Tech Selloff and Government Intervention Spark Market Concerns

2 Sources

2 Sources

[1]

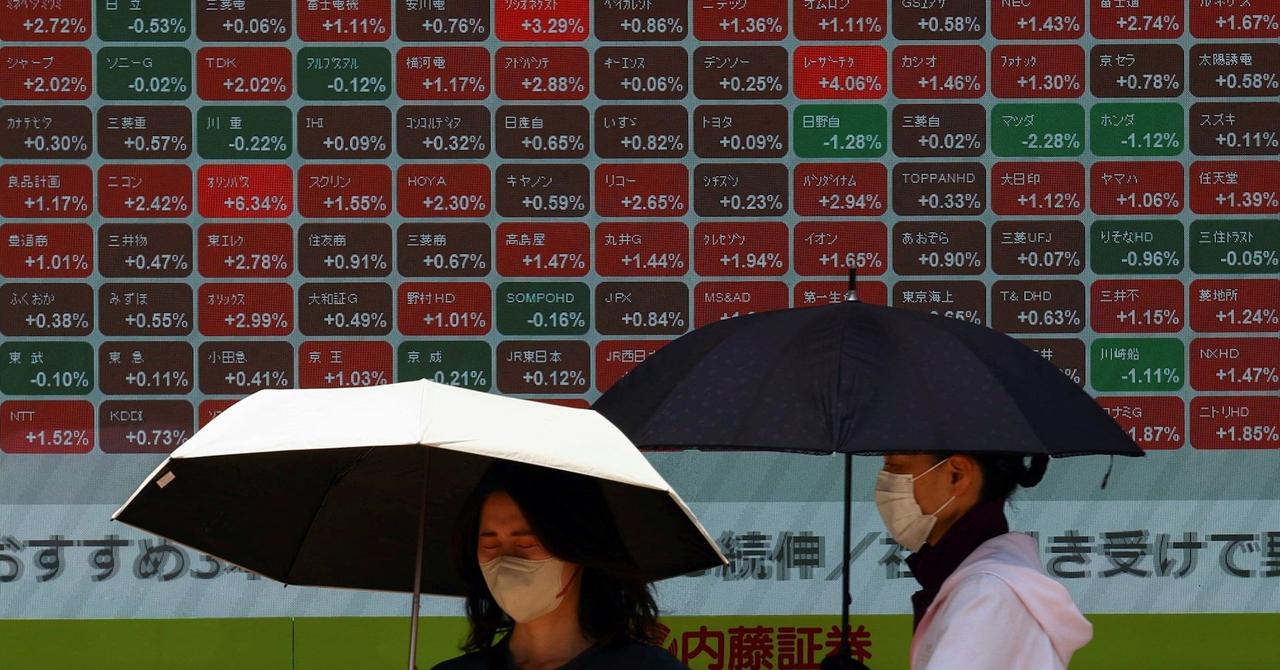

Tech selloff casts gloom over markets

SINGAPORE, Aug 20 (Reuters) - Global share markets came under pressure on Wednesday after a tech-led selloff on Wall Street, while the dollar gained some ground ahead of a key meeting of central bankers later in the week. Stock futures pointed to a lower opening in Europe and most Asian bourses were in the red, with tech-heavy indexes in Taiwan (.TWII), opens new tab and South Korea (.KS11), opens new tab among the biggest losers, in part due to worries about the Trump administration's growing influence on companies in the sector. U.S. Commerce Secretary Howard Lutnick is looking into the government taking equity stakes in Intel (INTC.O), opens new tab as well as other chip companies in exchange for grants under the CHIPS Act that was meant to spur factory-building around the country, sources told Reuters. The move comes on the back of other unusual deals Washington has recently struck with U.S. companies, including allowing AI chip giant Nvidia (NVDA.O), opens new tab to sell its H20 chips to China in exchange for the U.S. government receiving 15% of the revenue from those sales. "These developments signal that the U.S. government is heading in a concerning and more interventionist direction," said Tony Sycamore, a market analyst at IG. MSCI's broadest index of Asia-Pacific shares outside Japan (.MIAPJ0000PUS), opens new tab slid more than 1%, while EUROSTOXX 50 futures lost 0.64% and DAX futures shed 0.63%. S&P 500 futures dipped 0.27% and Nasdaq futures lost 0.44%, extending a fall from the cash session overnight. Japan's Nikkei (.N225), opens new tab lost 1.7% and Hong Kong's Hang Seng Tech Index (.HSTECH), opens new tab shed 1.3%. In commodities, oil prices trimmed losses from the previous session, as investors awaited the next steps in talks to end Russia's war on Ukraine, with uncertainty over whether oil sanctions might be eased or tightened. While a meeting between U.S. President Donald Trump, Ukrainian President Volodymyr Zelenskiy and a group of European allies over the Russia-Ukraine war concluded without much fanfare, Trump said the United States would help guarantee Ukraine's security in any deal to end Russia's war there. He later said on Tuesday that the United States might provide air support to Ukraine, while ruling out putting U.S. troops on the ground. "The U.S. is not categorically underwriting anything, any security for Ukraine, even if they're open to provide some, because we don't know the conditions under which they will. So there's quite a bit of risk left out there," said Vishnu Varathan, head of macro research for Asia ex-Japan at Mizuho. Brent crude futures were last up 0.15% at $65.89 a barrel, while U.S. crude tacked on 0.1% to $62.41 per barrel. AWAITING JACKSON HOLE All eyes are now on the Kansas City Federal Reserve's August 21-23 Jackson Hole symposium, where Fed Chair Jerome Powell is due to speak on the economic outlook and the central bank's policy framework on Friday. Focus will be on what Powell says about the near-term outlook for rates, with traders almost fully pricing in a rate cut next month. "Given the apparent tensions between U.S. CPI and PPI data, (it) does come across as ... premature to declare