AI Drives Market Highs Amid Tech Earnings and Trade Tensions

3 Sources

3 Sources

[1]

TRADING DAY AI drives new highs

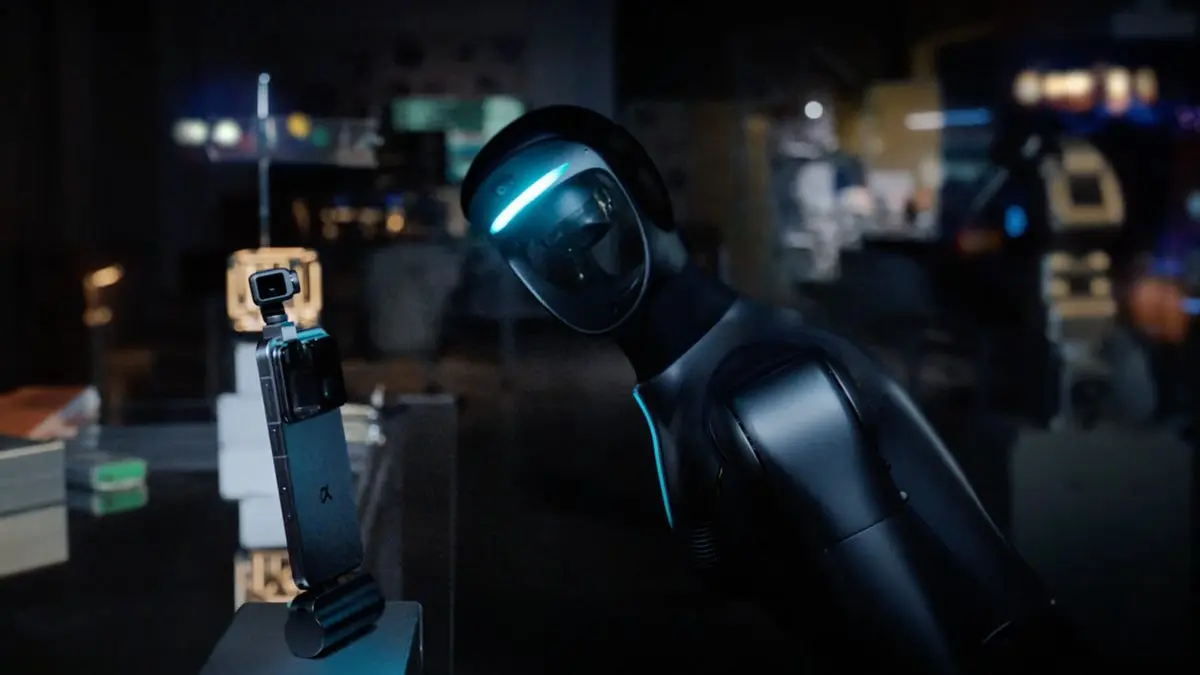

ORLANDO, Florida, July 24 (Reuters) - TRADING DAY Making sense of the forces driving global markets By Jamie McGeever, Markets Columnist Key U.S. and global stock markets clocked fresh highs on Thursday as Alphabet's earnings lifted tech, while investors digested the European Central Bank's interest rate decision and the latest signals from the European Union on trade talks with the U.S. More on that below. In my column today I ask if the stock market euphoria around the incoming U.S. trade deals is warranted. Remember, tariffs will be the highest since the 1930s and are set to raise inflation and lower growth. If you have more time to read, here are a few articles I recommend to help you make sense of what happened in markets today. Today's Key Market Moves * S&P 500, Nasdaq, FTSE 100 and MSCI All Country all hit new highs again. * But the Dow and Russell 2000, less tethered to the AI frenzy, fall 0.7% and 1.4%, respectively. * Some big U.S. names post big share price declines on Q2 earnings: Tesla -9%, IBM -8%, Honeywell -5%. * Oil snaps a four-day losing streak to rise over 1%. * China's yuan, opens new tab hits its strongest level this year against the U.S. dollar, both onshore and offshore. AI drives new highs In the absence of major economic data surprises, monetary policy changes or trade deal news on Thursday, world markets took their cue from corporate earnings, which continue to point to strength in artificial intelligence-related activity. Google's parent company Alphabet grabbed the spotlight, its second-quarter results highlighting that the heavy investment in AI is paying off. Indeed, a trend may be emerging from the earnings season that shows businesses focused on AI are massively outperforming companies like airlines, restaurants and food manufacturers that cater more to actual people. This isn't just a U.S. thing, it's global. Of course, this isn't a blanket rule but it will be worth keeping an eye on as the earnings season progresses. So far at least, investors are accentuating the positive and major indices are making new highs on a near daily basis. On the policy front, the ECB kept its deposit rate on hold at 2.0% as expected, biding its time while Brussels and Washington try to negotiate a trade deal that could ease tariff uncertainty. It appears that the bar to resume the easing cycle in September is a high one, and the euro closed the day little-changed around $1.1765. The U.S. economic data on Thursday were relatively upbeat, showing an acceleration in service sector activity and the lowest jobless claims figures in three months. With numbers like that, the S&P 500 at a record high and wider financial conditions loose, the Fed may not be in such a hurry to cut rates. And on that score, investors will be paying close attention to the readout from U.S. President Donald Trump's visit to the Fed late on Thursday. Fed Chair Jerome Powell is expected to be present during the visit. It will be an awkward meeting - Trump has repeatedly demanded that the Fed slash interest rates and has frequently raised the possibility of firing him. On Tuesday, he called Powell a "numbskull." Markets' trade deal euphoria ignores tariff reality The optimism sweeping world stock markets following news of emerging and expected U.S. trade deals is undeniable and understandable. But it is also puzzling. The S&P 500, Britain's FTSE 100 and the MSCI All Country index have powered to new highs this week, and other global benchmarks are not far behind. Analysts at Goldman Sachs and other big banks have recently been raising their year-end S&P 500 forecasts by as much as 10%. The catalyst is clear: baseline tariffs on imported goods into the U.S. will be much lower than the duties President Donald Trump had threatened previously. It emerged this week that the levy on Japanese goods will be 15%, not 25%, and indications are that a deal with the European Union will land on 15% too. That's half the rate Trump had threatened to impose. Suddenly, the picture is nowhere near as bleak as it looked a few months ago. Economists reckon that the final aggregate U.S. tariff rate will settle around 15-20% once deals with Brussels and Beijing are reached, a level markets are betting won't tip the economy into recession. This suggests that Trump's seemingly chaotic strategy - threaten mutually assured economic destruction, extract concessions and then pull back to limit the market damage - is paying off. But will it? SOMEONE MUST PAY Despite the market euphoria, the fact remains that on December 31 last year, the average aggregate U.S. tariff on imported goods was around 2.5%. So even if that ends up in the anticipated 15-20% range, it will still be at least six times what it was only a few months ago, and comfortably the highest it has been since the 1930s. U.S. Treasury Secretary Scott Bessent estimates that tariff revenues this year could reach $300 billion, which is the equivalent to around 1% of GDP. Extrapolating last year's goods imports of $3.3 trillion to next year, a 15% levy could raise close to $500 billion, or just over 1.5% of GDP. So who will pick up that tab? Is it the U.S. consumer, importers or the overseas exporters? Or a mixture of all three? The likelihood is it will mostly be split between U.S. consumers and companies, squeezing household spending and corporate profits. Either way, it's hard to see how this would not be detrimental to growth. We may not know for some time, as it will take months for the affected goods to come onshore and get onto U.S. shelves and for the tariff revenues to be collected. "We've got a ways to go before we can really say the U.S. economy is feeling the full effect of the tariff policies being announced," Bob Elliott, a former Bridgewater executive and founder of Unlimited, told CNBC on Wednesday. But in the meantime, equity investors appear to be ignoring all of this. SIGNS OF FROTH The market's short-term momentum is clear. The S&P 500 has closed above its 200-day moving average for 62 days in a row, the longest streak since 1997, according to Carson Group's Ryan Detrick. And the 'meme stock' craze is back too, another sign that risk appetite may be decoupling from fundamentals. Indeed, markets are priced for something approaching perfection. The consensus S&P 500 earnings growth for next year is 14%, according to LSEG I/B/E/S, barely changed from 14.5% on April 1, just before Trump's "Liberation Day" tariff salvo. Even the 2025 consensus of around 9% isn't that much lower than 10.5% on April 1. A Reuters poll late last year showed a 2025 year-end consensus estimate for the S&P 500 of 6,500. The index is nearly there already, and is trading at roughly the same multiple as it was on December 31, a 12-month forward price-to-earnings ratio of 22. Can these lofty expectations be supported by an economy whose growth rate next year is expected to be 2% or less? Possibly. But it will be a challenge for most firms, with the exception of the 'Magnificent Seven' tech giants whose size might better shield them from tariffs or slowing growth. Ultimately, this is all a huge experiment pitting protectionist trade policy and Depression-era tariffs against the economic orthodoxy of the past 40 years. And it's yet another example of equity investors' ability to find the silver lining in almost anything. As Brian Jacobsen, chief economist at Annex Wealth Management, says: "'It could have been worse' is not a good foundation for a market rally". What could move markets tomorrow? * Japan Tokyo CPI inflation (July) * Japan services PPI inflation (June) * UK GfK consumer confidence (July) * UK retail sales (June) * Germany Ifo business sentiment index (July) * U.S. durable goods (June) * U.S. Q2 earnings Want to receive Trading Day in your inbox every weekday morning? Sign up for my newsletter here. Opinions expressed are those of the author. They do not reflect the views of Reuters News, which, under the Trust Principles, opens new tab, is committed to integrity, independence, and freedom from bias. By Jamie McGeever; Editing by Nia Williams Our Standards: The Thomson Reuters Trust Principles., opens new tab * Suggested Topics: * Rates & Bonds Opinions expressed are those of the author. They do not reflect the views of Reuters News, which, under the Trust Principles, is committed to integrity, independence, and freedom from bias. Jamie McGeever Thomson Reuters Jamie McGeever has been a financial journalist since 1998, reporting from Brazil, Spain, New York, London, and now back in the US again. His experience and expertise are in global markets, economics, policy, and investment. Jamie's roles across text and TV have included reporter, editor, and columnist, and he has covered key events and policymakers in several cities around the world.

