NVIDIA's Next-Gen AI Chips: Vera Rubin Platform on Track Amid Soaring Demand and Geopolitical Challenges

4 Sources

4 Sources

[1]

NVIDIA CFO talks $5B AI GPU revenue in China, GB300 ramp up, next-gen Vera Rubin AI GPU demand

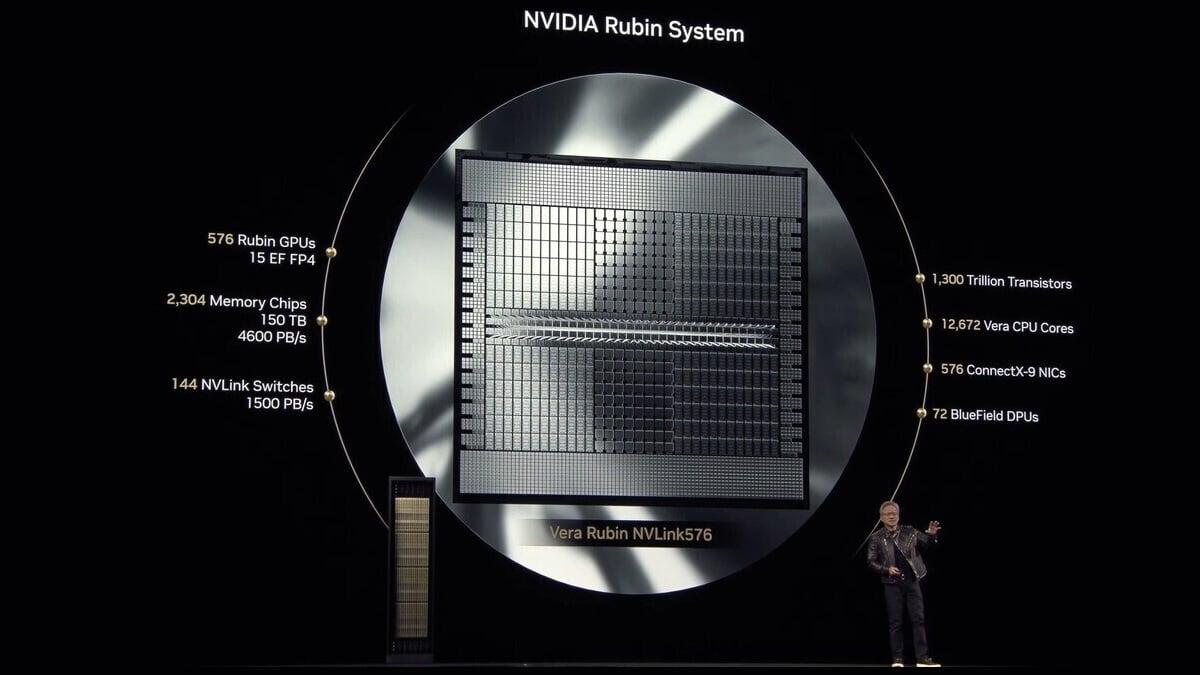

TL;DR: NVIDIA CFO Colette Kress highlighted strong AI-driven growth despite US-China geopolitical challenges affecting H20 AI GPU revenue recognition. NVIDIA targets 17% sequential growth in Q3 2025, driven by rapid GB300 AI server scaling and next-gen Vera Rubin AI chips, emphasizing high-performance, power-efficient data center solutions. NVIDIA CFO Colette Kress has discussed the ongoing geopolitical issues between the US and China, its H20 AI GPU, new Blackwell Ultra GB300 system, and next-gen Vera Rubin AI platform at the recent Goldman Sachs Communacopia + Technology Conference. Kress said that the geopolitical issues between the United States and China are affecting NVIDIA's ability to recognize revenues made from its H20 AI GPU to China, where the NVIDIA CFO said that the company has received H20 licenses from the Trump administration, and could account for around $5 billion in revenue from H20 AI GPU sales in Q3 2025. Kress started out her talk with NVIDIA data center revenues and its growth, despite removing its H20 AI GPU sales from the mix, where the NVIDIA CFO said if we look at NVIDIA's revenues -- including data center and networking -- there's a 12% sequential, or quarter-over-quarter growth in Q2 2025. She said: "what we're targeting right now for Q3 is our outlook is a 17% growth sequentially", indicating that NVIDIA is noticing a massive surge in demand for its AI products in the months (and year) ahead. Kress said that apart from the demand for its GB200 AI server racks, NVIDIA is "also at scale" with its new GB300 AI servers. GB300 scaling so fast surprised Kress, where she noted that a lot of "discussion that said, I didn't know that would actually be a big part". Kress continued, saying that the scale up "was seamless, it was a seamless transition that many people didn't understand the amount of scale and volume we were actually able to put into market as well". When it came to NVIDIA's next-gen Vera Rubin AI hardware, Kress said "Rubin is on a path and that one-year cadence is going to be a journey we're ready to take on with Rubin. So Vera Rubin, six chips, all of them taped out". Kress added that as part of NVIDIA's efforts to prepare data center operators to integrate Rubin, NVIDIA has "already had discussions to where we probably will see several gigawatts needs for our Vera Rubin" and have "penciled that in so even way before it's even ready to go to market, we already are seeing gigawatts worth of needs as we go forward". Kress said NVIDIA is looking to make massive AI systems because: "and so we are looking at our position of creating a data center scale that can do the most performant but the most performant per watt and the most performant per dollars, as well. That wattage is such an important thing. Right now you can decide whether or not capital or power is more important. In respects [inaudible] they both are tremendously important". She continued: "But when you are purchasing any type of large system as we are, you have to keep in mind, you will be using power throughout the journey of owning that full cluster, four, six years or even further. So having that high performance is going to be very important to make sure you are properly addressing that power that is going to be needed for that. So we stand very strong in terms of how we thought about that transition and moving to a full data center scale solution".

