AI Demand Crisis Drives Memory Prices to Breaking Point as Stores Abandon Fixed Pricing

7 Sources

7 Sources

[1]

64GB of DDR5 memory now costs more than an entire PS5, even after a discount -- Trident Z5 Neo kit jumps to $600 due to DRAM shortage, and it's expected to get worse into 2026

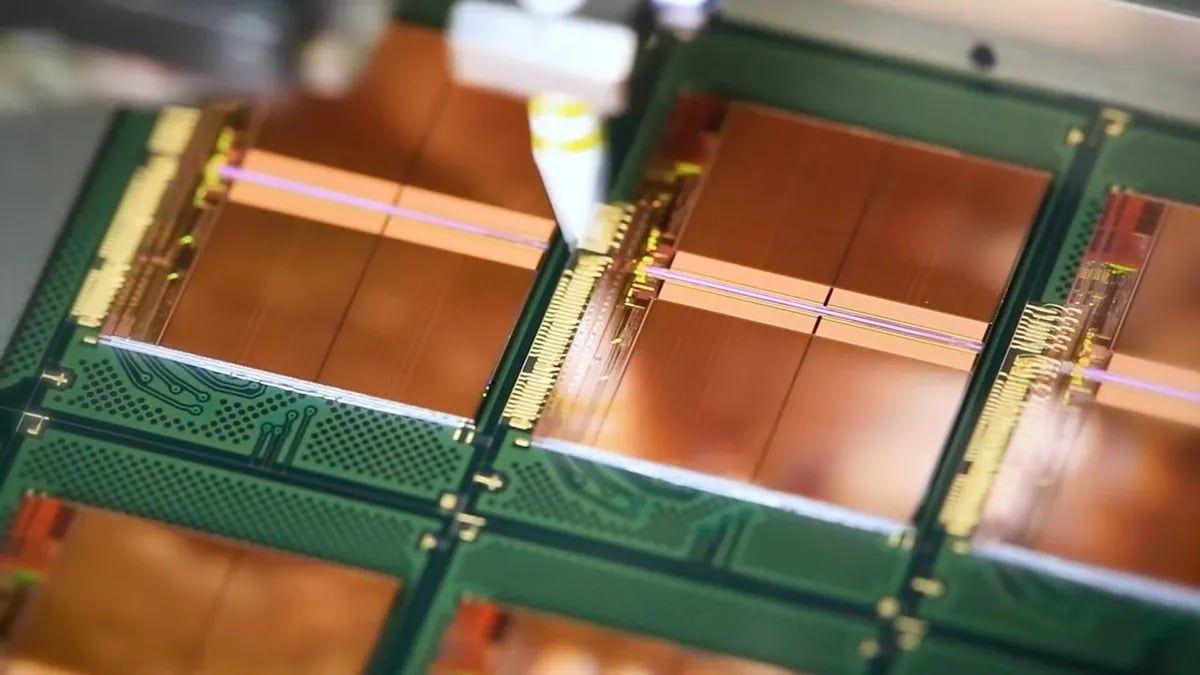

Thanks to the AI boom devouring the majority of the world's memory and storage supply, end-consumers are now facing increasingly inflated prices for common components. DDR5 RAM, a necessity for building current-gen Intel or AMD systems, has now reached record highs in terms of pricing; a 64 GB kit of G.Skill's Trident Z5 Neo 6000 MT/s RAM is listed at $599.99 on Newegg right now -- that's $200 more than a PS5 Slim or a Microsoft Xbox Series S, and just $50 shy off an entire PS5 Pro at the moment. That $600 price tag has a 6% discount already applied to its original $640 ask, as part of a Black Friday deal. For context, a more exclusive 64 GB limited edition Corsair Dominator Titanium kit cost only $349 when we reviewed it a few months ago. Earlier this year, we posted about DDR5 deals on Prime Day where the standard edition of the same kit was just $299, and you could get other comparable 64 GB kits for as low as $140. A quick glance at price tracking data, and G.Skill's Trident Z5 Neo kit has regularly sat at $205-$220 for the past few months, and it was only in late October that it started to pick up steam. From September 20th when it was listed at $220, to $640 now. In just 2 months we've witnessed an astounding ~190% surge. Right as this particular Trident Z5 Neo kit began to skyrocket in price was when the industry first started to pick up on the affects of the AI crunch. A few days later we published our initial coverage on DDR5 RAM price hikes; from there, the situation has only worsened to reach worrying levels. Insane mark-up aside, the kit itself is one of the best on the market, recommend as the top pick for DDR5 memory in our roundup. Unfortunately, it seems like high prices are going to be the story going forward. The surge in demand for AI projects will see production lines will prioritizing serving AI clients, leaving consumers to pay through the nose or make the best of what they have. Experts speculate that both DRAM and NAND constraints will become normal throughout 2026 as Big Tech looks to pursue AGI. In the meantime, hard drives are vanishing from store shelves to the point where microSD cards are serving as a feasible replacement for them. Large-capacity nearline HDDs are backordered for 2 years, as a result of which QLC SSDs are now being swept up at alarming rates. Many distributors are even selling memory and motherboards bundled together to combat the global shortage. Even Valve's upcoming Steam Machine will end up costing more than expected due to the production window of the device aligning with the DRAM crisis. That being said, memory has almost always lived in a rollercoaster cycle, with manufacturers oversupplying for a couple of years, then undersupplying for the next few. Looking at it optimistically, you're probably going to find DDR5 at bargain prices again in 2027.

