire announced on Monday. In a blog post, Musk said the acquisition was warranted because global electricity demand for AI cannot be met with "terrestrial solutions," and Silicon Valley will soon need to build data centers in space to power its AI ambitions. "In the long term, space-based AI is obviously the only way to scale," Musk wrote. "The only logical solution therefore is to transport these resource-intensive efforts to a location with vast power and space. I mean, space is called 'space' for a reason." The deal, which pulls together two of Musk's largest private ventures, values the combined entity at $1.25 trillion, making it the most valuable private company in the world, according to a report from Bloomberg. SpaceX was in the process of preparing to go public later this year before the xAI acquisition was announced. The space firm's plans for an initial public offering are still on, according to Bloomberg. In December, SpaceX told employees that it would buy insider shares in a deal that would value the rocket company at $800 billion, according to The New York Times. Last month, xAI announced that it had raised $20 billion from investors, bringing the company's valuation to roughly $230 billion. This isn't the first time Musk has sought to consolidate parts of his vast business empire, which is largely privately owned and includes xAI, SpaceX, the brain interface company Neuralink, and the tunnel transportation firm the Boring Company. Last year, xAI acquired Musk's social media platform X, formerly known as Twitter, in a deal that valued the combined entity at more than $110 billion. Since then, xAI's core product, Grok, has become further integrated into the social media platform. Grok is featured prominently in various X features, and Musk has claimed the app's content recommendation algorithm is powered by xAI's technology. A decade ago, Musk also used shares of his electric car company Tesla to purchase SolarCity, a renewable energy firm that was run at the time by cousin Lyndon Rive. The xAI acquisition demonstrates how Musk can use his expansive network of companies to help power his own often grandiose visions of the future. Elon Musk said in the blog post that SpaceX will immediately focus on launching satellites into space to power AI development on Earth, but eventually, the space-based data centers he envisions building could power civilizations on other planets, such as Mars. "This marks not just the next chapter, but the next book in SpaceX and xAI's mission: scaling to make a sentient sun to understand the Universe and extend the light of consciousness to the stars," Musk said in the blog post.

[5]

Elon Musk is making a big bet on his future vision - will it work?

Reports suggest that Elon Musk is eyeing up a merger involving SpaceX, Tesla and xAI, but what does he hope to achieve by consolidating his business empire? Elon Musk is a busy man, heading up multiple billion-dollar companies. While he is increasingly a divisive figure, there is no doubt that Tesla and SpaceX, his two most important ventures, have done much to advance the future of electric cars and spacecraft, respectively. But a series of corporate moves this week suggests Musk has a new vision of the future - and he may be combining all his companies to get there. First, Musk's electric car company, Tesla, announced that it was halting production of two of its flagship vehicles, the Model S and Model X. The decision doesn't mean Tesla will stop making vehicles altogether, but the factories for these two models will now be repurposed into a facility to produce Tesla's Optimus humanoid robots. At the same time, Tesla said it would invest $2 billion in xAI, another Musk firm that owns the social media site X and its controversial chatbot, Grok. Put together, it suggests that Tesla is shifting priorities towards more AI-intensive activities, which is where the next major revelation comes into play. According to reporting by Bloomberg and Reuters, Musk is planning to merge SpaceX with Tesla or xAI - or perhaps even both - as part of a plan to list the space firm on the stock market this year. So, what could Musk be hoping to achieve through consolidating his business empire? "By merging xAI and SpaceX, Musk is likely looking for resource optimisation across data flows, energy and computing," says Merve Hickok at the University of Michigan. "He had also entertained the possibility of a merger with Tesla to use each [vehicle] as a distributed computing resource." The calculation appears to be that Tesla's planned future in humanoid robots - Musk said this week that he wants to produce 1 million units of the third-generation Optimus robot per year from his newly converted Tesla factory - will need a lot of computing resources for AI. Interaction with a built-up environment alongside people, as humanoid robot adherents hope will happen, requires specialist AI models to crunch through lots of data. But the generative AI revolution is already stretching energy supplies to their limit. Musk's xAI was recently censured by the US Environmental Protection Agency for breaching legal limits of power generation for its Colossus data centre in Memphis, Tennessee. He has also previously spoken about the need to put data centres in space: at the recent World Economic Forum in Davos, Switzerland, Musk called the idea a "no-brainer" and said full-scale deployment was possible within two or three years. It should be noted that others are less bullish on these proposals, as a host of technical difficulties from cooling to radiation protection need to be solved first. Those objections aside, getting data centres into orbit means launching them - and SpaceX is one of the most reliable suppliers of rockets and launches to the private and public sectors, as well as being experienced in satellite orbits, thanks to its Starlink internet arm. "SpaceX is putting grids of satellites up in space - they already have 9000 - and those grids are about internet distribution," says Robert Scoble, a technology analyst Unaligned. "xAI is doing internet distribution and news, but they are really about building new kinds of AI models to run our cars, our humanoid robots, and our lives." He says that "adding these two together makes a lot of sense". In other words, Musk seems to believe that combining SpaceX, Tesla and xAI will let him dominate the future of AI in a way that will be difficult for competitors like OpenAI, Google and Microsoft to match. None of the three companies responded to a request for comment, nor did Musk himself. However, not everyone agrees that's what's behind the plans. "They all lack the economics, with the exception of Tesla, which is heading in the wrong direction, to fund their growth," says Edward Niedermeyer, author of Ludicrous: The unvarnished story of Tesla motors. He sees the decision as a "defensive" move designed to shore up their futures - and to engage a wider range of financing from public investors. That public investor cash will be vital, reckons Niedermeyer, because of the rate at which Musk's companies are reportedly running through cash is significant: the cost of training and then running AI models is expensive, as many AI companies are discovering. "It has to burn just insane amounts of cash," says Niedermeyer - and so Musk may be hoping that putting all of his eggs into one readily investable basket will make his vision attractive enough for people to part with their funds. If not - or if his envisioned future fails to come to fruition - it may all come crashing back to Earth.

[6]

Elon Musk's SpaceX officially acquires Elon Musk's xAI, with plan to build data centers in space | TechCrunch

SpaceX has acquired Elon Musk's artificial intelligence startup, xAI, creating the world's most valuable private company, the spaceflight company announced Monday. Musk, who is also the CEO of SpaceX, wrote in a memo posted to the rocket company's website that the merger is largely about creating space-based data centers -- an idea he has become fixated on over the last few months. "Current advances in AI are dependent on large terrestrial data centers, which require immense amounts of power and cooling. Global electricity demand for AI simply cannot be met with terrestrial solutions, even in the near term, without imposing hardship on communities and the environment," he wrote. (xAI has been accused of imposing some of that hardship on the communities near its data centers in Memphis, Tennessee.) The tie-up values the combined company at $1.25 trillion, according to Bloomberg News, which was first to report the completed deal. SpaceX has been reportedly preparing an IPO for as early as June of this year. It's unclear whether the merger will affect that timeline. Musk did not address the IPO in his public memo. The merger brings together two of Musk's companies, each with its own financial challenges. xAI is currently burning around $1 billion per month, according to Bloomberg. SpaceX, meanwhile, generates as much as 80% of its revenue from launching its own Starlink satellites, according to Reuters. Last year, xAI acquired X, the social media company also owned by Musk, with Musk claiming a combined company valuation of $113 billion. Musk wrote in his memo that it will take a constant stream of many -- although he did not specify how many -- satellites to create these space-based data centers, ensuring that SpaceX will have an even-larger constant stream of revenue for the foreseeable future. (That revenue loop likely looks even more attractive when you consider that satellites are required to be de-orbited every five years by the Federal Communications Commission.) While space data centers may be the stated goal, SpaceX and xAI have very different near-term objectives. SpaceX is currently trying to prove that its Starship rocket is capable of bringing astronauts to the moon and Mars, while xAI is competing with leading artificial intelligence companies like Google and OpenAI. The pressure on xAI is so great, the Washington Post reported Monday, that Musk loosened restrictions on the company's chatbot Grok -- which contributed to it becoming a tool for making AI-generated non-consensual sexual imagery of adults and children.

