AI Boom Sparks Decade-Long Memory and Storage Shortage Concerns

4 Sources

4 Sources

[1]

Phison CEO says memory shortage could last 10 years -- thanks, 'AI'

High demand for industrial data centers, heavy on both memory and solid-state storage, could create a massive crunch that raises prices for essentially all electronics. Between data centers sprouting up like daisies and formerly affordable DDR4 memory finally fading into the sunset, we're looking at some rough times ahead for memory and storage prices -- and that's before general economic turmoil and tariffs complicate things even further. Now, one major flash hardware producer's CEO is even warning that we could be looking at a decade-long shortage. Said CEO is Pua Khein-Seng of Phison Electronics. Phison doesn't get a lot of visibility in the consumer space, but it's one of the planet's biggest manufacturers of NAND memory controllers. (Pretty good odds that there are Phison chips in the gadget you're using to read these words.) In an interview with Tech Taiwan, Pua predicted that we'll be in a full-on memory shortage next year, with data centers made for increased capacity in general and "AI" products in particular creating an industry-wide dearth of hardware. That's especially true as large data centers transition from conventional hard drives (the last major holdout for the decades-old tech) to solid-state drives. That would inevitably push the price for flash-based memory and storage higher, and by extension, raise prices on more or less all consumer electronics, including phones, PCs, and graphics cards. Even devices with mostly "invisible" integrated electronics, like monitors or headphones, would be affected. With a wind-down of investment following the pandemic, immediately followed by surging demand for the AI bubble, Pua estimates that we could see a shortage that lasts as long as a decade, according to TechPowerUp. I should note that the CEO of a major memory controller supplier isn't exactly an unbiased source of information on the matter. Phison could be trying to spur investment or account for some rocky times in its own future. But speaking as someone who's definitely on the consumer side of this equation, I don't see anything that's obviously wrong about a shortage prediction. Most other analysts are already predicting higher prices in the short term, and it's certainly possible that the shortage could be sustained for multiple years. The biggest thing that might change that is if the "AI" bubble bursts... which might create some bigger problems for consumers, like finding a place to live or something to eat.

[2]

Decade-long SSD and RAM 'pricing apocalypse' predicted as AI data centers gobble up hardware on an epic scale

Are SSDs and memory prices headed the same way as graphics cards? Painfully high graphics card pricing has become a seemingly permanent norm and at least some of that comes down to the impact of the burgeoning AI boom. Are SSD and system memory prices poised to go the same way? According to analysis by Tom's Hardware, the unfortunate answer is yes. Tom's claims that, "nearly every analyst firm and memory maker is now warning of looming NAND and DRAM shortages that will send SSD and memory prices skyrocketing over the coming months and years, with some even predicting a shortage that will last a decade." The reason, inevitably, is explosive demand for AI hardware. Tom's notes that there's some of the usual cyclical variation going on here. Following a downturn in demand in 2022 and 2023 that saw DRAM and NAND memory manufacturers selling chips below cost, manufacturing volumes were scaled back, which eventually fed through into higher prices. But more recently, the insatiable demands of AI for training and inference is requiring vast amounts of storage and memory. One AI outfit alone, OpenAI, has signed a deal with Samsung and SK Hynix for fully 900,000 DRAM wafers per month, which could account for 40% of current global DRAM output. Meanwhile, Samsung's next-gen V9 3D NAND memory is said to be nearly booked out before it's even hit full release and Micron's High Bandwidth Memory production is nearly sold out through the end of 2026. It all adds up to a "supercycle" of storage and memory demand that Phison CEO Pua Khein-Seng thinks will translate into tight supply, "for the next 10 years." Needless to say, if all this is true, it's going to be a bummer for PC gamers. We're already having to soak up much higher GPU prices thanks to the insatiable demands of AI. Now, SSD and RAM prices could be next. Of course, none of this is a completely done deal. At the same time as all of these predictions are bing made, there are plenty of other observers betting on an AI crash. The investor community is increasingly concerned about a possible "trillion dollar" AI bubble that's ready to burst, while Warren Buffett increasingly cashing out is giving the market jitters. None of this may come to pass, then, but if the alternative to expensive PC components is a stock market meltdown, that's hardly a great alternative. In the end, we'll have to wait and see how it unfolds. In the meantime and all things currently considered, now might be a good moment to grab a decent deal on all kinds of PC kit, especially with the Amazon Prime day madness about to kick off.