[2]

Memory prices are so bad stores won't even list them - 64GB DDR5 now costs more than a PS5

Serving tech enthusiasts for over 25 years. TechSpot means tech analysis and advice you can trust. Ripple effect: What would you rather buy: 64GB of DDR5 or a PlayStation 5 console? Because right now, the memory kit costs more. As the memory crisis keeps worsening, DRAM prices are skyrocketing. Some stores aren't even displaying fixed prices on memory modules, relying on market rates because costs are changing so rapidly each day. As the AI industry continues to greedily take most of the world's DRAM, the impact on consumers is becoming increasingly obvious. Newegg, for example, is selling 64GB of G.Skill Trident Z5 DDR5 6000 memory for a stunning $599. That's $200 more than the digital PS5 and the Xbox Series S, and more expensive than the MSRP of an RTX 5070. Related reading: AI Is Eating All the DRAM. DDR5 Prices Just Doubled. GPUs Could Be Next. Shockingly, Newegg's price is actually reduced by 6% as part of the retailer's Black Friday deal - the usual price is $640, which is creeping closer to PS5 Pro territory. It's the same story elsewhere. Amazon product tracker CamelCamelCamel shows that 64GB of Crucial Pro DDR5 6000 RAM was just $139 between July and August. Today, it's $497, a 257.5% increase. The situation is so bad that we're now seeing brick-and-mortar stores remove the fixed price tags from their memory displays. BlueSky user Steve Lin photographed a sign at California retail chain Central Computers that highlights the problem. It states that the global memory chip shortage has caused the price of RAM and other components to increase by 20-50%. Costs are fluctuating massively on a daily basis, which means the store cannot display fixed prices as they change so much and so often. Micro Center has also stopped displaying prices on memory. Reddit user CassTexas posted a photo of the store's warning label, which advises customers to see a sales associate for pricing information. Taken at Microcenter on 11/23.. byu/CassTexas inpcmasterrace Memory has experienced volatile pricing over the years, but the current situation brings to mind the graphics card nightmare that happened during the height of Covid. Speaking of graphics cards, we're starting to see that product segment being affected, too. As noted in our deep dive into the situation, GDDR memory shares manufacturing capacity with other types of DRAM, and when manufacturers prioritize AI products, consumer-focused memory supply takes the hit. There were reports yesterday that AMD has informed partners to prepare for a 10% price increase across its product line. There were even claims that Nvidia and AMD could kill off some low- to mid-range cards where memory costs account for a large share of the bill of materials. Meanwhile, system builders are panic-buying memory, which could cause a chip shortage lasting until 2027. AI firms are striking rapid-build deals with data-center developers that aim to bring gigawatts of new capacity online within just two to three years, a surge that is creating a memory crunch. Modern AI workloads, especially those running on GPUs, demand enormous amounts of DRAM, and suppliers are already feeling the strain. SK Hynix, one of the world's leading memory makers, recently revealed that its DRAM, NAND, and even next-year's high-bandwidth memory (HBM) production have effectively been sold out in advance.