[7]

Elon Musk's SpaceX Is Acquiring xAI With Big Plans for Data Centers in Space

The massive merger is part of a plan to power "space-based AI," according to Musk. Two of Elon Musk's companies are merging to build data centers in space, according to a post on the SpaceX website. The rocket and satellite company has acquired xAI, Musk's artificial intelligence company, which also owns the social media platform X (formerly Twitter). In the post, Musk said the combined company is "the most ambitious, vertically integrated innovation engine on (and off) Earth, with AI, rockets, space-based internet, direct-to-mobile device communications and the world's foremost real-time information and free speech platform." SpaceX is planning a public offering, and the acquisition, the largest in history, could place the value of Musk's company at $1.5 trillion, according to Bloomberg, which first reported on the deal. The New York Times estimates the value as closer to $1 trillion. In the post, Musk cited concerns about Earth-based data centers, including their huge electricity needs and the "hardship on communities and the environment" they pose. He said the acquisition is part of a plan to use solar power to run data centers and space-based facilities that would train AI models and drive scientific breakthroughs. "My estimate is that within 2 to 3 years, the lowest cost way to generate AI compute will be in space," Musk said. A representative for SpaceX did not immediately respond to a request for comment.

[8]

Elon Musk's SpaceX reportedly mulling a merger with xAI

I agree my information will be processed in accordance with the Scientific American and Springer Nature Limited Privacy Policy. We leverage third party services to both verify and deliver email. By providing your email address, you also consent to having the email address shared with third parties for those purposes. Elon Musk's SpaceX and his artificial intelligence start-up xAI are reportedly mulling a merger, a move that would bring SpaceX's rockets and satellite Internet subsidiary Starlink under a single umbrella with xAI -- which oversees the social media platform X and the chatbot Grok. The two wings of Musk's sprawling tech empire could merge ahead of a plan to take SpaceX public later this year, according to Reuters, which cited and anonymous source and recent company filings. SpaceX's initial public offering could see the company valued at $1.5 trillion, according to the Financial Times. A merger with xAI could boost Musk's plan to use SpaceX's still-in-development Starship rocket to launch orbital AI data centers, experts have speculated. Musk and other AI leaders are increasingly bullish on space as an answer to all the problems with data centers: Though costly to build and expensive to power, increasingly sprawling data centers are central to many AI company's growth strategies. As demand for AI grows, earthbound data centers -- and power supplies -- may not be able to keep up. Data centers in orbit, however, would have practically unlimited access to solar energy -- although such hardware would also come with its limits. If you're enjoying this article, consider supporting our award-winning journalism by subscribing. By purchasing a subscription you are helping to ensure the future of impactful stories about the discoveries and ideas shaping our world today. SpaceX and xAI did not immediately respond to a request for comment.

[9]

Elon Musk is merging SpaceX and xAI to build data centers in space -- or so he says

On Monday, Elon Musk announced that he was merging two of his companies, SpaceX and xAI, in a deal said to be worth $1.25 trillion. The reason, Musk said in an announcement, was that in order for AI to grow, it needed to go to space. AI relies on "large terrestrial data centers" that run on "immense amounts of power and cooling," he said, which comes at great expense to the environment and community opposition. The solution: data centers in space. "In the long term, space-based AI is obviously the only way to scale," Musk said. Musk isn't the only one looking to launch data centers into orbit. Google has Project Suncatcher to build solar-powered AI data centers in space. China is looking into space-based data centers, as is Europe. As we reported last year, space-based data centers -- in the form of satellites with solar panels -- are Big Tech's latest fad and Silicon Valley's newest investable venture. On the surface, it sounds like a logical solution to the unique problem presented by power-hungry data centers. Local communities are rising up against data center projects over concerns about electricity demand, water usage, and rising utility rates. Launching those data centers into space means they are not taking up any space on Earth, and in a sun-synchronous orbit there is the availability of solar energy. But there's another, simpler way of looking at Musk's merger: SpaceX is profitable, and xAI is not. Not only is xAI not profitable, it's in the midst of a serious cash burn as it races to compete with well-financed rivals like Google and OpenAI. As Bloomberg recently reported, the AI company is burning about $1 billion a month as it spends heavily to build data centers, recruit talent, and run the social media platform X. Meanwhile, SpaceX generated about $8 billion in profit on an estimated $16 billion of revenue last year, Reuters reported. The main revenue driver is Starlink, which accounts for up to 80 percent of the company's revenue. Since 2019, SpaceX has launched over 9,500 satellites and boasts up to 9 million broadband internet users. The company is also a major government contractor, having secured over $20 billion in NASA and Defense Department deals since 2008. When it goes public later this year, SpaceX is expected to raise up to $50 billion in investment. Meanwhile, xAI has it own government tie-ups. The Department of Defense is using Grok, in addition to other chatbots, to analyze information that flows through its military intelligence networks. It's not clear how investors will feel about merging the cash-burning xAI with the profitable SpaceX. But it's important to note that Musk has done this before, when he merged the debt-ridden SolarCity with Tesla in 2016. Since Musk was the largest shareholder and chairman of both Tesla and SolarCity, shareholders sued to block the merger, alleging it was a $2.6 billion "bailout" of a cash-strapped, struggling company. Musk eventually won the lawsuit, with a judge ruling that he did not force Tesla to overpay for SolarCity. Musk now faces a new lawsuit from Tesla shareholders over his creation of xAI. The lawsuit alleges that Musk breached his fiduciary duty to Tesla by forming xAI, which competes with the automaker for AI talent, resources, and Musk's attention. The news that SpaceX is acquiring xAI certainly won't settle those concerns; if anything, it makes it more chaotic and complex. So where does this all leave Tesla? In the most recent earnings report, Tesla said it was investing $2 billion into xAI "to enhance Tesla's ability to develop and deploy AI products and services into the physical world at scale." Grok, xAI's chatbot that's currently under investigation in multiple countries for generating nonconsensual sexualized images of people, including children, was recently integrated into certain Tesla vehicles as a voice assistant. Grok also lags behind OpenAI's ChatGPT, Google's Gemini, Anthropic's Claude, and other large language models in several key metrics. Data centers in space is pure Musk futurism that has no guarantee of success. It's not as simple as just strapping a GPU to a rocket and hitting "launch." First off, GPUs are total power hogs. Unless you've got a nuclear reactor floating up there, you're going to need a massive solar arrays to power it. Then there's the communication situation; even if you're hitching a ride on Starlink, you still have to figure out the budget for sending info back and forth to Earth. Eventually, the numbers start to look pretty scary. Musk says merging SpaceX and xAI is the way to make it happen. And perhaps one day he'll take the suggestion of bullish investors to combine all his companies, including Tesla, Neuralink, and the Boring Company, into one massive, Musk-run mega-corporation: Musk Inc., if you will. How will Tesla shareholders react? "Tesla is Musk's liquid piggy bank, since it's publicly traded; his other companies are not," Tesla investor James McRitchie said during a prevote presentation before the company's 2024 shareholder meeting, according to The Wall Street Journal. "Either he sticks around long enough to use our shareholder capital to fund his other ventures, or he shifts his attention sooner if we reject his pay package and turn off the money tap."