[3]

Phison CEO says 'severe' NAND flash shortages and unprecedented SSD demand could last 10 years

TL;DR: NAND flash storage faces a severe shortage expected to last a decade due to rising AI data center demand and a shift from HDDs to SSDs. Phison's CEO highlights increasing SSD adoption, higher costs, and limited supply, driven by AI inference needs and advanced SSD controllers delivering faster, energy-efficient performance. When it comes to the new AI era of edge computing, data centers, and cloud services, NAND-based flash storage sits alongside high-powered GPUs or graphics cards as two bits of hardware that are seeing unprecedented demand. In a recent interview, Pua Khein-Seng, CEO of Phison Electronics Corporation, a leader in all things flash storage, shared some insight regarding the forecasted NAND flash storage of 2026. As seen over at the Taiwanese CommonWealth Magazine's tech column (via Tom's Hardware), Pua Khein-Seng notes that in addition to "severe shortages" next year, flash shortages "will be tight for the next ten years." That's a whole decade where it appears that buying SSDs and other NAND-based flash storage devices will become increasingly more expensive and difficult to source. One of the reasons for the shortages stems from a shift toward HBM manufacturing for AI data centers and systems, where the margins are significantly higher. This leaves less room for older technologies, even though the demand for even PCIe Gen4 storage is increasing. Additionally, as companies shift toward more AI inference rather than training, the need for high-speed flash storage is rising. In fact, it's marking a shift from more traditional platter-based HDDs to SSDs. "In 2020, the SSD-to-HDD ratio in data centers was in the single digits versus more than 90%," Pua Khein-Seng explains. "Today, it's about 20% to 80%. Looking ahead, SSDs will account for 80% to 100%. The real question is: how much new capacity will be needed to support that transition? That's why I say flash will remain strong for the next ten years." For day-to-day consumers, Phison SSD controllers can be found in a wide range of storage solutions from some of the biggest names in SSD technology. Its latest Phison E28 Gen5 SSD controller not only delivers up to 14.8GB/sec read speeds, but it can do so using just 7W of power.

[4]

AI boom is causing RAM and SSD supply shortage, will keep prices high for a decade