[3]

We're So Screwed: AI Is Making Every Gadget Cost More

Just when we thought we were settled into the new normal of tariff-borne PC and gaming console price hikes, next year’s devices are set to be even more expensive. You can blame the current favorite buzzwordâ€"AIâ€"for the increasing cost of RAM and flash storage. All computers depend on memory to some extent, but those who want the biggest, best PCs or gaming devices will feel the sticker shock worst of all. We’ve been reporting about the spiking cost of RAM prices since October. Essentially, AI data centers have such a demand for memory that the prices of SSDs (solid state drives), DRAM (dynamic random access memory), and HDDs (hard disk drives) are all ballooning in price. This is most keenly felt in the discrete PC RAM market. Corsair, one of the most popular brands for fast, gaming-ready RAM sticks, told Gizmodo over email, “Our DRAM prices have increased in response to the severe supply shortage we are seeing across the industry.†And it just keeps getting worse. A pack of 64GB DDR5 RAM from memory brand Crucial spiked from $150 to more than $400 in just two months, as evidenced by the Amazon price tracking site camelcamelcamel. Other, lower-end RAM sticks may see less of a bump, but users will inevitably find the more RAM they want, the more it will cost. Four sticks of 16GB DDR5 RAM from Corsair now sell for an astronomical $688. The same sticks in white demand $948. And they’re not even the priciest RAM available. Memory prices will inevitably impact the laptop industry as well. PCs are getting hit the hardest, especially if you had hopes of finally upgrading your desktop tower with new components. After months of scarcity, the price of GPUs from both Nvidia and AMD has normalized closer to the original suggested retail price. A Radeon RX 9070 XT remains a hot commodity and is still going for more than $600 MSRP at most retailers. However, numerous leakers have proposed that GPUs could see price hikes due to the ballooning cost of VRAM. PowerColor, one of AMD’s board partners who makes discrete GPUs, took to Reddit last week (via VideoCardz) to tell users to “buy before the last week of the year before prices kick up.†The PR rep in this case was referring to possible deals happening before Black Friday but added in an update that this was in response to consumers “asking for advice on if they should 'buy now' because of market conditions.†Taiwanese media outlet UDN further claimed, based on anonymous sources, that AMD GPU prices could go up from several major board partners, including Gigabyte and Asus, as well as PowerColor. Consoles won't be spared of potential price hikes, either. Microsoft’s Xbox brand pushed the cost of tariffs onto consumers twice in 2025 with its Xbox Series X and Series S. Now, the high-end console with a disc drive costs $650, $150 more than it did at launch five years ago. YouTuber "Moore’s Law Is Dead," who has consistently leaked information on unreleased AMD hardware, claimed in a recent video that Microsoft is telling partners that it may need to jack up prices for Xbox consoles once more, or else stock could significantly diminish “sooner rather than later.†The YouTuber further claimed that Sony “planned ahead, bought up gobs of RAM near the bottom of the pricing, and thus they should be fine for months.†That’s small comfort, however, for those who still plan to buy a Nintendo Switch 2. The system comes with 256GB of internal storage, and you need Express-level microSD cards to expand that limited storage capacity. Technohouse Toei, a Japan-centric computer store, told the Japanese outlet IT Media (read by machine translation) that it’s getting more difficult to acquire large-capacity microSD cards. Analysts anticipate that flash storage prices will climb through the roof in early 2026. Citing reports from the Commercial Times and Reuters, analyst firm TrendForce reported late last week that the makers of NAND storage are “taking turns raising prices.†And this situation may not get any better over the following months. Sure, TrendForce said the memory sector is going to grow as fast as the tale of Jack’s beanstalk, but that won’t necessarily fix demand. Earlier this month, Korean-centric newspaper Chosun Biz reported that major flash storage manufacturers like Samsung and SK Hynix actually cut supply in the second half of 2025. Samsung is “internally reviewing†price hikes of 20% to 30%, according to Chosun. Either memory production has to increase to meet demand, or else the AI data centers have to stop sucking down the world’s supply of SSDs and HDDs. The sooner the AI bubble bursts, the better it will be for PC prices.