[10]

Elon Musk's SpaceX and xAI in talks to merge, report says | TechCrunch

SpaceX and xAI, both companies led by Elon Musk, could merge ahead of a planned SpaceX IPO this year, according to a report from Reuters. This would bring products like the Grok chatbot, X platform, Starlink satellites, and SpaceX rockets together under one corporation. Company representatives have not discussed this possibility in public. However, recent filings show that two new corporate entities were established in Nevada on January 21, which are called K2 Merger Sub Inc. and K2 Merger Sub 2 LLC. Combining the two companies could allow xAI to put its data centers in space, something Musk has said he wants. This move would also fall in line with Musk's recent strategies to consolidate his companies. Last year, SpaceX agreed to invest $2 billion in xAI, according to The Wall Street Journal, and earlier this week, Tesla (also led by Musk) revealed it, too, invested $2 billion in the AI startup. Last year, xAI bought X in a deal that Musk said valued xAI at $80 billion and X at $33 billion. SpaceX, which has been around since 2002, reportedly launched a secondary sale that valued it at $800 billion, making it the most valuable private company in the U.S.

[11]

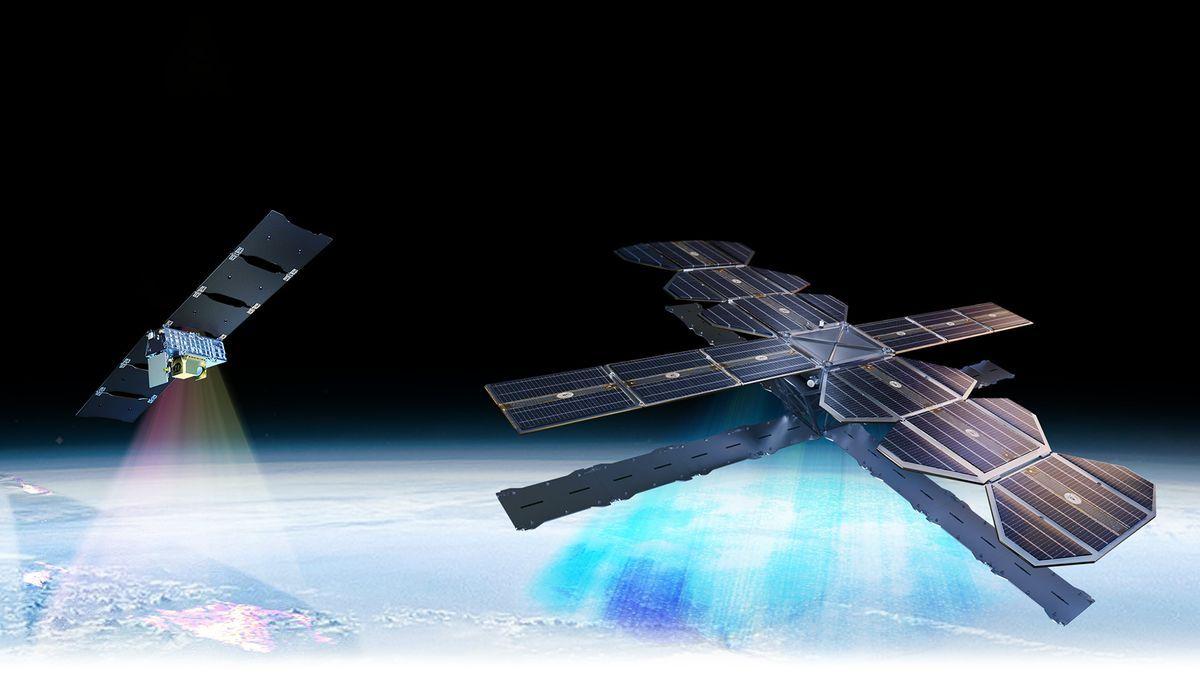

SpaceX acquires xAI in a bid to make orbiting data centers a reality -- Musk plans to launch a million tons of satellites annually, targets 1TW/year of space-based compute capacity

SpaceX has officially announced its acquisition of xAI, allowing the two companies to vertically integrate their operations and help Elon Musk achieve his dream of artificial intelligence in space. According to the company's announcement, space is the only logical solution to scaling AI data centers, as we do not have enough resources on Earth to power these systems. "Current advances in AI are dependent on large terrestrial data centers, which require immense amounts of power and cooling. Global electricity demand for AI simply cannot be met with terrestrial solutions, even in the near term, without imposing hardship on communities and the environment," the company said in its statement. "In the long term, space-based AI is obviously the only way to scale. To harness even a millionth of our Sun's energy would require over a million times more energy than our civilization currently uses!" The company has already begun taking the first steps to achieving this dream with its latest FCC filing mentioning plans to launch a million satellites into orbit. These orbital data centers would directly harness the power of the sun without interference from the Earth's atmosphere or rotation, allowing it to run more efficiently compared to terrestrial infrastructure. This isn't a small project, either. Musk says that "launching a million tons per year of satellites generating 100 kW of compute power per ton would add 100 gigawatts of AI compute capacity annually, with no ongoing operational or maintenance needs." He even mentioned launching up to 1TW/year, which would make this orbital data center the most powerful one operated by an AI tech company. Although launching satellites into space is quite an expensive and resource-intensive endeavor, Musk claims that the efficiency of these data centers would make them "the lowest cost way to generate AI compute." This is made possible by SpaceX's advancements with the reusable Starship rocket, which will also be launching the newer, much bigger V3 Starlink satellites this year. He also mentioned his plans of using the platform to build a manufacturing base on the moon and use it to launch up to 1,000TW/year into deep space and help humanity become a Kardashev Type II civilization. Despite Musk's massive financial resources, his dream still faces some challenges, which is why Nvidia CEO Jensen Huang doubts whether this project will work. For one, electronics like advanced AI chips are susceptible to cosmic radiation, corrupting data and frying circuits. There's also the question of cooling, as the usual solutions that work on Earth's surface aren't applicable in space, instead relying on the vacuum of space to serve as an "infinite heatsink." And last, but not least, putting so many satellites in orbit around the Earth risks a Kessler Syndrome event, which would throw enough space junk in orbit to make launching anything -- from satellites to crewed deep-space missions -- an utter impossibility for the next couple of hundred years.

[12]

SpaceX Acquires Musk's xAI to Fuel Orbital Data Center Plans

SpaceX is merging with Elon Musk's xAI ahead of a planned initial public offering and the billionaire's effort to create orbiting data centers. The IPO is expected to generate tens of billions of dollars, giving xAI a new source of funds. Musk also says the arrangement is meant to pave the way for space-based data centers, days after SpaceX filed a plan to operate up to one million satellites for the project. "In the long term, space-based AI is obviously the only way to scale," Musk says in a post announcing the xAI deal, which also cites the benefits of solar energy. "The only logical solution therefore is to transport these resource-intensive efforts to a location with vast power and space." The Information reports SpaceX is spending $250 billion to acquire xAI, citing a person familiar with the deal. SpaceX also describes the deal as creating "one of the most ambitious, vertically integrated innovation engines," pointing to how the orbiting data centers can source all their rockets and computing technology from SpaceX and xAI. (xAI also owns X or what used to be Twitter.) "It's always sunny in space!" Musk adds. "Launching a constellation of a million satellites that operate as orbital data centers is a first step towards becoming a Kardashev II-level civilization, one that can harness the Sun's full power, while supporting AI-driven applications for billions of people today and ensuring humanity's multi-planetary future." To pull this off, Musk is betting that SpaceX's more powerful next-generation rocket, Starship, will soon be capable of commercial missions. In addition, he envisions staging Starship launches "every hour carrying 200 tons per flight," enabling the company to deploy the space-based data centers at a rapid clip. Still, orbiting data centers remain an unproven concept. A key challenge includes maintenance and creating a way to cool the GPUs when there's no air in space to dissipate the heat. Others are already questioning the vast size of a one-million-satellite constellation when the existing Starlink network only has about 9,600 satellites. Even so, Musk predicts that his orbiting data centers will become mainstream in the near future at a time when ground-based data centers are facing backlash over the environmental and energy toll. "My estimate is that within 2 to 3 years, the lowest cost way to generate AI compute will be in space," he wrote. "This cost-efficiency alone will enable innovative companies to forge ahead in training their AI models and processing data at unprecedented speeds and scales, accelerating breakthroughs in our understanding of physics and invention of technologies to benefit humanity."