[2]

Analyst says all 6 of NVIDIA's next-gen Vera Rubin AI chips are in final pre-production at TSMC

TL;DR: NVIDIA confirms its next-gen Vera Rubin AI platform, featuring six chips taped out at TSMC, remains on track for a second-half 2026 release. Demand for current Blackwell Ultra AI GPUs outpaces supply, supporting strong growth prospects and a JPMorgan analyst's upgraded price target for NVIDIA stock. NVIDIA has confirmed its next-gen Vera Rubin AI AI platform isn't delayed, and that it's on track for release in the second half of 2026, with all 6 of its chips taped out at TSMC already. According to JPMorgan analyst Harlan Sur who attended an investor group meeting with Toshiya Hari, the VP of AI and strategic finance at NVIDIA, walked away with an upbeat view on the demand profile for NVIDIA's current-gen AI GPUs and the upcoming production cadence of its next-gen Vera Rubin AI platform. NVIDIA is pumping out its new Blackwell Ultra GB300 AI GPUs and AI servers, with Sur noting that the ramp-up of Blackwell AI chips: "we believe NVIDIA's 12-month forward order book continues to outstrip supply". He reinstates his previous "overweight" rating on NVIDIA stock, lifting his price target 26% from $170 to $215. At the meeting, NVIDIA confirmed that its next-gen Vera Rubin AI platform isn't delayed, contrary to previous rumors and reports, and that it's "on track" for a release in the second half of 2026. There are 6 chips in the Vera Rubin AI platform, and they're already fabbed and taped out at TSMC.

[3]

NVIDIA CFO Rejects Custom AI Chip Competition And Hints At $5 Billion H20 China Revenue & "Gigawatts" Of Next Gen Vera Rubin Chip Demand