[4]

AMD might soon increase the price of its Radeon RX 9000 GPUs

* AMD says RX 9000 card costs may rise as RAM (GDDR6) prices jump. * AI and data centers are hogging HBM/DRAM, squeezing consumer GPU memory supply. * Gamers may see higher RX 9000 MSRPs as partners pass rising BOM costs to consumers. AMD's RX 9000 GPUs represent a cheaper alternative to NVIDIA's ultra-powerful, but ultra-expensive RTX 5000 GPUs, but they're not quite the budget kings they used to be. Now, they might be getting even more expensive. And you can probably blame AI for this. AMD has reportedly notified partners that price hikes are coming that will eventually affect final MSRPs for AMD cards. The cost for manufacturing graphics cards is rising sharply, and it's all thanks to RAM prices -- hikes in the prices of DRAM and NAND memory are affecting what goes into graphics cards as well. This is something we've gone into in detail in the past, and not only is it affecting the actual RAM sticks we put in our computers, but also the RAM chips that go into the rest of our hardware as well. As a reminder, AMD's RX 9000 cards use specialized GDDR6 memory, and while this is distinct from the DDR5 used in system RAM, the manufacturing lines are linked nonetheless. If there's increased demand for one type of RAM, it's going to affect the others as well as semiconductor fabs shift their focus to the most profitable memory types to meet industrial demand. Because of this, there's less supply of consumer-grade video memory, while demand remains the same. The shortages are driving up the bill of materials for GPU manufacturers, and that cost is now being passed down the chain from AMD to its board partners -- and eventually, to the consumer. As we've told you before, the culprit is data centers that require immense amounts of high-bandwidth memory (HBM) and server-grade DRAM for AI processing. Major memory manufacturers like Samsung, SK hynix, and Micron are allocating more of their production capacity to AI-related hardware. It's a similar scenario to when there was increased demand for GPUs themselves around 2020-2022. The culprit back then was cryptocurrency mining, and now, it's AI. Companies hop on what's trendy, and that affects everyone, even if you don't care about AI yourself. The gaming market is becoming collateral damage in the AI arms race. As long as data center demand remains high, consumer hardware will likely face continued pricing pressure. As of now, AMD's price hikes are not official, but we'll have to wait and see how things pan out over the next few weeks.

[5]

RAM is so expensive that stores are selling it at market prices

Generative "AI" data centers are gobbling up trillions of dollars in capital, not to mention heating up the planet like a microwave. As a result there's a capacity crunch on memory production, shooting the prices for RAM sky high, over 100 percent in the last few months alone. Multiple stores are tired of adjusting the prices day to day, and won't even display them. You find out how much it costs at checkout. That's according to BlueSky user Steve Lin, who snapped a photo at Central Computers, a retail chain in central California. The store cites a global shortage in memory chips causing prices to change drastically every day. "Because of this, we can't display fixed prices on certain products at this time," reads the sign posted in front of a case full of Corsair RAM. "If you have questions or want current pricing on any item, our team is happy to help." A Reddit poster saw similar signs at a MicroCenter store, citing "market volatility" (via Tom's Hardware). Another user in the BlueSky thread showed a photo that appears to be a Best Buy case of RAM, showing a 32GB set of two DDR5 DIMMs going for over $400 USD, a 64GB kit for over $900. A look at Best Buy's online shop shows that as of today, that pricing is accurate. For the sake of comparison, I bought a pair of Patriot DIMMs at the same capacity and 6,000MHz speed a year and a half ago for $155. This is, in a word, insane. There are a lot of moving parts here, between a higher demand for DDR5 as DDR4-standard processors and motherboards finally exit the market, and prices in the United States in particular being stressed by a year of wildly fluctuating tariffs and exceptions. But the biggest driving factor is the booming construction of "AI" data centers, feeding a massive and growing industry with an unquenchable hunger for memory and storage. Data centers aren't gobbling up the same consumer-grade memory that goes into new laptops and gaming desktops, but there is a limited amount of production capacity popping out memory modules from factories. If a memory producer like Samsung, Micron, or SK Hynix can max out its capacity with gigantic, profitable orders from companies producing memory and storage for data centers, it will. That leaves little room for the production of new consumer-grade memory, and even less for the memory sold in its own packaging as RAM DIMMs and solid-state drives, since the lion's share will go to PC manufacturers like Dell and Lenovo. As prices climb higher, it's possible we could be seeing other exacerbating factors, such as scalpers buying up what scant supply is available, or retailers getting in a cheeky little bump hoping it'll go unnoticed in the chaos. That's what happened to graphics cards a few years ago, between the cryptocurrency boom and higher demand for gaming PCs during the pandemic. While prices for completed laptops and pre-built desktops are slower to change as their long manufacturing times lock in rates from weeks or months before, it seems inevitable that the cost of completed consumer electronics will rise, too. Memory prices may get a much-needed correction before too long, either from the market adjusting itself around a new reality, or as demand for new and as-yet-unproven "AI" capacity goes down. Economists are in dread of the "AI" bubble collapsing so quickly and catastrophically that it takes the rest of the U.S. economy (and large chunks of the global economy) with it, in a mirror of the dot-com boom and bust of 2000. At that point, memory should become more affordable...though we might have a lot more to worry about than our Counter-Strike frame rate.