[13]

Musk's xAI Merger Poses Bigger Threat to OpenAI, Anthropic

The combined company may go public this year, providing more cash for xAI and potentially leapfrogging rivals OpenAI and Anthropic, which are also considering public offerings. For much of the past three years, Elon Musk's xAI has tried to compete against the leading AI labs, including OpenAI, the company he co-founded and later clashed with. The results have been mixed: xAI's flagship product, the chatbot Grok, has made headlines for antisemetic responses and sexualized images that have overshadowed its technological advances. Now, Musk is attempting to supercharge his efforts to build more powerful AI systems with help from one of his most successful ventures. On Monday, he announced xAI would be merging with SpaceX, creating a combined company valued at $1.25 trillion. The tie-up is poised to help xAI secure more computing power, talent and data, the holy trinity of AI development. Like other AI startups, xAI has been burning through cash -- nearly $1 billion a month -- on data centers, chips and other investments to build artificial intelligence models. In the process, xAI has racked up $5 billion in corporate debt, a considerable amount for a young startup. Yet the scale of its AI infrastructure buildout is still far smaller than OpenAI, which has committed to spend more than $1.4 trillion on data centers and chips. Musk said SpaceX aims to put data centers in space, a sci-fi-sounding ambition that may help dramatically increase the computing power available for xAI. "In the long term, space-based AI is obviously the only way to scale," Musk said this week. Regardless of whether and when those projects take flight, SpaceX may also help with xAI's earthbound computing needs. The rocket maker has a much healthier balance sheet to support such investments and potentially make xAI's bottom line more palatable to Wall Street. Crucially, the space company is also planning to IPO this year, providing more cash for xAI and likely leapfrogging rivals OpenAI and Anthropic, which are also mulling public offerings. "This is going to be able to give them a significant amount of capital, probably a lot more capital than they probably could have raised on their own when they're private," said Joseph Alagna, founding partner of Buttonwood Funds and a shareholder of SpaceX and xAI. The new merged company will also be "viewed as a space opportunity more than an AI company, at least initially," said Mark Hackett, chief market strategist at Nationwide Funds Group. "They can tap a lot more investor bases than just AI." A combined SpaceX-xAI IPO could also undercut OpenAI's IPO somewhat by siphoning off some of the pent-up demand from public market investors for more exposure to cutting-edge, generative AI bets. At the same time, going public may bolster xAI's ability to hire and retain talent in a hyper-competitive market where AI researchers can get nine-figure compensation packages. As is typical with Musk's ventures, xAI has developed a reputation for long hours and burnout. Staffers have long posted online about working more than 30-hour shifts or sleeping in the office. "When you create a corporate environment where employees COMPETE to be the most exhausted, the most sleep-deprived, this takes a toll," Benjamin De Kraker, a former xAI employee, previously wrote on X. "This is exactly what many xAI workers have done, some posting about how they're so tired they can barely stay awake to drive home." However, xAI is competing in a far more crowded market than many Musk companies, certainly in their early years. Three of its 11 founding members (not counting Musk) have left, along with some key executives, including its chief financial officer and general counsel. Mike Liberatore, xAI's former CFO, joined OpenAI last year after just a few months in the role. The potential for burnout will certainly continue, but now xAI can entice new and existing employees with lucrative stock options in a soon-to-be publicly traded firm. Better still, xAI operates under the umbrella of a widely revered company sending rockets and satellites into space. Finally, SpaceX may provide xAI with a useful pipeline of data. Starlink, SpaceX's satellite-internet service, recently updated its privacy policy noting it can collect users' personal information - including financial and location data, as well as any files uploaded via e-mail, and social media - for model-training purposes. Starlink is also able to share that information with any company it merges with, such as xAI. Any new data would be welcome for xAI. Until now, Musk's X social network has been the primary source of training data for Grok. By contrast, rivals like OpenAI and Alphabet Inc.'s Google havestruck deals to license content from publishers and platforms. With or without SpaceX, Musk's AI startup still faces considerable challenges, including a controversial brand and growing regulatory scrutiny of Grok over the spread of sexualized images. Ongoing concerns about a possible AI bubble could weigh on his combined firm after it goes public. And there continues to be fierce competition among model makers, not just in the US but also China. Top startups, including OpenAI and Anthropic, have struck close partnerships with larger tech firms to keep at the forefront of the global AI race. Musk's bet appears to be that he can do the same for xAI within his own business empire. "You can never count Elon out," Alagna said. "I do think he's got something up his sleeve."

[14]

Elon Musk merging xAI with SpaceX in wild sci-fi vision

Elon Musk on Monday revealed his space company SpaceX has acquired his AI outfit xAI, and that the two will work together to escape the surly bonds of Earthly powers by tapping the sun's enduring glow. "This marks not just the next chapter, but the next book in SpaceX and xAI's mission: scaling to make a sentient sun to understand the Universe and extend the light of consciousness to the stars," Musk wrote in a bizarre blog post published to SpaceX's website on Monday. Musk argues that demand for AI cannot be satisfied with terrestrial resources, that building datacenters in space is therefore necessary as only limitless solar energy can power all the AI humans want to work with, and that SpaceX's Starship can do the job of getting this all into orbit. "My estimate is that within two to three years, the lowest cost way to generate AI compute will be in space," Musk contends in his post. "Long term space-based AI is obviously the only way to scale." Never mind that Starship has only completed test flights so far. Musk nonetheless contends that SpaceX will one day be capable of launching the rocket on an hourly schedule and carry a 200-ton payload on each flight. "The basic math is that launching a million tons per year of satellites generating 100kW of compute power per ton will add 100 gigawatts of AI compute capacity annually, with no ongoing operational or maintenance needs. Ultimately, there is a path to launching a terawatt per year from Earth," he wrote. Musk seems not to have noticed that computers fail and need human oversight. But don't worry, Musk hasn't forgotten about his commitment to returning man to the Moon and eventually Mars. From where else is he supposed to launch petawatts of AI datacenters into deep space if not the moon? "Factories on the Moon can take advantage of lunar resources to manufacture satellites and deploy them further into space," Musk rambled. "By using an electromagnetic mass driver and lunar manufacturing, it is possible to put 500 to 1,000 terawatts a year of AI satellites into deep space." While totally on brand for Musk, he isn't the first to suggest that space is the only place AI can scale unimpeded by Earth's supply of fossil fuels. Both Amazon founder Jeff Bezos and Google have made similar claims. Back in November, Google launched Project Suncatcher, a moonshot which also aims to establish a network of orbital AI datacenters packed with TPUs. Musk's post doesn't discuss the ethics of his ideas, a point The Register notes as AI services his companies provide have expressed sympathy for Nazism and churned out deep fake smut. Giant datacenters in the sky, an uncertain jurisdiction, could power all sorts of mischief down here. ®