one way or the other. And most importantly, given this kind of dilemma embedded within the data, it is hard to decipher whether the Fed would take or would emphasise the risks that start to mount on the job side of the equation or (the) need to sit firm," said Mizuho's Varathan. Ahead of the gathering, the dollar firmed slightly, pushing the euro down 0.13% to $1.1633, while sterling fell 0.16% to $1.3470. The New Zealand dollar tumbled more than 1% after its central bank cut rates as expected and flagged further reductions in coming months as policymakers warned of domestic and global headwinds to growth. The kiwi last bought $0.5835. Elsewhere, spot gold fell 0.07% to $3,312.89 an ounce. Reporting by Rae Wee; Editing by Shri Navaratnam and Sonali Paul Our Standards: The Thomson Reuters Trust Principles., opens new tab

[2]

Tech wrecks the party

A look at the day ahead in European and global markets from Rae Wee Markets in Europe were set for a dour opening on Wednesday, after a slump on Wall Street pushed Asian shares into the red, with technology stocks leading the decline. While there was no immediate trigger, analysts pointed to a confluence of factors, such as doubts over the lofty valuations of tech heavyweights and President Donald Trump's growing influence over the sector. U.S. Commerce Secretary Howard Lutnick is looking into the government taking equity stakes in Intel as well as other chip companies in exchange for grants under the CHIPS Act that was meant to spur factory-building around the country, sources told Reuters. The move comes on the back of other unusual deals Washington has recently struck with U.S. companies, including allowing AI chip giant Nvidia to sell its H20 chips to China in exchange for the U.S. government receiving 15% of those sales. The government's intervention in corporate matters has worried critics who say Trump's actions create new categories of corporate risk and that a bad bet could mean a hit to taxpayer funds. "This U.S. state/Presidential creep into tech, and the wider private sector, is unhealthy as it threatens to erode margins and dent demand/topline," said Mizuho's head of macro research for Asia ex-Japan Vishnu Varathan. Asia's tech-heavy indexes in Taiwan and South Korea slid 2.6% and 1.7%, respectively, while EUROSTOXX 50 futures shed 0.7%. Nasdaq futures were down 0.5%. Apart from the tech gloom, traders in London will be waking up to UK inflation figures, where expectations are for headline consumer prices to have picked up slightly in July on an annual basis. Inflation in Britain remains the highest of any major advanced economy and is around one percentage point more than in the United States or the euro zone. Any upside surprise would prove a headache for the Bank of England, with economists polled by Reuters expecting the central bank to cut interest rates by a quarter-point once more this year and then again in early 2026. Elsewhere in markets, the New Zealand dollar tumbled on Wednesday after the central bank cut rates and flagged further reductions in coming months as policymakers warned of domestic and global headwinds. The Reserve Bank of New Zealand said the economy had stalled in the second quarter, and lowered its projected floor for the cash rate to 2.55%, from 2.85% forecast in May. Key developments that could influence markets on Wednesday:

Share

Share

Copy Link

Global markets face pressure as tech stocks lead a selloff, while the U.S. government's increasing involvement in the tech sector raises eyebrows.

Tech Selloff Triggers Global Market Decline

Global share markets experienced significant pressure on Wednesday, primarily driven by a tech-led selloff on Wall Street. The ripple effect was felt across Asian bourses, with tech-heavy indexes in Taiwan and South Korea among the biggest losers

1

. European markets were also poised for a lower opening, as indicated by futures for EUROSTOXX 50 and DAX2

.U.S. Government's Growing Influence in Tech Sector

Source: Market Screener

A major factor contributing to market unease is the Trump administration's increasing involvement in the technology sector. U.S. Commerce Secretary Howard Lutnick is exploring the possibility of the government taking equity stakes in Intel and other chip companies in exchange for grants under the CHIPS Act

1

. This move follows other unusual deals, such as allowing Nvidia to sell its H20 chips to China with the U.S. government receiving 15% of the revenue from those sales.Tony Sycamore, a market analyst at IG, expressed concern about these developments, stating, "These developments signal that the U.S. government is heading in a concerning and more interventionist direction"

1

. Critics argue that such interventions create new categories of corporate risk and could potentially impact taxpayer funds if investments don't pan out as expected2

.Market Reactions and Economic Indicators

Source: Reuters

The tech selloff had a broad impact on global markets:

- MSCI's broadest index of Asia-Pacific shares outside Japan fell by more than 1%

- Japan's Nikkei lost 1.7%, while Hong Kong's Hang Seng Tech Index shed 1.3%

- S&P 500 futures and Nasdaq futures extended losses from the previous session

1

In the commodities market, oil prices showed signs of stabilizing after recent losses, with investors closely watching developments in talks to end Russia's war on Ukraine

1

.Related Stories

Central Bank Policies and Economic Outlook

Market attention is now focused on the upcoming Kansas City Federal Reserve's Jackson Hole symposium, scheduled for August 21-23. Fed Chair Jerome Powell's speech on Friday is highly anticipated, with traders expecting insights into the near-term outlook for interest rates

1

.In a surprising move, the Reserve Bank of New Zealand cut interest rates and signaled further reductions in the coming months, citing domestic and global headwinds to growth. This decision led to a significant drop in the New Zealand dollar

1

2

.UK Inflation and European Markets

Investors in London are awaiting the release of UK inflation figures, with expectations of a slight increase in headline consumer prices for July on an annual basis. The persistent high inflation in Britain, compared to other major advanced economies, poses a challenge for the Bank of England's monetary policy decisions

2

.As markets navigate through these complex economic and political factors, the interplay between government intervention, technological advancements, and global economic conditions continues to shape investor sentiment and market dynamics.

References

Summarized by

Navi

[1]

[2]

Related Stories

Recent Highlights

1

OpenAI secures $110 billion funding round from Amazon, Nvidia, and SoftBank at $730B valuation

Business and Economy

2

Anthropic stands firm against Pentagon's demand for unrestricted military AI access

Policy and Regulation

3

Pentagon Clashes With AI Firms Over Autonomous Weapons and Mass Surveillance Red Lines

Policy and Regulation