[2]

Trading Day: Tech cools, Trump's Fed ire burns

ORLANDO, Florida, July 22 (Reuters) - TRADING DAY Making sense of the forces driving global markets By Jamie McGeever, Markets Columnist The rally in U.S. tech stocks lost steam on Tuesday while bond yields and the dollar fell, as investors trimmed positions ahead of the first 'Big Tech' earnings reports and digested U.S. President Donald Trump's latest tirade against Fed Chair Jerome Powell. More on that below. In my column today I look at the differences - and potentially worrying similarities - between today's AI frenzy and the dotcom boom and bust of 25 years ago. Is today's bubble bigger than it was back then? If you have more time to read, here are a few articles I recommend to help you make sense of what happened in markets today. Today's Key Market Moves * Nasdaq snaps a six-day winning streak, falling 0.4%. In the S&P 500 tech falls 1%, real estate and health each rise nearly 2%. * Russell 2000 small caps index climbs 0.8%, Dow up 0.4%. * Hong Kong and Chinese stocks outperform globally, gaining 0.5% and 0.8%, respectively. Europe falls, hit by German stocks' worst day in two months. * U.S. 10-year yield slips to two-week low of 4.328%, down for a third day. * Dollar index also falls for a third day to a two-week low. * Gold up 1% to a five-week high of $3,433/oz, closing in on April's record $3,500/oz. Tech cools, Trump's Fed ire burns If investors cooled their stock-buying fervor on Tuesday, Trump showed no sign of relaxing the pressure he's heaping on Powell, branding the Fed chair a "numbskull" for not cutting interest rates. Financial markets may be getting inured to the attacks by now, but one wonders if Powell will be prepared to face another 10 months of them until his term as Fed Chair expires. With Powell in blackout period ahead of next week's Fed decision, investors are unlikely to hear from him until next Wednesday when he holds his scheduled post-meeting press conference. Powell has insisted he won't resign and that Trump does not have the legal authority to fire him, while the president doesn't appear to be in any mood to tone down his rhetoric against Powell or the Fed as an institution. The standoff is getting more tense. So much so, former PIMCO CEO and co-CIO Mohamed El-Erian posted on X that Powell should resign "to safeguard the Fed's operational autonomy," a far from ideal scenario but preferable to the growing and broadening threats to Fed independence which will "undoubtedly increase should he remain in office." Meanwhile, on trade, Treasury Secretary Scott Bessent said he will meet his Chinese counterpart next week in Stockholm to discuss extending an August 12 deadline for a deal to avert sharply higher tariffs. Trump said he may take up President Xi Jinping on his offer to visit "in the not-too-distant future". Washington announced a trade deal with the Philippines which will see imports from the South East Asian country slapped with 19% tariffs, while the U.S. will pay zero tariffs. Similar tariffs on imports from Indonesia were also announced. U.S.-Philippines and U.S.-Indonesia goods trade volumes last year were around $23.5 billion and $38.3 billion, respectively. The latest U.S. corporate earnings were a mixed bag, with Coca-Cola reporting strong profits and demand, while General Motors' net income slumped by a third as tariff costs took a $1.1 billion bite from its bottom line. Still, nearly 80% of the S&P 500 firms that have reported so far have beaten analyst expectations, according to LSEG data. Analysts' year-on-year aggregate earnings growth forecasts for the index now stand at 7.0%, up from 5.8% as of July 1. Attention on Wednesday rests squarely on Alphabet and Tesla, the first of the megacap tech firms to report. Is today's AI boom bigger than the dotcom bubble? Wall Street's concentration in the red-hot tech sector is, by some measures, greater than it has ever been, eclipsing levels hit during the 1990s dotcom bubble. But does this mean history is bound to repeat itself? The growing concentration in U.S. equities instantly brings to mind the internet and communications frenzy of the late 1990s. The tech-heavy Nasdaq peaked in March 2000 before cratering 65% over the following 12 months. And it didn't revisit its previous high for 14 years. It seems unlikely that we'll see a repeat of this today, right? Maybe. The market's reaction function appears to be different from what it was during the dotcom boom and bust. Just look at the current rebound from its post-'Liberation Day' tariff slump in early April - one of the fastest on record - or its rally during the pandemic. But despite all of these differences, there are also some worrying parallels. Investors would do well to keep both in mind. TOP 10 CLUB The most obvious similarity between these two periods is the concentration of tech and related industries in U.S. equity markets. The broad tech sector now accounts for 34% of the S&P 500's market cap, according to some data, exceeding the previous record of 33% set in