[6]

It's official: 64GB of DDR5-6000 RAM now costs way more than a PlayStation 5 console

TL;DR: DDR5 memory prices have surged dramatically due to AI-driven demand, with 64GB kits rising from $150 to over $500, surpassing the cost of a PlayStation 5 console. This RAM shortage is driving up PC upgrade costs and impacting prices of graphics cards and other DRAM-dependent devices, with further increases expected in 2026. You can buy an entire PlayStation 5 console for less than what a 64GB kit of DDR5-6000 memory would cost you, and it's only going to get worse. The RAM shortage is being blamed on the AI boom, which is consuming as much of the best DRAM memory chips it can, increasing the price of DDR5 memory and DDR5 memory kits for the PC. It's gotten to the point that a $205-$220 memory kit from a few months ago -- the G.SKILL Trident Z5 Neo RGB series 64GB DDR5-6000 memory kit -- now costs $599, and that's with some discount applied. Looking at the tracking data of DDR5 RAM prices, you could get a 64GB DDR5 memory kit for just $140, but now 64GB kits are $500+ in the last couple of months. Sony has its PlayStation 5 Digital console priced at $399, and the Microsoft Xbox Series S also at $399, while the PS5 Slim Disc costs $449, and the more powerful PS5 Pro costs $649. 64GB DDR5 RAM going from only $150 from a couple of months ago to $500+ is alarming, meaning anyone wanting to upgrade has missed the boat in terms of cheap DDR5 RAM pricing, but also the future of building and upgrading PC systems is going to be much more expensive. And it's not just the RAM market... but graphics cards, consoles, Valve's exciting new Steam Machine... anything with DRAM inside is going to be more expensive. We can expect higher prices on anything with DRAM inside of them starting in 2026, with AMD AIB partner PowerColor even recently saying that NOW is the time to buy, as graphics cards will be more expensive next year.

[7]

AMD's Radeon graphics cards are about to become a lot more expensive, report says

TL;DR: Memory shortages driven by AI demand and data center strategies are causing significant price increases for AMD Radeon and NVIDIA GeForce GPUs. Rising memory procurement costs, especially for GDDR6 and GDDR7, are expected to impact RDNA 4 and RTX 50 Series models, potentially delaying product launches and raising consumer prices throughout 2026. Recently, we've been reporting on how memory shortages created by the AI boom and the shift to a data center-first strategy for manufacturers are already causing prices to increase dramatically. It has been described as an unprecedented situation that will affect all corners of the tech world, with the situation expected to worsen throughout 2026. According to a new insider post over at Board Channels, the price for AMD's Radeon graphics cards could increase very soon due to a "significant increase in memory procurement costs." The post indicates that AMD is communicating to its partners in Asia that the upcoming shipment pricing and costs for GPUs and memory will increase, with the potential for it to be substantial. At this time, we can only guess as to what the outcome will be if these costs are passed down to consumers (which they probably will due to the small margins on GPUs), but it's expected to affect all RDNA 4 models, which include the Radeon RX 9060 XT, Radeon RX 9070, and the flagship Radeon RX 9070 XT. The price increase will also affect Radeon graphics cards for workstations and the AI market, too. AMD, of course, isn't alone, as there are rumors that NVIDIA is planning to raise the prices for its GeForce RTX 50 Series lineup in early 2026 for the same reason - memory shortages and rising costs. Although NVIDIA utilizes the newer and more expensive GDDR7 memory in its GPUs, it appears that AMD's decision to stick with the more affordable GDDR6 memory may not save it from its current situation. The problem, according to some, lies with the DRAM industry's inability to meet demand or increase production in a timely manner, thereby avoiding scarcity and price increases. So this is AMD and NVIDIA potentially raising prices in response to market conditions first and foremost. To such an extent that the shortage will reportedly cause NVIDIA's upcoming leaked GeForce RTX 50 Series SUPER refresh to be delayed by several months.

Share

Share

Copy Link

The AI boom has created a severe memory shortage, causing DDR5 RAM prices to surge over 190% in just two months. Some retailers have stopped displaying fixed prices due to daily fluctuations, with 64GB kits now costing more than gaming consoles.

