Commonwealth Fusion Systems Secures $863M in Funding to Advance Nuclear Fusion Technology

2 Sources

2 Sources

[1]

Nuclear fusion developer raises almost $900mn in new funding

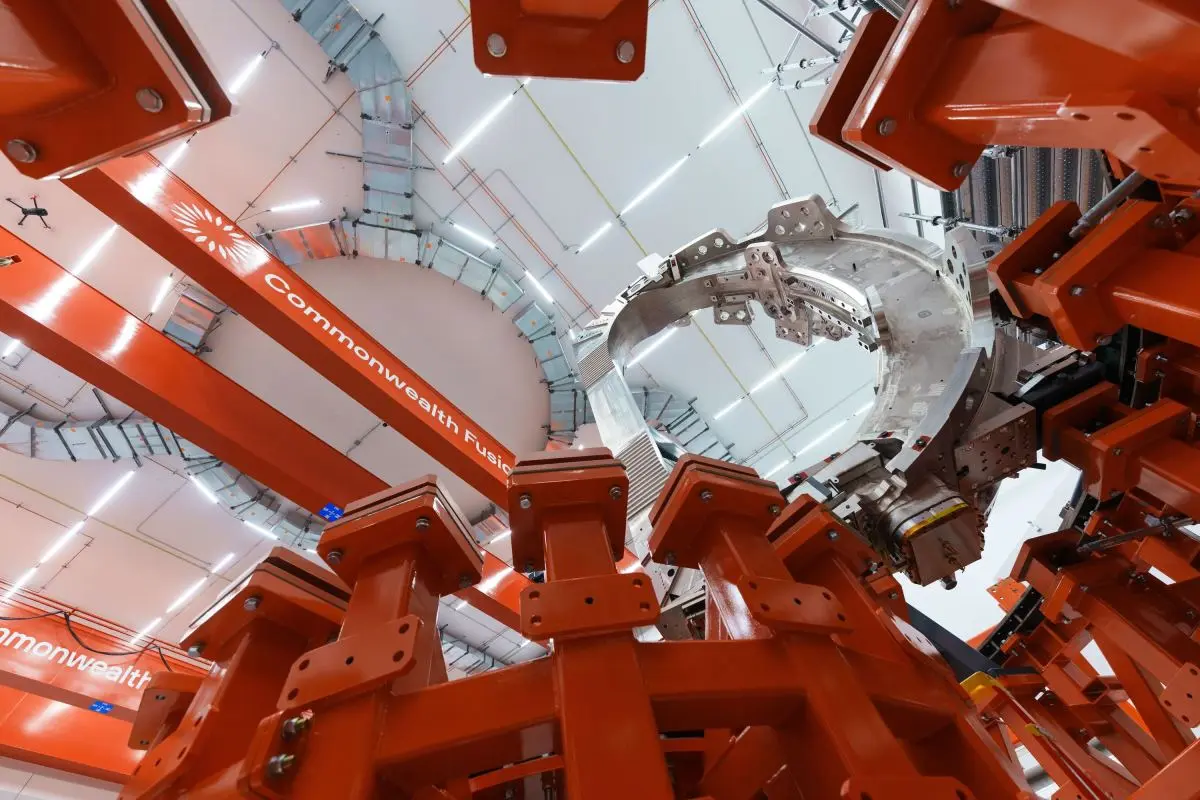

One of the most advanced nuclear fusion developers has raised about $900mn from backers including Nvidia and Morgan Stanley, as it races to complete a demonstration plant in the US and commercialise the nascent energy technology. Commonwealth Fusion Systems plans to use the money to complete its Sparc fusion demonstration machine and begin work on developing a power plant in Virgina, which secured a deal in June to supply 200 megawatts of electricity to technology giant Google. The Google deal was one of only a handful of such commercial agreements in the sector and placed CFS at the forefront of fusion companies trying to perfect the technology and develop a commercially viable machine. CFS has raised almost $3bn since it was spun out of the Massachusetts Institute of Technology in 2018, drawing investors amid heightened interest in nuclear to meet surging energy demand from artificial intelligence. "Investors recognise that CFS is making fusion power a reality. They see that we are executing and delivering on our objectives," said Bob Mumgaard, chief executive and co-founder of CFS. New investors in CFS's latest funding round, which raised $863mn, include NVentures, Nvidia's venture capital arm, Morgan Stanley's Counterpoint Global and a consortium of 12 Japanese companies led by Mitsui & Co. Nuclear fusion seeks to produce clean energy by combining atoms in a manner that releases a significant amount of energy. In contrast, fission -- the process used in conventional nuclear power -- splits heavy atoms such as uranium into smaller atoms, releasing heat. CFS is also planning to build the world's first large-scale fusion power plant in Virginia, which is home to the largest concentration of data centres in the world. BloombergNEF estimates that US data centre power demand will more than double to 78GW by 2035, from about 35GW last year, and nuclear energy start-ups already have raised more than $3bn in 2025, a 400 per cent increase on 2024 levels. But experts have warned that addressing the technological challenges to the development of fusion would be expensive, putting into question the viability of the technology. No group has yet been able to produce more energy from a fusion reaction than the system itself consumes despite decades of experimentation. "Fusion is radically difficult compared to fission," said Mark Nelson, managing director of the consultancy Radiant Energy Group, pointing to the incredibly high temperatures and pressures required to combine atoms. "The hard part is not making fusion reactors. Every step forward towards what may be a dead end economically, looks like something that justifies another billion or a Nobel Prize."