High DRAM NAND flash prices expected due to AI technology surge The rapid rise of artificial intelligence (AI) is reshaping not just software and services but also the very hardware that powers these technologies. As AI models grow larger and more complex, their appetite for memory and storage has reached unprecedented levels, creating a global supply crunch for RAM, SSDs, and other storage components. Industry experts now warn that this shortage could keep prices elevated for years, potentially spanning an entire decade, impacting everything from consumer PCs to enterprise-level data centers. Also read: Jeff Bezos says 'AI bubble' is real, benefits to humanity will be 'gigantic' Modern AI workloads are voracious consumers of memory and storage. Training a large language model or running a high-performance AI application can require petabytes of storage and terabytes of DRAM. Hyperscale cloud providers and tech giants are racing to secure these components, often pre-purchasing massive quantities to ensure uninterrupted operations. Some AI projects are reportedly consuming up to 40% of global DRAM output, illustrating just how significantly AI is driving the market. This demand surge is not limited to corporate users. As AI becomes integrated into more consumer applications - such as AI-assisted photo editing, real-time language translation, and advanced gaming experiences - smaller businesses and individual users are also feeling the strain. Even everyday devices like laptops, smartphones, and tablets now need faster, higher-capacity memory and storage to accommodate AI-enabled features. While demand is skyrocketing, supply has not kept pace. Memory manufacturers scaled back production during the market slowdown of 2022-2023, creating a shortfall when demand rebounded. Now, manufacturers are focusing on high-margin memory segments like High Bandwidth Memory (HBM) to support specialized AI and gaming applications, diverting resources away from mainstream DRAM and NAND flash production that most consumers rely on. Also read: IBM Granite 4.0: What you need to know about its hybrid AI models Compounding the issue are long-standing supply chain challenges. Building semiconductor fabrication plants is a time-consuming and expensive process, often taking several years to complete. Geopolitical tensions, particularly in regions critical for rare earth elements and chip manufacturing, are further complicating production. Additionally, the semiconductor industry faces a persistent shortage of skilled engineers and technicians, slowing efforts to expand capacity. The effects of this imbalance are already evident in the market. Contract prices for DRAM and NAND flash surged by 15-20% in late 2025, driven by AI-related cloud infrastructure projects and tight supply. Hard drives and SSDs are also facing extended lead times, with some models delayed by months. Major manufacturers, including Western Digital and SanDisk, have responded by raising prices to balance supply and demand. Analysts warn that these elevated prices may persist for years. Phison's CEO has even predicted a prolonged NAND flash shortage starting in 2026, driven by the combination of AI demand and historic underinvestment in flash production. For consumers, this could mean that the era of affordable storage upgrades may be over for the near future, while enterprises may need to budget significantly more for memory-intensive AI operations. For PC builders, gamers, and businesses alike, planning purchases in advance is now more important than ever. Monitoring price trends and buying early may help mitigate some of the impact of rising costs. Additionally, exploring alternative storage solutions, such as hybrid storage architectures that balance SSDs and hard drives, could offer temporary relief for those who need high-capacity storage without breaking the bank. The AI boom is not a passing trend, it represents a structural shift in technology demand. Unless significant investments are made in production capacity and supply chain resilience, the shortage of RAM and SSDs may continue well into the next decade. The memory and storage sectors are entering what some experts describe as a "supercycle," driven largely by AI's insatiable appetite for data processing and storage. In the coming years, the supply crunch could influence not just pricing but also innovation, with companies potentially prioritizing efficiency and optimization in memory usage. The AI revolution is transforming hardware markets, creating both challenges and opportunities that will shape technology, consumer experiences, and enterprise strategies for years to come.

Share

Share

Copy Link

Industry experts warn of a potential 10-year shortage in NAND flash and DRAM due to surging AI demand. This could lead to significant price increases for SSDs, RAM, and various electronic devices.

AI Boom Triggers Memory and Storage Crisis

The rapid advancement of artificial intelligence (AI) is not only revolutionizing software and services but also creating a significant impact on hardware markets. Industry experts are now warning of a potential decade-long shortage in NAND flash and DRAM, driven by the insatiable appetite of AI for memory and storage resources

1

4

.