This is not investment advice. The author has no position in any of the stocks mentioned. Wccftech.com has a disclosure and ethics policy. NVIDIA CFO Colette Kress pointed at geopolitical troubles between the US and China as hampering her firm's ability to recognize revenue from its H20 AI GPU sales to the Asian country. Kress was speaking at the Goldman Sachs Communacopa + Technology Conference, where she also shared details about the firm's next-generation Vera Rubin AI GPUs. According to Kress, NVIDIA has received H20 licenses from the Trump administration, and it could account for as much as $5 billion in revenue from H20 sales in the third quarter if tensions smooth out between the world's largest economies. NVIDIA CFO Comments On Blackwell GB300 Ramp In Q2 Kress started out by commenting on NVIDIA's data center revenues and the growth despite removing the China-specific H20 AI GPUs from the mix. According to her, looking at NVIDIA's revenue, which includes data center and networking, leads to a 12% sequential, or quarter-over-quarter, growth in the second quarter. She added that "what we're targeting right now for Q3 in our outlook is a 17% growth sequentially," which indicates that NVIDIA is witnessing a surge in demand for its products looking forward. According to the NVIDIA CEO, apart from seeing demand for the GB200 network racks, her firm was "also at scale with our GB300 Ultra." This scale-up was surprising to some as she mentioned a lot "of discussion that said, I didn't know that would actually be a big part." The scale-up was "was seamless, it was a seamless transition that many people didn't understand the amount of scale and volume we were actually able to put into market as well," she added. As a result, Kress believes that her firm will further scale up GB200 and GB300 racks in the third quarter. Her comments fall in line with a recent report which suggests that NVDIA might experience a 300% sequential growth with GB300 in Q3. The conversation then shifted to NVIDIA's ability to sell the H20 AI GPUs to China. KRess confirmed that NVIDIA has "received licenses for several of our key customers in China." She added that her firms wants the opportunity to complete the shipments and ship the H20 architecture to its Chinese customers. However, she added that right now "there is still, this position right now, a little geopolitical, situation that we need work through between the two governments." According to Kress, NVIDIA's Chinese customers want to ensure that the "government is also very well received in terms of receiving the H20 to them." Multiple reports have suggested that the Chinese government is urging local businesses to use local chips instead of NVIDIA's products. However, Kress asserted that the firm believes that "there's a strong possibility that this [the China H20 shipments] will occur." According to her, while it is hard to determine the amount of additional revenue the shipment should add, it could range between $2 billion to $5 billion. NVIDIA's shares have been under pressure lately due to Broadcom's earnings last week which saw the firm outline a new $10 billion custom AI chip contract. With reports suggesting that the contract could be from AI, and debate in the industry wondering whether a push towards cost-effective chips is the right approach, Kress asserted that power is indispensable when it comes to AI computing. According to her, individuals generating more tokens and inferencing demands for reasoning models account for a large portion of reasoning model demand. The reasoning models are important since if they execute successfully, they can do work through forms such as agentic AI. As a result, NVIDIA is focused on creating data center solutions on scale. According to the CFO, her firm is looking to create large AI systems because: "And so we are looking at our position of creating a data center scale that can do the most performant but the most performant per watt and the most performant per dollars, as well. That wattage is such an important thing. Right now you can decide whether or not capital or power is more important. In respects [inaudible] they both are tremendously important. But when you are purchasing any type of large system as we are, you have to keep in mind, you will be using power throughout the journey of owning that full cluster, four, six years or even further. So having that high performance is going to be very important to make sure you are properly addressing that power that is going to be needed for that. So we stand very strong in terms of how we thought about that transition and moving to a full data center scale solution. Some of them focus at it in terms of it's a rack scale type of capability. Where we put all of the different chips together so that they would be working together, be optimized together, in terms of the right performance. So we feel very good with our plan." As for NVIDIA's next generation Vera Rubin AI chips, Kress outlined that "Rubin is on a path and that one-year cadence is going to be a journey we're ready to take on with Rubin. So Vera Rubin, six chips, all of them taped out." Kress added that as part of her firm's efforts to prepare data centers to integrate Rubin, NVIDIA has "already had discussions to where we probably will see several gigawatts needs for our Vera Rubin" and has "pencilled that in so even way before it's even ready to go to market, we already are seeing gigawatts worth of needs as we go forward."

[4]

JPMorgan's Big NVIDIA Update: All 6 Next-Gen Vera Rubin AI Chips Enter Final Pre-Production Stages At TSMC Amidst Extremely High AI Demand!

This is not investment advice. The author has no position in any of the stocks mentioned. Wccftech.com has a disclosure and ethics policy. JPMorgan analyst Harlan Sur has come away from an investor group meeting with Toshiya Hari, the VP of IR and strategic finance at NVIDIA, with a fairly upbeat view of the demand profile for NVIDIA's current-gen GPUs and the tentative production cadence for its next-gen Vera Rubin platform. Sur notes with cheery effervescence the fact the lead times for NVIDIA's current-gen Blackwell Ultra GPUs remain firmly ensconced in the range of "quarters, not months," and that's despite Blackwell Ultra ramping up sharply in NVIDIA's fiscal Q2, now constituting around 50 percent of the Blackwell mix. According to the JPMorgan analyst, NVIDIA's stretched lead times more than 2 years into this AI spending cycle suggest that "demand [is] still outstripping supply." Moreover, in what constitutes a critical tidbit shared by NVIDIA at the meeting, all six Vera Rubin GPUs have entered final pre-production stages, negating reports of a purported delay: "[NVIDIA] confirmed that its upcoming Vera Rubin platform has not experienced any delays (despite recent noise to the contrary) and is on track for a C2H26 launch, with all 6 chips that make up the platform having already taped out at TSMC." Meanwhile, Reuters recently reported of budding excitement within some of China's biggest tech firms, including ByteDance and Alibaba, for NVIDIA's upcoming Blackwell-based, China-specific GPU, with these titans willing to pay as much as double the H20 GPU's price tag to get their hands on the B30A's reported 6x performance boost over its predecessor. This aligns with aggregate US broker research, which recently found a strong preference for NVIDIA's products in China. This is largely due to the fact that NVIDIA's GPUs offer superior software support, especially via the CUDA ecosystem. These GPUs also perform better in a cluster, thanks to the company's NVLink interconnect. Do note that NVIDIA's RTX Pro 6000D systems that are based on the B40 chip do not require a separate license to go on sale in China, as these systems do not use high-bandwidth memory (HBM) and their main use is for inference rather than training foundational AI models. It is, therefore, quite likely that these chips would sell like hot cake once they do become available for Chinese companies. For the benefit of those who might not be aware, the B30 is a more cut-down version of NVIDIA's Blackwell GPU vs. the B40, which is a relatively higher-end offering. The B30 focuses on scaling and multi-chip clusters with dynamic compression to compensate for lower performance per chip, while the B40 aims to offer a direct alternative to the banned H20 chip.