[2]

CFS secures $863M from Nvidia, Google, and major investors

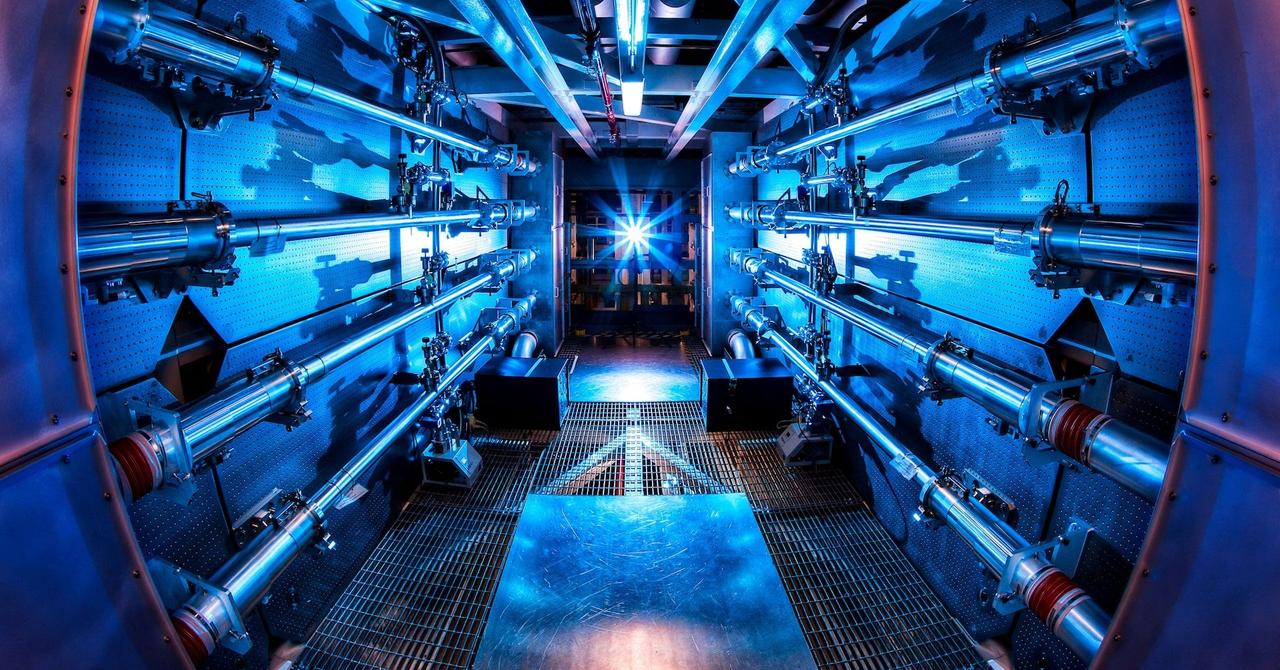

Fusion startup CFS secured $863M in new funding to advance its Sparc prototype and prepare for its first commercial power plant, Arc, planned for 2027-2028. Commonwealth Fusion Systems (CFS), a fusion power startup, has secured $863 million in funding from a diverse group of investors. The investment round included participation from Nvidia, Google, Breakthrough Energy Ventures, and others. This financial infusion aims to accelerate CFS's efforts to commercialize fusion energy technology, according to company executives. Bob Mumgaard, co-founder and CEO of Commonwealth Fusion Systems, addressed reporters, stating, "We're continuing our trend here of looking into the world and saying, 'How do we advance fusion as fast as possible?'" Mumgaard emphasized that the funding is specifically targeted at transforming fusion from a theoretical concept into a viable commercial and industrial enterprise. He highlighted the importance of translating the potential of fusion into practical applications. With this latest round of funding, the Massachusetts-based company has now raised nearly $3 billion in total, making it the most well-funded fusion startup to date. In 2021, Commonwealth Fusion Systems secured $1.8 billion in a previous funding round. These substantial investments reflect the growing confidence in the potential of fusion energy as a clean and sustainable power source. Fusion power has long been envisioned as a potentially limitless source of energy. However, it is only in recent years that investors have begun to seriously consider it as a viable investment opportunity. Advances in computing power and artificial intelligence have accelerated the pace of research and development in the field, leading to increased interest from both startups and investors. The fundamental principle behind fusion energy involves compressing and heating atoms to such an extent that they form plasma, a fourth state of matter. When the plasma reaches a critical temperature and pressure, the atoms begin to fuse together, releasing vast quantities of energy in the process. This process mirrors what occurs within the core of the sun and other stars. CFS is currently focused on constructing a prototype fusion reactor called Sparc, located in a suburb of Boston. The company anticipates activating Sparc sometime next year, with the goal of achieving scientific breakeven by 2027. Scientific breakeven is a crucial milestone in fusion research, representing the point at which the fusion reaction generates more energy than is required to initiate and sustain it. While Sparc is not designed to supply electricity to the power grid, its significance to CFS's overall strategy is paramount. According to Saskia Mordijck, an associate professor of physics at the College of William and Mary, "There are parts of the modeling and the physics that we don't yet understand." Mordijck added, "It's always an open question when you turn on a completely new device that it might go into plasma regimes we've never been into, that maybe we uncover things that we just did not expect." These statements highlight the inherent uncertainties and potential for unexpected discoveries in cutting-edge fusion research. Assuming that Sparc does not encounter any major technical obstacles during its operation, CFS plans to commence construction on Arc, its commercial-scale power plant, in Virginia, starting in 2027 or 2028. This timeline represents the company's ambitious roadmap for transitioning from prototype development to commercial energy production. Both the Sparc and Arc designs are based on the tokamak concept, a specific type of fusion reactor that utilizes powerful