AI Boom Triggers Unprecedented Shortage in Memory and Storage Components

4 Sources

4 Sources

[1]

Adata chairman says AI datacenters are gobbling up hard drives, SSDs, and DRAM alike -- insatiable upstream demand could soon lead to consumer shortages

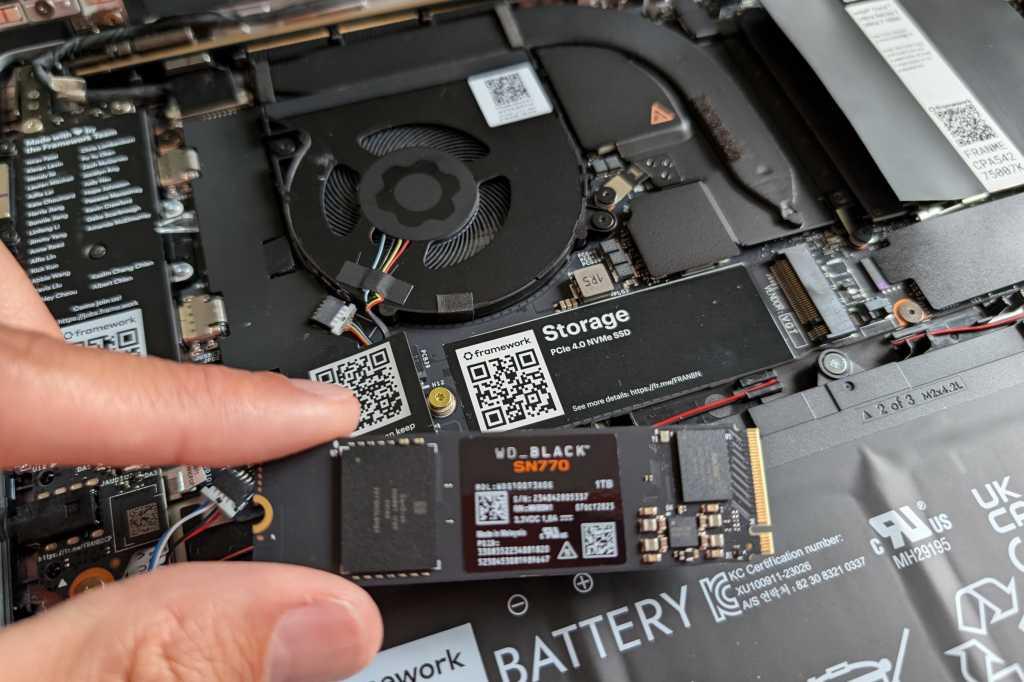

The GPU shortage during COVID could soon look like child's play. AI datacenters are eating up the world's supply standard DRAM memory, NAND flash for SSDs, and hard drives. Adata chairman Simon Chen just made it extremely clear that in his three-decade tenure in the industry, he's never witnessed a simultaneous shortage of all of the aforementioned components, via a DigiTimes Asia report. Chen goes on to explicitly state that Adata and its usual competitors aren't fighting between themselves for supply in what would be businesss as usual. Instead, cloud service providers (CSPs) -- almost always AI datacenters in this day and age -- are now gobbling up all available capacity of these components. As if all that wasn't enough, Chen believes that the shortage of hard drives is incentivizing customers to try and purchase SSDs for non-volatile storage needs instead, further twisting the spiral of storage scarcity. Adata's sales team has purportedly gotten instructions to "sell sparingly" and "give priority to loyal customers" in turn. Additionally, the inventory at upstream suppliers is charitably described as barebones, with only two to three weeks' worth of supply, down from the usual two-to-three months of capacity. In other words, that means that SK hynix, Samsung, Micron, Kioxia, and Western Digital are selling most everything they make to AI projects. In case you're not entirely convinced of how big a deal Chen's suspicion-confirming statements are, Adata had a 11% share in the SSD market in 2024, and holds a 5% slice of the memory market. Those are small percentages, but they're for the entire world, meaning that Adata purchases memory and flash chips at large volumes and careful negotiated prices. The deals are likely done multiple months in advance, and Adata certainly would otherwise have far bigger negotiation power than, say, Joe's Discount Memory. The company's stock price has climbed sky-high since August, and it hit a 15-year revenue high in Q2 2025. That's keeping in tandem with the general industry trend, with DRAM revenue jumping 17.1% in the past fiscal quarter, and enterprise SSD revenue boosting by 12.7%. Even CPU/GPU chipmakers are charging gigantic premiums for their top-shelf wares, too. All of this AI-fueled demand is now affecting the supply chain for all modern consumer electronics. Most any advanced device, including phones, TVs, consoles, and cars, all need one or more of the components that are now in high demand. If you're on the fence on whether to purchase a new handset, computer, or television, you'd be wise to consider moving sooner rather than later. Even if AI isn't taking all of our jobs, it seems poised to take all of our silicon.