Share

Share

Copy Link

NVIDIA confirms the development of its next-generation Vera Rubin AI platform, with all six chips in final pre-production at TSMC. The company faces strong demand for current Blackwell GPUs and navigates geopolitical challenges in China.

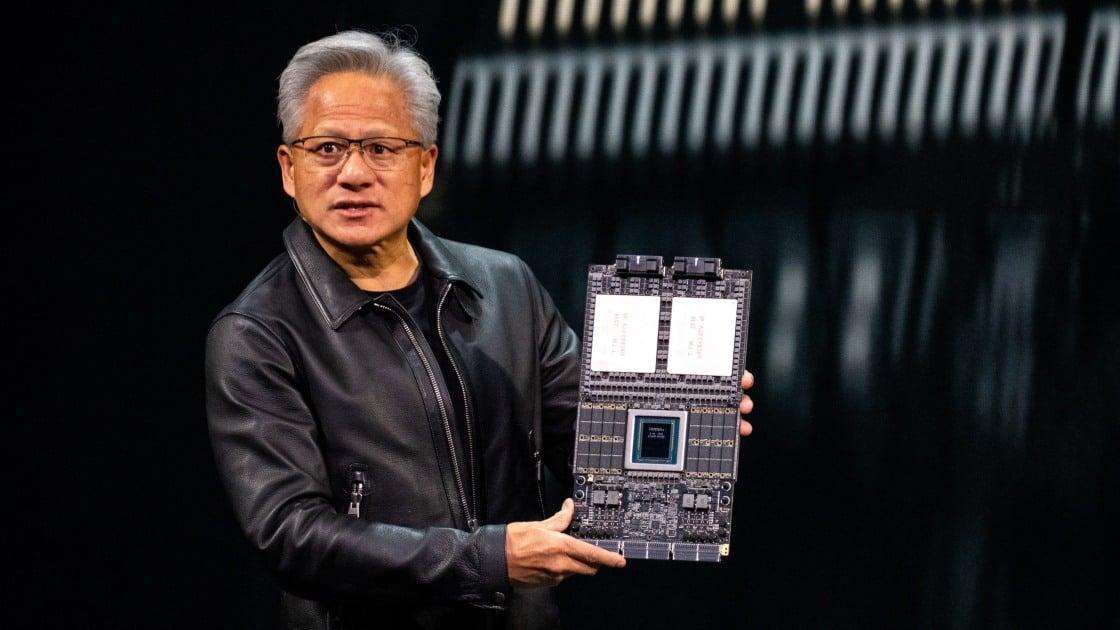

NVIDIA's Next-Gen Vera Rubin AI Platform Development

NVIDIA has confirmed that its highly anticipated next-generation Vera Rubin AI platform is on track for release in the second half of 2026. Contrary to previous rumors, all six chips that make up the platform have already been taped out at TSMC and are in the final pre-production stages

2

4

. NVIDIA CFO Colette Kress highlighted the company's commitment to maintaining its one-year cadence for new AI hardware releases1

.