superconducting magnets to confine and compress plasma. Tokamaks have been extensively studied and developed within the fusion research community for decades. The utilization of this established technology allows CFS to build upon existing knowledge and infrastructure. Mordijck commented, "We know that this kind of idea should work. The question is naturally, how will it perform?" This statement encapsulates the central challenge facing CFS and other fusion energy companies: translating theoretical understanding into practical and efficient energy generation. The extensive list of investors in the Series B2 funding round suggests a strong level of confidence in CFS's approach. Ally Yost, CFS's senior vice president of corporate development, indicated that no single investor led the round. Yost also stated that several existing investors chose to increase their stakes in the company, demonstrating continued commitment to CFS's long-term goals. Among the existing investors that increased their investments are Breakthrough Energy Ventures, Emerson Collective, Eni, Future Ventures, Gates Frontier, Google, Hostplus, Khosla Ventures, Lowercarbon Capital, Safar Partners, Eric Schmidt, Starlight Ventures, and Tiger Global. The participation of these prominent investment firms underscores the broad appeal of fusion energy as a potential solution for global energy challenges. New investors in this round include Brevan Howard, Morgan Stanley's Counterpoint Global, Stanley Druckenmiller, FFA Private Bank in Dubai, Galaxy Interactive, Gigascale Capital, HOF Capital, Neva SGR, Nvidia's NVentures, Planet First Partners, Woori Venture Partners US, and a consortium of 12 Japanese companies led by Mitsui & Co., Ltd. and Mitsubishi Corporation. The diversity of these new investors, spanning various sectors and geographic regions, highlights the widespread interest in fusion energy technology. CFS's ability to attract such a broad base of investors may prove advantageous as the company establishes its supply chain and identifies partners for the construction of its power plants and the purchase of electricity generated. To date, CFS has entered into an agreement with Google to supply 200 megawatts of power from Arc. This agreement represents a significant step toward commercializing fusion energy and integrating it into existing energy infrastructure. Mordijck noted that Arc, as the first of its kind, is likely to be more expensive than subsequent power plants. This observation reflects the inherent costs associated with pioneering new technologies and establishing proof of concept. Mumgaard told TechCrunch that Sparc will not only demonstrate the scientific validity of fusion but also provide valuable insights into the capabilities required to deliver commercially viable fusion power. He further explained that Sparc will provide critical cost data. "That's very important. But it's also to know the capabilities that you need to be able to deliver it. It's also to have the receipts, know what these things cost." While the new funding will support the progress of Sparc, it will not be sufficient to finance the construction of Arc, which Mumgaard estimates will cost several billion dollars. At this juncture, the company has not yet determined the precise structure of the financing for Arc. Mumgaard stated, "The fact that it's a first of a kind technology is a wrinkle that then has a big impact on where the capital will come from." Mumgaard concluded, "We're not entirely sure, but we are pretty committed to doing this. And our investors are pretty committed to doing this." These declarations demonstrate the unwavering commitment of CFS and its investors to realizing the potential of fusion energy as a clean and sustainable power source.