AI Boom Triggers Unprecedented Memory Crisis

The artificial intelligence revolution has created an unprecedented crisis in the global memory market, with consumer RAM prices experiencing dramatic increases that are fundamentally reshaping the PC hardware landscape. What began as gradual price increases has accelerated into a full-blown shortage, forcing retailers to abandon traditional pricing models and leaving consumers facing costs that rival entire gaming systems

1

.The scale of the price surge is staggering. A 64GB kit of G.Skill's Trident Z5 Neo DDR5 6000 MT/s RAM now sells for $599.99 on Newegg, representing a 190% increase from its September price of $220

1

. This pricing puts high-capacity memory kits above the cost of major gaming consoles, with the same kit costing $200 more than a PlayStation 5 Slim and approaching PlayStation 5 Pro territory .

Source: Tom's Hardware

Retailers Abandon Fixed Pricing Models

The volatility has become so severe that major retailers are fundamentally changing how they sell memory products. Central Computers, a California retail chain, has posted signs explaining they cannot display fixed prices due to daily fluctuations caused by the global memory chip shortage

5

. Similarly, MicroCenter has removed price tags from memory displays, requiring customers to consult sales associates for current pricing information .

Source: PCWorld

This unprecedented retail response reflects the chaotic nature of the current market. Amazon price tracking data shows that 64GB of Crucial Pro DDR5 6000 RAM jumped from $139 in July-August to $497 currently, representing a 257.5% increase . Even premium retailers like Best Buy are showing 32GB DDR5 kits for over $400 and 64GB sets exceeding $900

5

.AI Data Centers Drive Supply Shortage

The root cause of this crisis lies in the explosive growth of AI data centers and their insatiable demand for memory resources. Major memory manufacturers including Samsung, SK Hynix, and Micron are prioritizing production for AI applications, particularly high-bandwidth memory (HBM) and server-grade DRAM

3

. SK Hynix has revealed that its DRAM, NAND, and next-year's HBM production have been effectively sold out in advance .

Source: TweakTown

This shift in manufacturing priorities creates a ripple effect throughout the consumer market. While data centers don't use the same consumer-grade memory found in gaming PCs, the limited production capacity forces manufacturers to choose between profitable AI contracts and consumer products

5

. The result is a severe supply constraint that affects everything from discrete RAM modules to the memory integrated into graphics cards and other components.Related Stories

Broader Hardware Market Impact

The memory crisis extends beyond RAM into other critical components. Graphics card manufacturers are facing pressure as GDDR memory shares manufacturing capacity with other DRAM types

4

. AMD has reportedly notified partners about potential price increases for RX 9000 GPUs due to rising memory costs, with PowerColor advising consumers to purchase before year-end price hikes3

.Storage devices are experiencing similar pressures, with large-capacity hard drives backordered for two years and microSD cards becoming viable replacements for traditional storage solutions

1

. The shortage has become so acute that some distributors are bundling memory with motherboards to combat supply constraints1

.Long-term Market Outlook

Industry experts predict that both DRAM and NAND constraints will persist through 2026 as technology companies pursue artificial general intelligence (AGI) development

1

. Flash storage prices are anticipated to climb significantly in early 2026, with manufacturers taking turns raising prices and Samsung reportedly reviewing internal price hikes of 20-30%3

.The situation mirrors historical memory market cycles, though the AI-driven demand represents an unprecedented scale of industrial consumption. While memory markets have traditionally followed boom-bust cycles with manufacturers alternating between oversupply and undersupply, the current AI boom's duration and intensity remain uncertain

1

. Some analysts suggest that relief may not arrive until 2027, contingent on either increased production capacity or reduced AI sector demand5

.References

Summarized by

Navi

[2]

[4]

Related Stories

AI Demand Triggers Memory Crisis: DRAM Prices Surge 50% as Supply Chain Buckles

23 Oct 2025•Business and Economy

AI Demand Drives RAM Prices to Record Highs as Memory Shortage Threatens Device Market in 2026

23 Dec 2025•Business and Economy

AI Demand Triggers Component Shortage as Dell and Lenovo Plan 15% Price Increases for Servers

03 Dec 2025•Business and Economy

Recent Highlights

1

Pentagon threatens Anthropic with Defense Production Act over AI military use restrictions

Policy and Regulation

2

Google Gemini 3.1 Pro doubles reasoning score, beats rivals in key AI benchmarks

Technology

3

Anthropic accuses Chinese AI labs of stealing Claude through 24,000 fake accounts

Policy and Regulation