Source: TweakTown

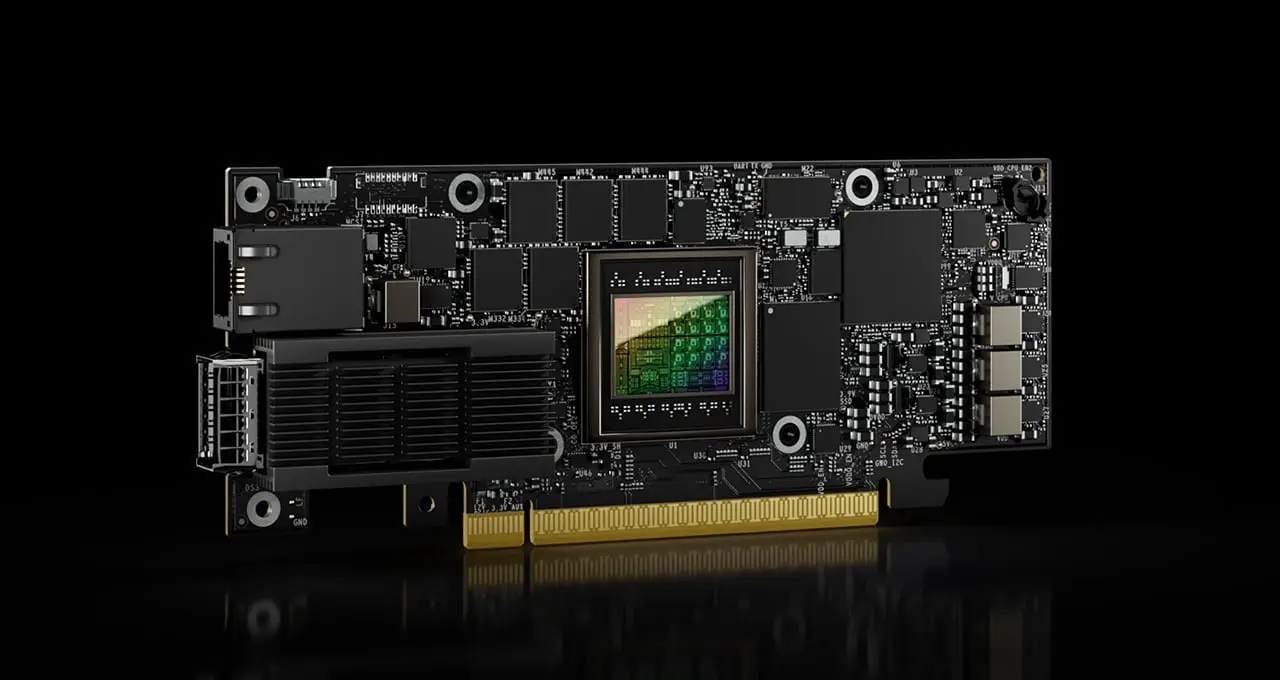

Surging Demand for Current-Gen AI GPUs

The demand for NVIDIA's current-generation Blackwell Ultra AI GPUs remains exceptionally strong. JPMorgan analyst Harlan Sur noted that lead times for these GPUs are still measured in quarters rather than months, indicating that demand continues to outstrip supply

4

. NVIDIA is experiencing rapid scaling of its GB300 AI servers, which has surprised even company executives with its seamless transition and volume1

.

Source: Wccftech

Geopolitical Challenges and China Market

NVIDIA faces ongoing geopolitical issues between the United States and China, affecting its ability to recognize revenues from H20 AI GPU sales to China. Despite these challenges, NVIDIA has received licenses for several key customers in China and estimates potential revenue of $2 billion to $5 billion if tensions ease

1

3

.

Source: TweakTown

Related Stories

Focus on High-Performance, Power-Efficient Solutions

Kress emphasized NVIDIA's commitment to creating data center-scale solutions that prioritize performance, power efficiency, and cost-effectiveness. The company recognizes the importance of balancing capital expenditure and power consumption in large-scale AI systems

1

3

.Future Outlook and Market Position

NVIDIA remains confident in its market position, targeting 17% sequential growth in Q3 2025. The company has already received indications of "gigawatts worth of needs" for the upcoming Vera Rubin platform, demonstrating strong market interest

1

. JPMorgan has raised its price target for NVIDIA stock by 26%, from $170 to $215, reflecting optimism about the company's growth prospects in the AI sector2

.References

Summarized by

Navi

[1]

[2]

Related Stories

NVIDIA Unveils Roadmap for Next-Gen AI GPUs: Blackwell Ultra and Vera Rubin

28 Feb 2025•Technology

NVIDIA's Rubin Platform: Next-Gen AI Architecture Set for 2026 Launch

23 Aug 2025•Technology

NVIDIA's AI AI server evolution: GB300 production ramps up as Vera Rubin looms on the horizon

19 Jul 2025•Technology

Recent Highlights

1

ByteDance's Seedance 2.0 AI video generator triggers copyright infringement battle with Hollywood

Policy and Regulation

2

Demis Hassabis predicts AGI in 5-8 years, sees new golden era transforming medicine and science

Technology

3

Nvidia and Meta forge massive chip deal as computing power demands reshape AI infrastructure

Technology