[15]

Musk's mega-merger of SpaceX and xAI bets on sci-fi future of data centers in space

Feb 4 (Reuters) - Seventy-five years ago, the idea of harnessing the power of the skies was little more than fantasy spun by futurists like Arthur C. Clarke and Isaac Asimov. Elon Musk's mega-merger of his companies xAI and SpaceX this week brings this sci-fi dream a step closer. NASA engineers and technologists have speculated for nearly two decades about moving energy‑hungry computing off the planet. More recently, the idea has captured the attention of Big Tech including Alphabet (GOOGL.O), opens new tab and Jeff Bezos' Blue Origin. The physics made sense, the solar energy was abundant. Still, the challenges seemed insurmountable. Musk, though, known for betting on seemingly far-out theories and getting them to work, may finally be laying the groundwork to make data centers in space a reality. He is armed with the world's busiest satellite launch fleet, an AI startup, and an appetite for infrastructure that stretches from Earth to vacuum. "In the long term, space-based AI is obviously the only way to scale," Musk said on Monday. "To harness even a millionth of our Sun's energy would require over a million times more energy than our civilization currently uses! The only logical solution therefore is to transport these resource-intensive efforts to a location with vast power and space." The merger sharpens investor focus on how he might overcome big hurdles through a tightly woven ecosystem of rockets, satellites and AI systems, to take AI infrastructure beyond Earth. It comes just as SpaceX is preparing for a potential $1.5 trillion IPO. SpaceX has sought permission to launch up to 1 million solar‑powered satellites engineered as orbital data centers, far beyond anything currently deployed or proposed. In a filing with the Federal Communications Commission, SpaceX describes a solar‑powered, optical‑link‑driven "orbital data-center system," though it did not say how many Starship launches would be required to scale the space data-center network to an operational degree. "Compute in space isn't sci-fi anymore," said David Ariosto, author and founder of space intelligence firm The Space Agency. "And Elon Musk has already proven himself capable across multiple domains." OLD IDEA MEETS NEW ECONOMICS Advocates argue space-based data centers would be a cheaper alternative to data centers on Earth, thanks to constant solar energy and the ability to dump heat directly into space. But some experts have warned that big commercial gains are years from reality as the concept faces daunting challenges and is fraught with technical risks: radiation, debris, heat management, latency, and formidable economics that include high maintenance costs. "There's some real challenges here, and how do you then make that cost-effective?" said Armand Musey, founder of Summit Ridge Group, who said the financial details of a project such as this was hard to model because the "technical unknowns haven't been clarified." "But never say never," said Musey, who called Musk's track record "unbelievable." "I think a large part of it is, it's a bet on Elon. His success is really hard for people to ignore." Even with Musk's ambitions, data centers in space may not be achievable for another decade, some experts have said. The underlying physics behind space-based infrastructure is not new. Harnessing solar power in orbit dates back to Cold War-era research, when the U.S. Department of Energy and NASA studied space-based solar power concepts in the 1970s, ultimately concluding that launch and materials costs made them impractical. What makes Musk's efforts different is that his companies have more direct control over key elements of the system - from the rockets that will carry the hardware, to the links to beam data back to Earth, to a Musk-owned social network to generate demand for cheap AI computing. "SpaceX has structural advantages that few others can match. It controls the world's most active launch fleet, has demonstrated mass production of spacecraft through Starlink, and has access to substantial private capital," said Kathleen Curlee, a research analyst at Georgetown University. BOMBARDING CHIPS WITH RADIATION Among the biggest challenges facing space data centers are radiation and cooling. Data-center hardware will be bombarded by cosmic rays from the sun. In the past, chips designed for space were specially "hardened" for such radiation but were rarely as fast as today's flagship AI chips. Cooling AI chips, which generate immense heat during computations, is the other hurdle. While space is cold, it is also a near vacuum, so heat cannot be carried away the way it is on Earth. Powerful chips must instead move heat into large radiators that shed it as infrared energy, adding significant size, weight, and therefore cost. SpaceX's filing with the FCC describes cooling via "passive heat dissipation into the vacuum of space" and outlines how satellites that suffer operational failures rapidly de-orbit. More recently, Alphabet's (GOOGL.O), opens new tab Google bombarded one of its AI chips with radiation at a university lab in California to see how it would endure a five- or six-year mission in space for a research effort to network solar-powered satellites into an orbital AI cloud called Project Suncatcher. "They held up quite well against that," said Travis Beals, a senior executive at Google and lead of the project, which is set for a prototype launch to space in 2027. Reporting by Akash Sriram in Bengaluru and Joey Roulette in Washington; Additional reporting by Stephen Nellis in San Francisco; Editing by Sayantani Ghosh and Matthew Lewis Our Standards: The Thomson Reuters Trust Principles., opens new tab * Suggested Topics: * Artificial Intelligence * Mergers & Acquisitions Akash Sriram Thomson Reuters Akash reports on technology companies in the United States, electric vehicle companies, and the space industry. His reporting usually appears in the Autos & Transportation and Technology sections. He has a postgraduate degree in Conflict, Development, and Security from the University of Leeds. Akash's interests include music, football (soccer), and Formula 1. Joey Roulette Thomson Reuters Joey Roulette is a space reporter for Reuters covering the business and politics of the global space industry, often focusing on space power competition and how commercial interests intersect with international relations. He was part of a team that won the 2024 Pulitzer Prize in national reporting for Reuters' coverage of Elon Musk's business empire. On the space beat for roughly a decade, Joey previously worked for the New York Times, the Verge, and various publications in Florida.

[16]

Elon Musk merges SpaceX with xAI (and X)

Elon Musk is merging two of the companies that he leads, SpaceX and xAI (which also owns X), into one. According to an announcement from Musk: SpaceX has acquired xAI to form the most ambitious, vertically-integrated innovation engine on (and off) Earth, with AI, rockets, space-based internet, direct-to-mobile device communications and the world's foremost real-time information and free speech platform. This marks not just the next chapter, but the next book in SpaceX and xAI's mission: scaling to make a sentient sun to understand the Universe and extend the light of consciousness to the stars! Current advances in AI are dependent on large terrestrial data centers, which require immense amounts of power and cooling. Global electricity demand for AI simply cannot be met with terrestrial solutions, even in the near term, without imposing hardship on communities and the environment. In the long term, space-based AI is obviously the only way to scale. To harness even a millionth of our Sun's energy would require over a million times more energy than our civilization currently uses! The only logical solution therefore is to transport these resource-intensive efforts to a location with vast power and space. I mean, space is called "space" for a reason.