Source: Digit

Unprecedented Demand from AI Data Centers

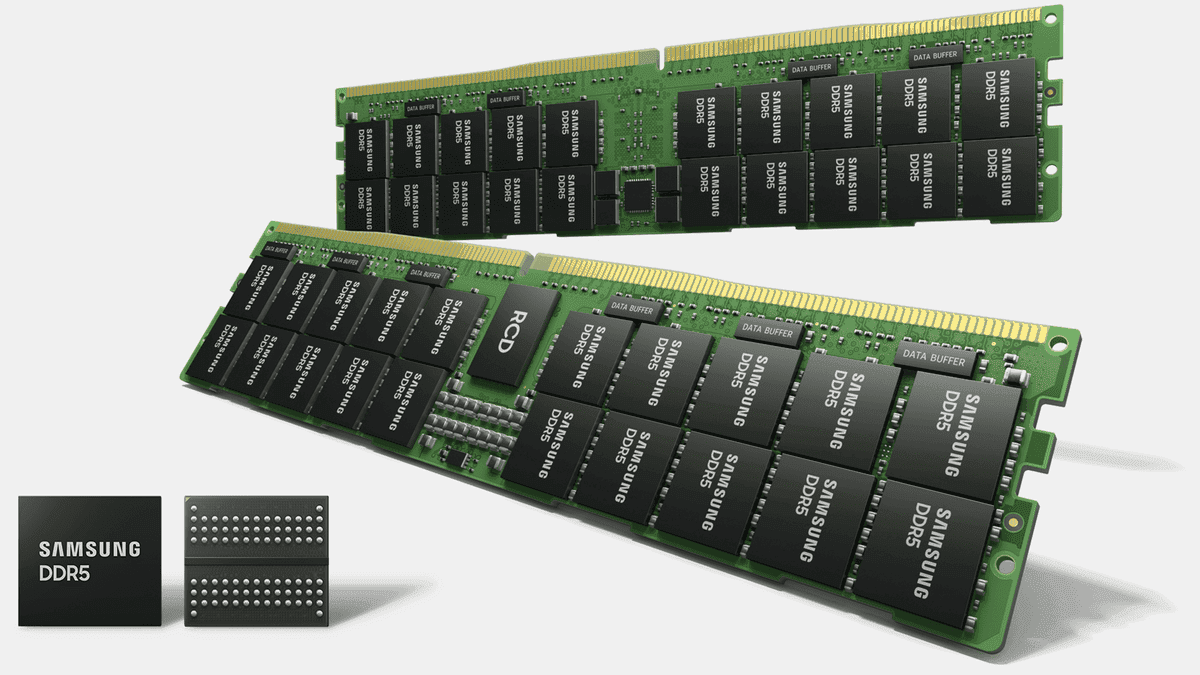

The surge in demand is primarily attributed to the explosive growth of AI-focused data centers. These facilities require vast amounts of high-speed memory and storage to support complex AI models and applications. According to reports, some AI projects are consuming up to 40% of global DRAM output, highlighting the scale of this demand

4

. For instance, OpenAI has reportedly signed a deal with Samsung and SK Hynix for 900,000 DRAM wafers per month, potentially accounting for 40% of current global DRAM production2

.

Source: PC Gamer

Shift from HDDs to SSDs

Another factor contributing to the shortage is the ongoing transition from traditional hard disk drives (HDDs) to solid-state drives (SSDs) in data centers. Pua Khein-Seng, CEO of Phison Electronics Corporation, notes that the ratio of SSDs to HDDs in data centers has shifted from single digits in 2020 to about 20% today, with projections suggesting it could reach 80-100% in the near future

3

.

Source: TweakTown

Supply Constraints and Manufacturing Challenges

The supply side is struggling to keep up with this surge in demand. Memory manufacturers had scaled back production during the market slowdown of 2022-2023, creating a shortfall as demand rebounded. Additionally, many manufacturers are now focusing on high-margin memory segments like High Bandwidth Memory (HBM) for specialized AI applications, diverting resources from mainstream DRAM and NAND flash production

4

.Related Stories

Impact on Consumers and Businesses

The consequences of this supply-demand imbalance are already visible in the market. Contract prices for DRAM and NAND flash have surged by 15-20% in late 2025. Consumers and businesses alike are facing the prospect of higher prices for a wide range of electronic devices, including smartphones, PCs, and graphics cards

1

2

.Long-Term Outlook and Industry Response

While some analysts predict that this shortage could last up to a decade, others caution about a potential AI bubble that might burst, which could alleviate some of the pressure on the memory and storage markets

2

. In response to these challenges, the industry may need to prioritize efficiency and optimization in memory usage, potentially driving innovation in hardware design and AI algorithms4

.References

Summarized by

Navi

[3]

Related Stories

AI Boom Triggers Unprecedented Shortage in Memory and Storage Components

15 Oct 2025•Technology

AI Demand Triggers Memory Crisis: DRAM Prices Surge 50% as Supply Chain Buckles

23 Oct 2025•Business and Economy

AI Demand Triggers Global Memory Shortage as RAM Prices Surge Up to 70% in 2026

06 Jan 2026•Business and Economy

Recent Highlights

1

Pentagon threatens Anthropic with Defense Production Act over AI military use restrictions

Policy and Regulation

2

Google Gemini 3.1 Pro doubles reasoning score, beats rivals in key AI benchmarks

Technology

3

Anthropic accuses Chinese AI labs of stealing Claude through 24,000 fake accounts

Policy and Regulation