[2]

Memory and storage prices will only get worse, Adata CEO says

Serving tech enthusiasts for over 25 years. TechSpot means tech analysis and advice you can trust. The big picture: Multiple manufacturers have recently frozen or hiked memory and storage prices as demand from AI data centers surges, and executives warn the situation may get worse before it gets better. Across the industry, AI companies and cloud giants are displacing traditional memory module makers, while DDR4 RAM - once the backbone of PCs and servers - is slowly being phased out. The result is an unprecedented perfect storm that's upending supply chains and reshaping the economics of the memory market. Adata chairman Simon Chen projects that manufacturing shortages in RAM, flash memory, solid-state drives, and hard drives will continue driving prices upward well into 2026. Speaking at a press conference, Chen said that this is the first time in his three-decade career that all four major manufacturing lines have experienced simultaneous shortages. Cloud service providers that have heavily invested in AI, such as OpenAI, Amazon Web Services, and Microsoft, require massive amounts of storage space to address the data needs for training large language models amid the ongoing AI boom. These companies have become the primary clients for memory and storage manufacturers, leaving traditional module manufacturers to sift through reserves that have reached historic lows. Since manufacturers began transitioning away from DDR4 RAM, prices for the previous-generation memory have surpassed those of its successor, DDR5. Chen expects DDR4 to bear the brunt of the crisis, with contract prices rising by 20 - 30% between the fourth quarter of this year and the first half of 2026, and spot prices rising higher. DDR5 prices are also expected to increase, and HDDs will suffer from low inventory through the first half of next year. AI server demands are stretching supplies despite efforts by Samsung and SK Hynix to intensify production by up to 30%. Chen explained that the AI craze has upset the traditional memory market cycle, lengthening the upswing period. The Adata chairman expects shortages to last for at least four years, but others have an even more pessimistic outlook. Phison CEO Pua Khein-Seng recently projected NAND flash shortages to begin next year and last for a decade, creating a "supercycle." Samsung, Micron, SanDisk, Western Digital, and Seagate have already adjusted prices in recent weeks. Since AI data centers require vast quantities of infrequently accessed storage, for which HDDs are ideal, demand has driven manufacturing into uncharted territory and spilled over into the SSD sector. Consumers might see prices climb by up to 30%. However, much of the speculation depends on the enduring popularity of AI, which faces growing fears of a bubble. Although concerns about the true financial benefits of using AI are growing, no one is sure when the AI bubble might burst or how demand could change afterward.

[3]

Uh oh, it's happening: ADATA chairman says the perfect storm of simultaneous DRAM, SSD and HDD shortages is already upon us and it looks like prices are only going in one direction

A couple of weeks ago I reported on the idea that the AI was going to cause a run on all kinds of memory and storage hardware. Well, it's already happening according to no less an authority than the chairman of memory specialist ADATA. ADATA's Chen Libai has said that supplies of all the major memory and storage technologies -- DRAM, NAND, and HDD -- are now in shortage. Chen says it's the first time that has happened in 30 years. The reason is clear enough: demand from AI. "Our competitors in the fight for supply are no longer our peers, but giant CSPs (cloud service providers)," Chen said. By way of example, OpenAI alone (yeah, it's always OpenAI) has signed a deals with Samsung and SK Hynix for fully 900,000 DRAM wafers per month, which is equivalent to 40% of current global DRAM output. Moreover, the AI-driven surge in demand is prompting manufacturers to prioritise production capacity for high-margin applications. Sound familiar? It's all rather too reminiscent of the GPU market for comfort, and we know what happened to graphics card prices in the last few years. Ouch. In terms of ADATA's own business, which majors in memory modules, Chen says the company has had to instruct sales staff to "sell sparingly and support key customers." He also thinks unprecedented demand from the AI industry means that the usual boom-and-bust DRAM cycle has been broken. As for what this means for we poor PC gamers, well, it looks like there's a good chance that RAM and SSD prices are set to join GPUs as significant pain points. Indeed, it's already happening. By way of example, this popular Crucial 32GB DDR5 kit was ticking along at $84.99 for much of 2025 on Amazon. Now it's $119.99. How high it will go in the coming months is hard to say. The good news is that, for now, SSD prices seem to be holding steady. But the implication of Chen's comments is that SSDs are likely to follow suit. Indeed, we've touched on the impact of AI companies sucking up all the HDDs and turning their attention to SSDs recently, too. All of which means PCs will probably be more expensive in the short term and stay that way for the medium term, which is a bummer. Oh, and if you're considering a new SSD, now seems like a good time to pull the trigger. It looks very likely that prices are only going one way.