March 2000. Of the top 10 companies by market capitalization today, eight are tech or communications behemoths. They include the so-called 'Magnificent 7' - Apple (AAPL.O), opens new tab, Amazon (AMZN.O), opens new tab, Alphabet (GOOGL.O), opens new tab, Meta (META.O), opens new tab, Microsoft (MSFT.O), opens new tab, Nvidia (NVDA.O), opens new tab and Tesla (TSLA.O), opens new tab - as well as Berkshire Hathaway (BRKa.N), opens new tab and JPMorgan (JPM.N), opens new tab. By contrast, only five of the 10 biggest companies in 1999 were tech firms. The other five were General Electric (GE.N), opens new tab, Citi, Exxon (XOM.N), opens new tab, Walmart (WMT.N), opens new tab, and Home Depot (HD.N), opens new tab. On top of that, the top 10 companies' footprint in the S&P 500 (.SPX), opens new tab today is much larger than it was back then. The combined market cap of the top 10 today is almost $22 trillion, or 40% of the index's total, significantly higher than the comparable 25% in 1999. This all reflects the fact that technology plays a much bigger role in the U.S. economy today than it did around the turn of the millennium. AI BUBBLE? By some measures, the current tech boom, driven in part by enthusiasm for artificial intelligence, is more extreme than the IT bubble of the late 1990s. As Torsten Slok, chief economist at Apollo Global Management, points out, the 12-month forward earnings valuation of today's top 10 stocks in the S&P 500 is higher than it was 25 years ago. However, it's worth remembering that the dotcom bubble was characterized by a frenzy of public offerings and a raft of companies with shares valued at triple-digit multiples of future earnings. That's not the case today. While the S&P tech sector is trading at 29.5 times forward earnings today, which is high by historical standards, this is nowhere near the peak of almost 50 times recorded in 2000. Similarly, the S&P 500 and Nasdaq are currently trading around 22 and 28.5 times forward earnings, compared with the dotcom peaks of 24.5 and over 70 times, respectively. $3 TRILLION INVESTMENT HURDLE With all that being said, a meaningful, prolonged market correction cannot be ruled out, especially if AI-driven growth isn't delivered as quickly as investors expect. AI, the new driver of technological development, will require vast capital outlays, especially on data centers, which may mean that earnings and share price growth in tech could slow in the short run. According to Morgan Stanley, the transformative potential of generative AI will require roughly $2.9 trillion of global data center spending through 2028, comprising $1.6 trillion on hardware like chips and servers and $1.3 trillion on infrastructure. That means investment needs of over $900 billion in 2028, they reckon. For context, combined capital expenditure by all S&P 500 companies last year was around $950 billion. Wall Street analysts are well aware of these figures, which suggests that at least some percentage of these huge sums should be factored into current share prices and expected earnings, but what if the benefits of AI take longer to deliver? Or what if an upstart (remember China's DeepSeek) dramatically shifts growth expectations for a major component of the index, like $4-trillion chipmaker Nvidia? Of course, technology is so fundamental to today's society and economy that it's difficult to imagine its market footprint shrinking too much, for too long, as this raises the inevitable question of where investor capital would go. It's therefore reasonable to question whether a tech crash today would take well over a decade to recover from. But, on the other hand, it's that type of thinking that has gotten investors into trouble before. What could move markets tomorrow? * Bank of Japan Deputy Governor Shinichi Uchida speaks * Taiwan industrial production (June) * U.S. existing home sales (June) * U.S. Treasury auctions $13 billion of 20-year bonds * U.S. Q2 earnings, including Alphabet, Tesla, IBM, AT&T Want to receive Trading Day in your inbox every weekday morning? Sign up for my newsletter here. Opinions expressed are those of the author. They do not reflect the views of Reuters News, which, under the Trust Principles, opens new tab, is committed to integrity, independence, and freedom from bias. By Jamie McGeever; Editing by Nia Williams Our Standards: The Thomson Reuters Trust Principles., opens new tab * Suggested Topics: * Rates & Bonds Opinions expressed are those of the author. They do not reflect the views of Reuters News, which, under the Trust Principles, is committed to integrity, independence, and freedom from bias. Jamie McGeever Thomson Reuters Jamie McGeever has been a financial journalist since 1998, reporting from Brazil, Spain, New York, London, and now back in the US again. His experience and expertise are in global markets, economics, policy, and investment. Jamie's roles across text and TV have included reporter, editor, and columnist, and he has covered key events and policymakers in several cities around the world.