Share

Share

Copy Link

Commonwealth Fusion Systems (CFS) has raised $863 million from investors including Nvidia and Morgan Stanley to accelerate the development of nuclear fusion technology, bringing its total funding to nearly $3 billion.

Groundbreaking Funding for Nuclear Fusion

Commonwealth Fusion Systems (CFS), a leading nuclear fusion developer, has secured approximately $863 million in a new funding round, bringing its total raised capital to nearly $3 billion since its inception in 2018

1

2

. This significant investment comes from a diverse group of backers, including tech giant Nvidia, financial powerhouse Morgan Stanley, and a consortium of 12 Japanese companies led by Mitsui & Co1

.Strategic Plans and Milestones

Source: FT

The substantial funding will be utilized to complete CFS's Sparc fusion demonstration machine and initiate the development of a commercial power plant in Virginia

1

. The company has already made headlines with its agreement to supply 200 megawatts of electricity to Google, positioning CFS at the forefront of fusion companies striving to commercialize this nascent energy technology1

.Investor Confidence and Market Trends

Bob Mumgaard, CEO and co-founder of CFS, emphasized the growing investor recognition of the company's progress, stating, "Investors recognize that CFS is making fusion power a reality. They see that we are executing and delivering on our objectives"

1

. This sentiment is echoed by the diverse range of investors participating in the funding round, including NVentures (Nvidia's venture capital arm), Morgan Stanley's Counterpoint Global, and various other prominent firms and individuals2

.Technological Challenges and Potential

Nuclear fusion, which aims to produce clean energy by combining atoms, faces significant technological hurdles. Despite decades of experimentation, no group has yet achieved net energy gain from a fusion reaction

1

. Mark Nelson, managing director of Radiant Energy Group, highlighted the complexity of fusion compared to fission, citing the extreme temperatures and pressures required1

.Future Prospects and Timeline

CFS is currently focused on constructing its Sparc prototype reactor near Boston, with plans to activate it next year. The company aims to achieve scientific breakeven by 2027, a crucial milestone where the fusion reaction generates more energy than required to sustain it

2

. Following this, CFS intends to commence construction of Arc, its commercial-scale power plant in Virginia, in 2027 or 20282

.Related Stories

Market Demand and Energy Landscape

The investment in fusion technology comes amid a surge in energy demand, particularly from the rapidly growing artificial intelligence sector. BloombergNEF projects that US data center power demand will more than double to 78GW by 2035

1

. This increasing demand has led to a 400% increase in funding for nuclear energy startups in 2025 compared to 2024 levels1

.Expert Opinions and Cautionary Notes

While the potential of fusion energy is immense, experts caution about the challenges ahead. Saskia Mordijck, an associate professor of physics at the College of William and Mary, noted the uncertainties in modeling and physics, stating, "There are parts of the modeling and the physics that we don't yet understand"

2

. This underscores the exploratory nature of fusion research and the potential for unexpected discoveries as new plasma regimes are explored.As CFS moves forward with its ambitious plans, the fusion energy sector continues to attract significant attention and investment. The success of this venture could potentially revolutionize the global energy landscape, offering a clean and virtually limitless power source for future generations.

References

Summarized by

Navi

Related Stories

Commonwealth Fusion Systems installs first reactor magnet, partners with Nvidia on digital twin

06 Jan 2026•Technology

Global Fusion Energy Investment Surges, Signaling Growing Confidence in Clean Energy Future

22 Jul 2025•Business and Economy

Google Backs TAE Technologies with $150 Million Investment in Fusion Power

04 Jun 2025•Science and Research

Recent Highlights

1

Google Gemini 3.1 Pro doubles reasoning score, beats rivals in key AI benchmarks

Technology

2

Pentagon Summons Anthropic CEO as $200M Contract Faces Supply Chain Risk Over AI Restrictions

Policy and Regulation

3

Canada Summons OpenAI Executives After ChatGPT User Became Mass Shooting Suspect

Policy and Regulation