[17]

Musk vows to put data centers in space and run them on solar power but experts have their doubts

NEW YORK (AP) -- Elon Musk vowed this week to upend another industry just as he did with cars and rockets -- and once again he's taking on long odds. The world's richest man said he wants to put as many as a million satellites into orbit to form vast, solar-powered data centers in space -- a move to allow expanded use of artificial intelligence and chatbots without triggering blackouts and sending utility bills soaring. To finance that effort, Musk combined SpaceX with his AI business on Monday and plans a big initial public offering of the combined company. "Space-based AI is obviously the only way to scale," Musk wrote on SpaceX's website Monday, adding about his solar ambitions, "It's always sunny in space!" But scientists and industry experts say even Musk -- who outsmarted Detroit to turn Tesla into the world's most valuable automaker -- faces formidable technical, financial and environmental obstacles. Here's a look: Capturing the sun's energy from space to run chatbots and other AI tools would ease pressure on power grids and cut demand for sprawling computing warehouses that are consuming farms and forests and vast amounts of water to cool. But space presents its own set of problems. Data centers generate enormous heat. Space seems to offer a solution because it is cold. But it is also a vacuum, trapping heat inside objects in the same way that a Thermos keeps coffee hot using double walls with no air between them. "An uncooled computer chip in space would overheat and melt much faster than one on Earth," said Josep Jornet, a computer and electrical engineering professor at Northeastern University. One fix is to build giant radiator panels that glow in infrared light to push the heat "out into the dark void," says Jornet, noting that the technology has worked on a small scale, including on the International Space Station. But for Musk's data centers, he says, it would require an array of "massive, fragile structures that have never been built before." Then there is space junk. A single malfunctioning satellite breaking down or losing orbit could trigger a cascade of collisions, potentially disrupting emergency communications, weather forecasting and other services. Musk noted in a recent regulatory filing that he has had only one "low-velocity debris generating event" in seven years running Starlink, his satellite communications network. Starlink has operated about 10,000 satellites -- but that's a fraction of the million or so he now plans to put in space. "We could reach a tipping point where the chance of collision is going to be too great," said University at Buffalo's John Crassidis, a former NASA engineer. "And these objects are going fast -- 17,500 miles per hour. There could be very violent collisions." Even without collisions, satellites fail, chips degrade, parts break. Special GPU graphics chips used by AI companies, for instance, can become damaged and need to be replaced. "On Earth, what you would do is send someone down to the data center," said Baiju Bhatt, CEO of Aetherflux, a space-based solar energy company. "You replace the server, you replace the GPU, you'd do some surgery on that thing and you'd slide it back in." But no such repair crew exists in orbit, and those GPUs in space could get damaged due to their exposure to high-energy particles from the sun. Bhatt says one workaround is to overprovision the satellite with extra chips to replace the ones that fail. But that's an expensive proposition given they are likely to cost tens of thousands of dollars each, and current Starlink satellites only have a lifespan of about five years. Musk is not alone trying to solve these problems. A company in Redmond, Washington, called Starcloud, launched a satellite in November carrying a single Nvidia-made AI computer chip to test out how it would fare in space. Google is exploring orbital data centers in a venture it calls Project Suncatcher. And Jeff Bezos' Blue Origin announced plans in January for a constellation of more than 5,000 satellites to start launching late next year, though its focus has been more on communications than AI. Still, Musk has an edge: He's got rockets. Starcloud had to use one of his Falcon rockets to put its chip in space last year. Aetherflux plans to send a set of chips it calls a Galactic Brain to space on a SpaceX rocket later this year. And Google may also need to turn to Musk to get its first two planned prototype satellites off the ground by early next year. Pierre Lionnet, a research director at the trade association Eurospace, says Musk routinely charges rivals far more than he charges himself -- - as much as $20,000 per kilo of payload versus $2,000 internally. He said Musk's announcements this week signal that he plans to use that advantage to win this new space race. "When he says we are going to put these data centers in space, it's a way of telling the others we will keep these low launch costs for myself," said Lionnet. "It's a kind of powerplay."

[18]

Musk's xAI, SpaceX combo is the biggest merger of all time, valued at $1.25 trillion

Elon Musk's rocket maker SpaceX has acquired his artificial intelligence startup xAI in a deal that will value the company at $1.25 trillion, CNBC's David Faber has confirmed. The record-setting deal will be the largest merger of all time and values SpaceX at $1 trillion and xAI at $250 billion, according to documents viewed by CNBC. Musk announced the deal in a blog post on Monday, saying he's creating "the most ambitious, vertically-integrated innovation engine on (and off) Earth, with AI, rockets, space-based internet," and the X social media platform." The main reason for the merger, he said, is to better build "orbital data centers." Bloomberg previously reported the merger valuation. The deal, which is structured as a share exchange, comes ahead of a highly anticipated blockbuster initial public offering for SpaceX later this year. Shares of xAI will be converted into 0.1433 shares of SpaceX stock. Documents show xAI at $75.46 per share and SpaceX at $526.59 a share. Bank valuation documents viewed by CNBC value SpaceX at between $859 billion and $1.26 trillion and xAI at $219 billion and $294 billion.

[19]

Elon Musk's SpaceX has acquired his AI company, xAI

Elon Musk's SpaceX has acquired xAI, the companies announced. The merger will "form the most ambitious, vertically-integrated innovation engine on (and off) Earth, with AI, rockets, space-based internet, direct-to-mobile device communications and the world's foremost real-time information and free speech platform," Musk wrote in an update. The AI company that right now is best known for its CSAM-generating chatbot might seem like a strange fit for a rocket company. But SpaceX is key to Musk's latest scheme to build AI data centers in space. In his update, Musk wrote that "global electricity demand for AI simply cannot be met with terrestrial solutions" and that moving the resource-intensive operations to space is "the only logical solution." SpaceX just days ago filed an application with the FCC to create an "orbital data center" by launching a million new satellites.

[20]

Elon Musk's SpaceX confirms it is taking over xAI

Elon Musk's rocket company SpaceX is taking over his artificial intelligence (AI) start-up, as the billionaire takes steps to unify some of his many different business interests. SpaceX on Monday confirmed the deal to acquire xAI, a smaller firm known for its Grok chatbot, posting a memo from Musk about the merger on its website. In the note, Musk said the combination would form an "innovation engine" putting AI, rockets, space-based internet, and media under one roof. Terms of the deal were not disclosed. Last month, his electric car company, Tesla, also announced it had invested $2bn into xAI.

[21]

Elon Musk's SpaceX to Combine with xAI Ahead of Mega IPO

Elon Musk plans to merge SpaceX with xAI, according to people familiar with the matter, in a deal that encompasses the billionaire's increasingly costly ambitions to dominate artificial intelligence and space exploration. The deal was announced in a memo, the people said, asking not to be identified as the information isn't public. Bloomberg News earlier reported on the discussions. SpaceX is planning an initial public offering that could raise as much as $50 billion and value the company at about $1.5 trillion, Bloomberg News has reported. It also discussed a possible merger with Tesla. Elon Musk is in advanced talks to combine Space Exploration Technologies Corp. with xAI, according to people familiar with the matter, underscoring how the billionaire's artificial intelligence ambitions have grown too costly for any one of his entities to shoulder alone. Musk's rocket and satellite group, better known as SpaceX, and his artificial intelligence firm have informed some of their investors about the plans, the people said, asking not to be identified because the information is private. They may announce an agreement as soon as this week, some of the people said. Talks are ongoing and may drag on longer or fall apart, the people said. Representatives for SpaceX and xAI didn't respond to requests for comment. But on his social media platform X, Musk responded to a post highlighting Bloomberg's reporting on the advanced talks with: "Yes." A deal would combine two of some of the largest closely held companies in the world. xAI raised funds at a $200 billion valuation in September, while SpaceX was set to go ahead with a share sale in December at about an $800 billion valuation. The central catalyst for a merger is AI's insatiable need for capital. The rate at which xAI has been burning through cash -- around $1 billion a month -- has compelled Musk to further blur corporate boundaries, pool capital and rethink whether his moonshots should stay separate. Unlike some of Musk's other ventures, SpaceX stands out as arguably his most successful and consistent business. The company, the only American one that can routinely send astronauts to and from the International Space Station, is a key rocket launch provider for both NASA and the US Department of War. The increasing revenue it's generating from the Starlink network of more than 9,000 satellites is even more significant, now outpacing launch sales and presenting a potential source of funding for xAI's capital-intensive business. It's unclear exactly how SpaceX would gain, if at all, from the merger. Musk has openly advertised his grand vision to use SpaceX to build data centers in space to power the complex computing behind xAI's models. On Friday, the company requested permission from the Federal Communications Commission to launch one million satellites for the venture into Earth orbit. But it remains to be seen how xAI's products could vastly benefit SpaceX in return, especially at a time when the company is already dominating the launch and low-Earth-orbit satellite communications markets. XAI's finances pose "a clear valuation headwind in any potential merger with SpaceX," Bloomberg Intelligence analysts wroteBloomberg Terminal in a note. "Still, a recent $200 million US Department of Defense contract could provide a catalyst for xAI's broader enterprise adoption." Among those who may help Musk run a merged empire is Gwynne Shotwell, the longtime president and chief operating officer of SpaceX. In October, Musk named Anthony Armstrong, a former Morgan Stanley executive, as chief financial officer of xAI. Armstrong holds the same role for X, and helped Musk complete his $44 billion acquisition of the social media platform, formerly known as Twitter. Musk is no stranger to moving assets around, or making hard cuts and sharing resources across his business empire when his companies have been in a bind. He merged xAI and X less than a year ago. The latter borrowed engineers from Tesla and SpaceX almost immediately after the billionaire took over the service formally known as Twitter in late 2022. Reuters reported last week that SpaceX and xAI were in discussions to merge, citing a person briefed on the matter and company filings. SpaceX, which is looking toward a potential initial public offering that could value it at about $1.5 trillion, has also discussed the feasibility of a tie-up with Musk's Tesla Inc., Bloomberg News has reported.