[3]

Trading Day: Tech cools, Trump's Fed ire burns

Making sense of the forces driving global markets By Jamie McGeever, Markets Columnist The rally in U.S. tech stocks lost steam on Tuesday while bond yields and the dollar fell, as investors trimmed positions ahead of the first 'Big Tech' earnings reports and digested U.S. President Donald Trump's latest tirade against Fed Chair Jerome Powell. More on that below. In my column today I look at the differences - and potentially worrying similarities - between today's AI frenzy and the dotcom boom and bust of 25 years ago. Is today's bubble bigger than it was back then? If you have more time to read, here are a few articles I recommend to help you make sense of what happened in markets today. 1. Fed reform may move markets more than Powell ouster:Mike Dolan 2. IN THE MARKET-How the ghost of 'transitory' inflation ishaunting the rate debate 3. Dollar's dive offsets tariff sting for some U.S.bellwethers 4. Industrial pruning won't pull China out of deflation asquickly as last time 5. How Japan's election outcome muddles the BOJ's policypath If investors cooled their stock-buying fervor on Tuesday, Trump showed no sign of relaxing the pressure he's heaping on Powell, branding the Fed chair a "numbskull" for not cutting interest rates. Financial markets may be getting inured to the attacks by now, but one wonders if Powell will be prepared to face another 10 months of them until his term as Fed Chair expires. With Powell in blackout period ahead of next week's Fed decision, investors are unlikely to hear from him until next Wednesday when he holds his scheduled post-meeting press conference. Powell has insisted he won't resign and that Trump does not have the legal authority to fire him, while the president doesn't appear to be in any mood to tone down his rhetoric against Powell or the Fed as an institution. The standoff is getting more tense. So much so, former PIMCO CEO and co-CIO Mohamed El-Erian posted on X that Powell should resign "to safeguard the Fed's operational autonomy," a far from ideal scenario but preferable to the growing and broadening threats to Fed independence which will "undoubtedly increase should he remain in office." Meanwhile, on trade, Treasury Secretary Scott Bessent said he will meet his Chinese counterpart next week in Stockholm to discuss extending an August 12 deadline for a deal to avert sharply higher tariffs. Trump said he may take up President Xi Jinping on his offer to visit "in the not-too-distant future". Washington announced a trade deal with the Philippines which will see imports from the South East Asian country slapped with 19% tariffs, while the U.S. will pay zero tariffs. Similar tariffs on imports from Indonesia were also announced. U.S.-Philippines and U.S.-Indonesia goods trade volumes last year were around $23.5 billion and $38.3 billion, respectively. The latest U.S. corporate earnings were a mixed bag, with Coca-Cola reporting strong profits and demand, while General Motors' net income slumped by a third as tariff costs took a $1.1 billion bite from its bottom line. Still, nearly 80% of the S&P 500 firms that have reported so far have beaten analyst expectations, according to LSEG data. Analysts' year-on-year aggregate earnings growth forecasts for the index now stand at 7.0%, up from 5.8% as of July 1. Attention on Wednesday rests squarely on Alphabet and Tesla, the first of the megacap tech firms to report. Is today's AI boom bigger than the dotcom bubble? Wall Street's concentration in the red-hot tech sector is, by some measures, greater than it has ever been, eclipsing levels hit during the 1990s dotcom bubble. But does this mean history is bound to repeat itself? The growing concentration in U.S. equities instantly brings to mind the internet and communications frenzy of the late 1990s. The tech-heavy Nasdaq peaked in March 2000 before cratering 65% over the following 12 months. And it didn't revisit its previous high for 14 years. It seems unlikely that we'll see a repeat of this today, right? Maybe. The market's reaction function appears to be different from what it was during the dotcom boom and bust. Just look at the current rebound from its post-'Liberation Day' tariff slump in early April - one of the fastest on record - or its rally during the pandemic. But despite all