[4]

ADATA chairman says unprecedented and historic shortage of DRAM, SSDs, and HDDs is here

TL;DR: ADATA chairman Chen Lebai confirms historic shortages in DRAM, NAND Flash, SSDs, and HDDs through 2026, driven by AI data center demand and manufacturing shifts. Major suppliers prioritize high-margin AI products, causing rising prices and limited consumer availability. This unprecedented supply crunch may impact PCs, smartphones, and more for years. Last week, we reported on Phison's CEO discussing "severe shortages" expected to hit the NAND-based flash memory and SSD market due to a manufacturing shift prioritizing AI data centers and systems. This week, ADATA chairman Chen Lebai (via DigiTimes) has chimed in to confirm that DRAM, NAND Flash, SSDs, and even traditional HDDs are about to face an unprecedented and historic shortage as we head into 2026. As foundries struggle to keep up with demand, including prominent players like Samsung Electronics, Micron, and SK Hynix, this will not only lead to rising prices but also make it much harder for consumers and non-AI-focused customers to get what they need. ADATA's chairman notes that when it comes to accessing stock for its own products, it's now competing directly with large cloud-based companies that are buying as much capacity as they can for their data centers. He also states that this is the first time he has seen a situation where everything from DDR4 and DDR5 memory to NAND-based SSDs and traditional HDDs is experiencing simultaneous shortages. It has already reached the point where Chen Lebai is instructing his sales teams at ADATA to sell sparingly and focus on existing customers. According to reports, ADATA still has inventory worth billions, but with limited supply, it's now essentially in "ration" mode for sales. ADATA chairman Chen Lebai is an industry veteran with almost three decades of experience in the memory field. With the rise of AI, he believes it has disrupted the typical cyclical pattern of technological innovation, where new technologies emerge. In contrast, older technology comes down in price before being phased out. The proof of this is evident in DDR4 memory, which is now more expensive than DDR5 due to shortages and chip manufacturers prioritizing high-profit-margin AI products. And with ADATA now competing with the likes of OpenAI, Google, Amazon, Microsoft, and others, for capacity and wafer allocation, it paints a very bleak picture for the future of consumer electronics and technology. Phison's CEO, Pua Khein-Seng, went so far as to say that the shortages will last up to a decade, which will have far-reaching effects on everything from desktop PCs to gaming consoles, smartphones, motor vehicles, and more.

Share

Share

Copy Link

ADATA chairman warns of historic shortages in DRAM, SSDs, and HDDs due to surging AI datacenter demand. This supply crunch is expected to impact consumer electronics prices and availability through 2026 and beyond.

AI-Driven Demand Reshapes Memory and Storage Markets

The rapid expansion of artificial intelligence technologies is causing an unprecedented shortage in memory and storage components, according to industry experts. ADATA chairman Simon Chen has warned that the world is facing a historic shortage of DRAM, NAND flash for SSDs, and hard drives simultaneously – a situation he hasn't witnessed in his three-decade career

1

4

.

Source: TweakTown

Cloud Service Providers Dominate Supply Chain

The primary driver behind this shortage is the insatiable demand from AI datacenters and cloud service providers (CSPs). Companies like OpenAI, Amazon Web Services, and Microsoft are now the primary clients for memory and storage manufacturers, leaving traditional module manufacturers struggling to secure supplies

2

. For instance, OpenAI alone has reportedly signed deals with Samsung and SK Hynix for 900,000 DRAM wafers per month, equivalent to 40% of current global DRAM output3

.Impact on Prices and Availability

The shortage is already affecting prices across the board. Chen projects that DDR4 RAM contract prices could rise by 20-30% between Q4 2025 and H1 2026, with spot prices potentially climbing even higher

2

. Interestingly, DDR4 prices have surpassed those of DDR5 due to manufacturers transitioning away from the older technology4

.

Source: PC Gamer

Long-Term Implications

Industry experts predict that this supply crunch could last for years. Chen expects shortages to persist for at least four years, while Phison CEO Pua Khein-Seng has an even more pessimistic outlook, projecting NAND flash shortages to last for a decade

2

4

.Related Stories

Consumer Impact and Market Disruption

The shortage is expected to have far-reaching effects on consumer electronics. PCs, smartphones, gaming consoles, and even automobiles could see price increases and limited availability

1

4

. ADATA has already instructed its sales team to 'sell sparingly' and prioritize key customers3

.

Source: Tom's Hardware

Industry Response and Future Outlook

Major manufacturers like Samsung and SK Hynix are attempting to increase production by up to 30%, but this may not be sufficient to meet the growing demand

2

. The AI boom has disrupted the traditional memory market cycle, potentially leading to a prolonged period of high prices and limited availability. However, some experts caution that the sustainability of this trend depends on the enduring popularity of AI, with growing concerns about a potential AI bubble2

.References

Summarized by

Navi

[1]

Related Stories

AI Boom Sparks Decade-Long Memory and Storage Shortage Concerns

06 Oct 2025•Technology

AI Demand Drives Memory Prices to Record Highs, Impacting Consumer Tech Market

31 Oct 2025•Business and Economy

AI Demand Triggers Memory Crisis: DRAM Prices Surge 50% as Supply Chain Buckles

23 Oct 2025•Business and Economy

Recent Highlights

1

Google Gemini 3.1 Pro doubles reasoning score, beats rivals in key AI benchmarks

Technology

2

Meta strikes up to $100 billion AI chips deal with AMD, could acquire 10% stake in chipmaker

Technology

3

Pentagon threatens Anthropic with supply chain risk label over AI safeguards for military use

Policy and Regulation