[22]

SpaceX and xAI: A merger of ambition, optics, and unanswered questions

If you look at the press releases and breathless commentary around the recent acquisition of xAI by SpaceX, you might think we're witnessing a tectonic shift in technological destiny. A $1.25 trillion "mega-company" is born, poised to reshape artificial intelligence, space infrastructure, satellite internet, and possibly the fate of humanity itself. That narrative, enthusiastically repeated across headlines, serves a purpose: it frames a somewhat messy corporate consolidation as inevitable progress. But let's take a closer look and separate actual substance from Silicon Valley myth-making. At its core, this acquisition solves one problem: xAI needed a place to spend its money. The startup that once raised billions and expanded by swallowing the social platform X was burning cash, an estimated very serious amount, chasing model performance and celebrity. Folding it into SpaceX gives it access to a deeper capital pool, a broader story, and a more flattering valuation context. SpaceX did not acquire xAI because xAI was on the verge of overtaking tech giants in artificial intelligence. It acquired it because running a massively expensive AI operation inside a standalone startup wasn't sustainable, even for Elon Musk's legion of investors. A merger with a revenue-generating aerospace company looks a lot like a bailout disguised as synergy. Let's not romanticize it. One of the dominant talking points from Musk's own statements is that this consolidation enables space-based data centers, because apparently, earthbound power and cooling infrastructure are so last decade. The story goes: launch AI compute into orbit, agglomerate solar energy, and power the future with starlight. Read that again. On paper, it's an imaginative riff. In practice, it's strategic sci-fi for the markets. Putting data centers in space involves launch costs, radiation-hardened hardware, maintenance logistics that make ISS servicing look pedestrian, and no meaningful economy of scale compared to terrestrial hyperscalers like AWS or Google Cloud. If it were primarily about economics, the industry wouldn't be scrambling to keep data on Earth. The truth is simpler: this narrative reframes costly AI ambitions in a cosmic, venture-capital-friendly guise. It makes investors feel like they're buying into a future where AI runs on sunshine in orbit, rather than into the present where AI training costs are a gating factor. It's good PR, dubious engineering economics. The timing of this merger speaks volumes. SpaceX is preparing for a public offering, potentially as early as mid-2026. Reports say the combined entity could fetch valuations worth of $1.2 trillion. Here's what happens when you're about to IPO: You package your story in a way that excites both institutional and retail investors. You highlight future potential, especially grand visions like "ethereal solar compute." You downplay structural weaknesses and uncertainties. And if you can fold in a shiny AI banner, all the better, because AI is the word that unlocks narrative premiums. From that standpoint, SpaceX's absorption of xAI makes sense. It's narrative arbitrage: build a storyline that elevates the combination well beyond its standalone track records. Who wouldn't want to invest in "AI in space," even if the commercial case is mostly speculative? If the goal was to create an AI powerhouse that actually threatens the likes of OpenAI, Google, or Anthropic, we'd see clear indicators: rapid model improvements, developer platform adoption, real enterprise deals, and benchmarks that are competitive on measurable terms. We don't. What we see is an AI startup struggling to define its identity, a chatbot (Grok) known more for quirks and moderation issues than transformative performance, and a social platform that, let's just say, gives fact-checking teams ulcers. None of this naturally scales into the kind of AI infrastructure leadership that justifies calling this a strategic technological fusion. That's not to say xAI has zero potential; it might. But there's no verifiable evidence that this merger suddenly elevates it to tier-one AI contender status. One striking consequence of this move is how deeply entwined Musk's personal corporate empire has become. With SpaceX, xAI, Starlink, X, and multiple ventures all orbiting around the same figure, there's little left that feels like a separate institution. That concentration raises questions about governance, accountability, and even regulatory scrutiny. Musk's critics have made this point before, whether about content moderation on social media platforms, intercompany transfers of resources, or governance decisions around publicly traded entities, and these concerns aren't going away just because the companies now share a name on a term sheet. Consolidation under one umbrella might be efficient from a control perspective, but it's not inherently a prescription for innovation. In fact, it can stifle internal dissent, obscure accountability, and concentrate risk. Again, there's a clear pragmatic logic to this merger: xAI gets access to SpaceX's balance sheet and a narrative boost; SpaceX gets an AI banner to highlight in its IPO pitch; investors get something that looks both futuristic and marketable. That's not a strategy grounded in technological merit. It's a financial and narrative maneuver, carefully calibrated to appeal to markets and media. In that sense, what just happened feels a lot like a bailout with a shiny new label and an extraterrestrial backstory. If this were genuinely about advancing AI, we'd be hearing about: None of those are the dominant themes of the current coverage. What we have instead is a $1.25 trillion headline and a promise that someday, somewhere, perhaps space will be the next frontier for AI compute. It's visionary in the way a concept car is visionary, exciting to look at, and flimsy on the economics. The SpaceX-xAI merger is undeniably a headline-grabbing moment, but it's not the strategic leap some commentators portray. It's a capital and narrative optimization, not a clear answer to the question of who leads AI or how AI's growth is sustainably powered. If nothing else, it highlights how difficult it is to build a credible, well-funded AI company from scratch, even for someone as resourceful and celebrated as Elon Musk. His answer was not to reforge the fundamentals of AI research, but to fold an ambitious but unproven AI arm into a larger, more established aerospace machine with a glossy story that sounds like science fiction.