of these differences, there are also some worrying parallels. Investors would do well to keep both in mind. TOP 10 CLUB The most obvious similarity between these two periods is the concentration of tech and related industries in U.S. equity markets. The broad tech sector now accounts for 34% of the S&P 500's market cap, according to some data, exceeding the previous record of 33% set in March 2000. Of the top 10 companies by market capitalization today, eight are tech or communications behemoths. They include the so-called 'Magnificent 7' - Apple, Amazon, Alphabet, Meta, Microsoft, Nvidia and Tesla - as well as Berkshire Hathaway and JPMorgan. By contrast, only five of the 10 biggest companies in 1999 were tech firms. The other five were General Electric, Citi, Exxon, Walmart, and Home Depot. On top of that, the top 10 companies' footprint in the S&P 500 today is much larger than it was back then. The combined market cap of the top 10 today is almost $22 trillion, or 40% of the index's total, significantly higher than the comparable 25% in 1999. This all reflects the fact that technology plays a much bigger role in the U.S. economy today than it did around the turn of the millennium. AI BUBBLE? By some measures, the current tech boom, driven in part by enthusiasm for artificial intelligence, is more extreme than the IT bubble of the late 1990s. As Torsten Slok, chief economist at Apollo Global Management, points out, the 12-month forward earnings valuation of today's top 10 stocks in the S&P 500 is higher than it was 25 years ago. However, it's worth remembering that the dotcom bubble was characterized by a frenzy of public offerings and a raft of companies with shares valued at triple-digit multiples of future earnings. That's not the case today. While the S&P tech sector is trading at 29.5 times forward earnings today, which is high by historical standards, this is nowhere near the peak of almost 50 times recorded in 2000. Similarly, the S&P 500 and Nasdaq are currently trading around 22 and 28.5 times forward earnings, compared with the dotcom peaks of 24.5 and over 70 times, respectively. $3 TRILLION INVESTMENT HURDLE With all that being said, a meaningful, prolonged market correction cannot be ruled out, especially if AI-driven growth isn't delivered as quickly as investors expect. AI, the new driver of technological development, will require vast capital outlays, especially on data centers, which may mean that earnings and share price growth in tech could slow in the short run. According to Morgan Stanley, the transformative potential of generative AI will require roughly $2.9 trillion of global data center spending through 2028, comprising $1.6 trillion on hardware like chips and servers and $1.3 trillion on infrastructure. That means investment needs of over $900 billion in 2028, they reckon. For context, combined capital expenditure by all S&P 500 companies last year was around $950 billion. Wall Street analysts are well aware of these figures, which suggests that at least some percentage of these huge sums should be factored into current share prices and expected earnings, but what if the benefits of AI take longer to deliver? Or what if an upstart (remember China's DeepSeek) dramatically shifts growth expectations for a major component of the index, like $4-trillion chipmaker Nvidia? Of course, technology is so fundamental to today's society and economy that it's difficult to imagine its market footprint shrinking too much, for too long, as this raises the inevitable question of where investor capital would go. It's therefore reasonable to question whether a tech crash today would take well over a decade to recover from. But, on the other hand, it's that type of thinking that has gotten investors into trouble before. What could move markets tomorrow? * Bank of Japan Deputy Governor Shinichi Uchida speaks * Taiwan industrial production (June) * U.S. existing home sales (June) * U.S. Treasury auctions $13 billion of 20-year bonds * U.S. Q2 earnings, including Alphabet, Tesla, IBM, AT&T Want to receive Trading Day in your inbox every weekday morning? Sign up for my newsletter here. Opinions expressed are those of the author. They do not reflect the views of Reuters News, which, under the Trust Principles, is committed to integrity, independence, and freedom from bias.

Share

Share

Copy Link

Global markets hit new highs as AI-focused companies outperform, while trade tensions and Fed criticism loom large. Tech concentration in markets surpasses dotcom era levels.

AI Fuels Market Rally Amid Earnings Season

Global stock markets reached fresh highs as artificial intelligence (AI) continued to drive investor enthusiasm. Alphabet's strong second-quarter results, which highlighted the success of its AI investments, set the tone for the market

1

. The trend emerging from this earnings season suggests that businesses focused on AI are significantly outperforming companies catering to more traditional consumer needs1

.Tech Concentration Surpasses Dotcom Era

Source: Reuters

The concentration of technology stocks in U.S. equity markets has reached unprecedented levels, surpassing even the dotcom bubble of the late 1990s. The tech sector now accounts for 34% of the S&P 500's market capitalization, exceeding the previous record of 33% set in March 2000

2

. Eight of the top ten companies by market capitalization are tech or communications giants, including the 'Magnificent 7' - Apple, Amazon, Alphabet, Meta, Microsoft, Nvidia, and Tesla2

.Trade Tensions and Tariff Concerns

While markets celebrate potential trade deals, concerns linger about the impact of higher tariffs. Even with negotiations ongoing, the average U.S. tariff on imported goods is expected to settle between 15-20%, significantly higher than the 2% rate at the end of last year

1

. Treasury Secretary Scott Bessent estimates that tariff revenues this year could reach $300 billion, equivalent to around 1% of GDP1

.Federal Reserve Under Pressure

Source: Reuters

U.S. President Donald Trump has intensified his criticism of Federal Reserve Chair Jerome Powell, calling him a "numbskull" for not cutting interest rates

3

. This ongoing tension has raised concerns about the Fed's independence, with some experts, like former PIMCO CEO Mohamed El-Erian, suggesting that Powell should consider resigning to safeguard the Fed's operational autonomy3

.Corporate Earnings Mixed

The earnings season has produced mixed results. While companies like Coca-Cola reported strong profits and demand, others like General Motors saw significant impacts from tariff costs

3

. Despite these challenges, nearly 80% of S&P 500 firms that have reported so far have beaten analyst expectations3

.Related Stories

Market Outlook and Comparisons to Dotcom Era

As the AI boom continues, some analysts draw parallels to the dotcom bubble of the late 1990s. However, key differences exist in market dynamics and the role of technology in today's economy

2

. The combined market cap of the top 10 companies now represents 40% of the S&P 500's total, significantly higher than the 25% seen in 19993

.Global Market Movements

While U.S. tech stocks showed signs of cooling, with the Nasdaq snapping a six-day winning streak, other global markets saw varied performance. Hong Kong and Chinese stocks outperformed, while European markets fell, hit by German stocks' worst day in two months

2

. The U.S. dollar and bond yields also fell, with gold reaching a five-week high2

.References

Summarized by

Navi

[1]

[3]

Related Stories

Recent Highlights

1

Google Gemini 3.1 Pro doubles reasoning score, beats rivals in key AI benchmarks

Technology

2

Nvidia and Meta forge massive chip deal as computing power demands reshape AI infrastructure

Technology

3

ChatGPT cracks decades-old gluon amplitude puzzle, marking AI's first major theoretical physics win

Science and Research