[23]

Elon Musk Considers Merging SpaceX With xAI, as He Races to Beat Sam Altman to IPO

Elon Musk’s rocket company is reportedly in talks to merge SpaceX with some of his other businesses, ahead of a planned initial public offering on Wall Street later this year. Several media outlets, including Bloomberg and Reuters, reported that SpaceX is considering a potential merger with Musk’s electric vehicle company, Tesla. Alternatively, it’s also weighing a deal with xAI, Musk’s artificial intelligence company that owns the chatbot Grok and the social media platform X. There are already signs SpaceX is preparing for either scenario. Bloomberg reported that two legal entities established in Nevada include “merger sub†in their names and list SpaceX Chief Financial Officer Bret Johnsen as an officer. SpaceX, xAI, and Tesla did not immediately respond to a request for comment from Gizmodo. A merger between SpaceX and either company could make sense. Musk has previously stated that one of SpaceX’s ambitions is to place data centers in space. Still, Bloomberg reports that investors appear particularly excited about the idea of a Tesla merger. In contrast, a merger between the private company and xAI could come with its own more personal benefits. The deal could make xAI the first major AI startup to get a big, glitzy public debut. That timing here is key. The Wall Street Journal reported that OpenAI is eyeing an IPO as early as the fourth quarter of this year. Anthropic, the company behind the Claude chatbot and coding agent, has also reportedly held talks with banks about going public, according to the newspaper. Neither company responded to a request for comment from Gizmodo. For its part, SpaceX is reportedly targeting a mid-June public debut to coincide with a conjunction of Jupiter and Venus near Musk’s birthday. If xAI were folded into that IPO, it would give public-market investors their first direct chance to buy into a major AI startup, essentially giving Musk the first access to a bigger pool of investors. Additionally, if there really is an AI bubble going on, it wouldn’t hurt to get investors on board before it bursts. There may also be a more personal motive behind a SpaceXâ€"xAI merger. Musk has had a contentious relationship with OpenAI and its CEO, Sam Altman, for years. Musk co-founded OpenAI but later left the company in 2018, reportedly due to disagreements over the direction of what was then a nonprofit organization. Musk is now suing OpenAI and Microsoft for $134 billion, alleging “wrongful gains.†He claims he invested $38 million in OpenAI’s seed funding and made significant nonmonetary contributions under the belief that the company would remain a nonprofit. OpenAI strongly disputes those claims. Earlier this month, the company published a blog post responding to Musk’s court filings, arguing that Musk had agreed that OpenAI would need to transition into a for-profit structure. According to OpenAI, Musk ultimately walked away after the company rejected his proposal to merge OpenAI into Tesla. If Musk gets xAI to Wall Street first, he’d almost certainly frame it as a win over OpenAI.

[24]

SpaceX acquires xAI: Key facts about the Musk-owned startups

Feb 3 (Reuters) - Elon Musk said on Monday SpaceX has acquired his artificial intelligence startup xAI in a record-setting deal, unifying the billionaire's AI and space ambitions by combining the rocket-and-satellite company with the maker of the Grok chatbot. The deal, first reported by Reuters last week, represents one of the most ambitious mergers in the technology sector yet. It values SpaceX at $1 trillion and xAI at $250 billion, a person familiar with the matter said. The deal would bolster Musk's data-center ambitions as competition heats up further in the AI race with rivals such as Alphabet's (GOOGL.O), opens new tab Google, Meta (META.O), opens new tab, Amazon (AMZN.O), opens new tab-backed Anthropic and OpenAI. Here are some key facts about SpaceX and xAI: SPACEX XAI Founded 2002 2023 Founders Elon Musk Founding team included Musk, former Google DeepMind engineer Igor Babuschkin, former Microsoft executive Greg Yang, and former Google research scientists Christian Szegedy and Tony Wu. Key executives - Elon Musk, CEO - Bret Johnsen, CFO - Gwynne Shotwell, President and COO - Elon Musk, CEO - Anthony Armstrong, CFO Headquarters Starbase, Texas Palo Alto, California Valuation $1 trillion in the SpaceX-xAI deal. Previously, the firm was valued at $800 billion in a December insider share sale. $250 billion in the deal. The startup was valued at $230 billion in November, according to the Wall Street Journal. Financials SpaceX generated about $8 billion in profit on $15 billion-$16 billion of revenue last year, Reuters reported last month. xAI's net loss widened to $1.46 billion in the September quarter from $1 billion in the prior quarter, Bloomberg News reported last month. Revenue nearly doubled to $107 million. Funding SpaceX plans to go public sometime this year, Reuters and other media have reported. Based on its most recent financials, some banks estimate the company could raise more than $50 billion at a valuation exceeding $1.5 trillion. Last month, xAI said it raised $20 billion in an upsized Series E funding round, with participation from Valor Equity Partners, StepStone Group, Fidelity Management & Research Company and Qatar Investment Authority. Reporting by Anhata Rooprai and Deborah Sophia in Bengaluru; Editing by Shreya Biswas Our Standards: The Thomson Reuters Trust Principles., opens new tab

[25]

Elon Musk links SpaceX and xAI in a record-setting merger to boost AI

Elon Musk's latest move highlights how soaring AI power demands are reshaping the future of data centers, even beyond Earth. SpaceX confirmed on Monday that it has acquired xAI, formally combining two of Elon Musk's most ambitious ventures and creating what could become the world's most valuable private company. The deal brings together a rocket-and-satellite giant with a fast-growing artificial intelligence firm at a time when global demand for computing power is accelerating. The announcement follows months of speculation about deeper ties between his companies and signals a sharper focus on using AI to shape the future of space operations.

[26]

Musk joins his rocket and AI businesses into a single company before an expected IPO this year

NEW YORK (AP) -- Elon Musk is joining his space exploration and artificial intelligence ventures into a single company before a massive planned initial public offering for the business later this year. His rocket venture, SpaceX, announced on Monday that it had bought xAI in an effort to help the world's richest man dominate the rocket and artificial intelligence businesses. The deal will combine several of his offerings, including his AI chatbot Grok, his satellite communications company Starlink, and his social media company X. Musk has talked repeatedly about the need to speed development of technology that will allow data centers to operate in space, a goal that may become easier in the combined company.

[27]

Elon Musk's SpaceX acquiring AI startup xAI ahead of potential IPO

Elon Musk is combining rocket maker SpaceX with his artificial intelligence startup, xAI, as the combined entity gears up for a massive IPO. The deal was announced on Monday in a blog post from SpaceX, which said it's forming "the most ambitious, vertically-integrated innovation engine on (and off) Earth, with AI, rockets, space-based internet," and its X social media platform. The combined company is expected to price shares in an IPO that would value it at $1.25 trillion, Bloomberg reported. Public records with the state of Nevada indicate that the deal was completed on Feb. 2, with Space Exploration Technologies Corp. listed as the "managing member" of X.AI Holdings. The deal marks the largest tie-up in Musk's vast business portfolio and brings together two companies that have been soaring in value on the private markets. SpaceX opened a secondary share sale last year at a valuation of $800 billion, while xAI was valued at about $230 billion in a $20 billion round that closed earlier this year. Tesla, Musk's electric vehicle maker and the source of most of his liquid wealth, said last week that it's agreed to invest about $2 billion into xAI. Early Last year, Musk expanded xAI by merging it with his social network X, formerly known as Twitter. XAI is facing a host of new regulatory probes by authorities in Europe, India and California after its Grok AI tools enabled users to easily generate and share sexualized images of children and non-consensual intimate images of adults, mostly women. Musk founded SpaceX in 2002 and has turned it into the leading provider of orbital launch services through contracts with NASA. SpaceX also owns the Starlink satellite service. In 2023, Musk launched xAI as a potential competitor to OpenAI, which kicked off the generative AI boom with the release of ChatGPT late the prior year. Musk was one of the co-founders of OpenAI in 2015, when the project was started as a nonprofit AI lab. He left in 2018, and is now involved in a heated legal battle with the company and CEO Sam Altman.

[28]

Elon Musk's SpaceX and xAI are reportedly holding merger talks